Professional Documents

Culture Documents

A Review On Data Mining in Banking Sector

Uploaded by

nhlOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Review On Data Mining in Banking Sector

Uploaded by

nhlCopyright:

Available Formats

American Journal of Applied Sciences 10 (10): 1160-1165, 2013

ISSN: 1546-9239

©2013 Science Publication

doi:10.3844/ajassp.2013.1160.1165 Published Online 10 (10) 2013 (http://www.thescipub.com/ajas.toc)

A REVIEW ON DATA MINING IN BANKING SECTOR

Vikas Jayasree and Rethnamoney Vijayalakshmi Siva Balan

Department of Computer Application,

Noorul Islam University, Kumaracoil, Thuckalay, Kanyakumari (Dt), Tamil Nadu, India

Received 2013-03-09, Revised 2013-05-16; Accepted 2013-08-26

ABSTRACT

The banking industry has undergone various changes in the way they conduct the business and focus on

modern technologies to compete the market. The banking industry has started realizing the importance of

creating the knowledge base and its utilization for the benefits of the bank in the area of strategic

planning to survive in the competitive market. In the modern era, the technologies are advanced and it

facilitates to generate, capture and store data are increased enormously. Data is the most valuable asset,

especially in financial industries. The value of this asset can be evaluated only if the organization can

extract the valuable knowledge hidden in raw data. The increase in the huge volume of data as a part of

day to day operations and through other internal and external sources, forces information technology

industries to use technologies like data mining to transform knowledge from data. Data mining

technology provides the facility to access the right information at the right time from huge volumes of

raw data. Banking industries adopt the data mining technologies in various areas especially in customer

segmentation and profitability, Predictions on Prices/Values of different investment products, money

market business, fraudulent transaction detections, risk predictions, default prediction on pricing. It is a

valuable tool which identifies potentially useful information from large amount of data, from which

organization can gain a clear advantage over its competitors. This study shows the significance of data

mining technologies and its advantages in the banking and financial sectors.

Keywords: Data Mining, Banking Sector, Fraud Detection, Risk Management, Customer Relationship

Management

1. INTRODUCTION Data Mining is the process of extracting hidden,

unknown, valid and actionable information from large

The introduction of modern technologies made databases and then using this information to make

drastic changes in banking business. The new crucial business decisions. Previously unknown means

generation banks with new banking technology and quantities that are not hypothesized in advance, valid

their approaches towards their business, forced other means if a large collection of data is scrutinized;

traditional banks to adopt or allocate more focus on patterns are not there may be found, Actionable means

new technologies. To improve the financial Action that must be translated into some business

performance and customer relationship, financial advantage (Han et al., 2011). Data mining is the

organizations started using web and other electronic application of statistical and machine-learning

channels to process applications for various products, techniques for extracting interesting patterns from raw

which reduces time and cost. World Wide Web, data (Hsu et al., 2012). Data Mining referred as

Electronic and Automated soft-wares have completely knowledge mining from data or knowledge extraction

changed the basic concepts of banking business and or data/pattern analysis or data archeology or data

way the business operations are being carried out. dredging. It turns a large collection of data into

Corresponding Author: Vikas Jayasree, Department of Computer Application, Noorul Islam University, Kumaracoil,

Thuckalay, Kanyakumari (Dt), Tamil Nadu, India

Science Publications 1160 AJAS

Vikas Jayasree and R.V. Siva Balan / American Journal of Applied Sciences 10 (10): 1160-1165, 2013

knowledge (Witten et al., 2011; Liao et al., 2012). With measures (Kontonasios et al., 2012; Wikum et al.,

the mounting growth of data in every application, data 2009)

mining meets the valuable and efficient requirements for • Representation. The step on which discovered

effective, scalable and flexible data analysis. knowledge visually represents. Visualization

Data Mining is the process of identifying and techniques (Herawan and Deris, 2011) are more

discovering the interesting patterns from massive amount effective in understanding the output for end users

of data (Mabroukeh and Ezeife, 2010). Data Mining can

be conducted on any kind of data as long as the data are Data Mining encompasses many different

meaningful for a target application. Data Mining can be techniques and algorithms. These differ in the kinds of

considered as a natural evaluation of information data that can be analyzed and the kinds of knowledge

technology and a confluence of several related disciplines representation used to convey the discovered

and application domains. (Blake and Mangiameli, 2011) knowledge (Mabroukeh and Ezeife, 2010).

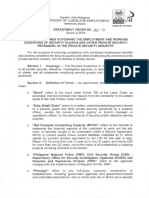

The knowledge Discovery process, depicts as Fig. 1,

1.1. Application of Data Mining in Banking Sector

consists of following steps which describes how

unprocessed data converts into meaningful information There are various areas in which data mining can

(Bhambri, 2011; Chen et al., 2009): be used in financial sectors (Ramageri and Desai,

2013; Moradi et al., 2013; Moin and Ahmed, 2012;

• Data Selection. In this step, identifies the location Hammawa, 2011) like customer segmentation and

of the data and relevance of the data for the

profitability, credit analysis, predicting payment default,

business objectives. Because of electronic data are

so pervasive, the quality of data plays a critical role marketing, fraudulent transactions, ranking investments,

in all business and governmental applications optimizing stock portfolios, cash management and

