Professional Documents

Culture Documents

Financial Statement

Financial Statement

Uploaded by

Mel Lissa0 ratings0% found this document useful (0 votes)

4 views11 pagesFinancial Statements 2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial Statements 2

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views11 pagesFinancial Statement

Financial Statement

Uploaded by

Mel LissaFinancial Statements 2

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 11

Fin Stmts 2

Overview

In this lesson, we will introduce the primary components of the

income statement, including: revenue, cost of goods sold, other

income and expenses, and net income. The lesson then focuses on

revenue and cost of goods sold. We will define “revenue” and explain

how revenue arises, then introduce the concept of “cost flow

assumptions” and how companies can make judgments that affect

cost of goods sold.

Suggested Readings

Introduction to Income Statement. Accounting Coach. Income

Statement (Explanation).

What is the inventory cost flow assumption? Accounting Tools.

Company Information

This module discusses financial statements from the following

companies:

Under Armour

Goals and Objectives

Upon successful completion of this module, you will be able to:

Understand what measurement question the income statement

seeks to answer.

Identify the common components of an income statement.

Explain what revenue represents and how it arises.

Describe what cost of goods sold represents.

Define the concept of “cost flow assumptions."

Key Phrases/Concepts

Keep your eyes open for the following key terms or phrases as you

interact with the lectures and complete the activities.

Income statement

Revenue

Cost of goods sold

Goods

FIFO cost assumption

LIFO cost assumption

Average cost assumption

Guiding Questions

Develop your answers to the following guiding questions while

watching lectures and working on assignments throughout the lesson.

What measurement question does the income statement

address?

How does the income statement differ from the balance sheet?

What is revenue and how is it generated?

How can a company influence the amount of cost of goods sold

it reports in its income statement?

Module 1 Readings

Suggested Readings

Introduction to Income Statement. Accounting Coach. Income

Statement (Explanation).

What is the inventory cost flow assumption? Accounting Tools.

Company Information

This module discusses financial statements from the following

companies:

Under Armour

Feel free to find other readings or resources and share them in the

forums.

As we begin this second course on understanding financial

statements,

I hope most of you completed the first course.

Just in case, let's highlight a few ideas before we get started.

In the first course you were introduced to the idea that financial

statements are representations or substitute attributes meant to

measure attributes of the company.

We saw that the balance sheet as a substitute attribute to the

company's position, helped answer two measurement questions,

what does the company own and what does the company owe.

However, there's a third measurement question that the balance

sheet does not

address, and that's where we'll begin our conversation about the

income statement.

Play video starting at 1 minute 4 seconds and follow transcript1:04

When we spoke about the balance sheet, we illustrated the balance

sheet as

a photograph taken of the company on some particular date.

Let's say that the date of the photograph is the first day of the year,

January 1st.

Play video starting at 1 minute 17 seconds and follow transcript1:17

Now, let's imagine we took the second photograph of the same

company, but

we take the photo on December 31st.

If we compare the two photographs taken a year apart,

it probably won't look the same.

In other words,

the company's position on December 31st will have changed since

January 1st.

What's the difference in the company's position and what caused this

difference?

Play video starting at 1 minute 40 seconds and follow transcript1:40

Well, that's what the income statement captures.

It depicts what occurred during the period that changed the

company's financial

position from the beginning of the period to its position at the end of

the period.

Play video starting at 1 minute 52 seconds and follow transcript1:52

The income statement answers the measurement question,

how did the company perform, because it shows how the company's

activities during

the period impacted its assets and liabilities.

Let's take a look at the simple income statement from the apparel

manufacturer,

Under Armour to see how it's organized.

Play video starting at 2 minutes 11 seconds and follow transcript2:11

The first line item you see is an item called revenue, or net sales.

Then you see something called cost of goods sold, or cost of sales.

Notice that the cost of goods sold is subtracted from revenue to arrive

at

gross profit.

Play video starting at 2 minutes 27 seconds and follow transcript2:27

Then, you run into an item that is selling general and administrative

expenses.

Play video starting at 2 minutes 34 seconds and follow transcript2:34

Under Armour uses this line item to aggregate several types of

expenses

that are subtracted from gross profit to yield net income before

income taxes.

