Professional Documents

Culture Documents

Ms. Motipur Zamindary Co. (Private) Ltd. v. State of Bihar - 52

Uploaded by

knkmuraliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ms. Motipur Zamindary Co. (Private) Ltd. v. State of Bihar - 52

Uploaded by

knkmuraliCopyright:

Available Formats

47

subject to the exceptions, if any, set out in the corresponding entry in the third

column thereof.

THE SCHEDULE

Serial No. of goods Description

6. Exception subject to which the exemption has been allowed.

Green vegetables other than potatoes Except when sold in

sealed containers….”

The question raised is that sugar-cane falls within the term “green vegetables” in Entry 6

of the Schedule and is therefore exempt from assessment to sales tax. In support of this

contention counsel for the appellant relied upon a judgment of the Bombay High Court, State

of Bombay v. R.S. Phadtare [7 STC 495], where it was held that sugar-cane is “fresh

vegetable” and is therefore exempt from sales tax under a similar notification issued under the

Bombay Sales Tax Act. Chagla, C.J. there observed at p. 496 as follows:

“In its plain and natural meaning a ‘vegetable’ clearly is wide enough to cover

‘sugar-cane’; but what is urged by the Advocate-General is that we must not give it

that wide meaning but must give it the popular meaning as understood by people who

deal in vegetables or eat vegetables, and it is urged that from that narrow and

restricted point of view sugar-cane is not vegetable. This is a taxing statute and if two

constructions are possible we must lean in favour of that construction which gives

relief to the subject. That was exactly the approach of the Sales Tax Tribunal and in

our opinion that approach was a very proper one.”

This observation is not in accord with the opinion given by this Court in Ramavatar

Budhaiprasad etc. v. Assistant Sales Tax Officer, Akola [AIR 1961 SC 1325], in which

under an almost identical entry it was held that “betel leaves” is not included in the term

“vegetables”. After quoting with approval a passage from the judgment of the Nagpur High

Court, Madhya Pradesh Pan Merchants’ Association v. State of Madhya Pradesh [7 STC

99], this court said:

“The word ‘vegetables’ in taxing statutes is to be understood as in common

parlance i.e. denoting class of vegetables which are grown in a kitchen garden or in a

farm and are used for the table.”

If that is the meaning of the word “vegetables” sugar-cane cannot fall within Entry 6

which relates to green vegetables. In Webster’s Dictionary “sugar-cane” has been defined as

“a grass extensively grown in tropical and warm regions for its sugar” and in Oxford

Dictionary it is defined as “a tall perennial grass cultivated in tropical and sub-tropical

countries and forming the chief source of unmanufactured sugar”. Therefore it cannot be said

that sugar-cane falls within the definition of the words “green vegetables”.

5. The second question which was raised before us and which arises in the petitions under

Article 32 is that the appellant Company is not a “dealer” within the meaning of the word as

defined in Section 2(c) of the Act which is as follows:

“ ‘dealer’ means any person who sells or supplies any goods (including goods sold or

supplied in the execution of a contract) whether for commission, remuneration or

You might also like

- AD Case Note IosDocument5 pagesAD Case Note IosparmeshwarNo ratings yet

- Ms. Motipur Zamindary Co. (Private) Ltd. v. State of Bihar - 51Document1 pageMs. Motipur Zamindary Co. (Private) Ltd. v. State of Bihar - 51knkmuraliNo ratings yet

- CUSB2113125011 - (Aditya Sinha) - State of U.P. vs. Nawab HussainDocument15 pagesCUSB2113125011 - (Aditya Sinha) - State of U.P. vs. Nawab HussainAditya SinhaNo ratings yet

- High Court Order Dismisses Petition Against NIA FIRDocument8 pagesHigh Court Order Dismisses Petition Against NIA FIRShreya SinhaNo ratings yet

- TC - 07 Petitioner MemorialDocument24 pagesTC - 07 Petitioner MemorialTC 05 - Speaker 2No ratings yet

- Memorial On Behalf of The PetitionerDocument28 pagesMemorial On Behalf of The PetitionerAyush YadavNo ratings yet

- Timber Tree As Movable or Immovable PropertyDocument6 pagesTimber Tree As Movable or Immovable PropertyAditya ShahNo ratings yet

