Professional Documents

Culture Documents

Lecture FinEcon6 A

Lecture FinEcon6 A

Uploaded by

Marium Owais0 ratings0% found this document useful (0 votes)

9 views10 pagesThis document discusses firm investment decisions and capital budgeting. It covers classifying projects, using the net present value (NPV) rule to evaluate projects, calculating cash flows and discount rates, and using the internal rate of return as an investment criterion. The objective is to increase the firm's current market value by taking projects with a positive NPV.

Original Description:

Original Title

Lecture_FinEcon6_a (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses firm investment decisions and capital budgeting. It covers classifying projects, using the net present value (NPV) rule to evaluate projects, calculating cash flows and discount rates, and using the internal rate of return as an investment criterion. The objective is to increase the firm's current market value by taking projects with a positive NPV.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views10 pagesLecture FinEcon6 A

Lecture FinEcon6 A

Uploaded by

Marium OwaisThis document discusses firm investment decisions and capital budgeting. It covers classifying projects, using the net present value (NPV) rule to evaluate projects, calculating cash flows and discount rates, and using the internal rate of return as an investment criterion. The objective is to increase the firm's current market value by taking projects with a positive NPV.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

Firm Investment decisions

ECO562-Financial Economics

Semester: Summer 2021

Dr. Zulfiqar Hyder

Institute of Business Administration, Karachi

June 19, 2021

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

Firm Investment decisions

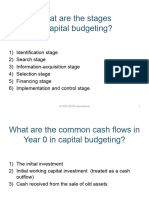

capital budgeting decisions

Capital budgeting decisions refer to financial decisions

regarding the use of a company’s scarce resources in making

capital investments.

Routine vs Strategic capital budgeting decisions

Projects with different degree of irreversibility.

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

Firm Investment decisions

Classification of investment projects

Classification according to economic life: Short-term

Investment and Long-term Investment.

Classification according to Risk of Returns: New products and

markets, replacement projects, expansion projects, and

mandated projects.

Classification according to Dependence on other projects:

independent, mutually exclusive, contingent, and

complementary projects.

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

Firm Investment decisions

NPV Rule

Objective: Increase Firms Current Market Value

Implication: take projects with positive NPV.

Project has cash flows of:

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

Firm Investment decisions

Example of NPV: An investment outlay of $10 million with

10% RRR

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

Firm Investment decisions

Example of NPV: Investment Decisions

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

Firm Investment decisions

The Investment Profile

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

Firm Investment decisions

Investment Criteria: Internal Rate of Return

For a single project, take it if and only if its NPV is positive

For many independent projects, take all those with positive

NPV

For mutually exclusive projects, take the one with positive and

highest NPV

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

Firm Investment decisions

Cash Flow Calculations: Main points

Use cash flows, not accounting earnings

Use after-tax cashflows

Use cash flows attributable to the project (compare firm value

with and without the project): Forget sunk costs: bygones are

bygones Include investment in working capital as capital

expenditure Include opportunity costs of using existing

equipment, facilities, etc. Correct for biases from fighting for

resources inside firm

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

Firm Investment decisions

Discount rate

A project’s discount rate (i.e., required rate of return) is the

expected rate of return demanded by investors for the project

The discount rate(s) in general depend on the timing and risk

of the cashflow(s)

The discount rate is usually different for different projects

Therefore, it is in general incorrect to use a company-wide

cost of capitalto discount cash flows of all projects

Dr. Zulfiqar Hyder ECO562-Financial Economics Semester: Summer 2021

You might also like

- Capital BudgetingDocument59 pagesCapital BudgetingDavid Abbam Adjei75% (4)

- Financial FeasibilityDocument53 pagesFinancial FeasibilityShyra MaximoNo ratings yet

- Capital Budgeting Cibg.Document36 pagesCapital Budgeting Cibg.Frederick Gbli100% (1)

- INR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EArnav KalraNo ratings yet

- Budget Project - PAD 5227Document23 pagesBudget Project - PAD 5227Sabrina SmithNo ratings yet

- LESSON 3 Capital BudgetingDocument10 pagesLESSON 3 Capital BudgetingNoel Salazar JrNo ratings yet