We then subtract the line item for income taxes to arrive at net

income.

Play video starting at 2 minutes 49 seconds and follow transcript2:49

With some new information to process, it's time to see what we've

learned so far.

Here are a few check questions.

Play video starting at 2 minutes 59 seconds and follow transcript2:59

With a broad overview of the income statement complete,

let's take a closer look at the first line item, revenue.

And to do that, let's take a road trip.

Here we are at my favorite bakery in Champaign, Sweet Indulgence.

Play video starting at 3 minutes 13 seconds and follow transcript3:13

I love walking into the bakery and seeing all the fantastic treats that

the owner,

Missy, has prepared that day.

Play video starting at 3 minutes 20 seconds and follow transcript3:20

Of course, the point of the bakery is not to give people like me

something to look at.

No way.

She wants someone to buy something.

And, today, I am going to oblige.

Play video starting at 3 minutes 31 seconds and follow transcript3:31

Ladies and gentlemen, Missy has just earned revenue.

Why?

Because revenue is an increase in Missy's asset or a decrease in

her

liabilities brought about by activities that are center to her normal

operations.

Let's break this down.

Play video starting at 3 minutes 48 seconds and follow transcript3:48

Missy's business is to provide food and drink to customers.

Play video starting at 3 minutes 53 seconds and follow transcript3:53

I took delivery of the most delicious cookie sandwich,

Play video starting at 3 minutes 58 seconds and follow transcript3:58

Missy received cash from me, which increases her assets.

Yep, that's revenue.

Let's see what else I might try to buy.

Play video starting at 4 minutes 7 seconds and follow transcript4:07

Yeah, the monster mixer that I told my wife about.

Boy, I'd be a hero if I brought home that baby.

Play video starting at 4 minutes 14 seconds and follow transcript4:14

I wonder if Missy would sell it to me.

Much for showing us the back room, all the things that you have, but

by the way, how much would you charge me for the monster mixer?

>> [LAUGH] Well if you could get it out of here, I don't know.

Probably about 13,000, or 14,000, and that's a used one, so.

>> Okay, I don't know.

Okay, truthfully.

I can't afford that mixer and if I bring it home to my wife,

I wouldn't be much of a hero if she found out how much it costs.

But let's pretend I did, and somehow I got the mixer in my car and

drove it home.

Would Missy have revenue?

Let's have a look.

Missy received cash from me, which increases her assets, check.

Play video starting at 4 minutes 57 seconds and follow transcript4:57

I took delivery of the monster mixer, check.

Play video starting at 5 minutes 0 seconds and follow transcript5:00

But wait a minute.

Is Missy in business to sell monster mixers?

Of course not.

Play video starting at 5 minutes 8 seconds and follow transcript5:08

This last example suggests an important idea.

A transaction that represents revenue for one company, may not

represent revenue for

a different company.

Play video starting at 5 minutes 18 seconds and follow transcript5:18

If Jed at Body and

Sole sells me a cupcake, then that wouldn't be revenue for Jed.

Play video starting at 5 minutes 25 seconds and follow transcript5:25

Or if rather than going to Regent Dance for dance lessons, I pay one

of Missy's employees for lessons, Sweet Indulgence would not

increase its revenue.

So, why is it so important to distinguish between

what transaction represents revenue versus not being revenue?

Play video starting at 5 minutes 43 seconds and follow transcript5:43

If the company's assets are increasing, who cares if it's revenue?

Play video starting at 5 minutes 48 seconds and follow transcript5:48

Well, let's think about this.

Play video starting at 5 minutes 51 seconds and follow transcript5:51

Let's say you are considering whether or not to lend $100,000 to Jed

at Body and

Sole or one of Jed's competitors, we'll call him Fred.

Play video starting at 6 minutes 0 seconds and follow transcript6:00

Remember Jed's business is to sell athletic shoes and

clothing and Fred has a similar business.

So, what is your concern if you're a lender.

Your concern is whether your loan will be repaid and

you'd like to see evidence that your debtor can pay you back.

Play video starting at 6 minutes 17 seconds and follow transcript6:17

Now, consider that both Jed and

Fred have income statements that show each earned net income of

$50,000.

