Professional Documents

Culture Documents

Screening All Emiten Done

Uploaded by

hani utari0 ratings0% found this document useful (0 votes)

59 views98 pagesThe document lists 122 Indonesian companies across various sectors including basic materials and capital goods. It provides information on each company's name, symbol, sector, market capitalization, share price. The top companies are Chandra Asri Petrochemical in basic materials with a market cap of 184.13 trillion and Semen Indonesia in capital goods with a market cap of 65.69 trillion. A wide range of companies from large to small are represented across the basic materials and capital goods sectors.

Original Description:

Original Title

SCREENING ALL EMITEN DONE

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists 122 Indonesian companies across various sectors including basic materials and capital goods. It provides information on each company's name, symbol, sector, market capitalization, share price. The top companies are Chandra Asri Petrochemical in basic materials with a market cap of 184.13 trillion and Semen Indonesia in capital goods with a market cap of 65.69 trillion. A wide range of companies from large to small are represented across the basic materials and capital goods sectors.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

59 views98 pagesScreening All Emiten Done

Uploaded by

hani utariThe document lists 122 Indonesian companies across various sectors including basic materials and capital goods. It provides information on each company's name, symbol, sector, market capitalization, share price. The top companies are Chandra Asri Petrochemical in basic materials with a market cap of 184.13 trillion and Semen Indonesia in capital goods with a market cap of 65.69 trillion. A wide range of companies from large to small are represented across the basic materials and capital goods sectors.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

