Professional Documents

Culture Documents

2003 © Learning Thomson / Western - South 2 - A3

Uploaded by

Mohammed Al-YagoobOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2003 © Learning Thomson / Western - South 2 - A3

Uploaded by

Mohammed Al-YagoobCopyright:

Available Formats

ﻣﺘﺮﺟﻢ ﻣﻦ "?" ﺇﻟﻰ ﺍﻟﻌﺮﺑﻴﺔ www.onlinedoctranslator.

com -

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺃﻫﺪﺍﻑﺍﻟﻔﺼﻞ

3 ﺍﻟﻔﺼﻞ

ﻟﻮﺻﻒﺍﻟﺨﻠﻔﻴﺔ ﻭﺍﺳﺘﺨﺪﺍﻡ ﺍﻟﺸﺮﻛﺎﺕ ﻟﻸﺳﻮﺍﻕ ﺍﻟﻤﺎﻟﻴﺔ • ﺍﻷﺳﻮﺍﻕﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺍﻟﺪﻭﻟﻴﺔ ﺍﻟﺘﺎﻟﻴﺔ:

¤ﺳﻮﻕ ﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ،

¤ﺳﻮﻕ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ ،

¤ﺳﻮﻕ ﻳﻮﺭﻭﻛﺮﻳﺪﻳﺖ ،

¤ﺳﻮﻕ ﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺪﻭﻟﻴﺔ ،ﻭ

¤ﺃﺳﻮﺍﻕ ﺍﻷﺳﻬﻢ ﺍﻟﺪﻭﻟﻴﺔ.

A3 -2 South-Western / Thomson Learning ©2003

2 1

ﺩﻭﺍﻓﻊﺍﻻﺳﺘﺨﺪﺍﻡ ﺩﻭﺍﻓﻊﺍﻻﺳﺘﺨﺪﺍﻡ

ﺍﻷﺳﻮﺍﻕﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ ﺍﻷﺳﻮﺍﻕﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﻳﺴﺘﺜﻤﺮﺍﻟﻤﺴﺘﺜﻤﺮﻭﻥ ﻓﻲ ﺍﻷﺳﻮﺍﻕ ﺍﻟﺨﺎﺭﺟﻴﺔ: • ﻳﺘﻢﻣﻨﻊ ﺃﺳﻮﺍﻕ ﺍﻷﺻﻮﻝ ﺍﻟﺤﻘﻴﻘﻴﺔ ﺃﻭ ﺍﻟﻤﺎﻟﻴﺔ ﻣﻦ ﺍﻟﺘﻜﺎﻣﻞ •

¤ﻟﻼﺳﺘﻔﺎﺩﺓ ﻣﻦ ﺍﻻﻗﺘﺼﺎﺩﻳﺔ ﺍﻟﻤﻮﺍﺗﻴﺔ ﺍﻟﺘﺎﻡ ﺑﺴﺒﺐ ﺣﻮﺍﺟﺰ ﻣﺜﻞ ﺍﻟﻔﺮﻭﻕ ﺍﻟﻀﺮﻳﺒﻴﺔ ،ﻭﺍﻟﺘﻌﺮﻳﻔﺎﺕ ،

ﺷﺮﻭﻁ؛ ﻭﺍﻟﺤﺼﺺ ،ﻭﻋﺪﻡ ﺗﺤﺮﻙ ﺍﻟﻌﻤﺎﻟﺔ ،ﻭﺗﻜﺎﻟﻴﻒ ﺍﻻﺗﺼﺎﻻﺕ ،

¤ﻋﻨﺪﻣﺎ ﻳﺘﻮﻗﻌﻮﻥ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ ﻝ ﻭﺍﻻﺧﺘﻼﻓﺎﺕ ﺍﻟﺜﻘﺎﻓﻴﺔ ،ﻭﺍﻻﺧﺘﻼﻓﺎﺕ ﻓﻲ ﺇﻋﺪﺍﺩ ﺍﻟﺘﻘﺎﺭﻳﺮ

ﻧﻘﺪﺭﺿﺪﻫﻢ ؛ ﻭ ﺍﻟﻤﺎﻟﻴﺔ.

¤ﻟﺠﻨﻲ ﺍﻟﻔﻮﺍﺉﺪ ﺍﻟﺪﻭﻟﻴﺔ

ﺗﻨﻮﻳﻊ. ﻭﻣﻊﺫﻟﻚ ،ﻳﻤﻜﻦ ﺃﻥ ﺗﺨﻠﻖ ﻫﺬﻩ ﺍﻟﺤﻮﺍﺟﺰ ﺃﻳﻀﺎً ﻓﺮﺻﺎً ﻓﺮﻳﺪﺓ •

ﻷﺳﻮﺍﻕ ﺟﻐﺮﺍﻓﻴﺔ ﻣﺤﺪﺩﺓ ﺗﺠﺬﺏ ﺍﻟﻤﺴﺘﺜﻤﺮﻳﻦ ﺍﻷﺟﺎﻧﺐ.

A3 -4 A3 -3

4 3

ﺻﻔﺤﺔ1-3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺩﻭﺍﻓﻊﺍﻻﺳﺘﺨﺪﺍﻡ ﺩﻭﺍﻓﻊﺍﻻﺳﺘﺨﺪﺍﻡ

ﺍﻷﺳﻮﺍﻕﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ ﺍﻷﺳﻮﺍﻕﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﻳﻘﺘﺮﺽﺍﻟﻤﻘﺘﺮﺿﻮﻥ ﻓﻲ ﺍﻷﺳﻮﺍﻕ ﺍﻟﺨﺎﺭﺟﻴﺔ: • ﻳﻘﺪﻡﺍﻟﺪﺍﺉﻨﻮﻥ ﺍﻻﺉﺘﻤﺎﻥ ﻓﻲ ﺍﻷﺳﻮﺍﻕ ﺍﻟﺨﺎﺭﺟﻴﺔ: •

¤ﻟﻼﺳﺘﻔﺎﺩﺓ ﻣﻦ ﻣﻌﺪﻻﺕ ﺍﻟﻔﺎﺉﺪﺓ ﺍﻷﺟﻨﺒﻴﺔ ﺍﻟﻤﻨﺨﻔﻀﺔ ؛

ﻭ ¤ﻟﻼﺳﺘﻔﺎﺩﺓ ﻣﻦ ﺍﻟﻔﻮﺍﺉﺪ ﺍﻷﺟﻨﺒﻴﺔ ﺍﻟﻤﺮﺗﻔﻌﺔ

¤ﻋﻨﺪﻣﺎ ﻳﺘﻮﻗﻌﻮﻥ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ ﻝ ﻣﻌﺪﻻﺕ؛

ﺗﻨﺨﻔﺾﻣﻘﺎﺑﻞ ﺍﻟﺨﺎﺻﺔ ﺑﻬﻢ. ¤ﻋﻨﺪﻣﺎ ﻳﺘﻮﻗﻌﻮﻥ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ ﻝ

ﻧﻘﺪﺭﺿﺪﻫﻢ ؛ ﻭ

¤ﻟﺠﻨﻲ ﺍﻟﻔﻮﺍﺉﺪ ﺍﻟﺪﻭﻟﻴﺔ

ﺗﻨﻮﻳﻊ.

A3 -6 A3 -5

6 5

ﺳﻮﻕﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ ﺳﻮﻕﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ

¤ﺃﻋﻘﺐ ﺫﻟﻚ ﻓﺘﺮﺓ ﻣﻦ ﻋﺪﻡ ﺍﻻﺳﺘﻘﺮﺍﺭ ، ﻳﺴﻤﺢﺳﻮﻕ ﺍﻟﺼﺮﻑ ﺍﻷﺟﻨﺒﻲ ﺑﺘﺒﺎﺩﻝ ﺍﻟﻌﻤﻼﺕ ﻣﻦ ﺃﺟﻞ •

ﻋﻨﺪﻣﺎﺑﺪﺃﺕ ﺍﻟﺤﺮﺏ ﺍﻟﻌﺎﻟﻤﻴﺔ ﺍﻷﻭﻟﻰ ﻭﺗﺒﻌﻬﺎ ﺗﺴﻬﻴﻞ ﺍﻟﺘﺠﺎﺭﺓ ﺍﻟﺪﻭﻟﻴﺔ ﺃﻭ ﺍﻟﻤﻌﺎﻣﻼﺕ ﺍﻟﻤﺎﻟﻴﺔ.

ﺍﻟﻜﺴﺎﺩ ﺍﻟﻌﻈﻴﻢ.

¤ﻋﺎﻡ 1944ﺍﺗﻔﺎﻗﻴﺔ ﺑﺮﻳﺘﻮﻥ ﻭﻭﺩﺯ ﻣﺴﻤﻰ

ﻷﺳﻌﺎﺭﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺍﻟﺜﺎﺑﺘﺔ. ﺗﻄﻮﺭﻧﻈﺎﻡ ﺗﺤﺪﻳﺪ ﺃﺳﻌﺎﺭ ﺍﻟﺼﺮﻑ ﺑﻤﺮﻭﺭ ﺍﻟﻮﻗﺖ. •

¤ﺑﺤﻠﻮﻝ ﻋﺎﻡ ، 1971ﻇﻬﺮ ﺍﻟﺪﻭﻻﺭ ﺍﻷﻣﺮﻳﻜﻲ

ﻣﺒﺎﻟﻎﻓﻴﻬﺎ .ﺍﻝﺍﺗﻔﺎﻗﻴﺔ ﺳﻤﻴﺜﺴﻮﻧﻴﺎﻥﺧﻔﻀﺖ ﻗﻴﻤﺔ ¤ﻣﻦ ﻋﺎﻡ 1876ﺇﻟﻰ ﻋﺎﻡ ، 1913ﻛﺎﻧﺖ ﻛﻞ ﻋﻤﻠﺔ

ﺍﻟﺪﻭﻻﺭ ﺍﻷﻣﺮﻳﻜﻲ ﻭﻭﺳﻌﺖ ﺣﺪﻭﺩ ﺗﻘﻠﺒﺎﺕ ﺃﺳﻌﺎﺭ ﻗﺎﺑﻞﻟﻠﺘﺤﻮﻳﻞ ﺇﻟﻰ ﺫﻫﺐ ﺑﺴﻌﺮ ﻣﺤﺪﺩ ،ﻋﻠﻰ ﺍﻟﻨﺤﻮ ﺍﻟﺬﻱ

ﺍﻟﺼﺮﻑ ﻣﻦ ٪1 ±ﺇﻟﻰ .٪2 ± ﺗﻤﻠﻴﻪ ﻣﻌﻴﺎﺭ ﺍﻟﺬﻫﺐ.

