Professional Documents

Culture Documents

Cardano vs Polkadot: Comparing Growth, Fees, Addresses, Staking ROI, Community, and More

Uploaded by

sfjsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cardano vs Polkadot: Comparing Growth, Fees, Addresses, Staking ROI, Community, and More

Uploaded by

sfjsCopyright:

Available Formats

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

3

Overall, Cardano seems to have stronger fundamentals than

Polkadot based on the metrics analyzed

Executive summary

Overview

Cardano vs.

Description

Polkadot

• Cardano’s price fluctuations seem to have been more volatile than Polkadot’s. Even though 12 months ago DOT and ADA’s market

Past growth

caps were almost identical, ADA’s current market cap is significantly higher than DOT’s; Having invested $100 in ADA 12 months

rate ago, would have yielded more than having invested in DOT (~+48 p.p. vs. Polkadot).

• Average daily fees collected on Cardano are ~1.78x more than the average daily fees collected on Polkadot ($54.1k vs. $30.3k),

Fees however average fee per transaction on Polkadot is ~63% higher than on Cardano suggesting that Cardano is cheaper (average

fee per transaction on Polkadot is ~$0.68 vs. ~$0.42 on Cardano).

New and • Cardano has more daily new addresses (~9.3x) and more daily active addresses (~11.7x) than Polkadot. However, Cardano’s

active market capitalization is less than proportionally higher (~+50 p.p.) than Polkadot’s, suggesting that Cardano might be undervalued

addresses ratio vs. Polkadot or that Polkadot might be overvalued vs. Cardano, based on number of new and active addresses on a daily basis.

• Gross staking rewards are higher for Polkadot than for Cardano (~13.8% vs ~5.7%). When inflation given by emission of new coins

Staking net

is considered, Polkadot net staking rewards are still higher than Cardano’s (~5.5% vs ~1.4%). This suggests that Polkadot is a

ROI better investment for a holder investor that aims at getting returns via staking.

• Cardano has a broader community (measured by Reddit users) than Polkadot (~660k vs ~66k). Moreover, Cardano seems to be

Community

more engaged given higher average number of comments per day. This might suggest that the Cardano’ user base is more active

engagement and more committed to the project.

Developers • Average number of weekly commits on GitHub by developers appears to be higher for Cardano, which might suggest that Cardano

activity development team is more active.

• Both projects’ Sharpe Ratio has been closely correlated for the past 12 months; Currently, the ratio for DOT is higher than that for

Sharpe

ADA, suggesting that its risk-adjusted upside potential is higher and hence that Polkadot might currently be a better investment

ratio than Cardano when potential rewards are weighted with the asset’s risk (volatility).

• Based on distribution of wealth across wallets on the two chains, the degree of decentralization of Polkadot and Cardano is

Decentralization comparable, suggesting that the two projects are similarly decentralized.

Source: Max Maher Show Research & Analysis

Confidential & Proprietary

Overall, Cardano seems to have stronger fundamentals than

Polkadot based on the metrics analyzed

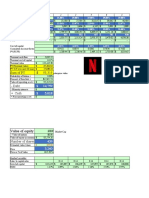

Comparison summary

Overview

New and

Past growth Staking net Community Developers Sharpe

Fees active Decentralization

rate ROI engagement activity ratio

addresses ratio

Source: Max Maher Show Research & Analysis

Confidential & Proprietary

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

6

ADA’s market cap is significantly higher than DOT’s; Having invested

$100 in ADA 12 months ago, would have yielded 48% more than

having invested in DOT

Market Cap Growth rate

$b, last 12 months, as of November 23rd, 2021 Indexed at 100, last 12 months, as of November 23rd, 2021

Cardano Polkadot Cardano Polkadot

100 2,000

90

80

1,500

70

60

50 1,000

+53% +48%

40

30

500

20

Indexed

10 at $100

0 0

10/1/2020 1/1/2021 4/1/2021 7/1/2021 10/1/2021 10/1/2020 1/1/2021 4/1/2021 7/1/2021 10/1/2021