There's a difference however, Jed's net income is driven mostly by

the revenue

associated by his selling shoes and clothing, but Fred's net income is

driven

mostly by his selling an old treadmill he kept in the store and

several display cases that remained empty during the last year.

So who would you lend money to Jed or Fred?

Play video starting at 6 minutes 46 seconds and follow transcript6:46

If it's me making the loan decision, I'm making the loan to Jed.

Jed's net income is driven by revenue.

He's earning income by doing what he's in business to do.

As a result, I expect Jed's net income to look similar next year and

the year after that, and maybe even the year after that,

because his net income is associated with his normal business.

Fred, on the other hand, I'm not so

sure what his net income will look like next year.

After all, Fred's net income came from selling off equipment,

not from his normal business.

So, if I want to lend money with the best hope of being repaid,

I have to go with Jed because Jed's net income, being driven by

revenue,

suggests his net income performance will persist in the future.

Well, this ends our lesson on revenue.

Next time we meet, we'll spend some time at Jed's store

as we discuss revenue's unpleasant little brother.

Until then, be well.

In our last lesson, we completed our overview

of the income statement.

Remember, the income statement helps us

answer the third measurement question, how did you perform? And as

such, it represents a substitute

attribute for the company's performance. Last time, we focused on the

income

statement line item revenue. In this lesson, our focus will be on

the line that typically follows revenue, cost of goods sold. The concept of

cost of goods

sold isn't complicated. We can start by asking the question,

what are goods? Goods are assets either manufactured or purchased

with the intent

to be sold to customers. Let's visit the athletic apparel store,

Body n' Sole, in search for the goods. Here we are at Body n' Sole, you

may

remember Jed's store from an earlier lesson, and

we are going to take another look around. Out on the floor of the store,

we see the apparel, and as we move to the back of

the store we see shelves of shoes, all of which Jed has purchased with

the intent to sell them to customers. Well ladies and gentlemen,

these are goods. I know what you're thinking. Isn't this just the

inventory

we saw in an earlier lesson? Of course it is. So, when we think about

cost of goods sold, you can also think about it

as cost of inventory sold. Let's go back to the studio and

dig a little deeper. We see now that there's a relationship

between cost of goods sold and inventory. We can formalize this a bit by

introducing the term, total cost of goods available for sale, where

Jed's total cost of goods available for sale represents the cost of

inventory that

Jed held at the beginning of the period. We'll say the period began

January 1st,

plus the cost of all the inventory Jed purchased and received during

the period, which ended December 31st. The maximum amount of

inventory

Jed can sell during the year is the inventory he started with,

and the inventory he added. Now, at the end of the year,

the cost of total goods available for sale is divided between two buckets.

