Professional Documents

Culture Documents

Tax3 Unit Plan UKAT3043 - 2021

Tax3 Unit Plan UKAT3043 - 2021

Uploaded by

Esther LuehOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax3 Unit Plan UKAT3043 - 2021

Tax3 Unit Plan UKAT3043 - 2021

Uploaded by

Esther LuehCopyright:

Available Formats

May

2020

UNIVERSITI TUNKU ABDUL RAHMAN (UTAR)

FACULTY OF BUSINESS AND FINANCE (FBF)

FACULTY OF ACCOUNTANCY AND MANAGEMENT (FAM)

Course Plan

UKAT3043 Taxation III

1. Course Code

& Course Name

Bachelor of Accounting

2. Programme of Study:

3. Year of Study: Year Three / Four

4. Year and Trimester: 202105

5. Credit Hour: 3 credit hours

6. Contact Hours: 2 hours lecture per week for the duration of 14 weeks

1.5 hours tutorial per week for the duration of 14 weeks

Lead lecturer and tutor (FAM): Ms.Shubatra

7. Name of academic staff

Shanmugaretnam

Tutor (FAM): Mr.Kho Guan Khai

Tutor (FAM): Ms.Leong May Li

Tutor(FAM): Ms.Logeswary Maheswaran

8. Moderator: Ms.Low Suet Cheng

9. Mode of Delivery: Lecture and tutorial

10. Course Learning Outcome: 1. Demonstrate on the planning issues, and the use of tax

efficiency arrangements, tax incentives and other standard

measures to minimize tax for individuals and companies.

2. Evaluate the impact of taxes on various business situations

and suggest course of action.

3. Demonstrate understanding of the process of tax audit and

investigation.

11. Reading List: Main readings:

1. Kasipillai J. A Guide to Malaysian Taxation (5th ed.)

Malaysia: McGraw-Hill (Malaysia) Sdn. Bhd.

2. Choong, K. F. (2021) Advanced Malaysian Taxation:

Principles and Practice. (22th ed.). Malaysia:

InfoWorld.

3. Choong, K. F. (2021) Malaysian Taxation: Principles

and Practice (27th ed.). Malaysia: InfoWorld.

Additional readings:

4. CCH Tax Editors (2021) Malaysian Master Tax Guide

(38rd ed.). Malaysia: CCH Asia Pte Limited.

Unit Plan of UBAT3043/UKAT3043 Taxation III 1

May

2020

5. Veerinder on Malaysian Tax Theory and Practice,

Malaysia: CCH Asia Pte Ltd

6. The Chartered Tax Institute of Malaysia, Malaysian

Institute of Accountants and The Malaysian Institute of

Certified Public Accountants, Budget Commentary &

Tax Information (annually).

7. The Chartered Tax Institute of Malaysia, Tax Guardian

(quarterly). ● The Malaysian Institute of Accountants,

Accountants Today (monthly).

8. Income Tax Act 1967.

9. Sales Tax 2018.

10. Service Tax 2018.

11. Stamp Duty Act 1949

12. Real Property Act 1976

13. Public Rulings and Guidelines issued by the Inland

Revenue Board.

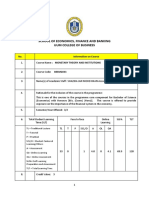

12 Constructive Alignment Table

No CLO PLO Delivery C/A/P and Assessment Methods &

Methods Taxonomy T

Mark Breakdown*

Level o

Assignment

Assessment

t

a

Final

Test l

Lecture,

1 CLO1 1 C6 20% 30% 50%

Tutorial

Lecture, 8%

2 CLO2 3 C6 15% 23%

Tutorial

Lecture, 12%

3 CLO3 6 C6 15% 27%

Tutorial

Total 20% 20% 60% 100%

Domain – Affective(A), Cognitive(C), Psychomotor(P),

Taxaonomy Level – A(Level 1 = 5), C - (Level 1 – 6), P – (Level 1- 5)

#

Domain – Affective (A), Cognitive (C), Psychomotor(P); Taxonomy Level – A (Level 1 –

5), C (Level 1 – 6), P (Level 1 – 5)

