Professional Documents

Culture Documents

Financial Ratio Analysis Guide for Short and Long Term Solvency, Liquidity, Profitability and Returns

Uploaded by

Mikaela Lacaba0 ratings0% found this document useful (0 votes)

23 views3 pagesOriginal Title

Financial Ratio Analysis-ratios

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views3 pagesFinancial Ratio Analysis Guide for Short and Long Term Solvency, Liquidity, Profitability and Returns

Uploaded by

Mikaela LacabaCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

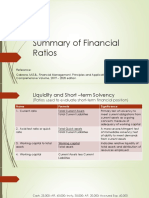

Financial Ratio Analysis

Short Term Solvency and Liquidity

Ratios Formulas

1. Current Ratio Total Current Assets

Total Current Liabilities

2. Acid-test ratio or quick ratio Total Quick Assets

Total Current Liabilities

3. Working Capital to Total Assets Working Capital

Total Assets

4. Working Capital Current Assets Less Current Liabilities

5. Cash flow liquidity ratio Cash + Marketable Securities + Cash

Flow from Operating Activities

Current Liabilities

6. Defensive interval ratio Current Liabilities

Cash and Cash Equivalents

Asset Liquidity and Management Efficiency

Ratios Formulas

1. Trade receivable turnover Net credit sales

Average Trade Receivable

2. Average collection period or number of 360 days

days’ sale uncollected Receivable Turnover

Or

Accounts Receivable

Net Sales / 360

3. Inventory Turnovers

a. Merchandise Turnover Cost of Goods Sold

Average Merchandise Inventory

b. Finished goods inventory turnover Cost of Goods Sold

Ave. Finished Goods Inventory

c. Goods in process turnover Cost of Goods Manufactured

Average Goods in Process Inventory

d. Raw materials turnover Raw Materials Used

Ave. Raw Materials Inventory

4. Days supply in inventory 360

Inventory Turnover

5. Working Capital Turnover Net Sales

Ave. Working Capital

6. Current Assets Turnover Cost of Sales + Operating Expenses +

Income Taxes + Other Expenses (excluding

depreciation and amortization

Ave. Current Assets

7. Payable Turnover Net Purchases

Average Accounts Payable

8. Operating Cycle Average Collection Period of Receivable

+

Average Conversion Period of Inventories

+

Days Cash

9. Days cash Ave. Cash Balance

Cash Operating Costs /360 days

10. Investment or Assets turnover Net Sales

Ave. Total Investment or Total Assets

11. Sales to fixed assets (Plant asset Net Sales

turnover ) Ave. Fixed Assets(net)

12. Capital Intensity ratio Total Assets

Net Sales

Long Term Financial Position or Stability

Ratios Formulas

1. Debt Ratio Total Liabilities

Total Assets

2. Equity ratio Total Owners’ Equity

Total Assets

3. Debt to equity ratio Total Liabilities

Total Owners’ Equity

4. Fixed Assets to Total owners’ equity Fixed Assets(net)

Total Owners’ Equity

5. Fixed Assets to Long term liabilities Fixed Assets(net)

Long Term Liabilities

6. Fixed Assets to Total equity Fixed Assets(net)

Total Assets

7. Book value per share of common stock Common Stockholders’ Equity

No. of Outstanding Shares of Common

Stock

8. Times interest earned Net income before Interest and Taxes

Annual Interest Charges

Profitability and Returns to Investors

Ratios Formulas

1. Gross profit margin Gross Profit

Net Sales

2. Operating profit margin Operating Profit

Net Sales

3. Net profit margin (rate of return on net sales) Net Profit

Net Sales

4. Cash flow margin Cash Flow for Operating Activities

Net Sales

5. Rate of return on assets (ROA) Net Profit

Ave. Total Assets

Or

Asset Turnover x Net Profit Margin

6. Rate of return on owners’ equity Net Income

Ave. Owners’ Equity

7. Earnings per share Net Income Less Preferred Dividends

Ave. Shares of Common Stock

Outstanding

8. Price-Earnings ratio Market Value Per Share of Common Stock

Earnings Per Share of Common Stock

9. Dividend payout Dividend Per Share

Earnings Per Share

10. Dividend yield Dividend Per Share

Market Value Per Share of Common Stock

11. Dividends per share Dividends Paid/Declared

Common Shares Outstanding

12. Rate of return on average current assets Net Income

Ave. Current Assets

13. Rate of return on average current assets Rate of Return on Ave. Current Assets

Current Assets Turnover

Note:

