Professional Documents

Culture Documents

Tariff Sheet - Regular / Basic Services Demat Account (BSDA)

Tariff Sheet - Regular / Basic Services Demat Account (BSDA)

Uploaded by

dwarakanath4Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tariff Sheet - Regular / Basic Services Demat Account (BSDA)

Tariff Sheet - Regular / Basic Services Demat Account (BSDA)

Uploaded by

dwarakanath4Copyright:

Available Formats

Tariff Sheet - Regular / Basic Services Demat Account (BSDA)

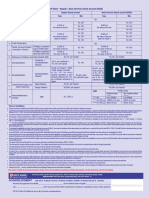

Sr. Regular Demat account Basic Services Demat account (BSDA)

Fee Head Type

No. Fees Min Fees Min

1 Account opening charges Nil

Debit Transactions Equity SPEED-e / Easiest Rs. 20/- Rs. 40/-

/ Mutual Funds (Market / 0.04% of 0.06% of

2 HDFC Securities Rs. 25/- Rs. 45/-

Off Market) the value of the txn. the value of the txn.

Manual Rs. 40/- Rs. 60/-

Debit Transactions Debt / SPEED-e / Easiest Rs. 20/- Rs. 40/-

0.04% of 0.06% of

3 Mutual Funds (Market / HDFC Securities the value of the txn. Rs. 25/- the value of the txn. Rs. 45/-

Off Market) (Max Rs 5000/-) (Max Rs 5000/-)

Manual Rs. 40/- Rs. 60/-

4 Credit Transactions Nil

Pledge Services(Creation If Pledge is marked in 0.02% of

Rs. 40/-

0.04% of

Rs. 60/-

/ Invocation / Closure) favour of HDFC Bank the value of the txn. the value of the txn

5

If Pledge is marked to 0.04% of 0.06% of

Rs. 40/- Rs. 60/-

other than HDFC Bank the value of the txn the value of the txn

6 Reissuance of Delivery Instruction Booklet (DIB) Rs.75/- per booklet Rs.75/- per booklet

Certi cate +

Rs.5/- per certi cate + Rs.5/- per certi cate +

7 Dematerialisation Dematerialisation Rs. 40/- Rs. 40/-

Rs. 35/- per request Rs. 35/- per request

Request

Rs.30/- per request + NSDL Rs.30/- per request + NSDL /

/ CDSL actuals, Currently CDSL actuals, Currently

a) Rs. 10/- for ever y a) Rs. 10/- for every hundred

Rematerialisation hundred securities or part

8 Rematerialisation Rs.40/- (min) securities or part thereof) a at Rs.40/- (min)

Request thereof) a at fee of Rs. 10/- Rs.5,00,000 (max) fee of Rs. 10/- per certi cate Rs.5,00,000 (max)

per certi cate whichever is whichever is higher

higher

Courier/Postal Charges only Inland Address Rs.35/- per request Rs.35/- per request

9

(Adhoc Statement) Foreign Address Rs.500/- per request Rs.500/- per request

AMC Holding Value

DebtSecurities Non DebtSecurities

Annual Maintenance **** *****

10 AMC Rs. 750 p.a. *** NIL 0 to 100000 0 to 50000

Charges

*** Rs 100 p.a 100001 to 2 lacs 50001 to 2 lacs

*** Rs 750 p.a Above 2 lacs Above 2 lacs

Terms & Conditions:

Demat customers eligible for the BSDA facility need to register their mobile number for the SMS alert facility for debit transactions.

Customers who have a banking relationship with HDFC Bank to provide a debit authorisation for the recovery of service charges. Customers having only a Depository relationship will be required to maintain a

balance of Rs. 7,500/- in an account maintained by Bank for each Demat account. The Customer also need to replenish the balances in the said account immediately if and when it falls below Rs.5,000/-.

The above charges are exclusive of applicable GST and other taxes / statutory charges levied by Government bodies / statutory authorities from time to time, which will be charged as applicable.

