Professional Documents

Culture Documents

The Capital Expenditure Decisions Have The Following Features

Uploaded by

Yosephine Kurniaty0 ratings0% found this document useful (0 votes)

21 views3 pagesCapital expenditure decisions involve large, long-term investments in fixed assets like property, buildings, or equipment that provide benefits over multiple years. They carry more risk than operational expenses and involve estimating future cash flows since outflows and inflows don't match up over time. Capital expenditures are evaluated through a budgeting process to prioritize projects that maximize returns and shareholder wealth while avoiding over- or under-investment in fixed assets.

Original Description:

Original Title

capex

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCapital expenditure decisions involve large, long-term investments in fixed assets like property, buildings, or equipment that provide benefits over multiple years. They carry more risk than operational expenses and involve estimating future cash flows since outflows and inflows don't match up over time. Capital expenditures are evaluated through a budgeting process to prioritize projects that maximize returns and shareholder wealth while avoiding over- or under-investment in fixed assets.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views3 pagesThe Capital Expenditure Decisions Have The Following Features

Uploaded by

Yosephine KurniatyCapital expenditure decisions involve large, long-term investments in fixed assets like property, buildings, or equipment that provide benefits over multiple years. They carry more risk than operational expenses and involve estimating future cash flows since outflows and inflows don't match up over time. Capital expenditures are evaluated through a budgeting process to prioritize projects that maximize returns and shareholder wealth while avoiding over- or under-investment in fixed assets.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Capital expenditure decisions are just the opposite of operating

expenditure decisions. It is the planning, evaluation and selection of

capital expenditure proposals, the benefits of which are expected to

accrue over more than one accounting year.

The capital expenditure decisions have the following

features:

i. They involve large amounts of funds.

ii. They involve greater amount of risk.

iii. Capital expenditure decisions are irreversible.

iv. Cash outflows and inflows occur at different points of time.

Meaning of Capital Expenditure Decisions:

The capital expenditure decision is the process of making decisions

regarding investments in fixed assets which are not meant for sale

such as land, building, plant & machinery, etc. Thus it refers to long-

term planning for proposed capital expenditures and includes raising

of long-term funds and their utilization. The key function of the

finance manager is selection of the most profitable project for invest-

ment. This task is very crucial because any action taken by the

manager in this area affects the working and profitability of the firm

for many years to come.

Nature of Capital Expenditure Decisions:

Capital expenditure decisions involve acquisition of assets that have a

long life span and which provide benefits spread over a long period of

time.

The nature of capital expenditure decisions can be explained

in brief as under:

i. Substantial Investments:

Capital expenditure decisions involve large amounts of funds. Such

decisions have its effect over a long span of time.

ii. Irreversible Decision:

Capital expenditure decisions once approved represent long term

investments that cannot be reversed or withdrawn any time.

Withdrawal or reversal of such decisions may lead to considerable

financial losses to the firm.

iii. Estimation of Future Cash Inflows:

Preparation of capital expenditure budget involves forecasting of cash

inflows over several years for evaluating the profitability of projects.

iv. Maximization of Shareholder’s Wealth:

It helps protect the interest of the shareholders as well as of the firm

because it avoids over-investment and under-investment in fixed

assets.

Purpose of Capital Expenditure Decisions:

The capital expenditure decision or capital budgeting is a process that

plans to ascertain the long-term investments of the firm. The main

purpose of capital budgeting is to recognize as well as prioritize capital

investments on the basis of maximum returns to the business. It is

also considered as a managerial tool required for efficient

management of collected capital of the firm.

Objectives of Capital Expenditure Decisions:

Financing decisions are one of the most crucial and critical decisions

of a firm as they have a significant impact on the profitability of the

firm.

There are number of objectives of capital expenditure

decisions, some of which are:

i. Increasing Output:

Output may be increased by utilizing existing facility or through

expansion by installing new plant and machinery.

ii. Cost Reduction:

The existence of a firm depends on profitability, which in turn

depends on the production of goods or services at a reasonable price.

