Professional Documents

Culture Documents

07.06.2021 - RMC No. 81-2021 List of VAT-Exempt Products 2

Uploaded by

CHUBZ0902Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07.06.2021 - RMC No. 81-2021 List of VAT-Exempt Products 2

Uploaded by

CHUBZ0902Copyright:

Available Formats

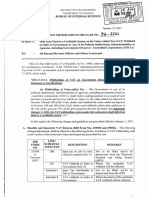

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

lul 0 0 2021

REVENUE MEM,nAr\DUM .TRCULAR No. fi - fur&l

SUBJECT : Publishing the futl text of the'letter from the F'oocl and Drug

Administration (fDA) of the Departrnent of tflealth (BOH) containing

the 'ol,ist of VAT-Exempt Products"- pursuant to Republic Act No.

11534 otherwise known as ttre Corporate Recovery and Tax Iincentives

for Enterprises (CREATE) Act

TO AII Internal Revenue Officers, Employees and Other Conc,erned

For the intbrmation and guidance of all internal revenue oflicers, employees zrnd others

concerned, attached is the letter dated June 17 , 2A21 from Rolando Enrique D. Dorningo,

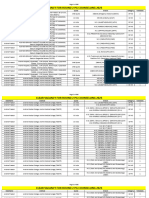

Director General of FDA, and the copy of the "List of VAT-Exempt Products'" consisting of

fifty-eight (58) pages. The VAT exemption for the sale or importa,,ion of the fbllowing shall

take effect on:

a. Medicines for diabetes, high cholesterol, and hypertension beginningJanuarv \,2$20.

b. Medicines for cancer, mental illness, tuberculosis, and kidney diseases !,eglllming

Januarv tr. 2021;

c. Drugs and vaccines prescribed and directly used trbr COVID-19 tre;itment b,e.ginning

Januarv I.2021 until Decernlrer 31. 2023; and

d. Medical devices directly used fbr COVID-i9 treatnrent beginrninE Jalrqari, X,.2021

until December 31 .2023.

All internal revenue of-ficials and employees are hereby enjoined to give this Circuiar

as wide a publicity as possible.

ir.r?rn-runL REvENUE

-/lt^$-4'-A:*=v

CAESAR. R. DTILA,Y

JUh'oi,ffi L' omrn is,s ioner of' Int ern ttl R evenue

K-l

r 043 3oo

0M

I

t

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Local Taxes PDFDocument16 pagesLocal Taxes PDFRobert RamirezNo ratings yet

- List of Financial RatiosDocument3 pagesList of Financial RatiosCyra Mae AlanoNo ratings yet

- List of Financial RatiosDocument3 pagesList of Financial RatiosCyra Mae AlanoNo ratings yet

- Important Notice To All ApplicantsDocument2 pagesImportant Notice To All ApplicantsCHUBZ0902No ratings yet

- Revenue Memorandum Circular No.Document5 pagesRevenue Memorandum Circular No.Joel SyNo ratings yet

- Revei (Ue Memorai/Dum Crrcular No.: Interi (AlDocument2 pagesRevei (Ue Memorai/Dum Crrcular No.: Interi (AlRONIN LEENo ratings yet

- 07.06.2021 - RMC No. 81-2021 List of VAT-Exempt Products 2Document1 page07.06.2021 - RMC No. 81-2021 List of VAT-Exempt Products 2CHUBZ0902No ratings yet

- 07.06.2021 - RMC No. 81-2021 FDA Endorsement LetterDocument1 page07.06.2021 - RMC No. 81-2021 FDA Endorsement LetterCHUBZ0902No ratings yet

- cmc-131-2021-FDA Updates and List of VAT-Exempt ProductsDocument50 pagescmc-131-2021-FDA Updates and List of VAT-Exempt ProductsCHUBZ0902No ratings yet

- List of VAT-Exempt ProductsDocument58 pagesList of VAT-Exempt ProductsMellinia MantesNo ratings yet

- 07.06.2021 - RMC No. 81-2021 List of VAT-Exempt Products 2Document1 page07.06.2021 - RMC No. 81-2021 List of VAT-Exempt Products 2CHUBZ0902No ratings yet

- cmc-131-2021-FDA Updates and List of VAT-Exempt ProductsDocument50 pagescmc-131-2021-FDA Updates and List of VAT-Exempt ProductsCHUBZ0902No ratings yet

- 07.06.2021 - RMC No. 81-2021 FDA Endorsement LetterDocument1 page07.06.2021 - RMC No. 81-2021 FDA Endorsement LetterCHUBZ0902No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- J Jaad 2020 07 037Document8 pagesJ Jaad 2020 07 037Abdelghani MILIANINo ratings yet

- Literature Review On Oxygen TherapyDocument6 pagesLiterature Review On Oxygen Therapyjzneaqwgf100% (1)

