Professional Documents

Culture Documents

ITX 240.01.B - VAT Monthly Return

Uploaded by

Fredben BenardCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITX 240.01.B - VAT Monthly Return

Uploaded by

Fredben BenardCopyright:

Available Formats

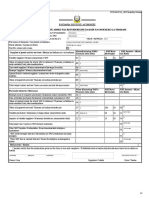

TANZANIA REVENUE AUTHORITY

VALUE ADDED TAX RETURN / RITANI YA KODI YA ONGEZEKO LA THAMANI

Note / Tanbihi Before filling this form please read carefully instructions provided overleaf.

Kabla ya kujaza fomu hii tafadhali soma kwa uangalifu maelezo yaliyopo nyuma ya fomu

Taxpayer Identification Number (TIN) / Namba ya Utambulisho

VAT registration number / Namba ya usajili wa VAT

This return is for the Month of / Ritani hii ni ya mwezi wa

Full name of business /

Jina kamili la biashara

Postal address / Anuni ya posta

For NIL return tick () here 01 Kwa ritani isiyo na malipo weka alama () hapa

Supplies of goods & or Services / Value (Excluding VAT) / VAT Rate / VAT Amount /

Mauzo ya bidhaa na / au huduma Thamani (bila kodi) (Kiwango) (Kiasi cha Kodi)

Standard rated supplies / 02 03 04

Mauzo yanayotozwa VAT

Zero rated supplies / 05

Mauzo yanayotozwa kiwango cha sifuri

Exempt supplies / 06

Mauzo yaliyosamehewa kodi

Special relief / deferred supplies / 07

Mauzo kwa watu waliopewa nafuu maalum

Purchase (Inputs) / Value (Excluding VAT) / Thamani VAT Rate / VAT Amount /

Manunuzi (bila kodi) (Kiwango) (Kiasi cha Kodi)

Exempt (local & imports) purchases / 08

Manunuzi yaliyo samehewa VAT

Non-Creditable purchases / 09

Manunuzi yasiyostahili Marejesho ya VAT

VAT deferred purchases / 10

Manunuzi ambayo VAT imeahirishwa

Standard rated purchases / 11 12 13

Manunuzi ya hapa nchini yanayotozwa kodi

Standard rated imports / 14 15 16

Manunuzi kutoka nje yanayotozwa kodi

Total input tax / 17

Jumla ya VAT kwenye manunuzi

Total VAT payable / Refundable 18

Kiasi kinachostahili kulipwa / kurejeshwa

VAT credit brought forward / Marejesho 19

ya VAT yatokanayo na miezi iliyopita

Total VAT due or carried forward / 20

Kiasi cha kulipwa au kusogezwa mbele

Declaration /Tamko

I hereby certify that the information given in this form is true and complete. / Nathibitisha kuwa taarifa niliyotoa kwenye fomu hii ni sahihi na kamili

…………………………………………….. ……………………………………... ………………………………………

Name (Jina) Signature (sahihi) Date (Tarehe}

FOR OFFICIAL USE ONLY / KWA MATUMIZI YA OFISI TU.

Date of Payment Pay In slip No. Name of Bank

Amount paid Payment type Cheque No

ITX240.01.B - VAT Monthly Return

Page 1 of 2

Posted by Designation

NOTES FOR COMPLETING THE RETURN (ITX240.01.B)

MAELEZO YA JINSI YA KUJAZA RITANI YA VAT (FOMU ITX240.01.B))

NOTE/TANBIHI

i) To be completed in triplicate/Jaza nakala tatu

ii) This return and payment must be submitted to the TRA Office not later than the last working day of the month following the month of

business/Ritani hii pamoja na malipo ni lazima viwasilishwe Ofisi ya TRA si zaidi ya siku ya mwisho ya kazi ya mwezi unaofuatia

mwezi wa biashara.

iii) Do not leave any box blank. If you have no entry for the box, insert “NIL”./Kila sanduku ni lazima lijazwe. Iwapo huna cha kujaza

andika “NIL”.

iv) Write in full the name of person signing the form, finally sign and date the declaration/andika jina kamili la anayesaini fomu hii. Kisha

weak saini na tarehe.

v) Declaration of details relating to Purchase Tax Invoices and Sales Documents (form ITX241.01.B) should be submitted with this

return./Taarifa ya maelezo yahusuyo Ankara za Kodi za Manunuzi na Hati za Mauzo (fomu ITX241.01.B) ni lazima iambatanishwe na

ritani hii.

