Professional Documents

Culture Documents

Boston Consulting Group

Uploaded by

Joanaliza CanlasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Boston Consulting Group

Uploaded by

Joanaliza CanlasCopyright:

Available Formats

BCG also known as Boston Consulting Group

• BCG Matrix is a chart that was created by Bruce Henderson for the Boston

Consulting group in 1970 to help corporation to analyze their product lines.

• The BCG Matrix is a graphical representation tool used by companies to assess

the market worth of their products and services. In any market, there are bound

to be competitors or rivals, and this competitor may create identical products. It

is also used as an analytical tool in brand marketing, product management,

strategic management, and portfolio analysis to help the organization allocate

resources.

According to Bruce Henderson, ‘to be successful, a company or business should have a portfolio

of products with different growth rates and different market shares.

BCG Matrix

: Boston Consulting Groups assist multidivisional firm in formulating strategies

: Autonomous division = business portfolio

: Divisions may compete in different industries

: Focus on relative market-share position & industry growth rate

WHY A NEED TO HAVE BCG MATRIX?

The chart is a tool, where the company’s products and services can be plotted to help make key

business decisions. These decision include whether to keep a particular business unit, sell it, or

invest more in it

➢ Market share or is also known as the x-axis is the percentage of either revenue or

volume of sales that the company has of total market

➢ Market growth or is also known as the y-axis is used as a measure of how attractive a

market is to existing providers and potential new entrants.

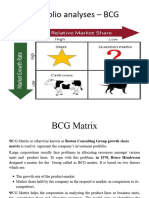

The BCG matrix is divided into four quadrants. It denotes a type of business that makes use of

specific resources and generates specific revenue. The following are the categories: (1) Cash

cows (2) Dogs (3) Question marks (4) Stars.

1. CASH COW (high market share, low market growth

- Cash cows are the leaders in the marketplace and generate more cash than they

consume. These are business units or products that have high market share, but low growth

prospect.

2. DOGS (low market share, low market growth)

- Product classified as dogs always have a weak market share in a low growth market.

These products are very likely making a loss or a very low profit at best. These products can be

a big drain on management time and resources.

3. QUESTION MARK (low market share, high market growth)

- Question mark has a low market share in a fast-growing market. Whilst this type of

product is likely to generate some revenue it may not be enough to sustain rapid growth and it

may become a net consumer of cash as it struggles to retain its market share.

4. STARS (high market share, high market growth)

- Stars are leaders in business.

- They also require heavy investment, to maintain its large market share.

- It leads to large amount cash consumption and cash generation.

You might also like

- BCG MatrixDocument18 pagesBCG Matrixsamm78992% (12)

- The BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementFrom EverandThe BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementRating: 2 out of 5 stars2/5 (1)

- Pricing and Costing SeminarDocument30 pagesPricing and Costing SeminarRichard V. SimanganNo ratings yet

- BCG Matrix: Presented byDocument10 pagesBCG Matrix: Presented by2285 Rishika VaidyaNo ratings yet

- BCG MatrixDocument3 pagesBCG MatrixVanshi PulasariaNo ratings yet

- Black Book SMDocument37 pagesBlack Book SMamitpandey6592No ratings yet

- Boston Consulting Group MatrixDocument20 pagesBoston Consulting Group MatrixReema Mamtani100% (1)

- Boston MatrixDocument6 pagesBoston MatrixNeeraja KesavarajNo ratings yet

- Boston Consulting Group MatrixDocument31 pagesBoston Consulting Group MatrixMic BaldevaronaNo ratings yet

- BCG Matrix Model and Cash FlowDocument4 pagesBCG Matrix Model and Cash FlowChristalynNo ratings yet

- Understanding The BCG Model Limitations / Problems of BCG ModelDocument13 pagesUnderstanding The BCG Model Limitations / Problems of BCG Modelshovit singhNo ratings yet

- BCG Growth ReportDocument13 pagesBCG Growth ReportShaine MalunjaoNo ratings yet

- 4.BCG MatrixDocument8 pages4.BCG Matrixsagar pawar100% (1)

