Professional Documents

Culture Documents

A Case Study of SME Clusters in Bogra

Uploaded by

Sajjad HossainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Case Study of SME Clusters in Bogra

Uploaded by

Sajjad HossainCopyright:

Available Formats

Dialogue on

Development of Small and Medium Enterprises of the Bogra Region

Challenges and Initiatives

Study on

National Budget and Decentralised Development of SMEs

A Case Study of SME Clusters in Bogra

Presentation by

Dr Khondaker Golam Moazzem

Additional Research Director, CPD

Bogra: 24 March 2016

Study Team

Dr Khondaker Golam Moazzem

Additional Research Director

Kishore Kumer Basak

Senior Research Associate

Mahtab Uddin Ahmed

Research Associate

CPD (2016): National Budget and Development of SMEs 2

Discussion Points

• Introduction: Objectives & Methodology

• Development of SMEs in National Budgets: FY2005-FY2015

• Major SME Clusters in the Bogra Region: Major Features and Challenges

• Addressing the Challenges Confronted by the SMEs in the Bogra Region

• Concluding Remarks

CPD (2016): National Budget and Development of SMEs 3

Introduction: Objectives & Methodology

• Development of SMEs is one of the major policy priorities of GoB

• Positive impact on alleviation of poverty by generating employment and

income as well as creating opportunities for new entrepreneurs

• Major national policies (6th & 7th FYPs, Industrial policy, SME strategy,

trade policy) have special focus on SME development

• International development agenda: MDGs and 2030 Agenda for sustainable

development have also highlighted the role of the private sector particularly of

the SMEs

• A large SME sector is in operation in Bangladesh as like in other

developing countries– 50% of the total manufacturing enterprises (with 10

or more workers)

• 36.6% are small and 14.3% are medium

• 35.5% of total manufacturing employment

• 47% of gross value added

CPD (2016): National Budget and Development of SMEs 4

Introduction: Objectives & Methodology

• National budget is a major policy instrument

• Successive governments have taken various fiscal, budgetary and monetary

measures targeted to the SMEs

• Macro-measures are likely to have positive impact on development of

SMEs at the regional level

• National data on SMEs is not so encouraging (share of small manufacturing

enterprises in the national GDP: from 3.22% in FY2006 to 3.65% in FY2015)

• SMEs often confront the criticism of lack of competitiveness

• Literature shows a mixed scenario of development of SMEs in the past decades

• In this backdrop, present paper highlights on how national policies and

budgetary measures ensure development of SMEs not in general but in

specific regional context.

CPD (2016): National Budget and Development of SMEs 5

Introduction: Objectives & Methodology

• The paper is prepared based on primary and secondary data and

information collected in last few months

• Primary data is collected through direct interviews of key stakeholders of

the Bogra region

• Selection of Bogra is quite obvious as it is one of the regional hubs of SMEs of

Bangladesh

• CPD’s survey team visited two clusters including glass bottle at Adamdighi

and home textile at Bogra city (see the map in next slide)

• Debriefed the key stakeholders of these clusters

• Met officials of BSCIC, commercial banks and discussed about major impact

and implications of government various policy measures

• Since the paper prepared based on brief interviews at limited time and

does not compare the findings with SMEs of other regions, the findings of

the paper would not be considered as robust.

• Similar kinds of exercise on SMEs of other regions would be required to get a

comprehensive outlook on this issue

CPD (2016): National Budget and Development of SMEs 6

PART A

National Budget and SMEs

CPD (2016): National Budget and Development of SMEs 7

Development of SMEs in National Budgets:

FY2005-FY2015

• Implementation of the SME related budgetary measures is under the

responsibility of a number of public sector organisations

• Ministry of Finance (particularly National Board of Revenue, Bangladesh

Bank), Ministry of Industry (particularly Bangladesh Small and Cottage

Industries Corporation (BSCIC), Small and Medium Enterprise Foundation

(SME Foundation)) and Ministry of Commerce.

