Professional Documents

Culture Documents

Ahorro, Jose Ramon R. Target Corporation Wal-Mart Stores, Inc

Uploaded by

Stye Sense Ph0 ratings0% found this document useful (0 votes)

28 views1 pageACCOUNTING

Original Title

Sheet1 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACCOUNTING

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views1 pageAhorro, Jose Ramon R. Target Corporation Wal-Mart Stores, Inc

Uploaded by

Stye Sense PhACCOUNTING

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

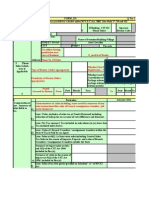

Ahorro, Jose Ramon R.

Target Wal-Mart Wal-mart

Corporation Stores, Inc. Target Corp. Stores, inc.

A. Current Ratio 1.604651163 0.8140589181 Net Sales $61,471.00 $374,526.00

Accounts Receivable Turnover 0.06393626571 0.07785877662 Cost of Goods sold $41,895.00 $286,515.00

Selling & administrative

Average collection period #DIV/0! #DIV/0! expenses $16,200.00 $70,847.00

Inventory Turnover 1.604651163 0.8140589181 Interest expense $647.00 $1,798.00

Days in inventory 1.468376166 2.865840997 Other income (expense) $1,896.00 $4,373.00

Profit margin 0.04634705796 0.0339922996 Income tax expense $1,776.00 $6,908.00

Asset turnover 0.09257181329 0.1244786379 Net income $2,849.00 $12,731.00

Return on assets #DIV/0! #DIV/0!

Return on common

stockholders' equity $0.00 $0.00 Current Assets $18,906.00 $47,585.00

Debt to assets ratio $0.00 $0.00 Noncurrent assets $25,654.00 $115,929.00

Times interest earned $0.00 $0.00 Total assets $44,560.00 $163,514.00

Current liablities $11,782.00 $58,454.00

long term debt $17,471.00 $40,452.00

Total stockholders' equity $15,307.00 $64,608.00

Total liablitities &

stockholders' equity $44,560.00 $163,514.00

Total Assets $37,349.00 $151,587.00

Total stockholders' equity $15,633.00 $61,573.00

Current liabilities $11,117.00 $52,148.00

total liabilities $21,716.00 $90,014.00

Average net accounts

receivable $7,124.00 $3,247.00

Average inventory $6,517.00 $34,433.00

Net cash provided by

operating activities $4,125.00 $20,354.00

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Financial Management Assignment 1Document3 pagesFinancial Management Assignment 12K22DMBA67 kushankNo ratings yet

- 2104040066 Nguyễn Thị Tuyết MaiDocument3 pages2104040066 Nguyễn Thị Tuyết MaiHoàng HuếNo ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- Verizon Communications Inc.: Horizontal AnalysisDocument42 pagesVerizon Communications Inc.: Horizontal Analysisjm gonzalezNo ratings yet

- Financial Management Week 4Document5 pagesFinancial Management Week 4giezel francoNo ratings yet

- Desarrollo de Caso Nº4 MERCURYDocument39 pagesDesarrollo de Caso Nº4 MERCURYclaudia aguillonNo ratings yet

- FINC 721 Project 2Document2 pagesFINC 721 Project 2Sameer BhattaraiNo ratings yet

- Standard Balance Sheet PT SEJAHATERADocument1 pageStandard Balance Sheet PT SEJAHATERAErma WulandariNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- File 000030Document4 pagesFile 000030Nicholas GunnellNo ratings yet

- PepsiCo Financial StatementsDocument9 pagesPepsiCo Financial StatementsBorn TaylorNo ratings yet

- Data Year-End Common Stock Price: Ratios SolutionDocument2 pagesData Year-End Common Stock Price: Ratios SolutionTarun KatariaNo ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- Balance Sheet As of January 2017: Jl. Kaliurang No. 34 YogyakartaDocument1 pageBalance Sheet As of January 2017: Jl. Kaliurang No. 34 YogyakartaTasya Vicky AngleNo ratings yet

- Financial PlanDocument12 pagesFinancial PlanNico BoialterNo ratings yet

- Genmo CorporationDocument12 pagesGenmo CorporationAarushi Pawar100% (1)

- Financial Management - Brigham Chapter 3Document4 pagesFinancial Management - Brigham Chapter 3Fazli AleemNo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- Value Drivers (Assumptions)Document6 pagesValue Drivers (Assumptions)Phuong ThaoNo ratings yet

- Cattle Fattening FinancialsDocument5 pagesCattle Fattening Financialsprince kupaNo ratings yet

- Druthers Forming Answer KeyDocument3 pagesDruthers Forming Answer KeyDesventes AdrienNo ratings yet