C1 - Remembering A1 – Receiving Phenomena P1 – Imitating

C2 - Understanding A2 – Responds to Phenomena P2 - Manipulating

C3 - Applying A3 - Valuing P3 – Developing Precision

C4 - Analyzing A4 – Organization P4 - Articulating

C5 - Evaluating A5 – Internalizes Values P5 - Naturalizing

(Characterization)

C6 - Creating

F2F : Faca to Face delivery, AL : Action Learning, CL: Collaborative Learning, SDL : Self

directed learning, PBL: Problem/Project based learning, TD: Technology- based delivery,

EM: Experiential method, WBL: Work- based learning

Unit Plan of UBAT3043/UKAT3043 Taxation III 2

May

2020

13. Methods of Assessment: No Method of Assessment Total

1. Continuous Assessment

a) Mid-term (individual) 20%

40%

b) Group assignment 20%

2. Final Assessment 60%

Grand Total 100%

1. Continuous Assessment (40% of the total assessment)

The objectives of continuous assessment are as follows:-

To assess students’ understanding of the subject and their

ability to apply the tax concepts and principles learnt to solve

problems.

To encourage students’ participation in discussions and to

share of ideas and knowledge

To instill teamwork among students

To develop students’ presentation and communication skills

To explore student awareness on the recent development and

using software.

a) Mid-term Test (20%)

A mid-term test is tentatively scheduled for 17th. July 2021

Saturday (9.00 a.m. – 11.00 a.m.) (Week 6) to assess students

understanding of topics covered up to Week 4 of lectures.

b) Group Assignment (20%)

Instructions and requirements of the assignment would be

distributed by Week 2. Students are required to prepare a

report on an assignment in a group of not more than 5

students from within the same tutorial group, and submitted

to their respective tutors by 12.00 p.m. on 6th. August 2021

Friday of Week 9).

Deadline for submission of assessment item(s) is to be

strictly adhered to. No extension of time will be allowed

except in extenuating circumstances.

2. Final Assessment (60% of the total assessment):

Students are required to answer four (4) questions within an

allotted time of three (3) hours in the final (main) assessment as

follows:

Four (4) compulsory question in which carries forty (25)

Unit Plan of UBAT3043/UKAT3043 Taxation III 3

May

2020

marks each

Students are required achieve a minimum of fifty (50) marks out

of one hundred (100) marks in the aggregate of continuous

assessment and final examination to pass the course.

14. Academic Regulations Attendance

Attendance at lectures and tutorials is compulsory. Students must

have a minimum 80 per cent attendance overall for both lectures

and tutorials. Absence from class have to be supported either by a

genuine medical leave certificate or an approved leave certificate

given by the Faculty. Students whose absence level exceeds 20 per

cent are likely to be barred from taking the final examination.

Plagiarism

Plagiarism is defined as the submission or presentation of work, in

any form, which is not one's own, without acknowledgment of the

sources. If a student obtains information or ideas from an outside

source, that source must be acknowledged. Another rule to follow is

that any direct quotation must be placed in quotation marks and the

source immediately cited.

Plagiarism is also defined as the copying of all or part of the work

of student or students of the current or a previous batch of this

University or another higher learning institution.

The University's degree and other academic awards are given in

recognition of the candidate's personal achievement. Plagiarism is

therefore considered an act of academic fraudulence and an offence

against University discipline.

Intellectual Property

Copyright must be seriously protected. The University takes a

strong stand against any illegal photocopying of textbooks and any

other materials by students. Students are forewarned of the

consequences and the penalty that may be meted out if they are

"caught in the act".

Modes of Referencing

Students are advised to incorporate proper academic modes of

referencing. The normally acceptable mode of academic referencing

is the American Psychological Association (APA) system; please

refer to the attached APA referencing system document for detailed

usage.

Unit Plan of UBAT3043/UKAT3043 Taxation III 4

May

2020

Teaching Plan

Lecture Topic Course Learning Tutorial

Week Reference

Course Learning Outcome Topic

Outcome Continuous

Assessment

1-2 Tax Audit and CLO3- Demonstrate Tax audit and 1. Kasipillai, J. (2009). A

Investigation understanding of the tax comprehensive guide to

(8/6 – 13/6) investigation

process of tax audit Malaysian Taxation

Learning outcome

(14/6 – 20/6) and investigation. Capital 2. Tax Audit Framework,

1. Distinguish

between tax audit Statement IRB

and investigation 3. Tax Investigation

2. Identify issues and Framework, IRB

areas under tax

audit and

investigation

3. Identify the

power of Director

General

4. Compute

Capital Statement

3–4 Real Property Gains CLO2 - Evaluate the Real Property 1. Singh, Veerinderjeet