The cost of inventory that

was sold during the year goes into the cost of goods sold bucket,

while the cost of inventory that wasn't sold remains on the balance

sheet as the cost of inventory. Okay, it's time to see

what we've learned so far. Try these two questions and

see how you do. With a conceptual understanding of cost

of goods sold reported on the income statement, we're ready to

introduce

a little more complexity to the issue. Consider this scenario, Jed receives

several shipments of a popular model of athletic shoes throughout the

year that

he stores on shelves in the back room. Each time he receives a shipment

of shoes

his cost to purchase the shoes increases. The first shipment cost $50 for

each pair of shoes. The shipment costs $60 per pair of shoes, the third

shipment costs $65 for

each pair of shoes and so on. Because all of the shoes look alike,

when Jed sells a pair of shoes, he doesn't know if that pair came from

the

first shipment, or the second shipment, or the third shipment. So, if Jed

has 200 pairs of

the popular shoe available for sale during the year and

he actually sells 150 pairs of the shoes, what cost should he associate

with the shoes that were sold? $50, $60, or $65? [MUSIC] This question

introduces the idea

of cost flow assumptions. The three cost flow assumptions

are first in first out, or FIFO, last in first out, or

LIFO, or average cost. If Jed adopts the first in, first out

assumption, he's assuming that the shoes he purchased for $50 were the

first

shoes he sold to customers. If Jed adopts the last in,

first out assumption, he assumes the $65 shoes were

the first shoes he sold to customers. While using the average cost

assumption, Jed calculates the weighted average cost

for the pairs of shoes available for sale during the year, and assigns that

cost to each pair of shoes actually sold. With respect to cost flow

assumptions,

there are two things you should remember. First, the cost flow

assumption chosen can affect the cost of goods sold

reported on the income statement. For example, if Jed adopts FIFO, his

reported cost of good flow would

be lower than if he adopts LIFO. Second, the cost flow assumption

that a company adopts need not match the physical flow of goods. Jed

could very well sell

the shoes he sees first, but adopt the cost flow assumption

other than first in, first out. Well, we've now tackled the first two

line items on the income statement, revenue and costs of goods sold.

What's unique about these two line

items is that they're used to calculate an important summary amount.

By subtracting the company's cost

of goods sold from it's revenue, we see the summary amount of gross

profit.

Gross profit is an important indicator

of a company's performance and future prospects. If gross profit is large

it might suggest

that the company is less at risk to small changes in the price of

manufacturing or

purchasing their inventory. Before closing out this lesson,

I'll point out one final thing. The line item cost of goods sold is

common in income statements, but you may see a slightly different

name like cost of sales. Don't let that confuse you. Often the different

label is related

to the company being a service provider rather than a provider of

goods. If a company sells dance lessons

rather than athletic shoes then there's little in

the way of inventory, so cost of goods sold would be a less

accurate characterization of a line item. Okay, we're not yet

done with the income statement. As we move to the next module, we'll

continue answering our measurement

question about how the company performed, but we'll add a new twist

to the conversation. Until then friends, be well.

You might also like

- Video Script TemplatesDocument30 pagesVideo Script TemplatesEric Marlow100% (2)

- YouTube 7 Hacks Todd PDFDocument14 pagesYouTube 7 Hacks Todd PDFSaravanan SivasangaranNo ratings yet

- VideoMarketingBlaster PDFDocument23 pagesVideoMarketingBlaster PDFMarcio Lima100% (2)

- Get Your Entire Faceless Youtube Channel Set Up... in The Next 30 Days... No Experience, Knowing What To Say, or Being Comfortable On Video Required!Document25 pagesGet Your Entire Faceless Youtube Channel Set Up... in The Next 30 Days... No Experience, Knowing What To Say, or Being Comfortable On Video Required!Ganesh100% (1)

- Fiverr Factory JVDocument24 pagesFiverr Factory JVRobertNo ratings yet

- 15 Tiny Tweaks James Wedmore+Document30 pages15 Tiny Tweaks James Wedmore+Angela J MurilloNo ratings yet

- How I Made 1 MM Res Lling SoftwareDocument77 pagesHow I Made 1 MM Res Lling SoftwareAshwin100% (1)

- Tej Dosa Letter 24Document19 pagesTej Dosa Letter 24Atilla NoNo ratings yet

- The 6-Figure Video Script PDFDocument9 pagesThe 6-Figure Video Script PDFCseh OliverNo ratings yet

- YouTube Money Method PDFDocument64 pagesYouTube Money Method PDFPunitha PoojaNo ratings yet

- Ranking Youtube Video PDFDocument33 pagesRanking Youtube Video PDFAmitNo ratings yet

- IlluminatiMastermind May4 SlidesDocument142 pagesIlluminatiMastermind May4 SlidesdianaNo ratings yet

- IBIG 04 02 Accounting 3 StatementsDocument99 pagesIBIG 04 02 Accounting 3 StatementsCarloNo ratings yet

- Making YouTube Videos: Star in Your Own Video!From EverandMaking YouTube Videos: Star in Your Own Video!Rating: 1 out of 5 stars1/5 (1)

- Method of Statement - Drainage WorksDocument6 pagesMethod of Statement - Drainage Worksainamin77No ratings yet

- Ultimate Guide - How To Script Your YouTube AdDocument6 pagesUltimate Guide - How To Script Your YouTube AdAaryanNo ratings yet

- Elefante Con Balón o FlorDocument13 pagesElefante Con Balón o FlorIsis Cunha100% (1)