(Batini et al., 2009; Yap et al., 2011) forecasting operations, high risk loan applicants, most

• Data Preparation. Once the data and its location are profitable Credit Card Customers and Cross Selling. Certain

identified, data cleaning and integration is done in this examples where banking industry has been utilizing the data

step. In Data Cleaning, noise data and irrelevant data mining technology effectively as follows.

are removed from the collected data. In Data

Integration, different data sources are combined in 1.2. Fraud Detection

a common source. Data quality is a major Fraud detection (Delamaire et al., 2009;

challenge in data mining (Blake and Mangiameli, Ravisankar et al., 2011; Raj and Portia, 2011; Wang et al.,

2011; Petry and Zhao, 2009) Data analysis underlies 2009; Petry and Zhao, 2009; Hu and Liao, 2011) is the

many computing applications as a part of their on-line recognition of symptoms of fraud where no prior

operations or in the design phase. Data analysis suspicion or tendency to fraud exists. According to The

procedures can be classified as either exploratory or American Heritage dictionary, second college edition,

confirmatory, based on the availability of existing and fraud is defined as ‘a deception deliberately practiced in

appropriate models for the data source, but the main order to secure unfair of unlawful gain.

point of interest in both types of procedures (whether Fraud detection refers to detection of criminal

for hypothesis formation or decision-making) is the

activities occurring in commercial organizations such as

grouping, clustering or classification of measurements

banks, credit card issuing organizations, insurance

based on either (i) goodness-of-fit to a postulated

model, or (ii) natural groupings (clustering) revealed agencies, mobile companies, stock market. The

through analysis (Shinde, 2012) malicious users might be the actual customers of the

• Fung et al. (2010) Data Transformation. In this organization or might be posing as a customer (also

step, the selected data is transformed into the known as identity theft) (Changdola et al., 2009).

form appropriate for the input of data mining Financial Organizations especially banking sectors

process (Han et al., 2011; Moin and Ahmed, follows mainly two approaches (Ramageri and Desai,

2012; Prakash et al., 2012) 2013; Moin and Ahmed, 2012) towards determining the

• Data Mining. This is the vital step on which fraud patterns, online transaction check and Offline

effective algorithms (Bhambri, 2011; Hsu et al., transaction Check. For this purpose, the institutions

2012) and techniques applied to process the data purchase and maintain data warehouses of sanctions

into potentially useful patterns to achieve business and Politically Exposed Persons data files from

objectives (Hammawa, 2011; Batini et al., 2009) Compliance and Anti Money Laundering solution and

• Evaluation. Patterns (Tremblay et al., 2010) data providers like The Office of Foreign Assets

representing knowledge are identified based on given Control (OFAC) of the US.

Science Publications 1161 AJAS

Vikas Jayasree and R.V. Siva Balan / American Journal of Applied Sciences 10 (10): 1160-1165, 2013

Fig. 1. Data mining as a step in the process of knowledge discovery

Department Treasury, World Check and update upon the the existing customers and find the products which they

changes in external data files. Data mining plays important are interested (Petry and Zhao, 2009) and how can they

role in the fraud detection from the transaction data towards market a another product in association with the

external data ware houses. The regulators define certain existing one. They can use DM techniques to analyze

rules for finding the fraud transaction patterns and data the past trends, find the current demands and predict

mining process can be applied with different techniques to the customer behavior of various products and services

show the desired fraudulent patterns as output. in order to attain more business opportunities, there by

Regulatory authorities like Financial Action Task Force establishing or maintaining their position highest in the

(FATAF), Financial Market Supervisory Authority market (Bhattacharya et al., 2011). Part of maintaining

(FINMA), Financial Services Authority (FSA), Hong Kong a highest position in the competitive market, financial

Monitory Authority (KKMA), Reserve Bank of India (RBI) institution are focusing on promoting unique products with

set standard and requests financial organizations to produce high quality service (Abdullah and Titus, 2010) and its

different reports on regular basis. System can be accessed trend analysis can be done by data mining techniques.

different data sources and preparing reports based on Data mining techniques helps strategic planning

combinations of data mining techniques (Handl and department to cluster their customers in different buckets

Knowles, 2012; Poovammal and Ponnavaiko, 2009; like highly potential, good, low and the periodic evaluation

Wang and Dong, 2009; Issam, 2012; Tremblay et al., on them and thereby providing better service to appropriate

2010; Akbar et al., 2010; Herawan and Deris, 2011; clusters (Li et al., 2010). Data mining techniques can be

Petry and Zhao, 2009) like classifying, clustering, used to identify the customer’s reaction on adjustment in

segmentation, association rules, sequencing, regression, interest rates on deposit and borrowing products and its

pattern analysis and decision trees. installment changes (Sergio et al., 2011).