BOX NUMBER/ COMPLETION NOTES/MAELEZO

SANDUKU NAMBA

01 Should be ticked for NIL return/Weka tiki endapo ritani haina malipo.

02 Value of taxable supplies/Thamani ya mauzo yanayotozwa kodi.

03 Rate of tax/Kiwango cha kodi.

04 Output tax amout/Kiasi cha kodi kilichotozwa.

05 Value of zero rated supplies/Thamani ya mauzo ya bidhaa/huduma zinazotozwa VAT kwa kiwango cha

asilimia sifuri.

06 Value of exempted supplies/Thamani ya mauzo ya bidhaa/huduma zilizosamehewa VAT.

07 Value of supplies to relieved persons or to persons entitled to VAT deferment/Thamani ya mauzo kwa

bidhaa/huduma zilizouzwa kwa watu/taasisi zilizopewa nafuu maalum au kwa watu ambao malipo ya VAT

yameahirishwa.

08 Value of exempted local purchases and imports i.e. goods and services listed on the Second Schedule to the

VAT Act, 1997./Thamani ya manunuzi yaliyosamehewa VAT (bidhaa na huduma zilizoorodheshwa kwenye

Jedwali la Pili la Sheria ya VAT ya mwaka 1997).

09 Value of non-creditable local purchases and imports eg. Motor cars or business entertainment. The portion

of taxable purchases which relates to exempt supplies should also be included here./Thamani ya manunuzi

yaliyolipiwa VAT lakini yasiyostahili marejesho ya VAT, kwa mfano ununuzi wa magari madogo au manunuzi

ya viburudisho vinavyohusiana na biashara. Sehemu ya manunuzi inayohusishwa na mauzo

yaliyosamehewa VAT nayo pia ihusishwe hapa.

10 Value of purchases on which VAT has been deferred/Thamani ya manunuzi ambayo malipo ya VAT

yameahirishwa.

11 Value of taxable purchases (from both VAT registered traders and unregistered ones) excluding those on

which VAT has been deferred/Thamani ya manunuzi ya hapa nchini yanayotozwa VAT (kutoka kwa wafanya

biashara waliosajiliwa VAT pamoja na wale wasiosajiliwa) bila kuhusisha yale ambayo VAT imeahirishwa.

12 Rate of tax/Kiwango cha kodi.

13 VAT amount as evidenced by tax invoices received from your suppliers. This amount may not necessarily be

20% of the value in 11./Kiasi cha kodi kilichotozwa, kama inavyoweza kudhihirishwa na Ankara za kodi

kwenye manunuzi. Kiasi hiki siyo lazima kilingane na 20% ya thamani iliyopo sanduku la 11.

14 Value of taxable imports excluding those on which VAT has been deferred/Thamani ya manunuzi kwa

bidhaa/huduma kutoka nje ya nchi bila kuhusisha yale ambayo VAT imeahirishwa.

15 Rate of tax/Kiwango cha kodi.

16 The amount of input tax paid on imports/Kiasi cha kodi kilicholipwa kwenye bidhaa na/au huduma

zilizoingizwa nchini.

17 Total input tax (boxes 13+16)/Jumla ya VAT kwenye manunuzi (Sanduku la 13+16)

18 Enter the difference between boxes 04 and 17. If box 04 exceeds box 17, the result is VAT payable in that

particular month. Where box 17 exceeds box 04 the result is VAT refundable and this figure must be entered

in brackets ( )./Jaza tofauti kati ya sanduku la 04 na 17. Iwapo kiasi kilichopo ndani ya sanduku la 04 ni

kikubwa zaidi, tofauti hiyo ni kodi unayostahili kulipa. Endapo kiasi kilichopo ndani ya sanduku la 17 ni

kikubwa kuliko kile cha sanduku la 04, tofauti hiyo iwekwe katika mabano ( ) na hicho ndicho kiasi

unachostahili kurejeshewa katika mwezi huo.

19 Enter the amount of any VAT credit brought forward from previous months/Jaza marejesho ya VAT

yanayotokana na miezi iliyopita.

20 Enter the difference between boxes 18 and 19. This is the amount actually due for payment to TRA or to be

carried forward by the trader (if it is a credit balance)/Jaza tofauti kati ya sanduku 18 na 19. Hiki ndicho kiasi

kinachostahili kulipwa TRA au kuhamishiwa mwezi unaofuata (endapo ni marejesho).