• A number of private sector organisations such as FBCCI, DCCI, NASCIB and

Women Chambers play key role at different phases of implementation of these

budgetary measures

Major Fiscal Measures during FY2005-15

Tax holiday/ Tax revision/Celling on investment and turnover

• Tax holiday facility since FY2006

• Plastic, melamine, ceramic and sanitary ware, insecticide & pesticides,

computer hardware, agricultural machineries, boilers & compressors, textile

machinery etc.

• Export-oriented handicraft sector enjoyed tax holiday facility from July 2008

to 30 June 2011

CPD (2016): National Budget and Development of SMEs 8

Development of SMEs in National Budgets:

FY2005-FY2015

• Investment ceiling has been raised for small and cottage industries several

times

• The threshold level for turnover tax at a rate of 4 per cent for SMEs was

extended number of times

• From Tk.40 lakh to Tk.60 lakh to Tk.70 lakh and finally to Tk.80 lakh

• In FY2012 annual turnover tax for SMEs was reduced from 4% to 3%, keeping

the turnover tax margin unchanged

• Minimum turnover tax for SMEs has been reduced to 0.5% from 0.3% in

FY2015

• Income tax relief for SMEs having an annual turnover below Tk. 2.4 million

was introduced in FY09

• SMEs have received special supports in different years to confront sudden

crisis and challenges

• 5% additional cash incentive in FY2011 for SMEs of the garment sector against

the apparels export in FY2008-09.

• SMEs which did not have captive generator facility have enjoyed 10% cash

incentives on electricity bill for the period ended in June 2010.

CPD (2016): National Budget and Development of SMEs 9

Development of SMEs in National Budgets:

FY2005-FY2015

Import duty/supplementary duty

• Government has taken a number of decisions with regard to CD, SD and

VAT at import stage on different products to support SMEs

• Plastic industry: CD and SD have been raised on a number of products

during FY2009

• Total tax incidence on these plastic products has increased by about 41% to

88%

• Electrical apparatus: CD has increased from 15% to 25% in FY2009 which

would make domestic industries more competitive

• Iron and steel: Reduction of import duty on some of the raw materials

during FY2012 would reduce the production cost of the light engineering

products

• ICT: Withdrawal of zero duty on computer accessories in FY2008 might

caused retail prices of computer accessories high

• Others: Reduction of CDs on raw materials (from 10-25% to 5-10%) during

FY2015 is likely to have positive impact on a number of industries

• Glass, ceramics, rubber, paper, furniture, paint, electrical, plastic and baby

diaper

CPD (2016): National Budget and Development of SMEs 10

Development of SMEs in National Budgets:

FY2005-FY2015

Excise duty/VAT

• FY09, GoB has withdrawn VAT from the production stage

• Handmade biscuits, fabrics produced from artificial fibre and thread using

handloom

• FY13, VAT was exempted for agriculture machineries

• Machineries used in manufacturing granular urea and organic fertilizer, machines

used for rice and wheat crushing and machines producing rice bran oil

• FY14, government proposed an upward revision of the eligibility for VAT on

the basis of firm turnover

• New VAT Act is likely to be in operation in July, 2016

• Unified VAT rate (perhaps at 15%)

• Mixed responses of different trade bodies

CPD (2016): National Budget and Development of SMEs 11

Development of SMEs in National Budgets:

FY2005-FY2015

Major Financial Measures targeted to SME development

• Access to finance for SMEs has been promoted by the successive

governments over the years

• FY05, BB had expanded refinancing facilities amounting to Tk. 250 crore to

financial institutions supporting SMEs

• Refinancing scheme was reintroduced in FY07 with an allocation of Tk. 100

crore and increased to 500 crore gradually

• Bangladesh Bank under ‘Equity Development Fund (EDF)’ has increased

the allocation from Tk.50 crore to Tk.100 crore in FY2007

• To develop agro-based and software industries

• FY 2012, the coverage of EEF was extended to silk, flowers and herbs

• During FY2009 the government has provided an endowment fund of Tk.