Tax (RPGT) impact of taxes on Gains Tax (2011). Veerinder on

(21/6 – 27/6)

Real Property various business Taxation (VT, SV)

Real Property

(28/6 -4/7) Companies situations and suggest Gains Tax Chapter 15

Learning outcome: course of action

2. Garis Panduan Cukai

1. Determine

Keuntungan Harta Tanah,

Disposal price and

LHDN

date

(www.hasil.gov.my)

2. Determine

Acquisition price

and date

3. Apply RPGT

exemption

4. Compute the

RPGT liability

5. Compute RPGT

on disposal of

shares

Unit Plan of UBAT3043/UKAT3043 Taxation III 5

May

2020

Lecture Topic Course Learning Tutorial

Week Reference

Course Learning Outcome Topic

Outcome Continuous

Assessment

5 Taxability of CLO 1 - Demonstrate 1. VT, SV (Chpt 6, 10)

on the planning Taxability of

Receipts 2.AMT, CKF

(5/7 – 11/7) Receipts

Deductibility of issues, and the use of 3. Public Ruling 2/2011,

Expenses tax efficiency 4/2011

arrangements, tax Deductibility

Learning outcome:

incentives and other of Expenses

1. Distinguish

between capital or standard measures to

revenue receipts minimize tax for

relating to individuals and

compensation companies.

receipts

2. Discuss CLO2 - Evaluate the

taxation of rental impact of taxes on

income various business

3. Determine situations and suggest

taxability of course of action

unclaimed deposits

4. Determine

deductibility of

interest expense.

5. Apply

relevant case laws

Tax Incentives:

6 -7 CLO 1 - Demonstrate Advanced Malaysian

Labuan Offshore Labuan

Taxation, Principles and

(12/7–18/7) Companies (LOC) on the planning Offshore

issues, and the use of Practice. Choong Kwai

(19/7- 25/7) Other Incentives Companies

tax efficiency Fatt. (AMT, CKF)

Tax incentives

Learning Outcome: arrangements, tax

1. Apply tax incentives and other

incentives Mid-term test

standard measures to

2. Make use of LOC on

by overseas minimize tax for

individuals and 17 July 2021 at

enterprise 9.00 a.m

companies

CLO2 - Evaluate the

impact of taxes on

various business

situations and suggest

course of action

Stamp Duty

8 Stamp Duty (SD) CLO2 - Evaluate the Advanced Malaysian

Lease or Buy impact of taxes on Stamp Duty Taxation, Principles and

(26/7– 1/8/)

various business Practice. Choong Kwai

Learning Outcome: Leasing

situations and suggest Fatt. (AMT, CKF)

1. Compute Stamp

Duty course of action

2. Apply Stamp Duty

Relief

3. Categorize leasing

income

Unit Plan of UBAT3043/UKAT3043 Taxation III 6

May

2020

Lecture Topic Course Learning Tutorial

Week Reference

Course Learning Outcome Topic

Outcome Continuous

Assessment

9 Individual Tax CLO 1 - Demonstrate Individual tax 1. Public Ruling 1/2011,

Planning on the planning planning 11/2012

(2/8- 8/8)

issues, and the use of

Learning Outcome:

1. Determine

tax efficiency

taxability of arrangements, tax

incentives and other Group

overseas

standard measures to Assignment

employment

Due for

income minimize tax for

submission: 6

2. Compute taxable individuals and August 2021,

value for employee companies. 12.00 pm

share option

3. Determine treaty

exemption for

employment

income.

4. Remuneration

packages.

10 – 11 Corporate Tax CLO 1 - Demonstrate Corporate Tax 1. AMT, CKF

Planning on the planning Planning 2. VT, SV (Chpt 17)

(9/8 - 15/8)

issues, and the use of

Learning outcomes:

(16/8 – 22/8) tax efficiency

1. Apply tax treatment

on transfer of asset arrangements, tax

including control incentives and other

transfer standard measures to

2. Advise on dividend minimize tax for

distribution individuals and

3. Advise on the tax companies.

treatment of

corporate

restructuring

Identify areas to

mitigate tax

liability.