Source: Coinmarketcap, Max Maher Show Research & Analysis

Confidential & Proprietary

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

8

Even though Cardano collects ~78% more fees than Polkadot on

average, average fee per transaction on Polkadot is ~63% higher

than on Cardano suggesting that Cardano is cheaper

Daily fees Fee per transaction

$k, last 4 weeks $, last 4 weeks

Cardano Polkadot Cardano Polkadot

Average daily fees collected on Cardano are Average fee per transaction on 0.99

~1.78x more than the average daily fees Polkadot is ~1.63x higher than

collected on Polkadot ($54.1k vs. $30.3k) on Cardano (~$0.68 vs. ~$0.42)

0.91

164.3

$HOSKY 0.82

faucet

reopens 0.76

Projects can start staking DOT to bid on

parachains, whose auctions officially

started on November 11th

96.0

86.2 84.2

75.6

70.8 70.1 0.54

55.7 0.48 0.49 0.49

0.45

41.7 0.42 0.43

37.7 0.40 0.40

32.6 48.7

40.5

16.2 0.33

29.2 27.5

9.2 7.7

28 October 5 November 12 November 19 November 28 October 5 November 12 November 19 November

Source: Polkadot.subscan.io, explorer.bitquery.io/cardano, Max Maher Show Research & Analysis

Confidential & Proprietary

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

10

Cardano seems to have a ~9.3x higher uptake on new daily

accounts than Polkadot and ~11.7x more active daily accounts on

average

New accounts daily Active accounts daily

#k, last 12 months #k, last 12 months

Cardano Polkadot Cardano Polkadot

320 500

300

450

280

260 $HOSKY 400 $HOSKY

faucet faucet

240 reopens reopens

220 350

200

300

180 Polkadot’s new active Polkadot’s daily active accounts

accounts in the past 12 in the past 12 months have

160 months have averaged ~5.2k, 250 averaged ~7.7k, vs. ~89.3k for

vs. ~47.9k for Cardano1 Cardano1

140

200

120

100 150

80

60 100

40

50

20

0 0

Nov-20 May-21 Nov-21 Nov-20 May-21 Nov-21

Projects can start staking DOT to bid on

parachains, whose auctions officially

started on November 11th

1) Excludes recent spike in Cardano (22nd and 23rd of November) to exclude $HOSKY effect;

Source: Polkadot.subscan.io, intotheblock, Max Maher Show Research & Analysis

Confidential & Proprietary

When comparing Polkadot’ and Cardano’s market caps and their

ratio of new and active accounts daily, Cardano seems to be

undervalued vs. Polkadot (or Polkadot overvalued vs. Cardano)

New accounts daily ratio1 Active accounts daily ratio1

last 12 months, Cardano vs. Polkadot, as of 23/11/21 last 12 months, Cardano vs. Polkadot, as of 23/11/21

Cardano Polkadot Cardano Polkadot

+827% +1,069%

9.3

11.7

When compared with market cap, When compared with market cap, there is

there is a high discrepancy between an even higher discrepancy between value

value and number of new addresses and number of active addresses daily,

daily, suggesting that Cardano might suggesting that Cardano might be

be undervalued vs. Polkadot (or undervalued vs. Polkadot (or Polkadot

Polkadot overvalued vs. Cardano) overvalued vs. Cardano)

+52%

+52%

1.5

1.0 1.0 1.5

1.0 1.0

Market cap New accounts Market cap Active accounts

1) Excludes recent spike in Cardano (22nd and 23rd of November) to exclude $HOSKY effect;

Source: Polkadot.subscan.io, intotheblock, Coinmarketcap, , Max Maher Show Research & Analysis

Confidential & Proprietary

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

13

Polkadot’s staking rewards are higher than Cardano’s both before

and after accounting for inflation given by the emission of new coins

ROI – Staking ADA ROI – Staking DOT

%, as of 23/11/21 %, as of 23/11/21

13.8%

8.3%

Annualised reward rate

adjusted by the inflation

of the network supply

Annualised reward rate

5.7% adjusted by the inflation 5.5%

of the network supply

4.4%

1.4%

Cardano Staking Cardano inflation Staking net ROI Polkadot Staking Polkadot inflation Staking net ROI

Source: Company website, Stakingrewards.com, Coinmarketcap, Max Maher Show Research & Analysis

