Professional Documents

Culture Documents

Detailed Class Schedules B-TMAS401

Uploaded by

Joris YapCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Detailed Class Schedules B-TMAS401

Uploaded by

Joris YapCopyright:

Available Formats

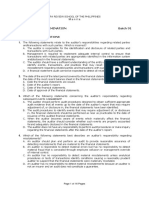

Assessments

Week # From To Module Sync Meeting Async SB Availability Deadlines

1 6-Sep 11-Sep Orientation/Uploading of Module 1

Syllabus Orientation & Local Government

2 17-Sep 18-Sep 1 Taxation

22-Sep 22-Sep

3 2

24-Sep 25-Sep Local Government and Real Property Taxation

Enabling Assessment #1 - Local Government &

Real Property Taxation 26-Sep 3-Oct

Formative Assessment #1 - Local Governement

Taxation & Real Property Taxation 15-Nov

4 1-Oct 2-Oct Summative Assessment 1_ Midterm period ( Local Government Taxation & Real Property Taxation ) 1-Oct 3 hours

5 4-Oct 9-Oct SELF CARE WEEK

6 15-Oct 16-Oct Magna Carta for Disabled Person & Senior

3 Citizen Act

7 22-Oct 23-Oct

8 29-Oct 30-Oct 4 Barangay Micro Business Entrepreneur

Enabling Assessment #2 - Magna Carta for

Disabled and Senior Citizen Act 23-Oct 30-Oct

Enabling Assessment #5 - BMBE 4-Nov 11-Nov

Formative Assessment #2 - Magna Carta for

Disabled and Senior Citizen and BMBE 20-Nov

9 3-Nov 9-Nov MIDTERM EXAMINATION ( Comprehensive examination _ Module 1-4)

10 12-Nov 13-Nov

11 19-Nov 20-Nov

5 Special Economic Zone Act

24-Nov 24-Nov

12 Omnibus Investment code

26-Nov 27-Nov 6

Enabling Assessment #4 - Special Economic

Zone Act

20-Nov 27-Nov

Enabling Assessment #5 - Ombnibus Code

28-Nov 5-Dec

Formative Assessment #3 - Special Economic

zone and Omnibus Investment code 15-Jan

13 3-Dec 4-Dec Summative Assessment 1_ Final period ( Special Economic Zone) 3-Dec 3 hours

14 6-Dec 11-Dec SELF CARE WEEK

15 20-Dec 21-Dec 7 Double Taxation ( Special Class)

16 14-Jan 15-Jan

17 21-Jan 22-Jan 8 Customs and Tariff modenization Act

Enabling Assessment #6 - Double Taxation and

Customs and Tariff modernization Act 24-Jan 31-Jan

Formative Assessment #4 - Special Economic

zone and Omnibus Investment code 31-Jan

18 24-Jan 28-Jan MIDTERM EXAMINATION ( Comprehensive examination _ Module 1-8) 20% , 80%

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- MAS AbitiagoDocument6 pagesMAS AbitiagoJoris YapNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Final Audpb-91st-Apr 2022 (Solutions)Document5 pagesFinal Audpb-91st-Apr 2022 (Solutions)Joris YapNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- RFBT Preweek 91Document30 pagesRFBT Preweek 91Joris YapNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Manila MAY 5, 2022 Preweek Material: Management Advisory ServicesDocument25 pagesManila MAY 5, 2022 Preweek Material: Management Advisory ServicesJoris YapNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Final Preboard ExaminationDocument14 pagesFinal Preboard ExaminationJoris YapNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Final Preboard Batch 91 Reviewees PDFDocument18 pagesFinal Preboard Batch 91 Reviewees PDFJoris YapNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- AFAR Preweek Lecture Part 2Document18 pagesAFAR Preweek Lecture Part 2Joris YapNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- AP-PW 91: Review Problems-1Document9 pagesAP-PW 91: Review Problems-1Joris YapNo ratings yet

- AUD Final Preboard Examination QuestionnaireDocument16 pagesAUD Final Preboard Examination QuestionnaireJoris YapNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 91 - Final Preaboard AFAR Solutions (WEEKENDS)Document9 pages91 - Final Preaboard AFAR Solutions (WEEKENDS)Joris YapNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Audit of InventoriesDocument9 pagesAudit of InventoriesJoris YapNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- ES 8 3 ChocholakovaDocument13 pagesES 8 3 ChocholakovaJoris YapNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- GROUP 1 - Sec 53-58Document3 pagesGROUP 1 - Sec 53-58Joris YapNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Business Law and Regulations ReviewerDocument6 pagesBusiness Law and Regulations ReviewerJoris YapNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- List of Operating Medical Tourism Zone: Total No. 2Document28 pagesList of Operating Medical Tourism Zone: Total No. 2Joris YapNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 91 - Final Preaboard Afar (Weekends)Document18 pages91 - Final Preaboard Afar (Weekends)Joris YapNo ratings yet

- B-Tmas401 Sy 2021 - 2022Document17 pagesB-Tmas401 Sy 2021 - 2022Joris YapNo ratings yet

- Political Globalization ModuleDocument34 pagesPolitical Globalization ModuleJoris YapNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Confirmatory Factor AnalysisDocument68 pagesConfirmatory Factor AnalysisJoris YapNo ratings yet

- Module 2 Case Study - India S Transformation To A Liberal EconomyDocument2 pagesModule 2 Case Study - India S Transformation To A Liberal EconomyJoris YapNo ratings yet