Data Mining can improve telemarketing and

1.3. Marketing electronic marketing (Hu and Liao, 2011) by identifying

Most widely used area of data mining in banking potential customers who are adhere to modern

technology (Ramageri and Desai, 2013; Wang and Dong, technologies like web, smart phone. In the areas of e-

2009; Hammawa, 2011; Sergio et al., 2011; Bhambri, Banking (Aburrous et al., 2009) and other web services

2011) is commercial and consumer product marketing. used for banking can use another algorithm called

Sales and Marketing department of Financial sequence pattern-mining effectively. A sequential

organizations can use data mining algorithm, to analyze pattern-mining algorithm mines the sequence database

Science Publications 1162 AJAS

Vikas Jayasree and R.V. Siva Balan / American Journal of Applied Sciences 10 (10): 1160-1165, 2013

looking for repeating patterns (Mimno, 2012) (known as 1.5. Customer Relationship Management

frequent sequences) that can be used later by end users or

management to find associations between the different Data Mining can be useful in all three phases of

customer relationship cycle: Customer Acquisition, Increase

items or events in their data (Abdullah and Titus, 2010).

Value of the customer and Customer Retention

1.4. Risk Management (Prakash et al., 2012; Ping and Liang, 2010). Financial

organizations especially banking sector recruits

Data Mining is used to identify the risk factors in each Relationship Managers or team of executives to pay proper

department of banking business (Moradi et al., 2013). attention to their customers. Due to the tight competition

Credit Approval authorities in the financial organization exists in the market (Sergio et al., 2011; Wang et al., 2009;

used data mining techniques to determine the risk factors Chen et al., 2009), customers will always with banks which

in lending decisions (Chen et al., 2009; Chen and Huang, provide better facility and more secured transaction option.

2011) by analyzing the data based on nationality, Data Mining techniques (Prakash et al., 2012; Wikum et al.,

repayment capacity and so on. Retail marketing 2009) can be used to determine the list of customers as

department uses data mining methodologies to find the per the set of definitions (Sergio et al., 2011; Wang et al.,

reliability (Yap et al., 2011) and the behavior of credit card 2009; Corne et al., 2012) and interest and the institution

applicant (Delamaire et al., 2009) while selling the credit can offer better facilities to them (Abdullah and Titus,

cards. They uses data mining techniques on existing 2010) customers are varying from their approach in

customers to sell credit cards or increase customers credits banking, like certain customers interested only electronic

or top up on credit card loans (Bhattacharya et al., 2011). banking while others want banking through the counter.

In commercial lending, data mining plays a vital role. In Classifying such customers can easily done using data

commercial lending, risk assessment is usually an attempt mining techniques and provide better facilities.

to quantify the risk of default or loss to the lender when Data mining can be used to find out customers holding

one product (Wu and Chou, 2011) having interest in similar

making a particular lending decision or approving a credit

to other one, there by promoting the product which benefits

facility (Chen and Huang, 2011).

the organization. Not only can data mining help the banking

Here credit risk can be quantified by the changes in the

industry to gain new customers, it can also helps to maintain

value of a credit products or of a whole credit customer

the existing customers with better service (Tremblay et al.,

portfolios, which is based on changes in the high risk

2010; Kontonasios et al., 2012; Liu et al., 2012).

tendency, default probability, instrument’s rating and

Within the context of Customer Relationship

recovery rate (Yap et al., 2011; Ravisankar et al., 2011;

Management (CRM), data mining can be seen as a

Liu et al., 2012) of the instrument in case of default. The

business driven process aimed at the discovery and

major part of implementation and care of credit risk

consistent use of profitable knowledge from

management system (Raj and Portia, 2011) will be a typical

organizational data (Wu and Chou, 2011). It can be used

data mining problem: the modeling of the credit

to fasten the decision making and guide to forecast the

instrument’s value through the default probabilities,

effects of decisions (Prakash et al., 2012). Data Mining

recovery rates and rating migrations (Fung et al., 2010).

can be used to increase the response rate of marketing

Data Mining can be used to derive credit behavior

campaign. This can be done by segmenting the customers

(Delamaire et al., 2009) of individual borrowers with

into groups with their needs and characteristics, it can

parameters card loans, mortgage value, repayment and

predict how likely an existing customer is to take the

using characteristics such as history of credit, employment

business to a competitor (Mimno, 2012). Each of the

period and length of residency. A score is thus produced

CRM elements can be supported by different data mining

that allow a lender to evaluate the customer and decide

models (Vaillancourt, 2010; Abdullah and Titus, 2010;

whether the person is a good candidate for a loan, or if

Herawan and Deris, 2011; Akbar et al., 2010; Shinde,

there is a tendency to become high risk of default (Raj and

2012; Delamaire et al., 2009) which generally include

Portia, 2011). Customers who have been with bank for a

classification, association, sequence discovery, clustering,

longer periods of time, remained better with bank and

regression, forecasting and visualization.

have good credit history and have higher salaries/wages,

are more likely to receive a loan than a new customer who 2. CONCLUSION

has no credit history with the bank, or who earns low

salaries/wages (Ravisankar et al., 2011). Bank can reduce Data Mining is a tool and techniques used to extract

the risk factors to maintain a better position by knowing meaningful information from the collected data, enables

the chances of a customer to become default (Dorr and financial institutions to make better decision-making

Anne, 2009; Tsai, 2012). process. Data Collections are in the form of maintaining

Science Publications 1163 AJAS

Vikas Jayasree and R.V. Siva Balan / American Journal of Applied Sciences 10 (10): 1160-1165, 2013

proper ware housing based on different databases and Corne, D., D. Clarisse and J. Laetitia, 2012. Synergies

other related sources like files into a acceptable data between operations research and data mining: The

format which becomes the input for data mining process. emerging use of multi-objective approaches. Eur. J.