100 crore to the SME foundation

• To provide low-cost credit to SMEs through private commercial bank

• ‘Thrust-fund’ with an allocation of Tk. 23 crore has been created to provide

loan to SMEs by the BSCIC

CPD (2016): National Budget and Development of SMEs 12

Development of SMEs in National Budgets:

FY2005-FY2015

• BB has introduced a separate department called ‘SME and Special

Programme Department’ in FY11

• BB sets yearly targets for disbursement of SME loan through commercial

banks, NBFI, specialised commercial banks and foreign banks

• Disbursement of SME loan has slowed down over the years (from 29.8% in

2011 and 14.8% in 2015)

• Overall, access to finance for SMEs is likely to make a good progress over

the years

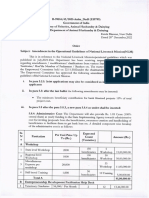

Figure: Disbursement and Growth of SME Credit

140000 35.0%

Growth of disbursement (per cetn)

Disbursement (Taka in crore)

120000 30.0%

100000 25.0%

80000 20.0%

60000 15.0%

40000 10.0%

20000 5.0%

0 0.0%

2011 2012 2013 2014 2015

Source: Bangladesh Bank

CPD (2016): National Budget and Development of SMEs 13

Development of SMEs in National Budgets:

FY2005-FY2015

Public Investment for the development of SMEs

• Public investment for the dev. of SMEs has been increasing over the years.

• A major focus of this public investment is to establish industrial estates and to

provide support facilities in potential SME regions/clusters

• During FY05-15, some of other ADP projects targeted to SME dev. are as

follows

• Self-Employment for Rural Destitute Women Through Cottage Industries;

• Small Enterprises Development Credit Project;

• Micro Credit Prog. for the Weavers, Strategic Support to SME Sector Training;

• Advanced Technological Support Prog. for Small and Cottage Industries;

• Small Scale Entrepreneurship Development in Diversified Jute Products;

• Socio-Eco Dev. through Cottage & Rural Ind. for the Monga affected people;

• Extension of BITAC Activities for Self-Employment;

• Establishment of Fashion Design and Training Centre for Handloom fabrics;

• Establishment of Permanent Tant Mela to Provide Institutional Marketing

Facilities to the Marginal Handloom Weavers; and

• Establishment of 3 Handloom Service Centers in Handloom intensive areas.

CPD (2016): National Budget and Development of SMEs 14

Development of SMEs in National Budgets:

FY2005-FY2015

Reflections on SME Development in National Budgets for Bogra

Region

• Public investment targeted to SME development of the Bogra region is not

so largely evident

• Very few development programmes have been introduced in the Bogra region

since 2005

• BSCIC was established in 1964 in order to provide necessary infrastructure

facility to small and medium scale industrial units

• The estate has extended during 1980s and 1990s

• BITAC was established to provide technical support to the SMEs.

• At present, Sirajgonj BSCIC industrial park is under construction.

Table: ADP projects for SME Development in the Bogra region

Year Type of projects

FY2005 Establishment of BITAC, Bogra (Jul, 03 – Jun, 06)

FY2007 Extension of BSCIC Industrial Estate (Jul, 05 – Jun, 08)

FY2010 BSCIC Industrial Park, Sirajgonj (Jan, 09 – Dec, 12)

Source: Planning Commission

CPD (2016): National Budget and Development of SMEs 15

PART B

Development of SMEs in the Bogra Region

Reflection of National Budget

CPD (2016): National Budget and Development of SMEs 16

SMEs in the Bogra Region: An Overview

• Bogra is a major economic hub in the northern region of Bangladesh

• Traditional agricultural activities and recently developed agro-based industries

• Region is popular as a major supplier of agricultural machineries and other

SME products in major agricultural areas and other areas

• A number of clusters have developed in the Bogra region including agro

products, fisheries, poultry and dairy farms

• These SME clusters have naturally formed with successful horizontal and

vertical integration with local and international markets for raw materials and

finished products.

• 7 clusters have been identified in the Bogra region

• About 4,000 industrial units of SMEs operate in different clusters along with

other traditional SMEs

• These clusters have maintained both local and national marketing networks

for selling their products.

• A small portion of these products are exported to the neighbouring countries.

