Professional Documents

Culture Documents

Budget Rock Star (Worksheets)

Uploaded by

Nursuhaidah SukorCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget Rock Star (Worksheets)

Uploaded by

Nursuhaidah SukorCopyright:

Available Formats

BUDGET

Roc Sta !

5 steps to tune up your budget

© MINT NOTION | MINTNOTION.COM

Finding My Why

Your WHY is the thing that inspires you. It's your reason for getting up every day, both personally and

professionally. It keeps you moving forward even when you're not motivated.

Step 1

What do you love to do? Make a list of things you love. Perhaps it's spending time with family or friends,

working on a hobby, traveling, or going to your job? Maybe it's a person that you really love and care about,

such as your partner, your parent, your child, or your sibling?

Step 2

Identify the times when you were the most happiest. What were you doing? What made these experiences

memorable for you? Use these experiences to help make a list of personal values that are important to you.

Perhaps you value financial security? Family? Health? Community?

Step 3

Write your WHY. Look at what you wrote down in Steps 1 and 2. For each point you've listed, ask yourself

why you love it. Why is it important to have in your life? You’ll find that by answering this question, you’ll

discover what’s really important to you. This will help you articulate your WHY.

© MINT NOTION | MINTNOTION.COM

Goal Setting

Use your WHY to help determine your financial goals. Knowing your goals can help you align your budget around

achieving them. You'll decide how much you need to set aside to reach each goal.

Goal #1

Monthly Amount

Goal Esitmated Cost Target Date

Needed

Action steps I need to take to achieve my goal

⃝

Goal #2

Monthly Amount

Goal Esitmated Cost Target Date

Needed

Action steps I need to take to achieve my goal

⃝

Goal #3

Monthly Amount

Goal Esitmated Cost Target Date

Needed

Action steps I need to take to achieve my goal

⃝

© MINT NOTION | MINTNOTION.COM

Fixed Expenses

Monthly Can it be reduced or eliminated? If yes,

Fixed Expense Yearly Amount

Amount how?

© MINT NOTION | MINTNOTION.COM

Variable Expenses

Monthly Can it be reduced or eliminated? If yes,

Variable Expense Yearly Amount

Amount how?

© MINT NOTION | MINTNOTION.COM

Debt Overview

If you want to reach your financial goals, you need to have an accurate picture of your current money situation. This

includes knowing your income, fixed and variable expenses, savings, and how much debt you have. Use this worksheet

to get a handle on how much debt you have so you can create a game plan for paying it back.

Interest Minimum New Monthly Target Payoff

Debt Name Balance

Rate Payment Payment Date

© MINT NOTION | MINTNOTION.COM

Budget Calendar

MONTH: GOAL:

SUNDAY M MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY SATURDAY

© MINT NOTION | MINTNOTION.COM

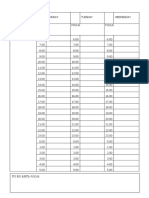

Zero-Based Budget MONTH: ____________________________

INCOME BUDGET ACTUAL SAVINGS PLAN BUDGET ACTUAL

TOTAL INCOME

MONTHLY BILLS DUE AMOUNT

TOTAL SAVINGS

LEFTOVER

DEBT PAYMENTS BUDGET ACTUAL

TOTAL DEBT

LEFTOVER

DAILY LIVING BUDGET ACTUAL

BILL TOTAL

LEFTOVER

SINKING FUNDS BUDGET ACTUAL

SINKING FUNDS TOTAL DAILY LIVING TOTAL

LEFTOVER Final Budget (make it zero)

© MINT NOTION | MINTNOTION.COM

You might also like

- Financial Empowerment - A Step-by-Step Guide to Achieving Financial FreedomFrom EverandFinancial Empowerment - A Step-by-Step Guide to Achieving Financial FreedomNo ratings yet

- Building A Budget That Works: The Power of Paycheck PlanningDocument10 pagesBuilding A Budget That Works: The Power of Paycheck PlanningcreditdotorgNo ratings yet

- Mint Notion - Budget Rock Star (How-To Guide)Document13 pagesMint Notion - Budget Rock Star (How-To Guide)Nursuhaidah SukorNo ratings yet

- PERSONAL BUDGETING - MEBC Financial Symposium v2Document12 pagesPERSONAL BUDGETING - MEBC Financial Symposium v2Ali ZiyanNo ratings yet