Based on the standard or rules set by the organization Operat. Res., 221: 469-479. DOI:

and regulatory authorities, data mining tool extract the 10.1016/j.ejor.2012.03.039

knowledge based on the rule set and throws the output in Delamaire, L., A. Hussein and P. John, 2009. Credit card

visual tools, thereby making end user life easy to make fraud and detection techniques: A review. Banks

decisions properly. Banks and Financial organizations Bank Syst., 4: 57-68.

started allocating funds and time for implementing data Dorr, D.M. and M.D. Anne, 2009. Establishing

mining tools in the area of decision making by realizing relationships among patterns in stock market data.

the necessity of data mining in their system. Data Knowl. Eng., 68: 318-337. DOI:

10.1016/j.datak.2008.10.001

3. REFERENCES Fung, B.C.M., K. Wang, R. Chen and P.S. Yu, 2010.

Privacy-preserving data publishing: A survey of

Abdullah, Z. and H. Titus, 2010. Mining significant least recent developments. ACM Comput. Surveys. DOI:

association rules using fast SLP-growth algorithm. 10.1145/1749603.1749605

Adv. Comput. Sci. Inform. Technol., 6059: 324-336. Hammawa, M.B., 2011. Data mining for banking and

DOI: 10.1007/978-3-642-13577-4_28 finance. Oriental J. Comput. Sci. Technol., 4: 273-

Aburrous, M., M.A. Hussain, K. Dahal and F. Thabatah, 280.

2009. Modelling intelligent phishing detection Han, J., M. Kamber and J. Pie, 2011. Data Mining

system for e-banking using fuzzy data mining.

Concepts and Techniques. 3rd Edn., Elsevier,

Proceedings of the International Conference on

Burlington, ISBN-10: 9780123814807, pp: 744.

Cyber Worlds, Sept. 7-11, IEEE Xplore Press,

Handl, J. and J. Knowles, 2012. Clustering criteria in

Bradford, pp: 265-272. DOI: 10.1109/CW.2009.43

multiobjective data clustering. Parallel Problem

Akbar, S., K.N. Rao and J.A. Chandulal, 2010. Intrusion

detection system methodologies based on data Solving Nat., 7492: 32-41. DOI: 10.1007/978-3-

analysis. Int. J. Comput. Applic., 5: 10-20. DOI: 642-32964-7_4

10.5120/892-1266 Herawan, T. and M.M. Deris, 2011. A soft set approach

Batini, C., C. Cappiello, C. Francalanci and A. Maurino, for association rules mining. Knowl.-Based Syst.,

2009. Methodologies for data quality assessment 24: 186-195. DOI: 10.1016/j.knosys.2010.08.005

and improvement. ACM Comput. Surveys. DOI: Hsu, F.M., L.P. Lu and C.M. Lin, 2012. Segmenting

10.1145/1541880.1541883 customers by transaction data with concept

Bhambri, V., 2011. Application of data mining in hierarchy. Expert Syst. Applic., 39: 6221-6228. DOI:

banking sector. IJCST, 2: 199-202. 10.1016/j.eswa.2011.12.005

Bhattacharya, S., S. Jha, K. Tharakunnel and J.C. Hu, Y.C. and P.C. Liao, 2011. Finding critical criteria of

Westland, 2011. Data mining for credit card fraud: A evaluating electronic service quality of internet

comparative study. Decision Support Syst., 50: 602- banking using fuzzy multiple-criteria decision

613. DOI: 10.1016/j.dss.2010.08.008 making. Applied Soft Comput., 11: 3764-3770. DOI:

Blake, R. and P. Mangiameli, 2011. The effects and 10.1016/j.asoc.2011.02.008

interactions of data quality and problem complexity Issam, A.R.M., 2012. Incremental dependency aided

on classification. J. Data Inform. Q. DOI: metapattern generator. Malaysian J. Comput. Sci.,

10.1145/1891879.1891881 25: 149-163.

Changdola, V., A. Banerjee and V. Kumar, 2009. Kontonasios, K.N., E. Spyropoulou and T.D. Bie, 2012.

Anomaly detection: A survey. ACM Comput. Knowledge discovery interestingness measures

Surveys, 9: 1-72. based on unexpectedness. Wiley Interdisciplinary

Chen, I., L. Chi-Jie, L. Tian-Shyug and L. Chung-Ta, 2009. Rev.: Data Min. Knowl. Discovery, 2: 386-399.