This is possible if over/under-investment in fixed assets is avoided.

iii. Providing Contemporary Goods:

Consumer tastes change every day. To satisfy the new demands from

customers, either proper utilization of existing facility or installation

of the latest machinery is necessary—which is not possible without

proper capital expenditure decision.

You might also like

- Capital Budgeting HDFCDocument68 pagesCapital Budgeting HDFCKasiraju Saiprathap43% (7)

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisValtteri Itäranta0% (2)

- Capital Budgeting of Coca ColaDocument7 pagesCapital Budgeting of Coca Colasomyajain2298_345069No ratings yet

- "A Study On Credit Card": (The Plastic Money)Document86 pages"A Study On Credit Card": (The Plastic Money)Gaurav Gaba100% (1)

- British Gas - OldDocument2 pagesBritish Gas - Oldky139396No ratings yet

- 04b Receivables (Part 2)Document6 pages04b Receivables (Part 2)JEFFERSON CUTE100% (1)

- Capital Budgeting Project ReportDocument24 pagesCapital Budgeting Project Reportnishiit92% (12)

- Capital BudgetingDocument68 pagesCapital BudgetingPranay GNo ratings yet

- Corporate Finance: Capital BudgetingDocument17 pagesCorporate Finance: Capital BudgetingpayataNo ratings yet

- Capital Budgeting NotesDocument5 pagesCapital Budgeting NotesDipin LohiyaNo ratings yet

- Ajith ProjectDocument89 pagesAjith ProjectAnonymous MhCdtwxQINo ratings yet

- Scope/Elements: Page - 1Document11 pagesScope/Elements: Page - 1amit2981987No ratings yet

- Need and Importance of Capital BudgetingDocument4 pagesNeed and Importance of Capital BudgetingSrinidhi PnaNo ratings yet

- Managers.: Investment Decisions Are Made by Investors and InvestmentDocument5 pagesManagers.: Investment Decisions Are Made by Investors and InvestmentRe KhanNo ratings yet

- Capital Budjeting NagarjunaDocument73 pagesCapital Budjeting NagarjunaSanthosh Soma100% (2)

- Financial Management Notes SRK UNIT 2Document13 pagesFinancial Management Notes SRK UNIT 2Pruthvi RajNo ratings yet

- Prof. (DR.) Nagendra Kumar Jha: Topic: Concept and Significance of Capital BudgetingDocument3 pagesProf. (DR.) Nagendra Kumar Jha: Topic: Concept and Significance of Capital BudgetingNisha BhardwajNo ratings yet

- Financial ManagementDocument42 pagesFinancial Managementnimala maniNo ratings yet

- Capital Budgeting MeaningDocument13 pagesCapital Budgeting MeaningHarihara PuthiranNo ratings yet

- FM I - CH 6 NoteDocument22 pagesFM I - CH 6 NoteEtsub SamuelNo ratings yet

- A Study On Capital Budgeting.Document15 pagesA Study On Capital Budgeting.Kumar SwamyNo ratings yet

- 8.capital BudgetingDocument82 pages8.capital BudgetingOblivion OblivionNo ratings yet

- Capital BudgetingDocument64 pagesCapital BudgetingNiaz AhmedNo ratings yet

- 19752ipcc FM Vol1 Cp6Document0 pages19752ipcc FM Vol1 Cp6M Waqas PkNo ratings yet

- 54 Capital BudgetingDocument4 pages54 Capital BudgetingCA Gourav JashnaniNo ratings yet

- Abstract CAPITAL BUDGETING UltratechDocument12 pagesAbstract CAPITAL BUDGETING UltratechraghunathreddychallaNo ratings yet

- MFDocument6 pagesMFJS Gowri NandiniNo ratings yet

- Investment Appraisal MethodsDocument15 pagesInvestment Appraisal MethodsFaruk Hossain100% (1)

- 2015@FM I CH 6-Capital BudgetingDocument16 pages2015@FM I CH 6-Capital BudgetingALEMU TADESSENo ratings yet

