Professional Documents

Culture Documents

MIDTERMS

Uploaded by

MitchayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MIDTERMS

Uploaded by

MitchayCopyright:

Available Formats

MIDTERMS -TAX

9.

The following income was obtained by Scooby Doo, a resident citizen in the year 2019:

All are converted in peso and in gross amounts.

Interest Income from bank deposits, Philippines 30,000- 20% = 6000

Interest Income from bank deposits, USA 50,000

Interest Income from domestic depository banks under the FCDU 70,000 - 15% =10,500

Interest income from debt instruments within the coverage

of deposit substitute 60,000 - 20% =12,000

Interest income from loans 12%, Philippines 50,000

Interest Income from loans 5%, USA 40,000

How much is the Final withholding tax on interests? 28,500

Using the preceding number, how much is the interest income subject to the graduated tax?

50k + 50k +40k =140

10. The following Royalty income were earned by DJ Squammy in the year

13. The following income were earned by Tokmol from Philippines Sources during the taxable year 2019.

Royalty on Published book 100,000 -10% = 10,000

Prizes 300,000 – 150,000 = 150,000*20% = 30,000

PCSO winnings 150,000 – 20% = 30,000

Gain from sale of shares of stocks not traded in the Stock Exchange Ph200,000

Share in the Net Income after tax of a Joint Venture 40,000 X 10% = 4,000

Included in the prizes is Ph150,000 received for his nomination as Gawad Kalinga Ulirang Mamamayan

award. No future services are required as a condition to receive the award.

Dividends Include

How much is the Total Final Tax (FWT) on Passive Income?

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Remedial Law NotesDocument5 pagesRemedial Law NotesMitchayNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Civ 2Document103 pagesCiv 2MitchayNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Modes - DiscussionDocument15 pagesModes - DiscussionMitchayNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ejercito vs. OrientalDocument3 pagesEjercito vs. OrientalMitchayNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Course Outline in CIVIL LAW REVIEW 2 May 26 2021Document22 pagesCourse Outline in CIVIL LAW REVIEW 2 May 26 2021MitchayNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Civ 2 Notes - Start To ComplianceDocument26 pagesCiv 2 Notes - Start To ComplianceMitchayNo ratings yet

- Liga CaseDocument6 pagesLiga CaseMitchayNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Giving Legal Advice On Cases of Annulment"Document6 pagesGiving Legal Advice On Cases of Annulment"MitchayNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Obligations - in GeneralDocument7 pagesObligations - in GeneralMitchayNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Sources of ObligationsDocument35 pagesSources of ObligationsMitchayNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Giving Legal Advice To Children in Conflict With LawDocument5 pagesGiving Legal Advice To Children in Conflict With LawMitchayNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Notes On Prac 1Document14 pagesNotes On Prac 1MitchayNo ratings yet

- Villaroel vs. EstradaDocument9 pagesVillaroel vs. EstradaMitchayNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Judicial AffidavitDocument4 pagesJudicial AffidavitMitchayNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Rule 16Document1 pageRule 16MitchayNo ratings yet

- Obligations - in GeneralDocument7 pagesObligations - in GeneralMitchayNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Giving Legal Advice To Children in Conflict With LawDocument5 pagesGiving Legal Advice To Children in Conflict With LawMitchayNo ratings yet

- Sources of ObligationsDocument8 pagesSources of ObligationsMitchayNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Rule 16Document1 pageRule 16MitchayNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tagapan Cicl PDFDocument255 pagesTagapan Cicl PDFMasacal Suhaib MosaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Legal Counseling NotesDocument1 pageLegal Counseling NotesMitchayNo ratings yet

- Villaroel vs. EstradaDocument9 pagesVillaroel vs. EstradaMitchayNo ratings yet

- 2019-Golden Notes-Civil Law PDFDocument710 pages2019-Golden Notes-Civil Law PDFErika Angela Galceran95% (21)

- Njpe Corpo Notes PDFDocument126 pagesNjpe Corpo Notes PDFBrenPeñarandaNo ratings yet

- Annual Income Tax Return: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument2 pagesAnnual Income Tax Return: Republic of The Philippines Department of Finance Bureau of Internal RevenueDCNo ratings yet

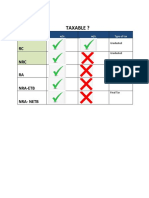

- Taxable ?: RC NRC RADocument4 pagesTaxable ?: RC NRC RAMitchayNo ratings yet

- Partnership QuestionsDocument2 pagesPartnership QuestionsMitchayNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Recit QuestionsDocument1 pageRecit QuestionsMitchayNo ratings yet

- Quiz#1 Partnership 1. True or FalseDocument3 pagesQuiz#1 Partnership 1. True or FalseMitchayNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)