Professional Documents

Culture Documents

Shoebox Client Data Sheet: Check All That Apply

Uploaded by

NCB School of Herbalism & Holistic Health0 ratings0% found this document useful (0 votes)

7 views1 pageTax Prep Template

Original Title

Shoebox Client Data Sheet

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax Prep Template

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageShoebox Client Data Sheet: Check All That Apply

Uploaded by

NCB School of Herbalism & Holistic HealthTax Prep Template

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

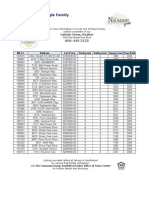

Shoebox Client Data Sheet

Taxpayer Name________________________________________ Spouse Name____________________________________________

SSN:______________________ Birthdates: _______________ SSN: _________________________ Birthdate: _____________________

Occupation: ____________________________ Occupation: _____________________________

Address: ____________________________________________City:__________________________ State: ______ Zip: _________________

Phone (Day) ___________________________________ Phone (Eve) _______________________________

E-mail Address: (Optional) _________________________________________________________________

Filing Status: ____Single ____Married filing Jointly ____Married filing Separate _____Head of Household

Dependents: (List Youngest First) Month, Day & Dependent’s Relationship to Months Lived in Your

Name(First, Initial and Last Name) Year of Birth SSN You Home

CHECK ALL THAT APPLY

Someone else can claim you as a dependent.

You and your spouse lived apart during the year.

You paid estimated Federal or State taxes last year. Federal $_________State____ State $________

You itemized last year. If yes, amount of Refund from / Balance Due to State $________________

You or your spouse were a resident of another state or earned income in another state during the last year.

You use your personal vehicle for work and were not reimbursed (excluding commuting).

You paid state and local real estate taxes.

Would you like your refund deposited into your bank account (not available for RAL Advance) ___YES ___NO

Routing Number_________________________Account Number__________________________________

Shoebox Accounting & Bookkeeping Service Guarantee

SATISFACTION GUARANTEE – We guarantee our service 100%.

ACCURACY GUARANTEE – We will give you the most accurate return and the largest possible refund.

FREE CONSULTATION – We offer you a 30 minute consultations FREE to discuss your needs & our

services with Shoebox Accounting & Bookkeeping.

AUDIT ASSISTANCE – If the IRS audits you for items we prepared for you, we will be happy to assist.

CORRESPONDENCE ASSISTANCE – We will help you handle your IRS correspondences &

recommend a tax attorney if you should need one.

I certify that I would like to have my Accounting & Bookkeeping Services prepared according to the information I have supplied.

`Taxpayer’s Signature________________________________________________________ Date________________________________

Spouse’s Signature__________________________________________________________ Date________________________________

You might also like

- Average - Costs Catering GuideDocument1 pageAverage - Costs Catering GuideNCB School of Herbalism & Holistic HealthNo ratings yet

- Kids Cooking Teams: That's FreshDocument74 pagesKids Cooking Teams: That's FreshNCB School of Herbalism & Holistic HealthNo ratings yet

- Holiday-Menu-Ideas For CateringDocument2 pagesHoliday-Menu-Ideas For CateringNCB School of Herbalism & Holistic HealthNo ratings yet

- Event PlanningDocument3 pagesEvent Planningshmoscribd100% (1)

- Offbeat Bride: First Things FirstDocument6 pagesOffbeat Bride: First Things FirstNCB School of Herbalism & Holistic HealthNo ratings yet

- Nutritional GuideDocument2 pagesNutritional GuiderigzNo ratings yet

- Base FoodDocument1 pageBase FoodNCB School of Herbalism & Holistic HealthNo ratings yet

- Meal Plan 4 MEAL PLAN 4 - Summer Summer: 7-Day "Real Food" Family Meal Plan & Grocery ListDocument3 pagesMeal Plan 4 MEAL PLAN 4 - Summer Summer: 7-Day "Real Food" Family Meal Plan & Grocery ListNCB School of Herbalism & Holistic HealthNo ratings yet

- Nutrient For Clients PT 3Document1 pageNutrient For Clients PT 3NCB School of Herbalism & Holistic HealthNo ratings yet

- Nutrient For Clients PT 2Document1 pageNutrient For Clients PT 2NCB School of Herbalism & Holistic HealthNo ratings yet

- Honest Food GuideDocument1 pageHonest Food Guidepeanutmilk100% (3)

- Dinner Menu & Shopping ListDocument3 pagesDinner Menu & Shopping ListNCB School of Herbalism & Holistic HealthNo ratings yet

- Meal Plan 1: 7-Day "Real Food" Family Meal Plan & Grocery ListDocument3 pagesMeal Plan 1: 7-Day "Real Food" Family Meal Plan & Grocery ListbdianNo ratings yet

- Meal Plan 4 MEAL PLAN 4 - Summer Summer: 7-Day "Real Food" Family Meal Plan & Grocery ListDocument3 pagesMeal Plan 4 MEAL PLAN 4 - Summer Summer: 7-Day "Real Food" Family Meal Plan & Grocery ListNCB School of Herbalism & Holistic HealthNo ratings yet

- Meal Plan 2: 7-Day "Real Food" Family Meal Plan & Grocery ListDocument3 pagesMeal Plan 2: 7-Day "Real Food" Family Meal Plan & Grocery ListNCB School of Herbalism & Holistic HealthNo ratings yet

- Salary Comparision Sheet - ShoeboxDocument2 pagesSalary Comparision Sheet - ShoeboxNCB School of Herbalism & Holistic HealthNo ratings yet

- This Agreement Is by and Between Shoebox Bookkeeping & Accounting &Document7 pagesThis Agreement Is by and Between Shoebox Bookkeeping & Accounting &NCB School of Herbalism & Holistic HealthNo ratings yet