- AIR 1955 SC 25 The Edward Mills Co. LTD., Beawar and Ors. v. The State of Ajmer and Anr.Document10 pagesAIR 1955 SC 25 The Edward Mills Co. LTD., Beawar and Ors. v. The State of Ajmer and Anr.Harsh GargNo ratings yet

- Family Law II Internal: Ajit Datt v. Ethel WaltersDocument5 pagesFamily Law II Internal: Ajit Datt v. Ethel WaltersUjjwal AnandNo ratings yet

- Contractual Liability of StateDocument18 pagesContractual Liability of StateShivanshu SinghNo ratings yet

- Mamlatdars' Courts Act, 1906Document17 pagesMamlatdars' Courts Act, 1906Adv. Ibrahim Deshmukh100% (1)

- Pure Theory of Law Hans Kelson-Ltp..Document45 pagesPure Theory of Law Hans Kelson-Ltp..ShabnamNo ratings yet

- C.I.T. v. G.R. KarthikeyanDocument2 pagesC.I.T. v. G.R. KarthikeyanRonit Kumar0% (1)

- High Court Jurisdiction Over Animal Preservation ActDocument17 pagesHigh Court Jurisdiction Over Animal Preservation ActswatiNo ratings yet

- Code of Criminal Procedure Project ReportDocument28 pagesCode of Criminal Procedure Project ReportUdhayveer Thakur50% (2)

- Case Law: Danamma Suman Surpur and Another V. Amar and OthersDocument8 pagesCase Law: Danamma Suman Surpur and Another V. Amar and OthersIndrakumar CheluvaranganNo ratings yet

- Art 21-1Document9 pagesArt 21-1AnonymousNo ratings yet

- Kehar Singh V Union of India (AIR 1989 SC 653)Document2 pagesKehar Singh V Union of India (AIR 1989 SC 653)ramanjeet singh100% (4)

- Courtroom Bail HearingDocument11 pagesCourtroom Bail HearingAbhishekGautamNo ratings yet

- Interpretation of Statue Case LawDocument18 pagesInterpretation of Statue Case LawHrishika NetamNo ratings yet

- Maneka Gandhi Vs UOIDocument4 pagesManeka Gandhi Vs UOIBiju Prasad100% (1)

- Mischief Rule of Interpretation: (Reason For Law)Document12 pagesMischief Rule of Interpretation: (Reason For Law)st dharmaNo ratings yet

- Chhattisgarh Rent Control Act, 2011Document10 pagesChhattisgarh Rent Control Act, 2011pankaj dhillonNo ratings yet

- Juvenile Justice Act proceduresDocument53 pagesJuvenile Justice Act proceduresRamseena UdayakumarNo ratings yet

- Rajasthan HC Rules on Land Auction Dispute Involving SC MemberDocument6 pagesRajasthan HC Rules on Land Auction Dispute Involving SC MemberMayank SenNo ratings yet

- Prakash V MST SahaniDocument8 pagesPrakash V MST SahaniAditi IndraniNo ratings yet

- Jasvinder Saini and Ors. vs. State (Govt. of NCT of Delhi) (02.07.2013 - SC)Document3 pagesJasvinder Saini and Ors. vs. State (Govt. of NCT of Delhi) (02.07.2013 - SC)tarun chhapolaNo ratings yet

- Supreme Court Memorial on Dismissal of Writ Petition Against Deemed UniversityDocument10 pagesSupreme Court Memorial on Dismissal of Writ Petition Against Deemed UniversityPulkit ChannanNo ratings yet

- Classes of Tenure-Holders: Dr. Nand Kishor Associate Professosr Law University of Lucknow LucknowDocument10 pagesClasses of Tenure-Holders: Dr. Nand Kishor Associate Professosr Law University of Lucknow Lucknowshweta100% (1)

- Ajit Pawar JudgementDocument40 pagesAjit Pawar JudgementShailesh GandhiNo ratings yet

- Contract IiDocument22 pagesContract IiPranay BhardwajNo ratings yet

- APCR Vs UOIDocument58 pagesAPCR Vs UOIAnaghNo ratings yet

- Arguments of Shayara BanoDocument17 pagesArguments of Shayara BanoSowmya ChowdaryNo ratings yet

- Versus: Upon Submission To The Honourable Chief Justice and His Companion Justices of Honourable Supreme Court of IndDocument7 pagesVersus: Upon Submission To The Honourable Chief Justice and His Companion Justices of Honourable Supreme Court of InddeekshaNo ratings yet

