Professional Documents

Culture Documents

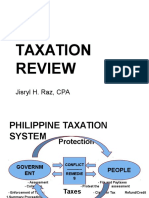

General Principles of Taxation

Uploaded by

Aljay LabugaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Principles of Taxation

Uploaded by

Aljay LabugaCopyright:

Available Formats

General Principles of Taxation

Taxation- one of the inherent powers of the State

Purpose- raise revenues

Why do we need to study?

Sound Knowledge of the basic principles., Interpretation of tax rulings,

1. Understanding and interpretation of the tax ruling

Taxation- inherent sovereign power

Pecuniary burden - money

Elements

1. Enforced proportional contribution from person

2. Imposed by the sate in its sovereign capacity

3. Levied for the support of the government

2 concepts

1. Power to tax(noun)

2. Act or the process to tax(verb)

Nature

1. Inherent in sovereignty

2. Legislative in character

Aspects phases

1. Levying stage-legislature NIRC

2. Assessment and collection

3. Payment of the tax

Implementation - executive

Power to tax- legislative

Purposes and objectives

1. Revenue raising

2. Non revenue

A. Promotion of general welfare(police power)

B. Regulation(caltex vs coa)

C. Reduction of social inequality(evolve a progressive tax system)

D. Encourage economic growth

E. Protectionism(protect local industries against foreign competition)

Theory of taxation Basis

1. Lifeblood theory- lifeblood of the state,

2. Necessity theory- State cannot continue without levying tax

3. Doctrine Symbiotic relationship

4. Jurisdiction over subjects and objects

Kinds of Taxes

1. As to Subject matter

Poll tax

Property tax

Excise tax

2. As to who bears the burden

a) Direct taxation- where the statutory tax payer is the one collected example income tax

b) Indirect taxation- where the statutory tax payer may pass the burden to another example

vat

3. As to the determination of amount

a) Specific example for gasoline

b) Ad valorem- example value added tax

4. As to scope

a) National taxes

b) Municipal or local taxes

5. As to gradation

A. Progressive

B. Regressive- more indirect than direct

The principles of a sound tax system are

fiscal adequacy, administrative feasibility, and theoretical justice.

Fiscal adequacy means the sources of revenue must be sufficient to meet government expenditures

and other public needs.

Administrative feasibility means tax laws and regulations must be capable of being effectively

enforced with the least inconvenience to the taxpayer.

And theoretical justice means that a sound tax system must be based on the taxpayers’ ability to pay.

tax as distinguished from other forms of exactions

- because remedies involve and different laws govern. Specially in issues of double taxations

1. If one claim is tax and the other is not, then no double taxation exist.

The purpose of tax is to raise revenue wh

ile the purpose of a license fee is for regulation only.

Impact and Incidence of Taxation!

The term impact is used to express the immediate result of or original imposition of the tax. The impact of a tax is on

the person on whom it is imposed first. Thus, the person who is Habile to pay the tax to the government bears its

impact. The impact of a tax, as such, denotes the act of impinging.

Inherent limitations

You might also like

- Principles of TaxationDocument29 pagesPrinciples of TaxationannyeongchinguNo ratings yet

- Updated Tax Accounting BIS, 2024Document234 pagesUpdated Tax Accounting BIS, 2024fyfyg411No ratings yet

- Basic Taxation - CAVSU - Teaching Demo - Feb 5, 2018Document30 pagesBasic Taxation - CAVSU - Teaching Demo - Feb 5, 2018Renalyn ParasNo ratings yet

- Taxation Review LectureDocument600 pagesTaxation Review LectureRaz Jisryl79% (53)

- Principles of Taxation Integ REVISED 2022Document37 pagesPrinciples of Taxation Integ REVISED 2022Dela cruz, Hainrich (Hain)No ratings yet

- Income Taxation Fundamental Principles Part 1Document4 pagesIncome Taxation Fundamental Principles Part 1gwyneth dian belotendosNo ratings yet