All charges / service standards are subject to revision at the Bank s sole discretion at any given point of time and the same shall be communicated to the customers with a notice of 30 days.

Incase you are applicable for submission of GSTIN details, please provide details in a separate "GST Annexure". GST Annexure is available on our website (www.hdfcbank.com >> Form Center>> Demat

Tab >> GST Annexure).

*** The Annual Maintenance Charges are levied, in advance, for a period of one year at the beginning of the billing cycle. For the computation of AMC for Managed Program, the transactions for the previous

year will be evaluated, and basis the number of transactions done by the customer, AMC will be levied as per the transaction slabs de ned. (For more details of Managed program, kindly refer our website

www.hdfcbank.com )

To evaluate the eligibility for Basic Services Demat Accounts (BSDA), the value of holdings will be determined on a daily basis, as per the le sent by the NSDL / CDSL The AMC will be calculated at the pro-rata

basis based on the value of holding of securities in the account.

In case of BSDA, such accounts would be levied AMC applicable basis the value of holdings exceeding the prescribed limit immediately from the next day of exceeding such limit.

Incase the Demat accounts with BSDA facility does not meet the listed eligibility as per guideline issued by SEBI or any such authority at any point of time, such BSDA accounts will be converted to Standard

program Demat accounts without further reference to the respective customers and will be levied standard Program pricing.

Incase if the Demat accounts with BSDA facility exceed the prescribed limits and move out of the stipulated BSDA criteria, the eligibility of such accounts for BSDA facility will be evaluated on the last day of the

Annual billing cycle.

The value of the transaction will be in accordance with rates provided by Depositories (NSDL / CDSL)

The transaction charges will be payable monthly. The charges quoted above are for the services listed. Any service not quoted above will be charged separately.

The operating instructions for the joint accounts must be signed by all the holders.

All instructions for transfer must be received at the designated DP servicing branches of the Bank at least 24 hours before the execution date.

In case of non- recovery of service charges due to inadequate balance in your linked bank account or inadequate advance fees or invalid bank account, the Depositor y services for your account will be

temporarily discontinued. The services will be resumed in a minimum of three working days from the date of receipt of request with HDFC Bank and post payment of all outstanding dues towards Depository

charges.

In case the Demat accounts are with nil balances / transactions or incase if the customer defaults in payment of AMC, the physical statement shall not be sent to the customer after period of 1 year. However the

electronic statement of holding will be sent only to the customers whose email IDs are registered for e-statement.

The Depositories have started dispatching Consolidated Account Statement (CAS) to the customers w.e.f. March 2015, hence despatch of physical statements has been discontinued.

Your Transaction cum Billing statement will be available on NetBanking under Demat tab by second week of every month with option to view /download.

Effective 01July'2020 stamp duty charges would be collected from BO on consideration amount of OffMarket transfer and from pledgee for Pledge invocation request, before execution of request.

Flat fee of Rs 20/- + taxes, would be levied for each Margin Pledge service instruction submitted.

I/we agree to abide by and to be bound by all the Terms and Conditions pertaining to Debit authorisation, E-mail statement and Fee & schedule.

HDFC Bank Limited, Depository Services, Empire Plaza I, 4th Floor, Chandan Nagar, LBS Marg, Vikhroli West, Mumbai - 400083.

Registered Office: HDFC Bank House, Senapati Bapat Marg, Lower Parel, Mumbai - 13.

ACKNOWLEDGMENT NSDL (DP ID - IN 300126 / IN 301151 / IN 301549 / IN 300476 / IN 300601 / IN 301436), CDSL (DP ID - 13012400)

Received the application from Mr/Ms_____________________________ as the sole/first holder alongwith _____________________________

Participant Stamp & Signature

and _______________________________ as the second and third holders respectively for opening of a depository account. Please quote the

DP ID & Client ID allotted to you in all your future correspondence.