A3 -8 A3 -7

8 7

ﺻﻔﺤﺔ2 - 3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺳﻌﺮﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ

ﺍﻟﻤﻌﺎﻣﻼﺕ ﺳﻮﻕﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ

ﻻﻳﻮﺟﺪ ﻣﺒﻨﻰ ﺃﻭ ﻣﻮﻗﻊ ﻣﺤﺪﺩ ﻳﺘﺒﺎﺩﻝ ﻓﻴﻪ ﺍﻟﺘﺠﺎﺭ • ¤ﺣﺘﻰ ﺫﻟﻚ ﺍﻟﺤﻴﻦ ،ﻛﺎﻧﺖ ﺍﻟﺤﻜﻮﻣﺎﺕ ﻻ ﺗﺰﺍﻝ ﺗﻮﺍﺟﻪ ﺻﻌﻮﺑﺎﺕ

ﺍﻟﻌﻤﻼﺕ .ﻳﺤﺪﺙ ﺍﻟﺘﺪﺍﻭﻝ ﺃﻳﻀﺎً ﻋﻠﻰ ﻣﺪﺍﺭ ﺍﻟﺴﺎﻋﺔ. ﺍﻟﺤﻔﺎﻅﻋﻠﻰ ﺃﺳﻌﺎﺭ ﺍﻟﺼﺮﻑ ﺩﺍﺧﻞ ﺍﻟﺤﺪﻭﺩ ﺍﻟﻤﺬﻛﻮﺭﺓ .ﻓﻲ

ﻋﺎﻡ ، 1973ﺗﻢ ﺇﻟﻐﺎء ﺍﻟﺤﺪﻭﺩ ﺍﻟﺮﺳﻤﻴﺔ ﻟﻠﻌﻤﻼﺕ

ﻳﻌُﺮﻑﺳﻮﻕ ﺍﻟﺘﺒﺎﺩﻝ ﺍﻟﻔﻮﺭﻱ ﺑﺎﺳﻢ ﺍﻟﺴﻮﻕ ﺍﻟﻔﻮﺭﻳﺔ. • ﺍﻟﻤﺘﺪﺍﻭﻟﺔ ﻋﻠﻰ ﻧﻄﺎﻕ ﻭﺍﺳﻊ ﻭﻧﻈﺎﻡ ﺳﻌﺮ ﺍﻟﺼﺮﻑ ﺍﻟﻌﺎﺉﻢ

ﺩﺧﻞ ﺣﻴﺰ ﺍﻟﺘﻨﻔﻴﺬ.

ﺍﻝﺍﻟﺴﻮﻕ ﺍﻵﺟﻞ ﺗﻤﻜﻦ ﺍﻟﺸﺮﻛﺎﺕ ﻣﺘﻌﺪﺩﺓ ﺍﻟﺠﻨﺴﻴﺎﺕ •

ﻣﻦ ﺗﺜﺒﻴﺖ ﺳﻌﺮ ﺍﻟﺼﺮﻑ ﺍﻟﺬﻱ ﺳﺘﺸﺘﺮﻱ ﺑﻪ ﺃﻭ ﺗﺒﻴﻊ ﻛﻤﻴﺔ

ﻣﻌﻴﻨﺔ ﻣﻦ ﺍﻟﻌﻤﻠﺔ ﻓﻲ ﺗﺎﺭﻳﺦ ﻣﺴﺘﻘﺒﻠﻲ ﻣﺤﺪﺩ.

A3 -10 A3 -9

10 9

ﺳﻌﺮﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺳﻌﺮﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ

ﺍﻟﻤﻌﺎﻣﻼﺕ ﺍﻟﻤﻌﺎﻣﻼﺕ

ﺗﻌﺘﺒﺮﺍﻟﺴﻤﺎﺕ ﺍﻟﺘﺎﻟﻴﺔ ﻟﻠﺒﻨﻮﻙ ﻣﻬﻤﺔ ﻟﻌﻤﻼء ﺍﻟﺼﺮﻑ ﺍﻷﺟﻨﺒﻲ: • ﺗﻘﻮﻡﻣﺉﺎﺕ ﺍﻟﺒﻨﻮﻙ ﺑﺘﺴﻬﻴﻞ ﻣﻌﺎﻣﻼﺕ ﺍﻟﺼﺮﻑ ﺍﻷﺟﻨﺒﻲ ، •

ﻋﻠﻰ ﺍﻟﺮﻏﻢ ﻣﻦ ﺃﻥ ﺍﻟﻤﺮﺍﻛﺰ ﺍﻟﻌﺸﺮﻳﻦ ﺍﻷﻭﻟﻰ ﺗﺘﻌﺎﻣﻞ ﻣﻊ

¤ﺍﻟﻘﺪﺭﺓ ﺍﻟﺘﻨﺎﻓﺴﻴﺔ ﻟﻼﻗﺘﺒﺎﺱ ﺣﻮﺍﻟﻲ ٪50ﻣﻦ ﺍﻟﻤﻌﺎﻣﻼﺕ.

¤ﻋﻼﻗﺔ ﺧﺎﺻﺔ ﺑﻴﻦ ﺍﻟﺒﻨﻚ ﻭ ﻓﻲﺃﻱ ﻭﻗﺖ ،ﺗﻀﻤﻦ ﺍﻟﻤﺮﺍﺟﺤﺔ ﺃﻥ ﺗﻜﻮﻥ ﺃﺳﻌﺎﺭ ﺍﻟﺼﺮﻑ •

ﺯﺑﻮﻧﻬﺎ ﻣﺘﺸﺎﺑﻬﺔ ﻋﺒﺮ ﺍﻟﺒﻨﻮﻙ.

¤ﺳﺮﻋﺔ ﺍﻟﺘﻨﻔﻴﺬ

ﺍﻟﺘﺪﺍﻭﻝﺑﻴﻦ ﺍﻟﺒﻨﻮﻙ ﻳﺤﺪﺙ ﻓﻲﺳﻮﻕ ﻣﺎ ﺑﻴﻦ ﺍﻟﺒﻨﻮﻙ. •

¤ﻧﺼﻴﺤﺔ ﺣﻮﻝ ﻇﺮﻭﻑ ﺍﻟﺴﻮﻕ ﺍﻟﺤﺎﻟﻴﺔ

ﻓﻲ ﻫﺬﺍ ﺍﻟﺴﻮﻕ ،ﺗﻌﻤﻞ ﺷﺮﻛﺎﺕ ﻭﺳﺎﻃﺔ ﺍﻟﺼﺮﻑ

¤ﻧﺼﻴﺤﺔ ﺍﻟﺘﻨﺒﺆ ﺍﻷﺟﻨﺒﻲ ﺃﺣﻴﺎﻧﺎً ﻛﻮﺳﻄﺎء.

A3 -12 A3 -11

12 11

ﺻﻔﺤﺔ3 - 3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺳﻌﺮﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺳﻌﺮﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ

ﺍﻟﻤﻌﺎﻣﻼﺕ ﺍﻟﻤﻌﺎﻣﻼﺕ

ﻋﺎﺩﺓﻣﺎ ﻳﻜﻮﻥ ﻓﺎﺭﻕ ﺍﻟﻌﺮﺽ /ﺍﻟﻄﻠﺐ ﺃﻛﺒﺮ ﺑﺎﻟﻨﺴﺒﺔ • ﺗﻘﺪﻡﺍﻟﺒﻨﻮﻙ ﺧﺪﻣﺎﺕ ﺍﻟﺼﺮﻑ ﺍﻷﺟﻨﺒﻲ ﻣﻘﺎﺑﻞ ﺭﺳﻮﻡ :ﺍﻟﺒﻨﻚ •

ﻟﻠﻌﻤﻼﺕ ﺍﻟﺘﻲ ﻳﺘﻢ ﺗﺪﺍﻭﻟﻬﺎ ﺑﺸﻜﻞ ﺃﻗﻞ. ﺍﻟﻤﻨﺎﻗﺼﺔ ) ﻋﺮﺽ ﺃﺳﻌﺎﺭ ﻟﻌﻤﻠﺔ ﺃﺟﻨﺒﻴﺔ ﺳﻴﻜﻮﻥ ﺃﻗﻞ ﻣﻦ

ﺳﻌﺮﻩ (buyﻳﻄﻠﺐ)ﺑﻴﻊ( ﺍﻻﻗﺘﺒﺎﺱ .ﻫﺬﺍ ﺍﻝﺍﻟﻌﺮﺽ

ﺍﻟﻔﺎﺭﻕﺃﻛﺒﺮ ﺃﻳﻀﺎً ﺑﺎﻟﻨﺴﺒﺔ ﻟﻤﻌﺎﻣﻼﺕ "ﺍﻟﺘﺠﺰﺉﺔ" • ﻭﺍﻟﻄﻠﺐ ﻧﺸﺮ.

ﻣﻨﻪ ﻓﻲ ﻣﻌﺎﻣﻼﺕ "ﺍﻟﺒﻴﻊ ﺑﺎﻟﺠﻤﻠﺔ" ﺑﻴﻦ ﺍﻟﺒﻨﻮﻙ ﺃﻭ ﺳﻌﺮﺍﻟﻌﺮﺽ /ﺍﻟﻄﻠﺐ ٪ﺍﻧﺘﺸﺎﺭ = ﺳﻌﺮ ﺍﻟﻄﻠﺐ -ﺳﻌﺮ ﺍﻟﻌﻄﺎء •

ﺍﻟﺸﺮﻛﺎﺕ ﺍﻟﻜﺒﻴﺮﺓ. ﻧﺴﺄﻝﻣﻌﺪﻝ

ﻣﺜﺎﻝ:ﺍﻓﺘﺮﺽ ﺃﻥ ﺳﻌﺮ ﺍﻟﻤﺰﺍﻳﺪﺓ ، $ = 1.52 £ •

ﺍﻟﺴﺆﺍﻝﻋﻦ ﺍﻟﺴﻌﺮ = 1.60ﺩﻭﻻﺭ.

