Professional Documents

Culture Documents

Discounted Cash Flow Model (TEMPLATE)

Uploaded by

Ignacio de DiegoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discounted Cash Flow Model (TEMPLATE)

Uploaded by

Ignacio de DiegoCopyright:

Available Formats

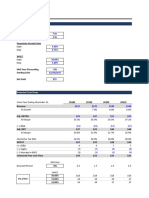

Discounted Cash Flow (DCF) Analysis

($ in millions, except per share data)

3 Quarters

Today Ending Projected Fiscal Years Ending September 30,

12/31/12 9/30/13 2014 2015 2016 2017 2018 2019 2020 2021 2022

Fractional years per period (0.75)% (1.00)% (1.00)% (1.00)% (1.00)% (1.00)% (1.00)% (1.00)% (1.00)% (1.00)%

Cumulative fractional years from close (0.75)% (1.75)% (2.75)% (3.75)% (4.75)% (5.75)% (6.75)% (7.75)% (8.75)% (9.75)%

Assumptions

Net debt ($25.6)%

Fully diluted shares outstanding (35.159)%

Tax rate (35.0%)

Unlevered Free Cash Flow (UFCF)

EBITDA ($94.9)% ($155.9)% ($160.1)% ($161.3)% ($162.4)% ($163.6)% ($164.8)% ($166.0)% ($167.2)% ($168.5)%

EBITA ($82.7)% ($139.7)% ($143.9)% ($144.9)% ($145.9)% ($147.0)% ($148.1)% ($150.7)% ($152.4)% ($153.4)%

( – ) Taxes ((28.9)% ((48.9)% ((50.4)% ((50.7)% ((51.1)% ((51.4)% ((51.8)% ((52.8)% ((53.3)% ((53.7)%

Unlevered net income (53.8)% (90.8)% (93.5)% (94.2)% (94.9)% (95.5)% (96.2)% (98.0)% (99.0)% (99.7)%

( + ) Depreciation (12.2)% (16.2)% (16.2)% (16.4)% (16.5)% (16.6)% (16.8)% (15.3)% (14.9)% (15.0)%

( – ) Capital expenditures ((12.8)% ((18.0)% ((19.0)% ((19.2)% ((19.3)% ((19.5)% ((19.7)% ((19.9)% ((20.0)% ((20.2)%

( – ) Change in working capital (2.0)% ((3.8)% ((1.3)% ((0.4)% ((0.4)% ((0.4)% ((0.4)% ((0.4)% ((0.4)% ((0.4)%

( – ) Change in deferred taxes (–)% (–)% (–)% (–)% (–)% (–)% (–)% (–)% (–)% (–)%

Unlevered free cash flow (–)% ($55.1)% ($85.2)% ($89.5)% ($91.0)% ($91.6)% ($92.2)% ($92.9)% ($93.0)% ($93.4)% ($94.1)%

DCF Valuation – XNPV Method

( + ) Terminal cash flow (5.0x terminal multiple) ($812.2)%

Total cash flow – EBITDA multiple method (–)% ($55.1)% ($85.2)% ($89.5)% ($91.0)% ($903.8)%

DCF valuation (XNPV) – EBITDA multiple method ($773.1)%

Check that XNPV yields same result as formulas below (–)%

( + ) Terminal cash flow (0.5% terminal growth) ($800.5)%

Total cash flow – perpetuity growth method (–)% ($55.1)% ($85.2)% ($89.5)% ($91.0)% ($892.1)%

DCF valuation (XNPV) – perpetuity growth method ($766.3)%

Check that XNPV yields same result as formulas below (–)%

DCF Sensitivity – EBITDA Multiple Method

NOTE: Enterprise value can be computed more simply using TABLEs sensitizing the XNPV result to the WACC and terminal multiple, but TABLEs were purposefully avoided to illustrate how this sensitivity

can be performed without TABLEs, which are slow to calculate.

