Professional Documents

Culture Documents

Data Analytics in Business and Accounting

Uploaded by

goufaprs0 ratings0% found this document useful (0 votes)

183 views17 pagesOriginal Title

slide-4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

183 views17 pagesData Analytics in Business and Accounting

Uploaded by

goufaprsCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 17

Tim Dosen Analitik

Adi Data

Data Analytics in Business

and Accounting

Outline

1. Truly Data Driven Organization

2. Accounting Analytics

3. Accounting Risk Analytics

4. Audit Analytics

5. Benchmark Analytics

6. Business Partnering Analytics

7. Financial Analytics

8. Tax Analytics

1. Truly Data Driven Organization

In a recent survey by the Chartered

Global Management Accountants,

almost 9 of 10 finance professionals

agreed the revolution is not only

coming, its already here.

Why Does (and Why Should!) Data Analytics Matter to

• Accountants will be

increasingly expected to add

value to the business

decision making within their

organizations and for their

clients (Wendell Gilland)

• Working with descriptive

analytics, predictive

analytics, and prescriptive

analytics comes more easily

to people who already

possess excellent

quantitative skills

2. Accounting Analytics

• Accountants use data analytics to help businesses uncover valuable

insights within their financials, identify process improvements that

can increase efficiency, and better manage risk.

• A strong facility with data analytics gives them the toolset to help

strengthen their partnership with business leaders.

• a few examples

• Auditors, both those working internally and externally, can shift from a

sample-based model to employ continuous monitoring where much larger

data sets are analyzed and verified. The result: less margin of error resulting

in more precise recommendations.

• Tax accountants use data science to quickly analyze complex taxation

questions related to investment scenarios. In turn, investment decisions can

be expedited, which allows companies to respond faster to opportunities to

beat their competition — and the market — to the punch.

• Accountants who assist, or act as, investment

advisors use big data to find behavioral

patterns in consumers and the market. These

patterns can help businesses build analytic

models that, in turn, help them identify

investment opportunities and generate

higher profit margins.

• Accounting analytics is the application of

data analytics and big data technologies

to the field of accounting.

• It helps accountants manage typical tasks

and enables financial professionals to

answer business questions, shape

corporate strategy, forecast financial

trends, thwart fraud, and more!

What for

• Analytics for Accounting

needs to work differently.

• It needs to help Accounting

identify potential risks, find

opportunities to boost process

efficiency, and empower

everyone from the accounting,

audit, and business teams to

get a better sense of the

financials.

3. Accounting Risk Analytics

• We can use comprehensive dashboards and reporting to give us real time

visibility into status, progress, exceptions, and risk points

• Risk analytics uses reports and dashboards to make the whole process

faster

• The goal with accounting risk

analytics is to quickly identify and

triage which areas present the

biggest risk to the balance sheet

and act quickly to address.

• Accounting risk analytics is

designed to help Accounting

spotlight the underlying risks that

may ultimately affect downstream

financial reports.

Accounting Process Analytics

• Accounting process analytics puts

Accounting in control with transparency

around which process improvement

efforts are bearing fruit, which need

tweaking, and where to focus next.

• Start with a top-level measure of

success, such as time to close.

Functional drivers provide the next level

of drill down—so link them back to your

overarching metrics. Operational drivers

provide the deepest level of process

insight and are the jump point to take

action.

4. Audit Analytics

• Audit analytics is one of the hottest

new areas in Accounting. Audit costs

have been rising for years, so better

self service for audit simply makes fiscal

sense.

• AICPA Definition: Audit data analytics

is the science and art of discovering and

analyzing patterns, identifying

anomalies, and extracting other useful

information from data underlying or

related to the subject matter of an audit

through analysis, modeling, and

visualization for planning or performing

the audit.

American Institute of Certified Public Accountant

5. Benchmark Analytics

• Benchmarking can help organizations show

that performance targets can be achieved,

accelerate and manage change, and enable

process improvement. It can also help them

maintain focus on the external environment

and generate an understanding of world class

performance. (CGMA)

• Traditional financial benchmarking

compares typical finance and operating

metrics—such as profit margin and return on

assets—against same-industry and same-

sized peers.

• Benchmarking for Accounting provides a different perspective.

• When performing risk, process, or audit analytics, accounting benchmarking pairs internal data

with curated external data for comparative statements. It also provides insight into where the

biggest margins are for improvement or redress.

6. Business Partnering Analytics

• Business partnering has

been on the agenda for

finance organizations. In fact,

about 83% of finance

organizations want to

increase the time spent on

business partnering, with top

sought after skills including

industry and business

knowledge as well as

analytics savvy

7. Financial Analytics

• Accounting organizations increasingly seeing more business exposure,

and the expectation of their greater role in decision support, there’s

never been a better time to take an active role in financial analytics—

interpreting the KPIs like revenue, expenses, and cash flow that are

critical for business decisions.

