Professional Documents

Culture Documents

Accounting Formulae Sheet

Uploaded by

Shania Mohammed0 ratings0% found this document useful (0 votes)

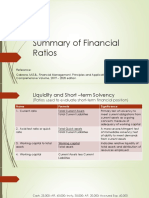

5 views3 pagesThe document defines 10 financial ratios used to analyze company performance and financial health. The ratios are grouped into categories including profitability (net profit margin, gross profit margin), efficiency (return on capital employed, return on investment), liquidity (current ratio, acid test ratio, working capital), inventory management (inventory turnover), accounts receivable (average collection period), and accounts payable (average payment period). Each ratio is defined by a formula and what aspect of the business it provides insight into.

Original Description:

Original Title

Accounting_formulae_sheet

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document defines 10 financial ratios used to analyze company performance and financial health. The ratios are grouped into categories including profitability (net profit margin, gross profit margin), efficiency (return on capital employed, return on investment), liquidity (current ratio, acid test ratio, working capital), inventory management (inventory turnover), accounts receivable (average collection period), and accounts payable (average payment period). Each ratio is defined by a formula and what aspect of the business it provides insight into.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesAccounting Formulae Sheet

Uploaded by

Shania MohammedThe document defines 10 financial ratios used to analyze company performance and financial health. The ratios are grouped into categories including profitability (net profit margin, gross profit margin), efficiency (return on capital employed, return on investment), liquidity (current ratio, acid test ratio, working capital), inventory management (inventory turnover), accounts receivable (average collection period), and accounts payable (average payment period). Each ratio is defined by a formula and what aspect of the business it provides insight into.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Name of Ratio Formulae Interpretation

1. Net profit Net Income/Profit For every $ of

margin Net sales sales made, how

aka net much net profit is

income as generated by the

a % of business after

sales deducting all

costs.

2. Gross Gross Profit For every $ of

Profit Net Sales sales made, how

Margin much Gross

aka G.P as Profit is earned

a % of after deducting

sales all direct costs of

production.

3. Return on Net Income/Profit X 100 Shows how much

Capital Capital Employed income is

Employed Where capital employed: generated by

( R O C E) Total Assets - Current employment of

Liabilities equity -

1:2:3.

4. Return Net Income/Profit Shows how much

Investmen Average Total Assets income is

t (ROI) Where Total assets: generated by the

aka Assets Opening asset + closing asset assets of the

Turnover 2 business.

Ratio

5. Current Current Assets Shows the

Ratio Current Liabilities business ability

to finance their

short- term

obligations.

6. Acid Test C. Assets- Stock-Prepayments A more stringent

Ratio Current Liabilities test of liquidity in

determining how

quick the

business can pay

its short term

debts.

7. Working Current Assets – Current Shows the

Capital Liabilities relative cash flow

aka of the business

( Net after

Current extinguishing

Assets) short term

obligations.

Name of Ratio Formulae Interpretation

8. Inventory Cost of sales__ Shows an average;

Turnover aka Average Inventory how quickly

Ratio of inventory Is being

Turnover Where an Inventory sold.

= Opening + closing

stock

2

9. Average Net Cr Sales__ Shows an average,

collection Avg. Net A/c Rec. how long the firm

Period aka A/c Where an A/c Rec. = takes to collect its

Receivable opening + closing outstanding debts.

ratio 2

10.Average Net Cr Purchases Shows an average,

payment Period aka Avg. A/c Payable how long the firm

A/c payable Ratio Where A/c payable= takes to pay its

Opening + closing outstanding trade

A/c Payable debts.