1. If there is an interest-bearing debt, Rate of return is computed as:

Net Income + [Interest expense (1-tax rate)]

Average Total Assets

2. ROE = Return on Assets x Equity Multiplier

Equity Multiplier = 1/Equity Ratio

You might also like

- Ratios to Evaluate Financial Position & PerformanceDocument15 pagesRatios to Evaluate Financial Position & PerformanceKeith Joshua GabiasonNo ratings yet

- Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)Document3 pagesRatios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)MJNo ratings yet

- Commonly Used RatiosDocument12 pagesCommonly Used RatioscyrilljoypNo ratings yet

- Commonly Used RatiosDocument12 pagesCommonly Used Ratiosg.canoneo.59990.dcNo ratings yet

- Finman, FormulasDocument6 pagesFinman, FormulasSHAZNEI ALIAH NAGA SANGCAANNo ratings yet

- Interest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeDocument3 pagesInterest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeAshley Levy San PedroNo ratings yet

- Cash + Marketable Securities + Accounts Receivable Total Current Assets - InventoryDocument18 pagesCash + Marketable Securities + Accounts Receivable Total Current Assets - InventoryCheenie C. CuraNo ratings yet

- Financial Ratio Analysis BreakdownDocument13 pagesFinancial Ratio Analysis BreakdownA.Rahman SalahNo ratings yet

- Summary of RatiosDocument1 pageSummary of RatiosShamima AkterNo ratings yet

- Summary of Financial RatiosDocument9 pagesSummary of Financial RatiosEdrian CabagueNo ratings yet

- I. Liquidity Ratios No Ratio Method of Computation SignificanceDocument14 pagesI. Liquidity Ratios No Ratio Method of Computation SignificanceVictor M Akbar TukanNo ratings yet

- Midterm ReviewerDocument19 pagesMidterm ReviewerDeseree De RamosNo ratings yet

- MidtermDocument11 pagesMidtermDeseree De RamosNo ratings yet

- Elements: Capital Adequecy Operating Performance Ratio (OPR)Document3 pagesElements: Capital Adequecy Operating Performance Ratio (OPR)HMS DeedNo ratings yet

- Liquidity ratios, leverage ratios, activity ratios, profitability ratiosDocument7 pagesLiquidity ratios, leverage ratios, activity ratios, profitability ratioslizie elizaldeNo ratings yet

- Analysis of RatioFormulaDocument1 pageAnalysis of RatioFormulaLinaNo ratings yet

- ECN320 - FINAL - Formula SheetDocument2 pagesECN320 - FINAL - Formula Sheetclerry29No ratings yet

- Liquidity Ratios: Working Capital To Total Asset RatioDocument3 pagesLiquidity Ratios: Working Capital To Total Asset RatioBlueBladeNo ratings yet

- Pertemuan 2 - (Rumus Ratio)Document1 pagePertemuan 2 - (Rumus Ratio)CrussitaNo ratings yet

- Analyze Financial Statements with RatiosDocument8 pagesAnalyze Financial Statements with RatiosMuhammad ImranNo ratings yet

- Marketable Securities + Receivable: Increase. IncreaseDocument4 pagesMarketable Securities + Receivable: Increase. IncreaseVergel MartinezNo ratings yet

- PAS and PFRSDocument3 pagesPAS and PFRSNicoleNo ratings yet

- Finman Formulas PDFDocument4 pagesFinman Formulas PDFAvliah Tabao DatimbangNo ratings yet

- Important RatiosDocument2 pagesImportant RatiosSudha SinghNo ratings yet

- Ratios Used To Evaluate Short-Term Financial Position Ratios Used To Evaluate Asset Liquidity and Management EfficiencyDocument5 pagesRatios Used To Evaluate Short-Term Financial Position Ratios Used To Evaluate Asset Liquidity and Management EfficiencyDan Miguel SangcapNo ratings yet

