Professional Documents

Culture Documents

Donating Anonymously

Uploaded by

LJBernardoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Donating Anonymously

Uploaded by

LJBernardoCopyright:

Available Formats

Legal aspects[edit]

Donations are given without return consideration. This lack of return consideration means that,

in common law, an agreement to make a donation is an "imperfect contract void for want of

consideration."[5] Only when the donation is actually made does it acquire legal status as a transfer or

property.[6]

In politics, the law of some countries may prohibit or restrict the extent to which politicians may

accept gifts or donations of large sums of money, especially from business or lobby

groups (see campaign finance). Donations of money or property to qualifying charitable

organizations are also usually tax deductible. Because this reduces the state's tax income, calls

have been raised that the state (and the public in general) should pay more attention towards

ensuring that charities actually use this 'tax money' in suitable ways.

There have been discussions on whether also a donation of time should be tax deductible. [7]

The person or institution giving a gift is called the donor, and the person or institution getting the gift

is called the donee.[6]

Donating in the name of others[edit]

It is possible to donate in the name of a third party, making a gift in honor or in memory of someone

or something. Gifts in honor or memory of a third party are made for various reasons, such as

holiday gifts, wedding gifts, in memory of somebody who has died, in memory of pets or in the name

of groups or associations no longer existing. Memorial gifts are sometimes requested by their

survivors (e.g. "in lieu of flowers, contributions may be made to ABC Charity"), usually directing

donations to a charitable organization for which the deceased was a donor or volunteer, or for a

cause befitting the deceased's priorities in life or manner of death. Memorial donations are also

sometimes given by people if they are unable to attend the ceremony.

Donating Anonymously[edit]

There are also circumstances when people like to donate funds to their preferred causes by not

revealing their names. Many donors such as public figures or philanthropists like to stay anonymous

while making generous donations according to their wishes. Many donors like to stay anonymous

because

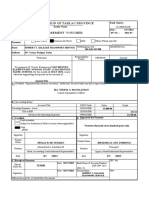

For every donation over One Million pesos (Php 1,000,000), the donor shall give a

letter of notice to the Revenue District Officer (RDO) where his place of business is

located within thirty (30) days after the receipt of the Certificate of Donation attaching

to the said letter the copy of the Certificate of Donation issued to him by the

accredited non-stock, non-profit corporation/NGO and statement of valuation, subject

to further confirmation by the Bureau as to its correctness and accuracy.

Claims for deductibility of donations and contributions by the donors shall be filed at

the time of filing their income tax returns by attaching the said certificate and

necessary evidence mentioned above.

However, tax deductibility based on generosity and compassion is not always

guaranteed because the donor is constrained by the requirements of tax deductibility

as mandated by law. This is to prevent corporations or individuals from claiming non-

existent donations to reduce their taxable income, and, on the other hand, to ensure

that recipients of donations faithfully use the funds for the intended causes.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Causes of Colour Blindness Genetic AcquireDocument2 pagesCauses of Colour Blindness Genetic AcquireLJBernardoNo ratings yet

- Color BlindnessDocument2 pagesColor BlindnessLJBernardoNo ratings yet

- Basler Brot - Wikipedia: Traditionally Made in The Swiss Cantons of Basel-Stadt and Basel-LandschaftDocument4 pagesBasler Brot - Wikipedia: Traditionally Made in The Swiss Cantons of Basel-Stadt and Basel-LandschaftLJBernardoNo ratings yet

- Donations and GiftsDocument1 pageDonations and GiftsLJBernardoNo ratings yet

- Swabian Lye Rolls Recipe: A Breakfast Delicacy From ..Document2 pagesSwabian Lye Rolls Recipe: A Breakfast Delicacy From ..LJBernardoNo ratings yet

- Love Is Color BlindDocument3 pagesLove Is Color BlindLJBernardoNo ratings yet

- Philippine Health Insurance CorporationDocument3 pagesPhilippine Health Insurance CorporationLJBernardoNo ratings yet

- Statement of The ProblemDocument2 pagesStatement of The ProblemLJBernardoNo ratings yet

- What Is The Individual Taxpayer Identification Number (ITIN) ?Document1 pageWhat Is The Individual Taxpayer Identification Number (ITIN) ?LJBernardoNo ratings yet

- Individual Taxpayer Identification Number (ITIN) Example: A Checking AccountDocument1 pageIndividual Taxpayer Identification Number (ITIN) Example: A Checking AccountLJBernardoNo ratings yet