Behavioral scoring model for bank customers using DOI: 10.1002/widm.1063

data envelopment analysis. Stud. Comput. Intell., 214: Li, W., X. Wu, Y. Sun and Q. Zhang, 2010. Credit card

99-104. DOI: 10.1007/978-3-540-92814-0_16 customer segmentation and target marketing based

Chen, S.C. and M.Y. Huang, 2011. Constructing credit on data mining. Proceedings of the International

auditing and control and management model with Conference on IEEE Computational Intelligence and

data mining technique. Expert Syst. Applic., 38: Security (CIS), Dec. 11-14, IEEE Xplore Press,

5359-5365. DOI: 10.1016/j.eswa.2010.10.020 Nanning, pp: 73-76. DOI: 10.1109/CIS.2010.23

Science Publications 1164 AJAS

Vikas Jayasree and R.V. Siva Balan / American Journal of Applied Sciences 10 (10): 1160-1165, 2013

Liao, S.H., P.H. Chu and P.Y. Hsiao, 2012. Data mining Sergio, M., R. Laureano and C. Paulo, 2011 Using data

techniques and applications-A decade review from mining for bank direct marketing: An application of

2000 to 2011. Expert Syst. Applic., 39: 11303- the CRISP-DM methodology. Proceedings of the

11311. DOI: 10.1016/j.eswa.2012.02.063 European Simulation and Modelling Conference,

Liu, B., Y. Li and Y.C. Tian, 2012. Discovering novel (ESMC’ 11), Guimarães, Portugal, pp: 117-121.

knowledge using granule mining. Rough Sets Curr. Shinde, P., 2012. Data mining using artificial neural

Trends Comput., 7413: 380-387. DOI: 10.1007/978- network tree. IOSR J. Eng.

3-642-32115-3_45 Tremblay, M.C., K. Dutta and D. Vandermeer, 2010.

Mabroukeh, N.R. and C.I. Ezeife, 2010. A taxonomy of Using data mining techniques to discover bias

sequential pattern mining algorithms. ACM Comput. patterns in missing data. J. Data Inform. Q., 2: 1-19.

Surveys. DOI: 10.1145/1824795.1824798 DOI: 10.1145/1805286.1805288

Mimno, D., 2012. Computational historiography: Data Tsai, H.H., 2012. Global data mining: An empirical study

mining in a century of classics journals. J. Comput. of current trends, future forecasts and technology

Cultural Heritage. diffusions. Expert Syst. Applic., 39: 8172-8181.

Moin, K.I. and Q.B. Ahmed, 2012. Use of data mining in DOI: 10.1016/j.eswa.2012.01.150

banking. Int. J. Eng. Res. Applic., 2: 738-742. Vaillancourt, J., 2010. Statistical methods for data

Moradi, M., M. Salehi, M.E. Ghorgani and H.S. Yazdi, mining and knowledge discovery. Proceedings of the

2013. Financial distress prediction of Iranian 8th International Conference on Formal Concept

companies by using data mining techniques. Analysis, Mar. 15-18, Springer Berlin Heidelberg,

Organizacija, 46: 20-27. Agadir, Morocco, pp: 51-60. DOI: 10.1007/978-3-

Petry, F.E. and L. Zhao, 2009. Data mining by attribute 642-11928-6_4

generalization with fuzzy hierarchies in fuzzy Wang, G., G. Nie, P. Zhang and Y. Shi, 2009. Personal

databases. Fuzzy Sets Syst., 160: 2206-2223. DOI: financial market segmentation based on clustering

10.1016/j.fss.2009.02.014 ensembles. Proceedings of the WRI World Congress

Ping, Z.L. and S.Q. Liang, 2010. Data mining on Computer Science and Information Engineering,

application in banking-customer relationship Mar. 31-Apr. 2, IEEE Xplore Press, Los Angeles,

management. Proceedings of the IEEE International CA., pp: 694-698. DOI: 10.1109/CSIE.2009.741

Conference on Computer Application and System Wang, X. and G. Dong, 2009. Research on money

Modelling, Oct. 22-24, IEEE Xplore Press, Taiyuan, laundering detection based on improved minimum

pp: 124-126. DOI: 10.1109/ICCASM.2010.5619002 spanning tree clustering and its application. Knowl.

Poovammal, E. and M. Ponnavaiko, 2009. An improved Acquisit. Model., 2: 62-64. DOI:

method for privacy preserving data mining. 10.1109/KAM.2009.221

Proceedings of the IEEE International Advance Wikum, G., G. Kasneci, M. Ramanath and F. Suchanek,

Computing Conference, Mar. 6-7, IEEE Xplore 2009. Database and information-retrieval methods

Press, Patiala, pp: 1453-1458. DOI: for knowledge discovery. Mag. Commun. ACM, 52:

10.1109/IADCC.2009.4809231 56-64. DOI: 10.1145/1498765.1498784

Prakash, B.V.A., D.V. Ashoka and V.N.M. Aradhya, Witten, I.H., E. Frank and M.A. Hall, 2011. Data

2012. Application of data mining techniques for Mining: Practical Machine Learning Tools and

software reuse process. Proc. Technol., 4: 384-389. Techniques. 3rd Edn., Morgan Kaufmann, ISBN-10:

DOI: 10.1016/j.protcy.2012.05.059 0123748569, pp: 664.

Raj, S.B.E. and A.A. Portia, 2011. Analysis on credit Wu, R.S. and P.H. Chou, 2011. Customer segmentation

card fraud detection methods. Proceedings of the of multiple category data in e-commerce using a

International Conference on Computer soft-clustering approach. Elect. Commerce Res.