- Chapter 2 Team ProjectDocument2 pagesChapter 2 Team ProjectRaisa TasnimNo ratings yet

- Tugas Kelompok Ke-2 (Minggu 5/ Sesi 7) Financial Modelling LaboratoryDocument13 pagesTugas Kelompok Ke-2 (Minggu 5/ Sesi 7) Financial Modelling LaboratoryRexy HannerNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- Ratio and Income and Balance SheetDocument12 pagesRatio and Income and Balance SheetJerry RodNo ratings yet

- Income StatementDocument3 pagesIncome StatementAjederezNo ratings yet

- Larrys Bicycle Shop - Annual Financial Statements - Original HardcodedDocument4 pagesLarrys Bicycle Shop - Annual Financial Statements - Original HardcodedLarry MaiNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationAyesha KanwalNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDocument4 pagesRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiNo ratings yet

- CH 22062017 1Document9 pagesCH 22062017 1MohitNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Copy of Broiler FinancialsDocument5 pagesCopy of Broiler Financialskevior2No ratings yet

- 1 - Week 6 Final Case Project Workbook - Abc Company - Spring 2019Document8 pages1 - Week 6 Final Case Project Workbook - Abc Company - Spring 2019Minh Van NguyenNo ratings yet

- Michael Hermawan Yuwono MGMT6346 Ba10 UtpDocument36 pagesMichael Hermawan Yuwono MGMT6346 Ba10 UtpchristianNo ratings yet

- Ratios and Financial Planning at East Coast YachtsDocument6 pagesRatios and Financial Planning at East Coast YachtsSpatiha Pathmanaban67% (3)

- Financial Planning Business Plan: 7.1 Important AssumptionsDocument32 pagesFinancial Planning Business Plan: 7.1 Important AssumptionstemesgenNo ratings yet

- FA Assignment (KDC) - Group 2Document3 pagesFA Assignment (KDC) - Group 2Himadri JanaNo ratings yet

- Financial Analysis of Amazom - Inc CompanyDocument9 pagesFinancial Analysis of Amazom - Inc Companyshepherd junior masasiNo ratings yet

- Balance Sheet of Tata Power Company: - in Rs. Cr.Document3 pagesBalance Sheet of Tata Power Company: - in Rs. Cr.ashishrajmakkarNo ratings yet

- Afs ExcelDocument8 pagesAfs ExcelAyesha SheheryarNo ratings yet

- Standard Balance Sheet JalalDocument1 pageStandard Balance Sheet JalalTeuku HafidhNo ratings yet

- Coffee Shop Financial PlanDocument27 pagesCoffee Shop Financial PlankkornchomNo ratings yet

- 20190312220046BN001184625Document10 pages20190312220046BN001184625Roifah AmeliaNo ratings yet

- Balance Sheet: SoniaDocument2 pagesBalance Sheet: Soniadelhi expressNo ratings yet

- Tarea Contabilidad Ingles - Es.enDocument2 pagesTarea Contabilidad Ingles - Es.enLUIS ENRIQUE VELASCO MENDOZANo ratings yet

- Income Statement: Dec-16 Dec-17Document14 pagesIncome Statement: Dec-16 Dec-17HetviNo ratings yet

- Annual Report: Balance SheetDocument2 pagesAnnual Report: Balance Sheetshruthi sainathNo ratings yet

- Homework Chapter 13 Case From Text BookDocument23 pagesHomework Chapter 13 Case From Text Bookjhanzab0% (1)

- Assignment 2Document5 pagesAssignment 2Ahmad SaleemNo ratings yet

- Below Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Document3 pagesBelow Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Ayushi SinghalNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Business AccountingDocument14 pagesBusiness AccountingLoguNo ratings yet

- Test 2 Financial MGTDocument4 pagesTest 2 Financial MGTBervie RondonuwuNo ratings yet

- Balance Sheet Formula Excel TemplateDocument5 pagesBalance Sheet Formula Excel TemplateD suhendarNo ratings yet

- Statement of IncomeDocument10 pagesStatement of IncomeScribdTranslationsNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosStye Sense PhNo ratings yet

- Ahorro, Jose Ramon R-Capital Budgeting ConceptsDocument1 pageAhorro, Jose Ramon R-Capital Budgeting ConceptsStye Sense PhNo ratings yet

- FinaMgt - Assignment - TVMDocument2 pagesFinaMgt - Assignment - TVMStye Sense PhNo ratings yet