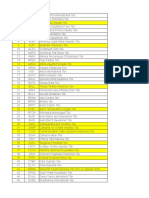

You are on page 1of 98

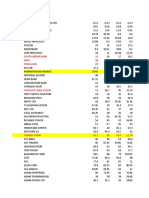

NO Name Symbol Sector Market Cap Share Price

1 Chandra Asri Petro TPIA Basic Materials 184.13T 10,625

2 Barito Pacific BRPT Basic Materials 82.17T 990

3 Indah Kiat Pulp & Paper INKP Basic Materials 70.85T 13,800

4 Aneka Tambang Persero ANTM Basic Materials 53.35T 2,600

5 Vale Indonesia INCO Basic Materials 53.16T 6,250

6 Merdeka Copper Gold TBK PT MDKA Basic Materials 52.99T 2,800

7 Pabrik Kertas Tjiwi TKIM Basic Materials 40.32T 14,800

8 Fajar Surya Wisesa FASW Basic Materials 17.35T 7,600

9 Timah Persero TINS Basic Materials 12.59T 2,050

10 Krakatau Steel Persero KRAS Basic Materials 11.22T 645

11 Cita Mineral CITA Basic Materials 11.09T 2,720

12 Impack Pratama Industri IMPC Basic Materials 6.53T 1,390

13 Bumi Resources Min BRMS Basic Materials 5.68T 84

14 J Resources PSAB Basic Materials 5.08T 224

15 Gunung Raja GGRP Basic Materials 4.84T 348

16 Aneka Gas AGII Basic Materials 4.28T 1,625

17 Kapuas Prima Coal ZINC Basic Materials 3.59T 125

18 Pelat Timah Nusantara NIKL Basic Materials 2.85T 1,320

19 Panca Budi Idaman PBID Basic Materials 2.77T 1,485

20 Kirana Megatara KMTR Basic Materials 2.71T 354

21 Madusari Murni Indah MOLI Basic Materials 2.38T 1,010

22 Citra Tubindo CTBN Basic Materials 2.35T 2,930

23 Bumi Teknokultura BTEK Basic Materials 2.31T 50

24 Supreme Cable SCCO Basic Materials 2.07T 9,575

25 Saraswanti Anugerah SAMF Basic Materials 2.00T 394

26 Garuda Metalindo Tbk BOLT Basic Materials 1.59T 690

27 Kmi Wire And Cable KBLI Basic Materials 1.57T 392

28 Unggul Indah Cahaya UNIC Basic Materials 1.57T 4,050

29 Toba Pulp Lestari INRU Basic Materials 1.39T 1,000

30 Indospring INDS Basic Materials 1.22T 1,880

31 Lotte Chemical Titan PT FPNI Basic Materials 1.19T 224

32 Tridomain Performance TDPM Basic Materials 1.13T 118

33 Trias Sentosa TRST Basic Materials 1.08T 360

34 Berlina BRNA Basic Materials 1.08T 1,155

35 Indopoly Swakarsa IPOL Basic Materials 1.02T 174

36 Ifishdeco IFSH Basic Materials 998.75B 492

37 Jembo Cable Company JECC Basic Materials 876.96B 5,800

38 Ekadharma EKAD Basic Materials 838.53B 1,185

39 Voksel Electric VOKS Basic Materials 831.12B 208

40 Central Omega Resources DKFT Basic Materials 794.99B 155

41 Lautan Luas LTLS Basic Materials 756.56B 488

42 Gunawan Dianjaya Steel GDST Basic Materials 734.74B 96

43 Satyamitra Kemas Lestari SMKL Basic Materials 686.80B 200

44 Suparma SPMA Basic Materials 609.00B 296

45 Polychem Indonesia ADMG Basic Materials 587.27B 157

46 Emdeki Utama MDKI Basic Materials 551.57B 212

47 Alkindo Naratama ALDO Basic Materials 514.77B 444

48 Tembaga Mulia Semanan TBMS Basic Materials 382.03B 1,010

49 Indo Acidatama SRSN Basic Materials 325.08B 55

50 Champion Pacific IGAR Basic Materials 320.83B 342

51 Kedawung Setia KDSI Basic Materials 315.90B 775

52 Tunas Alfin TALF Basic Materials 303.94B 242

53 Sriwahana SWAT Basic Materials 292.86B 96

54 Argha Karya Prima Ind AKPI Basic Materials 281.63B 480

55 Megalestari Epack EPAC Basic Materials 260.97B 73

56 Asiaplast Industries APLI Basic Materials 258.91B 210

57 HK Metals Utama HKMU Basic Materials 257.74B 84

58 Asia Pacific Fibers POLY Basic Materials 252.91B 54

59 Trinitan PURE Basic Materials 240.00B 168

60 Colorpak Indonesia CLPI Basic Materials 226.69B 775

61 Alakasa Industrindo Tbk ALKA Basic Materials 223.39B 274

62 Communication Cable Systems CCSI Basic Materials 220.00B 224

63 Betonjaya Manunggal BTON Basic Materials 211.68B 306

64 Saranacentral Bajatama BAJA Basic Materials 208.80B 119

65 Indal Aluminium INAI Basic Materials 207.82B 322

66 Intanwijaya INCI Basic Materials 165.72B 900

67 Ancora Indonesia OKAS Basic Materials 155.40B 89

68 Alumindo ALMI Basic Materials 151.54B 242

69 Prasidha Aneka Niaga PSDN Basic Materials 144.00B 97

70 Tira Austenite TIRA Basic Materials 141.12B 268

71 Langgeng Makmur LMPI Basic Materials 134.13B 136

72 Arkha Jayanti ARKA Basic Materials 100.00B 50

73 Indo Komoditi Korpora INCF Basic Materials 96.37B 65

74 Duta Pertiwi Nusantara DPNS Basic Materials 84.77B 276

75 Pelangi Indah Canindo PICO Basic Materials 81.85B 144

76 Bintang Mitra BMSR Basic Materials 76.51B 76

77 Perdana Bangun Pusaka KONI Basic Materials 74.70B 298

78 Eterindo Wahanatama ETWA Basic Materials 60.03B 62

79 Inter-Delta INTD Basic Materials 56.22B 102

80 Sinergi Inti ESIP Basic Materials 48.00B 72

81 Siwani Makmur SIMA Basic Materials 39.63B 50

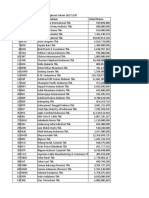

82 Semen Indonesia Persero SMGR Capital Goods 65.69T 11,525

83 Indocement Tunggal INTP Capital Goods 49.05T 14,100

84 Metropolitan Kentjana MKPI Capital Goods 27.31T 28,625

85 Pakuwon Jati PWON Capital Goods 23.02T 525

86 Bumi Serpong Damai BSDE Capital Goods 22.97T 1,185

87 Waskita Karya WSKT Capital Goods 19.21T 1,500

88 Ciputra Dev CTRA Capital Goods 17.05T 1,000

89 Wijaya Karya WIKA Capital Goods 15.42T 2,000

90 Solusi Bangun Indonesia SMCB Capital Goods 13.72T 1,820

91 Lippo Karawaci LPKR Capital Goods 12.35T 187

92 Puradelta Lestari Tbk Pt DMAS Capital Goods 10.41T 220

93 Pp Persero PTPP Capital Goods 9.98T 1,795

94 Summarecon Agung SMRA Capital Goods 9.88T 730

95 Semen Baturaja Persero SMBR Capital Goods 7.90T 910

96 Jaya Real Property JRPT Capital Goods 7.16T 540

97 Waskita Beton Precast WSBP Capital Goods 7.01T 262

98 Duta Pertiwi DUTI Capital Goods 6.97T 3,770

99 DMS Propertindo KOTA Capital Goods 5.17T 635

100 Jaya Konstruksi JKON Capital Goods 5.15T 302

101 Adhi Karya Persero ADHI Capital Goods 4.86T 1,485

102 Solusi Tunas Pratama SUPR Capital Goods 4.83T 4,250

103 Arwana Citramulia ARNA Capital Goods 4.75T 695

104 PP Properti Tbk PT PPRO Capital Goods 4.44T 75

105 Hanson MYRX Capital Goods 4.39T 50

106 Jaya Sukses Makmur RISE Capital Goods 4.20T 426

107 Mark Dynamics Indonesia MARK Capital Goods 3.78T 1,030

108 Nirvana Development NIRO Capital Goods 3.77T 159

109 Alam Sutera Realty ASRI Capital Goods 3.71T 220

110 Citra Putra CLAY Capital Goods 3.52T 1,450

111 Agung Podomoro APLN Capital Goods 3.47T 169

112 Sentul City BKSL Capital Goods 3.35T 50

113 Metropolitan Land MTLA Capital Goods 3.22T 416

114 Kawasan Jababeka KIJA Capital Goods 3.06T 158

115 Wijaya Karya Beton WTON Capital Goods 2.97T 358

116 Lippo Cikarang LPCK Capital Goods 2.87T 1,120

117 Hexindo Adiperkasa HEXA Capital Goods 2.73T 3,240

118 Acset Indonusa ACST Capital Goods 2.24T 370

119 Bukaka Teknik Utama BUKK Capital Goods 2.17T 850

120 Surya Toto Indonesia TOTO Capital Goods 2.17T 214

121 Pembangunan Perumahan PPRE Capital Goods 2.07T 210

122 Surya Semesta SSIA Capital Goods 2.06T 466

123 Wijaya Karya Bangunan Gedung WEGE Capital Goods 2.05T 214

124 Fortune Mate FMII Capital Goods 2.04T 650

125 Intiland Development DILD Capital Goods 2.00T 210

126 Gowa Makassar GMTD Capital Goods 1.82T 17,950

127 Totalindo Eka Persada TOPS Capital Goods 1.67T 50

128 Catur Sentosa CSAP Capital Goods 1.65T 370

129 Keramika Indonesia KIAS Capital Goods 1.47T 50

131 Bekasi Fajar BEST Capital Goods 1.34T 153

132 Indonesia Fibreboard IFII Capital Goods 1.30T 139

133 Makmur Berkah AMAN Capital Goods 1.26T 322

134 Steel Pipe Ind ISSP Capital Goods 1.24T 188

135 Asahimas Flat Glass AMFG Capital Goods 1.22T 2,850

136 Total Bangun Persada TOTL Capital Goods 1.15T 354

137 Ayana Land NASA Capital Goods 1.14T 104

138 Pratama Widya PTPW Capital Goods 1.14T 1,300

139 Superkrane Mitra Utama SKRN Capital Goods 1.13T 760

140 Rockfields Prop ROCK Capital Goods 1.13T 775

141 Grand House HOMI Capital Goods 1.03T 1,345

142 Natura City CITY Capital Goods 1.02T 177

143 Modernland Realty Ltd MDLN Capital Goods 936.70B 51

144 Greenwood Sejahtera GWSA Capital Goods 897.09B 127

145 Nusa Raya Cipta NRCA Capital Goods 831.47B 358

146 Perintis Triniti TRIN Capital Goods 765.34B 170

147 Mulia Industrindo MLIA Capital Goods 726.58B 575

148 Paramita Bangun Sarana PBSA Capital Goods 705.00B 470

149 Intikeramik Alamasri IKAI Capital Goods 665.29B 50

150 Megapolitan Dev EMDE Capital Goods 636.50B 188

151 Dana Brata Luhur TEBE Capital Goods 627.08B 520

152 Trimitra Propertindo LAND Capital Goods 619.96B 194

153 Indonesia Pondasi Raya Tbk PT IDPR Capital Goods 608.91B 280

154 Duta Anggada DART Capital Goods 590.58B 198

155 Intraco Penta INTA Capital Goods 568.47B 169

156 Sitara Propertindo TARA Capital Goods 503.48B 50

157 Gading Development GAMA Capital Goods 500.55B 50

158 Suryamas Dutamakmur SMDM Capital Goods 472.44B 99

159 Armidian Karyatama ARMY Capital Goods 450.31B 50

160 Grand Kartech KRAH Capital Goods 423.44B 436

161 Bumi Benowo BBSS Capital Goods 403.20B 85

162 Bukit Darmo BKDP Capital Goods 383.21B 50

163 LCK Global Kedaton LCKM Capital Goods 382.00B 382

164 Karya Bersama KBAG Capital Goods 357.50B 50

165 Repower Asia Ind REAL Capital Goods 331.68B 50

166 PT Dafam Property DFAM Capital Goods 328.63B 183

167 Sanurhasta Mitra MINA Capital Goods 328.13B 50

168 Nusantara Almazia NZIA Capital Goods 325.24B 149

169 Bima Sakti Pertiwi PAMG Capital Goods 281.25B 85

170 Nusa Konstruksi DGIK Capital Goods 276.09B 50

171 Ateliers Mecaniques D’Indonesie AMIN Capital Goods 274.32B 272

172 Kobexindo Tractors KOBX Capital Goods 261.34B 116

173 Perdana Gapura Prima GPRA Capital Goods 247.84B 61

174 Cowell Development COWL Capital Goods 243.56B 50

175 Pakuan UANG Capital Goods 235.95B 200

176 Chitose Internasional CINT Capital Goods 218.00B 220

177 Aesler Gr RONY Capital Goods 216.25B 170

178 Slj Global SULI Capital Goods 199.35B 50

179 Mitra Pemuda MTRA Capital Goods 187.88B 224

180 Arita Prima Indonesia APII Capital Goods 182.88B 164

181 Kokoh Inti Arebama KOIN Capital Goods 156.93B 161

182 Ristia Bintang RBMS Capital Goods 132.79B 50

183 Capri Nusa Satu Properti CPRI Capital Goods 121.67B 50

184 Protech Mitra Perkasa OASA Capital Goods 109.01B 350

185 Binakarya Jaya Abadi Tbk PT BIKA Capital Goods 104.24B 165

186 Pudjiadi Prestige PUDP Capital Goods 77.78B 234

187 PT Cahayasakti Investindo CSIS Capital Goods 75.81B 57

188 Cahayaputra Asa Keramik CAKK Capital Goods 75.81B 64