Confidential & Proprietary

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

15

Polkadot’s reddit user base is smaller than Cardano’s and appears

to also be less engaged based on average number of comments per

day

Reddit subscribers Reddit comments per day

#k, as of 23/11/21 #, as of 23/11/21

Cardano Polkadot Cardano Polkadot

700 4,500

650

4,000

600

550 3,500

500

3,000

450

400 2,500

-90%

350

300 2,000

250

1,500

200

150 1,000

100

500

50 Ø 375

0 0 Ø 52

1/1/2017 1/1/2018 1/1/2019 1/1/2020 1/1/2021 1/1/2022 1/1/2018 1/1/2019 1/1/2020 1/1/2021 1/1/2022

Source: Reddit, Max Maher Show Research & Analysis

Confidential & Proprietary

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

17

Average number of weekly commits on GitHub by developers

appears to be higher for Cardano, which might suggest that Cardano

development team is more active

GitHub weekly commits

Last 12 months

110 Cardano Polkadot

Includes commits for two

repositories; Cardano node

100 and Plutus

90

• A commit, or "revision", is an individual

80 change to a file (or set of files)

70 • It's like when you save a file, except with Git,

every time you save it creates a unique ID

60 (a.k.a. the "SHA" or "hash") that allows you to

keep record of what changes were made

50 when and by who

40

• Commits usually contain a commit message

which is a brief description of what changes

were made

30

20

10

0

Nov-20 May-21 Nov-21

Source: Stackoverflow, Github, Max Maher Show Research & Analysis

Confidential & Proprietary

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

19

Both projects’ Sharpe Ratio has been closely correlated for the past

12 months; Currently, the ratio for DOT is higher than that for ADA,

suggesting that its risk-adjusted upside potential is higher

Sharpe ratio

Last 12 months

Cardano Polkadot

14

12

• The Sharpe ratio is a financial metric used

10 to assess the return of an investment

compared to its risks

8

• The Sharpe ratio adjusts a portfolio’s past

6 performance—or expected future

performance—for the excess risk that was

4 taken by the investor

2 • A high Sharpe ratio is good when compared

to similar portfolios or funds with lower

0 returns

-2

-4

-6

-8

Nov-20 May-21 Nov-21

Source: Coinmarketcap, Max Maher Show Research & Analysis

Confidential & Proprietary

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

21

Degree of decentralization, measured by assessing distribution of

wealth among wallets is comparable for the two projects

Cardano Polkadot

Cardano, %, as of 23/11/21 Polkadot, %, as of 23/11/21

0.0% 0.0%

0.1% 0.1% 9.0%

0.7% 0.4%

3.8% 13.9% 2.3%

52.3%

31.2%

56.8%

29.2%

Addresses with Balance > $10M Addresses with Balance > $100K Addresses with Balance > $1K Addresses with Balance > $1

Addresses with Balance > $1M Addresses with Balance > $10K Addresses with Balance > $100

Source: Messari.io, Max Maher Show Research & Analysis

Confidential & Proprietary

Agenda

Executive Summary

Past growth rate

Fees

Addresses

Staking ROI

Community engagement

Developers’ activity

Sharpe ratio

Decentralization

Appendix

Confidential & Proprietary

23

Polkadot founding team is worldwide renowned thanks to

Gavin Wood, one of the Ethereum co-founders

Polkadot founding team

Overview

Robert Habermeier is a Thiel Fellow Gavin Wood began originating Peter Czaban is the Technology

and co-founder of Polkadot. He has a blockchain technology as co-founder Director of the Web3 Foundation,

research and development and CTO of Ethereum. He invented where he works on supporting the

background in blockchains, distributed fundamental components of the development of the next generation of

systems, and cryptography. A blockchain industry, including Solidity, distributed technologies. He obtained

longtime member of the Rust Proof-of-Authority consensus, and his Masters of Engineering degree at

community, he has focused on Whisper. At Parity, Gavin currently the University of Oxford, reading

leveraging the language’s features to leads innovation on Substrate and Engineering Science where he focused

build highly parallel and performant Polkadot. He coined the term Web 3.0 on Bayesian Machine Learning. He

solutions. in 2014 and serves as President of has worked across defense, finance

Web3 Foundation. and data analytics industries, working

on mesh networks, distributed

knowledge bases, quantitative pricing

models, machine learning and

business development.