- Capital BudgetingDocument50 pagesCapital Budgetinghimanshujoshi7789No ratings yet

- Unit 5 EEFMDocument9 pagesUnit 5 EEFMGayathri Bhupathi rajuNo ratings yet

- CH 5 6 Capital BudgetingDocument94 pagesCH 5 6 Capital BudgetingNikita AggarwalNo ratings yet

- Chapter9 Financial Management BusinessStudies Class12 LearnKaroClassesDocument53 pagesChapter9 Financial Management BusinessStudies Class12 LearnKaroClassesUpendra RajagopalanNo ratings yet

- Capital BudgetingDocument38 pagesCapital BudgetingTaha MadniNo ratings yet

- Capital Budgeting PDFDocument10 pagesCapital Budgeting PDFSenthil KumarNo ratings yet

- FM 1 CH 4 (Lti) My MLC ExtDocument19 pagesFM 1 CH 4 (Lti) My MLC ExtMELAT ROBELNo ratings yet

- Capital BudgetingDocument93 pagesCapital BudgetingKhadar100% (3)

- KC Financial DecisionsDocument111 pagesKC Financial DecisionsSatish PatilNo ratings yet

- Unit 03Document69 pagesUnit 03Shah Maqsumul Masrur TanviNo ratings yet

- Capital BudgetingDocument65 pagesCapital Budgetingarjunmba119624No ratings yet

- Capital BudgetingDocument35 pagesCapital Budgetinggkvimal nathan100% (3)

- Chapter-3: Capital Budgeting Chapter-Three Capital Budgeting/Investment Decision 3.1. Definition of Capital BudgetingDocument12 pagesChapter-3: Capital Budgeting Chapter-Three Capital Budgeting/Investment Decision 3.1. Definition of Capital Budgetingmalik macNo ratings yet

- FM Group AssignmentDocument11 pagesFM Group AssignmentHailemelekot TerefeNo ratings yet

- Capital Budgeting MainDocument11 pagesCapital Budgeting MainriddhiNo ratings yet

- Capital Budgeting Decision: NPV Vs Irr Conflicts and ResolutionDocument18 pagesCapital Budgeting Decision: NPV Vs Irr Conflicts and Resolutionnasir abdulNo ratings yet

- Capital Budgeting NotesDocument46 pagesCapital Budgeting NotesShilpa Arora NarangNo ratings yet

- Chapter One: Capital Budgeting Decisions: 1.2. Classification of Projects Independent Verses Mutually Exclusive ProjectsDocument25 pagesChapter One: Capital Budgeting Decisions: 1.2. Classification of Projects Independent Verses Mutually Exclusive ProjectsezanaNo ratings yet

- Unit 6 EditedDocument22 pagesUnit 6 Editedtibebu yacobNo ratings yet

- Investment Decisions Core Document For Investors 1698274685Document16 pagesInvestment Decisions Core Document For Investors 1698274685Anonymous knightNo ratings yet

- Long Term Inv + FundamentalsDocument13 pagesLong Term Inv + Fundamentalssamuel kebedeNo ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document217 pagesThe Basics of Capital Budgeting: Should We Build This Plant?CV CVNo ratings yet

- Financial NotesDocument23 pagesFinancial NotesrahulNo ratings yet

- Define Capital Budgeting: Qualitative CriteriaDocument12 pagesDefine Capital Budgeting: Qualitative Criteriastannis69420No ratings yet

- Importance of Capital BudgetingDocument4 pagesImportance of Capital BudgetingSauhard AlungNo ratings yet

- Lec5. Capital BudgetingDocument78 pagesLec5. Capital Budgetingvivek patelNo ratings yet

- Capital Budgeting: Presented by AglaiaDocument12 pagesCapital Budgeting: Presented by AglaiaVishal AsijaNo ratings yet

- Capital BudgetingDocument94 pagesCapital Budgetingrobinkapoor100% (9)