- Financial Ratios FormulaDocument2 pagesFinancial Ratios FormulaAlthea AcidreNo ratings yet

- Liquidity, Leverage, Profitability & Market Ratios Formula GuideDocument2 pagesLiquidity, Leverage, Profitability & Market Ratios Formula GuidePaula FornollesNo ratings yet

- Ratio Formula Comments: A. Liquidity RatiosDocument2 pagesRatio Formula Comments: A. Liquidity RatiosRes GosanNo ratings yet

- Formulas FTDocument6 pagesFormulas FTAnkita JaiswalNo ratings yet

- Financial Management - Compilation of Financial RatiosDocument6 pagesFinancial Management - Compilation of Financial RatiosIce AlojaNo ratings yet

- (FMDFINA) Bridging Blaze FMDFINA ReviewerDocument24 pages(FMDFINA) Bridging Blaze FMDFINA Reviewerseokyung2021No ratings yet

- Financial Ratio Analysis GuideDocument30 pagesFinancial Ratio Analysis GuideJohn Mark CabrejasNo ratings yet

- CFA RatiosDocument11 pagesCFA RatiosrooptejaNo ratings yet

- Current Assets Current Liabilties: Tests of LiquidityDocument5 pagesCurrent Assets Current Liabilties: Tests of LiquidityCesNo ratings yet

- RatiosDocument8 pagesRatiosNashwa KhalidNo ratings yet

- Formulas On Financial RatiosDocument2 pagesFormulas On Financial RatiosDanielle ValenciaNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisLalitha BalajiNo ratings yet

- Balance-Sheet Model of The FirmDocument32 pagesBalance-Sheet Model of The Firmswami vardhanNo ratings yet

- Ch-4 Ratios TheoryDocument3 pagesCh-4 Ratios TheoryShubham PhophaliaNo ratings yet

- # Ratio Formula Liquidity 7 1 7 2 Asset Management 7 3Document2 pages# Ratio Formula Liquidity 7 1 7 2 Asset Management 7 3JPNo ratings yet

- Three Basic Accounting Statements:: - Income StatementDocument14 pagesThree Basic Accounting Statements:: - Income Statementamedina8131No ratings yet

- Summary of RatiosDocument1 pageSummary of RatiosShamima AkterNo ratings yet

- Financial Statement Analysis GuideDocument3 pagesFinancial Statement Analysis GuideSHENo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisHassaan QaziNo ratings yet

- Financial Statement Analysis Using RatiosDocument26 pagesFinancial Statement Analysis Using RatiosSophia NicoleNo ratings yet

- Analysis of FSDocument10 pagesAnalysis of FSJhondel RabinoNo ratings yet

- Follow Up QuestionsDocument27 pagesFollow Up QuestionsVishal PoduriNo ratings yet

- Ratio Analysis: A Guide to Financial Statement InterpretationDocument9 pagesRatio Analysis: A Guide to Financial Statement InterpretationAbdullah shah khavreenNo ratings yet

- Accounting FM NotesDocument2 pagesAccounting FM NotessapbuwaNo ratings yet

- Financial Statement Ratio AnalysisDocument14 pagesFinancial Statement Ratio Analysissunil0507100% (1)

- Practice of Ratio Analysis Development of Financial StatementsDocument8 pagesPractice of Ratio Analysis Development of Financial StatementsZarish AzharNo ratings yet

- Institutional Determinants of Capital Structure, A Competitive Study of Islamic & Commercial Banks in PakistanDocument2 pagesInstitutional Determinants of Capital Structure, A Competitive Study of Islamic & Commercial Banks in PakistanUMAR MUSHTAQNo ratings yet

- Ratio AnalysisDocument21 pagesRatio Analysissoumyasundar720No ratings yet

- Major Accounting Terms: Asset - Any Item of Economic Value Owned by ADocument21 pagesMajor Accounting Terms: Asset - Any Item of Economic Value Owned by Aranisweta44No ratings yet

- Metalanguage: Big Picture in Focus: UlocDocument24 pagesMetalanguage: Big Picture in Focus: Ulocedwen pajeNo ratings yet

- Ratio Formulae and Interpretation GuideDocument3 pagesRatio Formulae and Interpretation GuideShania MohammedNo ratings yet