- Sba 4Document4 pagesSba 4Justine AbreaNo ratings yet

- Lecture 2 BCG MatrixDocument26 pagesLecture 2 BCG MatrixAnant MishraNo ratings yet

- BCG MatrixDocument14 pagesBCG MatrixNidhi GuptaNo ratings yet

- Understanding The BCG Growth Share Matrix and How To Use ItDocument9 pagesUnderstanding The BCG Growth Share Matrix and How To Use ItRUCHIKA BAJAJNo ratings yet

- MM Ansoff & BCG MatrixDocument31 pagesMM Ansoff & BCG MatrixAshirbad NayakNo ratings yet

- BCG Matrix: Kishor Kumar DekaDocument31 pagesBCG Matrix: Kishor Kumar DekaHansa SharmaNo ratings yet

- BCG MatrixDocument12 pagesBCG Matrixsplusk100% (6)

- Module 2Document45 pagesModule 2amit thakurNo ratings yet

- BCG MatrixDocument19 pagesBCG MatrixvittamsettyNo ratings yet

- Boston Consulting GroupDocument5 pagesBoston Consulting GroupTalk 2meNo ratings yet

- BCG MatrixDocument31 pagesBCG MatrixMifta Dian PratiwiNo ratings yet

- Usiness Policy AND Trategic Management: BCG MatrixDocument31 pagesUsiness Policy AND Trategic Management: BCG MatrixShreyaNo ratings yet

- Usiness Policy AND Trategic Management: BCG MatrixDocument31 pagesUsiness Policy AND Trategic Management: BCG MatrixVchair GuideNo ratings yet

- Usiness Policy AND Trategic Management: BCG MatrixDocument31 pagesUsiness Policy AND Trategic Management: BCG MatrixBijal DanichaNo ratings yet

- BCG Matrix ModelDocument10 pagesBCG Matrix ModelGiftNo ratings yet

- BCG Metrix - UploadDocument19 pagesBCG Metrix - UploadSaibal DuttaNo ratings yet

- Usiness Policy AND Trategic Management: BCG MatrixDocument31 pagesUsiness Policy AND Trategic Management: BCG MatrixUtkarsh SrivastavaNo ratings yet

- BCG &ansoff MatrixDocument13 pagesBCG &ansoff MatrixPreetam Biswas0% (1)

- BCG MatrixDocument17 pagesBCG Matrixchinmay manjrekarNo ratings yet

- BCG Matrix: The Growth Share Matrix Was Created in 1968 by BCG's Founder, Bruce HendersonDocument4 pagesBCG Matrix: The Growth Share Matrix Was Created in 1968 by BCG's Founder, Bruce HendersonRuhul Amin Rasel100% (1)

- BCG MatrixDocument12 pagesBCG MatrixA.Rahman SalahNo ratings yet

- BCG Matrix Presentation by Khalid MirzaDocument15 pagesBCG Matrix Presentation by Khalid Mirzakhan persianNo ratings yet

- MMK College Fybmm: Ii Semester: IntroductionDocument13 pagesMMK College Fybmm: Ii Semester: IntroductionnaarniyaNo ratings yet

- Boston Consulting Group MatrixDocument19 pagesBoston Consulting Group MatrixDeepika ShinhNo ratings yet

- Boston Consulting Group Matrix: Presented byDocument19 pagesBoston Consulting Group Matrix: Presented byhassaan kahnNo ratings yet

- Bruce Henderson: Boston Consulting Group (BCG) MATRIX Is Developed by Consulting Group in The Early 1970'SDocument17 pagesBruce Henderson: Boston Consulting Group (BCG) MATRIX Is Developed by Consulting Group in The Early 1970'SfahadfiazNo ratings yet

- Boston Consulting Group Matrix: Presented byDocument19 pagesBoston Consulting Group Matrix: Presented byArshad AliNo ratings yet

- Boston Consulting Group Matrix: Presented byDocument17 pagesBoston Consulting Group Matrix: Presented byparasscribdNo ratings yet

- BCG MatrixDocument11 pagesBCG MatrixKrupa VagalNo ratings yet

- Boston Consulting Group MatrixDocument19 pagesBoston Consulting Group MatrixAnonymous RRR15ZNo ratings yet