Enterprise Value Equity Value

Terminal EBITDA Multiple Terminal EBITDA Multiple

(4.5x)) (5.0x)) (5.5x)) (4.5x)) (5.0x)) (5.5x))

Discount 11.0%) ($751.7)% ($801.2)% ($850.6)% ($726.1)% ($775.6)% ($825.0)%

Rate 12.0%) ($725.7)% ($773.1)% ($820.5)% ($700.1)% ($747.5)% ($794.9)%

(WACC) 13.0%) ($700.9)% ($746.3)% ($791.8)% ($675.3)% ($720.7)% ($766.2)%

Implied Perpetuity Growth Rate Value Per Share

Terminal EBITDA Multiple Terminal EBITDA Multiple

(4.5x)) (5.0x)) (5.5x)) (4.5x)) (5.0x)) (5.5x))

Discount 11.0%) (1.4%) (0.3%) (0.7%) ($20.65)% ($22.06)% ($23.47)%

Rate 12.0%) (0.5%) (0.6%) (1.6%) ($19.91)% ($21.26)% ($22.61)%

(WACC) 13.0%) (0.4%) (1.5%) (2.5%) ($19.21)% ($20.50)% ($21.79)%

DCF Sensitivity – Perpetuity Growth Method

NOTE: Enterprise value can be computed more simply using TABLEs sensitizing the XNPV result to the WACC and terminal growth rate, but TABLEs were purposefully avoided to illustrate how this sensitivity

can be performed without TABLEs, which are slow to calculate.

Enterprise Value Equity Value

Terminal Perpetuity Growth Rate Terminal Perpetuity Growth Rate

(–)% (0.5%) (1.0%) (–)% (0.5%) (1.0%)

Discount 11.0%) ($813.7)% ($840.5)% ($870.0)% ($788.1)% ($814.9)% ($844.4)%

Rate 12.0%) ($744.6)% ($766.3)% ($789.9)% ($719.0)% ($740.7)% ($764.4)%

(WACC) 13.0%) ($686.1)% ($704.0)% ($723.3)% ($660.5)% ($678.4)% ($697.7)%

Implied Terminal EBITDA Multiple Value Per Share

Terminal Perpetuity Growth Rate Terminal Perpetuity Growth Rate

(–)% (0.5%) (1.0%) (–)% (0.5%) (1.0%)

Discount 11.0%) (5.1x))' (5.4x))' (5.7x))' ($22.42)% ($23.18)% ($24.02)%

Rate 12.0%) (4.7x))' (4.9x))' (5.2x))' ($20.45)% ($21.07)% ($21.74)%

(WACC) 13.0%) (4.3x))' (4.5x))' (4.7x))' ($18.79)% ($19.29)% ($19.84)%

You might also like

- Dcf-Analysis Calculator (Edit Items in Blue)Document4 pagesDcf-Analysis Calculator (Edit Items in Blue)Christopher GuidryNo ratings yet

- DCF AnalysisDocument3 pagesDCF AnalysisJerry YoungNo ratings yet

- Macabus DCF AnalysisDocument6 pagesMacabus DCF AnalysisNikolas JNo ratings yet

- Nerolac - Solution PDFDocument5 pagesNerolac - Solution PDFricha krishnaNo ratings yet

- DCF Template: Exit MultipleDocument11 pagesDCF Template: Exit MultipleShane BrooksNo ratings yet

- DCF Template: Start StepDocument11 pagesDCF Template: Start StepBrian DongNo ratings yet

- Financial Modeling Institute: Henderson ManufacturingDocument15 pagesFinancial Modeling Institute: Henderson ManufacturingTafadzwanashe MaringireNo ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- IC Discounted Cash Flow Analysis 10840Document5 pagesIC Discounted Cash Flow Analysis 10840Vishwas ParakkaNo ratings yet

- BREIT Monthly Performance - February 2020Document26 pagesBREIT Monthly Performance - February 2020MAYANK AGGARWALNo ratings yet

- Ind-Swift LabsDocument44 pagesInd-Swift Labssingh66222No ratings yet

- 107 10 DCF Sanity Check AfterDocument6 pages107 10 DCF Sanity Check AfterDavid ChikhladzeNo ratings yet

- LBO Completed ModelDocument210 pagesLBO Completed ModelBrian DongNo ratings yet