- (Lecture 1 & 2) - Introduction To Investment Appraisal MethodsDocument21 pages(Lecture 1 & 2) - Introduction To Investment Appraisal MethodsAjay Kumar Takiar100% (1)

- Capital Investment DecisionDocument16 pagesCapital Investment DecisionAbraham LinkonNo ratings yet

- Chapter 01 Long Term Investing and Financial DecisionsDocument30 pagesChapter 01 Long Term Investing and Financial DecisionsNida FatimaNo ratings yet

- PVL2602 FinalDocument2 pagesPVL2602 FinalGift MatoaseNo ratings yet

- (Lecture 1 & 2) - Introduction To Investment Appraisal Methods 2Document21 pages(Lecture 1 & 2) - Introduction To Investment Appraisal Methods 2Ajay Kumar TakiarNo ratings yet

- Basic Principles of Supply and Demand-1Document47 pagesBasic Principles of Supply and Demand-1Aniñon, Daizel Maye C.No ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Heiken-Ashi: PropertiesDocument6 pagesHeiken-Ashi: PropertieslportoNo ratings yet

- ECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderDocument25 pagesECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderMarium OwaisNo ratings yet

- ECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderDocument26 pagesECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderMarium OwaisNo ratings yet

- ECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderDocument19 pagesECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderMarium OwaisNo ratings yet

- Lecture FinEcon4 ADocument14 pagesLecture FinEcon4 AMarium OwaisNo ratings yet

- Capital Budgeting Decision: NPV Vs Irr Conflicts and ResolutionDocument18 pagesCapital Budgeting Decision: NPV Vs Irr Conflicts and Resolutionnasir abdulNo ratings yet

- Capital Budgeting: Learning OutcomesDocument11 pagesCapital Budgeting: Learning OutcomesSandia EspejoNo ratings yet

- S2 PPTDocument12 pagesS2 PPTPUSHKAL AGGARWALNo ratings yet

- R28 Uses of CapitalDocument16 pagesR28 Uses of CapitalSumair ChughtaiNo ratings yet

- CMA P2 Section E FCDocument25 pagesCMA P2 Section E FCM AyazNo ratings yet

- Capital BudgetingDocument32 pagesCapital BudgetingAKHIL JOSEPHNo ratings yet

- Chapter 6Document78 pagesChapter 6Tele ComNo ratings yet

- Finance 9 Capital BudgetingDocument33 pagesFinance 9 Capital BudgetingmohammedNo ratings yet

- CHAPTER-1 Introduction: 1.1 Overview 1.2 Meaning of Capital BudgetingDocument15 pagesCHAPTER-1 Introduction: 1.1 Overview 1.2 Meaning of Capital BudgetingPratibha NagvekarNo ratings yet

- Ch-7 CIDDocument17 pagesCh-7 CIDTas MimaNo ratings yet

- ch10 Fin202Document68 pagesch10 Fin202Nguyễn Thanh Nhàn K16No ratings yet

- FIN5203 Midterm Exam 2 FL22 ReviewDocument46 pagesFIN5203 Midterm Exam 2 FL22 Reviewmerly chermonNo ratings yet

- Chapter 11, R, F...Document26 pagesChapter 11, R, F...Rida FatimaNo ratings yet

- Hansen AISE IM Ch13Document59 pagesHansen AISE IM Ch13Aliyah rifdha syamNo ratings yet

- Capital BudgetingDocument30 pagesCapital BudgetingSyed Shaan KahnNo ratings yet

- CF Chapter 2 NotesDocument17 pagesCF Chapter 2 NotessdfghjkNo ratings yet

- Capital Budgeting Notes (MBA FA - 2023)Document10 pagesCapital Budgeting Notes (MBA FA - 2023)kavyaNo ratings yet

- Selection and Hierarchical Evaluation of Simple Investment Projects: NPV and IrrDocument24 pagesSelection and Hierarchical Evaluation of Simple Investment Projects: NPV and IrrFeenyxNo ratings yet

- Fundaments of Financial ManagementDocument13 pagesFundaments of Financial ManagementAadheesh SoodNo ratings yet