- BOSS Personal Planner - Budget SampleDocument6 pagesBOSS Personal Planner - Budget SampleMarcel Xyra RequitoNo ratings yet

- Real Life Money Plan WorkbookDocument26 pagesReal Life Money Plan WorkbookPatricia Antão Moutinho83% (6)

- Yali Entrepreneurs: Money Management WorkbookDocument15 pagesYali Entrepreneurs: Money Management WorkbookJesseNo ratings yet

- Create FutureDocument25 pagesCreate FutureShenbakamNo ratings yet

- Planning For Homeownership GuideDocument20 pagesPlanning For Homeownership Guideapi-295818061No ratings yet

- Budget Sheets RedoDocument3 pagesBudget Sheets RedoLeanna Abdul WahabNo ratings yet

- Journal ListDocument9 pagesJournal ListCashmere AbutanNo ratings yet

- PNC First-Time Homebuyer's GuideDocument7 pagesPNC First-Time Homebuyer's GuideKent Richardson100% (1)

- Free Brain Dump Worksheet by Fempreneur Secrets 2020 FillableDocument11 pagesFree Brain Dump Worksheet by Fempreneur Secrets 2020 Fillableফাহমিদা আঁখিNo ratings yet

- SMARTER Goal Setting WorksheetDocument3 pagesSMARTER Goal Setting WorksheetTanzibur Rashid 31No ratings yet

- Morning Routine: Cheat SheetDocument4 pagesMorning Routine: Cheat Sheetvipgaming fourthNo ratings yet

- ActionDocument1 pageActionNicoleEmptyCagesNo ratings yet

- Budget Planner PDFDocument1 pageBudget Planner PDFAden BanksNo ratings yet

- Monthly BudgetDocument2 pagesMonthly Budgetprince_misaNo ratings yet

- Weekly PlannerDocument120 pagesWeekly PlannerSuds NariNo ratings yet

- Fitness GuideDocument12 pagesFitness GuideBig DummyNo ratings yet

- Budget Planner PDFDocument1 pageBudget Planner PDFniza100% (1)

- 24 Mortgage Tips and TricksDocument10 pages24 Mortgage Tips and TricksBac LeNo ratings yet

- Happy Habit Planner 2024 - World of PrintablesDocument58 pagesHappy Habit Planner 2024 - World of PrintablesCherryl CalmaNo ratings yet

- Family Day Planner 02Document1 pageFamily Day Planner 02tina m fayzaNo ratings yet

- Uang Planner - Monthly Budget (English)Document20 pagesUang Planner - Monthly Budget (English)fildaa Kaimuddin50% (2)

- Week ofDocument2 pagesWeek ofYo Turtle KidzNo ratings yet

- Glow Up ChallengeDocument1 pageGlow Up ChallengeBrionna BockNo ratings yet

- GW First Time Homebuyer Book 20Document15 pagesGW First Time Homebuyer Book 20Adil HussainNo ratings yet

- 2021 Diary SimpleDocument38 pages2021 Diary SimpleAnonymous uuQoRtxuNo ratings yet

- Monthly Budget Sheet: Short Term Savings Primary Needs IncomeDocument2 pagesMonthly Budget Sheet: Short Term Savings Primary Needs IncomeLiya Apriani100% (1)

- Budget: Submitted By:-JappanjyotDocument16 pagesBudget: Submitted By:-JappanjyotJappanJyot Kalra100% (1)

- Behavior Think SheetDocument2 pagesBehavior Think Sheetapi-469730111No ratings yet

- Auto Pay TrackerDocument1 pageAuto Pay TrackerNurmuliana Abdul WahabNo ratings yet

- Relationship Crossword 2Document1 pageRelationship Crossword 2rubytran1983No ratings yet

- Mind Body Mastery Starter Pack PDFDocument36 pagesMind Body Mastery Starter Pack PDFnancyNo ratings yet

- WRAPDocument35 pagesWRAPGratsNo ratings yet

- Daily Planner : GratitudeDocument3 pagesDaily Planner : GratitudeRoxana Georgiana NicaNo ratings yet

- 30 Days ChallengeDocument6 pages30 Days ChallengevenedomNo ratings yet

- Reclaim Your Dreams WorksheetsDocument30 pagesReclaim Your Dreams Worksheetsxingin6607No ratings yet