2

You might also like

- Ratio Formula Comments: A. Liquidity RatiosDocument2 pagesRatio Formula Comments: A. Liquidity RatiosPaula FornollesNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Financial Ratios FormulaDocument2 pagesFinancial Ratios FormulaAlthea AcidreNo ratings yet

- Ratio Formula Comments: A. Liquidity RatiosDocument2 pagesRatio Formula Comments: A. Liquidity RatiosRes GosanNo ratings yet

- Midterm ReviewerDocument19 pagesMidterm ReviewerDeseree De RamosNo ratings yet

- MidtermDocument11 pagesMidtermDeseree De RamosNo ratings yet

- Ratio AnalysisDocument13 pagesRatio Analysismuralib4u5No ratings yet

- Marketable Securities + Receivable: Increase. IncreaseDocument4 pagesMarketable Securities + Receivable: Increase. IncreaseVergel MartinezNo ratings yet

- Financial Ratios ReportDocument12 pagesFinancial Ratios ReportGeloNo ratings yet

- Financial Statements As A Management ToolDocument20 pagesFinancial Statements As A Management TooldavidimolaNo ratings yet

- Ratio Analysis:: Liquidity Measurement RatiosDocument8 pagesRatio Analysis:: Liquidity Measurement RatiossammitNo ratings yet

- ACCCDocument6 pagesACCCAynalem KasaNo ratings yet

- Accounting KpisDocument6 pagesAccounting KpisHOCININo ratings yet

- Financial Statements Analysis Formulae AnalysisDocument13 pagesFinancial Statements Analysis Formulae AnalysisChico ChanchanNo ratings yet

- Metalanguage: Big Picture in Focus: UlocDocument24 pagesMetalanguage: Big Picture in Focus: Ulocedwen pajeNo ratings yet

- Financial Ratios 1.docx SourovDocument8 pagesFinancial Ratios 1.docx SourovHasnat nahid HimelNo ratings yet

- Csec-Poa-Formulae and DefinitionsDocument11 pagesCsec-Poa-Formulae and DefinitionsAiden100% (3)

- Ratio AnalysisDocument10 pagesRatio AnalysisUdayan KarnatakNo ratings yet

- Fa Cheat Sheet MM MLDocument8 pagesFa Cheat Sheet MM MLIrina StrizhkovaNo ratings yet

- Major Accounting Terms: Asset - Any Item of Economic Value Owned by ADocument21 pagesMajor Accounting Terms: Asset - Any Item of Economic Value Owned by Aranisweta44No ratings yet

- Interest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeDocument3 pagesInterest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeAshley Levy San PedroNo ratings yet

- Notes On Ratio AnalysisDocument12 pagesNotes On Ratio AnalysisVaishal90% (21)

- Ratios Analysis Notes AND ONE SOLVED QUIZDocument6 pagesRatios Analysis Notes AND ONE SOLVED QUIZDaisy Wangui100% (1)

- Summary of RatiosDocument1 pageSummary of RatiosShamima AkterNo ratings yet

- Fam - 1Document20 pagesFam - 1shahidNo ratings yet

- The Analysis and Interpretation of Financial StatementsDocument5 pagesThe Analysis and Interpretation of Financial StatementsBrenda ChatendeukaNo ratings yet

- Financial Ratios - Sheet1Document4 pagesFinancial Ratios - Sheet1Melanie SamsonaNo ratings yet

- SOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateDocument2 pagesSOURCES (Inflows of Cash) USES (Outflows of Cash) : TranslateRahul KapurNo ratings yet

- Topic 3 Internal Environment - 2023 For StudentsDocument63 pagesTopic 3 Internal Environment - 2023 For StudentsDuc Tao ManhNo ratings yet

- Guidance For Project AssignmentDocument3 pagesGuidance For Project AssignmentfauzinurhalimNo ratings yet

- Sno. Ratios Formula Result Analysis Liquidity RatioDocument6 pagesSno. Ratios Formula Result Analysis Liquidity RatioIndrani PanNo ratings yet

- Finance Quick Reference GuideDocument16 pagesFinance Quick Reference GuideNathalia Montoya DiazNo ratings yet

- Fs Analysis Formula: Discounts, and Allowances) Minus Cost of SalesDocument2 pagesFs Analysis Formula: Discounts, and Allowances) Minus Cost of SalesSamantha JoseNo ratings yet

- Commonly Used RatiosDocument12 pagesCommonly Used RatioscyrilljoypNo ratings yet

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDocument3 pagesExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGNo ratings yet

- Practice Questions (L3)Document3 pagesPractice Questions (L3)simraNo ratings yet

- Summary of Financial Ratios DiscussionDocument30 pagesSummary of Financial Ratios DiscussionJohn Mark CabrejasNo ratings yet