ITX240.01.B - VAT Monthly Return

Page 2 of 2

You might also like

- Anderson, Elle 2019 Federal Tax ReturnDocument13 pagesAnderson, Elle 2019 Federal Tax ReturnElle Anderson100% (2)

- 26 Contex Vs CIRDocument2 pages26 Contex Vs CIRIvan Romeo100% (1)

- Comprehensive VAT TaxationDocument172 pagesComprehensive VAT TaxationIan JameroNo ratings yet

- Congo Bomoko Earnings StatementDocument4 pagesCongo Bomoko Earnings StatementKeller Brown JnrNo ratings yet

- Proposal A The Chillspot TV Show PDFDocument13 pagesProposal A The Chillspot TV Show PDFFranco RuhindaNo ratings yet

- Percentage Taxes: Use BIR Form 2550MDocument17 pagesPercentage Taxes: Use BIR Form 2550Mcha11No ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Input Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument28 pagesInput Vat: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTAjey MendiolaNo ratings yet

- (SPIT) (Contex Corp. v. CIR) (Francisco)Document3 pages(SPIT) (Contex Corp. v. CIR) (Francisco)gundam_rose_01100% (4)

- Retired NPS: Life Ka Sahara, HamaraDocument1 pageRetired NPS: Life Ka Sahara, Hamaraहादीँक कुंभाणीNo ratings yet

- New W4Document1 pageNew W4Roberto MonterrosaNo ratings yet

- Noveltech Feeds Private Limited: Earnings DeductionsDocument1 pageNoveltech Feeds Private Limited: Earnings DeductionsPrakash LamaniNo ratings yet

- 100 - CIR v. Air India - MercadoDocument1 page100 - CIR v. Air India - MercadoVon Lee De LunaNo ratings yet

- VAT-VALUE ADDED TAX(UAEDocument64 pagesVAT-VALUE ADDED TAX(UAEAlex ko100% (1)

- Bruce Proof of ResidenceDocument1 pageBruce Proof of ResidencePaul Shenjere MutiswaNo ratings yet

- 30 Apr 2021Document1 page30 Apr 2021Madhuri MadhuNo ratings yet

- Tax2 DigestsDocument11 pagesTax2 DigestsErwin Roxas100% (1)

- How To Compute For VATDocument29 pagesHow To Compute For VATNardsdel RiveraNo ratings yet

- CIR v. PLDTDocument3 pagesCIR v. PLDTHoney BiNo ratings yet

- The 48-HOUR NoticeDocument2 pagesThe 48-HOUR NoticeKeziah Gayle ZamoraNo ratings yet

- VAT Compliance RequirementsDocument44 pagesVAT Compliance RequirementsAcademe100% (2)

- Form 1600Document4 pagesForm 1600KialicBetito50% (2)

- Chapter 9 Input VatDocument10 pagesChapter 9 Input VatHazel Jane EsclamadaNo ratings yet

- CONTEXT CORP. v. CIR - DigestDocument2 pagesCONTEXT CORP. v. CIR - DigestMark Genesis RojasNo ratings yet

- ITX 240.01.B - VAT Monthly ReturnDocument2 pagesITX 240.01.B - VAT Monthly ReturnAbracadabraGoonerLincol'otuNo ratings yet

- ISO 9001:2008 CERTIFIED ITX240.02.B_VAT Monthly ReturnDocument1 pageISO 9001:2008 CERTIFIED ITX240.02.B_VAT Monthly ReturnMartin MfinangaNo ratings yet

- Explanatory Notes For The Completion of Vat Return FormDocument3 pagesExplanatory Notes For The Completion of Vat Return FormTendai ZamangweNo ratings yet

- Contex Corporation v. Commissioner of Internal RevenueDocument2 pagesContex Corporation v. Commissioner of Internal Revenuerafael.louise.roca2244No ratings yet

- LU1 - Value-Added TaxDocument24 pagesLU1 - Value-Added Taxmandisanomzamo72No ratings yet

- How to Compute VAT Payable in the PhilippinesDocument5 pagesHow to Compute VAT Payable in the PhilippinesTere Ypil100% (1)

- Business-Tax VAT FAQsDocument11 pagesBusiness-Tax VAT FAQsBryan VidalNo ratings yet

