Professional Documents

Culture Documents

Liquidity Ratios: Working Capital To Total Asset Ratio

Uploaded by

BlueBladeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liquidity Ratios: Working Capital To Total Asset Ratio

Uploaded by

BlueBladeCopyright:

Available Formats

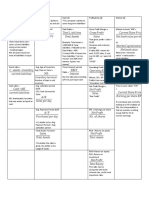

LIQUIDITY RATIOS C.

Debt to Equity Ratio

A. Current Ratio Debt to Total Liability

Equity

Total Current Assets

Ratio

Current Ratio Total Shareholder’s Equity

Total Current Liabilities

D. Times Interest Earned Ratio

B. Quick Ratio

Times Earnings before Interest and

Current Assets - Inventories Tax (EBIT)

Interest

Quick Ratio

Earned

Total Current Liabilities Ratio Interest Expense

C. Cash Ratio E. Cash Coverage Ratio

Cash + Marketable Securities

Cash Ratio Cash EBIT + Depreciation

Total Current Liabilities Coverage

Ratio Interest Expense

D. Working Capital to Total Asset Ratio

ACTIVITY RATIOS

Working

Capital to Current Assets - Current Liabilities

Total A. Asset Turnover Ratio

Asset

Ratio Total Assets

Asset Sales Revenue

Turnover

Ratio

Average Assets

LEVERAGE RATIOS B. Accounts Receivable Turnover Ratio

A. Debt Ratio Accounts

Total Liability Receivable Credit Sales

Debt Ratio Turnover

Ratio Average Accounts Receivable

Total Asset

B. Equity Ratio C. Days’ Sales Receivable

Equity Total Shareholder’s Equity Days’ Sales Average Receivables*

Ratio Receivable

Average Daily Sales**

Total Asset

* Beginning AR + Ending AR / 2

** Sales Revenue / 360

1 diamla, foronda, gan

D. Inventory Turnover Ratio ● ARP - Average Receivable Period or

Average Collection Period

Inventory Cost of Sales Average Receivables

Turnover ARP

Ratio Average Inventory Average Daily Sales

E. Days’ Sales Inventory ● APP - Average Payable Period

Average Accounts Payable

Days’ Sales Average Inventory* APP

Inventory

Average Daily Sales** Average Daily Purchases

* Beginning Inv. + Ending Inv. / 2

** Cost of Sales / 360

PROFITABILITY RATIO

F. Accounts Payable Turnover Ratio

AS TO MARGINS

1. Gross Profit Margin (GPM)

Accounts

Payable Purchases* Gross Profit

Turnover GPM

Ratio Accounts Payable Net Sales

* Cost of Goods Sold + Ending Inventory -

Beginning Inventory 2. Operating Profit Margin (OPM)

Operating Profit

G. Days’ Payable Outstanding

OPM

Days’ Sales Average Accounts Payable* Net Sales

Outstanding

Average Daily Purchases**

3. Net Profit Margin (NPM)

* Beginning AP + Ending AP / 2 Net Income After Tax

** Purchases / 360 NPM

Net Sales

H. Normal Operating Cycle

Cash AS TO RETURNS

Conversion AIP + ARP - APP

1. Return on Sales (ROS)

Cycle

Net Income

ROS

● AIP - Average Inventory Period Net Sales

Average Inventory

AIP

2. Return on Assets (ROA)

Average Daily Cost of Sales

Net Income

ROA

Average Assets

2 diamla, foronda, gan

3. Return on Equity (ROE)

Gross Profit

GPM

Net Sales

AS TO SHAREHOLDER’S INTEREST

1. Earnings Per Share (EPS)

Net Income - Preferred Stocks

EPS

Number of Outstanding Common

Stocks

2. Price-Earnings Ratio (PER)

Net Income - Preferred Stocks

PER

Number of Outstanding Common

Stocks

3. Dividend Yield (DY)

Dividend Per Share

DY

Market Price per Share

4. Pay-Out Ratio (POR)

Dividends per Share

POR

Earnings per Share

5. Plow Back Ratio (PBR)

Earnings per Share - Dividends per

PBR Share

Earnings per Share

3 diamla, foronda, gan

You might also like

- FL CFA Formula Sheet FRA 2020Document1 pageFL CFA Formula Sheet FRA 2020Opal Chais100% (1)