- Capital BudgetingDocument64 pagesCapital BudgetingNiaz AhmedNo ratings yet

- Chapter Five-Capital Budgeting DecisionsDocument43 pagesChapter Five-Capital Budgeting DecisionsSamuel AbebawNo ratings yet

- Investment Decisions Vtu Pervious Question Paper Question & AnswerDocument8 pagesInvestment Decisions Vtu Pervious Question Paper Question & AnswerushaNo ratings yet

- Vsa School of Management Department of MBA Salem 10: Key WordsDocument41 pagesVsa School of Management Department of MBA Salem 10: Key Wordscatch00000No ratings yet

- Capital BudgetingDocument28 pagesCapital BudgetingM SameerNo ratings yet

- Capital BudgetingDocument28 pagesCapital BudgetingDivya AgarwalNo ratings yet

- Managerial Accounting: Individual Report OnDocument13 pagesManagerial Accounting: Individual Report OnRishav KoiralaNo ratings yet

- Capital Budgeting: Exclusive ProjectsDocument6 pagesCapital Budgeting: Exclusive ProjectsMethon BaskNo ratings yet

- 07 Capital+BudgetingDocument23 pages07 Capital+BudgetingSaidatul DihaNo ratings yet

- Management Accounting: Capital Investment DecisionsDocument58 pagesManagement Accounting: Capital Investment DecisionsFify AmalindaNo ratings yet

- Topic 5 - Multinational Capital BudgetingDocument14 pagesTopic 5 - Multinational Capital BudgetingJeff MainaNo ratings yet

- Capital Budgeting TechniquesDocument11 pagesCapital Budgeting Techniquesnaqibrehman59No ratings yet

- Capital Budgeting: - Long Term Planning For Proposed Capital Outlays and Their FinancingDocument33 pagesCapital Budgeting: - Long Term Planning For Proposed Capital Outlays and Their FinancingMayank GargNo ratings yet

- Financial NotesDocument23 pagesFinancial NotesrahulNo ratings yet

- Lagos CityDocument19 pagesLagos CityYusuf OlawaleNo ratings yet

- Management Accounting: Student EditionDocument28 pagesManagement Accounting: Student EditionTri OktavianiNo ratings yet

- Summary Capital Budgeting (21!10!2021)Document4 pagesSummary Capital Budgeting (21!10!2021)Shafa ENo ratings yet

- Capital BudgetingDocument18 pagesCapital BudgetingHelping HandNo ratings yet

- Wukari Journalon Finance MGTDiscovery June 2022Document19 pagesWukari Journalon Finance MGTDiscovery June 2022AnishahNo ratings yet

- Chapter 6 - The Analysis of Investment ProjectsDocument16 pagesChapter 6 - The Analysis of Investment ProjectsAbdul Fattaah Bakhsh 1837065No ratings yet

- Project Management: by Tanushree BoseDocument14 pagesProject Management: by Tanushree BoseKalyan RaiNo ratings yet

- Unit 7Document29 pagesUnit 7Nigussie BerhanuNo ratings yet

- Chapter 6 Basic Methods For Making Economy StudiesDocument37 pagesChapter 6 Basic Methods For Making Economy StudiesJustine joy cruzNo ratings yet

- Unit 7: Investment DecisionsDocument29 pagesUnit 7: Investment DecisionstelilaalilemlemNo ratings yet

- Financial ManagementDocument60 pagesFinancial ManagementAhyaanNo ratings yet

- Unit III Open ElectiveDocument21 pagesUnit III Open ElectiveE11Ayush MinjNo ratings yet

- IRR and PI - Group 5Document24 pagesIRR and PI - Group 5Pallavi BhardwajNo ratings yet

- Capital Budgeting DecisionDocument5 pagesCapital Budgeting DecisionSneha KumarNo ratings yet

- Marketing Management SubmissionsDocument2 pagesMarketing Management SubmissionsMarium OwaisNo ratings yet

- ECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderDocument19 pagesECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderMarium OwaisNo ratings yet

- Lecture FinEcon4 ADocument14 pagesLecture FinEcon4 AMarium OwaisNo ratings yet

- ECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderDocument25 pagesECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderMarium OwaisNo ratings yet

- ECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderDocument26 pagesECO562-Financial Economics Semester: Summer 2021: Dr. Zulfiqar HyderMarium OwaisNo ratings yet

- N Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingDocument6 pagesN Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingMarium OwaisNo ratings yet

- N Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingDocument6 pagesN Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingMarium OwaisNo ratings yet

- The Constitution of The Islamic Republic of PakistanDocument2 pagesThe Constitution of The Islamic Republic of PakistanMarium OwaisNo ratings yet

- Systematic & Unsystematic Risk: N Amin - Summer 2020 BFII 6/20/2020Document4 pagesSystematic & Unsystematic Risk: N Amin - Summer 2020 BFII 6/20/2020Marium OwaisNo ratings yet

- GHIE ABM Steps in JournalizingDocument19 pagesGHIE ABM Steps in JournalizingRaizel chris VargasNo ratings yet

- Lofrans Progress 1 ManualDocument8 pagesLofrans Progress 1 ManualJulio AslaNo ratings yet

- International Financial Management 13 Edition: by Jeff MaduraDocument33 pagesInternational Financial Management 13 Edition: by Jeff MaduraJaime SerranoNo ratings yet

- Present Unit 14Document106 pagesPresent Unit 14Huyền HạnhNo ratings yet

- Acct Statement XX6194 28072023Document4 pagesAcct Statement XX6194 28072023Mohammad Sharafat KhanNo ratings yet

- Properties of Commercially Pure Titanium and Titanium AlloysDocument27 pagesProperties of Commercially Pure Titanium and Titanium AlloysZhu DanielNo ratings yet

- EconomicsDocument10 pagesEconomicsSuaNo ratings yet

- Ctanujit Classes of Mathematics Statistics & Economics: MSQMS 2015 Solution Paper QMA (Mathematics)Document14 pagesCtanujit Classes of Mathematics Statistics & Economics: MSQMS 2015 Solution Paper QMA (Mathematics)Shayan Sen GuptaNo ratings yet

- Model Dinamis Kebijakan InfrastrukturDocument55 pagesModel Dinamis Kebijakan InfrastrukturDe JangarzNo ratings yet

- Vivo T2x InvoiceDocument2 pagesVivo T2x Invoicearyanmehta27amNo ratings yet

- SPK Presentation 2021Document24 pagesSPK Presentation 2021Mohamed RazickNo ratings yet

- Manual - Koflo Static MixersDocument6 pagesManual - Koflo Static MixersFabian A Neira100% (1)

- S106508 Torqueo de Pernos Bastidores y PropelDocument2 pagesS106508 Torqueo de Pernos Bastidores y Propelbends1408No ratings yet

- Sample - Superstore Sales (Excel)Document804 pagesSample - Superstore Sales (Excel)MANIKANTH TALAKOKKULANo ratings yet

- 10-Column Worksheet FormDocument2 pages10-Column Worksheet FormImran ZulfiqarNo ratings yet

- ECON 1033 - Handout 1Document8 pagesECON 1033 - Handout 1Justin Deil AlbanoNo ratings yet

- Chapter 1-5Document6 pagesChapter 1-5Bien BibasNo ratings yet

- Activity 13: Unit One Test (CIA4U)Document4 pagesActivity 13: Unit One Test (CIA4U)LilithNo ratings yet

- Capital AllowanceDocument34 pagesCapital AllowancesamuelNo ratings yet

- T-5 Specification FormDocument4 pagesT-5 Specification FormMukta AktherNo ratings yet

- Paid 1 Oct 2014Document6 pagesPaid 1 Oct 2014MANSA MARKETINGNo ratings yet

- Read The Following Text and List The Steps in Starting A Business As Well As Explain Four Elements Involved in Every BusinessDocument2 pagesRead The Following Text and List The Steps in Starting A Business As Well As Explain Four Elements Involved in Every BusinessCessara Alfetty AngelitaNo ratings yet

- Scientific Writing - SlidesDocument19 pagesScientific Writing - SlidesDenise MacielNo ratings yet

- Real Business CyclesDocument139 pagesReal Business CyclesmanuzipeixotoNo ratings yet

- BAA000016646479Document2 pagesBAA000016646479Robin JamesNo ratings yet