- Financial Ratio AnalysisDocument20 pagesFinancial Ratio AnalysisNurul AsikinNo ratings yet

- Financial Statement Analysis Antonio Jaramillo DayagDocument11 pagesFinancial Statement Analysis Antonio Jaramillo DayagAldrin RomeroNo ratings yet

- Day 5 Ratios and Examples 2024Document18 pagesDay 5 Ratios and Examples 2024Kit KatNo ratings yet

- Bachelor of Science in Accountancy SubjectsDocument3 pagesBachelor of Science in Accountancy SubjectsMikaela LacabaNo ratings yet

- Financial Ratios Problemswith AnswersDocument17 pagesFinancial Ratios Problemswith AnswersMikaela LacabaNo ratings yet

- Inventory and Production ManagementDocument2 pagesInventory and Production ManagementMikaela LacabaNo ratings yet

- Bonds PayableDocument114 pagesBonds PayableMikaela LacabaNo ratings yet

- BA 99.1 - TheoriesDocument27 pagesBA 99.1 - TheoriesMikaela LacabaNo ratings yet

- Chapter 3Document2 pagesChapter 3Mikaela LacabaNo ratings yet

- Everything is BlueDocument3 pagesEverything is BlueMikaela LacabaNo ratings yet

- HappierDocument2 pagesHappierTotalenesya Reforrent SutiknoNo ratings yet

- California Church Shocked After Pastor Commits SuicideDocument74 pagesCalifornia Church Shocked After Pastor Commits SuicideMikaela LacabaNo ratings yet

- Fundamentals of Accounting ConceptsDocument4 pagesFundamentals of Accounting ConceptsMikaela LacabaNo ratings yet

- Champagne ProblemsDocument4 pagesChampagne ProblemsMikaela LacabaNo ratings yet

- Chapter 2Document9 pagesChapter 2Mikaela LacabaNo ratings yet

- AFTERGLOWDocument4 pagesAFTERGLOWMikaela LacabaNo ratings yet

- Break Even Chord ChartDocument3 pagesBreak Even Chord ChartMikaela LacabaNo ratings yet

- AGAINDocument2 pagesAGAINMikaela LacabaNo ratings yet

- These We Ask in The Name of Your Son, Jesus Christ Our LordDocument2 pagesThese We Ask in The Name of Your Son, Jesus Christ Our LordMikaela LacabaNo ratings yet

- Tips - Science Technology and Society An Introduction PDFDocument289 pagesTips - Science Technology and Society An Introduction PDFMichelle Cataga100% (1)

- C C/B Am Gsus4 F Gsus4Document4 pagesC C/B Am Gsus4 F Gsus4Mikaela LacabaNo ratings yet

- Alpha-Omega Learning Center of Tacloban City Inc. School ID No. 404796Document2 pagesAlpha-Omega Learning Center of Tacloban City Inc. School ID No. 404796Mikaela LacabaNo ratings yet

- AOLCMDRAFTDocument12 pagesAOLCMDRAFTMikaela LacabaNo ratings yet

- 18Document3 pages18Mikaela LacabaNo ratings yet

- Specific Issues in STS PDFDocument57 pagesSpecific Issues in STS PDFMikaela LacabaNo ratings yet

- Jim Latzko Webinar Handout - Portable Faith 1.5Document8 pagesJim Latzko Webinar Handout - Portable Faith 1.5Mikaela LacabaNo ratings yet

- Jim Latzko Webinar Handout - Digital World Missions-OutlineDocument2 pagesJim Latzko Webinar Handout - Digital World Missions-OutlineMikaela LacabaNo ratings yet

- 1.1 1.2 Summary Science Technology and Society in AncientDocument5 pages1.1 1.2 Summary Science Technology and Society in AncientMikaela LacabaNo ratings yet

- 1.7.a Summary Technology and Society in 20th Century by DrucDocument5 pages1.7.a Summary Technology and Society in 20th Century by DrucMikaela LacabaNo ratings yet

- Allegory's Transformative RoleDocument12 pagesAllegory's Transformative RoleMikaela LacabaNo ratings yet

- Discussion 1.1 Concepts Scope and DilemmasDocument2 pagesDiscussion 1.1 Concepts Scope and DilemmasMikaela LacabaNo ratings yet