- Taxation 1Document63 pagesTaxation 1Ella Joy MataNo ratings yet

- General Principles: Power of TaxationDocument21 pagesGeneral Principles: Power of TaxationCarl MurphyNo ratings yet

- Taxation Law 2021Document60 pagesTaxation Law 2021eayemeyemieNo ratings yet

- Chapter 2 Tax Laws EtcDocument56 pagesChapter 2 Tax Laws EtcKlare CadornaNo ratings yet

- General Principles of Taxation-HandoutDocument11 pagesGeneral Principles of Taxation-HandoutJhovet Christian M. CariÑoNo ratings yet

- Income & Business Tax GuideDocument17 pagesIncome & Business Tax GuideKimverlee Anne GarciaNo ratings yet

- Chapter 1 Income Tax RevisedDocument7 pagesChapter 1 Income Tax RevisedHannah BatallerNo ratings yet

- Basic Principles of Taxation (Inherent Powers of The State)Document2 pagesBasic Principles of Taxation (Inherent Powers of The State)Yeshua Santos100% (2)

- Tax Review General PrinciplesDocument11 pagesTax Review General PrinciplesElson TalotaloNo ratings yet

- Concepts of Taxation and Income TaxationDocument87 pagesConcepts of Taxation and Income TaxationEugene CejeroNo ratings yet

- Income Taxation Principles ExplainedDocument40 pagesIncome Taxation Principles ExplainedJessaNo ratings yet

- Definition or Concept of TaxationDocument24 pagesDefinition or Concept of TaxationJustine DagdagNo ratings yet

- Taxation PresentationDocument10 pagesTaxation Presentationmhilet_chiNo ratings yet

- DSSC Taxation Law Mid Term ModuleDocument77 pagesDSSC Taxation Law Mid Term ModuleJetroy DiazNo ratings yet

- DSSC Taxation Law Mid Term ModuleDocument77 pagesDSSC Taxation Law Mid Term ModuleNELLIE GRACE POTENTENo ratings yet

- Income TaxationDocument54 pagesIncome TaxationSebastian StanleyNo ratings yet

- Lecture 1 - General PrinciplesDocument5 pagesLecture 1 - General PrinciplesLovenia Magpatoc100% (1)

- CM TaxationDocument32 pagesCM TaxationErmawooNo ratings yet

- Prelim TaxationDocument8 pagesPrelim TaxationJocel Añasco LabiosNo ratings yet

- Direct Taxation Code2Document8 pagesDirect Taxation Code2MahekNo ratings yet

- Selam Proposal 2Document14 pagesSelam Proposal 2sebehadinahmed1992No ratings yet

- WFH-INCOME-TAXATIONDocument71 pagesWFH-INCOME-TAXATIONnachtandyNo ratings yet

- WFH#1 OnegoDocument4 pagesWFH#1 OnegoJoselito OñegoNo ratings yet

- Introduction To TaxationDocument26 pagesIntroduction To TaxationHiyakishu SanNo ratings yet

- TAXATION PROJECT MACROECONOMICSDocument12 pagesTAXATION PROJECT MACROECONOMICSHaris MalikNo ratings yet

- Principles of Taxation Section 1 Topic 1: Tax ResearchDocument82 pagesPrinciples of Taxation Section 1 Topic 1: Tax Researchbackbeat_2006No ratings yet

- Income Taxation - Topic 2Document4 pagesIncome Taxation - Topic 2jessamaepinas5No ratings yet

- ABM 11- FABM2 2ND SEMESTER FINALS MODULE 3 (PIELAGO)Document13 pagesABM 11- FABM2 2ND SEMESTER FINALS MODULE 3 (PIELAGO)edjay.mercado85No ratings yet

- Local Taxation GuideDocument20 pagesLocal Taxation GuideShanique WilliamsNo ratings yet

- BAC-103-SG-1 Module 1 TaxationDocument8 pagesBAC-103-SG-1 Module 1 TaxationEmmanuel DalioanNo ratings yet