• Accounting is often left out in the cold, unable to ask or answer

questions like:

• What is our risk exposure with specific customers?

• Where are the biggest revenue and expense risks?

• Are our capital and headcount investments aligned with the right

opportunities?

• Do we have a good handle on revenue from our new initiatives?

Financial

Analytics

Benefits

8. Tax Analytics

• Tax data analytics gathers data from

different sources to answer questions

about complex issues.

• This information comes from

different sources like presentations,

reports and returns filings.

• This level of insight provides the

accountants or members of the tax

department with a deeper

understanding of an organization’s

tax status, something they did not

have before, and it is opening up a

host of new opportunities.

References

1. https://www.kenan-flagler.unc.edu/perspectives/why-data-analytics-matter-

to-accountants/

2. Big Data And Accounting https://slideplayer.com/slide/11924182/

3. https://loginask.com/data-analytics-for-accountants

4. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/Tax/us-tax-

data-analytics-a-new-era-for-tax-planning-and-compliance.pdf

You might also like

- NIMS University Jaipur - Doctor of Medicine Pathology Course Fees, Eligibility, PlacementDocument4 pagesNIMS University Jaipur - Doctor of Medicine Pathology Course Fees, Eligibility, PlacementstepincollegeNo ratings yet

- Analytics in HealthcareDocument12 pagesAnalytics in Healthcarekirubha100% (1)

- Essential skills and competencies for frontline managersDocument3 pagesEssential skills and competencies for frontline managersSahaana KalyanramanNo ratings yet

- Simulation in manufacturing systems A Clear and Concise ReferenceFrom EverandSimulation in manufacturing systems A Clear and Concise ReferenceNo ratings yet

- Business Ethics, Governance & RiskDocument24 pagesBusiness Ethics, Governance & RiskSwapnil KeluskarNo ratings yet

- Patient-Doctor Relationship, HandoutDocument41 pagesPatient-Doctor Relationship, HandoutMiguel Angelo Ang CoNo ratings yet

- Strategic Healthcare Management: Planning and Execution, Third EditionFrom EverandStrategic Healthcare Management: Planning and Execution, Third EditionNo ratings yet

- Fraud Analysis Using ACL ReviewDocument1 pageFraud Analysis Using ACL ReviewCarlos H AngelNo ratings yet

- The Truth About Sucking Up: How Authentic Self-Promotion Benefits You and Your OrganizationFrom EverandThe Truth About Sucking Up: How Authentic Self-Promotion Benefits You and Your OrganizationNo ratings yet

- Textbook of Urgent Care Management: Chapter 34, Engaging Accountable Care Organizations in Urgent Care CentersFrom EverandTextbook of Urgent Care Management: Chapter 34, Engaging Accountable Care Organizations in Urgent Care CentersNo ratings yet

- Quality Crest Healthcare ConsultantsDocument8 pagesQuality Crest Healthcare ConsultantsMohammad Muntaz AliNo ratings yet

- MBA - AssignmentDocument11 pagesMBA - AssignmentDivyesh100% (1)

- 6 basic TQM concepts compared to previous quality elementsDocument3 pages6 basic TQM concepts compared to previous quality elementsArdalan_mar2001No ratings yet

- Business Leadership in Turbulent Times: Decision-Making for Value CreationFrom EverandBusiness Leadership in Turbulent Times: Decision-Making for Value CreationNo ratings yet

- Clinical Governance Structure A Complete Guide - 2020 EditionFrom EverandClinical Governance Structure A Complete Guide - 2020 EditionNo ratings yet

- Ahs Quality Fall 2016Document62 pagesAhs Quality Fall 2016nadsNo ratings yet

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- Case Study Assignment 27.10.021Document7 pagesCase Study Assignment 27.10.021Amrit BaniyaNo ratings yet

- An Entrepreneur's Strategy for Thriving in the New Normal: From Opportunity to AdvantageFrom EverandAn Entrepreneur's Strategy for Thriving in the New Normal: From Opportunity to AdvantageNo ratings yet

- Patient Complaints in HealthcareDocument12 pagesPatient Complaints in HealthcaresanaaNo ratings yet

- Managers in The New WorkplaceDocument6 pagesManagers in The New WorkplaceReylen MaderazoNo ratings yet

- EFQM Model Assessment Tool Boosts Work Motivation MeasurementDocument11 pagesEFQM Model Assessment Tool Boosts Work Motivation MeasurementBeatrice Georgiana100% (1)

- International Strategic Management A Complete Guide - 2020 EditionFrom EverandInternational Strategic Management A Complete Guide - 2020 EditionNo ratings yet

- Budgeting and MBO ReportDocument20 pagesBudgeting and MBO ReportjoiabelaNo ratings yet