189 Bumi Citra Permai BCIP Capital Goods 75.79B 57

190 Citatah CTTH Capital Goods 61.54B 50

191 Tirta Mahakam TIRT Capital Goods 50.59B 50

192 Andalan Sakti ASPI Capital Goods 45.68B 63

193 Agro Yasa Lestari PT Tbk AYLS Capital Goods 42.67B 50

194 Darmi Bersaudara KAYU Capital Goods 42.56B 64

195 Lionmesh Prima LMSH Capital Goods 33.60B 350

196 Bekasi Asri Pemula BAPA Capital Goods 33.09B 50

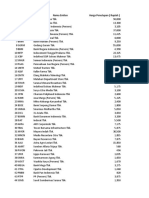

197 Bakrie & Brothers BNBR Conglomerates 1.04T 50

198 Astra International ASII Consumer Cyclical 246.95T 6,025

199 Multistrada Arah Sarana MASA Consumer Cyclical 11.34T 1,350

200 Gaya Abadi SLIS Consumer Cyclical 9.56T 4,600

201 Selamat Sempurna SMSM Consumer Cyclical 6.85T 1,290

202 Astra Otoparts AUTO Consumer Cyclical 4.89T 1,035

203 Sri Rejeki Isman SRIL Consumer Cyclical 4.34T 220

204 Integra Indocabinet WOOD Consumer Cyclical 3.82T 610

205 Indomobil Sukses IMAS Consumer Cyclical 3.67T 1,020

206 Gajah Tunggal GJTL Consumer Cyclical 2.40T 775

207 Tifico Fiber Indonesia TFCO Consumer Cyclical 2.20T 452

208 Indo Kordsa BRAM Consumer Cyclical 2.16T 5,000

209 Mitra Pinasthika MPMX Consumer Cyclical 2.13T 510

210 Indorama Synthetics INDR Consumer Cyclical 1.77T 2,750

211 Pan Brothers PBRX Consumer Cyclical 1.25T 192

212 Trisula Textile BELL Consumer Cyclical 1.11T 151

213 Sepatu Bata BATA Consumer Cyclical 806.00B 615

214 Sunindo Adipersada TOYS Consumer Cyclical 671.58B 476

215 Sunson Textile SSTM Consumer Cyclical 661.56B 560

216 Selaras Citra SCNP Consumer Cyclical 610.00B 252

217 Argo Pantes Tbk ARGO Consumer Cyclical 597.29B 1,740

218 Goodyear Indonesia GDYR Consumer Cyclical 578.10B 1,410

219 Gema Grahasarana GEMA Consumer Cyclical 556.80B 348

220 Star Petrcohem STAR Consumer Cyclical 465.60B 92

221 Golden Flower POLU Consumer Cyclical 453.75B 645

222 Panasia Indo Resources HDTX Consumer Cyclical 432.18B 120

223 Apac Citra Centertex MYTX Consumer Cyclical 387.36B 50

224 Trisula International TRIS Consumer Cyclical 380.03B 106

225 Inocycle INOV Consumer Cyclical 253.15B 139

226 Sejahtera Bintang SBAT Consumer Cyclical 240.68B 92

227 Yanaprima Hastapersada YPAS Consumer Cyclical 236.47B 380

228 Lion Metal Works LION Consumer Cyclical 208.06B 356

229 Boston Furniture SOFA Consumer Cyclical 163.35B 100

230 Eratex Djaja ERTX Consumer Cyclical 150.53B 114

231 Ever Shine Textile ESTI Consumer Cyclical 133.00B 72

232 Prima Alloy Steel PRAS Consumer Cyclical 110.76B 140

233 Multi Prima Sejahtera LPIN Consumer Cyclical 102.00B 250

234 Ricky Putra Globalindo RICY Consumer Cyclical 52.62B 84

235 Centex Prf CNTX_p Consumer Cyclical 36.80B 189

236 Primarindo Asia Infrastructure Tbk BIMA Consumer Cyclical 30.41B 50

237 Nusantara Inti Corpora UNIT Consumer Cyclical 24.65B 153

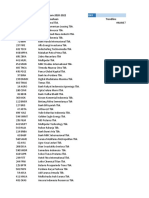

238 Unilever Indonesia UNVR Consumer Non Cyclical 270.87T 7,000

239 Hm Sampoerna HMSP Consumer Non Cyclical 152.96T 1,405

240 Indofood Cbp ICBP Consumer Non Cyclical 106.12T 9,500

241 Charoen Pokphand Indonesia CPIN Consumer Non Cyclical 95.93T 6,000

242 Gudang Garam GGRM Consumer Non Cyclical 73.16T 39,050

243 Mayora Indah MYOR Consumer Non Cyclical 62.60T 2,640

244 Indofood INDF Consumer Non Cyclical 54.88T 6,325

245 Astra Agro Lestari AALI Consumer Non Cyclical 21.36T 11,150

246 Multi Bintang Ind MLBI Consumer Non Cyclical 18.54T 8,825

247 Ultra Jaya Milk ULTJ Consumer Non Cyclical 17.50T 1,540

248 Japfa Comfeed Indonesia JPFA Consumer Non Cyclical 15.39T 1,405

249 Siantar Top STTP Consumer Non Cyclical 12.18T 9,300

250 Bentoel Int RMBA Consumer Non Cyclical 10.34T 294

251 Smart SMAR Consumer Non Cyclical 10.00T 3,700

252 Garudafood Putra Putri GOOD Consumer Non Cyclical 9.08T 1,250

253 Perusahaan Perkebunan LSIP Consumer Non Cyclical 8.97T 1,320

254 Sawit Sumbermas Sarana SSMS Consumer Non Cyclical 8.62T 1,030

255 Diamond Food DMND Consumer Non Cyclical 8.47T 910

256 Nippon ROTI Consumer Non Cyclical 8.31T 1,440

257 Tigaraksa Satria TGKA Consumer Non Cyclical 6.89T 7,600

258 Salim Ivomas Pratama SIMP Consumer Non Cyclical 5.92T 404

259 Uni Charm UCID Consumer Non Cyclical 5.84T 1,445

260 Dharma Satya DSNG Consumer Non Cyclical 5.75T 565

261 Sariguna Primatirta CLEO Consumer Non Cyclical 5.71T 496

262 Tunas Baru Lampung TBLA Consumer Non Cyclical 4.56T 905

263 Eagle High BWPT Consumer Non Cyclical 3.56T 114

264 Bisi International BISI Consumer Non Cyclical 3.35T 1,125

265 Kino Indonesia Tbk PT KINO Consumer Non Cyclical 3.29T 2,290

266 Sampoerna Agro SGRO Consumer Non Cyclical 3.15T 1,750

267 Delta Djakarta DLTA Consumer Non Cyclical 3.02T 3,800

268 Central Proteina CPRO Consumer Non Cyclical 2.98T 50

269 Mahkota MGRO Consumer Non Cyclical 2.74T 765

270 Buyung Poetra Sembada HOKI Consumer Non Cyclical 2.48T 950

271 Tiga Pilar Sejahtera AISA Consumer Non Cyclical 2.40T 272

272 Provident Agro PALM Consumer Non Cyclical 2.18T 330

273 Austindo Nusantara Jaya ANJT Consumer Non Cyclical 2.09T 625

274 Mulia Boga Raya KEJU Consumer Non Cyclical 1.95T 1,395

275 Palma Serasih PSGO Consumer Non Cyclical 1.89T 101

276 Sierad Produce SIPD Consumer Non Cyclical 1.74T 1,295

277 Fks Multi Agro FISH Consumer Non Cyclical 1.73T 3,600

278 Inti Kapuas Arowana IIKP Consumer Non Cyclical 1.68T 50

279 Campina Ice Cream CAMP Consumer Non Cyclical 1.58T 232

280 Malindo Feedmill MAIN Consumer Non Cyclical 1.46T 670

281 Mandom Indonesia TCID Consumer Non Cyclical 1.26T 6,350

282 Pradiksi Gunatama PGUN Consumer Non Cyclical 1.20T 250

283 Sekar Laut SKLT Consumer Non Cyclical 1.02T 1,630

284 Wilmar Cahaya Ind CEKA Consumer Non Cyclical 1.02T 1,795

285 Wismilak Inti Makmur WIIM Consumer Non Cyclical 961.74B 535

286 Akasha Wira ADES Consumer Non Cyclical 887.79B 1,580

287 Pinago Utama PNGO Consumer Non Cyclical 816.41B 1,065

288 Tri Banyan Tirta ALTO Consumer Non Cyclical 657.56B 308

289 Cisadane Sawit Raya CSRA Consumer Non Cyclical 586.30B 308

290 Wicaksana Overseas WICO Consumer Non Cyclical 558.34B 428

291 Prima Cakrawala Abadi PCAR Consumer Non Cyclical 555.33B 386

292 Sekar Bumi SKBM Consumer Non Cyclical 507.44B 352

293 Andira Agro ANDI Consumer Non Cyclical 476.85B 53

294 Indonesian Tobacco ITIC Consumer Non Cyclical 475.06B 560

295 Multi Agro Gemilang Plantation MAGP Consumer Non Cyclical 450.00B 50

296 Budi Starch & Sweetener BUDI Consumer Non Cyclical 445.40B 98

297 Asia Sejahtera Mina AGAR Consumer Non Cyclical 444.00B 416

298 Kurniamitra Duta KMDS Consumer Non Cyclical 424.00B 530

299 Jaya Agra Wattie JAWA Consumer Non Cyclical 301.97B 84

300 Gozco Plantations GZCO Consumer Non Cyclical 300.00B 50

301 PT Wahana Interfood COCO Consumer Non Cyclical 282.94B 498

302 Bakrie Sumatera UNSP Consumer Non Cyclical 260.02B 117

303 Estika Tata Tiara BEEF Consumer Non Cyclical 226.12B 132

304 Dua Putra Utama Makmur PT DPUM Consumer Non Cyclical 208.23B 50

305 Golden Plantation GOLL Consumer Non Cyclical 183.25B 50

306 Dharma Samudera DSFI Consumer Non Cyclical 118.86B 66

307 Martina Berto MBTO Consumer Non Cyclical 107.00B 104

308 Wahana Pronatural WAPO Consumer Non Cyclical 89.35B 69

309 Era Mandiri Cemerlang Tbk PT IKAN Consumer Non Cyclical 87.50B 99

310 Sentra Food FOOD Consumer Non Cyclical 63.70B 98

311 Kedaung Indah Can KICI Consumer Non Cyclical 56.86B 196

312 Cottonindo Ariesta KPAS Consumer Non Cyclical 43.01B 56

313 United Tractors UNTR Energy 83.93T 22,572

314 Bayan Resources BYAN Energy 48.33T 14,500

315 Adaro Energy ADRO Energy 37.90T 1,200

316 Perusahaan Gas Negara PGAS Energy 32.24T 1,470

317 Bukit Asam PTBA Energy 28.41T 2,490

318 Medco Energi MEDC Energy 15.37T 675

319 Golden Energy Mines GEMS Energy 15.00T 2,550

320 Indo Tambangraya ITMG Energy 13.13T 12,075

321 Harum Energy HRUM Energy 12.38T 6,075

322 Akr Corporindo AKRA Energy 11.32T 3,240

323 Dian Swastatika DSSA Energy 9.25T 11,950

324 Indika Energy INDY Energy 7.41T 1,435

325 Wilton Makmur Indonesia SQMI Energy 4.85T 312

326 Bumi Resources BUMI Energy 4.79T 63

327 Baramulti Suksessarana BSSR Energy 3.95T 1,560

328 Toba Bara Sejahtra TOBA Energy 3.86T 505

329 Mitrabara Adiperdana MBAP Energy 3.23T 2,770

330 Samindo Resources MYOH Energy 2.78T 1,280

331 Surya Esa Perkasa ESSA Energy 2.59T 230

332 Elnusa ELSA Energy 2.55T 366

333 Delta Dunia Makmur DOID Energy 2.47T 302

334 Benakat Integra BIPI Energy 2.23T 50

335 Abm Investama ABMM Energy 1.93T 710

336 Apexindo Pratama Duta APEX Energy 1.90T 620

337 Petrosea PTRO Energy 1.69T 1,795

338 Dwi Guna Laksana DWGL Energy 1.45T 170

339 Resource Alam Indonesia KKGI Energy 1.44T 302

340 Sumber Global SGER Energy 1.25T 645

341 Sugih Energy SUGI Energy 1.24T 50

342 Darma Henwa DEWA Energy 1.09T 50

343 Alfa Energi Investama FIRE Energy 1.06T 585

344 Energi Mega Persada ENRG Energy 1.03T 107

345 Atlas Resources ARII Energy 648.00B 218

346 Smr Utama SMRU Energy 624.97B 50

347 Sumber Energi Andalan ITMA Energy 539.83B 655

348 Exploitasi Energi CNKO Energy 447.82B 50

349 Ratu Prabu Energi ARTI Energy 392.00B 50

350 Golden Eagle Energy SMMT Energy 315.00B 103

351 Logindo Samudramakmur LEAD Energy 201.69B 50

352 Mitra Int MIRA Energy 198.07B 50

353 Radiant Utama RUIS Energy 189.42B 246

354 Borneo Olah Sarana BOSS Energy 177.80B 109

355 Ginting Jaya Energi WOWS Energy 126.26B 56

356 Akbar Indomakmur AIMS Energy 33.88B 130

357 Perdana Karya Perkasa PKPK Energy 30.00B 50

359 Bank Central Asia BBCA Financial 847.52T 34,000

360 Bank Rakyat Persero BBRI Financial 524.71T 4,360

361 Bank Mandiri Persero BMRI Financial 307.77T 6,475

362 Bank Negar BBNI Financial 103.16T 5,900

363 Sinar Mas Multiartha SMMA Financial 73.55T 12,000

364 Bank Artos Indonesia ARTO Financial 72.74T 7,100

365 Bank Permata BNLI Financial 65.90T 2,290

366 Bank Mega MEGA Financial 59.89T 8,925

367 Bank Mayapada MAYA Financial 34.03T 5,000

368 Bank Danamon BDMN Financial 27.56T 2,990

369 Bank BRISyariah BRIS Financial 25.94T 2,610

370 Bank Tabungan Pensiunan BTPS Financial 25.93T 3,600

371 Bank Pan Indonesia PNBN Financial 23.24T 1,000

372 Bank Maybank Indonesia BNII Financial 23.02T 318

373 Bank Tabungan BTPN Financial 21.42T 2,760