4. Explain the concept

of transfer pricing

and thin

capitalization

5. Identify issues in

transfer pricing

Unit Plan of UBAT3043/UKAT3043 Taxation III 7

May

2020

Lecture Topic Course Learning Tutorial

Week Reference

Course Learning Outcome Topic

Outcome Continuous

Assessment

12 Taxation of: CLO2 - Evaluate the Unit Trust 1.PR 7/2012, 8/2012,/2012,

(23/8–29/8) Unit Trust impact of taxes on Real Estate

2/2015

Real Estate various business 2. AMT, CKF

Investment

Investment Trust situations and suggest Trust

Learning Outcome: course of action

1. Determine the

taxable income of

REIT/ unit trust

2. Determine how

unit holders are

taxed on the

distribution from

unit trust.

13 Air/ Ship CLO2 - Evaluate the Air/ship PR10/2012

Undertaking impact of taxes on undertaking

(30/8 -5/9)

Learning outcome: various business

1. Compute tax situations and suggest

payable of air/ course of action

shipping company

14 Revision

(6/9 - 12/9)

This Course Plan is:

Prepared by: Moderated by: Approved by:

____________________ ____________________

______________

Low Suet Cheng Dr.Lim Wan Leng

Shubatra Shanmugaretnam

Moderator Head of Department

Lead Lecturer

Date : 3 June 2021 Date: 3rd June 2021 Date: 4 June 2021

Note: The information provided in this Course Plan is subject to changes by the Lecturer.

Students shall be notified in advance of any changes via WBLE.

Notes: The lecturer and the internal moderator have discussed and agreed on the content of this

course plan on 03/06/2021

Unit Plan of UBAT3043/UKAT3043 Taxation III 8

You might also like

- A Concept-Based Introduction To Financial Accounting Juta 6th Edition (Kolitz DL and Kolitz M) (Z-Library)Document44 pagesA Concept-Based Introduction To Financial Accounting Juta 6th Edition (Kolitz DL and Kolitz M) (Z-Library)kazimkorogluNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document23 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (4)

- SolutionDocument57 pagesSolutionJeremiah NcubeNo ratings yet

- COURSE OUTLINE SPRING-2020 - Zonaira Shehper - Audit and TaxationDocument6 pagesCOURSE OUTLINE SPRING-2020 - Zonaira Shehper - Audit and TaxationNoor FatimaNo ratings yet

- Universiti Tunku Abdul Rahman (Utar) : Faculty of Accountancy and ManagementDocument6 pagesUniversiti Tunku Abdul Rahman (Utar) : Faculty of Accountancy and ManagementalibabaNo ratings yet

- UM-PT01-MQF-BR006-S00 MAKLUMAT KURSUS UNTUK SEMESTER PENGGAL SEMASA (Adjusted COVID19)Document4 pagesUM-PT01-MQF-BR006-S00 MAKLUMAT KURSUS UNTUK SEMESTER PENGGAL SEMASA (Adjusted COVID19)Wong Yong Sheng WongNo ratings yet

- Universiti Tunku Abdul Rahman (Utar) : Faculty of Accountancy and Management (Fam)Document12 pagesUniversiti Tunku Abdul Rahman (Utar) : Faculty of Accountancy and Management (Fam)Wanqi LooNo ratings yet

- Taxation Law SyllabusDocument4 pagesTaxation Law SyllabusRohan JainNo ratings yet

- Tax 2Document5 pagesTax 2ShazyNo ratings yet

- English Manajemen PerpajakanDocument16 pagesEnglish Manajemen PerpajakanfifiNo ratings yet

- TAXATIONDocument4 pagesTAXATIONCza PeñaNo ratings yet

- Course Outline Advnced Business TaxationDocument4 pagesCourse Outline Advnced Business TaxationjohnNo ratings yet

- Simran Sharma ProjectDocument56 pagesSimran Sharma ProjectSimranNo ratings yet

- Course Title: TAXATION LAW Course Code: LAW442 L T P/ S SW/ FW Tota L Credi T UnitsDocument4 pagesCourse Title: TAXATION LAW Course Code: LAW442 L T P/ S SW/ FW Tota L Credi T UnitsYash TiwariNo ratings yet

