Professional Documents

Culture Documents

TAXATION

Uploaded by

Cza PeñaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAXATION

Uploaded by

Cza PeñaCopyright:

Available Formats

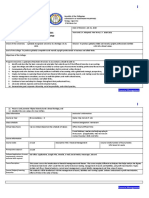

Republic of the Philippines

TARLAC AGRICULTURAL UNIVERSITY

Camiling, Tarlac

OFFICE OF CURRICULUM AND INSTRUCTION

COURSE SYLLABUS FORM

Course Code

BACC 03

Course Title TAU Vision

TAXATION TAU as one of the top 500

Semester / School Year universities in Asia

2nd Semester, 2022-2023 Breakthrough Goals

Course Description Anchored on the challenges

of the Sustainable

Philippine Tax System and Income Taxation deals with the laws, Development Goals for

principles and applications of income taxation in the Philippines. It aims inclusive growth, TAU will:

to provide thorough understanding and mastery of income taxation by 1. take lead in innovative

teaching methodologies and

teaching taxation as a whole body of interconnected concepts. It also appropriate technologies to

discusses and illustrates the accounting and legal technicalities of taxation. create an ideal environment

to optimize learning;

Credit: 2. advance sustainable

3-0-3 agricultural productivity and

improve income through

Pre-requisite/s: innovation, technology

N/A generation, transfer and

training; and

Target Outcomes 3. use Science, Technology

1. To define and understand the general principles and terminologies of and Engineering (STE)

taxation. effectively for climate

change resiliency, adaption

2. To understand the basic concept and nature of different kinds of tax in and agricultural

the Philippines. productivity.

3. To know the basic formula and to be able to compute taxes in Instructor’s Message

I am Sir Darwin and I will

accordance with the National Internal Revenue Code and relevant be your instructional coach

taxation laws. for the semester for the

4. To apply the theories, principles and formula in the computation of course, Strategic

Management. If you have

taxes in our everyday life. questions, talk to or email

me at my contact details

below.

Course Content Instructor’s Contact

A. Midterm Details

Chapter 1: General Principles and Concepts of Taxation Czarina Joy D. Peña

cjoypena2022@tau.edu.ph

Chapter 2: Tax Administration 09061206574

Chapter 3: Concept of Income

Chapter 4: Income Tax of Individuals

B. Finals

Chapter 5: Fringe Benefit and De Minimis Benefits

Chapter 5: Gross Income

Chapter 7: Exclusion from: Gross Income

Chapter 8: Deductions from Gross Income

Chapter 9: Withholding Taxes

References: Suggested Readings

RA No. 8424, National Internal Revenue Code of the Philippines, as

amended by RA No. 10963, Tax Reform for Acceleration and Inclusion

Form Code: Revision No.: Effectivity Date: Page:

TAU-OCI QF-01 00 May 15, 2021 2 of 2

Republic of the Philippines

TARLAC AGRICULTURAL UNIVERSITY

Camiling, Tarlac

OFFICE OF CURRICULUM AND INSTRUCTION

Law

BIR Revenue Regulations

LRP on Income Taxation made by Sir Darwin R. Pineda

Valencia, E, & Roxas, G. (2014). Income Taxation. Baguio City: Valencia

Educational Supply

The Tax Reviewer for CPAs, Lawyers, and Students of Tax 2021 by Atty.

Soriano, Atty. Manuel, & Atty. Laco

Red Notes on Tax of San Beda College

Golden Notes on Tax of University of Santo Tomas

Teaching and Learning Activities

Reading texts, writing lesson plans, conducting short-period instruction,

preparing and presenting special topic reports, discussion, self-directed

learning

Assessment Strategies

Scheduled quizzes, assignments, problem sets, performance assessment,

summative/term tests and exams

Grading System

MIDTERM & FINAL TERM GRADE COMPUTATION

Term Test/Examination 30%

Individual Performance 30%

Attendance

Quiz

Assignments

Recitation

Group Activities 30%

Study Journal 10%

Total 100%

Final Grade = (Midterm grade + Final term grade)/2

Class Policies

1. The learners are held responsible for all assignments and

requirements for the entire content on the course. Read the

materials provided through the links in all the lessons before the

scheduled meeting.