374 Bank Cimb Niaga BNGA Financial 21.19T 905

375 Capital Financial Ind CASA Financial 20.70T 356

376 Bank Ocbc Nisp NISP Financial 18.70T 830

377 Bank Rakyat AGRO Financial 17.18T 805

378 Bank Tabungan Negara BBTN Financial 16.63T 1,740

379 Bank Pembangunan BJBR Financial 14.32T 1,480

380 Bank Pembangunan Timur BJTM Financial 11.26T 755

381 Asuransi Jiwa Sinarmas LIFE Financial 10.08T 4,600

382 BFI Finance BFIN Financial 9.95T 680

383 Bank Sinarmas BSIM Financial 9.08T 570

384 Pacific Strategic APIC Financial 9.01T 815

385 Asuransi Kresna Mitra ASMI Financial 8.47T 945

386 Adira Dinamika ADMF Financial 8.40T 8,400

387 Panin Financial PNLF Financial 6.98T 228

388 Mnc Kapital Ind BCAP Financial 5.90T 137

389 Bank Mestika Dharma BBMD Financial 5.80T 1,400

390 Mandala Multifinance MFIN Financial 5.57T 1,060

391 Bank Bukopin BBKP Financial 5.42T 464

392 Batavia Prosperindo Int BPII Financial 4.47T 7,950

393 Bank Ina Perdana BINA Financial 4.21T 860

394 Bank Woori Indonesia SDRA Financial 4.05T 675

395 Asuransi Bina Dana Arta ABDA Financial 3.87T 5,900

396 Ashmore Asset AMOR Financial 3.47T 3,190

397 Bhakti Multi Artha BHAT Financial 3.27T 670

398 Paninvest PNIN Financial 3.21T 820

399 Bank Nationalnobu NOBU Financial 3.17T 740

400 Bank Harda Internasional Tbk PT BBHI Financial 2.82T 660

401 Asuransi Tugu Pratama TUGU Financial 2.82T 1,645

402 Bank Bisnis BBSI Financial 2.72T 1,425

403 Bank Capital Indonesia BACA Financial 2.66T 380

404 Maskapai Reasuransi MREI Financial 2.59T 5,000

405 Indomobil Multi Jasa IMJS Financial 2.51T 330

406 Bank Of India Indonesia BSWD Financial 2.43T 1,750

407 Bank Yudha Bhakti BBYB Financial 2.36T 328

408 Bank Agris AGRS Financial 2.30T 208

409 Bank Qnb Indonesia BKSW Financial 2.04T 100

410 Bank Amar Indonesia AMAR Financial 1.99T 248

411 Bank Windu MCOR Financial 1.96T 126

412 Bank Maspion Indonesia BMAS Financial 1.77T 340

413 Bank Dinar Indonesia DNAR Financial 1.60T 171

414 Capitalinc Inv MTFN Financial 1.59T 50

415 Bank Panin Syariah PNBS Financial 1.51T 69

416 Kresna Graha Investama KREN Financial 1.27T 77

417 Bank Mnc Internasional BABP Financial 1.27T 50

418 Danasupra DEFI Financial 1.15T 1,685

419 Bank Artha Graha INPC Financial 1.12T 70

420 Multi Artha Guna AMAG Financial 1.09T 230

421 Bank Victoria BVIC Financial 1000.00B 117

422 Bank Bumi Arta BNBA Financial 988.68B 436

423 Clipan Finance CFIN Financial 892.53B 230

424 Equity Dev Inv GSMF Financial 857.29B 116

425 Wahana Ottomitra WOMF Financial 835.56B 252

426 Panin Sekuritas PANS Financial 814.62B 1,270

427 Bank Ganesha Tbk PT BGTG Financial 763.37B 71

428 Radana Bhaskara Finance Tbk HDFA Financial 756.02B 128

429 Victoria Investama VICO Financial 695.41B 82

430 Yulie Sekurindo YULE Financial 671.16B 440

431 Trimegah Securities TRIM Financial 646.95B 92

432 Asuransi Ramayana ASRM Financial 617.09B 1,560

433 Minna Padi Investama PADI Financial 565.36B 50

434 Verena Multi Finance VRNA Financial 545.99B 96

435 Cashlez World CASH Financial 529.51B 318

436 Lippo General Insurance LPGI Financial 487.50B 3,230

437 Kioson Komersial KIOS Financial 476.96B 665

438 Bank Pembangunan BEKS Financial 474.41B 74

439 Reliance Securities RELI Financial 468.00B 300

440 Buana Finance BBLD Financial 457.53B 282

441 Majapahit Intiora AKSI Financial 442.80B 700

442 Intan Baruprana Finance IBFN Financial 412.71B 252

443 Panca Global PEGE Financial 354.18B 123

444 Lippo Securities LPPS Financial 325.38B 80

445 Trust Finance Ind TRUS Financial 276.80B 342

446 Pool Advista Finance POLA Financial 261.88B 74

447 Asuransi Jiwa Syariah JMAS Financial 177.00B 192

448 Asuransi Dayin Mitra ASDM Financial 171.84B 895

449 Charnic Capital NICK Financial 169.30B 268

450 Harta Aman Pratama AHAP Financial 164.64B 57

451 Fuji Finance Indonesia FUJI Financial 128.18B 120

452 Victoria Insurance Tbk PT VINS Financial 128.18B 89

453 Asuransi Jasa Tania ASJT Financial 121.20B 216

454 Pool Advista Indonesia POOL Financial 117.07B 50

455 Hd Capital HADE Financial 106.00B 50

456 Asuransi Bintang ASBI Financial 101.73B 296

457 PT First Indo American Leasing FINN Financial 93.01B 50

458 Malacca Trust Wuwungan MTWI Financial 83.92B 57

459 Lancartama Sejati TAMA Financial 75.00B 86

460 Onix Capital OCAP Financial 43.44B 159

461 Kalbe Farma KLBF Healt Care 69.14T 1,560

462 Mitra Keluarga Karyasehat MIKA Healt Care 41.30T 3,150

463 Jamu dan Farmasi Sido SIDO Healt Care 21.73T 770

464 Kimia Farma Persero KAEF Healt Care 17.33T 3,500

465 Medikaloka Hermina HEAL Healt Care 11.91T 4,050

466 Metro Health CARE Healt Care 9.97T 308

467 Indofarma INAF Healt Care 9.30T 3,190

468 Siloam International SILO Healt Care 8.45T 5,250

469 Soho Global SOHO Healt Care 6.09T 5,025

470 Tempo Scan Pacific TSPC Healt Care 5.92T 1,495

471 Enseval Putra EPMT Healt Care 5.90T 2,140

473 Prodia Widyahusada PRDA Healt Care 3.14T 3,380

474 Itama Ranoraya IRRA Healt Care 3.11T 1,860

475 Darya-Varia DVLA Healt Care 2.65T 2,390

476 Sarana Meditama SAME Healt Care 2.14T 382

477 Sejahteraraya SRAJ Healt Care 1.81T 162

478 Merck MERK Healt Care 1.33T 3,160

479 Phapros PEHA Healt Care 1.04T 1,375

480 Royal Prima PRIM Healt Care 739.77B 204

481 Pyridam Farma PYFA Healt Care 486.92B 1,010

482 Multi Indocitra MICE Healt Care 170.47B 288

483 Mustika Ratu MRAT Healt Care 66.77B 158

484 Telkom Indonesia TLKM Service 316.01T 3,240

485 Elang Mahkota EMTK Service 105.23T 2,120

486 Tower Bersama TBIG Service 48.02T 2,350

487 Sarana Menara Nusantara TOWR Service 47.34T 1,025

488 Indoritel Makmur DNET Service 45.96T 3,360

489 Pollux Properti POLL Service 32.94T 3,910

490 Surya Citra Media SCMA Service 32.40T 2,230

491 Sumber Alfaria Trijaya AMRT Service 32.39T 780

492 Indosat ISAT Service 26.84T 5,175

493 Ace Hardware ACES Service 26.74T 1,650

494 XL Axiata EXCL Service 23.96T 2,340

495 Propertindo Mulia MPRO Service 14.81T 1,490

496 Media Nusantara Citra MNCN Service 13.71T 1,085

497 Saratoga Investama SRTG Service 13.36T 5,300

498 Smartfren Telecom FREN Service 13.35T 58

499 Mitra Adiperkasa MAPI Service 12.90T 760

500 Inti Bangun Sejahtera IBST Service 11.99T 8,875

501 MNC Vision Networks IPTV Service 11.62T 276

502 Trikomsel Oke TRIO Service 11.08T 426

503 Plaza Indonesia Realty PLIN Service 8.66T 2,450

504 Mnc Land KPIG Service 8.14T 102

505 Indonesian Paradise INPP Service 7.60T 680

506 Link Net LINK Service 7.57T 3,100

507 Tunas Ridean TURI Service 7.25T 1,320

508 MAP Aktif Adiperkasa MAPA Service 6.87T 2,490

509 Mnc Sky Vision MSKY Service 6.18T 670

510 Midi Utama Indonesia MIDI Service 5.62T 1,900

511 Bintang Oto Global BOGA Service 5.02T 1,330

512 Centratama Telekom CENT Service 4.83T 156

513 Nusantara Properti NATO Service 4.52T 580

514 Ramayana Lestari RALS Service 4.48T 650

515 Fast Food Indonesia FAST Service 4.11T 1,040

516 Hero Supermarket HERO Service 4.00T 945

517 Global Mediacom BMTR Service 3.99T 266

518 Mnc Investama BHIT Service 3.84T 58

519 Super Energy SURE Service 3.29T 2,250

520 MD Pictures FILM Service 3.06T 302

521 Matahari LPPF Service 2.97T 1,150

522 Hotel Sahid Jaya SHID Service 2.93T 2,610

523 Map Boga Adiperkasa MAPB Service 2.91T 1,340

524 Bali Towerindo Sentra BALI Service 2.83T 730

525 Adi Sarana Armada ASSA Service 2.75T 840

526 Graha Layar Prima BLTZ Service 2.61T 3,000

527 Rimo International Lestari RIMO Service 2.25T 50

528 Bakrieland ELTY Service 2.18T 50

529 Batavia Prosperindo Fin BPFI Service 2.14T 1,150

530 PT Sarimelati Kencana PZZA Service 2.05T 715

531 Digital Mediatama Maxima DMMX Service 2.00T 260

532 Jakarta Setiabudi JSPT Service 1.97T 835

533 Sona Topas Tourism SONA Service 1.97T 5,850

534 Intermedia Capital MDIA Service 1.96T 55

535 PT Pelayaran Tamarin TAMU Service 1.88T 50

536 Jasuindo Tiga Perkasa JTPE Service 1.86T 1,215

537 Bakrie Telecom BTEL Service 1.83T 50

538 Surya Fajar Capital SFAN Service 1.71T 1,280

539 Putra Mandiri Jembar PMJS Service 1.71T 118

540 Pollux Investasi POLI Service 1.68T 795

541 MNC Studios MSIN Service 1.65T 178

542 Urban Jakarta Propertindo URBN Service 1.61T 462

543 Roda Vivatex RDTX Service 1.34T 5,200

544 PT Surya Pertiwi SPTO Service 1.26T 500

545 Bali Bintang Sejahtera BOLA Service 1.18T 270

546 Electronic City Ind ECII Service 1.14T 1,120

547 Graha Andrasentra JGLE Service 1.13T 50

548 Hotel Mandarine Regency HOME Service 1.11T 50

549 Multipolar MLPL Service 1.04T 63

550 Jakarta Int Hotels & Dev JIHD Service 1.01T 436

551 Hartadinata Abadi HRTA Service 976.32B 222

552 Gihon Telekom GHON Service 943.25B 1,800

553 Tiphone Mobile TELE Service 884.62B 121

554 Matahari Putra Prima MPPA Service 873.38B 121

555 Cahaya Bintang CBMF Service 843.75B 444

556 Pembangunan Jaya Ancol PJAA Service 840.00B 525

557 Kertas Basuki Rachmat KBRI Service 834.80B 50

558 Visi Media Asia VIVA Service 823.21B 50

559 Marga Abhinaya Abadi MABA Service 768.26B 50

560 Duta Intidaya DAYA Service 760.05B 362

561 Cipta Selera CSMI Service 750.78B 1,110

562 Industri Dan Perdagangan CARS Service 750.00B 50

563 Tifa Finance TIFA Service 744.99B 650

564 Pioneerindo Gourmet PTSP Service 733.08B 3,400

565 First Media KBLV Service 689.90B 400

566 Pikko Land Development RODA Service 679.61B 52

567 Supra Boga Lestari RANC Service 663.34B 434

568 Eureka Prima Jakarta LCGP Service 641.82B 114

569 Mas Murni Indonesia MAMI Service 615.26B 50

570 Indonesia Prima OMRE Service 575.85B 332

571 Arkadia Digital DIGI Service 572.00B 376

572 Pudjiadi & Sons PNSE Service 526.56B 620

573 Red Planet Indonesia Tbk PSKT Service 517.56B 50

574 Royalindo Investa INDO Service 486.94B 121

575 Mahaka Radio MARI Service 483.24B 94

576 Multifiling Mitra MFMI Service 469.70B 605

577 Global Teleshop GLOB Service 466.67B 420

578 Bliss Properti Indonesia POSA Service 419.44B 50

579 Sinergi Megah Internusa NUSA Service 385.00B 50

580 Modern Internasional MDRN Service 381.61B 50

581 Mega Perintis ZONE Service 361.99B 422

582 Diamond Citra DADA Service 358.85B 50

583 Bayu Buana BAYU Service 356.75B 1,060

584 Bukit Uluwatu Villa BUVA Service 340.56B 52