- BudgetingDocument23 pagesBudgetingShiela Marquez100% (6)

- BudgetingDocument23 pagesBudgetingShiela Marquez100% (6)

- CFA Level 1 Financial Ratios SheetDocument3 pagesCFA Level 1 Financial Ratios SheetVineet Kumar100% (1)

- Explicitly Available DerivativeDocument4 pagesExplicitly Available DerivativeNeeraj KumarNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisSHENo ratings yet

- Trading SimulationDocument9 pagesTrading SimulationЭрдэнэ-Очир НОМИНNo ratings yet

- Liquidity: Financial Statements (FS) Analysis Tools and TechniqueDocument6 pagesLiquidity: Financial Statements (FS) Analysis Tools and TechniqueDondie ArchetaNo ratings yet

- ICT Kill ZonesDocument9 pagesICT Kill ZonesArif Agustian100% (5)

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalSales ExecutiveNo ratings yet

- Three Basic Accounting Statements:: - Income StatementDocument14 pagesThree Basic Accounting Statements:: - Income Statementamedina8131No ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Interest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeDocument3 pagesInterest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeAshley Levy San PedroNo ratings yet

- Financial Ratio FormulasDocument2 pagesFinancial Ratio FormulasSyed Shariq AliNo ratings yet

- Aptitude PartnershipDocument12 pagesAptitude PartnershipKarthick100% (1)

- Common Ratios Used in Financial AnalysisDocument5 pagesCommon Ratios Used in Financial AnalysisSuperGuyNo ratings yet

- Lecture Notes Valuation of BondsDocument6 pagesLecture Notes Valuation of BondsBlueBladeNo ratings yet

- Risk and Rates of Return Problem SolvingDocument7 pagesRisk and Rates of Return Problem SolvingBlueBladeNo ratings yet

- FAR 1 ReviewerDocument11 pagesFAR 1 ReviewerBlueBladeNo ratings yet

- Module 5.3 Chapter 5 Answer Key 1Document8 pagesModule 5.3 Chapter 5 Answer Key 1BlueBladeNo ratings yet

- Book Publishing in The US Industry Report PDFDocument33 pagesBook Publishing in The US Industry Report PDFrednus100% (3)

- Capital Structure TheoriesDocument31 pagesCapital Structure TheoriesShashank100% (1)

- Engineering Economics Project ReportDocument9 pagesEngineering Economics Project ReportAbdulwahab AlmaimaniNo ratings yet

- Fundamentals of Accounting ExamDocument3 pagesFundamentals of Accounting ExamAngerica Bongaling0% (1)

- Finman Formulas Legit Eto Na Talaga HuhuDocument7 pagesFinman Formulas Legit Eto Na Talaga Huhulizie elizaldeNo ratings yet

- Finman Formulas PDFDocument4 pagesFinman Formulas PDFAvliah Tabao DatimbangNo ratings yet

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalMuhammad MussayabNo ratings yet

- Financial RatiosDocument15 pagesFinancial RatiosKeith Joshua GabiasonNo ratings yet

- FSA Part2Document19 pagesFSA Part2trangNo ratings yet

- COMM1140 Ratio ListDocument2 pagesCOMM1140 Ratio Listyifeiwang2006No ratings yet

- Financial Ratio Analysis-RatiosDocument3 pagesFinancial Ratio Analysis-RatiosMikaela LacabaNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- ECN320 - FINAL - Formula SheetDocument2 pagesECN320 - FINAL - Formula Sheetclerry29No ratings yet