- FMI Sample Model For AFM 2115Document17 pagesFMI Sample Model For AFM 2115RENJiiiNo ratings yet

- Valuation+ +excel+ +students+Document4 pagesValuation+ +excel+ +students+snigdha.sanaboinaNo ratings yet

- DCF Template - v1Document1 pageDCF Template - v1prathmesh KolteNo ratings yet

- Lady M ValuationDocument3 pagesLady M Valuationsairaj bhatkarNo ratings yet

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v2Siddhant AggarwalNo ratings yet

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelNo ratings yet

- Illustrative LBO AnalysisDocument21 pagesIllustrative LBO AnalysisBrian DongNo ratings yet

- Stitch Fix Inc NasdaqGS SFIX FinancialsDocument41 pagesStitch Fix Inc NasdaqGS SFIX FinancialsanamNo ratings yet

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- NBA Happy Hour Co - DCF Model - Task 4 - Revised TemplateDocument10 pagesNBA Happy Hour Co - DCF Model - Task 4 - Revised Templateww weNo ratings yet

- WWE q1 2020 Trending SchedulesDocument6 pagesWWE q1 2020 Trending SchedulesHeel By NatureNo ratings yet

- Task 3 - DCF ModelDocument10 pagesTask 3 - DCF Modeldavin nathanNo ratings yet

- Manaal - Commercial Banking W J.P MorganDocument9 pagesManaal - Commercial Banking W J.P Morganmanaal.murtaza1No ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Jollibee Foods Corporation PSE JFC FinancialsDocument38 pagesJollibee Foods Corporation PSE JFC FinancialsJasper Andrew AdjaraniNo ratings yet

- Enph EstimacionDocument38 pagesEnph EstimacionPablo Alejandro JaldinNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- YHOO Q110EarningsPresentation FinalDocument23 pagesYHOO Q110EarningsPresentation Finalhblodget6728No ratings yet

- MyfileDocument1 pageMyfilevdkvaibhav100% (1)

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Max S Group Inc PSE MAXS FinancialsDocument36 pagesMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniNo ratings yet

- Sea Limited NYSE SE FinancialsDocument36 pagesSea Limited NYSE SE FinancialsAdrian KurniaNo ratings yet

- Deutsche Bank - 4Q2016 Results: 02 February 2017Document49 pagesDeutsche Bank - 4Q2016 Results: 02 February 2017ovitrNo ratings yet

- Inputs: FCFF Stable Growth ModelDocument12 pagesInputs: FCFF Stable Growth ModelKojiro FuumaNo ratings yet

- Is Excel Participant Samarth - Simplified v2Document9 pagesIs Excel Participant Samarth - Simplified v2samarth halliNo ratings yet

- Cash Return On Invested CapitalDocument2 pagesCash Return On Invested CapitalMichael JacopinoNo ratings yet

- NBA Happy Hour Co - DCF Model v2Document10 pagesNBA Happy Hour Co - DCF Model v2Siddhant Aggarwal50% (2)

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art EuphoriaNo ratings yet

- Can Enterprise Value Be Negative? Sure!: Discounted Cash Flow (DCF) Analysis - Assumptions and OutputDocument1 pageCan Enterprise Value Be Negative? Sure!: Discounted Cash Flow (DCF) Analysis - Assumptions and OutputziuziNo ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- Ratio Analysis Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMDocument18 pagesRatio Analysis Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMAkshataNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2deepika0% (1)

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2animecommunity04No ratings yet

- Valuation - NVIDIADocument27 pagesValuation - NVIDIALegends MomentsNo ratings yet

- Kansai Nerolac QuestionDocument6 pagesKansai Nerolac Questionricha krishnaNo ratings yet

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v221BAM045 Sandhiya SNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Private Equity Model Template For InvestorsDocument12 pagesPrivate Equity Model Template For InvestorsousmaneNo ratings yet

- $ in Millions, Except Per Share DataDocument59 pages$ in Millions, Except Per Share DataTom HoughNo ratings yet

