Professional Documents

Culture Documents

Income Taxation

Uploaded by

Adriana Del rosario0 ratings0% found this document useful (0 votes)

9 views2 pagesOriginal Title

INCOME TAXATION

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesIncome Taxation

Uploaded by

Adriana Del rosarioCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

INCOME TAXATION customs duties and fees (e.g.

Special Duties imposed

by the Bureau of Customs)

1. DEFINITION AND CONCEPTS

5. PRINCIPLES OF A SOUND TAX SYSTEM

2. NATURE AND CHARACTERISTICS

A. Fiscal adequacy- revenue raised must be sufficient to

3. THEORY AND BASIS OF TAXATION

meet govt./public expenditures and other public needs.

A. Lifeblood Theory

B. Administrative feasibility - tax laws must be clear and

B. Necessity

concise; capable of effective and efficient enforcement;

C. Symbiotic Relationship (Benefits-Protection)

convenient as to time and manner of payment, must not

“The power to Tax is the Power to Destroy.”

obstruct business growth and economic development.

4. PURPOSE OF TAXATION:

(BIR rulings/Tax code)

A. Primary - revenue purposes

C. Theoretical Justice - must take consideration the

B. Secondary

taxpayer’s ability to pay (ability to pay theory). art. VI,

i. Promotion of general welfare - taxation may be

Sec. 28(1) of the 1987 Constitution mandates that the rule

used to implement police power (e.g. grant of VAT

on taxation must be uniform and equitable and that the

exemption and discounts to senior citizens)

State evolve a progressive systems of taxation.

ii. Regulation - where taxes are levied on excises or

1. Progressive (the higher tax base, the higher tax

privileges for purposes of rehabilitation and

rate)

stabilization of threatened industry which is affected

2. Regressive (the lower tax base, the higher tax

by public interest or to discourage consumption of

rate)

harmful products (e.g. excise taxes on cigarettes and

3. Proportional (fixed tax rate, ex. VAT 12%)

alcohol, motor vehicle registration fee)

NOTE: Non-observance of fiscal adequacy and

iii. Reduction of social inequality - this is made

administrative feasibility will render the tax measure

possible through the progressive system of taxation

unsound but not unconstitutional. However, non-

where the objective is to prevent the undue

observance of the principle of theoretical justice is invalid

concentration of wealth in the hands of few

because the Constitution itself requires that taxation must

individuals. Progressivity is key-stoned on the

be equitable.

principle that those who are able to pay should

6. ASPECTS OR STAGES OF TAXATION

shoulder the bigger portion of the tax burden (e.g.

A. Levy - the determination by Congress of the subject

income taxation)

and object of taxation as well as the rate. It refers to the

iv. Encouragement of economic growth - tax

enactment of laws or statutes.

incentives and reliefs may be granted to encourage

Subject - taxpayer

investment (I.e. Income Tax Holiday, 5% preferential

1. Individual

Gross Income Tax for PEZA registered entities)

A. Citizen

v. Protectionism - for the protection of local industries,

I. Resident Citizen

in case of foreign importations, protective tariffs and

II. Nonresident

B. Alien

I. Resident Alien

II. Nonresident

A. Nonresident Alien Engaged in Trade and Business

(NRA ETB)

B. Nonresident Alien Not Engaged in Trade and Business

(NRA NETB)

2. Non-individual

A. Corporation

B. Estates/Trust

Object

B. Assessment - is the determination of the correct

amount of taxes that should be paid by the taxpayer; it

may likewise refer to the notice received by the taxpayer

containing a demand for a definite amount to be paid

providing therefor a due date within which to make the

payment.

C. Collection - the enforcement of a previous assessment.

*payment - the act of compliance by the taxpayer,

including such options, schemes or remedies as

may be legally open or available to him.

4. Refund - the taxpayer asks for the restitution of

the money paid as tax which is either excessive or

erroneous.

You might also like

- Financial SystemDocument31 pagesFinancial SystemAdriana Del rosarioNo ratings yet

- Financial Markets and InstitutionsDocument29 pagesFinancial Markets and InstitutionsAdriana Del rosarioNo ratings yet

- Obligations and Contracts: Agabin, P.A., Mestizo: The Story of The Philippine Legal System (2011), Chapter 7, Pp. 169-216Document36 pagesObligations and Contracts: Agabin, P.A., Mestizo: The Story of The Philippine Legal System (2011), Chapter 7, Pp. 169-216Adriana Del rosarioNo ratings yet

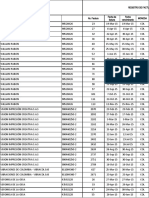

- Payroll Original Feb28 Mar6.Document4 pagesPayroll Original Feb28 Mar6.Adriana Del rosarioNo ratings yet

- Midterm Examination in TaxationDocument13 pagesMidterm Examination in TaxationAdriana Del rosarioNo ratings yet

- Physical Education 4: Lesson 1: Team Sports What Is Team Sports?Document14 pagesPhysical Education 4: Lesson 1: Team Sports What Is Team Sports?Adriana Del rosarioNo ratings yet

- OBLICON ReviewerDocument63 pagesOBLICON ReviewerAdriana Del rosarioNo ratings yet

- ART. 1197 o oDocument27 pagesART. 1197 o oAdriana Del rosarioNo ratings yet

- EXAM Oblicon 1stquiz WansDocument6 pagesEXAM Oblicon 1stquiz WansAdriana Del rosarioNo ratings yet