ﻧﺴﺒﺔﺍﻟﻌﺮﺽ /ﺍﻟﻄﻠﺐ ٪ﺍﻧﺘﺸﺎﺭ = )٪5 = 1.60/ (1.52-1.60

A3 -14 A3 -13

14 13

ﺍﻟﺘﺮﺟﻤﺔ ﺍﻟﺘﺮﺟﻤﺔ

ﻋﺮﻭﺽﺃﺳﻌﺎﺭ ﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ ﻋﺮﻭﺽﺃﺳﻌﺎﺭ ﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ

ﺍﻻﻗﺘﺒﺎﺳﺎﺕﺍﻟﻤﺒﺎﺷﺮﺓ ﺗﻤﺜﻞ ﻗﻴﻤﺔ ﺍﻟﻌﻤﻠﺔ ﺍﻷﺟﻨﺒﻴﺔ • ﻛﺜﻴﺮﺍًﻣﺎ ﻳﺘﻢ ﺳﺮﺩ ﻋﺮﻭﺽ ﺃﺳﻌﺎﺭ ﺍﻟﺼﺮﻑ ﻟﻠﻌﻤﻼﺕ •

ﺑﺎﻟﺪﻭﻻﺭ ،ﺑﻴﻨﻤﺎ ﺍﻻﻗﺘﺒﺎﺳﺎﺕ ﻏﻴﺮ ﺍﻟﻤﺒﺎﺷﺮﺓ ﺗﻤﺜﻞ ﻋﺪﺩ ﺍﻟﻤﺘﺪﺍﻭﻟﺔ ﻋﻠﻰ ﻧﻄﺎﻕ ﻭﺍﺳﻊ ﻓﻲ ﻭﺳﺎﺉﻞ ﺍﻹﻋﻼﻡ ﻋﻠﻰ

ﻭﺣﺪﺍﺕ ﺍﻟﻌﻤﻠﺔ ﺍﻷﺟﻨﺒﻴﺔ ﻟﻜﻞ ﺩﻭﻻﺭ. ﺃﺳﺎﺱ ﻳﻮﻣﻲ .ﻗﺪ ﻳﺘﻢ ﻋﺮﺽ ﺍﻷﺳﻌﺎﺭ ﺍﻵﺟﻠﺔ ﺃﻳﻀﺎً.

ﻻﺣﻆﺃﻥ ﻋﺮﻭﺽ ﺃﺳﻌﺎﺭ ﺍﻟﺼﺮﻑ ﺗﺘﻀﻤﻦ ﺃﺣﻴﺎﻧﺎً ﺣﻘﻮﻕ • ﺗﻌﻜﺲﻋﺮﻭﺽ ﺍﻷﺳﻌﺎﺭ ﻋﺎﺩﺓ ًﺃﺳﻌﺎﺭ ﺍﻟﻄﻠﺐ ﻟﻠﻤﻌﺎﻣﻼﺕ •

ﺍﻟﺴﺤﺐ ﺍﻟﺨﺎﺻﺔ ﺑﺼﻨﺪﻭﻕ ﺍﻟﻨﻘﺪ ﺍﻟﺪﻭﻟﻲ ).(SDRs ﺍﻟﻜﺒﻴﺮﺓ.

ﻳﻤﻜﻦﺃﻳﻀﺎً ﺍﺳﺘﺨﺪﺍﻡ ﻧﻔﺲ ﺍﻟﻌﻤﻠﺔ ﻣﻦ ﻗﺒﻞ ﺃﻛﺜﺮ ﻣﻦ ﺩﻭﻟﺔ •

ﻭﺍﺣﺪﺓ.

A3 -16 A3 -15

16 15

ﺻﻔﺤﺔ4-3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺍﻟﺘﺮﺟﻤﺔ

ﺳﻮﻕﺍﻟﻌﻤﻼﺕ ﺍﻵﺟﻠﺔ ﻭﻋﻘﻮﺩ ﺍﻟﺨﻴﺎﺭﺍﺕ ﻋﺮﻭﺽﺃﺳﻌﺎﺭ ﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ

ﺃﻋﻘﻮﺩ ﺍﻟﻌﻤﻼﺕ ﺍﻵﺟﻠﺔ ﻳﺤﺪﺩ ﺣﺠﻤﺎً ﻗﻴﺎﺳﻴﺎً ﻟﻌﻤﻠﺔ ﻣﻌﻴﻨﺔ • ﺃﻋﺒﺮ ﺳﻌﺮ ﺍﻟﺼﺮﻑ ﻳﻌﻜﺲ ﻣﺒﻠﻎ ﻋﻤﻠﺔ ﺃﺟﻨﺒﻴﺔ ﻭﺍﺣﺪﺓ ﻟﻜﻞ •

ﻟﻴﺘﻢ ﺗﺒﺎﺩﻟﻬﺎ ﻓﻲ ﺗﺎﺭﻳﺦ ﺗﺴﻮﻳﺔ ﻣﺤﺪﺩ .ﻋﻠﻰ ﻋﻜﺲ ﺍﻟﻌﻘﻮﺩ ﻭﺣﺪﺓ ﻋﻤﻠﺔ ﺃﺟﻨﺒﻴﺔ ﺃﺧﺮﻯ.

ﺍﻵﺟﻠﺔ ،ﻳﺘﻢ ﺑﻴﻊ ﺍﻟﻌﻘﻮﺩ ﺍﻵﺟﻠﺔ ﻓﻲ ﺍﻟﺒﻮﺭﺻﺎﺕ.

ﻗﻴﻤﺔ 1ﻭﺣﺪﺓ ﻣﻦ ﺍﻟﻌﻤﻠﺔ ﺃ ﻓﻲ ﻭﺣﺪﺍﺕ •

ﺍﻟﻌﻤﻠﺔﺏ = ﻗﻴﻤﺔ ﺍﻟﻌﻤﻠﺔ Aﺑﺎﻟﺪﻭﻻﺭ

ﻋﻘﻮﺩﺧﻴﺎﺭﺍﺕ ﺍﻟﻌﻤﻼﺕ ﻣﻨﺢ ﺍﻟﺤﻖ ﻓﻲ ﺷﺮﺍء ﺃﻭ ﺑﻴﻊ ﻋﻤﻠﺔ • ﻗﻴﻤﺔﺍﻟﻌﻤﻠﺔ ﺏ ﺑﺎﻟﺪﻭﻻﺭ

ﻣﻌﻴﻨﺔ ﺑﺴﻌﺮ ﻣﺤﺪﺩ ﺧﻼﻝ ﻓﺘﺮﺓ ﺯﻣﻨﻴﺔ ﻣﺤﺪﺩﺓ .ﻳﺘﻢ ﺑﻴﻌﻬﺎ

ﻓﻲ ﺍﻟﺒﻮﺭﺻﺎﺕ ﺃﻳﻀﺎً.

A3 -18 A3 -17

18 17

ﺳﻮﻕﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ $ ﺳﻮﻕﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ $

ﻳﺘﻜﻮﻥﺳﻮﻕ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ ﻣﻦ ﻋﺪﺓ ﺑﻨﻮﻙ ﻛﺒﻴﺮﺓ • ﺗﺴﻤﻰﺍﻟﻮﺩﺍﺉﻊ ﺑﺎﻟﺪﻭﻻﺭ ﺍﻷﻣﺮﻳﻜﻲ ﺍﻟﻤﻮﺿﻮﻋﺔ ﻓﻲ •

ﺗﺴﻤﻰ Eurobanksﺍﻟﺘﻲ ﺗﻘﺒﻞ ﺍﻟﻮﺩﺍﺉﻊ ﻭﺗﻘﺪﻡ ﺍﻟﻘﺮﻭﺽ ﺍﻟﺒﻨﻮﻙ ﻓﻲ ﺃﻭﺭﻭﺑﺎ ﻭﺍﻟﻘﺎﺭﺍﺕ ﺍﻷﺧﺮﻯﺍﻟﻴﻮﺭﻭ ﺩﻭﻻﺭ.

ﺑﻌﻤﻼﺕ ﻣﺨﺘﻠﻔﺔ.

ﻓﻲﺍﻟﺴﺘﻴﻨﻴﺎﺕ ﻭﺍﻟﺴﺒﻌﻴﻨﻴﺎﺕ ﻣﻦ ﺍﻟﻘﺮﻥ ﺍﻟﻤﺎﺿﻲ ،ﻛﺎﻥ •

ﻋﻠﻰﺳﺒﻴﻞ ﺍﻟﻤﺜﺎﻝ ،ﻗﺎﻡ ﺳﻮﻕ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ ﺗﺎﺭﻳﺨﻴﺎً • ﺳﻮﻕ ﺍﻟﻴﻮﺭﻭ ﺩﻭﻻﺭ ،ﺃﻭ ﻣﺎ ﻳﺸﺎﺭ ﺇﻟﻴﻪ ﺍﻵﻥ ﺑﺎﺳﻢﺳﻮﻕ

ﺑﺈﻋﺎﺩﺓ ﺗﺪﻭﻳﺮ ﻋﺎﺉﺪﺍﺕ ﺍﻟﻨﻔﻂ )ﺍﻟﺒﺘﺮﻭﺩﻭﻻﺭ( ﻣﻦ ﺍﻟﺪﻭﻝ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ ،ﻧﻤﺖ ﻻﺳﺘﻴﻌﺎﺏ ﺍﻷﻋﻤﺎﻝ ﺍﻟﺘﺠﺎﺭﻳﺔ

ﺍﻟﻤﺼﺪﺭﺓ ﻟﻠﻨﻔﻂ )ﺃﻭﺑﻚ( ﺇﻟﻰ ﺩﻭﻝ ﺃﺧﺮﻯ. ﺍﻟﺪﻭﻟﻴﺔ ﺍﻟﻤﺘﺰﺍﻳﺪﺓ ﻭﻟﺘﺠﺎﻭﺯ ﺍﻟﻠﻮﺍﺉﺢ ﺍﻷﻣﺮﻳﻜﻴﺔ ﺍﻷﻛﺜﺮ

ﺻﺮﺍﻣﺔ ﻋﻠﻰ ﺍﻟﺒﻨﻮﻙ ﻓﻲ ﺍﻟﻮﻻﻳﺎﺕ ﺍﻟﻤﺘﺤﺪﺓ

A3 -20 A3 -19

20 19

ﺍﻟﺼﻔﺤﺔ5 - 3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺳﻮﻕﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ $ ﺳﻮﻕﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ $

ﻋﺰﺯﺍﻟﺘﻮﺣﻴﺪ ﺍﻷﺧﻴﺮ ﻟﻸﻧﻈﻤﺔ ﺣﻮﻝ ﺍﻟﻌﺎﻟﻢ ﻋﻮﻟﻤﺔ ﺍﻟﺼﻨﺎﻋﺔ • ﻋﻠﻰﺍﻟﺮﻏﻢ ﻣﻦ ﺃﻥ ﺳﻮﻕ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ ﻳﺮﻛﺰ ﻋﻠﻰ •

ﺍﻟﻤﺼﺮﻓﻴﺔ. ﺍﻟﻤﻌﺎﻣﻼﺕ ﻛﺒﻴﺮﺓ ﺍﻟﺤﺠﻢ ،ﺇﻻ ﺃﻥ ﻫﻨﺎﻙ ﺃﻭﻗﺎﺗﺎً ﻻ ﻳﺮﻏﺐ

ﻓﻴﻬﺎ ﺑﻨﻚ ﻭﺍﺣﺪ ﻓﻲ ﺇﻗﺮﺍﺽ ﺍﻟﻤﺒﻠﻎ ﺍﻟﻤﻄﻠﻮﺏ.