- Every Partner Must Be Just and Faithful To The Other PartnersDocument1 pageEvery Partner Must Be Just and Faithful To The Other PartnersLJBernardoNo ratings yet

- Rights of A Limited PartnerDocument1 pageRights of A Limited PartnerLJBernardoNo ratings yet

- Render True AccountsDocument1 pageRender True AccountsLJBernardoNo ratings yet

- The Emergence of Angel Investment Networks in Southeast Asia Report I A Good Practice Guide To Effective Angel InvestingDocument58 pagesThe Emergence of Angel Investment Networks in Southeast Asia Report I A Good Practice Guide To Effective Angel InvestingRick WongNo ratings yet

- Transportation AttachmentDocument3 pagesTransportation AttachmentJessica CrisostomoNo ratings yet

- Trip FlightDocument1 pageTrip Flightkueking joresNo ratings yet

- Febrero 24Document12 pagesFebrero 24micasacontractors893No ratings yet

- Introduction To Corporate Finance: Fourth EditionDocument48 pagesIntroduction To Corporate Finance: Fourth EditionTyler NielsenNo ratings yet

- Meaning of WTO: WTO - World Trade OrganisationDocument13 pagesMeaning of WTO: WTO - World Trade OrganisationMehak joshiNo ratings yet

- History of Phil Economic CrisisDocument54 pagesHistory of Phil Economic CrisisAnatalio ViadoyNo ratings yet

- Benefits & Risks of The Resale Price MethodDocument2 pagesBenefits & Risks of The Resale Price MethodLJBernardoNo ratings yet

- International Economics Theory and Policy 10Th Edition Krugman Test Bank Full Chapter PDFDocument33 pagesInternational Economics Theory and Policy 10Th Edition Krugman Test Bank Full Chapter PDFjocastaodettezjs8100% (11)

- ReportDocument2 pagesReportMuh ArafaNo ratings yet

- AlbertvilleBoazGuntersville - AL - 2023Document93 pagesAlbertvilleBoazGuntersville - AL - 2023ravee12No ratings yet

- Marlin Natuna Job Vacancy 2nd Wave-1 PDFDocument24 pagesMarlin Natuna Job Vacancy 2nd Wave-1 PDFBeny ZulNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 2Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 2Roshan RamkhalawonNo ratings yet

- Street Vendors ThesisDocument7 pagesStreet Vendors Thesisstephaniebenjaminclarksville100% (2)

- Topic 6 OdlDocument19 pagesTopic 6 OdlNur NabilahNo ratings yet

- 3-Math Solved MCQs (For FPSC, PPSC, CSS, PMS, NTS)Document10 pages3-Math Solved MCQs (For FPSC, PPSC, CSS, PMS, NTS)SajidmehsudNo ratings yet

- A Seminar Report On Management of SupplyDocument25 pagesA Seminar Report On Management of SupplyRijana ShresthaNo ratings yet

- Yum S Equity Research Report 1661623813Document20 pagesYum S Equity Research Report 1661623813Javier ChanNo ratings yet

- Innovation Your Solution For Weathering UncertaintyDocument7 pagesInnovation Your Solution For Weathering Uncertaintyvae2797No ratings yet

- Shweta AggarwalDocument87 pagesShweta Aggarwalkomal vermaNo ratings yet

- Problem Solving Quiz 1Document1 pageProblem Solving Quiz 1Cherry DerramasNo ratings yet

- Assets Liabilities and EquityDocument2 pagesAssets Liabilities and EquityArian Amurao50% (2)

- Case 2: Doing Business in SingaporeDocument5 pagesCase 2: Doing Business in SingaporeHera AsuncionNo ratings yet

- SBMC Blank v2 2 PDFDocument1 pageSBMC Blank v2 2 PDFSusan BvochoraNo ratings yet

- People Moves Report: H1 2020 EmeaDocument24 pagesPeople Moves Report: H1 2020 EmeaAnonymous 2X8yWQTNo ratings yet

- Permanent Transfer ClaimDocument2 pagesPermanent Transfer ClaimdpdohisarNo ratings yet

- PegasusDocument1 pagePegasusشيماء ShejmaNo ratings yet

- Accounting For Merchandising Operations: Pertemuan 7Document16 pagesAccounting For Merchandising Operations: Pertemuan 7Herry ArsevenNo ratings yet

- Topic 1 - Introduction of Production and Operation ManagementDocument16 pagesTopic 1 - Introduction of Production and Operation ManagementTanisha SarafNo ratings yet

- Bubble House Final Report - 1Document17 pagesBubble House Final Report - 1Ngô RangNo ratings yet