585 PT Jaya Bersama DUCK Service 336.23B 280

586 Anugerah Kagum Karya AKKU Service 322.47B 50

587 Visi Telekomunikasi GOLD Service 303.99B 256

588 Menteng Heritage Realty HRME Service 297.94B 50

589 Berkah Prima Perkasa BLUE Service 296.78B 710

590 Puri Global Sukses PURI Service 296.00B 300

591 Optima Prima OPMS Service 294.00B 306

592 Bhakti Agung Propertindo BAPI Service 279.59B 50

593 Satria Mega Kencana SOTS Service 276.00B 296

594 Destinasi Tirta PDES Service 264.55B 428

595 Bhuwanatala Indah BIPP Service 251.43B 50

596 Mitra Komunikasi Nusantara Tbk PT MKNT Service 250.00B 50

597 Dyandra Media DYAN Service 243.56B 57

598 Jasnita Telekom JAST Service 234.32B 218

599 Eastparc Hotel EAST Service 226.95B 55

600 Shield On Service SOSS Service 212.87B 304

601 Star Pacific LPLI Service 182.33B 78

602 Saraswati Griya Lestari HOTL Service 177.50B 50

603 Tempo Inti Media TMPO Service 176.74B 168

604 Singaraja Putra SINI Service 161.75B 356

605 Mahaka Media ABBA Service 148.78B 62

606 Panorama Sentrawisata PANR Service 136.80B 133

607 Millennium Pharma SDPC Service 133.77B 110

608 Pembangunan Graha PGLI Service 115.17B 206

609 Arthavest ARTA Service 109.88B 276

610 Morenzo Abadi ENZO Service 108.13B 50

611 Forza Land Indonesia FORZ Service 99.20B 50

612 Kota Satu SATU Service 68.75B 50

613 Island Concepts ICON Service 67.56B 66

614 Esta Multi Usaha ESTA Service 65.52B 107

615 Polaris Investama PLAS Service 59.21B 50

616 Hotel Fitra International FITT Service 54.60B 85

617 Fortune Indonesia FORU Service 46.99B 100

618 Metro Realty MTSM Service 36.79B 173

619 Skybee SKYB Service 29.84B 51

620 Yelooo Integra YELO Service 19.00B 50

621 Erajaya Swasembada ERAA Technology 8.59T 2,680

622 Metrodata Electronics MTDL Technology 3.57T 1,515

623 M Cash Integrasi PT MCAS Technology 3.39T 4,250

624 Indosterling TECH Technology 2.99T 2,380

625 Nusantara Voucher DIVA Technology 1.64T 2,300

626 Anabatic Technologies Tbk ATIC Technology 1.62T 680

627 Multipolar Technology MLPT Technology 1.58T 875

628 NFC Indonesia NFCX Technology 1.40T 1,800

629 Astra Graphia ASGR Technology 1.03T 795

630 Sat Nusapersada PTSN Technology 988.47B 196

631 Telefast Indonesia TFAS Technology 796.67B 400

632 Galva Technologies GLVA Technology 567.00B 372

633 Nipress NIPS Technology 461.16B 282

634 Hensel Davest HDIT Technology 420.81B 268

635 Sumi Indo Kabel IKBI Technology 291.31B 228

636 Kabelindo Murni KBLM Technology 232.96B 210

637 Sentral Mitra Informatika LUCK Technology 91.62B 126

638 Envy Technologies ENVY Technology 90.00B 50

639 Limas Indonesia Makmur LMAS Technology 39.39B 50

640 Tourindo Guide PGJO Technology 17.46B 57

641 Transcoal Pacific TCPI Transportation 37.75T 7,600

642 Jasa Marga JSMR Transportation 31.43T 4,540

643 Garuda Indonesia GIAA Transportation 7.35T 320

644 Citra Marga CMNP Transportation 7.06T 1,435

645 Buana Listya Tama BULL Transportation 4.49T 368

646 Indah Prakasa Sentosa INPS Transportation 4.42T 7,200

647 Humpuss HITS Transportation 3.21T 450

648 Garuda Maintenance Facility GMFI Transportation 2.96T 114

649 Blue Bird BIRD Transportation 2.93T 1,245

650 Trada Maritime TRAM Transportation 2.48T 50

651 Nusantara Infra META Transportation 2.39T 161

652 Mega Manunggal Property MMLP Transportation 2.01T 350

653 Rimau Multi CMPP Transportation 1.97T 184

654 Trans Power Marine TPMA Transportation 1.97T 990

655 Jasa Armada Indonesia IPCM Transportation 1.94T 304

656 Satria Antaran Prima SAPX Transportation 1.77T 1,945

657 Sillo Maritime Perdana SHIP Transportation 1.67T 620

658 Nusantara Pelabuhan PORT Transportation 1.31T 520

659 Berlian Laju Tanker Tbk PT BLTA Transportation 1.30T 50

660 Soechi Lines SOCI Transportation 1.24T 214

661 PT Kendaraan Terminal IPCC Transportation 1.09T 595

662 Indonesia Trans & Infr IATA Transportation 953.63B 50

663 Pelita Samudera PSSI Transportation 915.48B 171

664 Batulicin Nusantara BESS Transportation 878.38B 254

665 Samudera Indonesia SMDR Transportation 831.88B 260

666 Putra Rajawali Kencana PURA Transportation 699.85B 114

667 Mitrabahtera Segara MBSS Transportation 682.51B 424

668 Pelayaran Tempuran TMAS Transportation 661.80B 126

669 Krida Jaringan Nusantara KJEN Transportation 475.00B 795

670 Cardig Aero CASS Transportation 467.48B 226

671 Wintermar WINS Transportation 415.82B 100

672 Capitol Nusantara CANI Transportation 328.38B 426

673 Pelayaran Nelly NELY Transportation 324.30B 142

674 Express Transindo TAXI Transportation 307.28B 50

675 Pelayaran Nasional BBRM Transportation 266.77B 50

676 Transkon Jaya TRJA Transportation 261.26B 164

677 Jaya Trishindo HELI Transportation 176.90B 196

678 Dewata Freight DEAL Transportation 155.19B 138

679 Rig Tenders RIGS Transportation 143.75B 244

680 Guna Timur Raya TRUK Transportation 123.54B 280

681 Batavia Prosperindo Trans BPTR Transportation 122.45B 79

682 Steady Safe TBK PT SAFE Transportation 116.88B 187

683 PT Trimuda Nuansa TNCA Transportation 101.19B 232

684 Indo Straits PTIS Transportation 84.73B 156

685 Zebra Nusantara ZBRA Transportation 83.61B 50

686 Prima Globalindo PPGL Transportation 80.25B 118

687 Eka Sari Lorena LRNA Transportation 63.00B 180

688 Sidomulyo Selaras SDMU Transportation 56.76B 50

689 Steadfast Marine KPAL Transportation 53.45B 50

690 Armada Berjaya JAYA Transportation 48.38B 129

691 Weha Transportasi WEHA Transportation 46.98B 60

692 Ictsi Jasa Prima KARW Transportation 38.75B 60

693 Tanah Laut INDX Transportation 21.90B 50

694 Cikarang Listrindo POWR Utilities 11.18T 710

695 Kencana Energi KEEN Utilities 1.09T 322

696 Rukun Raharja RAJA Utilities 714.38B 177

697 Terregra Asia TGRA Utilities 484.00B 180

698 Mitra Energi Persada KOPI Utilities 390.47B 520

699 Sky Energy JSKY Utilities 355.69B 188

700 Meta Epsi MTPS Utilities 248.10B 100

701 Leyand International LAPD Utilities 198.32B 50

702 Megapower Makmur MPOW Utilities 49.84B 53

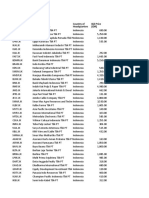

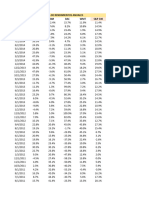

EPS BVPS Liability Equity PER PBV

22.18 1,454.08 22,700,000,000,000 25,930,000,000,000 479.04 7.31

2.40 475.26 64,070,000,000,000 44,380,000,000,000 412.50 2.08

1,045.10 11,642.47 59,350,000,000,000 63,700,000,000,000 13.20 1.19

46.37 787.71 12,040,000,000,000 18,930,000,000,000 56.07 3.30

153.42 3,030.26 3,880,000,000,000 30,110,000,000,000 40.74 2.06

51.95 390.23 5,660,000,000,000 8,550,000,000,000 53.90 7.18

1,075.03 7,406.02 23,390,000,000,000 23,060,000,000,000 13.77 2.00

123.05 1,798.98 6,780,000,000,000 4,460,000,000,000 61.76 4.22

45.68 661.78 11,820,000,000,000 4,930,000,000,000 44.88 3.10

28.17 318.29 41,880,000,000,000 6,160,000,000,000 22.90 2.03

236.30 907.51 749,900,000,000 3,590,000,000,000 11.51 3.00

23.94 307.60 1,200,000,000,000 1,490,000,000,000 58.06 4.52

0.68 121.05 1,440,000,000,000 8,600,000,000,000 123.53 0.69

3.29 198.91 9,230,000,000,000 5,260,000,000,000 68.09 1.13

24.56 833.63 5,110,000,000,000 10,100,000,000,000 14.17 0.42

12.84 1,083.36 3,800,000,000,000 3,320,000,000,000 126.56 1.50

1.46 31.97 595,850,000,000 807,340,000,000 85.62 3.91

8.31 263.36 1,190,000,000,000 664,540,000,000 158.84 5.01

191.26 973.13 503,850,000,000 1,820,000,000,000 7.76 1.53

14.22 232.22 2,790,000,000,000 1,910,000,000,000 24.89 1.52

32.42 528.96 859,490,000,000 1,240,000,000,000 31.15 1.91

41.04 1,913.53 387,830,000,000 1,530,000,000,000 71.39 1.53

10.72 39.60 3,160,000,000,000 1,830,000,000,000 4.66 1.26

1,128.82 15,625.99 727,880,000,000 3,210,000,000,000 8.48 0.61

19.05 144.19 633,190,000,000 738,980,000,000 20.68 2.73

10.19 315.46 436,840,000,000 739,350,000,000 67.71 2.19

30.17 565.97 590,320,000,000 2,270,000,000,000 12.99 0.69

710.36 7,236.54 574,530,000,000 2,770,000,000,000 5.70 0.56

134.95 1,516.25 4,810,000,000,000 2,110,000,000,000 7.41 0.66

71.62 3,873.22 240,260,000,000 2,540,000,000 26.25 0.49

10.06 273.73 928,760,000,000 1,520,000,000,000 22.27 0.82

16.81 225.68 2,770,000,000,000 2,370,000,000,000 7.02 0.52

19.13 841.46 2,110,000,000,000 2,360,000,000,000 18.82 0.43

108.60 905.90 1,220,000,000,000 886,970,000,000 10.64 1.27

12.74 391.67 1,580,000,000,000 252,000,000,000 13.66 0.44

10.93 235.22 748,320,000,000 499,850,000,000 45.01 2.09

108.75 5,078.27 677,170,000,000 767,830,000,000 53.33 1.14

137.94 1,297.08 118,350,000,000 906,370,000,000 8.59 0.91

2.25 268.70 1,690,000,000,000 1,120,000,000,000 92.44 0.77

21.39 144.22 1,830,000,000,000 813,120,000,000 7.25 1.07

22.94 1,431.17 3,590,000,000,000 2,230,000,000,000 21.27 0.34

14.91 87.54 859,740,000,000 809,130,000,000 6.44 1.10

7.67 200.80 936,040,000,000 682,720,000,000 26.08 1.00

52.74 690.18 946,570,000,000 1,460,000,000,000 5.61 0.43

109.39 693.73 477,440,000,000 2,700,000,000,000 1.44 0.23

15.91 332.81 77,750,000,000 842,050,000,000 13.32 0.64

41.77 524.48 358,800,000,000 576,930,000,000 10.63 0.85

103.30 1,982.78 1,110,000,000,000 728,350,000,000 9.78 0.51

6.18 88.22 359,910,000,000 531,060,000,000 8.90 0.62

48.95 597.00 98,220,000,000 580,410,000,000 6.99 0.57

149.67 1,585.99 578,650,000,000 642,330,000,000 5.18 0.49

18.30 758.60 414,670,000,000 1,030,000,000,000 13.22 0.32

2.57 115.53 324,540,000,000 348,810,000,000 37.35 0.83

42.42 1,970.32 1,380,000,000,000 1,340,000,000,000 11.32 0.24

3.32 55.27 185,610,000,000 182,580,000,000 21.99 1.32

1.55 153.79 179,280,000,000 209,570,000,000 135.48 1.37

28.50 201.45 1,050,000,000,000 649,030,000,000 2.95 0.42

129.70 5,724.13 17,580,000,000,000 14,290,000,000,000 0.42 0.01

77.93 57.89 678,280,000,000 77,180,000,000 2.16 2.90

109.61 1,562.86 178,510,000,000 478,760,000,000 7.07 0.50

27.99 235.88 455,290,000,000 119,750,000,000 9.79 1.16

19.62 329.09 123,170,000,000 329,090,000,000 11.42 0.68

21.15 270.40 53,170,000,000 194,690,000,000 14.47 1.13

0.55 41.89 711,710,000,000 75,410,000,000 216.36 2.84

0.16 479.02 1,020,000,000,000 303,500,000,000 2,012.50 0.67

213.00 1,887.23 68,600,000,000 370,130,000,000 4.23 0.48

29.06 71.01 2,460,000,000,000 125,410,000,000 3.06 1.25

291.91 296.13 1,680,000,000,000 180,000,000,000 0.83 0.82

52.71 88.48 659,110,000,000 127,420,000,000 1.84 1.10