- ACC 1100 Day 08&09 Ratio DefinitionsDocument1 pageACC 1100 Day 08&09 Ratio DefinitionsMai Anh ĐàoNo ratings yet

- Ratio Analysis GoodDocument13 pagesRatio Analysis GoodA.Rahman SalahNo ratings yet

- FS Analysis FormulasDocument3 pagesFS Analysis FormulasCzarhiena SantiagoNo ratings yet

- Stracos Notes 1Document1 pageStracos Notes 1bangtan sonyeondanNo ratings yet

- Days 8&9 Ratio DefinitionsDocument1 pageDays 8&9 Ratio Definitionslai chenNo ratings yet

- PAS and PFRSDocument3 pagesPAS and PFRSNicoleNo ratings yet

- Chapter 1 NumericalsDocument11 pagesChapter 1 Numericalssuraj banNo ratings yet

- Important RatiosDocument2 pagesImportant RatiosSudha SinghNo ratings yet

- Basics in FinanceDocument7 pagesBasics in FinanceAshraf S. Youssef100% (1)

- Current RatioDocument2 pagesCurrent RatioRujean Salar AltejarNo ratings yet

- Finman, FormulasDocument6 pagesFinman, FormulasSHAZNEI ALIAH NAGA SANGCAANNo ratings yet

- Accounting 2018Document32 pagesAccounting 2018zacrasheed2No ratings yet

- MAS Financial-RatiosDocument4 pagesMAS Financial-RatiosJulius Lester AbieraNo ratings yet

- Ratios PDFDocument1 pageRatios PDFSayan AcharyaNo ratings yet

- Cash + Marketable Securities + Accounts Receivable Total Current Assets - InventoryDocument18 pagesCash + Marketable Securities + Accounts Receivable Total Current Assets - InventoryCheenie C. CuraNo ratings yet

- Current Assets Current Liabilities: 365 DaysDocument2 pagesCurrent Assets Current Liabilities: 365 DaysMadina MamasalievaNo ratings yet

- Ratio FormulasDocument3 pagesRatio Formulasakk59No ratings yet

- List of formulas 公式表Document2 pagesList of formulas 公式表赵博No ratings yet

- Financial Analysis (Chapter 3)Document18 pagesFinancial Analysis (Chapter 3)kazamNo ratings yet

- CFA RatiosDocument11 pagesCFA RatiosrooptejaNo ratings yet

- Ratio AnalysisDocument21 pagesRatio Analysissoumyasundar720No ratings yet

- A. Liquidity Ratios - Short Term Solvency: Current Assets Current LiabilitiesDocument14 pagesA. Liquidity Ratios - Short Term Solvency: Current Assets Current LiabilitiesAshish kumar ThapaNo ratings yet

- Midterm ReviewerDocument19 pagesMidterm ReviewerDeseree De RamosNo ratings yet

- MidtermDocument11 pagesMidtermDeseree De RamosNo ratings yet

- Current Assets Current Liabilities Ca CL: Tratio Analysis FormulaeDocument3 pagesCurrent Assets Current Liabilities Ca CL: Tratio Analysis FormulaealshaNo ratings yet

- Kelompok 2 - Ch. 4 Analisis Laporan Keuangan & Ch. 6 Perencanaan Keuangan (Rev)Document57 pagesKelompok 2 - Ch. 4 Analisis Laporan Keuangan & Ch. 6 Perencanaan Keuangan (Rev)Remano GitzkyNo ratings yet

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocument9 pagesGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371No ratings yet

- Summary of RatiosDocument1 pageSummary of RatiosShamima AkterNo ratings yet

- Business Finance 1st TermDocument2 pagesBusiness Finance 1st TermBrendon BaguilatNo ratings yet

- Financial Ratios: I. ProfitabilityDocument2 pagesFinancial Ratios: I. ProfitabilityJose Francisco TorresNo ratings yet

- LU 1 - Analysis and Interpretation of Financial Statements - NotesDocument4 pagesLU 1 - Analysis and Interpretation of Financial Statements - NotesSherly Zanele SamboNo ratings yet