- 1 - Fiverr Profitable PlanDocument18 pages1 - Fiverr Profitable PlanHL SlimNo ratings yet

- Plano de SaturadorDocument6 pagesPlano de SaturadorRodrigo Andres CeledonNo ratings yet

- Chapter 27Document20 pagesChapter 27Daisy Ann Cariaga SaccuanNo ratings yet

- Free Pattern 985Document12 pagesFree Pattern 985Aida Toledo PonceNo ratings yet

- Questions & Solutions ACCTDocument246 pagesQuestions & Solutions ACCTMel Lissa33% (3)

- ACCOUNTINGDocument14 pagesACCOUNTINGMarimel DadullaNo ratings yet

- The Financial Books Is Targeted Primarily Towards External Parties or External Constituents Like Investors or CreditorsDocument74 pagesThe Financial Books Is Targeted Primarily Towards External Parties or External Constituents Like Investors or CreditorselzaracfNo ratings yet

- Strategic Sourcing-Part 3Document3 pagesStrategic Sourcing-Part 3Hà My NguyễnNo ratings yet

- W2. Importance of ProcurementDocument3 pagesW2. Importance of ProcurementHà My NguyễnNo ratings yet

- Inspiring and Motivating Individuals-1-Becoming A VisionaryDocument50 pagesInspiring and Motivating Individuals-1-Becoming A VisionaryFotso JamesNo ratings yet

- Business MathDocument4 pagesBusiness MathShekinah HuertaNo ratings yet

- Managerial Accounting Prof. Dr. Varadrajbapat School of Management Indian Institute of Technology, Bombay Lecture - 17 Financial Statements Analysis - Colgate Palmolive CaseDocument38 pagesManagerial Accounting Prof. Dr. Varadrajbapat School of Management Indian Institute of Technology, Bombay Lecture - 17 Financial Statements Analysis - Colgate Palmolive CaseRaul Dolo QuinonesNo ratings yet

- Lec 37Document31 pagesLec 37Roshan SinghNo ratings yet

- Financial Accounting Prof. Varadraj Bapat School of Management Indian Institute of Technology, Bombay Lecture - 02 Financial StatementsDocument9 pagesFinancial Accounting Prof. Varadraj Bapat School of Management Indian Institute of Technology, Bombay Lecture - 02 Financial StatementsMohankumarNo ratings yet

- Woof JunctionDocument4 pagesWoof JunctionAmr GamalNo ratings yet

- Busness EnglishDocument2 pagesBusness EnglishIsabel HernandezNo ratings yet

- Lec 15Document16 pagesLec 15sushil.tripathiNo ratings yet

- 6.2 in Order To Stand Out, Show Up and Add More ValueDocument4 pages6.2 in Order To Stand Out, Show Up and Add More ValueBim arraNo ratings yet

- Transcription and AnalysisDocument12 pagesTranscription and AnalysisPrashanth kamathNo ratings yet

- Income - Statement NotesDocument11 pagesIncome - Statement NotesDaveNo ratings yet

- Forecasting Revenues Explanation - Madiee - DavideDocument5 pagesForecasting Revenues Explanation - Madiee - Davidehermosamadeliene52No ratings yet

- Celebrities Who Should Consider A Career in Vidyz 2.0 ReviewDocument2 pagesCelebrities Who Should Consider A Career in Vidyz 2.0 Reviewp8hrxqn663No ratings yet

- MATH 1033 Module 7Document5 pagesMATH 1033 Module 7Gelo AgcaoiliNo ratings yet

- Learning ROE and Finance Practice ProblemsDocument10 pagesLearning ROE and Finance Practice ProblemsMore EssentialsNo ratings yet

- Managing Talent-2-Talent Pipeline-Match MakingDocument7 pagesManaging Talent-2-Talent Pipeline-Match MakingFotso JamesNo ratings yet

- ACC 103 Ch5 Lecture Part3Document8 pagesACC 103 Ch5 Lecture Part3Muhammad Farhan AliNo ratings yet

- Extreme CommerceDocument5 pagesExtreme CommerceTahha JavaidNo ratings yet

- Our Entire $200 Million+ YouTube Ads Strategy in 1 PDF - Aleric HeckDocument19 pagesOur Entire $200 Million+ YouTube Ads Strategy in 1 PDF - Aleric HeckAntonio BorgesNo ratings yet