- Cash ReceiptsDocument2 pagesCash ReceiptsStye Sense PhNo ratings yet

- Oct Nov DecDocument3 pagesOct Nov DecStye Sense PhNo ratings yet

- 7 8 21Document1 page7 8 21Stye Sense PhNo ratings yet

- Finamgt 8 - 9Document1 pageFinamgt 8 - 9Stye Sense PhNo ratings yet

- Quiz 3Document3 pagesQuiz 3Stye Sense PhNo ratings yet

- Mabola TradingDocument2 pagesMabola TradingStye Sense PhNo ratings yet

- Quiz July 27Document1 pageQuiz July 27Stye Sense PhNo ratings yet

- 5 11 20Document1 page5 11 20Stye Sense PhNo ratings yet

- Sales Budgeting6!10!21Document2 pagesSales Budgeting6!10!21Stye Sense PhNo ratings yet

- The World Is Yours 0923 Mit Fbo 1Document14 pagesThe World Is Yours 0923 Mit Fbo 1api-541901683No ratings yet

- ACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2Document14 pagesACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2727822TPMB005 ARAVINTHAN.SNo ratings yet

- Corporate Finance 2 SyllabusDocument11 pagesCorporate Finance 2 SyllabusMai NguyenNo ratings yet

- Maintain Financial Standards & Records RefinedDocument107 pagesMaintain Financial Standards & Records RefinedMamet LiangNo ratings yet

- M1 M5 Baen PoaDocument70 pagesM1 M5 Baen PoaFor Ni-kiNo ratings yet

- From NetDocument51 pagesFrom NetAsma ShoaibNo ratings yet

- 360 Degree Deal in Music Recording ContractsDocument8 pages360 Degree Deal in Music Recording ContractsPriyansh Singh RajputNo ratings yet

- Caf 06 Principles of Taxation QBDocument115 pagesCaf 06 Principles of Taxation QBSajid Ali100% (2)

- Tata Motors ValuationDocument32 pagesTata Motors ValuationraaunakNo ratings yet

- Bank Mergers PerformanceDocument19 pagesBank Mergers PerformanceLily SarriNo ratings yet

- Ibra Fa 1Document8 pagesIbra Fa 1Michael KitongaNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument33 pagesResponsibility Acctg Transfer Pricing GP AnalysisMoonNo ratings yet

- Form 231Document14 pagesForm 231Jignesh Dinesh MewadaNo ratings yet

- CAIIB BFM Important Formula PDF by Ambitious BabaDocument3 pagesCAIIB BFM Important Formula PDF by Ambitious BabasborboraNo ratings yet

- Program Budgetary Needs AssessmentDocument2 pagesProgram Budgetary Needs Assessmentapi-545672189100% (1)

- Finance Report 2022Document191 pagesFinance Report 2022Cam TuNo ratings yet

- Pmegp: Readymade Garments BusinessDocument6 pagesPmegp: Readymade Garments Businesskartik DebnathNo ratings yet

- Progressive Dev't Corp. v. Quezon CityDocument4 pagesProgressive Dev't Corp. v. Quezon CityOne TwoNo ratings yet

- Flint Water and Strategic-Structural Racism FinalDocument67 pagesFlint Water and Strategic-Structural Racism FinalJaimeNo ratings yet

- FRA Eicher Motors - Saurav Raj and Radhesh MadirajuDocument64 pagesFRA Eicher Motors - Saurav Raj and Radhesh MadirajuSaurav RajNo ratings yet

- Lecture 8 Construction Contracts Ias 11 Revision Notes PDFDocument6 pagesLecture 8 Construction Contracts Ias 11 Revision Notes PDFKim Nicole ReyesNo ratings yet

- Aat FSTP Tutor QB 2015-16 - QsDocument26 pagesAat FSTP Tutor QB 2015-16 - Qskbassignment100% (1)

- Cadet Uniform ServicesDocument62 pagesCadet Uniform ServicesManzoor A Khoda67% (6)

- Oracle 11i and R12 Time and Labor (OTL) Timecard Configuration (Doc ID 304340.1)Document17 pagesOracle 11i and R12 Time and Labor (OTL) Timecard Configuration (Doc ID 304340.1)krishnaNo ratings yet

- Solution To In-Class Quiz 2Document11 pagesSolution To In-Class Quiz 2Piyush SharmaNo ratings yet

- BU330 Accounting For ManagerDocument88 pagesBU330 Accounting For ManagerG Jha100% (1)

- Revenue PlaybookDocument46 pagesRevenue PlaybookJesse Haller100% (1)

- First Statement:: Answer: ADocument6 pagesFirst Statement:: Answer: AJames DiazNo ratings yet

- Income StatementDocument4 pagesIncome StatementBurhan AzharNo ratings yet

- Financial Statement Analysis and Valuation For Rio Tinto CompanyDocument9 pagesFinancial Statement Analysis and Valuation For Rio Tinto CompanyBachia Trương100% (1)