- 2017 Accounting Examination PaperDocument30 pages2017 Accounting Examination PaperAccount NiceNo ratings yet

- Financial Statement and Cash Flow AnalysisDocument6 pagesFinancial Statement and Cash Flow AnalysisSandra MoussaNo ratings yet

- Ch-4 Ratios TheoryDocument3 pagesCh-4 Ratios TheoryShubham PhophaliaNo ratings yet

- Compilation of Formulas For RatioDocument2 pagesCompilation of Formulas For RatiojozetteypilNo ratings yet

- Current Assets Current Liabilties: Tests of LiquidityDocument5 pagesCurrent Assets Current Liabilties: Tests of LiquidityCesNo ratings yet

- Analisis Keuangan PershDocument8 pagesAnalisis Keuangan PershMeilinda AryantoNo ratings yet

- RatiosDocument2 pagesRatiosMina EskandarNo ratings yet

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet

- Home Office and BranchDocument3 pagesHome Office and BranchBlueBladeNo ratings yet

- Ethics and Moral Philosophy - General Introduction - 2020 - Lecture 5bDocument3 pagesEthics and Moral Philosophy - General Introduction - 2020 - Lecture 5bBlueBladeNo ratings yet

- Ethics and Moral Philosophy - General Introduction - 2020 - Lecture 3Document2 pagesEthics and Moral Philosophy - General Introduction - 2020 - Lecture 3BlueBlade100% (1)

- Ethics and Moral Philosophy - General Introduction - 2020 - Lecture 5aDocument3 pagesEthics and Moral Philosophy - General Introduction - 2020 - Lecture 5aBlueBladeNo ratings yet

- Ethics and Moral Philosophy - General Introduction - 2020 - Lecture 4Document3 pagesEthics and Moral Philosophy - General Introduction - 2020 - Lecture 4BlueBladeNo ratings yet

- Module 1 Financial Statement AnalysisDocument56 pagesModule 1 Financial Statement AnalysisBlueBladeNo ratings yet

- HO, BR, AgencyDocument10 pagesHO, BR, AgencyBlueBladeNo ratings yet

- Ethics and Moral Philosophy - General Introduction - 2020 - Lecture 5cDocument3 pagesEthics and Moral Philosophy - General Introduction - 2020 - Lecture 5cBlueBladeNo ratings yet

- Ethics and Moral Philosophy - General Introduction - 2020 - Lecture 1Document3 pagesEthics and Moral Philosophy - General Introduction - 2020 - Lecture 1BlueBladeNo ratings yet

- Ethics General Introduction Lecture 1 - 6Document23 pagesEthics General Introduction Lecture 1 - 6BlueBladeNo ratings yet

- Ethics and Moral Philosophy - General Introduction - 2020 - Lecture 2Document4 pagesEthics and Moral Philosophy - General Introduction - 2020 - Lecture 2BlueBladeNo ratings yet

- Problem Solving 7 Steps of Problem SolvingDocument3 pagesProblem Solving 7 Steps of Problem SolvingBlueBladeNo ratings yet

- Ethics Compilation CompleteDocument92 pagesEthics Compilation CompleteBlueBladeNo ratings yet

- Reviewer Bond ValuationDocument10 pagesReviewer Bond ValuationBlueBladeNo ratings yet

- Cfas - Chapter 4 - Exercise 1Document8 pagesCfas - Chapter 4 - Exercise 1BlueBladeNo ratings yet

- Financial Accounting and Reporting Chapter 2Document9 pagesFinancial Accounting and Reporting Chapter 2BlueBladeNo ratings yet

- Management Science: The Father of Scientific ManagementDocument15 pagesManagement Science: The Father of Scientific ManagementBlueBladeNo ratings yet

- Prelims Finance MergedDocument149 pagesPrelims Finance MergedBlueBladeNo ratings yet