- ERO AgreementDocument6 pagesERO AgreementNCB School of Herbalism & Holistic HealthNo ratings yet

- Why Buy Sustainable Lesson PlanDocument10 pagesWhy Buy Sustainable Lesson PlanNCB School of Herbalism & Holistic HealthNo ratings yet

- Monday Tuesday WED Thursday Friday SAT Sunday DateDocument2 pagesMonday Tuesday WED Thursday Friday SAT Sunday DateNCB School of Herbalism & Holistic HealthNo ratings yet

- Shoebox Tax Preparation CouponDocument1 pageShoebox Tax Preparation CouponNCB School of Herbalism & Holistic HealthNo ratings yet

- Information Referral: Form (2-2007) Department of The Treasury - Internal Revenue Service OMB # 1545-1960Document2 pagesInformation Referral: Form (2-2007) Department of The Treasury - Internal Revenue Service OMB # 1545-1960NCB School of Herbalism & Holistic HealthNo ratings yet

- Grocery List PlannerDocument3 pagesGrocery List PlannerNCB School of Herbalism & Holistic HealthNo ratings yet

- Kids Cooking Teams: That's FreshDocument74 pagesKids Cooking Teams: That's FreshNCB School of Herbalism & Holistic HealthNo ratings yet

- Base FoodDocument1 pageBase FoodNCB School of Herbalism & Holistic HealthNo ratings yet

- Event Budget Workbook - GuidebookDocument3 pagesEvent Budget Workbook - GuidebookNCB School of Herbalism & Holistic HealthNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PitchBook 2017 Annual US PE Lending League TablesDocument15 pagesPitchBook 2017 Annual US PE Lending League TablesbloombergaccountNo ratings yet

- Teil 12 Foreclosure FraudDocument44 pagesTeil 12 Foreclosure FraudNathan Beam100% (1)

- Miscellaneous Information: Copy B For RecipientDocument4 pagesMiscellaneous Information: Copy B For RecipientAubree Gates100% (1)

- 12 568bk PDFDocument60 pages12 568bk PDFAReliableSourceNo ratings yet

- M Business 5th Edition Ferrell Test Bank 1Document51 pagesM Business 5th Edition Ferrell Test Bank 1carrie100% (45)

- Business Man BangloreDocument19 pagesBusiness Man BanglorevishalNo ratings yet

- F 1120 FM 1Document1 pageF 1120 FM 1croyal01No ratings yet

- Date Region Retailer Type Customer Quantity RevenueDocument36 pagesDate Region Retailer Type Customer Quantity RevenueSk Intekhaf AlamNo ratings yet

- PMJFB Puils DF Mlysliaf 'C Kfvkuaf Dy Awzy Hox DF Dfavf: $100 125 GmtyDocument40 pagesPMJFB Puils DF Mlysliaf 'C Kfvkuaf Dy Awzy Hox DF Dfavf: $100 125 Gmtysingh1699No ratings yet

- Creditcardrush JSONDocument31 pagesCreditcardrush JSONStaceyNo ratings yet

- 300x Netflix USA by Jonathan OpDocument11 pages300x Netflix USA by Jonathan Op27999703210jNo ratings yet

- Alpha Prefix List Reg-PremDocument3 pagesAlpha Prefix List Reg-Premseattlecarol0% (1)

- Note: Posted Transactions Until The Last Working Day Are ShownDocument36 pagesNote: Posted Transactions Until The Last Working Day Are ShownMuhammad Azhar QaziNo ratings yet

- DineroDocument4 pagesDineroValeria Amaya Burgos0% (1)

- President Donald J. Trump's Accomplishment List Archive. - MAGAPILL PDFDocument33 pagesPresident Donald J. Trump's Accomplishment List Archive. - MAGAPILL PDFpeter100% (1)

- 2020 Tax Return Documents (DERICK BROOKS A)Document2 pages2020 Tax Return Documents (DERICK BROOKS A)Patricia100% (2)

- SMChap004 PDFDocument57 pagesSMChap004 PDFhshNo ratings yet

- e-StatementBRImo 032001017410501 Dec2023 20240116 181101Document7 pagese-StatementBRImo 032001017410501 Dec2023 20240116 181101Mobilkamu JakartaNo ratings yet

- Lop Nhua Tham BamDocument10 pagesLop Nhua Tham BamMai Tuan AnhNo ratings yet

- 3.31 Paystub 1Document1 page3.31 Paystub 1disipiw20No ratings yet

- Assurance Wireless ApplicationDocument2 pagesAssurance Wireless Applicationforhonor20004No ratings yet

- Non-Tax Filer Student 2021 Certification 23-24Document1 pageNon-Tax Filer Student 2021 Certification 23-24Kamal GroverNo ratings yet

- SouthWood Home Inventory (July)Document2 pagesSouthWood Home Inventory (July)Nathan Cross100% (2)

- US Internal Revenue Service: f13206Document2 pagesUS Internal Revenue Service: f13206IRSNo ratings yet

- The Heritage School Common Assessment Test TERM 1 2021: InstructionsDocument15 pagesThe Heritage School Common Assessment Test TERM 1 2021: InstructionsTichafara NyahundaNo ratings yet

- SBI PO Prelims 2023 Memory Based Paper (6th Nov - Shift 1)Document71 pagesSBI PO Prelims 2023 Memory Based Paper (6th Nov - Shift 1)SritharNo ratings yet

- XAT Essay Writing TipsDocument17 pagesXAT Essay Writing TipsShameer PhyNo ratings yet

- Walmart MemoDocument3 pagesWalmart MemoRahul JainNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- PPP 523930 Investment AdvisorsDocument23 pagesPPP 523930 Investment AdvisorsZerohedgeNo ratings yet