CPD (2016): National Budget and Development of SMEs 17

Introduction: Objectives & Methodology

SME Cluster Map in the Bogra Region

Source: Prepared by authors, 2016

CPD (2016): National Budget and Development of SMEs 18

SME Clusters in the Bogra region: Major

Features and Challenges

Rice mill cluster

• Largest SME cluster in Bogra mostly located in Sherpur area

• More than 2,500 units of such mills where around 25,000 workers are

employed – 50% are women

• Fully domestic market based

• Two types of rice mills in this cluster

• Automated rice mills that are large in size with better facilities

• Small manual rice mills that are mostly managed by the owners

• Challenges

• Most of the small millers do not have any financial transaction with

banks

• Rice millers are eligible for receiving commercial loan

• Difficulties in bank transactions

• The cluster has not received technical assistance from government

• Some local NGOs provide some technical support

CPD (2016): National Budget and Development of SMEs 19

SME Clusters in the Bogra region: Major

Features and Challenges

Light engineering cluster

• Second largest SME cluster in the Bogra region

• 400 industrial units employ over 6,000 skilled and semi-skilled workers

• Products include agri-machineries such as tube-well and pumps with casting

iron

• Making considerable progress over the years

• Challenges: Owners have their own business documents, but many

enterprises do not maintain official document properly

• Owners often find it difficult to get the environmental clearance on scheduled

time mainly due to inefficiencies of the authority as well as of themselves

• Factories located in the BSCIC area suffers for poor physical connection

• No empty plot in BSCIC, a separate area is needed

CPD (2016): National Budget and Development of SMEs 20

SME Clusters in the Bogra region: Major

Features and Challenges

Handloom/home textile/tailoring cluster

• About 400 households are involved in the handloom industry

• Garment tailoring cluster is located at Sonatola of Bogra district

• Approximately 100 units - 2,500 skilled and semi-skilled workers

• Products produced in these units which sold both locally and nationally

• Challenges: Most enterprises lack of proper documents (e.g.

Trade license, VAT registration and TIN)

• Shortage of skilled family labour

• Limited financial transaction with the commercial banks

• Micro finance from different NGOs such as MIDAS, ASA and Grameen Bank

• Weekly payment system followed by NGOs found to be difficult

• Lack of awareness among the entrepreneurs with regard to banking facility

CPD (2016): National Budget and Development of SMEs 21

SME Clusters in the Bogra region: Major

Features and Challenges

Glass bottle cluster

• 100 firms are clustered near Adamdighi, Bogra

• 20% products are sold at local level and the rest 80% are sold at the national

level

• Challenge: Low demand of these bottles have constrained the growth of

this cluster

Printing and publishing cluster

• Relatively small which is mainly located in the Bogra city

• Demand for the products across the country - from Northern region of

Bangladesh as well as from the Khulna region

• Given the considerable demand, the cluster is likely to grow in the coming

years

CPD (2016): National Budget and Development of SMEs 22

Addressing the Challenges Confronted by the

SMEs in the Bogra Region

1. Formalisation of SMEs

• A large part of SME units operate informally without any business

registration.

• A large number of industrial units do not have documents such VAT, TIN

and registration number etc.

• These entrepreneurs would face much trouble if new VAT Act implement with

a unified VAT rate.

• Major barrier for accessing low cost as well as normal commercial credit

through formal channel

• Microfinances from local NGOs are easy to access; repayment schedule is very

stringent

• Raising awareness to formalise them should be a major target

• Both by the central and local governments

• Cluster based associations/groups could provide necessary support

CPD (2016): National Budget and Development of SMEs 23

Addressing the Challenges Confronted by the

SMEs in the Bogra Region

2. ‘Customisation’ of Financial Products for Better Access to

finance

• Access to finance has yet to reach to the doorstep of the small

entrepreneurs due to various reasons.