0.69 283.86 184,580,000,000 166,910,000,000 388.41 0.94

39.65 257.14 449,110,000,000 259,330,000,000 3.43 0.53

14.74 50.03 349,780,000,000 100,070,000,000 3.39 1.00

7.51 97.29 313,280,000,000 139,930,000,000 8.66 0.67

16.08 860.46 35,850,000,000 284,930,000,000 17.16 0.32

87.69 377.21 875,610,000,000 214,400,000,000 1.64 0.38

3.51 139.30 453,340,000,000 161,480,000,000 21.65 0.55

89.03 185.96 79,470,000,000 28,270,000,000 3.35 1.60

92.42 357.30 1,470,000,000,000 350,000,000,000 0.67 0.17

7.77 66.20 4,760,000,000 39,180,000,000 13.13 1.54

2.17 81.73 25,060,000,000 52,310,000,000 33.18 0.88

51.84 4.53 261,720,000,000 2,010,000,000 0.96 11.04

346.58 5,953.54 44,900,000,000,000 35,310,000,000,000 33.25 1.94

404.48 6,069.94 3,990,000,000,000 22,340,000,000,000 34.86 2.32

280.72 5,856.52 1,990,000,000,000 5,550,000,000,000 101.97 4.89

16.63 357.93 8,810,000,000,000 17,240,000,000,000 31.57 1.47

29.57 1,619.10 26,610,000,000,000 34,280,000,000,000 40.07 0.73

259.02 1,750.94 91,860,000,000,000 23,770,000,000,000 5.79 0.86

16.68 908.59 21,920,000,000,000 16,860,000,000,000 59.95 1.10

7.46 1,802.67 45,260,000,000,000 16,170,000,000,000 268.10 1.11

76.30 962.04 12,880,000,000,000 7,370,000,000,000 23.85 1.89

44.02 440.60 28,850,000,000,000 31,240,000,000,000 4.25 0.42

8.37 117.79 1,300,000,000,000 5,680,000,000,000 26.28 1.87

5.67 2,298.88 39,760,000,000,000 14,250,000,000,000 316.58 0.78

1.13 643.87 15,640,000,000,000 9,290,000,000,000 646.02 1.13

15.12 337.45 2,390,000,000,000 3,350,000,000,000 60.19 2.70

68.06 556.43 3,700,000,000,000 7,650,000,000,000 7.93 0.97

57.79 218.73 8,520,000,000,000 5,770,000,000,000 4.53 1.20

252.13 5,542.45 3,150,000,000,000 10,250,000,000,000 14.95 0.68

3.18 121.15 308,360,000,000 1,280,000,000,000 199.69 5.24

3.97 159.98 1,990,000,000,000 2,610,000,000,000 76.07 1.89

5.76 1,568.91 31,970,000,000,000 5,590,000,000,000 257.81 0.95

192.48 2,704.86 8,840,000,000,000 3,080,000,000,000 22.08 1.57

40.23 165.28 654,020,000,000 1,210,000,000,000 17.28 4.20

1.65 73.59 13,960,000,000,000 4,540,000,000,000 45.45 1.02

1.10 90.23 4,400,000,000,000 8,500,000,000,000 45.45 0.55

2.36 188.19 462,620,000,000 1,870,000,000,000 180.51 2.26

31.57 98.21 248,180,000,000 373,200,000,000 32.63 10.49

0.86 288.19 3,840,000,000,000 6,400,000,000,000 184.88 0.55

66.34 480.45 12,230,000,000,000 9,440,000,000,000 3.32 0.46

25.89 56.42 481,750,000,000 145,010,000,000 56.01 25.70

25.27 485.96 19,540,000,000,000 11,030,000,000,000 6.69 0.35

6.47 156.60 8,210,000,000,000 10,510,000,000,000 7.73 0.32

33.51 523.49 1,870,000,000,000 4,010,000,000,000 12.41 0.79

17.03 290.76 6,320,000,000,000 6,060,000,000,000 9.28 0.54

8.40 380.88 5,950,000,000,000 3,320,000,000,000 42.62 0.94

304.74 4,044.76 3,220,000,000,000 10,840,000,000,000 3.68 0.28

268.78 2,822.49 1,380,000,000,000 2,370,000,000,000 12.05 1.15

156.34 160.35 2,770,000,000,000 1,030,000,000,000 2.37 2.31

153.20 1,093.57 2,060,000,000,000 2,740,000,000,000 5.55 0.78

7.08 187.27 1,180,000,000,000 1,930,000,000,000 30.23 1.14

2.12 271.12 4,390,000,000,000 2,770,000,000,000 99.06 0.77

56.07 895.06 3,560,000,000,000 4,210,000,000,000 8.31 0.52

18.24 226.82 3,360,000,000,000 2,170,000,000,000 11.73 0.94

0.16 230.72 247,060,000,000 627,790,000,000 4,062.50 2.82

5.07 576.26 9,900,000,000,000 5,970,000,000,000 41.42 0.36

138.49 6,901.02 396,240,000,000 700,720,000,000 129.61 2.60

2.74 33.42 1,590,000,000,000 1,110,000,000,000 18.25 1.50

18.13 455.14 5,070,000,000,000 2,030,000,000,000 20.41 0.81

5.03 57.06 185,000,000,000 851,780,000,000 9.94 0.88

14.85 452.07 2,040,000,000,000 4,360,000,000,000 10.30 0.34

7.88 107.21 72,910,000,000 1,010,000,000,000 17.64 1.30

1.50 148.86 224,760,000,000 576,600,000,000 214.67 2.16

9.17 437.99 3,110,000,000,000 3,150,000,000,000 20.50 0.43

2,006.66 6,415.91 5,430,000,000,000 2,780,000,000,000 1.42 0.44

33.50 330.85 1,880,000,000,000 1,130,000,000,000 10.57 1.07

0.43 98.12 56,300,000,000 1,080,000,000,000 241.86 1.06

47.77 444.76 73,460,000,000 390,580,000,000 27.21 2.92

35.34 339.01 1,100,000,000,000 508,510,000,000 21.51 2.24

7.31 545.49 311,710,000,000 782,890,000,000 106.02 1.42

6.57 148.13 125,360,000,000 116,660,000,000 204.72 9.08

2.02 147.81 183,850,000,000 798,550,000,000 87.62 1.20

143.17 469.90 9,740,000,000,000 5,890,000,000,000 0.36 0.11

11.71 907.98 562,110,000,000 7,080,000,000,000 10.85 0.14

35.00 488.28 1,150,000,000,000 1,220,000,000,000 10.23 0.73

3.66 144.09 766,270,000,000 630,130,000,000 46.45 1.18

12.56 1,910.76 3,130,000,000,000 2,530,000,000,000 45.78 0.30

32.21 347.37 128,320,000,000 521,050,000,000 14.59 1.35

5.33 64.40 446,870,000,000 856,880,000,000 9.38 0.78

20.43 215.13 1,490,000,000,000 720,690,000,000 9.20 0.87

13.33 499.22 201,830,000,000 641,500,000,000 39.01 1.04

5.88 178.03 263,600,000,000 497,170,000,000 32.99 1.09

137.21 499.01 693,330,000,000 999,520,000,000 2.04 0.56

124.68 961.77 3,650,000,000,000 3,020,000,000,000 1.59 0.21

67.05 127.39 4,210,000,000,000 430,000,000,000 2.52 1.33

1.27 103.70 69,280,000,000 1,040,000,000,000 39.37 0.48

1.55 108.90 317,860,000,000 1,090,000,000,000 32.26 0.46

1.66 554.44 555,030,000,000 2,650,000,000,000 59.64 0.18

2.10 160.72 407,500,000,000 1,450,000,000,000 23.81 0.31

33.21 35.54 563,690,000,000 34,510,000,000 13.13 12.27

0.10 52.47 4,540,000,000 251,840,000,000 850.00 1.62

3.70 65.28 320,680,000,000 490,500,000,000 13.51 0.77

1.40 130.76 15,160,000,000 130,760,000,000 272.86 2.92

2.10 55.47 73,130,000,000 396,630,000,000 23.81 0.90

0.01 52.60 2,730,000,000 348,890,000,000 5,000.00 0.95

6.28 44.84 230,590,000,000 85,170,000,000 29.14 4.08

1.11 18.37 3,710,000,000 120,560,000,000 45.05 2.72

2.70 232.98 155,010,000,000 511,980,000,000 55.19 0.64

1.17 142.24 142,520,000,000 444,500,000,000 72.65 0.60

6.55 116.20 472,600,000,000 643,890,000,000 7.63 0.43

49.00 162.16 208,310,000,000 175,130,000,000 5.55 1.68

47.89 171.57 1,370,000,000,000 389,880,000,000 2.42 0.68

3.77 249.33 691,830,000,000 1,070,000,000,000 16.18 0.24

3.99 183.19 2,770,000,000,000 892,380,000,000 12.53 0.27

26.02 99.72 204,770,000,000 120,660,000,000 7.69 2.01

0.48 388.14 116,490,000,000 388,140,000,000 458.33 0.57

2.36 30.14 4,510,000,000 37,670,000,000 72.03 5.64

62.82 34.78 1,530,000,000,000 140,000,000,000 0.80 1.44

5.61 131.33 222,490,000,000 101,120,000,000 39.93 1.71

27.49 300.48 197,030,000,000 323,240,000,000 5.97 0.55

5.89 92.12 430,610,000,000 90,360,000,000 27.33 1.75

15.75 215.41 194,520,000,000 572,170,000,000 3.17 0.23

1.40 77.85 30,170,000,000 189,440,000,000 35.71 0.64

3.73 132.28 640,000,000 47,430,000,000 93.83 2.65

77.37 832.02 1,800,000,000,000 492,790,000,000 2.13 0.20

66.09 984.08 218,290,000,000 324,310,000,000 3.54 0.24

6.17 206.93 280,850,000,000 270,460,000,000 9.24 0.28

8.54 177.96 108,720,000,000 214,140,000,000 7.49 0.36

15.34 315.66 422,640,000,000 451,360,000,000 3.72 0.18

30.49 218.63 479,630,000,000 269,100,000,000 1.64 0.23

564.66 377.44 782,160,000,000 380,000,000,000 0.09 0.13

6.09 108.72 29,830,000,000 74,120,000,000 10.34 0.58

5.67 61.32 23,700,000,000 54,530,000,000 8.82 0.82

0.02 117.46 35,370,000,000 78,110,000,000 3,200.00 0.54

81.96 1,122.23 27,420,000,000 107,730,000,000 4.27 0.31

5.26 200.53 10,990,000,000 132,710,000,000 9.51 0.25

15.29 99.34 13,430,000,000 2,070,000,000 3.27 0.50

462.38 4,817.39 146,240,000,000 195,030,000,000 13.03 1.25

28.27 338.43 3,350,000,000,000 3,110,000,000,000 47.75 3.99

16.99 89.15 191,050,000,000 178,310,000,000 270.75 51.60

81.66 450.84 642,050,000,000 260,000,000,000 15.80 2.86

67.20 2,312.27 4,440,000,000,000 11,140,000,000,000 15.40 0.45

71.77 482.63 16,010,000,000,000 9,870,000,000,000 3.07 0.46

40.02 461.07 2,740,000,000,000 2,910,000,000,000 15.24 1.32

155.97 2,328.01 37,350,000,000,000 9,300,000,000,000 6.54 0.44

40.02 1,783.08 11,760,000,000,000 6,210,000,000,000 19.37 0.43

4.21 893.19 284,910,000,000 4,310,000,000,000 107.36 0.51

27.44 6,961.07 752,230,000,000 3,130,000,000,000 182.22 0.72

3.25 1,443.25 2,620,000,000,000 6,440,000,000,000 156.92 0.35

71.78 8,521.72 5,280,000,000,000 5,580,000,000,000 38.31 0.32

63.21 647.45 5,450,000,000,000 4,190,000,000,000 3.04 0.30

0.29 37.66 303,800,000,000 273,050,000,000 520.69 4.01

139.16 398.52 313,650,000,000 518,070,000,000 4.42 1.54

7.96 167.68 107,920,000,000 279,020,000,000 59.80 2.84

4.86 167.46 284,740,000,000 196,080,000,000 115.23 3.34

5.32 162.30 53,090,000,000 405,750,000,000 47.37 1.55

188.19 3,992.63 2,570,000,000,000 1,340,000,000,000 9.25 0.44

209.19 1,751.35 1,137,000,000,000 718,050,000,000 6.74 0.81

2.95 235.30 475,220,000,000 376,490,000,000 117.97 1.48

1.27 103.04 90,350,000,000 494,590,000,000 72.44 0.89

17.37 210.74 166,540,000,000 158,050,000,000 37.13 3.06

16.26 7.28 374,320,000,000 26,230,000,000 7.38 16.48

1.26 45.33 3,950,000,000,000 351,190,000,000 39.68 1.10

2.82 213.27 463,380,000,000 669,990,000,000 37.59 0.50

12.35 166.38 482,280,000,000 300,860,000,000 11.26 0.84

2.17 86.60 383,090,000,000 184,020,000,000 42.40 1.06

6.47 186.18 143,220,000,000 124,370,000,000 58.73 2.04

8.29 907.29 199,860,000,000 471,940,000,000 42.94 0.39

0.30 7.65 17,990,000,000 9,570,000,000 333.33 13.07

1.14 227.69 738,040,000,000 292,930,000,000 100.00 0.50

4.93 95.92 650,680,000,000 193,300,000,000 14.60 0.75

12.65 773.19 1,150,000,000,000 542,040,000,000 11.07 0.18

28.70 736.20 23,720,000,000 312,880,000,000 8.71 0.34

165.79 586.53 1,330,000,000,000 376,380,000,000 0.51 0.14

272.13 385.47 649,250,000,000 77,090,000,000 0.69 0.49

61.29 58.96 196,340,000,000 35,860,000,000 0.82 0.85

5.83 3,274.66 116,650,000,000 246,980,000,000 26.24 0.05

190.07 170.01 14,590,000,000,000 6,490,000,000,000 36.83 41.17

79.22 246.37 16,090,000,000,000 28,660,000,000,000 17.74 5.70

453.08 4,089.29 54,470,000,000,000 47,690,000,000,000 20.97 2.32

185.48 1,343.66 9,210,000,000,000 22,030,000,000,000 32.35 4.47

3,913.35 29,405.09 20,350,000,000,000 56,580,000,000,000 9.98 1.33

92.82 483.62 8,190,000,000,000 10,810,000,000,000 28.44 5.46

569.84 8,572.95 86,260,000,000,000 75,270,000,000,000 11.10 0.74