Communication and Electrical Technology, Mar. 18- Applic., 10: 331-341. DOI:

19, IEEE Xplore Press, Tamilnadu, pp: 152-156. 10.1016/j.elerap.2010.11.002

DOI: 10.1109/ICCCET.2011.5762457 Yap, B.W., S.H. Ong and N.H.M. Hussain, 2011. Using

Ramageri, B.M. and B.L. Desai, 2013 Role of data data mining to improve assessment of credit

mining in retail sector. Int. J. Comput. Sci. Eng., 5. worthiness via credit scoring models. Expert Syst.

Ravisankar, P., V. Ravi, G.R. Rao and I. Bose, 2011. Appli., 38: 13274-13283. DOI:

Detection of financial statement fraud and feature 10.1016/j.eswa.2011.04.147

selection using data mining techniques. Decision

Support Syst., 50: 491-500. DOI:

10.1016/j.dss.2010.11.006

Science Publications 1165 AJAS

You might also like

- Data as a Product: Elevating Information into a Valuable ProductFrom EverandData as a Product: Elevating Information into a Valuable ProductNo ratings yet

- Data Mining (Banking)Document8 pagesData Mining (Banking)Anonymous R0vXI894TNo ratings yet

- Data Mining in Banking and Its Applications - A RevDocument9 pagesData Mining in Banking and Its Applications - A Revgayathri juluriNo ratings yet

- Role of Data and Information Within The FinancialDocument12 pagesRole of Data and Information Within The Financialcollins makokhaNo ratings yet

- WK9 Data MiningDocument7 pagesWK9 Data MiningErvin Phillip FranklinNo ratings yet

- 2.data Mining Technology Full ArticleDocument18 pages2.data Mining Technology Full ArticleHind YasinNo ratings yet

- Data Warehouse and Data Mining: AssignmentDocument4 pagesData Warehouse and Data Mining: AssignmentPraveen RawalNo ratings yet

- Mark Lokanan Royal Roads UniversityDocument19 pagesMark Lokanan Royal Roads UniversityBellaNo ratings yet

- A Survey on Big Data Applications and ChallengesDocument4 pagesA Survey on Big Data Applications and ChallengesdagenalwotNo ratings yet

- Data Mining Techniques in Finance Industry ReviewDocument17 pagesData Mining Techniques in Finance Industry ReviewFunnyVideo1 TubeNo ratings yet

- Developing banking intelligenceDocument11 pagesDeveloping banking intelligencefarazphd88No ratings yet

- Benefits of Educational Data Mining: An IntroductionDocument5 pagesBenefits of Educational Data Mining: An IntroductionShujat Hussain GadiNo ratings yet

- Data mining literature surveyDocument4 pagesData mining literature surveyrajeshkumarNo ratings yet

- A Seminar Report: Big DataDocument22 pagesA Seminar Report: Big DatalavhackNo ratings yet

- Understanding The Internet Banking Adoption - A Unified Theory of Acceptance and Use of Technology and Perceived Risk ApplicationOriginalDocument13 pagesUnderstanding The Internet Banking Adoption - A Unified Theory of Acceptance and Use of Technology and Perceived Risk ApplicationOriginalJoe NguyenNo ratings yet

- A Comparative Study of Data Mining Techniques in Predicting Consumers' Credit Card Risk in BanksDocument6 pagesA Comparative Study of Data Mining Techniques in Predicting Consumers' Credit Card Risk in BankserwismeNo ratings yet

- Deep Learning Powers Finance InnovationTITLEDocument5 pagesDeep Learning Powers Finance InnovationTITLEtoNo ratings yet

- Data Moning Seminar ReportDocument12 pagesData Moning Seminar ReportSankalp MishraNo ratings yet

- Get PDF 1Document4 pagesGet PDF 1Poorni BablooNo ratings yet

- Data Mining and Business IntelligenceDocument41 pagesData Mining and Business IntelligenceAnonymous m13yWyGyNo ratings yet

- Synopsis Data Warehouse and Data MiningDocument4 pagesSynopsis Data Warehouse and Data MiningRahul AroraNo ratings yet

- Uncertainty in Big Data AnalyticsDocument16 pagesUncertainty in Big Data Analyticsycy5pxtb74No ratings yet

- Overview of Data MiningDocument4 pagesOverview of Data MiningEditor IJTSRDNo ratings yet

- Big Data Seminar Report on Supply Chain ManagementDocument17 pagesBig Data Seminar Report on Supply Chain ManagementDancan OwinoNo ratings yet

- Predicting Customer Churn in Banking Industry Using Neural NetworksDocument9 pagesPredicting Customer Churn in Banking Industry Using Neural NetworksHải YếnNo ratings yet

- An Investigation Into The Acceptance of Online Banking in Saudi ArabiaDocument12 pagesAn Investigation Into The Acceptance of Online Banking in Saudi ArabiaViệt Huỳnh TrươngNo ratings yet

- VivekDocument4 pagesVivekBiribiri WeixianNo ratings yet

- Final Revised Big DataDocument7 pagesFinal Revised Big DataRuth KatakaNo ratings yet

- Data Mining in Banking SectorDocument5 pagesData Mining in Banking SectorrachikaNo ratings yet

- Drivers and Barriers To Business Intelligence AdoptionDocument24 pagesDrivers and Barriers To Business Intelligence AdoptionSaif Ali MominNo ratings yet

- Technology in OrganisationsDocument18 pagesTechnology in OrganisationsmengalvioNo ratings yet