- Syllabus A212 2022 Group ADocument6 pagesSyllabus A212 2022 Group AFatinNo ratings yet

- 2 Advanced Stage TAX Module Outline Sept 2018Document5 pages2 Advanced Stage TAX Module Outline Sept 2018Aniss1296No ratings yet

- Course Plan Taxation Law BA - LLB - CLCC4001Document16 pagesCourse Plan Taxation Law BA - LLB - CLCC4001amandeep kansalNo ratings yet

- Managerial Economics Course HandoutDocument3 pagesManagerial Economics Course HandoutADITYA JAMAN VAGHASIANo ratings yet

- CV Azian 2024Document4 pagesCV Azian 2024api-737366780No ratings yet

- Silabus Perpajakan 2Document8 pagesSilabus Perpajakan 2Yuliana PriscillaNo ratings yet

- Macroeconomics ModuleDocument144 pagesMacroeconomics Modulekinde kassahunNo ratings yet

- Course Teaching Plan MAA 4043Document4 pagesCourse Teaching Plan MAA 4043fatini farghalyNo ratings yet

- 2022-11-Course Syllabus-Public Finance and TaxationDocument4 pages2022-11-Course Syllabus-Public Finance and TaxationYonas BamlakuNo ratings yet

- List Bibliography PDFDocument1 pageList Bibliography PDFHAHAHANo ratings yet

- Lecturenote - 1669791855public Finance and Taxation AccountingDocument121 pagesLecturenote - 1669791855public Finance and Taxation Accountingaschalew shimelsNo ratings yet

- Ita Prospectus 2022-2023 Revised Print of March29 FinalDocument108 pagesIta Prospectus 2022-2023 Revised Print of March29 Finalkanudasasi2No ratings yet

- Learning Guide (Specific To TAX03A3)Document18 pagesLearning Guide (Specific To TAX03A3)fisekilenhlapoNo ratings yet

- Universiti Tunku Abdul Rahman (Utar) Faculty of Accountancy and ManagementDocument8 pagesUniversiti Tunku Abdul Rahman (Utar) Faculty of Accountancy and ManagementLee HansNo ratings yet

- Income Tax Authories: BangladeshDocument3 pagesIncome Tax Authories: BangladeshSalah UddinNo ratings yet

- BMA 3201 - Strategic Tax Management - EditedDocument10 pagesBMA 3201 - Strategic Tax Management - EditedMark Dave YuNo ratings yet

- HRDF Rama NewDocument4 pagesHRDF Rama NewRamawathyNo ratings yet

- Universiti Sains Malaysia Course SyllibusDocument5 pagesUniversiti Sains Malaysia Course SyllibusNor Ihsan Abd LatifNo ratings yet

- ACT3211 Course Outline Sem 1 Sesi 20 N 21 Group 1 DR NazrulDocument2 pagesACT3211 Course Outline Sem 1 Sesi 20 N 21 Group 1 DR NazrulSITI FARAH LIYANA BT MD SAIDNo ratings yet

- Course Plan GST III (State) 2020Document10 pagesCourse Plan GST III (State) 2020Nitish Kumar NaveenNo ratings yet

- A Project ProposalDocument8 pagesA Project ProposalPasang TamangNo ratings yet

- Taxation Lesson 0 Course OutlineDocument14 pagesTaxation Lesson 0 Course OutlineStudy GirlNo ratings yet

- Paper3Document33 pagesPaper3Inten Meutia MustafaNo ratings yet

- AF101 Course Outline s1 2024Document11 pagesAF101 Course Outline s1 2024Maciu TuilevukaNo ratings yet

- Course Outline: International FinanceDocument6 pagesCourse Outline: International FinanceShammo AhzNo ratings yet

- Abdul Jabbarand Pope 2008 ATFDocument20 pagesAbdul Jabbarand Pope 2008 ATFNayy DaniaNo ratings yet

- UKFF3363 Course Plan StudentDocument5 pagesUKFF3363 Course Plan StudentWEN EN KOAYNo ratings yet

- AF101 Course Outline MUST READ PDFDocument9 pagesAF101 Course Outline MUST READ PDFMalia i Lutu Leonia Kueva LosaluNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)BakhtawarNo ratings yet

- AF101 Introduction To Accounting & Financial Management Part IDocument11 pagesAF101 Introduction To Accounting & Financial Management Part IRoiti TarauNo ratings yet

