Professional Documents

Culture Documents

Summary of The Audit Process

Uploaded by

Rawrnalen Fortes0 ratings0% found this document useful (0 votes)

14 views4 pagesOriginal Title

Summary of the Audit Process

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views4 pagesSummary of The Audit Process

Uploaded by

Rawrnalen FortesCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Summary of the Audit Process

Pre-Engagement Activities

Volume II – Form # and Volume I

Function Title Reference

1. Acceptance of client. AP 1 Engagement Acceptance

Obtain preliminary Form (for new clients) Sections 3.1 and

understanding of client’s 3.2

business and assess AP 2 Client Continuation Form

risk/benefit of (for existing clients) Section 3.1

acceptance.

2. Prepare Audit

Engagement Letter Letter 1 Engagement Letter Section 3.3

and/or contract.

Audit Planning Activities

Volume II – Form # and Volume I

Function Title Reference

1. Obtain in-depth AP 3a Knowledge of Client’s

understanding of Business

client’s business and AP 3b Knowledge of Client’s Sections 4.2 and

internal control Internal Control System 4.3

structure. AP 3c Knowledge of Client’s

Accounting and Financial

Reporting Systems

AP 3d Walk-Through Checklist

AP 3e Financial Reporting

Documentation Form

2. Perform evaluation of AP 3h Questionnaire for Risk of

control and inherent Fraud Section 4.4

risk. AP 3j Inherent and Combined

Risk Assessment Form

3. Determine materiality AP 3f Materiality Worksheet for

limits. Audit Planning Purposes Section 4.5

4. Determine the audit AP 3g Planning Worksheet to

approach Determine Extent of Substantive Section 4.6

Testing

5. Design substantive AP 10 – 80 Audit Work Programs

tests (should be modified for specific Section 5

engagement)

6. Assign audit personnel

and prepare a time AP 3i Personnel Assignment and Section 4.7

budget for audit work Time Budget for the Audit

Audit Fieldwork Activities

Volume II – Form # and Volume I

Function Title Reference

1. Perform analytical Audit Work Programs (modified

procedures and for specific engagement): Section 6.1. 6.2

substantive testing. AP 10 Cash and 6.3

AP 15 Accounts Receivable and

Sales

AP 20 Prepaid Expenses and

Other Assets

AP 25 Investments

AP 30 Inventories

AP 32 Physical Inventory Counts

AP 35 Fixed Assets

AP 50 Accounts Payable and

Purchases

AP 55 Accrued Liabilities

AP 60 Debt

AP 70 Revenue and Expense

AP 80 Equity

AP 4a Summary of Audit

Differences

C-1 through C-4 Sample Audit

Confirmations

2. Document audit

procedures performed Section 6.4 and

and conclusions Appendix II

reached.

Finalizing the Audit

Volume II – Form # and Volume I

Function Title Reference

1. Review audit working

papers at appropriate All documentation prepared in Section 6.4

levels (in accordance planning and conducting the audit

with firm policy). work.

2. Evaluate audit AP 4b Evaluation of Audit

differences. Differences Section 7

3. Obtain and review

financial statements AP 125 Audit Report Checklist Section 8

prepared by the client

(or assist client in

preparing).

4. Perform audit AP 100 Subsequent Events

conclusion procedures: AP 105 Contingencies and

Perform review of Litigation Section 8

subsequent events and AP 110 Audit Review and

contingencies. Approval Form

Consider going AP 115 Audit Completion

concern assumption. Questionnaire

Obtain Management AP 120 Going Concern

Representation Letter Questionnaire

and Legal Letter 2 Management

Representation Letter. Representation Letter

Perform final Review Letter 3 Legal Representation

and Approval. Letter

5. Issue the Audit Example Audit Reports 1-11 Section 9

Report.

You might also like

- Audit Process PDFDocument30 pagesAudit Process PDFŘõmęõ Ji100% (2)

- P018 Internal Audit Procedure: ISO 9001:2008 Clause 8.2.2Document9 pagesP018 Internal Audit Procedure: ISO 9001:2008 Clause 8.2.2Álvaro Martínez Fernández100% (1)

- Auditor GuidelinesDocument15 pagesAuditor GuidelinesAnubhav GuptaNo ratings yet

- Audit ProcedureDocument11 pagesAudit Procedureumair80% (30)

- Audit Documentation: Requirements Application ParagraphsDocument5 pagesAudit Documentation: Requirements Application ParagraphsBilal RazaNo ratings yet