- Profitability AnalysisDocument22 pagesProfitability AnalysisAnkit JainNo ratings yet

- Transcription+Document+ +Profitability+Analysis - Docx+Document22 pagesTranscription+Document+ +Profitability+Analysis - Docx+Shafa IzwanNo ratings yet

- Module 3 - TextDocument33 pagesModule 3 - TextbangrhomaNo ratings yet

- LESSON No 7 and 8 Fourth ClassDocument5 pagesLESSON No 7 and 8 Fourth ClassYAHIRA ELIZABETH GUTIERREZ MORANo ratings yet

- Corporate Auto Saved - 121415Document173 pagesCorporate Auto Saved - 121415Emane EbubeNo ratings yet

- How Do I Successfully Pick Stacks - QuoraDocument9 pagesHow Do I Successfully Pick Stacks - QuorakwbollingerNo ratings yet

- Aboot IndDocument5 pagesAboot IndAyushNo ratings yet

- Three Ways M A Vallue Part TwoDocument5 pagesThree Ways M A Vallue Part TwoBhuwanNo ratings yet

- HMM Scipt TFYDocument4 pagesHMM Scipt TFYyukibambam_28No ratings yet

- The Sales Play Book: Resolving Negative Responses From ClientsDocument6 pagesThe Sales Play Book: Resolving Negative Responses From ClientsMatei DumitruNo ratings yet

- Video 1: EntrepreneurshipDocument23 pagesVideo 1: EntrepreneurshipelzaracfNo ratings yet

- VBB Pitch Copy-220314-093345Document99 pagesVBB Pitch Copy-220314-093345viniciuspietrofeNo ratings yet

- The Affiliate Marketing CommaDocument27 pagesThe Affiliate Marketing CommaonlinewealthwarriorsxNo ratings yet

- Negotiation ProcessDocument4 pagesNegotiation ProcessNguyen Ngoc Anh (K16HL)No ratings yet

- BM Module 1 CommissionsDocument15 pagesBM Module 1 CommissionsHp laptop sorianoNo ratings yet

- Lec 7Document18 pagesLec 7ROADYNo ratings yet

- What Is The Accounting Equation?Document19 pagesWhat Is The Accounting Equation?Carlo OpenariaNo ratings yet

- PSI For BusinessDocument60 pagesPSI For BusinesstmsaniNo ratings yet

- Premium Product Profit FormulaDocument1 pagePremium Product Profit FormulaAlemayehu NegashNo ratings yet

- Lec 40Document32 pagesLec 40Roshan SinghNo ratings yet

- Excel Lesson 1Document6 pagesExcel Lesson 1Mel LissaNo ratings yet

- Practice Quiz - 30 MinDocument6 pagesPractice Quiz - 30 MinMel LissaNo ratings yet

- Creating and Uploading VideosDocument2 pagesCreating and Uploading VideosMel LissaNo ratings yet

- Components of The Income StatementDocument4 pagesComponents of The Income StatementMel LissaNo ratings yet

- LeavellDocument17 pagesLeavellMel LissaNo ratings yet

- Lab - Forensic Investigation Using EnCaseDocument24 pagesLab - Forensic Investigation Using EnCaseMel Lissa100% (1)

- Fairy Tales of Hans Christian Andersen: The Princess and The PeaDocument2 pagesFairy Tales of Hans Christian Andersen: The Princess and The PeaMel LissaNo ratings yet

- Outline: Topic: How To Write An EssayDocument1 pageOutline: Topic: How To Write An EssayMel LissaNo ratings yet

- Advance-OrganizersDocument2 pagesAdvance-OrganizersMel LissaNo ratings yet

- 3 - Cash Larceny 2015Document28 pages3 - Cash Larceny 2015Mel LissaNo ratings yet

- Lasekan 3Document8 pagesLasekan 3Mel LissaNo ratings yet

- Contex DiagramDocument10 pagesContex DiagramMel LissaNo ratings yet

- Trinidad and Tobago Air GuardDocument1 pageTrinidad and Tobago Air GuardMel LissaNo ratings yet

