Professional Documents

Culture Documents

Summary

Summary

Uploaded by

MARY JUSTINE PAQUIBOTOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary

Summary

Uploaded by

MARY JUSTINE PAQUIBOTCopyright:

Available Formats

Based on the video lecture by Sir Carlo Pinto, I acquired a foundational knowledge on the basic

accounting equation, assets equals liabilities plus owner’s equity (Asset=Liabilities Owner’s Equity). One

important rationale of this equation is the fact that companies increase their resources through

borrowing from creditors or investing from the owner. This equation can however be expanded into

assets equals liabilities plus owner’s capital minus owner’s withdrawal plus income minus expenses

(Asset=Liabilities + [Owner’s Capital-Withdrawals+Income-Expenses]). An understanding on this

equation can served as a guide in transaction analysis which is just a part of the accounting cycle. In the

video, it was mentioned that accounting cycle usually covers a period of one month and thereafter the

cycle continues. Transaction analysis, journalizing, posting, trial balance, adjustment, preparation of

financial statements and closing entries are the chronological order of the accounting cycle.

Transaction analysis is the first step in accounting cycle. Since companies may maintain many

accounts composing the financial statement elements, relevant transactions need to be stored and

organized consistently in the form of chart of accounts which is a list of all accounts maintain by an

entity with an account number. The chart of accounts depends on the business needs, the type and

form of business, rules set by the accounting body and the business preference. Transactions involve at

least two accounts. In order to analyze a transaction, it is important to determine what account is

affected and by how much. To reiterate, the understanding on the basic accounting equation is an

important application.

For example, On June 1, 2020 Justine Cute invested 500,000 to organize a laundry service

business by opening a bank account in BDO in the name of JC Laundry Services. The existence of

relevant information with at least two accounts involved is an indication that such economic event is a

financial transaction. To analyze why this is a financial transaction is because of capital valued at 500,000

which increases the owner’s capital (an owner’s equity account) and increases the cash (an asset

account) of JC Laundry Services. Suppose on the same day, the entity purchased laundry equipment

worth 100,000 then assets are affected as cash account decreased by 100,000 and the equipment

account increased by 100,000. Suppose on June 3, 2020, the entity rendered laundry services worth

3,000 cash then income account increases by 3,000 and the cash account by 3,000. Suppose on June 4,

2020, the entity borrowed 50,000 in the form of loan agreement with Louisa Financing Company to have

an additional cash needed for the business operations then this increase both assets and liabilities as the

cash account (asset) increase by 50,000 and the loans payable account (liability) increased by 50,000.

Suppose on June 5, Justine Cute withdraw 2,000 cash for personal use and on the same day the entity

incurred transportation expense worth 300. The former affects the assets as cash decreased by 2,000

and owner’s equity as withdrawal increased by 2,000 while the latter decrease assets as cash decreased

by 300 and increase expenses as transportation expense increase by 300. The effects of the foregoing

transactions are analyzed as follows in the form of accounting equation.

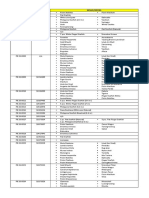

Assets = Liabilities + Owner’s Capital - Withdrawals + Income - Expenses

Date Cash + Equipment Loans Payable + Justine Cute, Capital - Justine Cute, Withdrawal + Service Income- Transportation Expense

Jun-01 500,000 500,000

-100,000 100,000

Jun-03 3000 3000

Jun-04 50,000 50,000

Jun-05 -2,000 2,000

-300 300

450,700 100,000

Balance 550,700 Balance 550,700

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 14Document31 pagesChapter 14MARY JUSTINE PAQUIBOT100% (1)

- Ansys ExercisesDocument20 pagesAnsys Exerciseskpvraj100% (1)

- E-Marketing Analysis and Plan For HovisDocument25 pagesE-Marketing Analysis and Plan For HovisAtiqah Ismail100% (1)

- I. The Holy Spirit'S Works Manifest PersonalityDocument2 pagesI. The Holy Spirit'S Works Manifest PersonalityMARY JUSTINE PAQUIBOTNo ratings yet

- RFBT ReviewerDocument11 pagesRFBT ReviewerMARY JUSTINE PAQUIBOTNo ratings yet

- Objectives of Educational Technology at The Macro LevelDocument1 pageObjectives of Educational Technology at The Macro LevelMARY JUSTINE PAQUIBOTNo ratings yet

- Genus Long Bond PaperDocument1 pageGenus Long Bond PaperMARY JUSTINE PAQUIBOTNo ratings yet

- Orca Share Media1605010109407 6731900321930361605Document37 pagesOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTNo ratings yet

- "How Well Am I Doing?" Statement of Cash Flows: Managerial Accounting, 9/eDocument51 pages"How Well Am I Doing?" Statement of Cash Flows: Managerial Accounting, 9/eMARY JUSTINE PAQUIBOTNo ratings yet