- Assignment Brief - International Finance 2022Document6 pagesAssignment Brief - International Finance 2022Ahmed Munawar100% (1)

- Strategic Tax Management - Bma22 - SyllabusDocument8 pagesStrategic Tax Management - Bma22 - SyllabusJames Ryan AlzonaNo ratings yet

- Intermediate Course Study Material: TaxationDocument34 pagesIntermediate Course Study Material: TaxationMd IbrarNo ratings yet

- ACCT3161AB Taxation Term 1 2021-22Document8 pagesACCT3161AB Taxation Term 1 2021-22Park Ji EunNo ratings yet

- Course OL TaxationDocument3 pagesCourse OL TaxationSayed Mukhtar HedayatNo ratings yet

- Cost and Management Accounting I Mohammed Hanif Full ChapterDocument67 pagesCost and Management Accounting I Mohammed Hanif Full Chapterrobert.hoppe659100% (6)

- Taxation Syllabus ACCADocument4 pagesTaxation Syllabus ACCAMadina NugmetNo ratings yet

- BAC4644 Advanced Tax March 2011-OBEDocument3 pagesBAC4644 Advanced Tax March 2011-OBEchunlun87No ratings yet

- Advanced Taxation (Cuac 408) Module NotesDocument89 pagesAdvanced Taxation (Cuac 408) Module Notesprecious mountainsNo ratings yet

- The Acceptance of E-Filing by Pakistani - A Case Study of FBRDocument25 pagesThe Acceptance of E-Filing by Pakistani - A Case Study of FBRMangi110No ratings yet

- UKAM1033 Course PlanDocument10 pagesUKAM1033 Course PlanRhinndhi SakthyvelNo ratings yet

- Financial ReportingDocument3 pagesFinancial Reportinggembel mlithiNo ratings yet

- Econ f315 Fin f315 Financial Management Sem II 2017-18Document4 pagesEcon f315 Fin f315 Financial Management Sem II 2017-18Jayesh MahajanNo ratings yet

- Handbook of Singapore — Malaysian Corporate FinanceFrom EverandHandbook of Singapore — Malaysian Corporate FinanceTan Chwee HuatNo ratings yet

- Assignment QuestionDocument6 pagesAssignment QuestionEsther LuehNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Accountancy & Management Bachelor of Accounting (Hons) UKAM3043 Management Accounting III (Y3S1) Tutorial 5Document1 pageUniversiti Tunku Abdul Rahman Faculty of Accountancy & Management Bachelor of Accounting (Hons) UKAM3043 Management Accounting III (Y3S1) Tutorial 5Esther LuehNo ratings yet

- Group Assignment (20%) : Any Question Related To Group Assignment Should Be Directed To Lead LecturerDocument7 pagesGroup Assignment (20%) : Any Question Related To Group Assignment Should Be Directed To Lead LecturerEsther Lueh100% (1)

- Ukaf4023 Accounting Theory and Practice: October 2021 Assignment (20%)Document8 pagesUkaf4023 Accounting Theory and Practice: October 2021 Assignment (20%)Esther LuehNo ratings yet

- Tutorial 13 14 RevisedDocument4 pagesTutorial 13 14 RevisedEsther LuehNo ratings yet

- Understanding and Appreciating The Time Value of MoneyDocument68 pagesUnderstanding and Appreciating The Time Value of MoneyEsther LuehNo ratings yet

- Tutorial 12 Performance MeasurementDocument4 pagesTutorial 12 Performance MeasurementEsther LuehNo ratings yet

- Bachelor of Engineering (Honours) Biomedical Engineering Bachelor of Engineering (Honours) Mechatronics EngineeringDocument3 pagesBachelor of Engineering (Honours) Biomedical Engineering Bachelor of Engineering (Honours) Mechatronics EngineeringEsther LuehNo ratings yet

- Lecture 1 (Chapter 1 & 2)Document77 pagesLecture 1 (Chapter 1 & 2)Esther LuehNo ratings yet

- Bachelor of Engineering (Honours) Biomedical Engineering Bachelor of Engineering (Honours) Mechatronics EngineeringDocument11 pagesBachelor of Engineering (Honours) Biomedical Engineering Bachelor of Engineering (Honours) Mechatronics EngineeringEsther LuehNo ratings yet