- Bank Audit Work PaperDocument47 pagesBank Audit Work PaperKaushal JhaNo ratings yet

- Aud Red SirugDocument12 pagesAud Red SirugRisaline CuaresmaNo ratings yet

- ACCO.710 Audit Process Jose Cintron, Mba: PlanningDocument30 pagesACCO.710 Audit Process Jose Cintron, Mba: Planningganesamoorthy1987No ratings yet

- Auditing Problems SyllabusDocument1 pageAuditing Problems SyllabustgenteroneNo ratings yet

- Mse Module-5 Pre1-AapDocument13 pagesMse Module-5 Pre1-AapJemalyn PiliNo ratings yet

- BMG-F-8Q Stage 1 ReportDocument7 pagesBMG-F-8Q Stage 1 ReportremeshsankarNo ratings yet

- Audit MethodologyDocument20 pagesAudit MethodologyVikasAgarwalNo ratings yet

- Ssa 230 Aug 2019Document12 pagesSsa 230 Aug 2019Bennice 8No ratings yet

- 7 Test Plan Template Evaluation of Test Results Template and ExamplesDocument13 pages7 Test Plan Template Evaluation of Test Results Template and ExamplesSofa SofianaNo ratings yet

- Chapter 14 AnsDocument9 pagesChapter 14 AnsDave ManaloNo ratings yet

- Internal Audit ProcedureDocument6 pagesInternal Audit ProcedureEric AnastacioNo ratings yet

- ACCT3014 Lecture05 s12013Document53 pagesACCT3014 Lecture05 s12013thomashong313No ratings yet

- Silabus MK. Auditing ISA (International Standard Auditing) Pert. Ke: Silabus: Pokok Dan Sub Pokok Bahasan ReferensiDocument3 pagesSilabus MK. Auditing ISA (International Standard Auditing) Pert. Ke: Silabus: Pokok Dan Sub Pokok Bahasan ReferensiRahmi FitriNo ratings yet

- Chapter 21 and 22Document47 pagesChapter 21 and 22Erica DizonNo ratings yet

- Lesson3-Audit Documentation, Audit Evidence & Audit SamplingDocument7 pagesLesson3-Audit Documentation, Audit Evidence & Audit Samplingangel caoNo ratings yet

- ISO/IEC 17021-1:2015 Requirement Matrix: Authority: Director of Accreditation Effective: 2015/06/16Document6 pagesISO/IEC 17021-1:2015 Requirement Matrix: Authority: Director of Accreditation Effective: 2015/06/16Mohamed Abbas100% (1)

- Audit DocumentationDocument15 pagesAudit DocumentationSunny BalaNo ratings yet

- QM-F-7.1-15 Ver.2.0 - Annual Quality Audit of VendorsDocument5 pagesQM-F-7.1-15 Ver.2.0 - Annual Quality Audit of VendorssanjaydeNo ratings yet

- Psa 230 RedraftedDocument15 pagesPsa 230 Redrafted2nd julieNo ratings yet

- Suggested Solution Mock Exam With Marking Scheme and Source of QDocument18 pagesSuggested Solution Mock Exam With Marking Scheme and Source of QHuma BashirNo ratings yet

- Group A (Umar, Fatima, Rafaqat) - Syndicate Ex 2Document2 pagesGroup A (Umar, Fatima, Rafaqat) - Syndicate Ex 2syedumarahmed52No ratings yet

- ACCT3014 Lecture12 s12013Document41 pagesACCT3014 Lecture12 s12013thomashong313No ratings yet

- Isa 230Document11 pagesIsa 230baabasaamNo ratings yet

- Planning Activity ISA Audit Manual Reference Preliminary Engagement ActivitiesDocument11 pagesPlanning Activity ISA Audit Manual Reference Preliminary Engagement ActivitiesMoffat MakambaNo ratings yet

- Quezon City University Auditing and Assurance Principles: Acpaud1Document17 pagesQuezon City University Auditing and Assurance Principles: Acpaud1agent2100No ratings yet

- Audit Documentation With Special Reference To CARO, 2003: Vijay KapurDocument41 pagesAudit Documentation With Special Reference To CARO, 2003: Vijay KapurAnand ChandrasekarNo ratings yet

- Paper 12 Sep 2021Document542 pagesPaper 12 Sep 2021Ajmal SalihNo ratings yet

- Internal Audit Procedure ExampleDocument5 pagesInternal Audit Procedure ExampleISO 9001 Checklist95% (37)