• Commercial banks should identify innovative and new financial products

to reach to the non-compliant but highly potential customers

• Local commercial banks could create business links with NGOs and use NGOs

networks to disburse loan to the poor

• Sometimes these formal credit sources are found to be stringent

• Given the nature of market demand, entrepreneurs expect more flexibility in

the repayment schedule of formal loans

• Commercial banks and NGOs need to develop innovative financial

products as per the demand

• Need ‘customization’ of their financial products

CPD (2016): National Budget and Development of SMEs 24

Addressing the Challenges Confronted by the

SMEs in the Bogra Region

3. Necessary Support to Organise the Unorganised Entrepreneurs

• The voice of small firms of these SME clusters are often unheard because

of lack of cluster based association/groups in most cases

• It is important to raise the voices of the SMEs in the national budget

making process

• Forming cluster-based groups/associations and thereafter lobbying with

appropriate authority are very important

• Refocusing/introducing SME related activities of local government such as

City Corporation, pouro sava and upazilla parishad are important

• Private initiative such as NASCIB has been appreciated by many clusters,

however it has yet to reach all the clusters as per expectation

• Expanding activities of NASCIB at the local level reaching all clusters is very

important.

CPD (2016): National Budget and Development of SMEs 25

Addressing the Challenges Confronted by the

SMEs in the Bogra Region

4. Support for development of ‘customised’ infrastructure

• Many clusters complained higher production/business cost due to lack of

proper infrastructure connecting clusters with markets

• Despite the advantage of highways, entrepreneurs face the difficulty due to

poor linking roads within the village and other community

• SMEs need land at their own locality at low cost

• Establishment of SEZs undertaken by the BEZA may not facilitate SME much

• BSCIC may consider further expansion of industrial estates targeting small

clusters

• Creating more local Haat (markets) for marketing of locally made products

produced by SMEs in the rural areas can be effective

CPD (2016): National Budget and Development of SMEs 26

Addressing the Challenges Confronted by the

SMEs in the Bogra Region

5. Providing Technical Assistance

• Although there are technical institutes (BITAC and private institutes)

available in the region, entrepreneurs have less knowledge about those

organisations

• Entrepreneurs of some of the clusters receive training from the NGO

• Household based SMEs require advanced knowledge and techniques to

make them competitive in the local and international markets

• Cottage based industries are increasingly facing the constraints of skilled

workers at home

• Sufficient budget allocation is required for improving entrepreneurial,

managerial and technical skills of these entrepreneurs

• Need to develop innovative technical tools which could cater to the need of

different clusters as per their requirement

• To be made available at their door step so that they could overcome the

constraints of their remoteness.

CPD (2016): National Budget and Development of SMEs 27

Addressing the Challenges Confronted by the

SMEs in the Bogra Region

6. Overcoming the Challenges of Lack of Competitiveness

• The clusters in the Bogra region, by and large, are doing well and most of

them have good prospect to expand their market shares both at local and

national levels.

• Very few enterprises of these enterprises have experienced with exporting

abroad

• Overall competitiveness of these clusters varies

• Differences in market demand, quality of product, competition with alternate

products (both local and imported), market connection and lack of

infrastructure define the variation in competitiveness

• Moreover, greater integration with regional and global markets not only

open new opportunities

• But also put the SMEs in newer challenges to confront suppliers of regional

countries.

• Challenges need to be addressed on a case by case basis as the nature of

problems are different for different industries

• Cluster-based approach is needed for the development of SMEs in different

regions

CPD (2016): National Budget and Development of SMEs 28

Addressing the Challenges Confronted by the

SMEs in the Bogra Region

7. Developing women entrepreneurship

• House-hold based enterprises are managed by females along with the male

entrepreneurs

• Owing to difficulties in categorising women SMEs as well as poor operational

method followed by these enterprises, banks often are less interested to

provide funding to these enterprises

• Innovative and targeted financial products are needed for women SMEs

8. Support for Increasing institutional efficiencies

• SME Foundation despite their appreciated works, has yet to reach to the

marginalised in extended scale

• More activities require at regional as well as local level through various means

• BSCIC industrial estates need to be extended where possible and

government should create incentives in order to make use of unused BSCIC

plots

CPD (2016): National Budget and Development of SMEs 29

Addressing the Challenges Confronted by the

SMEs in the Bogra Region

9. Awareness Building on National Compliance Standards

• SMEs need to be complaint with national standard on environment and

labour related issues

• Entrepreneurs often face the hassles taking environmental clearance because

of lack of cooperation or lack of inefficiency from both sides

• It is important to aware entrepreneurs to comply with national standards

• Need to get prepared for new realities on social and environmental standards

• Proper training for the entrepreneurs and management officials could improve

knowledge on compliance

• Enterprises need to be complaint with VAT and tax related matters as well

• Local government offices with the support of the cluster groups and

associations could take necessary measures

CPD (2016): National Budget and Development of SMEs 30

Concluding Remarks: More ‘Customised’