- Sewatama 8301379118, Revisi DPR02-0058-23Document2 pagesSewatama 8301379118, Revisi DPR02-0058-23denny palimbungaNo ratings yet

- Marketing Strategy For Icici BankDocument8 pagesMarketing Strategy For Icici BankNeha SinghNo ratings yet

- Understanding The Market Opportunities From Market Access MAP, India Trade Portal and Service Trade Restrictiveness Index DataDocument14 pagesUnderstanding The Market Opportunities From Market Access MAP, India Trade Portal and Service Trade Restrictiveness Index DataB.S. RawatNo ratings yet

- Engl4 klk1Document13 pagesEngl4 klk1jelena bozinovicNo ratings yet

- GU 02 TRANSPORT Principles and ParticipantsDocument3 pagesGU 02 TRANSPORT Principles and ParticipantsTanmayNo ratings yet

- Herbert Feis PDFDocument489 pagesHerbert Feis PDFLuis Osvaldo AlvarezNo ratings yet

- Eclectica January ReportDocument2 pagesEclectica January Reportpick6No ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- Strike Lockout Layoff and ClosureDocument12 pagesStrike Lockout Layoff and ClosureAseem TyagiNo ratings yet

- Chap 5 PDFDocument22 pagesChap 5 PDFHiren ChauhanNo ratings yet

- Overview of Financial ManagementDocument16 pagesOverview of Financial ManagementKAUSHIKNo ratings yet

- Lakshwiz Bazaar - Marketing Case Study Challenge.Document3 pagesLakshwiz Bazaar - Marketing Case Study Challenge.Dushyant Singh SolankiNo ratings yet

- Types of EmployeeDocument2 pagesTypes of EmployeeAlyssa PaularNo ratings yet

- Construction of Gardani Bagh Housing Society, Patna BiharDocument16 pagesConstruction of Gardani Bagh Housing Society, Patna BiharagalyaNo ratings yet

- NBT EnglishDocument103 pagesNBT EnglishAr Shubham KumarNo ratings yet

- 1 What Is A Difference Between A Forward Contract and A Future ContractDocument6 pages1 What Is A Difference Between A Forward Contract and A Future ContractAlok SinghNo ratings yet

- UK Quarterly Marketbeat March 2016Document16 pagesUK Quarterly Marketbeat March 2016mannantawaNo ratings yet

- Evolution of An Amateure Value InvestorDocument13 pagesEvolution of An Amateure Value InvestorAscanioNo ratings yet

- S4 HANA FIORI Analytical ReportingDocument105 pagesS4 HANA FIORI Analytical ReportingJit Ghosh50% (2)

- Chapter 1 The Context of Accounting (MBA)Document38 pagesChapter 1 The Context of Accounting (MBA)redwan bcNo ratings yet

- Articles - Harvard Business Review - Mckinsey Awards For Best HBR ArticlesDocument7 pagesArticles - Harvard Business Review - Mckinsey Awards For Best HBR ArticlesSandeepSingh67% (3)

- Lesson Plan Group 3 Semi Final Docx 2Document12 pagesLesson Plan Group 3 Semi Final Docx 2Tayapad, Irene C.No ratings yet

- Consolidated Balance Sheet: Britannia Industries LimitedDocument11 pagesConsolidated Balance Sheet: Britannia Industries Limitedtuhinkakashi0% (1)

- Agricultural EconomicsDocument59 pagesAgricultural EconomicsLaila Ubando100% (1)

- Book Catalogue 2017 Low Res PDFDocument30 pagesBook Catalogue 2017 Low Res PDFalgeriacandaNo ratings yet

- Future of The ConnectivityDocument10 pagesFuture of The ConnectivityWalisan turiNo ratings yet

- O. Mahalanobis. Review of Myrdal Asian Drama. Sankhya 1969Document25 pagesO. Mahalanobis. Review of Myrdal Asian Drama. Sankhya 1969jorgekmpoxNo ratings yet

- ERP TestDocument2 pagesERP TestSravanthi BkNo ratings yet

- LIST OF YGC and AYALA COMPANIESDocument3 pagesLIST OF YGC and AYALA COMPANIESJibber JabberNo ratings yet

- About CompanyDocument13 pagesAbout CompanyDivya ChokNo ratings yet