Professional Documents

Culture Documents

Week-2-Chapter-3-Financial-Build-A-Mode L

Week-2-Chapter-3-Financial-Build-A-Mode L

Uploaded by

Crusty GirlOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week-2-Chapter-3-Financial-Build-A-Mode L

Week-2-Chapter-3-Financial-Build-A-Mode L

Uploaded by

Crusty GirlCopyright:

Available Formats

lOMoARcPSD|10113730

Week 2 Chapter 3 - Financial Build A Model

Corporate Financial Accounting (Johnson & Wales University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Rudjene Estelloso (rudjeneestelloso19@gmail.com)

lOMoARcPSD|10113730

Build a Model

Chapter: 3

Problem: 15

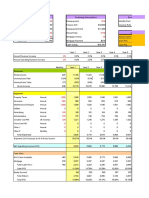

Joshua & White Technologies: December 31 Balance Sheets

(Thousands of Dollars)

Assets 2019 2018

Cash and cash equivalents $21,000 $20,000

Short-term investments 3,759 3,240

Accounts Receivable 52,500 48,000

Inventories 84,000 56,000

Total current assets $161,259 $127,240

Net fixed assets 223,097 200,000

Total assets $384,356 $327,240

Liabilities and equity

Accounts payable $33,600 $32,000

Accruals 12,600 12,000

Notes payable 19,929 6,480

Total current liabilities $66,129 $50,480

Long-term debt 67,662 58,320

Total liabilities $133,791 $108,800

Common stock 178,440 178,440

Retained Earnings 72,125 40,000

Total common equity $250,565 $218,440

Total liabilities and equity $384,356 $327,240

Joshua & White Technologies December 31 Income Statements

(Thousands of Dollars)

2019 2018

Sales $420,000 $400,000

COGS except excluding depr. and amort. 300,000 298,000

Depreciation and Amortization 19,660 18,000

Other operating expenses 27,600 22,000

EBIT $72,740 $62,000

Interest Expense 5,740 4,460

EBT $67,000 $57,540

Taxes (25%) 16,750 14,385

Net Income $50,250 $34,524

Common dividends $18,125 $17,262

Addition to retained earnings $32,125 $17,262

Other Data 2019 2018

Year-end Stock Price $90.00 $96.00

Downloaded by Rudjene Estelloso (rudjeneestelloso19@gmail.com)

lOMoARcPSD|10113730

# of shares (Thousands) 4,052 4,000

Lease payment (Thousands of Dollars) $20,000 $20,000

Sinking fund payment (Thousands of Dollars) $5,000 $5,000

Ratio Analysis 2019 2018 Industry Avg

Liquidity Ratios

Current Ratio 2.44 2.52 2.58

Quick Ratio 1.17 1.41 1.53

Asset Management Ratios

Inventory Turnover (Total COGS/Inventories) 3.81 5.64 7.69

Days Sales Outstanding 45.63 43.80 47.45

Fixed Assets Turnover 1.88 2.00 2.04

Total Assets Turnover 1.09 1.22 1.23

Debt Management Ratios

Debt Ratio (Total debt-to-assets) 22.8% 19.8% 20.0%

Liabilities-to-assets ratio 34.8% 33.2% 32.1%

Times-interest-earned ratio 12.67 13.90 15.33

EBITDA coverage ratio 3.66 3.39 4.18

Profitability Ratios

Profit Margin 11.96% 8.63% 8.86%

Basic Earning Power 18.93% 18.95% 19.48%

Return on Assets 13.07% 10.55% 10.93%

Return on Equity 20.05% 15.80% 16.10%

Market Value Ratios

Earnings per share $12.40 $8.63 NA

Price-to-earnings ratio 7.26 11.12 10.65

Cash flow per share $17.25 $13.13 NA

Price-to-cash flow ratio 5.22 7.31 7.11

Book Value per share $61.84 $54.61 NA

Market-to-book ratio 1.46 1.76 1.72

a. Has Joshua & White's liquidity position improved or worsened? Explain.