- Lecture Slides - Lecture 01 - VAT (Part 1)Document6 pagesLecture Slides - Lecture 01 - VAT (Part 1)nkosinathiNo ratings yet

- Chapter 9 Part 1 Input VatDocument25 pagesChapter 9 Part 1 Input VatChristian PelimcoNo ratings yet

- Form 231Document9 pagesForm 231Pushkar JoshiNo ratings yet

- Tax.3213-7 Output Input and Vat PayableDocument11 pagesTax.3213-7 Output Input and Vat PayableMira Louise HernandezNo ratings yet

- Chapter 9 Input VatDocument2 pagesChapter 9 Input Vatnewlymade641No ratings yet

- Buslaw3 VATDocument58 pagesBuslaw3 VATVan TisbeNo ratings yet

- Distinguish Nature of VATDocument2 pagesDistinguish Nature of VATMark Dela CruzNo ratings yet

- Journal Entries for VATDocument11 pagesJournal Entries for VATTanbir Ahsan RubelNo ratings yet

- Frequently Asked QuestionsDocument40 pagesFrequently Asked Questionsroy rebosuraNo ratings yet

- CONTEX CORPORATION, Petitioner, Vs - HON. Commissioner of Internal Revenue, RespondentDocument13 pagesCONTEX CORPORATION, Petitioner, Vs - HON. Commissioner of Internal Revenue, RespondentJhudith De Julio BuhayNo ratings yet

- Vat+ +New+Requirements+for+Tax+InvoicesDocument3 pagesVat+ +New+Requirements+for+Tax+InvoicesCj Brits Finansiële DiensteNo ratings yet

- Value Added Tax Get The MaxDocument23 pagesValue Added Tax Get The MaxSubhash SahuNo ratings yet

- 1 Understanding VAT For BusinessesDocument6 pages1 Understanding VAT For BusinessesBensonNo ratings yet

- 2551Q-Miflores-1st-QuarterDocument3 pages2551Q-Miflores-1st-Quartercatherine aleluyaNo ratings yet

- VAT GuideZRADocument56 pagesVAT GuideZRADaniel Glen-WilliamsonNo ratings yet

- Lec 7 - VATDocument82 pagesLec 7 - VATShaun LeeNo ratings yet

- VAT FormDocument2 pagesVAT FormGbenga Ogunsakin67% (3)

- VAT Powerpoint - 2023 - Tax2ABDocument43 pagesVAT Powerpoint - 2023 - Tax2ABPitso VingerNo ratings yet

- VAT AnnotatedDocument46 pagesVAT AnnotatedDr SafaNo ratings yet

- Value Added Tax - VatDocument37 pagesValue Added Tax - VatTimoth MbwiloNo ratings yet

- Republic of the Philippines Annual Income Tax ReturnDocument14 pagesRepublic of the Philippines Annual Income Tax ReturnJoyce Ann CortezNo ratings yet

- VAT Powerpoint - 2022 - Tax2ABDocument47 pagesVAT Powerpoint - 2022 - Tax2ABNande JongaNo ratings yet

- AQ2016 IDRX FA2016 Reference MaterialDocument31 pagesAQ2016 IDRX FA2016 Reference Materialmarla_ffonteNo ratings yet

- Guide to Zambia's VAT rulesDocument56 pagesGuide to Zambia's VAT rulesC ChamaNo ratings yet

- Final PaperDocument20 pagesFinal PaperLaila PaleyanNo ratings yet

- Monthly VAT ReturnDocument34 pagesMonthly VAT ReturnEdris MatovuNo ratings yet

- 1 Basics of Value Added TaxDocument58 pages1 Basics of Value Added TaxHazel Andrea Garduque LopezNo ratings yet

- Document1BackgroundDocument3 pagesDocument1BackgroundCj Brits Finansiële DiensteNo ratings yet

- Value Added Tax (Vat) On Merchandise Purchased and SoldDocument4 pagesValue Added Tax (Vat) On Merchandise Purchased and SoldSamiha ManggisNo ratings yet

- 2015 VAT in Cambodia Sesion II 22aug 2015Document27 pages2015 VAT in Cambodia Sesion II 22aug 2015Sovanna HangNo ratings yet

- Tax BT Introduction To VATDocument5 pagesTax BT Introduction To VATJoshua Phillip TorcedoNo ratings yet