2. The learners should read the links provided in each chapter. The

resources provided in the supplementary will help the learner

deeply understand each lesson.

3. Utilization of Learning is available in Google Classroom for

convenient submission of requirements. Be aware of schedules,

import Google Calendar online or marked dates in your

traditional, hardcopy calendars so you couldn’t miss important

dates.

4. Make sure that you have your own scientific calculator during

your quiz/activity/examination. You can purchase/borrow one

Form Code: Revision No.: Effectivity Date: Page:

TAU-OCI QF-01 00 May 15, 2021 2 of 2

Republic of the Philippines

TARLAC AGRICULTURAL UNIVERSITY

Camiling, Tarlac

OFFICE OF CURRICULUM AND INSTRUCTION

5. Copying the assignment of fellow learners will not help you to get

better in this subject.

6. Cheating in all forms is prohibited.

7. Read the links provided in each chapter. The resources will help

you to deeply understand each lesson.

Form Code: Revision No.: Effectivity Date: Page:

TAU-OCI QF-01 00 May 15, 2021 2 of 2

Republic of the Philippines

TARLAC AGRICULTURAL UNIVERSITY

Camiling, Tarlac

OFFICE OF CURRICULUM AND INSTRUCTION

Prepared by:

CZARINA JOY D. PEÑA

Instructor I

Recommending Approval:

JEROME D. SORIANO, DBA MARIBEL C. RAMALES, MBA

Program Chairperson Chairperson, Curriculum Committee

SILVERIO RAMON DC. SALUNSON, DBA ARLENE V. TOMAS, Ph.D

Dean, College of Business and Management Director, Curriculum & Instruction

Approved:

ARLENE V. TOMAS, Ph.D

Vice President, Academic Affairs

Form Code: Revision No.: Effectivity Date: Page:

TAU-OCI QF-01 00 May 15, 2021 2 of 2

You might also like

- BUILDING THE SKILLS: LEARNING EXPERIENCE AT A CHARTERED ACCOUNTANT FIRMFrom EverandBUILDING THE SKILLS: LEARNING EXPERIENCE AT A CHARTERED ACCOUNTANT FIRMNo ratings yet

- Adult & Continuing Professional Education Practices: Cpe Among Professional ProvidersFrom EverandAdult & Continuing Professional Education Practices: Cpe Among Professional ProvidersNo ratings yet

- TAX1 OBTL Syllabus 1s 20-21Document12 pagesTAX1 OBTL Syllabus 1s 20-21Paula Rodalyn MateoNo ratings yet

- Tax 2 Flexible Obtl Midyear 2021Document13 pagesTax 2 Flexible Obtl Midyear 2021Jamaica DavidNo ratings yet

- Labor Relations and NegotiationsDocument4 pagesLabor Relations and NegotiationsCza PeñaNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document23 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (4)

- BMA 3201 - Strategic Tax Management - EditedDocument10 pagesBMA 3201 - Strategic Tax Management - EditedMark Dave YuNo ratings yet

- Microsyllabus CREDITCOLLECTIONDocument4 pagesMicrosyllabus CREDITCOLLECTIONAlyssa Joy TercenioNo ratings yet

- College For Research & Technology of Cabanatuan: VisionDocument8 pagesCollege For Research & Technology of Cabanatuan: VisionAnn De GuzmanNo ratings yet

- ACCO 20133 - Income TaxationDocument10 pagesACCO 20133 - Income TaxationTachado, Angel Francsjeska A.No ratings yet

- Intermediate Course Study Material: TaxationDocument27 pagesIntermediate Course Study Material: TaxationBharath WajNo ratings yet

- ACCT 370-Applied Taxation-Huzaima BukhariDocument5 pagesACCT 370-Applied Taxation-Huzaima Bukharinetflix accountNo ratings yet

- Course Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Document8 pagesCourse Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Jackie RaborarNo ratings yet