- Introduction to Income Taxation Course OverviewDocument9 pagesIntroduction to Income Taxation Course Overviewᜊ᜔ᜎᜀᜈ᜔ᜃ᜔ ᜃᜈ᜔ᜊᜐ᜔No ratings yet

- Mike's Tax Law Reviewer (Compressed)Document23 pagesMike's Tax Law Reviewer (Compressed)Miguel Anas Jr.No ratings yet

- Taxation CTDocument8 pagesTaxation CTJoy NathNo ratings yet

- BBINCTAX2Document6 pagesBBINCTAX2Less BalesoroNo ratings yet

- UNIT-2 Public Revenue: An Overview of PRDocument67 pagesUNIT-2 Public Revenue: An Overview of PRmelaNo ratings yet

- Income Taxation - MODULE 1Document13 pagesIncome Taxation - MODULE 1Joe P PokaranNo ratings yet

- Tax TVDocument151 pagesTax TVAngel MarieNo ratings yet

- Income Taxation - Topic 1Document2 pagesIncome Taxation - Topic 1jessamaepinas5No ratings yet

- Income Taxation BsaDocument11 pagesIncome Taxation BsaCrizel SerranoNo ratings yet

- Taxation Week 1Document8 pagesTaxation Week 1JUAN GABONNo ratings yet

- Principles of Taxation ExplainedDocument25 pagesPrinciples of Taxation ExplainedMarinella GonzalesNo ratings yet

- Taxation LawDocument106 pagesTaxation Lawjohnanthony201No ratings yet

- Basic Principles - What You Need To KnowDocument2 pagesBasic Principles - What You Need To KnowMayla Masxcxl100% (1)

- A4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicsDocument38 pagesA4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicscharlesjoshdanielNo ratings yet

- 4 Tax AdmDocument99 pages4 Tax AdmErmi ManNo ratings yet

- Taxes, Laws, and Administration ExplainedDocument32 pagesTaxes, Laws, and Administration ExplainedSenja SoreNo ratings yet

- Bar NIEL Final TAX PrintDocument48 pagesBar NIEL Final TAX PrintNiel S. DefensorNo ratings yet

- Taxation Law 1 ReviewerDocument11 pagesTaxation Law 1 ReviewerCyril Dave LimNo ratings yet

- Income Taxation: by Mark Oliver V. Estavillo, LLBDocument18 pagesIncome Taxation: by Mark Oliver V. Estavillo, LLBPrincess MogulNo ratings yet

- Definition of TaxationDocument4 pagesDefinition of TaxationAlisyaNo ratings yet

- مالیه گذاریDocument11 pagesمالیه گذاریHashim AhmadiNo ratings yet

- Definition of Tax: Chapter - 1Document12 pagesDefinition of Tax: Chapter - 1Joy NathNo ratings yet

- Tax 311 Topic PDFDocument22 pagesTax 311 Topic PDFAnnie Mae YnotNo ratings yet

- Attendance - Asst Prof I - Batch 1 (Oct.4,2021-DSF)Document1 pageAttendance - Asst Prof I - Batch 1 (Oct.4,2021-DSF)Aljay LabugaNo ratings yet

- Digest Taxation Cases PDFDocument414 pagesDigest Taxation Cases PDFKent Bryan Rubin100% (2)

- People vs. LarrañagaDocument3 pagesPeople vs. LarrañagaAljay LabugaNo ratings yet

- People vs. BaidDocument2 pagesPeople vs. BaidAljay LabugaNo ratings yet

- TEAM PARA PIA, Dipolog Paragliding: Greetings!Document1 pageTEAM PARA PIA, Dipolog Paragliding: Greetings!Aljay LabugaNo ratings yet

- Agency Cases and DigestDocument12 pagesAgency Cases and DigestPaul Christopher PinedaNo ratings yet

- Attendance - Inst1 - Batch 1 & 2 (Oct.4,2021-DSF)Document2 pagesAttendance - Inst1 - Batch 1 & 2 (Oct.4,2021-DSF)Aljay LabugaNo ratings yet