ﻋﻠﻰﻭﺟﻪ ﺍﻟﺨﺼﻮﺹ ،ﻓﺈﻥ ﻓﻌﻞ ﺍﻭﺭﺑﻲ ﻣﻨﻔﺮﺩ ﻓﺘﺤﺖ •

ﺍﻟﺼﻨﺎﻋﺔ ﺍﻟﻤﺼﺮﻓﻴﺔ ﺍﻷﻭﺭﻭﺑﻴﺔ. ﺃﻧﻘﺎﺑﺔ ﻳﻤﻜﻦ ﺑﻌﺪ ﺫﻟﻚ ﺗﺸﻜﻴﻞ Eurobanksﻟﻼﻛﺘﺘﺎﺏ ﻓﻲ •

1988ﺍﺗﻔﺎﻕ ﺑﺎﺯﻝ ﺍﻟﺘﻲ ﻭﻗﻌﺘﻬﺎ ﺍﻟﺒﻨﻮﻙ ﺍﻟﻤﺮﻛﺰﻳﺔ G-10 • ﺍﻟﻘﺮﻭﺽ .ﻋﺎﺩﺓ ﻣﺎ ﻳﺘﻢ ﺗﺤﺼﻴﻞ ﺭﺳﻮﻡ ﺇﺩﺍﺭﺓ ﺍﻟﻮﺍﺟﻬﺔ

ﺣﺪﺩﺕ ﻣﻌﺎﻳﻴﺮ ﺭﺃﺱ ﺍﻟﻤﺎﻝ ﺍﻟﻤﺸﺘﺮﻛﺔ ،ﻣﺜﻞ ﻫﻴﻜﻞ ﺍﻷﻣﺎﻣﻴﺔ ﻭﺍﻻﻟﺘﺰﺍﻡ ﻣﻘﺎﺑﻞ ﻗﺮﻭﺽ ﺍﻟﻌﻤﻠﺔ ﺍﻷﻭﺭﻭﺑﻴﺔ

ﺃﻭﺯﺍﻥ ﺍﻟﻤﺨﺎﻃﺮ ،ﻟﻠﺼﻨﺎﻋﺎﺕ ﺍﻟﻤﺼﺮﻓﻴﺔ. ﺍﻟﻤﺸﺘﺮﻛﺔ ﻫﺬﻩ.

A3 -22 A3 -21

22 21

ﻗﺮﻭﺽ ﺳﻮﻕﻳﻮﺭﻭﻛﺮﻳﺪﻳﺖ $ ﺳﻮﻕﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ

ﻳﺘﻢﺗﻤﺪﻳﺪ ﺍﻟﻘﺮﻭﺽ ﻟﻤﺪﺓ ﻋﺎﻡ ﻭﺍﺣﺪ ﺃﻭ ﺃﻛﺜﺮ ﻣﻦ ﻗﺒﻞ • ﻳﺸﺎﺭﺃﺣﻴﺎﻧﺎً ﺇﻟﻰ ﺳﻮﻕ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ ﻓﻲ ﺁﺳﻴﺎ •

Eurobanksﻟﻠﺸﺮﻛﺎﺕ ﻣﺘﻌﺪﺩﺓ ﺍﻟﺠﻨﺴﻴﺎﺕ ﺃﻭ ﺍﻟﻮﻛﺎﻻﺕ ﺑﺸﻜﻞ ﻣﻨﻔﺼﻞ ﺑﺎﺳﻢﺳﻮﻕ ﺍﻟﺪﻭﻻﺭ ﺍﻵﺳﻴﻮﻱ.

ﺍﻟﺤﻜﻮﻣﻴﺔ ﻓﻲ ﺳﻮﻕ ﻳﻮﺭﻭﻛﺮﻳﺪﻳﺖ .ﺗﻌُﺮﻑ ﻫﺬﻩ ﺍﻟﻘﺮﻭﺽ

ﺑﺎﺳﻢ ﻗﺮﻭﺽ ﻳﻮﺭﻭﻛﺮﻳﺪﻳﺖ. ﺗﺘﻤﺜﻞﺍﻟﻮﻇﻴﻔﺔ ﺍﻷﺳﺎﺳﻴﺔ ﻟﻠﺒﻨﻮﻙ ﻓﻲ ﺳﻮﻕ ﺍﻟﺪﻭﻻﺭ •

ﺗﺴُﺘﺨﺪﻡﺍﻟﻤﻌﺪﻻﺕ ﺍﻟﻌﺎﺉﻤﺔ ﺑﺸﻜﻞ ﺷﺎﺉﻊ ،ﻧﻈﺮﺍً ﻷﻥ • ﺍﻵﺳﻴﻮﻱ ﻓﻲ ﺗﺤﻮﻳﻞ ﺍﻷﻣﻮﺍﻝ ﻣﻦ ﺍﻟﻤﻮﺩﻋﻴﻦ ﺇﻟﻰ

ﺁﺟﺎﻝ ﺍﺳﺘﺤﻘﺎﻕ ﺍﻷﺻﻮﻝ ﻭﺍﻟﺨﺼﻮﻡ ﻟﺪﻯ ﺍﻟﺒﻨﻮﻙ ﻗﺪ ﻻ ﺍﻟﻤﻘﺘﺮﺿﻴﻦ.

ﺗﺘﻄﺎﺑﻖ -ﺗﻘﺒﻞ ﺍﻟﺒﻨﻮﻙ ﺍﻷﻭﺭﻭﺑﻴﺔ ﺍﻟﻮﺩﺍﺉﻊ ﻗﺼﻴﺮﺓ ﺍﻷﺟﻞ ﻭﻇﻴﻔﺔﺃﺧﺮﻯ ﻫﻲ ﺍﻹﻗﺮﺍﺽ ﻭﺍﻻﻗﺘﺮﺍﺽ ﺑﻴﻦ ﺍﻟﺒﻨﻮﻙ. •

ﻭﻟﻜﻨﻬﺎ ﺗﻘﺪﻡ ﺃﺣﻴﺎﻧﺎً ﻗﺮﻭﺿﺎً ﻃﻮﻳﻠﺔ ﺍﻷﺟﻞ.

A3 -24 A3 -23

24 23

ﺻﻔﺤﺔ6 - 3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺳﻨﺪﺍﺕ ﺳﻮﻕﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺪﻭﻟﻴﺔ ﺳﻨﺪﺍﺕ ﺳﻮﻕﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺪﻭﻟﻴﺔ

ﻳﻌﻮﺩﻇﻬﻮﺭ ﺳﻮﻕ ﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺪﻭﻟﻴﺔ ﺟﺰﺉﻴﺎً ﺇﻟﻰ ﺍﻟﻔﺎﺉﺪﺓ ﻓﻲ •

ﻫﻨﺎﻙﻧﻮﻋﺎﻥ ﻣﻦ ﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺪﻭﻟﻴﺔ.

ﻋﺎﻡ 1963

ﻣﻌﺎﺩﻟﺔﺍﻟﻀﺮﻳﺒﺔ ﺍﻟﻤﻔﺮﻭﺿﺔ ﻓﻲ ﺍﻟﻮﻻﻳﺎﺕ ﺍﻟﻤﺘﺤﺪﺓ -ﺗﺴﻤﻰ ﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﻤﻘﻮﻣﺔ ﺑﻌﻤﻠﺔ ﺍﻟﺒﻠﺪ ﺍﻟﺬﻱ ﻭﺿﻌﺖ ﻓﻴﻪ

ﻭﻟﻜﻦ ﺻﺎﺩﺭﺓ ﻋﻦ ﻣﻘﺘﺮﺿﻴﻦ ﺃﺟﺎﻧﺐ ﻟﻠﺒﻠﺪ ﺍﻟﺴﻨﺪﺍﺕ

ﺃﺛﻨﺖﺍﻟﻀﺮﻳﺒﺔ ﺍﻟﻤﺴﺘﺜﻤﺮﻳﻦ ﺍﻷﻣﺮﻳﻜﻴﻴﻦ ﻋﻦ ﺍﻻﺳﺘﺜﻤﺎﺭ ﻓﻲ •

ﺍﻷﺟﻨﺒﻴﺔ ﺃﻭ ﺭﻭﺍﺑﻂ ﻣﻮﺍﺯﻳﺔ.

ﺍﻷﻭﺭﺍﻕ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻷﺟﻨﺒﻴﺔ ،ﻟﺬﻟﻚ ﺑﺤﺚ ﺍﻟﻤﻘﺘﺮﺿﻮﻥ ﻏﻴﺮ

ﺍﻷﻣﺮﻳﻜﻴﻴﻦ ﻓﻲ ﻣﻜﺎﻥ ﺁﺧﺮ ﻋﻦ ﺍﻷﻣﻮﺍﻝ.

-ﺗﺴﻤﻰ ﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺘﻲ ﺗﺒﺎﻉ ﻓﻲ ﺩﻭﻝ ﻏﻴﺮ ﺍﻟﺪﻭﻟﺔ ﺍﻟﺘﻲ

ﺛﻢﻓﻲ ﻋﺎﻡ ، 1984ﺳﻤُﺢ ﻟﻠﺸﺮﻛﺎﺕ ﺍﻷﻣﺮﻳﻜﻴﺔ ﺑﺈﺻﺪﺍﺭ •

ﺗﻤﺜﻠﻬﺎ ﺍﻟﻌﻤﻠﺔ ﺍﻟﻤﺤﺪﺩﺓ ﻟﻬﺎﺳﻨﺪﺍﺕ ﺍﻟﻴﻮﺭﻭ.

ﺳﻨﺪﺍﺕ ﻟﺤﺎﻣﻠﻬﺎ ﻣﺒﺎﺷﺮﺓ ﺇﻟﻰ ﻣﺴﺘﺜﻤﺮﻳﻦ ﻏﻴﺮ ﺃﻣﺮﻳﻜﻴﻴﻦ ،

ﻭﺃﻟﻐﻴﺖ ﺍﻟﻀﺮﻳﺒﺔ ﺍﻟﻤﻘﺘﻄﻌﺔ ﻋﻠﻰ ﻣﺸﺘﺮﻳﺎﺕ ﺍﻟﺴﻨﺪﺍﺕ.