- DPC Case SolutionDocument11 pagesDPC Case Solutionburiticas992No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Engineering Economics Lect 3Document43 pagesEngineering Economics Lect 3Furqan ChaudhryNo ratings yet

- Tutorial 2 Financial Management 1Document39 pagesTutorial 2 Financial Management 1VignashNo ratings yet

- Paper 4 Financial ManagementDocument321 pagesPaper 4 Financial ManagementExcel Champ0% (2)

- Tutorial Set 2 - Key SolutionsDocument4 pagesTutorial Set 2 - Key SolutionsgregNo ratings yet

- Property ValuationDocument38 pagesProperty ValuationSherineLiewNo ratings yet

- FIN 5001 - Course OutlineDocument9 pagesFIN 5001 - Course OutlineJoel DsouzaNo ratings yet

- Ch-5 - Stock ValuationDocument27 pagesCh-5 - Stock ValuationTas MimaNo ratings yet

- Tutorial 5Document5 pagesTutorial 5Jian Zhi TehNo ratings yet

- FE&IA Question BankDocument61 pagesFE&IA Question BankSwarnaNo ratings yet

- FI - M Lecture 3-What Do Interest Rates Mean - What Is Their Role in ValuationDocument25 pagesFI - M Lecture 3-What Do Interest Rates Mean - What Is Their Role in ValuationMoazzam ShahNo ratings yet

- Solutions To Textbook Recommended ProbleDocument12 pagesSolutions To Textbook Recommended Probleasyraf.esftNo ratings yet

- Net Present Value and Capital Budgeting: Only Cash Flow Is RelevantDocument20 pagesNet Present Value and Capital Budgeting: Only Cash Flow Is RelevantadextNo ratings yet

- Summary Notes Columbia Uni PDFDocument1 pageSummary Notes Columbia Uni PDFNIKHIL SODHINo ratings yet

- Ch12sol PDFDocument3 pagesCh12sol PDFAmine IzamNo ratings yet

- Practice Questions - Eqty1Document17 pagesPractice Questions - Eqty1gauravroongtaNo ratings yet

- Corporate Finance LectureDocument124 pagesCorporate Finance LectureMuhammad Kashif ZafarNo ratings yet

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsDocument90 pages35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- Practice Multiple Choice Test 9: .08 (1n C) /.08 (LN 2.5)Document8 pagesPractice Multiple Choice Test 9: .08 (1n C) /.08 (LN 2.5)api-3834751No ratings yet

- InvLecture - W10-11 Capital BudgettingDocument264 pagesInvLecture - W10-11 Capital BudgettingJuan Camilo Gómez RobayoNo ratings yet

- FIN 205 Lecture Notes Sem 3 2021Document808 pagesFIN 205 Lecture Notes Sem 3 2021黄于绮No ratings yet

- Valuation and Rates of Return: Powerpoint Presentation Prepared by Michel Paquet, SaitDocument41 pagesValuation and Rates of Return: Powerpoint Presentation Prepared by Michel Paquet, SaitArundhati SinhaNo ratings yet

- Capital Budgeting - Part I PDFDocument83 pagesCapital Budgeting - Part I PDFJannat JavedNo ratings yet

- Chapter 2.1Document39 pagesChapter 2.1Jay BetaizarNo ratings yet

- Jul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearDocument32 pagesJul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearProtyay ChakrabortyNo ratings yet

- FinMan Module 5 Time Value of Money - Part 2Document13 pagesFinMan Module 5 Time Value of Money - Part 2erickson hernanNo ratings yet

- Chapter6 Matematika BusinessDocument17 pagesChapter6 Matematika BusinessKarlina DewiNo ratings yet

- Chapter-05 Time Value of MoneyDocument20 pagesChapter-05 Time Value of MoneyZakaria SakibNo ratings yet

- Financial Management: Liquidity DecisionsDocument10 pagesFinancial Management: Liquidity Decisionsaryanboxer786No ratings yet

- First Principles of FinanceDocument6 pagesFirst Principles of FinanceFrancis Kwame OwireduNo ratings yet

- Stock Valuation: Div PP R PDocument7 pagesStock Valuation: Div PP R PLeanne TehNo ratings yet