Source: Max Maher Show Research & Analysis

Confidential & Proprietary

World-renowned and Cardano’s public face Charles Hoskinson

founded IOHK, the tech and engineering company contracted to

design, build, and maintain the Cardano platform, with Jeremy Wood

Cardano (IOHK) founding team

Overview

Charles Hoskinson is a Colorado-based technology Immediately upon finishing his studies at Indiana University-

entrepreneur and mathematician. He attended Metropolitan Purdue University Indianapolis, Jeremy Wood packed a

State University of Denver and University of Colorado Boulder suitcase and bought a one-way ticket to Asia. He lived in

to study analytic number theory before moving into Osaka, Japan from 2008, and was bitten by the crypto-bug in

cryptography through industry exposure. 2013, becoming a founding member of the Kansai Bitcoin

His professional experience includes founding three Meet-up. He soon became entranced by the potential of next

cryptocurrency-related start-ups – Invictus Innovations, generation blockchains and joined Ethereum at the end of

Ethereum and IOHK – and he has held a variety of posts in 2013, managing operations. After leaving Ethereum, Jeremy

both the public and private sectors. He was the founding consulted on cryptocurrencies before starting Input Output

chairman of the Bitcoin Foundation’s education committee and with Charles Hoskinson in 2015. He moved back to the US

established the Cryptocurrency Research Group in 2013. three years later and stepped down from his role as chief

His current projects focus on educating people about strategy officer in 2020. Jeremy believes that the future of

cryptocurrency, being an evangelist for decentralization and fintech will progress only through experimentation and

making cryptographic tools easier to use for the mainstream. research, and by promoting collaboration between diverse

This includes leading the research, design and development of groups and organizations.

Cardano, a third-generation cryptocurrency that launched in

September 2017.

Source: IOHK, Max Maher Show Research & Analysis

Confidential & Proprietary

Number of ADA hodlers has been decreasing in the past 12 months

and has plateaued at ~9%; High share of hodlers and cruisers

wallets indicates that many investors invested for the long-term

ADA addresses

By holding time, as of 23/11/21

Hodlers (1Y+) Cruisers (1-12M) Traders (<1M)

568,177 611,716 727,631 1,030,493 1,250,725 1,472,015 1,772,393 1,956,520 2,105,405 2,344,336 2,700,799 3,055,010 3,607,874

9% 9% 10% 10% 9% 8% 7%

13% 11%

16%

24%

34% 31%

34%

46% 52% 52%

67% 68%

68% 68%

45% 72% 76%

50%

49%

50%

41% 38%

37%

31%

24% 22% 23% 24%

18% 20% 19% 16%

11/30/2020 12/31/2020 1/31/2021 2/28/2021 3/31/2021 4/30/2021 5/31/2021 6/30/2021 7/31/2021 8/31/2021 9/30/2021 10/31/2021 11/22/2021

Source: Intotheblock, Max Maher Show Research & Analysis

Confidential & Proprietary

You might also like

- Why Choosing Spac Over IpoDocument6 pagesWhy Choosing Spac Over IpoNNo ratings yet

- Georgetown University Public Real Estate Fund Valuation ModelDocument35 pagesGeorgetown University Public Real Estate Fund Valuation Modelmzhao8No ratings yet

- Marathon Oil Research Paper Form FORD Research 11.23.223Document3 pagesMarathon Oil Research Paper Form FORD Research 11.23.223physicallen1791No ratings yet

- JP Morgan The Maltese Falcoin 1644068844Document31 pagesJP Morgan The Maltese Falcoin 1644068844Christian Gazzetta ManciniNo ratings yet

- Intrinsic Value Spreadsheet 1Document12 pagesIntrinsic Value Spreadsheet 1Soham AherNo ratings yet

- Cardano (ADA) CryptoSlateDocument1 pageCardano (ADA) CryptoSlatePravin KharateNo ratings yet

- Envy Rides Case DecisionDocument4 pagesEnvy Rides Case DecisionMikey MadRatNo ratings yet

- Week 1 Minicase Computron Industries Members:: Current Assets Current Liability 2680000 1039800Document10 pagesWeek 1 Minicase Computron Industries Members:: Current Assets Current Liability 2680000 1039800Eve Grace SohoNo ratings yet