A3 -26 A3 -25

26 25

ﺳﻨﺪﺍﺕ ﺳﻮﻕﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺪﻭﻟﻴﺔ ﺳﻨﺪﺍﺕ ﺳﻮﻕﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺪﻭﻟﻴﺔ

ﺗﺘﻐﻴﺮﺃﺳﻌﺎﺭ ﺍﻟﻔﺎﺉﺪﺓ ﻟﻜﻞ ﻋﻤﻠﺔ ﻭﻇﺮﻭﻑ ﺍﻻﺉﺘﻤﺎﻥ ﻓﻲ ﺳﻮﻕ • ﻳﺘﻢﺗﺄﻣﻴﻦ ﺳﻨﺪﺍﺕ ﺍﻟﻴﻮﺭﻭﺑﻮﻧﺪ ﻣﻦ ﻗﺒﻞ ﻧﻘﺎﺑﺔ ﺑﻨﻮﻙ •

ﺳﻨﺪﺍﺕ ﺍﻟﻴﻮﺭﻭﺑﻮﻧﺪ ﺑﺎﺳﺘﻤﺮﺍﺭ ،ﻣﻤﺎ ﻳﺘﺴﺒﺐ ﻓﻲ ﺍﺧﺘﻼﻑ ﺍﻻﺳﺘﺜﻤﺎﺭ ﻣﺘﻌﺪﺩﺓ ﺍﻟﺠﻨﺴﻴﺎﺕ ﻭﻳﺘﻢ ﻭﺿﻌﻬﺎ ﻓﻲ ﻧﻔﺲ

ﺷﻌﺒﻴﺔ ﺍﻟﺴﻮﻕ ﺑﻴﻦ ﺍﻟﻌﻤﻼﺕ. ﺍﻟﻮﻗﺖ ﻓﻲ ﺍﻟﻌﺪﻳﺪ ﻣﻦ ﺍﻟﺒﻠﺪﺍﻥ ﻣﻦ ﺧﻼﻝ ﺍﻟﻤﺮﺣﻠﺔ

ﺍﻟﺜﺎﻧﻴﺔ ،ﻭﻓﻲ ﻛﺜﻴﺮ ﻣﻦ ﺍﻟﺤﺎﻻﺕ ،ﺍﻟﻤﺮﺣﻠﺔ ﺍﻟﺜﺎﻟﺜﺔ ،

ﺣﻮﺍﻟﻲ ٪70ﻣﻦ ﺳﻨﺪﺍﺕ ﺍﻟﻴﻮﺭﻭﺑﻮﻧﺪﺯ ﻣﻘﻮﻣﺔ • ﺷﺮﻛﺎﺕ ﺍﻟﺘﺄﻣﻴﻦ.

ﺑﺎﻟﺪﻭﻻﺭ ﺍﻷﻣﺮﻳﻜﻲ. ﻳﺘﻢﺇﺻﺪﺍﺭ ﺳﻨﺪﺍﺕ ﺍﻟﻴﻮﺭﻭﺑﻮﻧﺪ ﻋﺎﺩﺓ ًﻓﻲ ﺷﻜﻞ ﻟﺤﺎﻣﻠﻬﺎ ، •

ﻓﻲﺍﻟﺴﻮﻕ ﺍﻟﺜﺎﻧﻮﻳﺔ ،ﻏﺎﻟﺒﺎً ﻣﺎ ﻳﻜﻮﻥ ﺻﺎﻧﻌﻮ ﺍﻟﺴﻮﻕ ﻫﻢ • ﻭﺩﻓﻊ ﻛﻮﺑﻮﻧﺎﺕ ﺳﻨﻮﻳﺔ ،ﻭﻗﺪ ﺗﻜﻮﻥ ﻗﺎﺑﻠﺔ ﻟﻠﺘﺤﻮﻳﻞ ،ﻭﻗﺪ

ﻧﻔﺲ ﺍﻟﻤﺘﻌﻬﺪﻳﻦ ﺍﻟﺬﻳﻦ ﻳﺒﻴﻌﻮﻥ ﺍﻹﺻﺪﺍﺭﺍﺕ ﺍﻷﺳﺎﺳﻴﺔ. ﻳﻜﻮﻥ ﻟﻬﺎ ﻣﻌﺪﻻﺕ ﻣﺘﻐﻴﺮﺓ ،ﻭﻋﺎﺩﺓ ﻣﺎ ﻳﻜﻮﻥ ﻟﻬﺎ ﺍﻟﻘﻠﻴﻞ

ﻣﻦ ﺍﻟﺘﻌﻬﺪﺍﺕ ﺍﻟﻮﻗﺎﺉﻴﺔ.

A3 -28 A3 -27

28 27

ﺍﻟﺼﻔﺤﺔ7 - 3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﻣﻘﺎﺭﻧﺔﺃﺳﻌﺎﺭ ﺍﻟﻔﺎﺉﺪﺓ ﻣﻘﺎﺭﻧﺔﺃﺳﻌﺎﺭ ﺍﻟﻔﺎﺉﺪﺓ

ﺑﻴﻦﺍﻟﻌﻤﻼﺕ ﺑﻴﻦﺍﻟﻌﻤﻼﺕ

ﻧﻈﺮﺍًﻷﻥ ﺟﺪﺍﻭﻝ ﺍﻟﻌﺮﺽ ﻭﺍﻟﻄﻠﺐ ﺗﺘﻐﻴﺮ ﺑﻤﺮﻭﺭ ﺍﻟﻮﻗﺖ • ﺗﺨﺘﻠﻒﺃﺳﻌﺎﺭ ﺍﻟﻔﺎﺉﺪﺓ ﺑﺸﻜﻞ ﻛﺒﻴﺮ ﺑﺎﺧﺘﻼﻑ ﺍﻟﺒﻠﺪﺍﻥ ،ﺣﻴﺚ •

ﻟﻌﻤﻠﺔ ﻣﻌﻴﻨﺔ ،ﻓﺈﻥ ﺳﻌﺮ ﺍﻟﻔﺎﺉﺪﺓ ﺍﻟﻤﺘﻮﺍﺯﻥ ﻟﺘﻠﻚ ﺍﻟﻌﻤﻠﺔ ﺗﺘﺮﺍﻭﺡ ﻣﻦ ﺣﻮﺍﻟﻲ ٪1ﻓﻲ ﺍﻟﻴﺎﺑﺎﻥ ﺇﻟﻰ ﺣﻮﺍﻟﻲ ٪60ﻓﻲ ﺭﻭﺳﻴﺎ.

ﺳﻴﺘﻐﻴﺮ ﺃﻳﻀﺎً.

ﺗﻌﺘﺒﺮﺃﺳﻌﺎﺭ ﺍﻟﻔﺎﺉﺪﺓ ﺣﺎﺳﻤﺔ ﻷﻧﻬﺎ ﺗﺆﺛﺮ ﻋﻠﻰ ﺗﻜﻠﻔﺔ •

ﻻﺣﻆﺃﻥ ﺣﺮﻳﺔ ﺗﺤﻮﻳﻞ ﺍﻷﻣﻮﺍﻝ ﻋﺒﺮ ﺍﻟﺒﻠﺪﺍﻥ ﺗﺆﺩﻱ ﺇﻟﻰ • ﺗﻤﻮﻳﻞ ﺍﻟﺸﺮﻛﺎﺕ ﻣﺘﻌﺪﺩﺓ ﺍﻟﺠﻨﺴﻴﺎﺕ.

ﺗﻜﺎﻣﻞ ﺷﺮﻭﻁ ﺍﻟﻌﺮﺽ ﻭﺍﻟﻄﻠﺐ ﻟﻸﻣﻮﺍﻝ ﺇﻟﻰ ﺣﺪ ﻣﺎ ، ﻳﺘﻢﺗﺤﺪﻳﺪ ﺳﻌﺮ ﺍﻟﻔﺎﺉﺪﺓ ﻟﻌﻤﻠﺔ ﻣﻌﻴﻨﺔ ﻣﻦ ﺧﻼﻝ ﺍﻟﻄﻠﺐ •

ﺑﺤﻴﺚ ﻳﺘﻢ ﺩﻣﺞ ﺗﺤﺮﻛﺎﺕ ﺃﺳﻌﺎﺭ ﺍﻟﻔﺎﺉﺪﺓ ﺃﻳﻀﺎً. ﻋﻠﻰ ﺍﻷﻣﻮﺍﻝ ﻭﺗﻮﺭﻳﺪﻫﺎ ﺑﻬﺬﻩ ﺍﻟﻌﻤﻠﺔ.

A3 -30 A3 -29

30 29

ﺃﺳﻮﺍﻕﺍﻷﺳﻬﻢ ﺍﻟﻌﺎﻟﻤﻴﺔ ﺃﺳﻮﺍﻕﺍﻷﺳﻬﻢ ﺍﻟﻌﺎﻟﻤﻴﺔ

ﻳﺘﻢﺍﺳﺘﺪﻋﺎء ﺍﻷﺳﻬﻢ ﺍﻟﺼﺎﺩﺭﺓ ﻓﻲ ﺍﻟﻮﻻﻳﺎﺕ ﺍﻟﻤﺘﺤﺪﺓ ﻣﻦ • ﺑﺎﻹﺿﺎﻓﺔﺇﻟﻰ ﺇﺻﺪﺍﺭ ﺍﻷﺳﻬﻢ ﻣﺤﻠﻴﺎً ،ﻳﻤﻜﻦ ﻟﻠﺸﺮﻛﺎﺕ ﻣﺘﻌﺪﺩﺓ •

ﻗﺒﻞ ﺍﻟﺸﺮﻛﺎﺕ ﺃﻭ ﺍﻟﺤﻜﻮﻣﺎﺕ ﻏﻴﺮ ﺍﻷﻣﺮﻳﻜﻴﺔ ﻋﺮﻭﺽ ﺍﻷﺳﻬﻢ ﺍﻟﺠﻨﺴﻴﺎﺕ ﺃﻳﻀﺎً ﺍﻟﺤﺼﻮﻝ ﻋﻠﻰ ﺃﻣﻮﺍﻝ ﻋﻦ ﻃﺮﻳﻖ ﺇﺻﺪﺍﺭ

ﻳﺎﻧﻜﻲ .ﻧﺘﺞ ﺍﻟﻌﺪﻳﺪ ﻣﻦ ﻋﺮﻭﺽ ﺍﻷﺳﻬﻢ ﻫﺬﻩ ﻋﻦ ﺑﺮﺍﻣﺞ ﺍﻷﺳﻬﻢ ﻓﻲ ﺍﻷﺳﻮﺍﻕ ﺍﻟﺪﻭﻟﻴﺔ.