- B5 Sun 2020 Undated PDFDocument213 pagesB5 Sun 2020 Undated PDFBella MarciaNo ratings yet

- 72 Free Crusher WorkoutsDocument135 pages72 Free Crusher WorkoutsAlberto ClnNo ratings yet

- Smart Money: Financial Literacy 101Document4 pagesSmart Money: Financial Literacy 101Lots To Gardens100% (1)

- 401k MistakesDocument43 pages401k MistakesIRS100% (1)

- Dynamic TemplateDocument14 pagesDynamic TemplateprotostarNo ratings yet

- Beauty Checklist PrintableDocument1 pageBeauty Checklist PrintableSandyDavidNo ratings yet

- 4-6 Months Baby DevelopmentDocument8 pages4-6 Months Baby DevelopmentHyeNo ratings yet

- Alissarose Passiveoffer Editable r1Document8 pagesAlissarose Passiveoffer Editable r1Nyanshe StarkNo ratings yet

- TCM 2021 Weekly Household Planner BLANKDocument63 pagesTCM 2021 Weekly Household Planner BLANKMaria Lira Jalandoni100% (1)

- 5 Minute Journal, 6x9, 120p, No BleedDocument120 pages5 Minute Journal, 6x9, 120p, No BleedSkelliNo ratings yet

- 058 - Ds Relationship Design Part 1 - Class HandoutDocument9 pages058 - Ds Relationship Design Part 1 - Class HandoutnouveauxplaisirsNo ratings yet

- Paycheck Bill TrackerDocument1 pagePaycheck Bill TrackerBeach and BudgetNo ratings yet

- SMA-3718 Lifestyle 11pDocument11 pagesSMA-3718 Lifestyle 11pConnie KirkpatrickNo ratings yet

- Career Planner 2019Document9 pagesCareer Planner 2019Maria Zappa KasapidiNo ratings yet

- Pinterest Trends 2021 DecemberDocument9 pagesPinterest Trends 2021 DecemberLuxury Empire lifeNo ratings yet

- The Revolution MethodDocument14 pagesThe Revolution MethodLuis AlvaradoNo ratings yet

- Free Downloadable and Printable Monthly Budget Planner.Document4 pagesFree Downloadable and Printable Monthly Budget Planner.cass1611No ratings yet

- ACS Survival Guide - NYCDocument85 pagesACS Survival Guide - NYCAnonymous v3dT7UF100% (1)

- The Wisdom of Play - Community PlaythingsDocument28 pagesThe Wisdom of Play - Community PlaythingsNursuhaidah SukorNo ratings yet

- Year at A GlanceDocument1 pageYear at A GlanceNursuhaidah SukorNo ratings yet

- Savings Goals: Saving For: Saving ForDocument1 pageSavings Goals: Saving For: Saving ForNursuhaidah SukorNo ratings yet

- Bab 13 Meteoroid Asteroid Dan KometDocument11 pagesBab 13 Meteoroid Asteroid Dan KometNursuhaidah SukorNo ratings yet

- Debt Paydown WorksheetDocument1 pageDebt Paydown WorksheetNursuhaidah SukorNo ratings yet

- Expense Log: Date Description Category Amount Notes XDocument1 pageExpense Log: Date Description Category Amount Notes XNursuhaidah SukorNo ratings yet

- Bill Paymen Tracker 2Document1 pageBill Paymen Tracker 2Nursuhaidah SukorNo ratings yet

- Account TrackerDocument1 pageAccount TrackerNursuhaidah SukorNo ratings yet

- Kindergarten Curriculum Framework Guide For Parents PDFDocument23 pagesKindergarten Curriculum Framework Guide For Parents PDFArchana SekharNo ratings yet

- Early Childhood Care and Education (ECCE)Document38 pagesEarly Childhood Care and Education (ECCE)Nursuhaidah SukorNo ratings yet

- Lesson 2.1Document22 pagesLesson 2.1Nursuhaidah SukorNo ratings yet

- (Asian Connections) Prasenjit Duara - The Crisis of Global Modernity - Asian Traditions and A Sustainable Future-Cambridge University Press (2015)Document339 pages(Asian Connections) Prasenjit Duara - The Crisis of Global Modernity - Asian Traditions and A Sustainable Future-Cambridge University Press (2015)MichaelCarloVillasNo ratings yet