Approach Needed for SME Development

• National policies and budgetary measures need to be ‘customised’ in order

to better service the SMEs operate at the regional level

• Local SMEs are either unaware of the benefits of various fiscal, budgetary

and monetary measures or they are not adequately benefitted through

those measures

• Government’s various supports need to be ‘customised’ - innovative and

specific to the need of different types of SMEs

• These SMEs are largely unheard by the policymakers and likewise, their

problems, challenges need to be better addresses in the national budget

• Organisation of these SME groups in order to ensure regular dialogue between

them with the policy makers is important

• Organisations having the local root should engage intensely at the grass

root level and raise the voices of the marginalised SMEs

CPD (2016): National Budget and Development of SMEs 31

Thank You

CPD (2016): National Budget and Development of SMEs

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Fdot bc851 RPTDocument265 pagesFdot bc851 RPTSajjad HossainNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Tomasz Ambroziak, Agnieszka Malesa, Mariusz KostrzewskiDocument16 pagesTomasz Ambroziak, Agnieszka Malesa, Mariusz KostrzewskiSajjad HossainNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Commuting in Almaty Agglomeration: An Analysis of Pilot Survey ResultsDocument8 pagesCommuting in Almaty Agglomeration: An Analysis of Pilot Survey ResultsSajjad HossainNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- OPRE 6201: 4. Network Problems: 1.1 An LP FormulationDocument39 pagesOPRE 6201: 4. Network Problems: 1.1 An LP FormulationSajjad HossainNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- University Choice List With SubjectDocument9 pagesUniversity Choice List With SubjectSajjad HossainNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Appoinment Letter 5369A210Document1 pageAppoinment Letter 5369A210Sajjad HossainNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Consideration of Traffic Congestion by Using Traffic Flow Analysis in Bogura, BangladeshDocument5 pagesConsideration of Traffic Congestion by Using Traffic Flow Analysis in Bogura, BangladeshSajjad HossainNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- CMP Bengaluru - Final ReportDocument242 pagesCMP Bengaluru - Final ReportSajjad HossainNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Bogura 2011 CENSUSDocument151 pagesBogura 2011 CENSUSSajjad HossainNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- A Sustainable Perspective On Urban Freight Transport: Factors Affecting Local Authorities in The Planning ProceduresDocument12 pagesA Sustainable Perspective On Urban Freight Transport: Factors Affecting Local Authorities in The Planning ProceduresSajjad HossainNo ratings yet

- Land Use and Land Cover Change Detection Study at THESISDocument31 pagesLand Use and Land Cover Change Detection Study at THESISSajjad HossainNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A GIS-based Traffic Analysis Zone Design ImplementDocument14 pagesA GIS-based Traffic Analysis Zone Design ImplementSajjad HossainNo ratings yet

- Karon Sustainable 2017 2Document9 pagesKaron Sustainable 2017 2Sajjad HossainNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Land Use Change Analysis in A Highway Cooridor An Application of Markov Model Using GISDocument71 pagesLand Use Change Analysis in A Highway Cooridor An Application of Markov Model Using GISSajjad HossainNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chilagane DISSERTATIONDocument91 pagesChilagane DISSERTATIONSajjad HossainNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Land Use and Land Cover Change in Dhaka 1991 To 2022Document19 pagesLand Use and Land Cover Change in Dhaka 1991 To 2022Sajjad HossainNo ratings yet

- Agriculture Sector Challenges and Way Forward+Document43 pagesAgriculture Sector Challenges and Way Forward+Optimistic PashteenNo ratings yet

- PAS 41 AgricultureDocument34 pagesPAS 41 AgricultureCurly Spaghetti 88No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Focus On Ag (1-15-24)Document3 pagesFocus On Ag (1-15-24)Mike MaybayNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Overview of Organic Food and Grocery RetailingDocument5 pagesOverview of Organic Food and Grocery RetailingSeshank Ramanuja DasanNo ratings yet