- Introduction To Strategic ManagementDocument31 pagesIntroduction To Strategic ManagementRatchana VasudevNo ratings yet

- Schermerhorn Ch09Document49 pagesSchermerhorn Ch09Kien TranNo ratings yet

- Planning Health Promotion Programs Workbook en 2015Document74 pagesPlanning Health Promotion Programs Workbook en 2015teamirNo ratings yet

- Managing CareersDocument52 pagesManaging CareersSonam AroraNo ratings yet

- Wound Forum 14Document12 pagesWound Forum 14Lia Mar'atush SholihahNo ratings yet

- HIMSS10 GuideDocument24 pagesHIMSS10 Guidemr_histalk5532No ratings yet

- The Future of Healthcare Leadership, Talent and Culture: Four Key Areas For ChangeDocument9 pagesThe Future of Healthcare Leadership, Talent and Culture: Four Key Areas For ChangeMuhammad BilalNo ratings yet

- Cost Audit Techniques and ProceduresDocument31 pagesCost Audit Techniques and ProceduresAkash BhavsarNo ratings yet

- Tesco training methods and ROIDocument5 pagesTesco training methods and ROIMoona Lisa100% (2)

- CH 1Document22 pagesCH 1hamid_bashir1No ratings yet

- Accounting During Industrial RevolutionDocument16 pagesAccounting During Industrial RevolutionYasir ABNo ratings yet

- Accounting and Financial Management Study NotesDocument72 pagesAccounting and Financial Management Study NotesShani BitonNo ratings yet

- MD (Unani) - Amraz-e-Niswan PDFDocument2 pagesMD (Unani) - Amraz-e-Niswan PDFarjun vsNo ratings yet

- WorkbookDocument420 pagesWorkbookMudit Kothari100% (1)

- Critical Analysis of Patient and Family Rights in Jci Accreditation and Cbahi Standards For HospitalsDocument10 pagesCritical Analysis of Patient and Family Rights in Jci Accreditation and Cbahi Standards For HospitalsImpact JournalsNo ratings yet

- Certification in Integrated Treasury Management SyllabusDocument4 pagesCertification in Integrated Treasury Management Syllabusshubh.icai0090No ratings yet

- Hospital MarketinDocument47 pagesHospital Marketinchandraprakash_shuklNo ratings yet

- Northern State Medical UniversityDocument36 pagesNorthern State Medical Universitygoldindia100% (1)

- Meaning & Scope of Management AccountingDocument2 pagesMeaning & Scope of Management AccountingHafizullah AnsariNo ratings yet

- Analyzing The Internal Environment of The FirmDocument7 pagesAnalyzing The Internal Environment of The FirmRegine Balaan Anua100% (1)

- Training Stress Testing and Scenario AnalysisDocument7 pagesTraining Stress Testing and Scenario AnalysisUshal VeeriahNo ratings yet

- Riphah International University Faculty of Management Sciences Riphah School of Leadership Final Term Examinations, Fall 2020Document3 pagesRiphah International University Faculty of Management Sciences Riphah School of Leadership Final Term Examinations, Fall 2020noor hudaNo ratings yet

- Corporate Culture:: The Second Ingredient in A World-Class Ethics and Compliance ProgramDocument8 pagesCorporate Culture:: The Second Ingredient in A World-Class Ethics and Compliance ProgramEric Nguyen Duc HieuNo ratings yet

- PEST AnalysisDocument1 pagePEST AnalysisTrey Poppi CausleyNo ratings yet

- Health Care Risk ManagementDocument13 pagesHealth Care Risk ManagementsaadNo ratings yet

- Impact Model: Identifying Problem, Mastering Data, Planning An Action, Addressing and Refining, Communicating, TrackingDocument35 pagesImpact Model: Identifying Problem, Mastering Data, Planning An Action, Addressing and Refining, Communicating, TrackinggoufaprsNo ratings yet

- Big Data Vs Traditional DatabaseDocument19 pagesBig Data Vs Traditional DatabasegoufaprsNo ratings yet

- Boost Business Decisions with Data Analytics ConceptsDocument16 pagesBoost Business Decisions with Data Analytics ConceptsgoufaprsNo ratings yet

- Overview Bigdata Analytics For Business & Accounting: Adi DataDocument12 pagesOverview Bigdata Analytics For Business & Accounting: Adi DatagoufaprsNo ratings yet

- IMPACT Cycle: Advance: Big DataDocument15 pagesIMPACT Cycle: Advance: Big DatagoufaprsNo ratings yet

- IMPACT Cycle: Overview: Big DataDocument17 pagesIMPACT Cycle: Overview: Big DatagoufaprsNo ratings yet

- Ha16 18PXDocument2 pagesHa16 18PXStefce PetrovNo ratings yet

- Channelling Done: Channel DetailsDocument2 pagesChannelling Done: Channel DetailsKaushala SamarawickramaNo ratings yet