- IP law midterms exam questionsDocument5 pagesIP law midterms exam questionsAljay LabugaNo ratings yet

- Attendance - Asst Prof I - Batch 1 (Oct.4,2021-DSF)Document1 pageAttendance - Asst Prof I - Batch 1 (Oct.4,2021-DSF)Aljay LabugaNo ratings yet

- TEAM PARA PIA, Dipolog Paragliding: Greetings!Document1 pageTEAM PARA PIA, Dipolog Paragliding: Greetings!Aljay LabugaNo ratings yet

- Pacto de Retro Sale Refers To The Sale Wherein The Seller Has The Right To Repurchase The Subject Matter or TheDocument2 pagesPacto de Retro Sale Refers To The Sale Wherein The Seller Has The Right To Repurchase The Subject Matter or TheAljay LabugaNo ratings yet

- Attendance - WCMN1 - Batch 1 & 2 (Oct.4,2021-DSF)Document1 pageAttendance - WCMN1 - Batch 1 & 2 (Oct.4,2021-DSF)Aljay LabugaNo ratings yet

- Discussion April 17Document3 pagesDiscussion April 17Aljay LabugaNo ratings yet

- TEAM PARA PIA, Dipolog Paragliding: Greetings!Document1 pageTEAM PARA PIA, Dipolog Paragliding: Greetings!Aljay LabugaNo ratings yet

- Election Law 2Document2 pagesElection Law 2Aljay LabugaNo ratings yet

- PartnershipDocument1 pagePartnershipAljay LabugaNo ratings yet

- Transportation Law EssentialsDocument24 pagesTransportation Law Essentialswalnutwitch100% (3)

- RapeDocument3 pagesRapeAljay LabugaNo ratings yet

- Insurrance LawDocument2 pagesInsurrance LawAljay LabugaNo ratings yet

- Ipl Finals FEBRUARY 2, 2022 IDocument4 pagesIpl Finals FEBRUARY 2, 2022 IAljay LabugaNo ratings yet

- DiscussDocument1 pageDiscussAljay LabugaNo ratings yet

- CONFLICT OF LAWS AnswersDocument61 pagesCONFLICT OF LAWS AnswersAljay LabugaNo ratings yet

- FinalsDocument2 pagesFinalsAljay LabugaNo ratings yet

- Conflict of Laws EssentialsDocument8 pagesConflict of Laws EssentialsAljay LabugaNo ratings yet

- Reviewer 1st WsDocument3 pagesReviewer 1st WsAljay LabugaNo ratings yet

- Kinds of Wills Testamentary Succession Degree The Disposition of His Estate To Take Effect After His DeathDocument5 pagesKinds of Wills Testamentary Succession Degree The Disposition of His Estate To Take Effect After His DeathAljay LabugaNo ratings yet

- Discussion IPLDocument1 pageDiscussion IPLAljay LabugaNo ratings yet

- The Nationality TheoryDocument2 pagesThe Nationality TheoryAljay LabugaNo ratings yet

- The Elements of Abuse of Right That May Be ActionaDocument1 pageThe Elements of Abuse of Right That May Be ActionaAljay LabugaNo ratings yet

- Tax CasesDocument1 pageTax CasesAljay LabugaNo ratings yet

- Cons of Global Free TradeDocument4 pagesCons of Global Free TradeGlydel Mae LaidanNo ratings yet

- Dwnload Full Business Statistics 1st Edition Donnelly Solutions Manual PDFDocument35 pagesDwnload Full Business Statistics 1st Edition Donnelly Solutions Manual PDFerichuel33a100% (12)

- False 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinDocument2 pagesFalse 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinLazy LeathNo ratings yet

- Impact of GST On Common Man 2Document99 pagesImpact of GST On Common Man 2Diya100% (1)

- Marketing The Core 7th Edition Kerin Test Bank DownloadDocument57 pagesMarketing The Core 7th Edition Kerin Test Bank DownloadEdith Stack100% (19)