- Capital Budgeting - THEORYDocument9 pagesCapital Budgeting - THEORYAarti PandeyNo ratings yet

- Project Hemanth EditDocument70 pagesProject Hemanth Editajaykumar royalNo ratings yet

- Financial Decision Making: MCCOM2005C04Document72 pagesFinancial Decision Making: MCCOM2005C04GLBM LEVEL 1No ratings yet

- Study Note - 7: Capital BudgetingDocument36 pagesStudy Note - 7: Capital Budgetingshivam kumarNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- One Track Minds. The Surprising Psychology of The InternetDocument292 pagesOne Track Minds. The Surprising Psychology of The InternetArt Marr100% (2)

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseMayur bhujadeNo ratings yet

- Chapter 15 PPT - Holthausen & Zmijewski 2019Document100 pagesChapter 15 PPT - Holthausen & Zmijewski 2019royNo ratings yet

- Internet BillDocument4 pagesInternet BillKanchan Asnani0% (1)

- Echallan MH010490649202223 EDocument1 pageEchallan MH010490649202223 EPramod PawarNo ratings yet

- Liquidation Based ValuationDocument45 pagesLiquidation Based ValuationMagic ShopNo ratings yet

- Cutomer and Banker RelationshipDocument23 pagesCutomer and Banker RelationshipSamridhiNo ratings yet

- Merchant BankingDocument93 pagesMerchant BankingSaadhana MuthuNo ratings yet

- c73s1ch48 PDFDocument2 pagesc73s1ch48 PDFChandra JacksonNo ratings yet

- NMIMS - SBM: Teaching Plan Financial Management Academic Year: 2017-18 Course Code Course Title Course Instructor/sDocument3 pagesNMIMS - SBM: Teaching Plan Financial Management Academic Year: 2017-18 Course Code Course Title Course Instructor/sManav ManochaNo ratings yet

- Digital EnvironmentDocument13 pagesDigital EnvironmentPrathameshNo ratings yet

- The Venus ProjectDocument27 pagesThe Venus Projectapi-252242159100% (1)

- International Financial Reporting and Analysis 7th Edition Alexander Solutions ManualDocument13 pagesInternational Financial Reporting and Analysis 7th Edition Alexander Solutions Manualcrastzfeiej100% (15)

- Final Intermediate 1 2015 2016Document10 pagesFinal Intermediate 1 2015 2016ZeeNo ratings yet

- The Basics of Accounting For Derivatives and Hedge AccountingDocument7 pagesThe Basics of Accounting For Derivatives and Hedge AccountingRENU BALANo ratings yet

- Treasury Code: The Andhra PradeshDocument104 pagesTreasury Code: The Andhra PradeshacesrspNo ratings yet

- MSF LCR Fallcr Tools For LRM in The Banks 1626896525Document6 pagesMSF LCR Fallcr Tools For LRM in The Banks 1626896525G GNo ratings yet

- Nike FInancial ResourceDocument2 pagesNike FInancial ResourceهانيNo ratings yet

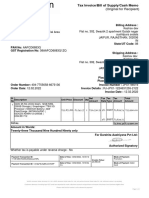

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)erjasdNo ratings yet

- XL EnergyDocument18 pagesXL EnergyvishalNo ratings yet

- Kfs Credit CardsDocument4 pagesKfs Credit CardsVijayakumar C SNo ratings yet

- NPO MidtermDocument4 pagesNPO MidtermPatrick Ferdinand AlvarezNo ratings yet

- Module 1 - Financial Statement AnalysisDocument15 pagesModule 1 - Financial Statement AnalysisSiddhesh Kolgaonkar100% (1)

- Tax.3201-2 Classification of TaxesDocument3 pagesTax.3201-2 Classification of TaxesMira Louise HernandezNo ratings yet

- Colourplus GST Invoice - 2020-2021 - TruptiDocument1 pageColourplus GST Invoice - 2020-2021 - TruptiSRJOFFICIAL7No ratings yet

- On Bank AuditDocument101 pagesOn Bank Auditrinky123123100% (4)