- Applications of Data Mining in The Banking SectorDocument8 pagesApplications of Data Mining in The Banking SectorGunjan JainNo ratings yet

- Trabajo IntegradorDocument15 pagesTrabajo IntegradorClara MejiaNo ratings yet

- Article IJPEbigdata Revision Final January 2015 OnlineDocument34 pagesArticle IJPEbigdata Revision Final January 2015 Onlineshay malulNo ratings yet

- 2022 Business Intelligence Trends A Review of Mobile BusinessDocument12 pages2022 Business Intelligence Trends A Review of Mobile Businessimygad53No ratings yet

- Data Mining3Document4 pagesData Mining3PHẠM THỊ DUYÊN DHTI13A3HNNo ratings yet

- Big Data Ingestion and Preparation ToolsDocument16 pagesBig Data Ingestion and Preparation Toolssoukaina el krissiiNo ratings yet

- Data Mining Prologues: K.Sankar Lecturer / M.E., (P.HD) ., D.V.Rajkumar M.C.A., M.Phil LecturerDocument4 pagesData Mining Prologues: K.Sankar Lecturer / M.E., (P.HD) ., D.V.Rajkumar M.C.A., M.Phil LecturerJournal of Computer ApplicationsNo ratings yet

- Unit 1 Hints: Data Science FundamentalsDocument16 pagesUnit 1 Hints: Data Science Fundamentalsakshaya vijayNo ratings yet

- Project WorkDocument36 pagesProject WorkOrah SeunNo ratings yet

- 86Document11 pages86Bui Thi Hoai (BTEC HN)No ratings yet

- Strategic Information Management and E-Business AssignmentDocument6 pagesStrategic Information Management and E-Business AssignmentBrenda ChatendeukaNo ratings yet

- Learning Fraud Detection Algorithms from Big Data in Online Banking TransactionsDocument5 pagesLearning Fraud Detection Algorithms from Big Data in Online Banking TransactionshokipiggyNo ratings yet

- Business IntelligenceassDocument6 pagesBusiness IntelligenceassAshley Wairimu OtienoNo ratings yet

- Data Mining1Document37 pagesData Mining1MarufNo ratings yet

- Impact of Next-Gen Tech on Marketing StrategiesDocument23 pagesImpact of Next-Gen Tech on Marketing StrategiesRoronoa ZoldyckNo ratings yet

- (IJCST-V5I3P23) :fatima, Dr. Jawed Ikbal KhanDocument3 pages(IJCST-V5I3P23) :fatima, Dr. Jawed Ikbal KhanEighthSenseGroupNo ratings yet

- Big_Data_visualization___An_empirical_study_highlighting_techniques__tools__future_research_challenges_and_issues_ (1)Document24 pagesBig_Data_visualization___An_empirical_study_highlighting_techniques__tools__future_research_challenges_and_issues_ (1)RANIA_MKHININI_GAHARNo ratings yet

- Big Data PaperDocument8 pagesBig Data PaperNazira SardarNo ratings yet

- Evaluations of Big Data Processing PDFDocument10 pagesEvaluations of Big Data Processing PDFd_aparigrahaNo ratings yet

- Learning Unit 1Document34 pagesLearning Unit 1sphamandla kubhekaNo ratings yet

- IT Unit 4Document7 pagesIT Unit 4ShreestiNo ratings yet

- The Use of Big Data Analytics in The Retail IndustDocument17 pagesThe Use of Big Data Analytics in The Retail Industputra bimoNo ratings yet

- The Impact of Big Data Analytics On The Banking Industry: July 2015Document7 pagesThe Impact of Big Data Analytics On The Banking Industry: July 2015lightspeed richNo ratings yet

- D3M, Domain Driven Data Mining - Application To Business IntelligenceDocument4 pagesD3M, Domain Driven Data Mining - Application To Business IntelligenceAmir MosaviNo ratings yet

- Big Data and Its Applications in Smart RDocument53 pagesBig Data and Its Applications in Smart Raarthi devNo ratings yet

- Data mining process steps and applicationsDocument4 pagesData mining process steps and applicationsmanojNo ratings yet

- Critical Success Factors in E-Banking: An Indian PerspectiveDocument15 pagesCritical Success Factors in E-Banking: An Indian PerspectiveFlorence KatonjeNo ratings yet

- Impact of Next-Gen Technologies On Marketing: Manpreet SinghDocument23 pagesImpact of Next-Gen Technologies On Marketing: Manpreet SinghRoronoa ZoldyckNo ratings yet

- Bit 4101 Business Data Minning and WarehousingDocument11 pagesBit 4101 Business Data Minning and WarehousingVictor NyanumbaNo ratings yet

- A Decision Support Based On Data MiningDocument5 pagesA Decision Support Based On Data MiningnhlNo ratings yet

- Data Mining Techniques in Finance Industry ReviewDocument17 pagesData Mining Techniques in Finance Industry ReviewFunnyVideo1 TubeNo ratings yet

- Credit Risk Management Model for Iranian Banks Using Data MiningDocument11 pagesCredit Risk Management Model for Iranian Banks Using Data MiningnhlNo ratings yet

- 1 Dashen - ATM - Fasika Wondimu 2019Document95 pages1 Dashen - ATM - Fasika Wondimu 2019nhlNo ratings yet