- Learning Packet (BA4) FM2-MM2Document26 pagesLearning Packet (BA4) FM2-MM2Judy Anne RamirezNo ratings yet

- SolutionDocument57 pagesSolutionJeremiah NcubeNo ratings yet

- Bachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeDocument9 pagesBachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeReena BoliverNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document15 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (1)

- AE11Document11 pagesAE11Jinrey AzuriasNo ratings yet

- Eastern Samar State University Borongan City, Eastern Samar: Accounting 514 Accounting Review Part 1 (Taxation)Document7 pagesEastern Samar State University Borongan City, Eastern Samar: Accounting 514 Accounting Review Part 1 (Taxation)Peter Daniel Cinco BugtasNo ratings yet

- Tax 2Document14 pagesTax 2EgildNo ratings yet

- Philippine Women'S University: College DepartmentDocument3 pagesPhilippine Women'S University: College DepartmentJui Provido100% (2)

- TX-UK J24-M25 Syllabus and Study Guide - FinalDocument24 pagesTX-UK J24-M25 Syllabus and Study Guide - FinalKhin Lapyae TunNo ratings yet

- BSA 2105 - Business TaxDocument12 pagesBSA 2105 - Business TaxSherwin Benedict SebastianNo ratings yet

- Syllabus GHOU3063 HOSPITALITY AND TOURISM LAW LATESTDocument7 pagesSyllabus GHOU3063 HOSPITALITY AND TOURISM LAW LATESTJasmine TehNo ratings yet

- Food and BEv Cost ControlDocument8 pagesFood and BEv Cost ControlKarl VillarubiaNo ratings yet

- Acctg20. AIS Course OutlineDocument6 pagesAcctg20. AIS Course Outlinegenelyn ingatNo ratings yet

- Instructional Materials For Income TaxationDocument126 pagesInstructional Materials For Income TaxationNadi HoodNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document19 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella67% (3)

- College of Business and Entrepreneurial Technology: Rizal Technological UniversityDocument8 pagesCollege of Business and Entrepreneurial Technology: Rizal Technological Universitypraise ferrerNo ratings yet

- Ic 110 - General EconomicsDocument8 pagesIc 110 - General EconomicsGenner RazNo ratings yet

- Accounting PreliminariesDocument9 pagesAccounting PreliminariesCharlene SibolboroNo ratings yet

- Student Training ContractDocument4 pagesStudent Training ContractJunessa TadinaNo ratings yet

- Bos 41987 in It PagesDocument17 pagesBos 41987 in It PagesAnju TresaNo ratings yet

- BAC1 Module3 Week3 StudentsDocument25 pagesBAC1 Module3 Week3 StudentsSim BelsondraNo ratings yet

- Taxation 1-Course-SyllabusDocument6 pagesTaxation 1-Course-SyllabusArmalyn Cangque0% (1)

- Conceptual Framework and Accounting Standard SyllabusDocument12 pagesConceptual Framework and Accounting Standard Syllabusrenzelmagbitang222No ratings yet

- ACCT1000 AccountingDocument12 pagesACCT1000 AccountingNadjah JNo ratings yet

- BC 103. Taxation IncomeDocument8 pagesBC 103. Taxation Incomezekekomatsu0No ratings yet

- Mib Business LawDocument21 pagesMib Business LawKai Sheng TanNo ratings yet

- IntroDocument18 pagesIntroDrishti PriyaNo ratings yet

- Syllabus For Managerial EconomicsDocument18 pagesSyllabus For Managerial EconomicsCharo GironellaNo ratings yet

- Institute of Graduate Studies: Philippine State College of AeronauticsDocument6 pagesInstitute of Graduate Studies: Philippine State College of AeronauticsLaurise Martinez100% (1)

- Tarlac State University: College of Teacher EducationDocument10 pagesTarlac State University: College of Teacher EducationDwayne Ashley SilveniaNo ratings yet

- Intermediate Course Study Material: TaxationDocument34 pagesIntermediate Course Study Material: TaxationMd IbrarNo ratings yet