- Trust Laws in India: An Overview of Key ConceptsDocument7 pagesTrust Laws in India: An Overview of Key ConceptsSaurabh Krishna SinghNo ratings yet

- Tej Kiran Jain v. N. Sanjiva Reddy-36-37Document2 pagesTej Kiran Jain v. N. Sanjiva Reddy-36-37knkmuraliNo ratings yet

- Case Notes All Cases Family II TermDocument20 pagesCase Notes All Cases Family II TermRishi Aneja100% (1)

- Ebrahim Vazir Mavat AppellantDocument15 pagesEbrahim Vazir Mavat AppellantAdv Saif MobhaniNo ratings yet

- ADR in Village Courts Act: Access To Justice or Long Way To Go?Document8 pagesADR in Village Courts Act: Access To Justice or Long Way To Go?Debjyoti SarkarNo ratings yet

- Section 9 of The Hindu Marriage ActDocument2 pagesSection 9 of The Hindu Marriage ActPranav PalNo ratings yet

- Rules of The High Court of Kerala, 1971Document120 pagesRules of The High Court of Kerala, 1971gensgeorge4328No ratings yet

- Shibu Soren Vs Dayanand Sahay & Ors. 19 July, 2001 PDFDocument18 pagesShibu Soren Vs Dayanand Sahay & Ors. 19 July, 2001 PDFPiyush KulshreshthaNo ratings yet

- Supreme Court's sky-high powers to remedy injusticeDocument16 pagesSupreme Court's sky-high powers to remedy injusticeMuhammad Siraj Khan100% (1)

- Bachan Singh Vs State of PunjabDocument2 pagesBachan Singh Vs State of PunjabKrishnaNo ratings yet

- Specific performance of sale agreementsDocument6 pagesSpecific performance of sale agreementsraju634100% (1)

- Family Law Case Commentary on Disinheritance of a Murderer's WifeDocument9 pagesFamily Law Case Commentary on Disinheritance of a Murderer's WiferishabhNo ratings yet

- Lachhman Das and Anr V, Mt. Gulab Devi-1Document14 pagesLachhman Das and Anr V, Mt. Gulab Devi-1Atul100% (1)

- Result of Munsiff Magistrate ExamDocument12 pagesResult of Munsiff Magistrate Examjishin100% (2)

- Commissioner Of Sales Tax, U.P vs Madan Lal Dass & Sons, 1977 SCR (1) 683Document2 pagesCommissioner Of Sales Tax, U.P vs Madan Lal Dass & Sons, 1977 SCR (1) 683RenuNo ratings yet

- CRPC Project (190101131)Document21 pagesCRPC Project (190101131)Sonal YadavNo ratings yet

- CRPC VS BNSSDocument41 pagesCRPC VS BNSSudisha tyagiNo ratings yet

- PROJECT FILE- COMPANY LAWDocument25 pagesPROJECT FILE- COMPANY LAWParamjit SinghNo ratings yet

- Vishnu - Sale Deed - First DraftDocument3 pagesVishnu - Sale Deed - First Draftvishnu PNo ratings yet

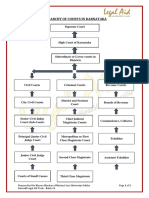

- Hierarchy of Courts in KarnatakaDocument2 pagesHierarchy of Courts in Karnatakadiya dollyNo ratings yet

- Kamarajar PDFDocument3 pagesKamarajar PDFDinesh KumarNo ratings yet

- Effect of Flaws in ConsentDocument24 pagesEffect of Flaws in Consentgowtham100% (1)

- Compensation Nilabati Behera V State of Orissa 1993 SCC 746: A. Supreme CourtDocument2 pagesCompensation Nilabati Behera V State of Orissa 1993 SCC 746: A. Supreme CourtkendredpNo ratings yet

- State of West Bengal Vs Washi AhmedDocument4 pagesState of West Bengal Vs Washi AhmedAthiban VijayNo ratings yet

- St. of WB v. Washi AhmedDocument4 pagesSt. of WB v. Washi AhmedAnkitaNo ratings yet

- Ramavatar Budhaiprasad v. Asstt. S.T.O-49-50Document2 pagesRamavatar Budhaiprasad v. Asstt. S.T.O-49-50knkmuraliNo ratings yet