- Data Mining Application in Banking Sector With Clustering and ClassificationDocument9 pagesData Mining Application in Banking Sector With Clustering and ClassificationnhlNo ratings yet

- 2 CBE Predict CSTMR CHRN Kassahun GebremeskelDocument134 pages2 CBE Predict CSTMR CHRN Kassahun GebremeskelnhlNo ratings yet

- 3 Abyssinia - PRDCT - CRDT - RSK - Teninet Belay Alemu Thesis Proposal For 06-08-2019Document75 pages3 Abyssinia - PRDCT - CRDT - RSK - Teninet Belay Alemu Thesis Proposal For 06-08-2019nhlNo ratings yet

- 4 MFI CSTNR SGMTN and PRDCN BelachewReganeDocument107 pages4 MFI CSTNR SGMTN and PRDCN BelachewReganenhlNo ratings yet

- Data Mining Role in Bank TransactionsDocument137 pagesData Mining Role in Bank TransactionsnhlNo ratings yet

- Accounting MemeDocument2 pagesAccounting MemeIan Jay DescutidoNo ratings yet

- Revenue Regulations on Compromise SettlementDocument6 pagesRevenue Regulations on Compromise SettlementMilane Anne CunananNo ratings yet

- BCG - ACC3 - 28 June 2021 - S1Document5 pagesBCG - ACC3 - 28 June 2021 - S1Ntokozo Siphiwo Collin DlaminiNo ratings yet

- Rules On Demutualization of Securities Exchanges in Nigeria April 27 2015Document7 pagesRules On Demutualization of Securities Exchanges in Nigeria April 27 2015abubakar mohammad saniNo ratings yet

- CV - Tim SonmezDocument1 pageCV - Tim Sonmezapi-356802988No ratings yet

- Opportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatDocument8 pagesOpportunities Weight Rating Weighted Score: Chosen Opportunity: Chosen ThreatUmbertoNo ratings yet

- Bus Continuity 1Document24 pagesBus Continuity 1api-3733759No ratings yet

- MCI Communications CorporationDocument6 pagesMCI Communications Corporationnipun9143No ratings yet

- Gandhian Philosophy of TrusteeshipDocument9 pagesGandhian Philosophy of Trusteeshipvaidrahul2002No ratings yet

- Investigation of Factors Affecting Termination of Construction Contracts in Gaza StripDocument122 pagesInvestigation of Factors Affecting Termination of Construction Contracts in Gaza Stripsuranjan deyNo ratings yet

- Gurpreet Gill: ObjectiveDocument3 pagesGurpreet Gill: ObjectiveJustin EverettNo ratings yet

- BCG MatrixDocument22 pagesBCG Matrixnomanfaisal1No ratings yet

- Trading The Ichimoku WayDocument4 pagesTrading The Ichimoku Waysaa6383No ratings yet

- "Study of Different Loans Provided by SBI Bank": Project Report ONDocument55 pages"Study of Different Loans Provided by SBI Bank": Project Report ONAnonymous g7uPednINo ratings yet

- La Performance Des Fusions Et Acquisitions Bancaires - BCM at AwbDocument11 pagesLa Performance Des Fusions Et Acquisitions Bancaires - BCM at AwbyousseffNo ratings yet

- Credit Card PresentationDocument24 pagesCredit Card Presentationpradeep367380% (5)

- FranchisingDocument39 pagesFranchisingWilsonNo ratings yet

- Ra 11058 OshlawDocument17 pagesRa 11058 OshlawArt CorbeNo ratings yet

- Full Notes SapmDocument472 pagesFull Notes SapmJobin JohnNo ratings yet

- ACEF APPLICATION FormDocument2 pagesACEF APPLICATION FormDaniel Mirabel100% (3)

- Rolta Wins 13 Million Dollar Contract For Engineering Systems (Company Update)Document1 pageRolta Wins 13 Million Dollar Contract For Engineering Systems (Company Update)Shyam SunderNo ratings yet

- CBMEC 1 - Assignment 3Document4 pagesCBMEC 1 - Assignment 3Tibay, Genevive Angel Anne A.No ratings yet

- Money Master The GameDocument48 pagesMoney Master The GameSimon and Schuster72% (18)

- C1 Introduction To AuditDocument24 pagesC1 Introduction To AuditTan Yong Feng MSUC PenangNo ratings yet

- Group II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksDocument23 pagesGroup II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksMahesh BabuNo ratings yet

- IIMB Vista Prodigy 2021 CaseDocument2 pagesIIMB Vista Prodigy 2021 CasedannyNo ratings yet

- Test Bank For Financial Reporting Financial Statement Analysis and Valuation 8th EditionDocument23 pagesTest Bank For Financial Reporting Financial Statement Analysis and Valuation 8th Editionbriansmithmwgrebcstd100% (25)

- Petrol Prices in IndiaDocument24 pagesPetrol Prices in IndiaRakhi KumariNo ratings yet

- Pump Quotation DetailsDocument2 pagesPump Quotation Detailsdhavalesh1No ratings yet

- Project Management Process OverviewDocument49 pagesProject Management Process OverviewIlyaas OsmanNo ratings yet