- Analyzing DataDocument32 pagesAnalyzing DataMARY JUSTINE PAQUIBOTNo ratings yet

- Tangerine Dream - Electronics & Music Maker MagazineDocument12 pagesTangerine Dream - Electronics & Music Maker Magazinecocovscarlos100% (3)

- DCT IdctDocument29 pagesDCT IdctsheethalsunilNo ratings yet

- Mục 13. Máy xọc AJAX-AJSL300 PDFDocument2 pagesMục 13. Máy xọc AJAX-AJSL300 PDFVăn ST QuangNo ratings yet

- HandiLaz Mini User Manual ReveDocument76 pagesHandiLaz Mini User Manual Revethao nguyenNo ratings yet

- Mechanised Tamping & StabilisationDocument218 pagesMechanised Tamping & StabilisationCEG BangladeshNo ratings yet

- WWW - Caa.co - Uk: Uk Notam Guidance Material ReferencesDocument12 pagesWWW - Caa.co - Uk: Uk Notam Guidance Material ReferencesHani BoudiafNo ratings yet

- Mba 09 41 Strategic Management - SyllabusDocument2 pagesMba 09 41 Strategic Management - SyllabusVinooj ViswanathanNo ratings yet

- R168 PDFDocument2 pagesR168 PDFGuidoDorigoniNo ratings yet

- SumoDocument21 pagesSumoWalid JiNo ratings yet

- NASA Information Summaries Wind-Up TurnDocument10 pagesNASA Information Summaries Wind-Up TurnBob Andrepont100% (1)

- The Private/Industrial Security & Investigation Industry in Nigeria: Opportunities, Challenges and The Way ForwardDocument13 pagesThe Private/Industrial Security & Investigation Industry in Nigeria: Opportunities, Challenges and The Way ForwardDon OkerekeNo ratings yet

- West Crame - Brgy Ordinance 03-2023 - Prescribing Rules and Regulation On Livelihood AreaDocument3 pagesWest Crame - Brgy Ordinance 03-2023 - Prescribing Rules and Regulation On Livelihood AreaMitch Fronteras100% (1)

- Buku Orang Rimba AP in English - RevisiDocument229 pagesBuku Orang Rimba AP in English - RevisiluteliteNo ratings yet

- Mulberry Homes: George John Mystic Rose Thrissur 5112018Document1 pageMulberry Homes: George John Mystic Rose Thrissur 5112018Melwin PaulNo ratings yet

- Emerge™ Pc/Abs 7740: Technical InformationDocument3 pagesEmerge™ Pc/Abs 7740: Technical InformationbobNo ratings yet

- Importance of Taxation KnowledgeDocument3 pagesImportance of Taxation KnowledgeElizabeth Wee Ern Cher33% (3)

- SH 2016 FinalJuly252016byCJose&BOmbrogDocument117 pagesSH 2016 FinalJuly252016byCJose&BOmbrogMiyageEmplamadoAquinoNo ratings yet

- MFSO COURSE OUTLINE (3 Days)Document7 pagesMFSO COURSE OUTLINE (3 Days)malaysiamadani01No ratings yet

- Updated Assessors' Application FormDocument1 pageUpdated Assessors' Application FormLieza MarianoNo ratings yet

- Chapter 2 Foundamental Theory of DamagesDocument19 pagesChapter 2 Foundamental Theory of DamagesabelNo ratings yet

- Classification Labelling o EquipmentDocument1 pageClassification Labelling o EquipmentAbdul RahmanNo ratings yet

- Product CatalogDocument73 pagesProduct CatalogJaimasaNo ratings yet

- Learning Objective 16-1: Chapter 16 The Statement of Cash FlowsDocument105 pagesLearning Objective 16-1: Chapter 16 The Statement of Cash FlowsMarqaz MarqazNo ratings yet

- Technical Manual Manual TécnicoDocument19 pagesTechnical Manual Manual Técnicooscar salvadorNo ratings yet

- 2015 Prosthetics Lower Limb Global CatalogDocument352 pages2015 Prosthetics Lower Limb Global CatalogChandan Mahapatra100% (2)

- Conformal Cooling 140217011257 Phpapp01 PDFDocument50 pagesConformal Cooling 140217011257 Phpapp01 PDFcute7707No ratings yet

- Philippine National Construction Corp. v. Asiavest Merchant Bankers M Berhad G.R. No. 172301 August 19 2015Document3 pagesPhilippine National Construction Corp. v. Asiavest Merchant Bankers M Berhad G.R. No. 172301 August 19 2015Kyla Ellen CalelaoNo ratings yet

- Business Account Statement: Account Summary For This PeriodDocument2 pagesBusiness Account Statement: Account Summary For This PeriodBrian TalentoNo ratings yet