Joshua & White's current and quick ratio were both below indsutry average for 2018 & 2019. It is diffic

if the co's liquidity position has worsened. From a creditors perspective, the decrease could imply that

current liabilities are increasing . And from a shareholder's perspective, the decrease could mean the

tied up in nonproductive assets.

b. Has Joshua & White's ability to manage its assets improved or worsened? Explain.

Joshua & White's ability to manage assets has worsened. Not only is the 2019 debt-asset ratio higher

standard but it has also increased from 2018. Which means that the company has increased liabilites

putting itself at risk of defaulting in the instance that interest rates were to rise suddenly.

c. How has Joshua & White's profitability changed during the last year?

Joshua & White's sales and net income have increased since 2018. Therefore, the company saw a ris

Downloaded by Rudjene Estelloso (rudjeneestelloso19@gmail.com)

lOMoARcPSD|10113730

profit margin or their profit per dollar of sales. Their profit margin is significantly over the industry avera

d. Perform an extended Du Pont analysis for Joshua & White for each year.

ROE = PM x TA Turnover x Equity Multiplier

2019 20.05% 11.96% 1.09 1.53

2018 15.80% 8.63% 1.22 1.50

The ROE has improved because of the profit margin increases - regardless of the decrease in total as

This company became more profitable and financially leveraged

e. Perform a common size analysis. What has happened to the composition

Downloaded by Rudjene Estelloso (rudjeneestelloso19@gmail.com)

lOMoARcPSD|10113730

11/26/2018

Downloaded by Rudjene Estelloso (rudjeneestelloso19@gmail.com)

lOMoARcPSD|10113730

cult to dtermine

t the co.'s

less money

r than industry

and potentially

se in their net

Downloaded by Rudjene Estelloso (rudjeneestelloso19@gmail.com)

lOMoARcPSD|10113730

age for 2019 .

sset turnover.

Downloaded by Rudjene Estelloso (rudjeneestelloso19@gmail.com)

You might also like

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Sap Accounting Entries MM SD FADocument6 pagesSap Accounting Entries MM SD FAcdhars100% (3)

- Verizon Communications Inc.: Horizontal AnalysisDocument42 pagesVerizon Communications Inc.: Horizontal Analysisjm gonzalezNo ratings yet

- Chapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument8 pagesChapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen Harris100% (1)

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Cheating SheetDocument13 pagesCheating SheetAlfian Ardhiyana PutraNo ratings yet

- Chapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument3 pagesChapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- Linear TechnologyDocument6 pagesLinear Technologyprashantkumarsinha007100% (1)

- Mercury Athletic Footwear Answer Key FinalDocument41 pagesMercury Athletic Footwear Answer Key FinalFatima ToapantaNo ratings yet

- D'leon Financial Statements Analysis Exercise - SolvedDocument8 pagesD'leon Financial Statements Analysis Exercise - SolvedDIPESH KUNWARNo ratings yet

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Questions Financial Statements Financial AnalysisDocument3 pagesQuestions Financial Statements Financial AnalysisBir kişiNo ratings yet

- FCF 12th Edition Case SolutionsDocument66 pagesFCF 12th Edition Case SolutionsDavid ChungNo ratings yet

- Financial Statements Model: 1 Income Statement 2 Balance Sheet 3 Cash Flow Statement 4 Scenarios 5 Supporting SchedulesDocument20 pagesFinancial Statements Model: 1 Income Statement 2 Balance Sheet 3 Cash Flow Statement 4 Scenarios 5 Supporting SchedulesEmperor OverwatchNo ratings yet

- HW 3 - ACME RoadrunnerDocument7 pagesHW 3 - ACME Roadrunnerkartik lakhotiyaNo ratings yet

- ICARE Preweek FAR by Sir RainDocument13 pagesICARE Preweek FAR by Sir Rainjohn paulNo ratings yet

- HW 2 - Ch03 P15 Build A Model - HrncarDocument2 pagesHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaNo ratings yet

- IFM11 Solution To Ch08 P15 Build A ModelDocument2 pagesIFM11 Solution To Ch08 P15 Build A ModelDiana Soriano50% (2)

- Chapter 8. Student Ch08 P 8-15 Build A Model: AssetsDocument2 pagesChapter 8. Student Ch08 P 8-15 Build A Model: Assetsseth litchfield100% (1)