- Chapter 5 - Ia3Document3 pagesChapter 5 - Ia3Xynith Nicole RamosNo ratings yet

- Introduction To Internet of Things Assignment-Week 9Document6 pagesIntroduction To Internet of Things Assignment-Week 9Mr.M. ArivalaganNo ratings yet

- List of Languages in The Eurovision Song ContestDocument7 pagesList of Languages in The Eurovision Song ContestNajda DurmoNo ratings yet

- GD190018051 Purvi Anil Ladge Anil/Vinanti Female 21/04/1997: Admit Card - 2019Document1 pageGD190018051 Purvi Anil Ladge Anil/Vinanti Female 21/04/1997: Admit Card - 2019Purvi LadgeNo ratings yet

- Self, IdentityDocument32 pagesSelf, IdentityJohnpaul Maranan de Guzman100% (2)

- Ward Planning GuidelinesDocument159 pagesWard Planning GuidelinesHemant Chandravanshi100% (1)

- Prelims 2A Judge - SCORESHEETDocument2 pagesPrelims 2A Judge - SCORESHEETMeetali RawatNo ratings yet

- Inset Program Design - Final 2024Document10 pagesInset Program Design - Final 2024Emelyn NombreNo ratings yet

- Multiple Choice Questions: Compiled by CA Bhanwar BoranaDocument45 pagesMultiple Choice Questions: Compiled by CA Bhanwar BoranaGirishNo ratings yet

- Hanoi, 19 October 2015: Translation Update Service Since 1 April, 1999Document3 pagesHanoi, 19 October 2015: Translation Update Service Since 1 April, 1999Nguyen Van ThanhNo ratings yet

- The University of Alabama PowerpointDocument18 pagesThe University of Alabama Powerpointapi-305346442No ratings yet

- Comprehensive Review For CorporationDocument14 pagesComprehensive Review For CorporationJoemar Santos Torres33% (3)

- Labor Case Digest CompilationDocument119 pagesLabor Case Digest CompilationErvin CavalidaNo ratings yet

- Ansi B16.30 Asme FlangeDocument22 pagesAnsi B16.30 Asme FlangePedro Nelvedir Barrera CelyNo ratings yet

- Quarter 3: Performance Test 1Document2 pagesQuarter 3: Performance Test 1CLARIBEL BUENAVENTURANo ratings yet

- Summary of The Integration of Total Quality Management (TQM) and Six-SigmaDocument7 pagesSummary of The Integration of Total Quality Management (TQM) and Six-SigmaAlbert ArominNo ratings yet

- 1957 - Wasson - Life Magazine - Secret of Divine Mushrooms (Web) PDFDocument31 pages1957 - Wasson - Life Magazine - Secret of Divine Mushrooms (Web) PDFSam Ruger100% (1)

- Basics of Accounting Notes MBA 2nd SemDocument30 pagesBasics of Accounting Notes MBA 2nd SemVikash ChauhanNo ratings yet

- FFFDocument12 pagesFFFever.nevadaNo ratings yet

- Speed Up Your BSNL BroadBand (Guide)Document13 pagesSpeed Up Your BSNL BroadBand (Guide)Hemant AroraNo ratings yet

- Ethics A Very Short Introduction PDFDocument2 pagesEthics A Very Short Introduction PDFKimberly0% (1)

- Wassel Mohammad WahdatDocument110 pagesWassel Mohammad WahdatKarl Rigo Andrino100% (1)

- Doctype HTML Qq8821Document202 pagesDoctype HTML Qq8821H.kelvin 4421No ratings yet

- Pak Afghan Relations PDFDocument16 pagesPak Afghan Relations PDFMOHAMMAD KASHIFNo ratings yet

- SCM - Case Assin Group 2 Sec - BDocument8 pagesSCM - Case Assin Group 2 Sec - BHarmeet kapoorNo ratings yet

- CV Ilham AP 2022 CniDocument1 pageCV Ilham AP 2022 CniAzuan SyahrilNo ratings yet

- 3 Expressive Arts - DemoDocument21 pages3 Expressive Arts - DemoJack Key Chan AntigNo ratings yet

- Amadeo Modigliani BiographyDocument3 pagesAmadeo Modigliani BiographyactenfenNo ratings yet

- Become A Partner Boosteroid Cloud Gaming PDFDocument1 pageBecome A Partner Boosteroid Cloud Gaming PDFNicholas GowlandNo ratings yet