ﺍﻟﺨﺼﺨﺼﺔ ﻓﻲ ﺃﻣﺮﻳﻜﺎ ﺍﻟﻼﺗﻴﻨﻴﺔ ﻭﺃﻭﺭﻭﺑﺎ. ﺳﻴﺆﺩﻱﺫﻟﻚ ﺇﻟﻰ ﺗﺤﺴﻴﻦ ﺻﻮﺭﺓ ﺍﻟﺸﺮﻛﺔ ﻭﺍﻟﺘﻌﺮﻑ ﻋﻠﻰ •

ﺃﺳﻤﺎﺉﻬﺎ ،ﻭﺗﻨﻮﻳﻊ ﻗﺎﻋﺪﺓ ﺍﻟﻤﺴﺎﻫﻤﻴﻦ .ﻳﻤﻜﻦ ﺃﻳﻀﺎً ﻫﻀﻢ

ﻗﺪﺗﺼﺪﺭ ﺍﻟﺸﺮﻛﺎﺕ ﻏﻴﺮ ﺍﻷﻣﺮﻳﻜﻴﺔ ﺃﻳﻀﺎً ﺇﻳﺼﺎﻻﺕ ﺍﻹﻳﺪﺍﻉ • ﺍﻟﻤﺨﺰﻭﻧﺎﺕ ﺑﺴﻬﻮﻟﺔ ﺃﻛﺒﺮ.

ﺍﻷﻣﺮﻳﻜﻴﺔ ) ، (ADRsﻭﻫﻲ ﺷﻬﺎﺩﺍﺕ ﺗﻤﺜﻞ ﺣﺰﻡ ﻣﻦ

ﺍﻟﻤﺨﺰﻭﻥ .ﺍﻟﺘﻔﺎﻋﻼﺕ ﺍﻟﺪﻭﺍﺉﻴﺔ ﺍﻟﻀﺎﺉﺮﺓ ﺃﻗﻞ ﺗﻨﻈﻴﻤﺎً ﻻﺣﻆﺃﻥ ﺍﻟﻤﻨﺎﻓﺴﺔ ﻓﻲ ﺍﻟﺴﻮﻕ ﻳﺠﺐ ﺃﻥ ﺗﺰﻳﺪ ﻣﻦ •

ﺑﺸﻜﻞ ﺻﺎﺭﻡ. ﻛﻔﺎءﺓ ﺍﻹﺻﺪﺍﺭﺍﺕ ﺍﻟﺠﺪﻳﺪﺓ.

A3 -32 A3 -31

32 31

ﺍﻟﺼﻔﺤﺔ8 - 3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺃﺳﻮﺍﻕﺍﻷﺳﻬﻢ ﺍﻟﻌﺎﻟﻤﻴﺔ ﺃﺳﻮﺍﻕﺍﻷﺳﻬﻢ ﺍﻟﻌﺎﻟﻤﻴﺔ

ﺗﻢﺇﻧﺸﺎء ﺷﺒﻜﺎﺕ ﺍﻻﺗﺼﺎﻻﺕ ﺍﻹﻟﻜﺘﺮﻭﻧﻴﺔ ) (ECNﻟﻤﻄﺎﺑﻘﺔ • ﻳﻤﻜﻦﺃﻥ ﺗﺆﺛﺮ ﻣﻮﺍﻗﻊ ﻋﻤﻠﻴﺎﺕ ﺍﻟﺸﺮﻛﺎﺕ ﻣﺘﻌﺪﺩﺓ ﺍﻟﺠﻨﺴﻴﺎﺕ •

ﺍﻟﻄﻠﺒﺎﺕ ﺑﻴﻦ ﺍﻟﻤﺸﺘﺮﻳﻦ ﻭﺍﻟﺒﺎﺉﻌﻴﻦ ﻓﻲ ﺍﻟﺴﻨﻮﺍﺕ ﺍﻷﺧﻴﺮﺓ. ﻋﻠﻰ ﺍﻟﻘﺮﺍﺭ ﺑﺸﺄﻥ ﻣﻜﺎﻥ ﻭﺿﻊ ﺍﻟﻤﺨﺰﻭﻥ ،ﻓﻲ ﺿﻮء

ﺍﻟﺘﺪﻓﻘﺎﺕ ﺍﻟﻨﻘﺪﻳﺔ ﺍﻟﻼﺯﻣﺔ ﻟﺘﻐﻄﻴﺔ ﻣﺪﻓﻮﻋﺎﺕ ﺍﻷﺭﺑﺎﺡ.

ﻧﻈﺮﺍًﻷﻥ ﺷﺒﻜﺎﺕ ECNﺃﺻﺒﺤﺖ ﺃﻛﺜﺮ ﺷﻴﻮﻋﺎً ﺑﻤﺮﻭﺭ • ﺧﺼﺎﺉﺺﺍﻟﺴﻮﻕ ﻣﻬﻤﺔ ﺃﻳﻀﺎ .ﻗﺪ ﺗﺨﺘﻠﻒ ﺃﺳﻮﺍﻕ ﺍﻷﺳﻬﻢ •

ﺍﻟﻮﻗﺖ ،ﻓﻘﺪ ﻳﺘﻢ ﺩﻣﺠﻬﺎ ﻓﻲ ﺍﻟﻨﻬﺎﻳﺔ ﻣﻊ ﺑﻌﻀﻬﺎ ﺍﻟﺒﻌﺾ ﺃﻭ ﻓﻲ ﺍﻟﺤﺠﻢ ،ﻭﻣﺴﺘﻮﻯ ﻧﺸﺎﻁ ﺍﻟﺘﺪﺍﻭﻝ ،ﻭﺍﻟﻤﺘﻄﻠﺒﺎﺕ

ﻣﻊ ﺍﻟﺒﻮﺭﺻﺎﺕ ﺍﻷﺧﺮﻯ ﻹﻧﺸﺎء ﺑﻮﺭﺻﺔ ﻋﺎﻟﻤﻴﺔ ﻭﺍﺣﺪﺓ. ﺍﻟﺘﻨﻈﻴﻤﻴﺔ ،ﻭﻣﻌﺪﻝ ﺍﻟﻀﺮﺍﺉﺐ ،ﻭﻧﺴﺒﺔ ﻣﻠﻜﻴﺔ ﺍﻟﻔﺮﺩ

ﻣﻘﺎﺑﻞ ﻣﻠﻜﻴﺔ ﺍﻷﺳﻬﻢ ﺍﻟﻤﺆﺳﺴﻴﺔ.

A3 -34 A3 -33

34 33

ﻣﻘﺎﺭﻧﺔ ﻣﻘﺎﺭﻧﺔ

ﺍﻷﺳﻮﺍﻕﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ ﺍﻷﺳﻮﺍﻕﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

-ﺍﻻﺳﺘﺜﻤﺎﺭ ﺍﻷﺟﻨﺒﻲ ﺍﻟﻤﺒﺎﺷﺮ ) .(DFIﺍﻟﺘﺪﻓﻘﺎﺕ ﺍﻟﻨﻘﺪﻳﺔ ﻳﻤﻜﻦﺗﺼﻨﻴﻒ ﺣﺮﻛﺎﺕ ﺍﻟﺘﺪﻓﻖ ﺍﻟﻨﻘﺪﻱ ﺍﻷﺟﻨﺒﻲ ﻟﺸﺮﻛﺔ •

ﺍﻟﺨﺎﺭﺟﺔ ﻟﻠﺤﺼﻮﻝ ﻋﻠﻰ ﺍﻷﺻﻮﻝ ﺍﻷﺟﻨﺒﻴﺔ ﺗﻮﻟﺪ ﻧﻤﻮﺫﺟﻴﺔ ﻣﺘﻌﺪﺩﺓ ﺍﻟﺠﻨﺴﻴﺎﺕ ﺇﻟﻰ ﺃﺭﺑﻊ ﻭﻇﺎﺉﻒ ﻣﺆﺳﺴﻴﺔ ،

ﺗﺪﻓﻘﺎﺕ ﻣﺴﺘﻘﺒﻠﻴﺔ. ﺗﺘﻄﻠﺐ ﺟﻤﻴﻌﻬﺎ ﺑﺸﻜﻞ ﻋﺎﻡ ﺍﺳﺘﺨﺪﺍﻡ ﺃﺳﻮﺍﻕ ﺍﻟﺼﺮﻑ

-ﺍﺳﺘﺜﻤﺎﺭ ﺃﻭ ﺗﻤﻮﻳﻞ ﻗﺼﻴﺮ ﺍﻷﺟﻞ ﻓﻲ ﺍﻷﻭﺭﺍﻕ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻷﺟﻨﺒﻲ.

ﺍﻷﺟﻨﺒﻴﺔ ،ﻋﺎﺩﺓ ﻓﻲ ﺳﻮﻕ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ.

-ﺍﻟﺘﺠﺎﺭﺓ ﺍﻟﺨﺎﺭﺟﻴﺔ .ﺗﻮﻟﺪ ﺍﻟﺼﺎﺩﺭﺍﺕ ﺗﺪﻓﻘﺎﺕ ﻧﻘﺪﻳﺔ ﺃﺟﻨﺒﻴﺔ

-ﺗﻤﻮﻳﻞﻃﻮﻳﻞ ﺍﻷﺟﻞ ﻓﻲ Eurocreditﺃﻭ Eurobondﺃﻭ ﺑﻴﻨﻤﺎ ﺗﺘﻄﻠﺐ ﺍﻟﻮﺍﺭﺩﺍﺕ ﺗﺪﻓﻘﺎﺕ ﻧﻘﺪﻳﺔ ﺧﺎﺭﺟﻴﺔ.

ﺃﺳﻮﺍﻕ ﺍﻷﺳﻬﻢ ﺍﻟﺪﻭﻟﻴﺔ.