- Mini Case (Financial Statements)Document12 pagesMini Case (Financial Statements)Melissa López GarzaNo ratings yet

- 3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsDocument3 pages3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsQudsiya KalhoroNo ratings yet

- Problem Case Financial Manager Chapter 1Document5 pagesProblem Case Financial Manager Chapter 1Sukindar Ari Shuki SantosoNo ratings yet

- Integ Case 1 FsDocument7 pagesInteg Case 1 FsIra BenitoNo ratings yet

- Deber Capitulo 2 - 3 FINDocument3 pagesDeber Capitulo 2 - 3 FINMiguel TapiaNo ratings yet

- Mini CaseDocument7 pagesMini CaseHarrisha Arumugam0% (1)

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Midterm Exam Part 2 - AtikDocument8 pagesMidterm Exam Part 2 - AtikAtik MahbubNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- 11.0 Enager Industries, Inc. - DataDocument3 pages11.0 Enager Industries, Inc. - DataAliza RizviNo ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- Assets: Café Richard Balance Sheet As at 31 December 2019 & 2020Document3 pagesAssets: Café Richard Balance Sheet As at 31 December 2019 & 2020Jannatul Ferdousi PrïtyNo ratings yet

- Finance Quiz 3Document43 pagesFinance Quiz 3Peak ChindapolNo ratings yet

- Chapter 2 SolutionsDocument19 pagesChapter 2 SolutionsSorken75No ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Colgate Ratio Analysis SolvedDocument7 pagesColgate Ratio Analysis SolvedKavitha RagupathyNo ratings yet

- Current Assets: Liabilities and Stockholders' EquityDocument9 pagesCurrent Assets: Liabilities and Stockholders' EquityIrakli SaliaNo ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- Excel File For Financial Ratio Activities UpdatedDocument4 pagesExcel File For Financial Ratio Activities Updated0a0lvbht4No ratings yet

- Finance Final Pitch General ElectricDocument8 pagesFinance Final Pitch General Electricbquinn08No ratings yet

- Excel 1 - Common Sized Financial Statements - IrvinDocument2 pagesExcel 1 - Common Sized Financial Statements - Irvinapi-581024555No ratings yet

- Chapter 6 Mini Case: SituationDocument9 pagesChapter 6 Mini Case: SituationUsama RajaNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Annl Report 2022 FinancialsDocument7 pagesAnnl Report 2022 FinancialsTiffany TNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- 770976ce9 - DLeon Part IDocument5 pages770976ce9 - DLeon Part IMuhammad sohailNo ratings yet

- Ch.17 HW Acc PDFDocument2 pagesCh.17 HW Acc PDFyizhou FengNo ratings yet

- Final Req VCMDocument8 pagesFinal Req VCMMaxine Lois PagaraganNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- Evidencia 2 ANALISIS E INTERPRETACION DE ESTADOS FINANCIEROSDocument5 pagesEvidencia 2 ANALISIS E INTERPRETACION DE ESTADOS FINANCIEROSRegina De LeónNo ratings yet

- M1 C2 Case Study WorkbookDocument25 pagesM1 C2 Case Study WorkbookfenixaNo ratings yet

- Data Year-End Common Stock Price: Ratios SolutionDocument2 pagesData Year-End Common Stock Price: Ratios SolutionTarun KatariaNo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- Presentation 1Document13 pagesPresentation 1Kaleab TadesseNo ratings yet

- Finance Questions 4Document3 pagesFinance Questions 4asma raeesNo ratings yet

- VCMMMM Final RequirementDocument8 pagesVCMMMM Final RequirementMaxine Lois PagaraganNo ratings yet

- WEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2Document42 pagesWEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2GIRLNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Test 2023Document12 pagesTest 2023paingheinkhanttNo ratings yet

- Chapter 2: Financial Markets and Financial Institutions: Providers and Users of FundsDocument6 pagesChapter 2: Financial Markets and Financial Institutions: Providers and Users of FundsCrusty GirlNo ratings yet

- Recitation in Rizal's Life 3rd WeekDocument3 pagesRecitation in Rizal's Life 3rd WeekCrusty GirlNo ratings yet

