Professional Documents

Culture Documents

Capital Budgeting

Uploaded by

cherein6soriano6pael0 ratings0% found this document useful (0 votes)

5 views2 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesCapital Budgeting

Uploaded by

cherein6soriano6paelCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

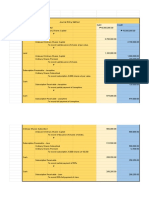

In considering a major expansion of its product line and has

estimated the following free cash cash flows associated with

1.) CALCULATE THE NET PR

such an expansion . The initial outlay associated with the

expansion would be 1,950,000 and the project would generate

2.) CALCULATE THE PROFIT

a free cash flows of 450,000 per year for six years . The appropr

required rate of return is 9 percent .

3.) CALCULATE THE INTER

1 Calculate the net present value

2 Calculate the profitability index

3 Calculate the internal rate of return 4.) SHOULD THIS PROJECT

4 Should this project be accepted ?

SOLUTIONS:

1.) Net Present Value 2

Present Value of Cash Inflows

= Cash flows per year x Present

2,018,700

Value factor

=P 450000 x 4.486

Less: Cost of Investment -1950000

3 Internal Rate of Retu

NET PRESENT VALUE P 68,700

A

PV Factor = [1 - (1/1+.09)^6]/0.09 Year

4.485691859 or 4.486 0

1

2

4.) Yes, this project should be accepted. 3

4

5

6

IRR

CULATE THE NET PRESENT VALUE

P68,700

CULATE THE PROFITABILITY INDEX

1.0352

LCULATE THE INTERNAL RATE OF RETURN

10.17%

ULD THIS PROJECT BE ACCEPTED ? YES

Profitability Index

PI = (450,000 x 4.486) / 1,950,000

1.0352

Internal Rate of Return

B

Cash Flows

(1,950,000.00)

450,000

450,000

450,000

450,000

450,000

450,000

10.1725%

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Test Bank For Principles of Cost Accounting, 16th EditionDocument56 pagesTest Bank For Principles of Cost Accounting, 16th EditionFornierNo ratings yet

- Hydrostatic Test Pressure For Flanges PDFDocument2 pagesHydrostatic Test Pressure For Flanges PDFChegg ChemNo ratings yet

- IE8693 - Production Planning and Control (Ripped From Amazon Kindle Ebooks by Sai Seena)Document342 pagesIE8693 - Production Planning and Control (Ripped From Amazon Kindle Ebooks by Sai Seena)hemnath kamachiNo ratings yet

- QAMDocument10 pagesQAMRavi Krishna IIM, CalcuttaNo ratings yet

- Acct Statement - XX9642 - 10082022Document87 pagesAcct Statement - XX9642 - 10082022sunkenapelli adityaNo ratings yet

- BudgetingDocument2 pagesBudgetingcherein6soriano6paelNo ratings yet

- Cherein Pael - Midterm Project Sept 30 - PROBLEM1Document1 pageCherein Pael - Midterm Project Sept 30 - PROBLEM1cherein6soriano6paelNo ratings yet

- Allocation of Common Costs - Sheet1Document2 pagesAllocation of Common Costs - Sheet1cherein6soriano6paelNo ratings yet

- The Master Budget HandoutsDocument4 pagesThe Master Budget Handoutscherein6soriano6paelNo ratings yet

- B. Research A Country of Your Choice. Share Information of The FollowingDocument4 pagesB. Research A Country of Your Choice. Share Information of The Followingcherein6soriano6paelNo ratings yet

- 1st VoyageDocument40 pages1st Voyagecherein6soriano6paelNo ratings yet

- Journal Entry Method - Exercise #4 - Sheet1Document2 pagesJournal Entry Method - Exercise #4 - Sheet1cherein6soriano6paelNo ratings yet

- Exercise-1 pg.103Document4 pagesExercise-1 pg.103cherein6soriano6paelNo ratings yet

- 1 - GDP Per CapitaDocument28 pages1 - GDP Per CapitaTrung TạNo ratings yet

- Economics Marking - Scheme - PB - Ii - 2022-23Document9 pagesEconomics Marking - Scheme - PB - Ii - 2022-23TRAP GAMINGNo ratings yet