- Topic: Using Pascal Triangle in The Derivative FunctionsDocument13 pagesTopic: Using Pascal Triangle in The Derivative FunctionsBlueBladeNo ratings yet

- Cfas Exercise 2Document7 pagesCfas Exercise 2BlueBladeNo ratings yet

- Chapter 1 NotesDocument4 pagesChapter 1 NotesBlueBladeNo ratings yet

- GROUP 5 Chapter 1Document11 pagesGROUP 5 Chapter 1BlueBladeNo ratings yet

- GROUP 5 Chapter 2Document22 pagesGROUP 5 Chapter 2BlueBladeNo ratings yet

- Capital MarketDocument32 pagesCapital MarketlalitNo ratings yet

- Optionvue InfoDocument19 pagesOptionvue InfotanmartinNo ratings yet

- Problems: Set B: InstructionsDocument2 pagesProblems: Set B: InstructionsflrnciairnNo ratings yet

- GCP Applied Technologies: Receives Binding Offer From Henkel AG & Co. To Acquire Darex Packaging TechnologiesDocument8 pagesGCP Applied Technologies: Receives Binding Offer From Henkel AG & Co. To Acquire Darex Packaging TechnologiesAnonymous 6tuR1hzNo ratings yet

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- Pepsico Accounting ProjectDocument6 pagesPepsico Accounting Projectapi-2811075140% (1)

- Coinbase Institutional MicroStrategy Case Study Dec 2020Document5 pagesCoinbase Institutional MicroStrategy Case Study Dec 2020Brian JonesNo ratings yet

- Midterm SolveDocument3 pagesMidterm SolveMD Hafizul Islam HafizNo ratings yet

- Graham CriteriaDocument7 pagesGraham CriteriakamtzompingNo ratings yet

- The Awesome Notes: Prohibited Services SEC. 54Document40 pagesThe Awesome Notes: Prohibited Services SEC. 54Ars MoriendiNo ratings yet

- Fins 2624 Problem Set 3 SolutionDocument11 pagesFins 2624 Problem Set 3 SolutionUnswlegend100% (2)

- Statement of Cash FlowDocument9 pagesStatement of Cash FlowJoyce Ann Agdippa BarcelonaNo ratings yet

- Castle Trust Direct PLC Fortress Bonds ProspectusDocument186 pagesCastle Trust Direct PLC Fortress Bonds ProspectushyenadogNo ratings yet

- Green Brick Partners, Inc. GRBK - The Best Kept Secret On Wall StreetDocument3 pagesGreen Brick Partners, Inc. GRBK - The Best Kept Secret On Wall StreetThe Focused Stock TraderNo ratings yet

- Instructions 1. Indicate The Effect of Each Transaction and The Balances After Each Transaction, Using The FollowingDocument3 pagesInstructions 1. Indicate The Effect of Each Transaction and The Balances After Each Transaction, Using The FollowingAdinda NurningtyasNo ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementRaHul Rathod100% (1)

- Sample Questions: 1 Midterm PracticeDocument6 pagesSample Questions: 1 Midterm PracticeValdimiro BelezaNo ratings yet

- Adnan Mirzoyev CVDocument2 pagesAdnan Mirzoyev CVZhanna AkopyanNo ratings yet

- BalcoDocument4 pagesBalcoFaliyavivekNo ratings yet

- Class 1 CF BBA Course OutlineDocument4 pagesClass 1 CF BBA Course OutlineArif BokhtiarNo ratings yet

- BUS330: International Finance: Post-Topic11 (Chapter 17) International Equity MarketsDocument2 pagesBUS330: International Finance: Post-Topic11 (Chapter 17) International Equity MarketsDelishaNo ratings yet

- Im Module 4 NotesDocument29 pagesIm Module 4 NotesJauhar Ul HaqNo ratings yet

- Volatility PuzzleDocument20 pagesVolatility PuzzleANUSHKA CHATURVEDINo ratings yet