- Basic Ethical Principles 1. StewardshipDocument5 pagesBasic Ethical Principles 1. Stewardshipmitsuki_sylph83% (6)

- Spesifikasi Draeger Evita V300 AdvanceDocument3 pagesSpesifikasi Draeger Evita V300 AdvanceTaufiq RizqullahNo ratings yet

- Adnexal Torsion: Clinical, Radiological and Pathological Characteristics in A Tertiary Care Centre in Southern IndiaDocument6 pagesAdnexal Torsion: Clinical, Radiological and Pathological Characteristics in A Tertiary Care Centre in Southern IndiaKriti KumariNo ratings yet

- Therapeutic Controversies: Antmi Yric Prophylaxis in Cesarean SectionDocument6 pagesTherapeutic Controversies: Antmi Yric Prophylaxis in Cesarean Sectionnurul wahyuniNo ratings yet

- Cebu City Medical Center-College of NursingDocument5 pagesCebu City Medical Center-College of NursingJimnah Rhodrick BontilaoNo ratings yet

- Foundation Timetable 2017Document13 pagesFoundation Timetable 2017Wahida Amalin Ab RazakNo ratings yet

- Scoring Systems in Anesthesia and PACUDocument16 pagesScoring Systems in Anesthesia and PACUmissyaaaaNo ratings yet

- Tiered Response AgreementDocument3 pagesTiered Response AgreementThe Hamilton SpectatorNo ratings yet

- Patients With Acid, High Fat and Low Protein Diet Have Higher Laryngopharyngeal Reflux Episodes at The Impedance PH MonitoringDocument10 pagesPatients With Acid, High Fat and Low Protein Diet Have Higher Laryngopharyngeal Reflux Episodes at The Impedance PH MonitoringLucien HaNo ratings yet

- Nclex RN Infection ControlDocument4 pagesNclex RN Infection Controlstring44100% (9)

- Deep Learning For Cardiovascularmedicine: A Practical PrimerDocument16 pagesDeep Learning For Cardiovascularmedicine: A Practical PrimersilviaNo ratings yet

- Clear Vacancy R2Document696 pagesClear Vacancy R2bhuviNo ratings yet

- 2000 Microbiology MCQs With KeyDocument100 pages2000 Microbiology MCQs With KeyAbdurrahman ZahidNo ratings yet

- Termin Kel 3Document20 pagesTermin Kel 3stewart lips hotNo ratings yet

- Ardc 2Document1 pageArdc 2Camille GuintoNo ratings yet

- UnaniDocument16 pagesUnaniRahul Banik888No ratings yet

- TheLightintheHeartofDarkness - V20-2 - KEVIN BILLETDocument218 pagesTheLightintheHeartofDarkness - V20-2 - KEVIN BILLETDezvoltare IntegrativaNo ratings yet

- Presented By:: Aya Adel Abd El-Hafez Rana Mohamed EL-AbasseryDocument36 pagesPresented By:: Aya Adel Abd El-Hafez Rana Mohamed EL-AbasseryRisky Anita OktavianiNo ratings yet

- H02E Assignment 8Document4 pagesH02E Assignment 8Good ChannelNo ratings yet

- NCP Dengue Fever Hyperthermia and Acute PainDocument4 pagesNCP Dengue Fever Hyperthermia and Acute PainJordz PlaciNo ratings yet

- Respiratory Acidosis: Dr. Ann Valerie F. Habana Critical Care MedicineDocument21 pagesRespiratory Acidosis: Dr. Ann Valerie F. Habana Critical Care Medicineannv748687No ratings yet

- PSI INDIA - Will Balbir Pasha Help Fight AIDS: Target AudienceDocument2 pagesPSI INDIA - Will Balbir Pasha Help Fight AIDS: Target AudienceShambhawi SinhaNo ratings yet

- Dataset On Child Vaccination in Brazil From 1996 To 2021: Data DescriptorDocument9 pagesDataset On Child Vaccination in Brazil From 1996 To 2021: Data DescriptorlaireneNo ratings yet

- Apple Cider Vinegar Health Benefits and Unwanted EffectsDocument4 pagesApple Cider Vinegar Health Benefits and Unwanted EffectsBlackpicassoNo ratings yet

- Samir 10.1007 - s11046-014-9845-2Document7 pagesSamir 10.1007 - s11046-014-9845-2قصوري سميرNo ratings yet

- HypertensionDocument22 pagesHypertensionLubeeha HaselNo ratings yet

- PDF History of Medical Technology Profession CompressDocument5 pagesPDF History of Medical Technology Profession CompressJose KruzNo ratings yet

- Theoretical Sampling and Category Development in Grounded TheoryDocument12 pagesTheoretical Sampling and Category Development in Grounded Theorysamas7480No ratings yet