- Chapter 4 Duality and Post Optimal AnalysisDocument37 pagesChapter 4 Duality and Post Optimal AnalysisMir Md Mofachel HossainNo ratings yet

- Ivent201 - Manual de Usuario (220-290)Document71 pagesIvent201 - Manual de Usuario (220-290)Wilber AleluyaNo ratings yet

- State Board of Education Memo On Broward County (Oct. 4, 2021)Document40 pagesState Board of Education Memo On Broward County (Oct. 4, 2021)David SeligNo ratings yet

- Databases 2 Exercise Sheet 4Document2 pagesDatabases 2 Exercise Sheet 4Shivam ShuklaNo ratings yet

- VALS System: Presented By: Atul Agarwal Balu K Thomas Dhiraj BhabhulgaonkarDocument18 pagesVALS System: Presented By: Atul Agarwal Balu K Thomas Dhiraj BhabhulgaonkarBalu K Thomas100% (1)

- Module 4 - Nursing Process and Administration-PharmaDocument13 pagesModule 4 - Nursing Process and Administration-PharmaKelsey MacaraigNo ratings yet

- Content Analysis Research Paper ExampleDocument5 pagesContent Analysis Research Paper Examplefvfzfa5d100% (1)

- Measuring The Sustainability of Urban Water ServicesDocument10 pagesMeasuring The Sustainability of Urban Water ServicesWalter RodríguezNo ratings yet

- Fundamentals of Metal Matrix CompositesDocument19 pagesFundamentals of Metal Matrix CompositesAstriaNo ratings yet

- DATACOM Multiple Choice Question 6Document1 pageDATACOM Multiple Choice Question 6girijamohapatraNo ratings yet

- Colloquium: A Learner-Centric View of Mobile Seamless Learning Lung-Hsiang WongDocument5 pagesColloquium: A Learner-Centric View of Mobile Seamless Learning Lung-Hsiang WongWayne LeungNo ratings yet

- North American Free Trade Agreement: Prof. MakhmoorDocument15 pagesNorth American Free Trade Agreement: Prof. MakhmoorShikha ShuklaNo ratings yet

- Health 10 Performance TaskDocument4 pagesHealth 10 Performance TaskMary Kryss DG SangleNo ratings yet

- Passive Fire Protection PDFDocument7 pagesPassive Fire Protection PDFVictor SampaNo ratings yet

- Forms6i 10GDocument42 pagesForms6i 10GRolando OcañaNo ratings yet

- Power Converters Simulation Lab Manual - (2015-2016)Document41 pagesPower Converters Simulation Lab Manual - (2015-2016)Leela KrishnaNo ratings yet

- Allison - Dp-8000 - Manual de Servicio - Pag-390Document390 pagesAllison - Dp-8000 - Manual de Servicio - Pag-390Manuales De Maquinaria Jersoncat100% (1)

- User Manual Rish Insu 10Document10 pagesUser Manual Rish Insu 10Manoj TyagiNo ratings yet

- Nameet Kumar Jain: Education ProjectsDocument1 pageNameet Kumar Jain: Education ProjectsNameet JainNo ratings yet

- Basic IT Tutorial 2 - No Answer, Candidates Are To Work Out The Answers ThemselveDocument3 pagesBasic IT Tutorial 2 - No Answer, Candidates Are To Work Out The Answers ThemselveTri Le MinhNo ratings yet

- PATHFit 4 Volleyball BSEDDocument7 pagesPATHFit 4 Volleyball BSEDJULIUS JIM CREDONo ratings yet

- 524 799 Coach - K - Coach - Knight - CaseDocument15 pages524 799 Coach - K - Coach - Knight - Casekaushalmighty100% (1)

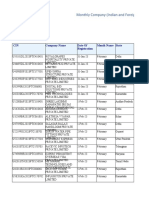

- Monthly-Company (Indian-and-Foreign) - and LLPs-20230301Document724 pagesMonthly-Company (Indian-and-Foreign) - and LLPs-20230301Yogesh Paigude0% (1)

- Welding Cost Optimization with GMAWDocument6 pagesWelding Cost Optimization with GMAWratneshkumar2004No ratings yet

- Discover Haxeflixel FullDocument182 pagesDiscover Haxeflixel FullKristian Macanga100% (3)

- RELAP5 Simulation of CANDU Station Blackout AccideDocument20 pagesRELAP5 Simulation of CANDU Station Blackout AccideWhite HeartNo ratings yet

- Yaskawa Ac Servo Drives & Controllers PDFDocument40 pagesYaskawa Ac Servo Drives & Controllers PDFNur CholisNo ratings yet

- Board Resolution for Execution of Sale DeedDocument3 pagesBoard Resolution for Execution of Sale DeedRizwan GhafoorNo ratings yet