- TLAW301 Taxation Law (T2, 2022) Unit OutlineDocument21 pagesTLAW301 Taxation Law (T2, 2022) Unit OutlineKang LINo ratings yet

- Learning Packet (CAE16)Document26 pagesLearning Packet (CAE16)Judy Anne RamirezNo ratings yet

- Conceptual Framework SyllabusDocument14 pagesConceptual Framework SyllabusMariya BhavesNo ratings yet

- Syllabus - BCA001 2023 2024Document25 pagesSyllabus - BCA001 2023 2024Angeline De JesusNo ratings yet

- Taxation Syllabus 01-14-2024 SignedDocument6 pagesTaxation Syllabus 01-14-2024 SignedLiezel Jane Ambay IbañezNo ratings yet

- 01 Inetial PagesDocument33 pages01 Inetial PagesTushar RathiNo ratings yet

- College of Business Administration and Accountancy: Financial ManagementDocument8 pagesCollege of Business Administration and Accountancy: Financial ManagementCholophrex SamilinNo ratings yet

- Tax Final (Taxation 1) As at 5th October 2004Document275 pagesTax Final (Taxation 1) As at 5th October 2004Victor J Odongo50% (4)

- Income+tax+with+rubrics+with+plo,+so,+clo+2016 PDFDocument22 pagesIncome+tax+with+rubrics+with+plo,+so,+clo+2016 PDFErika TroncoNo ratings yet

- English Manajemen PerpajakanDocument16 pagesEnglish Manajemen PerpajakanfifiNo ratings yet

- 2021 2nd AC - AcctgBusCom SyllabusDocument7 pages2021 2nd AC - AcctgBusCom SyllabusKate Crystel reyesNo ratings yet

- Course Title: Corporate Tax Planning& Management Course Code: ACCT801 Credit Units:03 Level: PGDocument5 pagesCourse Title: Corporate Tax Planning& Management Course Code: ACCT801 Credit Units:03 Level: PGradhika makkarNo ratings yet

- Quantitative Techniques and Analysis in BusinessDocument7 pagesQuantitative Techniques and Analysis in BusinessCjhay MarcosNo ratings yet

- San Beda College Alabang: College of Arts and Sciences Legal Management DepartmentDocument5 pagesSan Beda College Alabang: College of Arts and Sciences Legal Management DepartmentMichael SanchezNo ratings yet

- BUA ACCTG Flexible OBTL A4Document12 pagesBUA ACCTG Flexible OBTL A4Alexandra De LimaNo ratings yet

- Course SyllabusDocument8 pagesCourse SyllabusKimberly AvendanoNo ratings yet

- Case Digest Rem 2Document53 pagesCase Digest Rem 2Cza PeñaNo ratings yet

- Thanks SirDocument64 pagesThanks SirCza PeñaNo ratings yet

- Legal Aspects in Tourism and Hospitality FinalsDocument2 pagesLegal Aspects in Tourism and Hospitality FinalsCza PeñaNo ratings yet

- Homicide ScriptDocument99 pagesHomicide ScriptCza PeñaNo ratings yet

- PENA Midterm and Final ExamsDocument43 pagesPENA Midterm and Final ExamsCza PeñaNo ratings yet

- Abella v. Francisco: 55 Phil. 447 (1931) FactsDocument1 pageAbella v. Francisco: 55 Phil. 447 (1931) FactsCza PeñaNo ratings yet

- De Minimis and Fringe BenefitsDocument14 pagesDe Minimis and Fringe BenefitsCza PeñaNo ratings yet

- Scanned With CamscannerDocument10 pagesScanned With CamscannerCza PeñaNo ratings yet

- Part 1 Answers Midterm Exam TaxDocument4 pagesPart 1 Answers Midterm Exam TaxCza PeñaNo ratings yet

- Income Taxation On Individuals ModuleDocument18 pagesIncome Taxation On Individuals ModuleCza PeñaNo ratings yet

- Abella v. Francisco, 55 Phil. 447 (1931)Document4 pagesAbella v. Francisco, 55 Phil. 447 (1931)Cza PeñaNo ratings yet