- Boston Consulting Group Matrix: Presented byDocument19 pagesBoston Consulting Group Matrix: Presented byRaghu AnjanNo ratings yet

- Question No. 1: A. Define MarketingDocument9 pagesQuestion No. 1: A. Define MarketingNipuNo ratings yet

- BCG and Ge MatrixDocument17 pagesBCG and Ge Matrixanish1012No ratings yet

- Boston Consulting Group Matrix: Presented byDocument17 pagesBoston Consulting Group Matrix: Presented byamrita_chohan6806No ratings yet

- Assignment Human Resource Planning 086Document4 pagesAssignment Human Resource Planning 086Mani RayNo ratings yet

- Boston Consulting Group Matrix: Presented byDocument19 pagesBoston Consulting Group Matrix: Presented bynayant007No ratings yet

- The BCG Matrix or Also Called BCG Model Relates To MarketingDocument3 pagesThe BCG Matrix or Also Called BCG Model Relates To MarketingRahil AnwarmemonNo ratings yet

- Chapter 7 BCG MatrixDocument5 pagesChapter 7 BCG Matriximranpathan30No ratings yet

- BCG MatrixDocument30 pagesBCG MatrixmridulNo ratings yet

- Boston Consulting Group MatrixDocument19 pagesBoston Consulting Group MatrixRupok AnandaNo ratings yet

- Value Chain: Department of Management Studies, NIT Durgapur Strategic ManagementDocument8 pagesValue Chain: Department of Management Studies, NIT Durgapur Strategic ManagementSukantaNo ratings yet

- BCG MatrixDocument19 pagesBCG MatrixRishab MehtaNo ratings yet

- BCG MatrixDocument7 pagesBCG MatrixRa babNo ratings yet

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- Model Answer: Launch of a laundry liquid detergent in Sri LankaFrom EverandModel Answer: Launch of a laundry liquid detergent in Sri LankaNo ratings yet

- Marketing Management for Beginners: How to Create and Establish Your Brand With the Right Marketing Management, Build Sustainable Customer Relationships and Increase Sales Despite a Buyer’s MarketFrom EverandMarketing Management for Beginners: How to Create and Establish Your Brand With the Right Marketing Management, Build Sustainable Customer Relationships and Increase Sales Despite a Buyer’s MarketNo ratings yet

- The Market Makers (Review and Analysis of Spluber's Book)From EverandThe Market Makers (Review and Analysis of Spluber's Book)No ratings yet

- Team Sardan Chapter 1 5 (Pr2) !!Document32 pagesTeam Sardan Chapter 1 5 (Pr2) !!Joanaliza CanlasNo ratings yet

- History 2 AKDocument1 pageHistory 2 AKJoanaliza CanlasNo ratings yet

- Work Immersion CHENDocument41 pagesWork Immersion CHENJoanaliza CanlasNo ratings yet

- Weekly Progress Report JessaDocument6 pagesWeekly Progress Report JessaJoanaliza CanlasNo ratings yet

- Ayabel - S Intense Desire - CompletedDocument90 pagesAyabel - S Intense Desire - CompletedJoanaliza CanlasNo ratings yet

- Ayabel - S Intense Desire - CompletedDocument90 pagesAyabel - S Intense Desire - CompletedJoanaliza CanlasNo ratings yet

- Work Immersion CHENDocument41 pagesWork Immersion CHENJoanaliza CanlasNo ratings yet

- Ayabel - S Intense Desire - CompletedDocument90 pagesAyabel - S Intense Desire - CompletedJoanaliza CanlasNo ratings yet

- Weekly CalendarDocument1 pageWeekly CalendarJoanaliza CanlasNo ratings yet

- Summary of Payments: 1 Week 2 Week 3 Week 4 Week 5 Week TotalDocument2 pagesSummary of Payments: 1 Week 2 Week 3 Week 4 Week 5 Week TotalJoanaliza CanlasNo ratings yet