- Adobe Scan Aug 29, 2022Document12 pagesAdobe Scan Aug 29, 2022Piyush GoyalNo ratings yet

- PromotersDocument20 pagesPromotersTharun pranavNo ratings yet

- Solution Far560 - Jul 2017Document8 pagesSolution Far560 - Jul 2017MUHAMAD MUKHAIRI MUHAMAD HANIFAHNo ratings yet

- Revised Elleys Quarterly SchemeDocument8 pagesRevised Elleys Quarterly SchemePriyansh BachaniNo ratings yet

- Stevenson PTTDocument13 pagesStevenson PTTErezwa100% (1)

- CV Sadam Ok and Yes1Document4 pagesCV Sadam Ok and Yes1sadam abdi100% (1)

- Consumer and Firm Behavior: The Work-Leisure Decision and Profit MaximizationDocument21 pagesConsumer and Firm Behavior: The Work-Leisure Decision and Profit MaximizationRachit BhagatNo ratings yet

- Production Possiblities CurveDocument2 pagesProduction Possiblities CurveJay MehtaNo ratings yet

- DSE - ECON - Past Paper - Sorted - Paper II - 2012 - 2021 - A Basic Econ ProblemDocument9 pagesDSE - ECON - Past Paper - Sorted - Paper II - 2012 - 2021 - A Basic Econ ProblemS.No ratings yet

- Virtual Consulting - BlueprintDocument1 pageVirtual Consulting - BlueprintVinadagu VishayaaluNo ratings yet

- High Fitness BooksDocument3 pagesHigh Fitness Booksaziz64pNo ratings yet

- Microeconomics Canada in The Global Environment Canadian 8th Edition Parkin Test BankDocument26 pagesMicroeconomics Canada in The Global Environment Canadian 8th Edition Parkin Test BankBrettClinewdjc100% (55)

- SSW Apr 2019Document96 pagesSSW Apr 2019Yohanes KurniawanNo ratings yet

- The Objective of Chapter 9 Is To Address The Question of Whether A Currently Owned Asset Should Be Kept in Service or Immediately ReplacedDocument24 pagesThe Objective of Chapter 9 Is To Address The Question of Whether A Currently Owned Asset Should Be Kept in Service or Immediately ReplacedAykut YıldızNo ratings yet

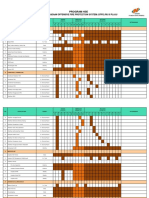

- Matrix Training & Program HSE - OFPS Plaju 19.56Document4 pagesMatrix Training & Program HSE - OFPS Plaju 19.56NurhalizaNo ratings yet

- Impact of World Cup On India 4oct2023Document4 pagesImpact of World Cup On India 4oct2023Keval RajparaNo ratings yet

- Besa Adverse ClaimDocument3 pagesBesa Adverse Claimjohn kenneth maguddayaoNo ratings yet

- Ebook Cost Benefit Analysis 4Th Edition Boardman Solutions Manual Full Chapter PDFDocument36 pagesEbook Cost Benefit Analysis 4Th Edition Boardman Solutions Manual Full Chapter PDFCherylHorngjmf100% (10)

- Acc GR 11 T4 Week 1&2 Manuftring Costs ENGDocument4 pagesAcc GR 11 T4 Week 1&2 Manuftring Costs ENGsihlemooi3No ratings yet

- PDF DocumentDocument6 pagesPDF DocumentJai Sam DanielNo ratings yet

- E-Statement 121403 31aug23 Tipc01Document1 pageE-Statement 121403 31aug23 Tipc01Khairi MahyudinNo ratings yet

- Obstructed Views: Illinois' 102 County Online Transparency AuditDocument21 pagesObstructed Views: Illinois' 102 County Online Transparency AuditIllinois Policy100% (1)

- Apush - Concept - 7.1.IIIDocument9 pagesApush - Concept - 7.1.IIIJayson_HNo ratings yet

- Salient Features of GSTDocument8 pagesSalient Features of GSTNaraesh KNo ratings yet

- Bill of QuantityDocument35 pagesBill of QuantityJoshua LopezNo ratings yet