- Vacuum Packaging Manual New KorDocument44 pagesVacuum Packaging Manual New KorSameer KhanNo ratings yet

- UI 8 - Application For Registration As An EmployerDocument1 pageUI 8 - Application For Registration As An EmployerSheunesu GumbieNo ratings yet

- Product Manual For Plugs and Socket-Outlets For Household and Similar Purposes of Rated Voltage Up To and Including 250 V and Rated Current Up To and Including 16 A According ToDocument13 pagesProduct Manual For Plugs and Socket-Outlets For Household and Similar Purposes of Rated Voltage Up To and Including 250 V and Rated Current Up To and Including 16 A According Toakki3007No ratings yet

- Airport Transfer Booking Form: D D M M Y Y Y YDocument1 pageAirport Transfer Booking Form: D D M M Y Y Y YPankaj PoudyalNo ratings yet

- Stability StrategyDocument4 pagesStability StrategyButtercupNo ratings yet

- Sectoral and Regional Analysis of The Ethiopian Investment ScenarioDocument69 pagesSectoral and Regional Analysis of The Ethiopian Investment Scenariokassahun meseleNo ratings yet

- Chapter - 5 Capital BudgetingDocument9 pagesChapter - 5 Capital BudgetingShuvro RahmanNo ratings yet

- Chap 1 Intro of BookkeepDocument14 pagesChap 1 Intro of BookkeepTan Shu YuinNo ratings yet

- Bernard Hodgson (Auth.), Professor Bernard Hodgson (Eds.) - The Invisible Hand and The Common Good - (2004)Document465 pagesBernard Hodgson (Auth.), Professor Bernard Hodgson (Eds.) - The Invisible Hand and The Common Good - (2004)Erickson SantosNo ratings yet

- Spectrum BillDocument2 pagesSpectrum BilldrikiddoNo ratings yet

- DataSheet 06042022051050Document2 pagesDataSheet 06042022051050dassourjya2.0No ratings yet

- 20220729174019MOHAMED014CMC Block 10 Summary DecisionDocument37 pages20220729174019MOHAMED014CMC Block 10 Summary Decisionnicholas wijayaNo ratings yet

- Production PLANNINGDocument16 pagesProduction PLANNINGFauzi RahmanNo ratings yet

- Profile PDFDocument13 pagesProfile PDFWakari Masta0% (1)

- Maria Wuwur Asset ManagementDocument3 pagesMaria Wuwur Asset ManagementJenet Menno BireNo ratings yet

- Strategic Plan For The Stockyard, Clark-Fulton, & Brooklyn Centre Community Development Office For 2015-2018Document12 pagesStrategic Plan For The Stockyard, Clark-Fulton, & Brooklyn Centre Community Development Office For 2015-2018Tom RomitoNo ratings yet

- PSA Trial Entry Form 2013Document2 pagesPSA Trial Entry Form 2013Ashley ChmaraNo ratings yet

- Industrial Pricing Decisions in B2B Marketing: Ravi R Ahuja Roll No:01Document9 pagesIndustrial Pricing Decisions in B2B Marketing: Ravi R Ahuja Roll No:01taru88No ratings yet

- NR - EE Chapter IDocument15 pagesNR - EE Chapter IGetachew GurmuNo ratings yet

- Child Labour Within The Framework of Economic Development in CameroonDocument18 pagesChild Labour Within The Framework of Economic Development in CameroonMbua NyanshiNo ratings yet

- Final Exam Bsma 1a June 15Document12 pagesFinal Exam Bsma 1a June 15Maeca Angela SerranoNo ratings yet

- Business School ADA University ECON 6100 Economics For Managers Instructor: Dr. Jeyhun Mammadov Student: Exam Duration: 18:45-21:30Document5 pagesBusiness School ADA University ECON 6100 Economics For Managers Instructor: Dr. Jeyhun Mammadov Student: Exam Duration: 18:45-21:30Ramil AliyevNo ratings yet

- Prosidur Pemfailan Baru Cap Dagangan Version 5.0 2020 - MasterDocument15 pagesProsidur Pemfailan Baru Cap Dagangan Version 5.0 2020 - Masterbaia salihin100% (1)