- Izza ClothDocument1 pageIzza ClothJoanaliza CanlasNo ratings yet

- JFC - Integrated Annual Corporate Governance Report For The Year Ended December 31 2017 - May 29 2018 PDFDocument113 pagesJFC - Integrated Annual Corporate Governance Report For The Year Ended December 31 2017 - May 29 2018 PDFAnonymous RFTbx1No ratings yet

- Swathi thatiCV 240119 000558Document3 pagesSwathi thatiCV 240119 000558Kannan MariappanNo ratings yet

- Dessler 03Document13 pagesDessler 03Yose DjaluwarsaNo ratings yet

- Assignment 1 (March 2012)Document16 pagesAssignment 1 (March 2012)anushya_ramasegarNo ratings yet

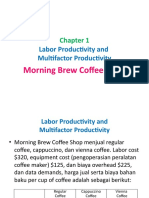

- Labor Productivity and Multifactor ProductivityDocument8 pagesLabor Productivity and Multifactor ProductivityAlexander The GreatNo ratings yet

- AcronymsDocument6 pagesAcronymsEmil Laurence PastorNo ratings yet

- 2 - Information Systems For Competitive AdvantageDocument44 pages2 - Information Systems For Competitive AdvantageMinh NguyênNo ratings yet

- Job Order Costing QuestionsDocument2 pagesJob Order Costing QuestionsPASCHAL IBELENo ratings yet

- Tugas Manajemen StrategiDocument2 pagesTugas Manajemen Strategimprul antoniNo ratings yet

- Human Resource PlanningDocument45 pagesHuman Resource PlanningVora Kevin100% (6)

- F/41-"Ivu-L: To Whom It May ConcernDocument12 pagesF/41-"Ivu-L: To Whom It May ConcernTese AyicheNo ratings yet

- Corporate Governance of WiproDocument34 pagesCorporate Governance of WiproMohammad Imran100% (2)

- Chapter 1 Introduction On Is AuditDocument5 pagesChapter 1 Introduction On Is AuditSteffany RoqueNo ratings yet

- Control TechniquesDocument22 pagesControl Techniquesirfankhan007No ratings yet

- RISE With SAP For Building Products - L1 PresentationDocument37 pagesRISE With SAP For Building Products - L1 PresentationAyazNo ratings yet

- SAG GRC Audit-Management WP Feb12 Print 0Document14 pagesSAG GRC Audit-Management WP Feb12 Print 0sdm_pedroNo ratings yet

- 5 Facets of Business AnalysisDocument2 pages5 Facets of Business AnalysisAnkit SaxenaNo ratings yet

- Eight Steps For Organizational Development InterventionsDocument6 pagesEight Steps For Organizational Development InterventionsArvin Anthony Sabido AranetaNo ratings yet

- Internal AuditingDocument2 pagesInternal AuditingApril ManjaresNo ratings yet

- Special Issue On Economy & Sustainable Development in UzbekistanDocument112 pagesSpecial Issue On Economy & Sustainable Development in UzbekistanMalcolm ChristopherNo ratings yet

- Presentation - NISTS RISK MANAGEMENT FRAMEWORK V2 CHANGES CHALLENGES AND WHAT YOU CAN DO NOWDocument99 pagesPresentation - NISTS RISK MANAGEMENT FRAMEWORK V2 CHANGES CHALLENGES AND WHAT YOU CAN DO NOWJustin LNo ratings yet

- Six Sigma PresentationDocument17 pagesSix Sigma PresentationDhular HassanNo ratings yet

- College Management Project PlanDocument7 pagesCollege Management Project PlanC TharmaNo ratings yet

- Compensation Amp BenefitsDocument26 pagesCompensation Amp BenefitsSasha SGNo ratings yet

- WM PPTDocument12 pagesWM PPTpraveennbsNo ratings yet

- Corrective Action PlanDocument3 pagesCorrective Action Plansohail100% (2)

- 11 ConclusionDocument27 pages11 ConclusionNorwegian WoodNo ratings yet

- Assignment-1 MGT101Document4 pagesAssignment-1 MGT101TAHER AL-NEMERNo ratings yet

- Engagement LetterDocument1 pageEngagement LetterCrystal Jenn Balaba100% (1)