- Overall Audit StrategyDocument4 pagesOverall Audit StrategyHatterlessNo ratings yet

- 09 - Outline - Audit of Fixed AssetsDocument2 pages09 - Outline - Audit of Fixed AssetsThao PhuongNo ratings yet

- DEANA SARI BR HASIBUAN (Nomor Absen 06) PAPER PERTEMUAN 7Document9 pagesDEANA SARI BR HASIBUAN (Nomor Absen 06) PAPER PERTEMUAN 7Deea HasibuanNo ratings yet

- Homework Solutions Audit Planning and Analytical ProceduresDocument5 pagesHomework Solutions Audit Planning and Analytical ProceduresSaad Ahmed KhanNo ratings yet

- Planning FileDocument64 pagesPlanning FileMian Tahir WaseemNo ratings yet

- Self Audit Checklist PresentationDocument20 pagesSelf Audit Checklist Presentationnashwan mustafaNo ratings yet

- Audit DocumentationDocument6 pagesAudit Documentationemc2_mcv100% (4)

- Completing The AuditDocument38 pagesCompleting The AuditMazmurNo ratings yet

- Sa 230Document12 pagesSa 230meghanaNo ratings yet

- Tutorial Pemeriksaan AkuntansiDocument43 pagesTutorial Pemeriksaan AkuntansiNovi YantiNo ratings yet

- Bank Audit Work PaperDocument61 pagesBank Audit Work PaperSwastika SharmaNo ratings yet

- Iso/Iec 17021 Requirement Matrix: Accreditation Manager 02 JUNE 2009Document5 pagesIso/Iec 17021 Requirement Matrix: Accreditation Manager 02 JUNE 2009Bang CacihNo ratings yet

- Audit CH 19 Completing The AuditDocument19 pagesAudit CH 19 Completing The AuditAnji GoyNo ratings yet

- Chapter - 2 (Short Notes)Document4 pagesChapter - 2 (Short Notes)Aakansha SinghNo ratings yet

- Audit DocumentationDocument48 pagesAudit DocumentationHoney LimNo ratings yet

- SodapdfDocument10 pagesSodapdfangel caoNo ratings yet

- Ssa 230 Nov 2015Document12 pagesSsa 230 Nov 2015Eugene TayNo ratings yet

- Applied AuditingDocument2 pagesApplied Auditingctcasiple50% (2)

- SOP-02 (Procedure For Management Review)Document11 pagesSOP-02 (Procedure For Management Review)Farhan97% (30)

- 2018 POC Performance Audit Packaging of DocumentsDocument13 pages2018 POC Performance Audit Packaging of DocumentsDilg RoxasCityNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- The Sarbanes-Oxley Section 404 Implementation Toolkit: Practice Aids for Managers and AuditorsFrom EverandThe Sarbanes-Oxley Section 404 Implementation Toolkit: Practice Aids for Managers and AuditorsNo ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- Wiley Practitioner's Guide to GAAS 2016: Covering all SASs, SSAEs, SSARSs, PCAOB Auditing Standards, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2016: Covering all SASs, SSAEs, SSARSs, PCAOB Auditing Standards, and InterpretationsNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Iso 9001 Audit Trail: A Practical Guide to Process Auditing Following an Audit TrailFrom EverandIso 9001 Audit Trail: A Practical Guide to Process Auditing Following an Audit TrailRating: 5 out of 5 stars5/5 (3)

- Advanced Accounting-Volume 2Document4 pagesAdvanced Accounting-Volume 2ronnelson pascual25% (16)

- Obligations and ContractsDocument27 pagesObligations and ContractsMiGay Tan-Pelaez93% (80)

- Summary of The Audit ProcessDocument4 pagesSummary of The Audit ProcessRawrnalen FortesNo ratings yet

- Obligations and ContractsDocument27 pagesObligations and ContractsMiGay Tan-Pelaez93% (80)

- Adeyinka Oluwafunsho (134) $693.5 Thu Sep 03 11 48 00 EDT 2020 PDFDocument1 pageAdeyinka Oluwafunsho (134) $693.5 Thu Sep 03 11 48 00 EDT 2020 PDFGrace AdeyinkaNo ratings yet

- Citi Card Pay PDFDocument1 pageCiti Card Pay PDFShamim KhanNo ratings yet

- Quiz - QuestionsDocument20 pagesQuiz - QuestionsArturo ArbajeNo ratings yet

- Enron Case StudyDocument14 pagesEnron Case Studyvlabrague6426No ratings yet

- Chapter 12 Insurance Tax PowerpointDocument30 pagesChapter 12 Insurance Tax Powerpointapi-302252730No ratings yet