- Tej Kiran Jain v. N. Sanjiva Reddy-36-37Document2 pagesTej Kiran Jain v. N. Sanjiva Reddy-36-37knkmuraliNo ratings yet

- Ms. Motipur Zamindary Co. (Private) Ltd. v. State of Bihar - 53Document1 pageMs. Motipur Zamindary Co. (Private) Ltd. v. State of Bihar - 53knkmuraliNo ratings yet

- D. M., Aravali Golf Club v. Chander Hass - 27-35Document9 pagesD. M., Aravali Golf Club v. Chander Hass - 27-35knkmuraliNo ratings yet

- Jugalkishore v. Raw Cotton Co-38-40Document3 pagesJugalkishore v. Raw Cotton Co-38-40knkmuraliNo ratings yet

- D. M., Aravali Golf Club v. Chander Hass - 27-35Document9 pagesD. M., Aravali Golf Club v. Chander Hass - 27-35knkmuraliNo ratings yet

- Jugalkishore v. Raw Cotton Co-38-40Document3 pagesJugalkishore v. Raw Cotton Co-38-40knkmuraliNo ratings yet

- B.N. Mutto v. T.K. Nandi (DR) - 41-48Document8 pagesB.N. Mutto v. T.K. Nandi (DR) - 41-48knkmuraliNo ratings yet

- Padma Sundara Rao v. State of T.N - 22-26Document5 pagesPadma Sundara Rao v. State of T.N - 22-26knkmurali100% (1)

- Criminal Revisison Petition Format - VIPDocument3 pagesCriminal Revisison Petition Format - VIPknkmurali100% (2)

- Padma Sundara Rao v. State of T.N - 22-26Document5 pagesPadma Sundara Rao v. State of T.N - 22-26knkmurali100% (1)

- DIVORCE GROUNDS FOR CHRISTIANS IN INDIADocument3 pagesDIVORCE GROUNDS FOR CHRISTIANS IN INDIAknkmuraliNo ratings yet

- B.N. Mutto v. T.K. Nandi (DR) - 41-48Document8 pagesB.N. Mutto v. T.K. Nandi (DR) - 41-48knkmuraliNo ratings yet

- Medical Books TenderDocument30 pagesMedical Books Tenderknkmurali0% (1)

- Corruption Perceptions Index 2015 Report PDFDocument20 pagesCorruption Perceptions Index 2015 Report PDFDavid SarmientoNo ratings yet

- SC On Dp3 ImplementationDocument6 pagesSC On Dp3 ImplementationknkmuraliNo ratings yet

- HCCH - DetailsDocument5 pagesHCCH - DetailsknkmuraliNo ratings yet

- High Court Criminal Side VakalatDocument2 pagesHigh Court Criminal Side Vakalatknkmurali50% (12)

- Best Sections of CRPCDocument1 pageBest Sections of CRPCknkmuraliNo ratings yet

- The International Court of Justice and Human RightsDocument8 pagesThe International Court of Justice and Human RightsknkmuraliNo ratings yet

- Punjab and Haryana HC Dowry Case AcquittedDocument5 pagesPunjab and Haryana HC Dowry Case AcquittedknkmuraliNo ratings yet

- Asset Declaration in UkraineDocument9 pagesAsset Declaration in UkraineknkmuraliNo ratings yet

- Template of D.P Section 3 ComplaintDocument7 pagesTemplate of D.P Section 3 ComplaintknkmuraliNo ratings yet

- 19dec2008 DNA WomanBookedForGivingDowryDocument1 page19dec2008 DNA WomanBookedForGivingDowryknkmuraliNo ratings yet

- HC-SNDhingra - 01Nov07-498Acquit - DowryclaimsNotVerified - Narender Kumar and Anr. Vs StateDocument10 pagesHC-SNDhingra - 01Nov07-498Acquit - DowryclaimsNotVerified - Narender Kumar and Anr. Vs StateknkmuraliNo ratings yet

- Asset Declaration in Ukraine PDFDocument9 pagesAsset Declaration in Ukraine PDFknkmuraliNo ratings yet

- Dp3 Filled On FIL - Karkardooma CourtDocument6 pagesDp3 Filled On FIL - Karkardooma CourtknkmuraliNo ratings yet