403.56 10,077.10 8,720,000,000,000 19,400,000,000,000 27.63 1.11

96.90 615.98 1,800,000,000,000 1,300,000,000,000 91.07 14.33

112.37 401.77 942,380,000,000 4,640,000,000,000 13.70 3.83

29.24 969.20 15,430,000,000,000 11,370,000,000,000 48.05 1.45

487.95 1,925.54 785,230,000,000 2,520,000,000,000 19.06 4.83

20.65 215.86 6,730,000,000,000 7,860,000,000,000 14.24 1.36

99.68 3,899.02 20,760,000,000,000 11,200,000,000,000 37.12 0.95

38.29 359.58 2,380,000,000,000 2,650,000,000,000 32.65 3.48

54.14 1,269.49 1,880,000,000,000 8,660,000,000,000 24.38 1.04

37.09 423.58 7,890,000,000,000 4,030,000,000,000 27.77 2.43

26.04 555.45 1,110,000,000,000 4,560,000,000,000 34.95 1.64

27.41 435.67 1,310,000,000,000 2,700,000,000,000 52.54 3.31

523.46 1,620.82 2,150,000,000,000 1,490,000,000,000 14.52 4.69

14.55 1,105.87 18,030,000,000,000 17,490,000,000,000 27.77 0.37

64.10 1,051.84 4,200,000,000,000 4,370,000,000,000 22.54 1.37

20.60 362.12 7,840,000,000,000 3,840,000,000,000 27.43 1.56

10.48 71.49 465,180,000,000 857,880,000,000 47.33 6.94

101.11 1,048.24 14,380,000,000,000 5,600,000,000,000 8.95 0.86

31.38 121.84 11,630,000,000,000 3,840,000,000,000 3.63 0.94

68.19 786.13 447,460,000,000 2,360,000,000,000 16.50 1.43

150.92 1,934.42 2,560,000,000,000 2,760,000,000,000 15.17 1.18

12.45 2,212.62 5,400,000,000,000 4,180,000,000,000 140.56 0.79

117.70 1,217.58 224,800,000,000 974,950,000,000 32.29 3.12

1.54 4.35 5,890,000,000,000 258,870,000,000 32.47 11.49

13.92 179.52 851,120,000,000 638,090,000,000 54.96 4.26

15.97 269.87 242,970,000,000 643,990,000,000 59.49 3.52

16.59 288.63 3,510,000,000,000 1,380,000,000,000 16.40 0.94

44.30 415.33 200,060,000,000 2,960,000,000,000 7.45 0.79

8.90 1,698.61 3,430,000,000,000 5,700,000,000,000 70.22 0.37

105.94 288.00 183,150,000,000 431,990,000,000 13.17 4.84

0.16 62.56 2,020,000,000,000 1,180,000,000,000 631.25 1.61

31.15 707.56 1,450,000,000,000 947,500,000,000 41.57 1.83

467.63 3,758.44 3,960,000,000,000 1,800,000,000,000 7.70 0.96

0.31 10.46 24,530,000,000 351,610,000,000 161.29 4.78

5.17 162.67 132,280,000,000 957,290,000,000 44.87 1.43

43.18 874.56 2,990,000,000,000 1,960,000,000,000 15.52 0.77

499.91 9,196.42 425,950,000,000 1,850,000,000,000 12.70 0.69

11.79 161.21 1,100,000,000,000 805,770,000,000 21.20 1.55

50.76 575.25 359,750,000,000 397,350,000,000 32.11 2.83

258.53 1,995.23 197,600,000,000 1,190,000,000,000 6.94 0.90

69.01 536.02 427,910,000,000 1,130,000,000,000 7.75 1.00

168.13 1,088.87 248,040,000,000 642,320,000,000 9.40 1.45

4.63 573.17 975,640,000,000 447,790,000,000 230.02 1.86

5.02 169.92 728,260,000,000 372,450,000,000 61.35 1.81

41.64 283.01 821,220,000,000 580,170,000,000 7.40 1.09

22.12 179.58 393,500,000,000 227,880,000,000 19.35 2.38

13.39 62.10 40,270,000,000 72,450,000,000 28.83 6.22

8.18 561.25 823,950,000,000 968,720,000,000 43.03 0.63

3.54 30.37 238,960,000,000 283,980,000,000 14.97 1.75

19.21 296.86 210,610,000,000 279,260,000,000 29.15 1.89

6.45 36.52 954,670,000,000 328,680,000,000 7.75 1.37

5.48 284.54 1,660,000,000,000 1,280,000,000,000 17.88 0.34

3.09 111.22 72,140,000,000 111,220,000,000 134.63 3.74

18.78 156.47 12,980,000,000 125,180,000,000 28.22 3.39

79.35 43.35 3,350,000,000,000 163,650,000,000 1.06 1.94

36.24 105.26 996,610,000,000 631,550,000,000 1.38 0.48

4.12 198.29 156,440,000,000 111,090,000,000 120.87 2.51

417.27 2,601.55 15,090,000,000,000 6,500,000,000,000 0.28 0.04

71.95 162.27 529,810,000,000 305,770,000,000 1.83 0.81

50.53 219.05 715,890,000,000 914,520,000,000 0.99 0.23

17.60 204.25 1,850,000,000,000 748,560,000,000 2.84 0.24

5.78 101.76 177,330,000,000 188,990,000,000 11.42 0.65

102.63 142.81 370,130,000,000 152,810,000,000 1.01 0.73

1.14 62.20 5,690,000,000 77,190,000,000 60.53 1.11

2.01 82.77 64,090,000,000 68,970,000,000 49.25 1.20

9.97 106.59 51,400,000,000 69,290,000,000 9.83 0.92

7.90 310.58 71,350,000,000 85,720,000,000 24.81 0.63

2.37 188.40 105,220,000,000 144,700,000,000 23.63 0.30

1,908.16 17,170.06 40,540,000,000,000 64,050,000,000,000 11.83 1.31

645.82 2,678.37 11,330,000,000,000 8,930,000,000,000 22.45 5.41

68.02 1,813.63 38,520,000,000,000 58,010,000,000,000 17.64 0.66

43.70 1,994.68 63,540,000,000,000 48,350,000,000,000 33.64 0.74

200.01 1,439.11 7,930,000,000,000 16,580,000,000,000 12.45 1.73

103.27 810.57 74,570,000,000,000 20,310,000,000,000 6.54 0.83

216.29 936.88 5,870,000,000,000 5,510,000,000,000 11.79 2.72

703.89 11,399.81 4,720,000,000,000 12,880,000,000,000 17.15 1.06

189.36 2,329.05 637,000,000,000 6,300,000,000,000 32.08 2.61

220.99 2,567.43 8,050,000,000,000 10,310,000,000,000 14.66 1.26

687.53 33,476.36 30,890,000,000,000 25,800,000,000,000 17.38 0.36

200.44 2,665.97 35,570,000,000,000 13,890,000,000,000 7.16 0.54

3.85 12.57 602,380,000,000 200,000,000,000 81.04 24.82

40.50 94.36 44,520,000,000,000 6,360,000,000,000 1.56 0.67

187.38 1,052.91 1,010,000,000,000 2,750,000,000,000 8.33 1.48

72.92 555.25 6,770,000,000,000 4,470,000,000,000 6.93 0.91

413.78 1,657.83 643,670,000,000 2,030,000,000,000 6.69 1.67

128.83 806.00 378,210,000,000 1,780,000,000,000 9.94 1.59

13.54 293.34 8,060,000,000,000 4,190,000,000,000 16.99 0.78

34.17 504.43 3,920,000,000,000 3,680,000,000,000 10.71 0.73

8.52 493.84 11,270,000,000,000 4,260,000,000,000 35.45 0.61

11.04 157.31 13,510,000,000,000 5,740,000,000,000 4.53 0.32

38.82 1,240.26 9,620,000,000,000 3,410,000,000,000 18.29 0.57

106.20 236.03 6,610,000,000,000 627,810,000,000 5.84 2.63

256.41 3,170.32 4,340,000,000,000 3,200,000,000,000 7.00 0.57

10.15 1.74 833,930,000,000 15,120,000,000 16.75 97.70

29.89 246.26 404,070,000,000 1,230,000,000,000 10.10 1.23

28.74 147.16 308,090,000,000 244,880,000,000 22.44 4.38

1.10 92.60 4,900,000,000,000 2,300,000,000,000 45.45 0.54

0.81 183.47 4,320,000,000,000 4,010,000,000,000 61.73 0.27

15.14 241.20 172,190,000,000 355,860,000,000 38.64 2.43

80.84 292.36 10,240,000,000,000 3,020,000,000,000 1.32 0.37

67.93 170.55 4,860,000,000,000 511,660,000,000 3.21 1.28

18.31 48.17 875,750,000,000 602,150,000,000 2.73 1.04

172.07 2,658.40 4,130,000,000 2,310,000,000,000 3.81 0.25

45.39 68.80 2,260,000,000,000 620,000,000,000 1.10 0.73

0.98 13.45 1,030,000,000,000 110,000,000,000 51.02 3.72

5.47 179.82 298,950,000,000 566,430,000,000 18.83 0.57

12.40 140.12 1,560,000,000,000 567,420,000,000 4.03 0.36

5.86 54.21 107,540,000,000 214,760,000,000 8.53 0.92

39.11 585.67 839,360,000,000 450,970,000,000 6.29 0.42

49.13 101.28 595,440,000,000 141,790,000,000 2.22 1.08

3.73 241.80 179,550,000,000 598,630,000,000 15.01 0.23

3.80 59.14 6,120,000,000 13,010,000,000 34.21 2.20

3.91 70.16 40,520,000,000 42,100,000,000 12.79 0.71

1,094.44 7,339.22 824,500,000,000,000 179,140,000,000,000 31.07 4.63

151.24 1,620.74 131,189,000,000,000 199,910,000,000,000 28.83 2.69

370.55 4,194.72 1,235,540,000,000,000 193,800,000,000,000 17.47 1.54

308.84 6,055.90 804,020,000,000,000 112,930,000,000,000 19.10 0.97

246.50 3,549.13 79,160,000,000,000 22,600,000,000,000 48.68 3.38

13.11 113.14 511,120,000,000 1,220,000,000,000 541.57 62.75

23.29 858.94 142,670,000,000,000 24,090,000,000,000 98.33 2.67

431.99 2,614.70 93,990,000,000,000 18,210,000,000,000 20.66 3.41

40.64 2,379.50 70,390,000,000,000 16,260,000,000,000 123.03 2.10

201.45 4,499.63 152,650,000,000,000 43,980,000,000,000 14.84 0.66

25.30 555.35 52,270,000,000,000 5,440,000,000,000 103.16 4.70

88.56 726.32 9,930,000,000,000 5,540,000,000,000 40.65 4.96

128.04 1,851.33 171,990,000,000,000 44,590,000,000,000 7.81 0.54

19.23 349.53 150,690,000,000,000 26,640,000,000,000 16.54 0.91

252.70 4,001.19 154,290,000,000,000 32,610,000,000,000 10.92 0.69

98.92 1,594.21 241,630,000,000,000 40,070,000,000,000 9.15 0.57

2.47 142.70 22,870,000,000,000 7,770,000,000,000 144.13 2.49

113.10 1,288.02 168,370,000,000,000 29,550,000,000,000 7.34 0.64

1.59 197.62 23,720,000,000,000 4,220,000,000,000 506.29 4.07

142.42 1,680.25 339,360,000,000,000 17,620,000,000,000 12.22 1.04

162.65 1,134.80 136,420,000,000,000 11,170,000,000,000 9.10 1.30

97.63 642.29 72,440,000,000,000 9,640,000,000,000 7.73 1.18

160.73 3,679.76 6,940,000,000,000 7,730,000,000,000 28.62 1.25

43.48 394.47 10,440,000,000,000 6,300,000,000,000 15.64 1.72

7.47 333.43 31,400,000,000,000 5,760,000,000,000 76.31 1.71

11.71 165.08 3,380,000,000,000 1,940,000,000,000 69.60 4.94

11.93 50.26 586,510,000,000 450,220,000,000 79.21 18.80

1,085.61 7,662.06 24,540,000,000,000 7,660,000,000,000 7.74 1.10

57.04 821.09 3,980,000,000,000 26,290,000,000,000 4.00 0.28

0.53 128.03 12,400,000,000,000 5,090,000,000,000 258.49 1.07

69.92 834.57 10,060,000,000,000 3,410,000,000,000 20.02 1.68

88.70 876.76 1,770,000,000,000 2,320,000,000,000 11.95 1.21

43.46 318.61 69,960,000,000,000 10,360,000,000,000 10.68 1.46

151.94 2,400.68 1,360,000,000,000 1,350,000,000,000 52.32 3.31

2.23 205.68 4,290,000,000,000 1,150,000,000,000 385.65 4.18

84.79 1,085.66 32,270,000,000,000 7,140,000,000,000 7.96 0.62

165.36 2,086.37 1,220,000,000,000 1,300,000,000,000 35.68 2.83

35.91 247.56 72,770,000,000 275,070,000,000 88.83 12.89

0.30 104.36 112,050,000,000 521,790,000,000 2,233.33 6.42

228.44 6,900.38 3,990,000,000,000 28,070,000,000,000 3.59 0.12

14.87 334.76 10,790,000,000,000 1,490,000,000,000 49.76 2.21

15.58 84.04 1,780,000,000,000 348,160,000,000 42.36 7.85

171.91 4,718.78 11,800,000,000,000 8,390,000,000,000 9.57 0.35

11.86 271.92 476,840,000,000 708,470,000,000 120.15 5.24

11.40 229.20 17,600,000,000,000 1,620,000,000,000 33.33 1.66

156.98 3,096.91 2,480,000,000,000 1,600,000,000,000 31.85 1.61

6.98 418.76 20,850,000,000,000 3,620,000,000,000 47.28 0.79

7.57 819.53 2,680,000,000,000 1,130,000,000,000 231.18 2.14

0.86 166.27 3,180,000,000,000 1,110,000,000,000 381.40 1.97

11.66 187.93 6,160,000,000,000 2,100,000,000,000 17.84 1.11

43.21 167.76 17,540,000,000,000 3,430,000,000,000 2.31 0.60

4.42 133.13 2,180,000,000,000 1,070,000,000,000 56.11 1.86

1.41 160.30 19,190,000,000,000 6,020,000,000,000 89.36 0.79

12.53 285.61 7,410,000,000,000 1,270,000,000,000 27.13 1.19

1.99 227.01 3,300,000,000,000 2,020,000,000,000 85.93 0.75