- Report Rural Studio DocsDocument171 pagesReport Rural Studio DocsNurdhin AbdillehNo ratings yet

- RCEF Mechanization Program FAQsDocument12 pagesRCEF Mechanization Program FAQsLinchoco Rice DealerNo ratings yet

- Chapter - 1 Indian Economy On The Eve of IndependenceDocument19 pagesChapter - 1 Indian Economy On The Eve of IndependenceShweta SharmaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Amendment Operational Guidelines NLMDocument4 pagesAmendment Operational Guidelines NLMThe Match PointNo ratings yet

- INTERVIEW SCHEDULE New JBLDocument8 pagesINTERVIEW SCHEDULE New JBLRavi yadavNo ratings yet

- Zambia - Natl Ag Policy 2012 To 2030 DRAFT-2011Document31 pagesZambia - Natl Ag Policy 2012 To 2030 DRAFT-2011KahimbiNo ratings yet

- ATI QF PAD 71 Rev. 01 Effectivity Date August 2 2022 Acceptance To Become LSA IDocument1 pageATI QF PAD 71 Rev. 01 Effectivity Date August 2 2022 Acceptance To Become LSA IJELYN DELA CRUZNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- 01 Guide Questions - AUDITS OF AGRICULTUREDocument5 pages01 Guide Questions - AUDITS OF AGRICULTUREJhoanne Marie TederaNo ratings yet

- Equali TEADocument2 pagesEquali TEAYachna SrivastavaNo ratings yet

- National Plant Quarantine Services:: Dracaena Angolensis, Dracaena Patens, Dracaena Kirkii, Dracenana FrancissiDocument1 pageNational Plant Quarantine Services:: Dracaena Angolensis, Dracaena Patens, Dracaena Kirkii, Dracenana FrancissiWin McLandaNo ratings yet

- Ias 41 AgricultureDocument19 pagesIas 41 AgricultureNestyn Hanna VillarazaNo ratings yet

- Literature Review AssignmentDocument24 pagesLiterature Review AssignmentMohamed Bachir CamaraNo ratings yet

- Agricultural CrisisDocument18 pagesAgricultural CrisisAnneSitjar100% (1)

- Agricultural Policies, Trade and Sustainable Development in EgyptDocument60 pagesAgricultural Policies, Trade and Sustainable Development in EgyptReCyoNo ratings yet

- Loksabhaquestions Annex 1714 AS135Document12 pagesLoksabhaquestions Annex 1714 AS135skparamjyotiNo ratings yet

- Notes-Biological AssetsDocument2 pagesNotes-Biological AssetsMary Justine PaquibotNo ratings yet

- Top Agro CompaniesDocument4 pagesTop Agro Companiesgp.mishraNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ternakmart: Business Model CanvasDocument12 pagesTernakmart: Business Model CanvasAry PurwantiniNo ratings yet

- Annualreport 2011Document23 pagesAnnualreport 2011Hagos GebreamlakNo ratings yet

- Problems and Prospects of Farm MechanizationDocument7 pagesProblems and Prospects of Farm Mechanizationsileshi AngerasaNo ratings yet

- (Sa) Agriculture by Shiv Arpit Sir for GeographyDocument26 pages(Sa) Agriculture by Shiv Arpit Sir for GeographyDj ShaanNo ratings yet

- Criminology, Oxford University Press, OxfordDocument3 pagesCriminology, Oxford University Press, OxfordNitin PawarNo ratings yet

- Project Fabrication of Solar SprayerDocument15 pagesProject Fabrication of Solar SprayerNanda NandanNo ratings yet

- About Cropin StartupDocument16 pagesAbout Cropin StartupMadhavilatha25% (4)

- 74-Nirmal Kumar ADocument24 pages74-Nirmal Kumar ANirmal kumarNo ratings yet

- Bachelor of Information Technology: Centre For Open and Distance Learning University of MoratuwaDocument10 pagesBachelor of Information Technology: Centre For Open and Distance Learning University of MoratuwaUdeshika WanninayakeNo ratings yet