- Understanding Politics, Laws and EconomicsDocument20 pagesUnderstanding Politics, Laws and EconomicsJoris YapNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- De La Salle University-Dasmarinas College of Liberal Arts and Communication Social Sciences Department Summative Test No.2 Contemporary WorldDocument2 pagesDe La Salle University-Dasmarinas College of Liberal Arts and Communication Social Sciences Department Summative Test No.2 Contemporary WorldJoris YapNo ratings yet

- Summative Assessment No. 1 2021-20223Document2 pagesSummative Assessment No. 1 2021-20223Joris Yap100% (1)

- The DLSU Medical Center at The CrossroadDocument22 pagesThe DLSU Medical Center at The CrossroadJoris YapNo ratings yet

- Isf PPT CompiDocument88 pagesIsf PPT CompiJoris YapNo ratings yet

- Module 2 Case Study - India S Transformation To A Liberal EconomyDocument2 pagesModule 2 Case Study - India S Transformation To A Liberal EconomyJoris YapNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Conflict Management HandbookDocument193 pagesConflict Management HandbookGuillermo FigueroaNo ratings yet

- Erasmus Training Agreement and Quality CommitmentDocument5 pagesErasmus Training Agreement and Quality CommitmentSofia KatNo ratings yet

- The Performance of The Legazpi City Police Station in Rendering Police Services Calendar Year 2014-2016Document13 pagesThe Performance of The Legazpi City Police Station in Rendering Police Services Calendar Year 2014-2016Kiel Riñon EtcobanezNo ratings yet

- Health Records and The Law 5th EditionDocument436 pagesHealth Records and The Law 5th Editionprasad sardarNo ratings yet

- DL Services GhashyamDocument2 pagesDL Services GhashyamGhanshyam ChaudharyNo ratings yet

- The PassiveDocument12 pagesThe PassiveCliver Rusvel Cari SucasacaNo ratings yet

- GOTS 3.0-4.0 Positive List 1Document8 pagesGOTS 3.0-4.0 Positive List 1Kushagradhi DebnathNo ratings yet

- Chinese OCW Conversational Chinese WorkbookDocument283 pagesChinese OCW Conversational Chinese Workbookhnikol3945No ratings yet

- Water Quality Categorization Using WQI in Rural Areas of Haridwar, IndiaDocument16 pagesWater Quality Categorization Using WQI in Rural Areas of Haridwar, IndiaESSENCE - International Journal for Environmental Rehabilitation and ConservaionNo ratings yet

- RJK03S3DPADocument7 pagesRJK03S3DPAvineeth MNo ratings yet

- DRRM School Memo and Letter of InvitationDocument7 pagesDRRM School Memo and Letter of InvitationRames Ely GJNo ratings yet

- Beebe ME Chain HoistDocument9 pagesBeebe ME Chain HoistDan VekasiNo ratings yet

- Commercial Banking Operations:: Types of Commercial BanksDocument6 pagesCommercial Banking Operations:: Types of Commercial BanksKhyell PayasNo ratings yet

- Mongodb Use Case GuidanceDocument25 pagesMongodb Use Case Guidancecresnera01No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Beta Price List Conduit 22-03-2021Document1 pageBeta Price List Conduit 22-03-2021Jugno ShahNo ratings yet

- Is 14394 1996 PDFDocument10 pagesIs 14394 1996 PDFSantosh KumarNo ratings yet

- People V Oloverio - CrimDocument3 pagesPeople V Oloverio - CrimNiajhan PalattaoNo ratings yet

- Icici Marketing Strategy of Icici BankDocument68 pagesIcici Marketing Strategy of Icici BankShilpi KumariNo ratings yet

- Oman Foreign Capital Investment LawDocument8 pagesOman Foreign Capital Investment LawShishir Kumar SinghNo ratings yet

- Suggested Solution Far 660 Final Exam December 2019Document6 pagesSuggested Solution Far 660 Final Exam December 2019Nur ShahiraNo ratings yet

- 2nd Notice W-4 TerminationDocument2 pages2nd Notice W-4 TerminationMichael Kovach100% (4)

- Regulatory RequirementsDocument6 pagesRegulatory RequirementsAmeeroddin Mohammad100% (1)

- United States Court of Appeals, Third CircuitDocument25 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- United States of America Ex Rel. Maria Horta v. John Deyoung, Warden Passaic County Jail, 523 F.2d 807, 3rd Cir. (1975)Document5 pagesUnited States of America Ex Rel. Maria Horta v. John Deyoung, Warden Passaic County Jail, 523 F.2d 807, 3rd Cir. (1975)Scribd Government DocsNo ratings yet

- (Onati International Series in Law and Society) Eric L. Jensen, Jorgen Jepsen - Juvenile Law Violators, Human Rights, and The Development of New Juvenile Justice Systems - Hart Publishing (2006)Document497 pages(Onati International Series in Law and Society) Eric L. Jensen, Jorgen Jepsen - Juvenile Law Violators, Human Rights, and The Development of New Juvenile Justice Systems - Hart Publishing (2006)Cristelle FenisNo ratings yet

- Swot of ICICI BankDocument12 pagesSwot of ICICI Bankynkamat100% (6)

- Financial Statement of Raymond & Bombay DyingDocument18 pagesFinancial Statement of Raymond & Bombay DyingGaurav PoddarNo ratings yet

- Branch - QB Jan 22Document40 pagesBranch - QB Jan 22Nikitaa SanghviNo ratings yet

- Karnataka Current Affairs 2017 by AffairsCloudDocument13 pagesKarnataka Current Affairs 2017 by AffairsCloudSinivas ParthaNo ratings yet

- Thermal Physics Assignment 2013Document10 pagesThermal Physics Assignment 2013asdsadNo ratings yet