- 16Apr2009-DNA-DP3 - Delhi - Man Moves Court Against Wife in False Dowry CaseDocument1 page16Apr2009-DNA-DP3 - Delhi - Man Moves Court Against Wife in False Dowry CaseknkmuraliNo ratings yet

- Agr Kcse 2016 P1Document13 pagesAgr Kcse 2016 P1lixus mwangiNo ratings yet

- Orchids Are Easily Distinguished From Other PlantsDocument7 pagesOrchids Are Easily Distinguished From Other PlantsxxxNo ratings yet

- 01 Alca Plant Problem Diagnosis 2020Document111 pages01 Alca Plant Problem Diagnosis 2020madni_sthNo ratings yet

- KahootDocument5 pagesKahootapi-533955325No ratings yet

- Price Quotation PDFDocument7 pagesPrice Quotation PDFMoana AranasNo ratings yet

- Louis Xiv PowerpointDocument6 pagesLouis Xiv PowerpointMaya KhaledNo ratings yet

- Chain Link Fence GuideDocument9 pagesChain Link Fence GuideChase GietterNo ratings yet

- Avocado Growing in UgandaDocument2 pagesAvocado Growing in UgandaIsaac MusinguziNo ratings yet

- Crop Production and Manegment Notes Class 8Document6 pagesCrop Production and Manegment Notes Class 8Nyasa GandhiNo ratings yet

- Detailed Lesson Plan in Tle 6Document2 pagesDetailed Lesson Plan in Tle 6Jhasmine Sulit100% (6)

- 4/3/2 Ielts 4/3/2 IeltsDocument13 pages4/3/2 Ielts 4/3/2 IeltsRICHARD SIMMONSNo ratings yet

- NXTLVL Farms Case StudyDocument11 pagesNXTLVL Farms Case StudyFrancis Anne DoradoNo ratings yet

- Y. D. Pawar and Pushpraj SinghDocument16 pagesY. D. Pawar and Pushpraj SinghShivraj PatilNo ratings yet

- Reading Comprehension IDocument2 pagesReading Comprehension IGisela Farinelli TagliacolloNo ratings yet

- HAPAG Monitoring Report 2nd SemesterDocument4 pagesHAPAG Monitoring Report 2nd SemesterDon PerfectoNo ratings yet

- Daily Reporting Format Kalbar 16 September 2023Document21 pagesDaily Reporting Format Kalbar 16 September 2023Muhammad MaulanaNo ratings yet

- Dec 2 Wild Bitter GourdDocument1 pageDec 2 Wild Bitter GourdJob Zine'dineNo ratings yet

- Primary Tillage Equipment: Tillage Is The Preparation of The Soil ForDocument8 pagesPrimary Tillage Equipment: Tillage Is The Preparation of The Soil ForYendis SamsonNo ratings yet

- Lexus Ls500 2018 Electrical Wiring DiagramDocument22 pagesLexus Ls500 2018 Electrical Wiring Diagramjacquelinelee021200sfj100% (131)

- Calculating Reinforcing Steel Weight in 1 Cubic Meter of ConcreteDocument122 pagesCalculating Reinforcing Steel Weight in 1 Cubic Meter of ConcreteAlfiyaNo ratings yet

- Agri Science SBADocument11 pagesAgri Science SBADylan Douglas0% (1)

- UNIT IV (Irrigation Notes)Document30 pagesUNIT IV (Irrigation Notes)Varun Singh ChandelNo ratings yet

- Agri PPT Valpoly Maam GallibotDocument107 pagesAgri PPT Valpoly Maam GallibotCamila DaleNo ratings yet

- 2022 FAOaDocument60 pages2022 FAOaPriscila FerriteNo ratings yet

- Agric Notes Form 1-3Document101 pagesAgric Notes Form 1-3Thabiso MaikanoNo ratings yet

- GR 4 Science Study Content UpdatedDocument28 pagesGR 4 Science Study Content UpdatedAbdullah SajidNo ratings yet

- Class 8th ScienceDocument238 pagesClass 8th ScienceSanchiNo ratings yet

- Brochure ProduitDocument48 pagesBrochure ProduitLiv CBNo ratings yet

- Fractions and properties of multiplication worksheetDocument5 pagesFractions and properties of multiplication worksheetXandra Sadiwa DiamanteNo ratings yet

- Landscape Design (3. Plants and Design)Document8 pagesLandscape Design (3. Plants and Design)Hafsah SiddiquaNo ratings yet