A3 -36 A3 -35

36 35

ﺍﻟﺼﻔﺤﺔ9 - 3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﺗﺄﺛﻴﺮﺍﻷﺳﻮﺍﻕ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﻌﺎﻟﻤﻴﺔ

ﻣﺮﺍﺟﻌﺔﺍﻟﻔﺼﻞ

ﻋﻠﻰﻗﻴﻤﺔ ﺍﻟﺸﺮﻛﺎﺕ ﻣﺘﻌﺪﺩﺓ ﺍﻟﺠﻨﺴﻴﺎﺕ

ﺗﻜﻠﻔﺔﺍﻗﺘﺮﺍﺽ ﺍﻷﻣﻮﺍﻝ ﺗﺤﺴﻴﻦﺍﻟﺼﻮﺭﺓ ﺍﻟﻌﺎﻟﻤﻴﺔ ﻣﻦ ﺇﺻﺪﺍﺭ

ﻓﻲﺍﻷﺳﻮﺍﻕ ﺍﻟﻌﺎﻟﻤﻴﺔ ﺍﻷﺳﻬﻢ ﻓﻲ ﺍﻷﺳﻮﺍﻕ ﺍﻟﻌﺎﻟﻤﻴﺔ

ﺩﻭﺍﻓﻊﺍﺳﺘﺨﺪﺍﻡ ﺍﻷﺳﻮﺍﻕ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ •

¤ﺩﻭﺍﻓﻊ ﺍﻻﺳﺘﺜﻤﺎﺭ ﻓﻲ ﺍﻷﺳﻮﺍﻕ ﺍﻟﺨﺎﺭﺟﻴﺔ

¤ﺩﻭﺍﻓﻊ ﺗﻘﺪﻳﻢ ﺍﻻﺉﺘﻤﺎﻥ ﻓﻲ ﺍﻟﺨﺎﺭﺝ

ﺍﻷﺳﻮﺍﻕ

ﺗﻜﻠﻔﺔﺃﻣﻮﺍﻝ ﺍﻟﺸﺮﻛﺔ ﺍﻷﻡ ﺗﻜﻠﻔﺔﺣﻘﻮﻕ ﻣﻠﻜﻴﺔ ﺍﻟﻮﺍﻟﺪﻳﻦ

¤ﺩﻭﺍﻓﻊ ﺍﻻﻗﺘﺮﺍﺽ ﻓﻲ ﺍﻷﺳﻮﺍﻕ ﺍﻷﺟﻨﺒﻴﺔ ﺍﻟﻤﻘﺘﺮﺿﺔ ﻓﻲ ﺍﻷﺳﻮﺍﻕ ﺍﻟﻌﺎﻟﻤﻴﺔ ﻓﻲﺍﻷﺳﻮﺍﻕ ﺍﻟﻌﺎﻟﻤﻴﺔ

E )CFﻱ ،ﺕ ( = ﺍﻟﺘﺪﻓﻘﺎﺕ ﺍﻟﻨﻘﺪﻳﺔ ﺍﻟﻤﺘﻮﻗﻌﺔ ﺑﺎﻟﻌﻤﻠﺔ ﻱ ﻟﻴﺘﻢ ﺍﻻﺳﺘﻼﻡ

ﻣﻦﻗﺒﻞ ﺍﻟﻮﺍﻟﺪ ﺍﻷﻣﺮﻳﻜﻲ ﻓﻲ ﻧﻬﺎﻳﺔ ﺍﻟﻔﺘﺮﺓ ﺭ

E )ERﻱ ،ﺕ ( = ﺳﻌﺮ ﺍﻟﺼﺮﻑ ﺍﻟﻤﺘﻮﻗﻊ ﺑﺄﻱ ﻋﻤﻠﺔ ﻱ ﻋﻠﺒﺔ

ﻳﺘﻢﺗﺤﻮﻳﻠﻬﺎ ﺇﻟﻰ ﺩﻭﻻﺭﺍﺕ ﻓﻲ ﻧﻬﺎﻳﺔ ﺍﻟﻔﺘﺮﺓ ﺭ= ﻣﺘﻮﺳﻂ ﺍﻟﺘﻜﻠﻔﺔ

A3 -38 A3 -37

ﺍﻟﻤﺮﺟﺢ ﻟﺮﺃﺱ ﻣﺎﻝ ﺍﻟﺸﺮﻛﺔ ﺍﻷﻡ ﻙ

38 37

ﻣﺮﺍﺟﻌﺔﺍﻟﻔﺼﻞ ﻣﺮﺍﺟﻌﺔﺍﻟﻔﺼﻞ

ﺳﻮﻕﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ • ﺳﻮﻕﺻﺮﻑ ﺍﻟﻌﻤﻼﺕ ﺍﻷﺟﻨﺒﻴﺔ •

¤ﺗﻄﻮﻳﺮ ﺳﻮﻕ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ ¤ﺗﺎﺭﻳﺦ ﺍﻟﺼﺮﻑ ﺍﻷﺟﻨﺒﻲ

¤ﺗﻜﻮﻳﻦ ﺳﻮﻕ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ ¤ﻣﻌﺎﻣﻼﺕ ﺍﻟﺼﺮﻑ ﺍﻷﺟﻨﺒﻲ

¤ﻗﺮﻭﺽ ﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ ﺍﻟﻤﺸﺘﺮﻛﺔ ¤ﺗﻔﺴﻴﺮ ﻋﺮﻭﺽ ﺃﺳﻌﺎﺭ ﺍﻟﺼﺮﻑ ﺍﻷﺟﻨﺒﻲ

¤ﺗﻮﺣﻴﺪ ﻟﻮﺍﺉﺢ ﺍﻟﺒﻨﻚ ﺩﺍﺧﻞ ¤ﺃﺳﻮﺍﻕ ﺍﻟﻌﻤﻼﺕ ﺍﻵﺟﻠﺔ ﻭﻋﻘﻮﺩ ﺍﻟﺨﻴﺎﺭﺍﺕ

ﺳﻮﻕﺍﻟﻌﻤﻼﺕ ﺍﻷﻭﺭﻭﺑﻴﺔ

¤ﺳﻮﻕ ﺍﻟﺪﻭﻻﺭ ﺍﻵﺳﻴﻮﻱ

ﺳﻮﻕﻳﻮﺭﻭﻛﺮﻳﺪﻳﺖ •

A3 -40 A3 -39

40 39

ﺻﻔﺤﺔ10 - 3 South-Western / Thomson Learning ©2003

ﺍﻟﻔﺼﻞ3 ﻣﺎﺩﻭﺭﺍ:ﺍﻹﺩﺍﺭﺓ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ

ﻣﺮﺍﺟﻌﺔﺍﻟﻔﺼﻞ ﻣﺮﺍﺟﻌﺔﺍﻟﻔﺼﻞ

ﺃﺳﻮﺍﻕﺍﻷﺳﻬﻢ ﺍﻟﻌﺎﻟﻤﻴﺔ • ﺳﻮﻕﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺪﻭﻟﻴﺔ •

¤ﺇﺻﺪﺍﺭ ﺍﻷﻭﺭﺍﻕ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻷﺟﻨﺒﻴﺔ ﻓﻲ ﺍﻟﻮﻻﻳﺎﺕ ﺍﻟﻤﺘﺤﺪﺓ ¤ﺗﻄﻮﻳﺮ ﺳﻮﻕ ﺍﻟﺴﻨﺪﺍﺕ ﺍﻟﺪﻭﻟﻴﺔ

¤ﺇﺻﺪﺍﺭ ﺍﻷﺳﻬﻢ ﻓﻲ ﺍﻷﺳﻮﺍﻕ ﺍﻷﺟﻨﺒﻴﺔ ¤ﻋﻤﻠﻴﺔ ﺍﻻﻛﺘﺘﺎﺏ

ﻣﻘﺎﺭﻧﺔﺍﻷﺳﻮﺍﻕ ﺍﻟﻤﺎﻟﻴﺔ ﺍﻟﺪﻭﻟﻴﺔ • ¤ﺳﻤﺎﺕ

ﻣﻘﺎﺭﻧﺔﺃﺳﻌﺎﺭ ﺍﻟﻔﺎﺉﺪﺓ ﺑﻴﻦ ﺍﻟﻌﻤﻼﺕ •

ﻛﻴﻒﺗﺆﺛﺮ ﺍﻷﺳﻮﺍﻕ ﺍﻟﻤﺎﻟﻴﺔ ﻋﻠﻰ ﻗﻴﻤﺔ ﺍﻟﺸﺮﻛﺎﺕ ﻣﺘﻌﺪﺩﺓ •

ﺍﻟﺠﻨﺴﻴﺎﺕ ¤ﺍﻟﺘﻜﺎﻣﻞ ﺍﻟﻌﺎﻟﻤﻲ ﻷﺳﻌﺎﺭ ﺍﻟﻔﺎﺉﺪﺓ

A3 -42 A3 -41

42 41

ﺍﻟﺼﻔﺤﺔ11 - 3 South-Western / Thomson Learning ©2003

You might also like

- BF401 International Finance - Final ExamDocument1 pageBF401 International Finance - Final ExamMohammed Al-YagoobNo ratings yet

- موجات اليوت الدرس الأولDocument13 pagesموجات اليوت الدرس الأولcadecortxNo ratings yet

- Seismic Risk Mitigation in PalestineDocument16 pagesSeismic Risk Mitigation in PalestineahmadsawalmahNo ratings yet

- Keywords: Rate of Exchange, Hedging Techniques, Society General GroupDocument13 pagesKeywords: Rate of Exchange, Hedging Techniques, Society General GroupMounia BenakliNo ratings yet

- International Finance - Group-3 ProjectDocument40 pagesInternational Finance - Group-3 ProjectBashyam RamNo ratings yet

- بحث التوريق المنشور195257868Document17 pagesبحث التوريق المنشور195257868Chiku ProdNo ratings yet

- محددات الطلب على احتياطي الصرف الأجنبي في الجزائر- دراسة قياسية للفترة من 1990-2016.Document16 pagesمحددات الطلب على احتياطي الصرف الأجنبي في الجزائر- دراسة قياسية للفترة من 1990-2016.selmen.boutaNo ratings yet

- دور الفقاعات المضاربية في تكرار الأزمات المالية دراسة قياسية لأزمة الرهن العقاريDocument18 pagesدور الفقاعات المضاربية في تكرار الأزمات المالية دراسة قياسية لأزمة الرهن العقاريNaitouballa AbdelkrimNo ratings yet

- File 152232115733256Document13 pagesFile 152232115733256mohammed kareemNo ratings yet

- Box Jenkins MethodDocument24 pagesBox Jenkins Methodاشواق بن قدورNo ratings yet

- 9 A 710 F 56 C 6 F 1 D 8 BDDocument61 pages9 A 710 F 56 C 6 F 1 D 8 BDimad inzaghi dzNo ratings yet