You might also like

- Your Bill Explained:: SSE AirtricityDocument4 pagesYour Bill Explained:: SSE AirtricitySteinerOkNo ratings yet

- INB 301 Sharif MelamineDocument19 pagesINB 301 Sharif MelamineSadman Sakib100% (1)

- A Project Report On GSTDocument15 pagesA Project Report On GSTAnjali RatudiNo ratings yet

- Phole BillDocument2 pagesPhole BillmadhavarapuNo ratings yet

- HDFC Fees For DEMAT TransactionsDocument1 pageHDFC Fees For DEMAT TransactionsPAWAN KAMALESHNo ratings yet

- HDFC Fees For DEMAT TransactionsDocument1 pageHDFC Fees For DEMAT TransactionsPAWAN KAMALESHNo ratings yet

- Tariff Sheet - Regular / Basic Services Demat Account (BSDA) Tariff Sheet - Regular / Basic Services Demat Account (BSDA)Document1 pageTariff Sheet - Regular / Basic Services Demat Account (BSDA) Tariff Sheet - Regular / Basic Services Demat Account (BSDA)laughterclub84No ratings yet

- Tariff Sheet - Regular / Basic Services Demat Account (BSDA)Document1 pageTariff Sheet - Regular / Basic Services Demat Account (BSDA)Munish ParasharNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat Accounts - Classic CustomerDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accounts - Classic CustomerSourav mNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat Accounts - Regular / Basic Services Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accounts - Regular / Basic Services Demat AccountRAPETI SAI KUMAR (N160490)No ratings yet

- DownloadDocument1 pageDownloadkishore kumarNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- IDBI-Trade-Current-Account-2022Document4 pagesIDBI-Trade-Current-Account-2022majhi.deepashreeNo ratings yet

- Start-Up-Current-Account-2022Document3 pagesStart-Up-Current-Account-2022majhi.deepashreeNo ratings yet

- Cash-Current-AccountDocument4 pagesCash-Current-Accountmajhi.deepashreeNo ratings yet

- Edelweiss Broking LTD.: V03/Feb/2020Document2 pagesEdelweiss Broking LTD.: V03/Feb/2020Shyam KukrejaNo ratings yet

- Schedule of Charges For Nri Accounts PrimeDocument4 pagesSchedule of Charges For Nri Accounts PrimeSonam SharmaNo ratings yet

- Loans: Proposed Schedule of Charges - 1st Jan-30th June, 2015Document2 pagesLoans: Proposed Schedule of Charges - 1st Jan-30th June, 2015Junaid MalikNo ratings yet

- alite-Current-AccountDocument5 pagesalite-Current-Accountmajhi.deepashreeNo ratings yet

- Schedule of Charges For Nri PriorityDocument4 pagesSchedule of Charges For Nri PriorityAnnuRawatNo ratings yet

- Demat ComparisonDocument2 pagesDemat ComparisonMohit ChhabraNo ratings yet

- Acc No: 207977242 Bsno: 33: Ms Sapna D/O Sh. Gurbachan Lal AroraDocument4 pagesAcc No: 207977242 Bsno: 33: Ms Sapna D/O Sh. Gurbachan Lal Aroraranjanrajeev1501No ratings yet

- Caart PDFDocument2 pagesCaart PDFvinodNo ratings yet

- New Bank of Baroda New Commission Chart 28.11.2020Document1 pageNew Bank of Baroda New Commission Chart 28.11.2020kaleeswaran MNo ratings yet

- Nri Schedule of ChargesDocument4 pagesNri Schedule of ChargesRishiNo ratings yet

- Plans Margins and Plan Information: Charges Currency Futures Currency OptionsDocument1 pagePlans Margins and Plan Information: Charges Currency Futures Currency OptionsManu ShrivastavaNo ratings yet

- Issuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesIssuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABSäñtôsh Kûmãr PrâdhäñNo ratings yet

- Branch)Document3 pagesBranch)Jeyavel NagarajanNo ratings yet

- Schedule of Charges Edge Business 1st Feb 20 PDFDocument2 pagesSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaNo ratings yet