- ABakadaDocument13 pagesABakadanikko janNo ratings yet

- BAUTISTA, Ghislaine Faye M. ELE-EIT (10:00-11:30) Economics, Investments, and Taxation Ms. Eloisa Dela CruzDocument7 pagesBAUTISTA, Ghislaine Faye M. ELE-EIT (10:00-11:30) Economics, Investments, and Taxation Ms. Eloisa Dela CruzGHISLAINE FAYE BAUTISTANo ratings yet

- Us Id-116342Document106 pagesUs Id-116342Marius BuysNo ratings yet

- Review of GSTDocument41 pagesReview of GSTAdiNo ratings yet

- BM2427I003995376Document7 pagesBM2427I003995376ANANT NITANWARNo ratings yet

- GST Council 2022: GST Rates 2022 - Complete List of Goods and Service Tax Rates, Slab & RevisionDocument13 pagesGST Council 2022: GST Rates 2022 - Complete List of Goods and Service Tax Rates, Slab & RevisionAkshaya ilangoNo ratings yet

- 2022 Annual SummaryDocument2 pages2022 Annual SummaryTareqAFC 408No ratings yet

- Drawback Section 75.Document4 pagesDrawback Section 75.PRATHAMESH MUNGEKARNo ratings yet

- 211 Scra 219Document2 pages211 Scra 219pyulovincentNo ratings yet

- Bos 050121 Interp 4Document214 pagesBos 050121 Interp 4samartha umbare100% (1)

- Abraham Final CommentDocument60 pagesAbraham Final CommentYimmamNo ratings yet

- DOCUMENT Port Health Services BatamDocument2 pagesDOCUMENT Port Health Services BatamRayma RichardNo ratings yet

- As Fiscal PolicyDocument8 pagesAs Fiscal PolicyZunaira JamilNo ratings yet

- Response Letter 1.0Document10 pagesResponse Letter 1.0Sune Payne- Daily MaverickNo ratings yet

- Cheap Totally In-Demand: and For BeingDocument7 pagesCheap Totally In-Demand: and For Beingmotilal oswalNo ratings yet

- The International Trade ProcessDocument22 pagesThe International Trade ProcessPeleoneNo ratings yet

- Form GST REG-25: Government of India and Government of Madhya PradeshDocument1 pageForm GST REG-25: Government of India and Government of Madhya PradeshAnonymous hQpEadSf0% (1)

- Bill - KalyanpurDocument2 pagesBill - KalyanpurPronceNo ratings yet

- EPDA MV ORIENT PLUTO - RDMP CONSTRUCTION JETTY - BALIKPAPAN - 14 July 2021Document1 pageEPDA MV ORIENT PLUTO - RDMP CONSTRUCTION JETTY - BALIKPAPAN - 14 July 2021Mahamuk BiniNo ratings yet

- IRFAN AHMAD S/O IKHLAQ AHMAD'S ELECTRICITY BILL FOR JULY 2021Document1 pageIRFAN AHMAD S/O IKHLAQ AHMAD'S ELECTRICITY BILL FOR JULY 2021ahsanNo ratings yet

- Hotel Check-In Registration FormDocument1 pageHotel Check-In Registration FormPutu BudaNo ratings yet

- Philippine Association of Certified Tax TechniciansDocument3 pagesPhilippine Association of Certified Tax Techniciansucc second yearNo ratings yet

- Topic:-Direct and Indirect Taxes: Department of Electronics & Telecommunication EngineeringDocument15 pagesTopic:-Direct and Indirect Taxes: Department of Electronics & Telecommunication EngineeringSakshi DewadeNo ratings yet

- Pi20210316a Performa Invoice Fco20210316a Palm Oil Cp10 Git Hadeer TR Group Mar 23Document1 pagePi20210316a Performa Invoice Fco20210316a Palm Oil Cp10 Git Hadeer TR Group Mar 23Chandan JstNo ratings yet

- Topic: Taxation: Readings in Philippine History (Readphi)Document9 pagesTopic: Taxation: Readings in Philippine History (Readphi)Joy Santos100% (1)