- Exclusions From Income TaxationDocument9 pagesExclusions From Income TaxationCza PeñaNo ratings yet

- G.R. No. 189871: August 13, 2013 Dario Nacar, Petitioner, V. Gallery Frames And/Or Felipe BORDEY, JR., Respondents. Peralta, J.Document5 pagesG.R. No. 189871: August 13, 2013 Dario Nacar, Petitioner, V. Gallery Frames And/Or Felipe BORDEY, JR., Respondents. Peralta, J.Cza PeñaNo ratings yet

- Erma Industries, Inc. v. Security Bank Corporation, GR No. 191274, December 6, 2017Document20 pagesErma Industries, Inc. v. Security Bank Corporation, GR No. 191274, December 6, 2017Cza PeñaNo ratings yet

- Almeda v. CA: G.R. No. 113412, April 17, 1996, 256 SCRA 292 FactsDocument1 pageAlmeda v. CA: G.R. No. 113412, April 17, 1996, 256 SCRA 292 FactsCza PeñaNo ratings yet

- Chavez v. Gonzales (Digest)Document2 pagesChavez v. Gonzales (Digest)Arahbells94% (17)

- Federal Builders, Inc. v. Foundation Specialists, Inc., GR No. 194507, September 8, 2014Document11 pagesFederal Builders, Inc. v. Foundation Specialists, Inc., GR No. 194507, September 8, 2014Cza PeñaNo ratings yet

- Abella v. Francisco, 55 Phil. 447 (1931)Document4 pagesAbella v. Francisco, 55 Phil. 447 (1931)Cza PeñaNo ratings yet

- Ong v. BPI Family Savings Bank, Inc., GR No. 208638, January 24, 2018Document6 pagesOng v. BPI Family Savings Bank, Inc., GR No. 208638, January 24, 2018Cza PeñaNo ratings yet

- Ong v. BPI Family Savings Bank, Inc., GR No. 208638, January 24, 2018Document6 pagesOng v. BPI Family Savings Bank, Inc., GR No. 208638, January 24, 2018Cza PeñaNo ratings yet

- de Guia v. Manila Electric CoDocument4 pagesde Guia v. Manila Electric CoBru GalwatNo ratings yet

- de Guia v. Manila Electric CoDocument4 pagesde Guia v. Manila Electric CoBru GalwatNo ratings yet

- Erma Industries, Inc. v. Security Bank Corporation, GR No. 191274, December 6, 2017Document20 pagesErma Industries, Inc. v. Security Bank Corporation, GR No. 191274, December 6, 2017Cza PeñaNo ratings yet

- Federal Builders, Inc. v. Foundation Specialists, Inc., GR No. 194507, September 8, 2014Document11 pagesFederal Builders, Inc. v. Foundation Specialists, Inc., GR No. 194507, September 8, 2014Cza PeñaNo ratings yet

- Godines v. CADocument6 pagesGodines v. CACza PeñaNo ratings yet

- IP Views: Case Digest: Pharmawealth vs. Pfizer (Patent Infringement)Document2 pagesIP Views: Case Digest: Pharmawealth vs. Pfizer (Patent Infringement)Cza PeñaNo ratings yet

- Phil. Pharmaweath, Inc. v. Pfizer Inc., G. R. No. 167715, November 17,2010Document12 pagesPhil. Pharmaweath, Inc. v. Pfizer Inc., G. R. No. 167715, November 17,2010Cza PeñaNo ratings yet

- Philip Morris, Inc. v. Fortune Tobacco Corporation, G.R. No.158589, June 27, 2006Document16 pagesPhilip Morris, Inc. v. Fortune Tobacco Corporation, G.R. No.158589, June 27, 2006Cza PeñaNo ratings yet

- Water Jet Machining and Abrasive Water Jet MachiningDocument6 pagesWater Jet Machining and Abrasive Water Jet Machiningsree1810No ratings yet

- Averting Financial Crises: Advice From Classical Economists: Ederal EserveDocument6 pagesAverting Financial Crises: Advice From Classical Economists: Ederal EserveNguyen Anh VuNo ratings yet