- AnnexA-SoC Comfort01062014Document4 pagesAnnexA-SoC Comfort01062014satyabrataNo ratings yet

- HDFC Bank Marketing StrategiesDocument28 pagesHDFC Bank Marketing Strategiespriya choudharyNo ratings yet

- Statement 052321Document3 pagesStatement 052321Prince NakulNo ratings yet

- KFS Deutsche Bank AG - PakistanDocument3 pagesKFS Deutsche Bank AG - PakistanPrijin UnnunnyNo ratings yet

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of Chargesmayankmehta052No ratings yet

- Soc Ca 01.01.22Document4 pagesSoc Ca 01.01.22Abhishek ShivappaNo ratings yet

- Baroda Apex Academy, Gandhinagar: S. No Commission Per TransactionDocument1 pageBaroda Apex Academy, Gandhinagar: S. No Commission Per TransactionJitenNo ratings yet

- Service BasicDocument9 pagesService Basickselvaa1No ratings yet

- Service Basic PDFDocument9 pagesService Basic PDFkselvaa1No ratings yet

- Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesGrace Period Granted - 1 Month As Per RBI Guidelines To Restore MABprasanNo ratings yet

- Indian Bank A/c No. 6526577760 Indian Bank A/c No. 6526577760 Indian Bank A/c No. 6526577760Document1 pageIndian Bank A/c No. 6526577760 Indian Bank A/c No. 6526577760 Indian Bank A/c No. 6526577760Akn NanthanNo ratings yet

- Savings - Account - Mar - 2019 - 20190325104947Document4 pagesSavings - Account - Mar - 2019 - 20190325104947Manish kumar yadavNo ratings yet

- DP Tariff Latest 1500Document1 pageDP Tariff Latest 1500Vinodh KumarNo ratings yet

- Schedule of ChargesDocument6 pagesSchedule of ChargesRayan PaulNo ratings yet

- Schedule of Charges-Depository Services: MandatoryDocument3 pagesSchedule of Charges-Depository Services: MandatorysandeepksrinivasNo ratings yet

- 141121120000AMIOP Key Fact Current Accounts ConvDocument5 pages141121120000AMIOP Key Fact Current Accounts Convdesignify101No ratings yet

- Changes in Upcoming Schedule of Charges (Jan-Jun-2021) : Sno. Description Existing Charges Revised Charges Adc ServicesDocument1 pageChanges in Upcoming Schedule of Charges (Jan-Jun-2021) : Sno. Description Existing Charges Revised Charges Adc ServicesNawaz SharifNo ratings yet

- Core Bundled Savings AccountDocument2 pagesCore Bundled Savings AccountSweta MistryNo ratings yet

- Bob - Revised Commission StructureDocument1 pageBob - Revised Commission StructureJai mishra100% (1)

- Jubilee Plus Savings Account: (January 01,2020)Document2 pagesJubilee Plus Savings Account: (January 01,2020)Ruthvik TMNo ratings yet

- Statement 122925Document3 pagesStatement 122925Itsmevenki SmileNo ratings yet

- Indusind Bank BenefitsDocument1 pageIndusind Bank BenefitsParvinder MehraNo ratings yet

- Notice To SB CA OD Account Customer Annexure IIIDocument4 pagesNotice To SB CA OD Account Customer Annexure IIIratnesh singhNo ratings yet

- HDFC Vs IciciDocument10 pagesHDFC Vs IciciRahulNo ratings yet

- Depositoryparticipants MZDocument146 pagesDepositoryparticipants MZsekradNo ratings yet

- General Charges of Kotak BankDocument2 pagesGeneral Charges of Kotak BankSarafraj BegNo ratings yet

- Depository Participants AmDocument386 pagesDepository Participants AmCorparate GuruNo ratings yet

- SoC Non Comfort August2018Document5 pagesSoC Non Comfort August2018Ashish KushwahNo ratings yet