- Financial Statement: Iasb FrameworkDocument3 pagesFinancial Statement: Iasb FrameworkFaizSheikhNo ratings yet

- Ratios Analysis Notes and Questions NewDocument7 pagesRatios Analysis Notes and Questions NewAnthony OtiatoNo ratings yet

- Handout Fin Man 2304Document9 pagesHandout Fin Man 2304Sheena Gallentes LeysonNo ratings yet

- Current Assets Current Liabilties: Tests of LiquidityDocument5 pagesCurrent Assets Current Liabilties: Tests of LiquidityCesNo ratings yet

- Financial Statement Analysis Using RatiosDocument26 pagesFinancial Statement Analysis Using RatiosSophia NicoleNo ratings yet

- Financial RatiosDocument9 pagesFinancial RatiosTariq qandeelNo ratings yet

- Ch-4 Ratios TheoryDocument3 pagesCh-4 Ratios TheoryShubham PhophaliaNo ratings yet

- 6 - Financial StrategyDocument14 pages6 - Financial StrategyHUY NGUYỄN ĐÌNHNo ratings yet

- FAR ReviewerDocument1 pageFAR ReviewerAllyson Charissa AnsayNo ratings yet

- Ratio Analysis FormulasDocument3 pagesRatio Analysis FormulasVinayaniv YanivNo ratings yet

- Total Financial RatiosDocument2 pagesTotal Financial RatioshoangsubaxdNo ratings yet

- Cash Flow AnalysisDocument5 pagesCash Flow AnalysisJayanta SarkarNo ratings yet

- Project of Financial Reporting AnalysisDocument29 pagesProject of Financial Reporting AnalysisAhmad Mujtaba PhambraNo ratings yet

- FABM2 - Q1 - V2a Page 102 114Document12 pagesFABM2 - Q1 - V2a Page 102 114Kate thilyNo ratings yet

- Financial RatiosDocument3 pagesFinancial RatiosluudieulinhNo ratings yet

- Chapter 10Document12 pagesChapter 10Ginnie G Cristal50% (2)

- Ratio Analysis 2022Document34 pagesRatio Analysis 2022Asanka8522No ratings yet

- Commonly Used RatiosDocument12 pagesCommonly Used Ratiosg.canoneo.59990.dcNo ratings yet

- MAS 08 - FS Analysis PDFDocument20 pagesMAS 08 - FS Analysis PDFAaron tamboongNo ratings yet

- How Formula Expressed Meaning: Current Assets Current LiabilitiesDocument5 pagesHow Formula Expressed Meaning: Current Assets Current LiabilitiesHemraj VermaNo ratings yet

- Working Capital Manageme NTDocument63 pagesWorking Capital Manageme NTGargi PandeyNo ratings yet

- Financial Statement Analysis Antonio Jaramillo DayagDocument11 pagesFinancial Statement Analysis Antonio Jaramillo DayagAldrin RomeroNo ratings yet

- Introduction: Please Read The Information Below.: Benefits of Large Scale ProductionDocument1 pageIntroduction: Please Read The Information Below.: Benefits of Large Scale ProductionShania MohammedNo ratings yet

- Surplus Exports More Than It Imports Gaining More Foreign ExchangeDocument1 pageSurplus Exports More Than It Imports Gaining More Foreign ExchangeShania MohammedNo ratings yet

- Benefits of E - CommerceDocument1 pageBenefits of E - CommerceShania MohammedNo ratings yet

- Balance of Payments Accounting Record of A Country's Transactions With The Rest of The World Always Balances I.E. It Sums To ZeroDocument1 pageBalance of Payments Accounting Record of A Country's Transactions With The Rest of The World Always Balances I.E. It Sums To ZeroShania MohammedNo ratings yet

- Examples Coral Reefs in The CaribbeanDocument8 pagesExamples Coral Reefs in The CaribbeanShania MohammedNo ratings yet

- Econ U2 P1s 2010 - 2013 - WITH ANSWERSDocument60 pagesEcon U2 P1s 2010 - 2013 - WITH ANSWERSShania MohammedNo ratings yet