- How To Apply For SBI Green Remit Card OnlineDocument3 pagesHow To Apply For SBI Green Remit Card OnlineThakur sahabNo ratings yet

- Achieving Superior QualityDocument2 pagesAchieving Superior QualityPradeep ChintuNo ratings yet

- Nifty 50 FactsheetDocument2 pagesNifty 50 FactsheetShubhashish SaxenaNo ratings yet

- EVision 7.0 Installation Guide For UNIXDocument82 pagesEVision 7.0 Installation Guide For UNIXAshish BajpaiNo ratings yet

- Demerger of BajajDocument30 pagesDemerger of BajajNikhil100% (1)

- Chapter 3 Case Part 2Document3 pagesChapter 3 Case Part 2graceNo ratings yet

- CV and Cover Letter Guide: Career Development CentreDocument26 pagesCV and Cover Letter Guide: Career Development CentreAbdul RohhimNo ratings yet

- Lailat Research 2022Document18 pagesLailat Research 2022Eddy MalongoNo ratings yet

- Ec Bed Linen CaseDocument8 pagesEc Bed Linen CaseAditya PandeyNo ratings yet

- Chapter 8 - Bank ReconciliationDocument6 pagesChapter 8 - Bank ReconciliationAdan EveNo ratings yet

- Contract Agreement Form InfrastructureDocument4 pagesContract Agreement Form InfrastructureAnne Lorraine DioknoNo ratings yet

- P.P On Dairy (4 Lacs)Document6 pagesP.P On Dairy (4 Lacs)Shyamal DuttaNo ratings yet

- Foundation OBDocument35 pagesFoundation OBSushant VermaNo ratings yet

- Unit-3: Project SelectionDocument101 pagesUnit-3: Project SelectionMandeep Singh BhatiaNo ratings yet

- FAIS Assignment 1 - Mariam Jabbar PDFDocument4 pagesFAIS Assignment 1 - Mariam Jabbar PDFMariamNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherAnithaNo ratings yet

- Qatar Airways NotesDocument4 pagesQatar Airways Noteszigova1997No ratings yet

- EconomicsDocument5 pagesEconomicsDeepa SharadhiNo ratings yet

- FSSC 22000 GUIDELINE - FSSC CertificationDocument14 pagesFSSC 22000 GUIDELINE - FSSC CertificationFelix MwandukaNo ratings yet

- Lec - SOP DM LTP MPS MRPDocument12 pagesLec - SOP DM LTP MPS MRPCamran KhanNo ratings yet

- BRIDGE The Definitive Guide To Employee DevelopmentDocument16 pagesBRIDGE The Definitive Guide To Employee DevelopmentSam EjowoNo ratings yet

- Training Design On Expanded Monthly Agricultural and Fisheries Situation Reporting System (EMAFSRS)Document6 pagesTraining Design On Expanded Monthly Agricultural and Fisheries Situation Reporting System (EMAFSRS)Gamel DeanNo ratings yet

- 7 PHILIPPINE NATIONAL BANK, Petitioner, vs. GREGORIO B. MARAYA, JR. and WENEFRIDA MARAYA, Respondents.Document2 pages7 PHILIPPINE NATIONAL BANK, Petitioner, vs. GREGORIO B. MARAYA, JR. and WENEFRIDA MARAYA, Respondents.Ken MarcaidaNo ratings yet

- Provide SHORT and SIMPLE Answers To The Following QuestionsDocument3 pagesProvide SHORT and SIMPLE Answers To The Following QuestionsMITA AGUSTIANANo ratings yet

- Matrix FAQDocument5 pagesMatrix FAQSafix YazidNo ratings yet

- Nayong Pilipino FoundationDocument20 pagesNayong Pilipino FoundationCynthia Lysa CordelNo ratings yet

- The Most Basic Things Your Company Needs To Know About Sales (Fog Creek Software)Document24 pagesThe Most Basic Things Your Company Needs To Know About Sales (Fog Creek Software)alessandraNo ratings yet

- About TVSDocument39 pagesAbout TVSVinodh Kumar LNo ratings yet