- WEEK 3 The Philippines in The 19th Century As Rizals Context WordDocument7 pagesWEEK 3 The Philippines in The 19th Century As Rizals Context WordCrusty GirlNo ratings yet

- Document 8Document1 pageDocument 8Crusty GirlNo ratings yet

- Family, Childhood, and Early Education: Rizal's LifeDocument21 pagesFamily, Childhood, and Early Education: Rizal's LifeCrusty GirlNo ratings yet

- Partnership Accounts FormatDocument7 pagesPartnership Accounts FormatJamsheed Rasheed100% (1)

- Financial Reporting QualityDocument64 pagesFinancial Reporting QualityAishwin RajNo ratings yet

- 上海证券交易所股票上市规则(英文版)Document145 pages上海证券交易所股票上市规则(英文版)monicakuoNo ratings yet

- For Each of The Following Scenarios Estimate How Much ValueDocument1 pageFor Each of The Following Scenarios Estimate How Much ValueAmit PandeyNo ratings yet

- BaselDocument28 pagesBaselKavithaNo ratings yet

- Afar.3401 PartnershipDocument8 pagesAfar.3401 PartnershipEverly Mae ElondoNo ratings yet

- Gautam KDocument12 pagesGautam Kgautam kayapakNo ratings yet

- Comptes 31dec 2007 enDocument88 pagesComptes 31dec 2007 enthaituan2808No ratings yet

- TL), I), W./ / TL), / I), /I% / : ThomsonDocument64 pagesTL), I), W./ / TL), / I), /I% / : ThomsonKostas RigasNo ratings yet

- CasestudyfinalDocument54 pagesCasestudyfinalSree Harsha VardhanNo ratings yet

- UntitledDocument84 pagesUntitledMary Jenel Nodalo ColotNo ratings yet

- Chapter 10 MCQs On IFOSDocument25 pagesChapter 10 MCQs On IFOSShozab AliNo ratings yet

- Chapter 17 HomeworkDocument3 pagesChapter 17 HomeworkTracy LeeNo ratings yet

- Chap 3: Problem 4: Multiple Choice-ComputationalDocument30 pagesChap 3: Problem 4: Multiple Choice-ComputationalAlarich CatayocNo ratings yet

- SEC Memorandum Circular No. 08 S. 2020Document3 pagesSEC Memorandum Circular No. 08 S. 2020Carlo Garcia, CPANo ratings yet

- Consolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsDocument221 pagesConsolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsAurcus JumskieNo ratings yet

- Financial Statement AnalysisDocument24 pagesFinancial Statement AnalysisJezzie SantosNo ratings yet

- Musaffah Shabia Sector-10, Abu Dhabi, UAE.: Kashif Rasheed Senior AccountantDocument3 pagesMusaffah Shabia Sector-10, Abu Dhabi, UAE.: Kashif Rasheed Senior AccountantKashif RasheedNo ratings yet

- Espresso Cash Flow Statement SolutionDocument2 pagesEspresso Cash Flow Statement SolutionraviNo ratings yet

- Chapter 7 - InventoryDocument13 pagesChapter 7 - InventorySyed Huzaifa SamiNo ratings yet

- Caso Tire City Finanzas Corporativas 1Document6 pagesCaso Tire City Finanzas Corporativas 1Sergio Andres Fandiño CamposNo ratings yet

- Lautan Luas Sep 2019Document116 pagesLautan Luas Sep 2019justinliem06No ratings yet

- Handout No. 2Document4 pagesHandout No. 2Gertim CondezNo ratings yet

- Ia 3 Chapter 4 DraftDocument32 pagesIa 3 Chapter 4 DraftRuiz, CherryjaneNo ratings yet

- Accounting For ManagementDocument5 pagesAccounting For ManagementZahid HassanNo ratings yet

- Kementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisDocument2 pagesKementerian Riset, Teknologi Dan Pendidikan Tinggi Universitas Lampung Fakultas Ekonomi Dan BisnisAntique NariswariNo ratings yet

- NepseDocument17 pagesNepseThapa Shu MeanNo ratings yet