- CFAS 04 Conceptual Framework - Underlying AssumptionsDocument7 pagesCFAS 04 Conceptual Framework - Underlying AssumptionsAdriana Del rosarioNo ratings yet

- CFAS 01 The Accountancy ProfessionDocument20 pagesCFAS 01 The Accountancy ProfessionAdriana Del rosarioNo ratings yet

- COST - ch2Document3 pagesCOST - ch2Adriana Del rosarioNo ratings yet

- Introduction To Cost Accounting: La Verdad Christian Colleges Cost Accounting First Term SY 2021-2022Document3 pagesIntroduction To Cost Accounting: La Verdad Christian Colleges Cost Accounting First Term SY 2021-2022Adriana Del rosarioNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Unclaimed Dividend FY2009 10Document185 pagesUnclaimed Dividend FY2009 10harsh bangurNo ratings yet

- Quotation: Delivery Address CustomerDocument3 pagesQuotation: Delivery Address Customering.jmatiasNo ratings yet

- Basic - Financial - Plan - Template - With Explanation JeackeecDocument1 pageBasic - Financial - Plan - Template - With Explanation JeackeecfahrianiputNo ratings yet

- Account StatementDocument12 pagesAccount StatementKedar PadhyNo ratings yet

- Dissertation Final SubmitDocument51 pagesDissertation Final SubmitTawheeda MashooqNo ratings yet

- Globalization of ReligionDocument11 pagesGlobalization of ReligionJerica GanNo ratings yet

- BUSA 4800: Airbus Case Study: Boeing PerspectiveDocument15 pagesBUSA 4800: Airbus Case Study: Boeing PerspectiveAntonio BanderasNo ratings yet

- Rightship GHG Emission RatingDocument27 pagesRightship GHG Emission Ratingscribdtaker12345No ratings yet

- Prudential Norms On Income Recognition, Asset ClassificationDocument6 pagesPrudential Norms On Income Recognition, Asset ClassificationsharventhiriNo ratings yet

- Lecture 4-Break Even and Contribution Margin AnalysisDocument13 pagesLecture 4-Break Even and Contribution Margin AnalysisFathurrahman AnwarNo ratings yet

- ANSP ContactsDocument43 pagesANSP Contactsanand krishnaNo ratings yet

- Wa0014.Document4 pagesWa0014.ishangupta8aug2012No ratings yet

- Public Administration: Journal ofDocument208 pagesPublic Administration: Journal ofNonhlanhla MahlaseNo ratings yet

- In Case of Additional Business Line TAXDocument2 pagesIn Case of Additional Business Line TAXdeosa villamonteNo ratings yet

- GSFM7223-Econs eBookExcerpts L1-Chap1Document6 pagesGSFM7223-Econs eBookExcerpts L1-Chap1Yaga KanggaNo ratings yet

- Registro de FacturasDocument1,415 pagesRegistro de FacturasMusicinterworld David CasasNo ratings yet

- Proposal GraceDocument11 pagesProposal GraceEmmanuelNo ratings yet

- Invoice Cum Packing List.: MR - Siba (Sales Manager)Document2 pagesInvoice Cum Packing List.: MR - Siba (Sales Manager)Gopi NarayanasamyNo ratings yet

- MA 1.2-Fundamentals of Managerial AccountingDocument45 pagesMA 1.2-Fundamentals of Managerial Accountingvini2710No ratings yet

- Debre Markos University College of Business and Economics Department of Accounting and FinanceDocument53 pagesDebre Markos University College of Business and Economics Department of Accounting and FinanceEyuel SintayehuNo ratings yet

- Nestle Case Study: BY: - Rajwinder Puri Mayank Talwar Rohan Kir Partha Sarthi Rout Anshul Chabra Mba 1 Year, Section - ADocument10 pagesNestle Case Study: BY: - Rajwinder Puri Mayank Talwar Rohan Kir Partha Sarthi Rout Anshul Chabra Mba 1 Year, Section - APartha Sarathi RoutNo ratings yet

- Commodities Market Module Workbook-Revised W.E.F Sep 09, 2019 PDFDocument188 pagesCommodities Market Module Workbook-Revised W.E.F Sep 09, 2019 PDFhimanshuNo ratings yet

- Apc 301 Week 8Document2 pagesApc 301 Week 8Angel Lourdie Lyn HosenillaNo ratings yet

- Vestian Insights HyderabadDocument3 pagesVestian Insights Hyderabadsridhar chennuNo ratings yet

- AA133.AUDIL II Question CMA May 2022 ExaminationDocument7 pagesAA133.AUDIL II Question CMA May 2022 Examinationkm nafizNo ratings yet

- SEBL Sunflower Jan To 20th AugDocument2 pagesSEBL Sunflower Jan To 20th AugDeco DewNo ratings yet

- Builder Hoist OperationDocument2 pagesBuilder Hoist OperationDhananjai TiwariNo ratings yet

- TCW Course Pack W3Document17 pagesTCW Course Pack W3Kyla Artuz Dela CruzNo ratings yet

- Development Studies-Notes & Revision Questions Module 1-4Document164 pagesDevelopment Studies-Notes & Revision Questions Module 1-4laone sephiri100% (1)

- Investing 101Document27 pagesInvesting 101KaramSoftNo ratings yet