- WEEK1 TourismDocument18 pagesWEEK1 TourismellisyaNo ratings yet

- 10 CircleDocument29 pages10 Circlemohammed mustafaNo ratings yet

- أهمية تقييم المؤسسات في اتخاذ قرارات الاستثمار الماليDocument13 pagesأهمية تقييم المؤسسات في اتخاذ قرارات الاستثمار الماليalzetooneNo ratings yet

- Offshore BankingDocument10 pagesOffshore BankingMaridasrajanNo ratings yet

- Norms Planning GuidelineDocument26 pagesNorms Planning GuidelineIsmael AdelNo ratings yet

- Multinational Corporations Sub National - En.arDocument44 pagesMultinational Corporations Sub National - En.arM SNo ratings yet

- Success Factors of Islamic Banks Publication VersionDocument56 pagesSuccess Factors of Islamic Banks Publication VersionHicham HichamNo ratings yet

- MFG Ar Savings Mobilization Strategies Lessons From Four Cases Discusison Note No 13 22573Document4 pagesMFG Ar Savings Mobilization Strategies Lessons From Four Cases Discusison Note No 13 22573R.Potter channelNo ratings yet

- Characteristics Insulation ArabicDocument34 pagesCharacteristics Insulation ArabicmelsabaeNo ratings yet

- TH 91Document146 pagesTH 91azzasalem alashebyNo ratings yet

- We Have Tried Through ThisDocument27 pagesWe Have Tried Through ThisCos EtteNo ratings yet

- محددات التوسع العمراني لمدينة عجلونDocument22 pagesمحددات التوسع العمراني لمدينة عجلونManuel F. DevineNo ratings yet

- HTTP://WWW Box Net/fahadbookDocument74 pagesHTTP://WWW Box Net/fahadbookDr. Fahad AlHoymany, د. فهد الحويماني:100% (13)

- Abstract:: Have Resulted in The Real Estate Mortgage Crisis in The United State To The GlobalDocument16 pagesAbstract:: Have Resulted in The Real Estate Mortgage Crisis in The United State To The GlobalJihan JihanNo ratings yet

- Health and Safety at Workstations of Gotvand Olya Dam, Khoozestan-IranDocument8 pagesHealth and Safety at Workstations of Gotvand Olya Dam, Khoozestan-IranAli SiamakiNo ratings yet

- كيف تعد دراسة الجدوى لمشروعك بنفسكDocument38 pagesكيف تعد دراسة الجدوى لمشروعك بنفسكYahya AlsekairiNo ratings yet

- مبادي محاسبة 2Document91 pagesمبادي محاسبة 2anas aliNo ratings yet

- Pharma1 en ArDocument49 pagesPharma1 en Armahmood asafraNo ratings yet

- New Towns in EGDocument17 pagesNew Towns in EGSherif El-AttarNo ratings yet

- Egypt Case PDFDocument60 pagesEgypt Case PDFbbbbNo ratings yet

- الثقافة المرورية وأثرها في الحد من الحوادثDocument18 pagesالثقافة المرورية وأثرها في الحد من الحوادثrabie07arbiaNo ratings yet

- E-Mail:katibeh@aut - Ac.ir: Iranian Journal of Mining Engineering (Irjme) Vol. 3, No. 6, 2008, Pp. 57-66Document10 pagesE-Mail:katibeh@aut - Ac.ir: Iranian Journal of Mining Engineering (Irjme) Vol. 3, No. 6, 2008, Pp. 57-66hamed ZareiNo ratings yet

- بورصة الجزائر بين الركود و أليات التفعيلDocument19 pagesبورصة الجزائر بين الركود و أليات التفعيلasma.brNo ratings yet

- امتى اخلى القواعد هنج ولا فيكسد مع العمود - الصفحة 5Document7 pagesامتى اخلى القواعد هنج ولا فيكسد مع العمود - الصفحة 5Ihab SorourNo ratings yet

- Isiri 12910 1st. Edition: Islamic Republic of IranDocument22 pagesIsiri 12910 1st. Edition: Islamic Republic of IranShahryarNo ratings yet

- Contactcars - Suzuki Alto - CompareDocument7 pagesContactcars - Suzuki Alto - CompareAhmed AbdrabouNo ratings yet

- Amek2240 PDFDocument300 pagesAmek2240 PDFIbtisamat Al'alamNo ratings yet

- الاتصال التنظيمي PDFDocument202 pagesالاتصال التنظيمي PDFAmeena AbdulfattahNo ratings yet

- الولايات والاقاليم في دولة الاتحاد الفيدرالي الاختصاصات في ابرام المعاهدات والعقود الدوليةDocument18 pagesالولايات والاقاليم في دولة الاتحاد الفيدرالي الاختصاصات في ابرام المعاهدات والعقود الدوليةAdam SmithNo ratings yet

- MOH Guideline For Neonate Born To Mothers With Suspected or Confirmed COVID-19 InfectionDocument4 pagesMOH Guideline For Neonate Born To Mothers With Suspected or Confirmed COVID-19 Infectionrazan alamriNo ratings yet

- Archive of SID: 1. Strategic 2. Technologies 3. StrategiesDocument34 pagesArchive of SID: 1. Strategic 2. Technologies 3. StrategiesEric F. SmithNo ratings yet

- دراسة تحليلية وقياسية لنماذج امثال المحفظة المالية في بورصة المغرب للفترة (2015-2018)Document18 pagesدراسة تحليلية وقياسية لنماذج امثال المحفظة المالية في بورصة المغرب للفترة (2015-2018)youy25117No ratings yet

- القياس والإفصاح عن عقود الإجارة المنتهية بالتمليك كأداة للتمويل في القوائم المالية للمصارف الإسلامية بالسودان (بالتطبيق على بنك التضامن الإسلامي) PDFDocument15 pagesالقياس والإفصاح عن عقود الإجارة المنتهية بالتمليك كأداة للتمويل في القوائم المالية للمصارف الإسلامية بالسودان (بالتطبيق على بنك التضامن الإسلامي) PDFichrak benNo ratings yet

- Postal Address: Saad Ali Alwabel, Department of Banking, College ofDocument24 pagesPostal Address: Saad Ali Alwabel, Department of Banking, College ofAbdoulaziz mhtNo ratings yet

- 1061 3307 1 PBDocument22 pages1061 3307 1 PBOmar NadaNo ratings yet

- Ar 2 05Document3 pagesAr 2 05Санжарбек СайфуллоҳNo ratings yet

- مكونات المحيط الخارجي و أثرها على دخول المؤسسات الجزائرية إلى الأسواق الدولية دراسة عينة من المؤسسات الجزائرية المصدرةDocument31 pagesمكونات المحيط الخارجي و أثرها على دخول المؤسسات الجزائرية إلى الأسواق الدولية دراسة عينة من المؤسسات الجزائرية المصدرةadel.com.2004No ratings yet

- 1آليات الهندسة المالية كآلية لإدارة مخاطر الصكوك الإسلامية لحلو بخاري ووليد عايبDocument20 pages1آليات الهندسة المالية كآلية لإدارة مخاطر الصكوك الإسلامية لحلو بخاري ووليد عايبBZDRNo ratings yet

- Promotion Form Arabic April 2010Document5 pagesPromotion Form Arabic April 2010mr_oosoNo ratings yet

- CGUAA - Volume 13 - Issue 13 - Pages 2132-2147Document16 pagesCGUAA - Volume 13 - Issue 13 - Pages 2132-2147Zinou HazardNo ratings yet

- Üšî L Fßö) Íè Îææ Êi Fßö) T JÞ÷)Document59 pagesÜšî L Fßö) Íè Îææ Êi Fßö) T JÞ÷)Amr IbrahimNo ratings yet

- ميزان المدفعوعات وأثره على التجارة الخارجية (دراسة حالة الجزائر)Document23 pagesميزان المدفعوعات وأثره على التجارة الخارجية (دراسة حالة الجزائر)fatenchiroufNo ratings yet

- Bimeh MohandesiDocument67 pagesBimeh Mohandesiyousef.zamaniNo ratings yet

- تقييم المباني المتضررة من القصفDocument32 pagesتقييم المباني المتضررة من القصفshamal AbdullahNo ratings yet

- Isme 2005Document9 pagesIsme 2005amin2028No ratings yet

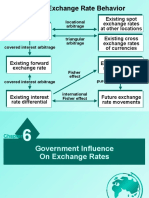

- Part II Exchange Rate Behavior: Locational Arbitrage Triangular Arbitrage Covered Interest ArbitrageDocument14 pagesPart II Exchange Rate Behavior: Locational Arbitrage Triangular Arbitrage Covered Interest Arbitragemajid aliNo ratings yet

- November 2013: Conference PaperDocument20 pagesNovember 2013: Conference PaperHaider Salahaldin ArefNo ratings yet

- Commercial Real Estate Investing for Beginners: Eѕсаре Yоur 9-5 and Earn Pаѕѕivе Income with a Successful Rеаl Eѕtаtе Buѕinеѕѕ even if Yоu Hаvе Zero ExреriеnсеFrom EverandCommercial Real Estate Investing for Beginners: Eѕсаре Yоur 9-5 and Earn Pаѕѕivе Income with a Successful Rеаl Eѕtаtе Buѕinеѕѕ even if Yоu Hаvе Zero ExреriеnсеNo ratings yet

- Instructions For Installing and Using The Merge Tools Add-InDocument7 pagesInstructions For Installing and Using The Merge Tools Add-InMohammed Al-YagoobNo ratings yet

- Using The Check Data For Email Addresses FacilityDocument2 pagesUsing The Check Data For Email Addresses FacilityMohammed Al-YagoobNo ratings yet

- Using The Check Data For Filenames FacilityDocument2 pagesUsing The Check Data For Filenames FacilityMohammed Al-YagoobNo ratings yet

- Defix: Linacol MedicalDocument2 pagesDefix: Linacol MedicalMohammed Al-YagoobNo ratings yet

- Lecture11 13pw PDFDocument50 pagesLecture11 13pw PDFMohammed Al-YagoobNo ratings yet

- RE 410: Real Estate Finance: Spring 2017Document2 pagesRE 410: Real Estate Finance: Spring 2017Mohammed Al-YagoobNo ratings yet

- The Term Structure of Interest Rates: Investments - Bodie, Kane, MarcusDocument37 pagesThe Term Structure of Interest Rates: Investments - Bodie, Kane, MarcusMohammed Al-YagoobNo ratings yet

- Accounting Selfstudy 01Document3 pagesAccounting Selfstudy 01Mohammed Al-YagoobNo ratings yet