- 1702-EX Jan 2018 ENCS Final v3 PDFDocument3 pages1702-EX Jan 2018 ENCS Final v3 PDFLuz SudarioNo ratings yet

- VAT Guide 2023Document46 pagesVAT Guide 2023ELIJAHNo ratings yet

- Usage of VAT Journal in BUSYDocument6 pagesUsage of VAT Journal in BUSYSaileshResumeNo ratings yet

- Advanced II - Chapter 0 TaxDocument79 pagesAdvanced II - Chapter 0 TaxHawultu AsresieNo ratings yet

- VAT Form 201 v1.0Document27 pagesVAT Form 201 v1.0Bibhas KabiNo ratings yet

- 1701 - ITR For 2022 SampleDocument1 page1701 - ITR For 2022 SampleKaixeR 0125No ratings yet

- Value Added Tax-PDocument20 pagesValue Added Tax-PMa. Corazon CaramalesNo ratings yet

- VAT Module OverviewDocument9 pagesVAT Module OverviewCSJNo ratings yet

- Consolidation Q72Document5 pagesConsolidation Q72Fredben BenardNo ratings yet

- Venture CapitalistDocument10 pagesVenture CapitalistFredben BenardNo ratings yet

- AuditDocument3 pagesAuditFredben BenardNo ratings yet

- Ndalichako International Forex MarketDocument45 pagesNdalichako International Forex MarketFredben BenardNo ratings yet

- Answers (A) 8 Bits Are Needed (2 250 2) Then An Extended Network Prefix Is /24 or 255.255.255.0Document3 pagesAnswers (A) 8 Bits Are Needed (2 250 2) Then An Extended Network Prefix Is /24 or 255.255.255.0Fredben BenardNo ratings yet

- Calculate Self-Employment IncomeDocument6 pagesCalculate Self-Employment IncomejoanaNo ratings yet

- SolutionDocument4 pagesSolutionFareha RiazNo ratings yet

- Taxation of Motor Car PerquisiteDocument2 pagesTaxation of Motor Car PerquisiteHusain SulemaniNo ratings yet

- PriceList - Ramky One Orbit - 99acresDocument2 pagesPriceList - Ramky One Orbit - 99acresVishal SoniNo ratings yet

- Invoice 5120673474.pdf-1571570645654Document1 pageInvoice 5120673474.pdf-1571570645654Shaunak JādhavNo ratings yet

- Income Tax Assessment TypesDocument2 pagesIncome Tax Assessment TypesJNVU WEBINARNo ratings yet

- BIR Requirements for Starting and Closing a BusinessDocument4 pagesBIR Requirements for Starting and Closing a BusinessMa Therese MontessoriNo ratings yet

- PORD3105221240039A324Document1 pagePORD3105221240039A324arkadebhaldarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document9 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961VVB MULTI VENTURE FINANCENo ratings yet

- Qhicfsheet 12Document3 pagesQhicfsheet 12Shahid HamidNo ratings yet

- InvertedDocument2 pagesInvertedShrikant KeskarNo ratings yet

- Tambunting Pawnshop vs. CIR DGDocument1 pageTambunting Pawnshop vs. CIR DGKimberly ResurreccionNo ratings yet

- Meesho Payments A4lfl 1627030049858Document5 pagesMeesho Payments A4lfl 1627030049858Ramakrishna SriNo ratings yet

- Tax Invoice: Neo Structo Construction Pvt. LTDDocument1 pageTax Invoice: Neo Structo Construction Pvt. LTDnithinNo ratings yet

- Statement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2018-19Document1 pageStatement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2018-19Nivedh VijayakrishnanNo ratings yet

- US Tax Preparation Course - Orientation - 01 SepDocument18 pagesUS Tax Preparation Course - Orientation - 01 Sepadnan.riaz81155No ratings yet

- AffidavitOfNonfiling ITR MedallaDocument1 pageAffidavitOfNonfiling ITR MedallaHeart LeroNo ratings yet

- Understanding The Basics of GSTDocument2 pagesUnderstanding The Basics of GSTAishwarya ShelarNo ratings yet

- Foreign Investment Real Property Tax Act (FIRPTA)Document1 pageForeign Investment Real Property Tax Act (FIRPTA)book15wormNo ratings yet

- Business Tax AssignementDocument7 pagesBusiness Tax AssignementAleya MonteverdeNo ratings yet