- Project Profile: M/S Ragini Kirana Store (Prop Upendra Yadav)Document18 pagesProject Profile: M/S Ragini Kirana Store (Prop Upendra Yadav)Satendra DhakarNo ratings yet

- Assignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionDocument6 pagesAssignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionAbdul Lateef KhanNo ratings yet

- PDFDocument19 pagesPDFRam SriNo ratings yet

- Bzu, Bahadur Sub-Campus Layyah: Submitted To: Mr. Muhammad Saleem Student GroupDocument23 pagesBzu, Bahadur Sub-Campus Layyah: Submitted To: Mr. Muhammad Saleem Student GroupMuhammad Ihsan ToorNo ratings yet

- Fac4863 104 - 2020 - 0 - BDocument93 pagesFac4863 104 - 2020 - 0 - BNISSIBETINo ratings yet

- MBA 662 Financial Institutions and Investment ManagementDocument4 pagesMBA 662 Financial Institutions and Investment ManagementAli MohammedNo ratings yet

- The Last Mile Playbook For FinTech On Polygon 2Document31 pagesThe Last Mile Playbook For FinTech On Polygon 2alexNo ratings yet

- Auditing Practice (AP) : #128 Maginhawa ST., Brgy. Teacher's Village East, Quezon City Pinnaclecpareview - PHDocument27 pagesAuditing Practice (AP) : #128 Maginhawa ST., Brgy. Teacher's Village East, Quezon City Pinnaclecpareview - PHWinnie ToribioNo ratings yet

- Summer Training Report at "Financial Performance Analysis With Ratio Analysis With Reference To South Eastern Coal Fields Limited" Bilaspur (C.G.)Document35 pagesSummer Training Report at "Financial Performance Analysis With Ratio Analysis With Reference To South Eastern Coal Fields Limited" Bilaspur (C.G.)Sanskar YadavNo ratings yet

- deeganAFA 7e ch28 ReducedDocument19 pagesdeeganAFA 7e ch28 Reducedmail2manshaaNo ratings yet

- Economics PrimerDocument16 pagesEconomics PrimerAbinesh MaranNo ratings yet

- MSCI Equity Indexes November 2020 Index Review: Press ReleaseDocument4 pagesMSCI Equity Indexes November 2020 Index Review: Press ReleaseAlbert Wilson DavidNo ratings yet

- MACROECONOMIC AGGREGATES (At Constant Prices) : Base Year:2011-12Document3 pagesMACROECONOMIC AGGREGATES (At Constant Prices) : Base Year:2011-12Vishnu KanthNo ratings yet

- Islamic Banking: Financial Institutions and Markets Final ProjectDocument27 pagesIslamic Banking: Financial Institutions and Markets Final ProjectNaina Azfar GondalNo ratings yet

- Act 282 Lembaga Kemajuan Wilayah Pulau Pinang Act 1983Document34 pagesAct 282 Lembaga Kemajuan Wilayah Pulau Pinang Act 1983Adam Haida & CoNo ratings yet

- Cost of Capital ChapterDocument26 pagesCost of Capital Chapteremon hossainNo ratings yet

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopNo ratings yet

- Part F - Additional QuestionsDocument9 pagesPart F - Additional QuestionsDesmond Grasie ZumankyereNo ratings yet

- Annexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeDocument1 pageAnnexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeenamsribdNo ratings yet

- CFTC Commitments of Traders Report - CME (Futures Only) 06082013Document10 pagesCFTC Commitments of Traders Report - CME (Futures Only) 06082013Md YusofNo ratings yet

- Macroeconomics Assignment 2Document4 pagesMacroeconomics Assignment 2reddygaru1No ratings yet

- Section 14 Unab Rid Dged Written VersionDocument17 pagesSection 14 Unab Rid Dged Written VersionPrashant TrivediNo ratings yet

- Reading Nego 2Document9 pagesReading Nego 2wearegertNo ratings yet

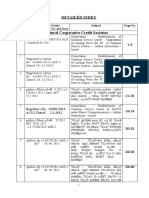

- Detailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NoDocument10 pagesDetailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NokalkibookNo ratings yet

- Receivable ManagementDocument39 pagesReceivable ManagementIquesh Gupta100% (1)