Professional Documents

Culture Documents

131 Bates vs. Dresser

Uploaded by

Dexter GasconCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

131 Bates vs. Dresser

Uploaded by

Dexter GasconCopyright:

Available Formats

131 Bates vs.

Dresser AUTHOR: Arthur

March 1, 1920 251 U.S. 524 - The degree of care required of director of a national

TOPIC: .Duties of Directors and Controlling Stockholders bank depends upon the subject to which it is to be

PONTENTE: Justice Holmes applied, and each case is to be determined in view

of all the circumstance.

FACTS

1. This is a bill in equity brought by the receiver of a national bank to charge its former president and directors with

the loss of a great part of its assets through the thefts of an employee of the bank while they were in power.

2. Case was sent to a master, who found for the defendants, but the district court entered a decree against all of them.

3. Circuit court of appeals reversed this decree, dismissed the bill as against all except the administrator of Edwin

Dresser, the president.

4. Before and during the time of the losses, Dresser was its president and executive officer, a large stockholder, with

an inactive deposit of from $35,000 to $50,000.

5. From July, 1903, to the end, Frank L. Earl was cashier. Coleman, who made the trouble, entered the service of the

bank as messenger in September, 1903. In January, 1904, he was promoted to be bookkeeper, being then not quite

eighteen but having studied bookkeeping.

6. an auditor employed on the retirement of a cashier had reported that the daily balance book was very much behind,

that it was impossible to prove the deposits, and that a competent bookkeeper should be employed upon the work

immediately

7. In May, 1906, Coleman took $2,000 cash from the vaults of the bank, but restored it the next morning. In

November of the same year, he began the thefts that come into question here. Perhaps in the beginning he took the

money directly. But as he ceased to have charge of the cash in November, 1907, he invented another way

8. By May 1, 1907, Coleman had abstracted $17,000, concealing the fact by false additions in the column of total

checks and false balances in the deposit ledger.

9. a total of $310,143.02 was stolen, when the bank closed on February 21, 1910. As a result of this, the amount of

the monthly deposits seemed to decline noticeably, and the directors considered the matter in September, but

concluded that the falling off was due in part to the springing up of rivals, whose deposits were increasing, but was

parallel to a similar decrease in New York. An examination by a bank examiner in December, 1909, disclosed

nothing wrong to him.

ISSUE: whether they (the directors) neglected their duty by accepting the cashier's statement of liabilities and failing to

inspect the depositors' ledger

HELD: No. but the president is responsible

RATIO:

- That directors, serving gratuitously, who were without knowledge of the cashier's negligence or of the possibility

of such a fraud, and who had assurance from the president, as from the bank examiners' reports, were not negligent

in accepting the cashier's statements of liabilities, like his statements of assets, which always were correct, and

were not bound to inspect the depositors' ledger or call in the pass-books and compare them with it, although there

was a bylaw, nearly obsolete, calling for examinations by a committee semiannually

- That the president, who, beside being a large depositor, was habitually at the bank, in control of its affairs, with

immediate access to the depositors' ledger, and who had received certain warnings that the bookkeeper was living

fast and dealing in stocks, was guilty of negligence in failing to make an examination. One who accepts the

presidency of a national bank accepts responsibility for any losses the bank may suffer through his fault.

CASE LAW/ DOCTRINE:

1. The degree of care required of director of a national bank depends upon the subject to which it is to be applied, and

each case is to be determined in view of all the circumstance.

DISSENTING/CONCURRING OPINION:

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Market Research Toolbox A Concise Guide For BeginnersDocument61 pagesThe Market Research Toolbox A Concise Guide For Beginnersverna.chee563100% (33)

- Environment of Financial Accounting and Reporting: FalseDocument6 pagesEnvironment of Financial Accounting and Reporting: Falsekris mNo ratings yet

- CRMA Reference ResourcesDocument1 pageCRMA Reference ResourcesJoe FrostNo ratings yet

- Project Report On Make My TripDocument13 pagesProject Report On Make My TripSumit Singh50% (2)

- Long Quiz AgricultureDocument3 pagesLong Quiz AgricultureTet Gomez100% (5)

- SUDHA DairyDocument50 pagesSUDHA DairyAtul Kumar78% (18)

- Bernachtungsteuer Merkblatt Gast EnglishDocument3 pagesBernachtungsteuer Merkblatt Gast EnglishWojciech KosmaNo ratings yet

- SR Arapan Janice D.Document1 pageSR Arapan Janice D.Janice ArapanNo ratings yet

- Assignment 2Document2 pagesAssignment 2mikeeNo ratings yet

- We Care: Mega Lifesciences Public Company Limited (MEGA)Document14 pagesWe Care: Mega Lifesciences Public Company Limited (MEGA)hau vuvanNo ratings yet

- QLD0jkEvSzGvQxXU5ynp W Activity Template Project Status ReportDocument2 pagesQLD0jkEvSzGvQxXU5ynp W Activity Template Project Status ReportAhmad HussainNo ratings yet

- IA 2 Major Project Liberty Chapter 2 & 3Document25 pagesIA 2 Major Project Liberty Chapter 2 & 3Akshat ShrivastavNo ratings yet

- 3Document9 pages3Amneet sistersNo ratings yet

- Automation Solution Guide PDFDocument282 pagesAutomation Solution Guide PDFTariq SaeedNo ratings yet

- Master in Tourism ManagementDocument2 pagesMaster in Tourism ManagementArchana SarmaNo ratings yet

- Finance (Salaries) Department: Loans and Advances by The State Government - Advances ToDocument2 pagesFinance (Salaries) Department: Loans and Advances by The State Government - Advances ToGowtham RajNo ratings yet

- Arms Length PrincipleDocument18 pagesArms Length PrincipleMARY IRUNGUNo ratings yet

- ENGIE Services Thailand Menus V2Document20 pagesENGIE Services Thailand Menus V2ฐานพล ภาสวัตNo ratings yet

- Guest Comment Report - AnalysisDocument119 pagesGuest Comment Report - AnalysisHenov Rizzky PratamaNo ratings yet

- Topic 3Document28 pagesTopic 3Learner's LicenseNo ratings yet

- Controlling PLPDocument17 pagesControlling PLPclaire yowsNo ratings yet

- Case Study 5Document1 pageCase Study 5DawitNo ratings yet

- KB220820BICLQ - Sanction LetterDocument4 pagesKB220820BICLQ - Sanction LetterSiddhantNo ratings yet

- Korean Coffee Discussion QuestionDocument15 pagesKorean Coffee Discussion QuestionShreyNo ratings yet

- 2016 03 04 HPCL Analyst Pres - Mumbai PDFDocument78 pages2016 03 04 HPCL Analyst Pres - Mumbai PDFHemant KumarNo ratings yet

- Practice Test 3-Date 9.3Document9 pagesPractice Test 3-Date 9.3Bao TranNo ratings yet

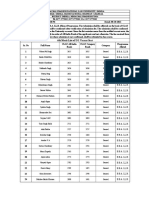

- 6th Merit List of UG Vacant SeatDocument4 pages6th Merit List of UG Vacant SeatRavindra RathoreNo ratings yet

- INFORMANTDocument2 pagesINFORMANTsddsfsdfNo ratings yet

- Schedule of Charges For MTB Credit CardsDocument4 pagesSchedule of Charges For MTB Credit CardsRana BabuNo ratings yet

- Research Papers On Mergers and Acquisitions in Indian Banking SectorDocument7 pagesResearch Papers On Mergers and Acquisitions in Indian Banking Sectorc9qb8gy7No ratings yet