0.35 0.43 873,740,000,000 13,630,000,000 142.86 116.28

0.01 68.26 9,060,000,000,000 1,640,000,000,000 6,900.00 1.01

19.52 149.36 737,070,000,000 2,720,000,000,000 3.94 0.52

0.14 60.31 9,310,000,000,000 1,530,000,000,000 357.14 0.83

0.07 124.03 580,000,000 85,240,000,000 24,071.43 13.59

2.05 208.82 25,190,000,000,000 3,300,000,000,000 34.15 0.34

21.61 378.68 3,070,000,000,000 1,890,000,000,000 10.64 0.61

1.28 305.44 21,550,000,000,000 2,730,000,000,000 91.41 0.38

17.58 648.58 6,550,000,000,000 1,500,000,000,000 24.80 0.67

20.65 1,193.35 6,120,000,000,000 4,750,000,000,000 11.14 0.19

0.72 207.28 3,280,000,000,000 1,550,000,000,000 161.11 0.56

21.54 343.38 5,070,000,000,000 1,200,000,000,000 11.70 0.73

191.18 1,629.84 670,180,000,000 1,170,000,000,000 6.64 0.78

1.59 102.59 3,610,000,000,000 1,150,000,000,000 44.65 0.69

10.98 88.71 335,120,000,000 540,830,000,000 11.66 1.44

3.16 355.32 21,720,000,000,000 3,250,000,000,000 25.95 0.23

48.28 162.59 4,340,000,000 290,220,000,000 9.11 2.71

2.54 117.15 2,060,000,000,000 832,840,000,000 36.22 0.79

218.94 1,567.68 1,280,000,000,000 477,020,000,000 7.13 1.00

10.61 24.64 27,820,000,000 278,660,000,000 4.71 2.03

0.33 110.74 2,070,000,000,000 629,800,000,000 290.91 0.87

5.44 79.46 62,200,000,000 113,470,000,000 58.46 4.00

616.50 5,235.80 1,620,000,000,000 785,370,000,000 5.24 0.62

23.40 127.92 145,830,000,000 91,750,000,000 28.42 5.20

2.87 6.43 5,830,000,000,000 412,070,000,000 25.78 11.51

42.17 283.53 156,430,000,000 510,350,000,000 7.11 1.06

12.72 728.07 3,080,000,000,000 1,200,000,000,000 22.17 0.39

41.61 127.01 132,340,000,000 91,450,000,000 16.82 5.51

44.22 148.31 1,210,000,000,000 225,040,000,000 5.70 1.70

5.06 173.86 14,540,000,000 492,620,000,000 24.31 0.71

18.25 389.35 540,000,000,000 1,010,000,000,000 4.38 0.21

16.00 367.54 30,950,000,000 294,030,000,000 21.38 0.93

3.99 97.87 7,890,000,000 327,800,000,000 18.55 0.76

188.89 113,125.99 102,180,000,000 113,130,000,000 1.02 0.00

57.03 1,704.91 856,850,000,000 327,340,000,000 15.69 0.52

5.24 150.76 1,950,000,000 98,170,000,000 51.15 1.78

3.49 54.10 418,540,000,000 159,040,000,000 16.33 1.05

7.16 110.36 520,000,000 143,470,000,000 16.76 1.09

5.65 124.53 112,330,000,000 181,400,000,000 15.75 0.71

0.59 351.98 167,430,000,000 211,190,000,000 366.10 0.61

32.44 213.34 16,690,000,000 499,510,000,000 1.54 0.23

0.63 6.76 2,260,000,000 14,330,000,000 79.37 7.40

4.76 836.44 554,740,000,000 291,400,000,000 62.18 0.35

48.72 2.79 374,020,000,000 6,110,000,000 1.03 17.92

4.35 88.67 324,420,000,000 135,290,000,000 13.10 0.64

0.58 54.24 119,660,000,000 54,240,000,000 148.28 1.59

100.62 690.70 215,170,000,000 190,000,000,000 1.58 0.23

57.67 381.92 4,550,000,000,000 17,900,000,000,000 27.05 4.08

49.18 354.81 822,410,000,000 5,050,000,000,000 64.05 8.88

28.48 110.16 394,950,000,000 3,300,000,000,000 27.04 6.99

8.93 1,245.10 10,770,000,000,000 6,920,000,000,000 391.94 2.81

117.35 1,048.28 2,700,000,000,000 3,110,000,000,000 34.51 3.86

0.44 98.88 158,700,000,000 3,290,000,000,000 700.00 3.11

8.12 156.83 1,010,000,000,000 486,050,000,000 392.86 20.34

40.02 3,631.45 2,810,000,000,000 5,900,000,000,000 131.18 1.45

157.05 1,726.35 1,600,000,000,000 2,190,000,000,000 32.00 2.91

146.86 1,353.44 2,810,000,000,000 6,090,000,000,000 10.18 1.10

214.80 2,340.64 2,580,000,000,000 6,340,000,000,000 9.96 0.91

173.91 1,779.50 401,620,000,000 1,670,000,000,000 19.44 1.90

29.56 109.12 71,000,000,000 174,600,000,000 62.92 17.05

175.35 1,209.65 553,530,000,000 1,350,000,000,000 13.63 1.98

103.43 94.42 1,270,000,000,000 557,100,000,000 3.69 4.05

6.04 143.44 2,560,000,000,000 1,720,000,000,000 26.82 1.13

163.89 1,334.53 333,880,000,000 597,870,000,000 19.28 2.37

79.38 861.09 1,490,000,000,000 723,310,000,000 17.32 1.60

6.96 256.03 41,830,000,000 868,830,000,000 29.31 0.80

40.17 263.23 77,760,000,000 140,850,000,000 25.14 3.84

9.56 1,118.18 343,780,000,000 670,910,000,000 30.13 0.26

1.87 861.63 197,470,000,000 368,780,000,000 84.49 0.18

224.49 1,190.05 115,330,000,000 117,890,000,000 14.43 2.72

112.62 2,003.45 6,330,000,000,000 11,300,000,000 18.82 1.06

43.99 291.40 27,660,000,000,000 6,600,000,000,000 53.42 8.06

49.68 190.58 23,520,000,000,000 9,720,000,000,000 20.63 5.38

6.77 683.86 6,160,000,000,000 9,700,000,000,000 496.31 4.91

3.79 279.29 3,620,000,000,000 2,320,000,000,000 1,031.66 14.00

82.45 377.10 1,320,000,000,000 5,570,000,000,000 27.05 5.91

20.50 168.50 18,350,000,000,000 7,000,000,000,000 38.05 4.63

112.26 2,445.43 48,550,000,000,000 13,290,000,000,000 46.10 2.12

41.18 283.20 2,090,000,000,000 4,860,000,000,000 40.07 5.83

258.42 1,949.44 47,530,000,000,000 20,870,000,000,000 9.06 1.20

1.04 137.14 415,710,000,000 1,360,000,000,000 1,432.69 10.86

123.11 939.20 4,460,000,000,000 13,970,000,000,000 8.81 1.16

588.99 8,760.33 3,590,000,000,000 23,770,000,000,000 9.00 0.61

9.27 43.59 24,820,000,000,000 10,980,000,000,000 6.26 1.33

48.62 385.48 12,090,000,000,000 6,400,000,000,000 15.63 1.97

85.14 4,610.59 4,280,000,000,000 6,230,000,000,000 104.24 1.92

7.32 175.34 3,400,000,000,000 6,720,000,000,000 37.70 1.57

2.54 144.18 8,850,000,000,000 3,750,000,000,000 167.72 2.95

125.85 3,256.51 1,260,000,000,000 11,560,000,000,000 19.47 0.75

3.08 287.09 5,910,000,000,000 23,150,000,000,000 33.12 0.36

8.81 565.93 1,730,000,000,000 6,330,000,000,000 77.19 1.20

325.47 1,591.99 3,100,000,000,000 3,100,000,000,000 9.52 1.95

30.70 714.34 1,770,000,000,000 3,990,000,000,000 43.00 1.85

51.77 1,007.05 2,870,000,000,000 2,870,000,000,000 48.10 2.47

92.00 1,358.02 1,460,000,000,000 2,710,000,000,000 7.28 0.49

63.59 450.11 4,390,000,000,000 1,300,000,000,000 29.88 4.22

1.17 113.31 135,160,000,000 430,990,000,000 1,136.75 11.74

3.56 80.49 5,580,000,000,000 2,510,000,000,000 43.82 1.94

0.34 100.57 2,260,000,000 804,660,000,000 1,705.88 5.77

17.89 526.49 1,040,000,000,000 3,740,000,000,000 36.33 1.23

99.69 344.10 2,140,000,000,000 1,370,000,000,000 10.43 3.02

108.19 756.85 2,830,000,000,000 3,170,000,000,000 8.73 1.25

60.08 1,198.68 11,600,000,000,000 19,880,000,000,000 4.43 0.22

4.81 441.29 27,190,000,000,000 29,900,000,000,000 12.06 0.13

0.45 83.66 397,770,000,000 125,290,000,000 5,000.00 26.89

6.26 141.43 14,480,000,000 1,350,000,000,000 48.24 2.14

313.06 302.02 6,650,000,000,000 793,150,000,000 3.67 3.81

42.19 803.75 535,450,000,000 899,660,000,000 61.86 3.25

91.14 478.79 1,570,000,000,000 1,040,000,000,000 14.70 2.80

17.02 527.47 2,310,000,000,000 2,080,000,000,000 42.89 1.38

20.09 413.13 3,410,000,000,000 1,400,000,000,000 41.81 2.03

462.34 1,076.49 1,700,000,000,000 94,079,000,000 6.49 2.79

2.27 136.91 569,640,000,000 6,170,000,000,000 22.03 0.37

3.40 199.44 3,550,000,000,000 8,680,000,000,000 14.71 0.25

19.73 472.64 632,040,000,000 842,570,000,000 58.29 2.43

3.81 407.85 1,020,000,000,000 1,230,000,000,000 187.66 1.75

4.30 88.08 109,600,000,000 677,510,000,000 60.47 2.95

89.31 1,287.80 2,520,000,000,000 2,990,000,000,000 9.35 0.65

416.57 2,202.57 236,660,000,000 729,490,000,000 14.04 2.66

4.88 58.78 4,050,000,000,000 2,310,000,000,000 11.27 0.94

0.22 16.21 625,950,000,000 607,770,000,000 227.27 3.08

30.02 434.06 494,150,000,000 743,540,000,000 40.47 2.80

2.18 262.56 9,670,000,000,000 9,670,000,000,000 22.94 0.19

4.08 145.31 66,980,000,000 197,610,000,000 313.73 8.81

3.40 164.87 821,170,000,000 2,270,000,000,000 34.71 0.72

23.21 850.84 795,550,000,000 1,710,000,000,000 34.25 0.93

31.86 289.56 822,250,000,000 1,510,000,000,000 5.59 0.61

0.48 619.77 2,050,000,000,000 2,000,000,000,000 962.50 0.75

912.42 9,986.65 295,220,000,000 2,680,000,000,000 5.70 0.52

35.14 826.73 1,100,000,000,000 1,960,000,000,000 14.23 0.60

4.98 74.54 68,150,000,000 447,230,000,000 54.22 3.62

24.35 966.44 491,440,000,000 1,290,000,000,000 46.00 1.16

3.83 92.84 1,250,000,000,000 2,100,000,000,000 13.05 0.54

0.74 95.36 334,090,000,000 2,120,000,000,000 67.57 0.52

71.59 323.64 12,060,000,000,000 4,740,000,000,000 0.88 0.19

49.88 2,086.94 1,940,000,000,000 4,860,000,000,000 8.74 0.21

38.82 284.17 1,480,000,000,000 1,310,000,000,000 5.72 0.78

143.46 1,285.87 149,090,000,000 707,230,000,000 12.55 1.40

69.68 586.03 4,940,000,000,000 4,280,000,000,000 1.74 0.21

58.86 26.34 4,420,000,000,000 198,280,000,000 2.06 4.59

4.06 133.15 95,640,000,000 249,660,000,000 109.36 3.33

210.11 118.31 2,320,000,000,000 1,900,000,000,000 2.50 4.44

5.18 15.65 876,710,000,000 135,950,000,000 9.65 3.19

80.54 2.74 8,450,000,000,000 45,060,000,000,000 0.62 18.25

17.03 18.48 1,940,000,000,000 283,980,000,000 2.94 2.71

27.74 49.30 548,590,000,000 119,330,000,000 13.05 7.34

46.89 52.77 112,360,000,000 43,060,000,000 23.67 21.03

17.37 106.03 5,220,000,000,000 1,590,000,000,000 2.88 0.47

24.64 361.83 555,380,000,000 390,670,000,000 26.38 1.80

366.60 585.03 203,720,000,000 129,180,000,000 9.27 5.81

44.36 511.60 5,750,000,000,000 891,300,000,000 9.02 0.78

4.78 173.09 1,640,000,000,000 2,350,000,000,000 10.88 0.30

55.34 345.72 689,690,000,000 540,880,000,000 7.84 1.26

1.04 282.55 44,310,000,000 1,590,000,000,000 109.62 0.40

0.04 110.76 373,000,000,000 1,360,000,000,000 1,250.00 0.45

106.00 2,090.01 606,360,000,000 3,650,000,000,000 3.13 0.16

37.90 88.29 19,100,000,000 28,690,000,000 9.92 4.26

62.68 278.49 193,080,000,000 222,180,000,000 9.89 2.23

1.98 37.00 63,170,000,000 382,980,000,000 25.25 1.35

16.64 225.43 2,050,000,000 971,390,000,000 7.27 0.54

3.93 43.31 106,530,000,000 227,500,000,000 23.92 2.17

21.83 198.05 227,140,000,000 150,040,000,000 27.71 3.05

2.47 672.33 758,640,000,000 750,000,000,000 170.04 0.62

10.70 22.96 831,630,000,000 192,610,000,000 4.67 2.18

1.96 97.81 64,770,000,000 753,150,000,000 25.51 0.51

6.12 47.88 960,630,000,000 370,000,000,000 8.17 1.04

45.17 300.34 299,610,000,000 261,350,000,000 9.34 1.41

9.76 42.17 250,990,000,000 302,650,000,000 5.12 1.19

48.72 1,159.64 311,480,000,000 409,610,000,000 21.76 0.91

18.82 281.23 1,760,000,000,000 1,920,000,000,000 2.76 0.18

21.39 719.17 421,650,000,000 922,930,000,000 13.09 0.39

2.44 89.25 359,120,000,000 575,620,000,000 20.49 0.56

11.03 265.18 34,250,000,000 338,710,000,000 23.21 0.97