- 6 FIL Kabanta IIDocument6 pages6 FIL Kabanta IIMikaela LacabaNo ratings yet

- Cash and Cash Equivalents GuideDocument15 pagesCash and Cash Equivalents GuideSofia NadineNo ratings yet

- 9 - ch27 Money, Interest, Real GDP, and The Price LevelDocument48 pages9 - ch27 Money, Interest, Real GDP, and The Price Levelcool_mechNo ratings yet

- Philguarantee Vs VPECI and 3plexDocument1 pagePhilguarantee Vs VPECI and 3plexChaNo ratings yet

- Case FriaDocument7 pagesCase FriaMichelle Marie TablizoNo ratings yet

- Mezan BankDocument13 pagesMezan BankRizwan AkramNo ratings yet

- Leave and License AgreementDocument4 pagesLeave and License AgreementAmitabh AbhijitNo ratings yet

- Foreign Market Entry StrategyDocument121 pagesForeign Market Entry StrategyDivya singhNo ratings yet

- Inter IKEA Holding B.V. Annual Report FY18 Financial StatementsDocument4 pagesInter IKEA Holding B.V. Annual Report FY18 Financial StatementsaretaNo ratings yet

- PWC IFRS For SMEs - Illustrative Consolidated Financial Statements 2017Document65 pagesPWC IFRS For SMEs - Illustrative Consolidated Financial Statements 2017PawanNo ratings yet

- Case InstructionsDocument4 pagesCase InstructionsHw SolutionNo ratings yet

- Book Summary Assignment: Mohammad Muhtasim Mashfy 170011054Document21 pagesBook Summary Assignment: Mohammad Muhtasim Mashfy 170011054Mohammad Muhtasim Mashfy, 170011054No ratings yet

- Cash Flow Statement AnalysisDocument5 pagesCash Flow Statement AnalysisJeanelle ColaireNo ratings yet

- Azure SOX Guidance PDFDocument7 pagesAzure SOX Guidance PDFajsosaNo ratings yet

- Construction of Bridge Over Andermanik River With Related Works at Payra Port Under Payra Port's First Terminal ProjectDocument2 pagesConstruction of Bridge Over Andermanik River With Related Works at Payra Port Under Payra Port's First Terminal ProjectParvez Syed RafiNo ratings yet

- Martingales, Wiener Processes & Ito's LemmaDocument35 pagesMartingales, Wiener Processes & Ito's Lemmanischal mathurNo ratings yet

- Memorandum of Agreement For Livelihood Loan FacilityDocument9 pagesMemorandum of Agreement For Livelihood Loan Facilityglenn padernal100% (1)

- 144A Vs RegSDocument1 page144A Vs RegSshrutias1989No ratings yet

- Contract of Loan: WitnessethDocument2 pagesContract of Loan: WitnessethJameson UyNo ratings yet

- 4B. Cost of CapitalDocument10 pages4B. Cost of Capitalshadhat331No ratings yet

- Investment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFDocument43 pagesInvestment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFWilliamCartersafg100% (11)

- Conference: 2021 International VirtualDocument5 pagesConference: 2021 International Virtualusama zedanNo ratings yet

- Building A Trading PlanDocument38 pagesBuilding A Trading Planamy100% (1)

- Study Guide Topic A: European CouncilDocument9 pagesStudy Guide Topic A: European CouncilAaqib ChaturbhaiNo ratings yet

- Most Important One Liner Questions and Answers, July 2022Document16 pagesMost Important One Liner Questions and Answers, July 2022HarishankarsoniNo ratings yet

- Nil TFDocument3 pagesNil TFlachimolala. kookieee97No ratings yet

- Thank You Letter Template for Cash DonationDocument3 pagesThank You Letter Template for Cash Donationbogtik100% (2)

- Trevor Young Resume 1-26-10Document3 pagesTrevor Young Resume 1-26-10trevoryoung00No ratings yet

- SJFM Coop ByLawsDocument10 pagesSJFM Coop ByLawsruth sab-itNo ratings yet

- Phillips PLL 6e Chap05Document38 pagesPhillips PLL 6e Chap05snsahaNo ratings yet