- Balance Confirmation LetterDocument14 pagesBalance Confirmation LetterMajharul IslamNo ratings yet

- AirAsia India - Fees and ChargesDocument1 pageAirAsia India - Fees and ChargesAbhishekNo ratings yet

- Dcs Act, 2003Document94 pagesDcs Act, 2003Ritik TiwariNo ratings yet

- Business Banking: You and Wells FargoDocument4 pagesBusiness Banking: You and Wells Fargobilly barker white50% (2)

- RP Super Capsule 2024Document85 pagesRP Super Capsule 2024brayten.hazemNo ratings yet

- Analisis Laporan Keuangan PT Blue BirdDocument4 pagesAnalisis Laporan Keuangan PT Blue BirdSedih BerasaNo ratings yet

- Your Vi Bill: Mr. N G SuneelDocument3 pagesYour Vi Bill: Mr. N G SuneelIgnou Support100% (1)

- Strategic Factor Analysis 1Document2 pagesStrategic Factor Analysis 1Chocolate BabeNo ratings yet

- (Updated 0323) - Vở ghi TACN2 - Cô Minh HiềnDocument50 pages(Updated 0323) - Vở ghi TACN2 - Cô Minh HiềnK58 TRAN ANH VANNo ratings yet

- Monthly Budget Template-2Document8 pagesMonthly Budget Template-2Kirit0% (1)

- PR1 Peta 2Document7 pagesPR1 Peta 2rycowyne06No ratings yet

- Pag-Ibig Mp2 SavingsDocument37 pagesPag-Ibig Mp2 SavingsVanessa GestaNo ratings yet

- TEXTFINALDocument8 pagesTEXTFINALCarlos Muñoz VitorNo ratings yet

- Chapter 6 Brief ExercisesDocument8 pagesChapter 6 Brief ExercisesPatrick YazbeckNo ratings yet

- Session 20 Portfolio Management Framework: The Grand DesignDocument37 pagesSession 20 Portfolio Management Framework: The Grand DesignEkta Saraswat VigNo ratings yet

- Chapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)Document18 pagesChapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)XNo ratings yet

- SPRING 2018 BUS 498 EXIT ASSESSMENT TEST Questions - NSUDocument8 pagesSPRING 2018 BUS 498 EXIT ASSESSMENT TEST Questions - NSURafina Aziz 1331264630No ratings yet

- MM 4 4th Edition Dawn Iacobucci Solutions Manual DownloadDocument13 pagesMM 4 4th Edition Dawn Iacobucci Solutions Manual DownloadJamie Guzman100% (22)

- Answer KeyDocument2 pagesAnswer KeySHAZ NAY GULAYNo ratings yet

- Mock Exam 1Document59 pagesMock Exam 1paramrajeshjainNo ratings yet

- Taxation CasesDocument3 pagesTaxation CasesalmsypayosNo ratings yet

- Concept Understanding of Prospectus of Company Under Companies ActDocument8 pagesConcept Understanding of Prospectus of Company Under Companies ActNikhilNo ratings yet

- Indian Institute of Planning and Management, NewDocument74 pagesIndian Institute of Planning and Management, NewChetan SharmaNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisMuhammad FaizanNo ratings yet

- Price Output Under P.CDocument17 pagesPrice Output Under P.CNo OneNo ratings yet

- Math 12-ABM Org - Mgt-Q1-Week-3Document18 pagesMath 12-ABM Org - Mgt-Q1-Week-3Lennie DiazNo ratings yet

- LTT BST 8203374437Document1 pageLTT BST 8203374437Santosh UpadhyayNo ratings yet

- Far 6813 - Inventory Cost Flow Lower of Cost or Net Realizable Value (LCNRV)Document2 pagesFar 6813 - Inventory Cost Flow Lower of Cost or Net Realizable Value (LCNRV)Kent Raysil PamaongNo ratings yet

- Adobe Scan Apr 18, 2023Document6 pagesAdobe Scan Apr 18, 2023Yan PaingNo ratings yet

- Modelo de Contrato AlibabaDocument8 pagesModelo de Contrato AlibabaEduardo Franklin Vasquez HuamanNo ratings yet