- Core Savings Account - IDBIDocument2 pagesCore Savings Account - IDBIprasanNo ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet

- Service Charges As Per Rbi GuidelinesDocument10 pagesService Charges As Per Rbi Guidelineskrunal3726No ratings yet

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocument2 pagesSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- With GST 022Document1 pageWith GST 022mshNo ratings yet

- Hescom GSTN No: 29Aabch3176Jezz: Meter Readings For Meter ID 8164969558Document2 pagesHescom GSTN No: 29Aabch3176Jezz: Meter Readings For Meter ID 8164969558Vella YoutuberNo ratings yet

- Rice Tariffication LawDocument2 pagesRice Tariffication LawJonalyn Jho BelardoNo ratings yet

- TDS TRS GST (2) 20211228151919Document38 pagesTDS TRS GST (2) 20211228151919Rishi PriyadarshiNo ratings yet

- Full Download Global Business 2nd Edition Peng Solutions ManualDocument35 pagesFull Download Global Business 2nd Edition Peng Solutions Manualdynam.turkeys7yb44100% (39)

- 2 and 5 Civic AssignmentDocument3 pages2 and 5 Civic AssignmentSime ChalaNo ratings yet

- Preamble IntergratedDocument83 pagesPreamble IntergratedUshan De SilvaNo ratings yet

- Politica Regională A ArgentineiDocument13 pagesPolitica Regională A ArgentineiJohnNo ratings yet

- Buslaw3 VATDocument58 pagesBuslaw3 VATVan TisbeNo ratings yet

- Boeing Versus Airbus DB4Document5 pagesBoeing Versus Airbus DB4BACraft04100% (1)

- GST (Impact On Common Man)Document2 pagesGST (Impact On Common Man)Kajal kumariNo ratings yet

- Econ 101: Principles of Microeconomics Fall 2012Document1 pageEcon 101: Principles of Microeconomics Fall 2012wwongvgNo ratings yet

- GR L-26521 - VILLANUEVA Vs CITY OF ILOILO - Delosa JR., RDocument1 pageGR L-26521 - VILLANUEVA Vs CITY OF ILOILO - Delosa JR., RRaakista18 SWNo ratings yet

- Assignment - Chapter 5 (Due 10.11.20)Document4 pagesAssignment - Chapter 5 (Due 10.11.20)Tenaj KramNo ratings yet

- Rajasthan Electricity Regulatory Commission: Petition No. RERC-1905/21 and 1933/21Document32 pagesRajasthan Electricity Regulatory Commission: Petition No. RERC-1905/21 and 1933/21bhupendra barhatNo ratings yet

- Chapter - 9 MarketDocument89 pagesChapter - 9 Marketnisrina nursyianaNo ratings yet

- BillDocument2 pagesBillMalik NajeebullahNo ratings yet

- PFP Tutorial 8Document2 pagesPFP Tutorial 8stellaNo ratings yet

- Obstacles in Doing Business GloballyDocument14 pagesObstacles in Doing Business GloballySTAR CHINEMANo ratings yet

- Dynamic Environment of International TradeDocument35 pagesDynamic Environment of International TradeChinmoy RoyNo ratings yet

- 40 BPI V CIRDocument4 pages40 BPI V CIRCarlo FernandezNo ratings yet

- 25.2 MR of TOLENTINO V Secretary of FinanceDocument2 pages25.2 MR of TOLENTINO V Secretary of FinanceTelle MarieNo ratings yet

- Division "A": VIDYA SAGAR CAREER INSTITUTE LIMITED, Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document281 pagesDivision "A": VIDYA SAGAR CAREER INSTITUTE LIMITED, Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54mktg.seagullshippingNo ratings yet

- Tariff ActivitiesDocument8 pagesTariff Activitiesjazzifyy1No ratings yet

- Sample 19583 PDFDocument16 pagesSample 19583 PDFSwapnil hivareNo ratings yet

- BilldetailDocument1 pageBilldetailsenthilSKNo ratings yet