- KTrade - Startup Funding Report 2021Document51 pagesKTrade - Startup Funding Report 2021UsaidMandvia100% (1)

- Building A Significant Critical Minerals Business: MARCH 2023Document25 pagesBuilding A Significant Critical Minerals Business: MARCH 2023Alibek MeirambekovNo ratings yet

- Allen Lane Case Write UpDocument2 pagesAllen Lane Case Write UpAndrew Choi100% (1)

- Visa Inc Fiscal 2022 Annual ReportDocument143 pagesVisa Inc Fiscal 2022 Annual ReportPankaj GoyalNo ratings yet

- AFM Notes by - Taha Popatia - Volume 1Document68 pagesAFM Notes by - Taha Popatia - Volume 1Ashfaq Ul Haq OniNo ratings yet

- Smart GC 1.00Document17 pagesSmart GC 1.00aassgroup786No ratings yet

- BLK 1Q22 Earnings ReleaseDocument15 pagesBLK 1Q22 Earnings ReleaseFrancisco Jiménez TrincadoNo ratings yet

- Palantir Stock Research 11.23.23 From FORD ResearchDocument3 pagesPalantir Stock Research 11.23.23 From FORD Researchphysicallen1791No ratings yet

- Cash Flow Estimation and Risk Analysis: by Dr. Yi ZhangDocument35 pagesCash Flow Estimation and Risk Analysis: by Dr. Yi ZhangBibi KathNo ratings yet

- DocSend Fundraising ResearchDocument19 pagesDocSend Fundraising ResearchGimme DunlodsNo ratings yet

- GrupoAxo Corporate Presentation-3Q21Document17 pagesGrupoAxo Corporate Presentation-3Q21jose peñaNo ratings yet

- Suggested Answers To Even-Numbered Problems: Analysis For Financial Management, 10eDocument2 pagesSuggested Answers To Even-Numbered Problems: Analysis For Financial Management, 10eDr-Émpòrìó MàróNo ratings yet

- MCQ 6019 testDocument38 pagesMCQ 6019 testpathiranapremabanduNo ratings yet

- KR Valuation 28 Sept 2019Document54 pagesKR Valuation 28 Sept 2019ket careNo ratings yet

- DROID DAO September Treasury UpdateDocument5 pagesDROID DAO September Treasury UpdateFrank GallagherNo ratings yet

- IRBT Investor Presentation Baird111120Document31 pagesIRBT Investor Presentation Baird111120ABermNo ratings yet

- ROKU Buying the DipDocument5 pagesROKU Buying the DipAslam HossainNo ratings yet

- Crowd Real Estate Site TrackingDocument56 pagesCrowd Real Estate Site TrackingahgonzalezpNo ratings yet

- AR2021Document169 pagesAR2021Dennis AngNo ratings yet

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNo ratings yet

- John Case Company ValuationDocument6 pagesJohn Case Company Valuationryancoburn100% (2)

- Financial Analysis & Tools For Product ManagementDocument33 pagesFinancial Analysis & Tools For Product ManagementFarrukh JunaidNo ratings yet

- Teladoc Health, Inc. (TDOC) : Truist SecuritiesDocument8 pagesTeladoc Health, Inc. (TDOC) : Truist SecuritiesPramod BeriNo ratings yet

- Smart GCDocument17 pagesSmart GCaassgroup786No ratings yet

- P 7-15 Common Stock Value: All Growth ModelsDocument8 pagesP 7-15 Common Stock Value: All Growth ModelsAlvira FajriNo ratings yet

- 1 Chatterjee2016Document28 pages1 Chatterjee2016Julieta Tiurma NapitupuluNo ratings yet

- Module 5: Evaluating A Single ProjectDocument50 pagesModule 5: Evaluating A Single Project우마이라UmairahNo ratings yet

- How A Private Equity Deal WorksDocument2 pagesHow A Private Equity Deal Worksdarthvader79No ratings yet

- The Future of SaaS: Record Funding Continues Despite PandemicDocument14 pagesThe Future of SaaS: Record Funding Continues Despite PandemicTawfeeg AwadNo ratings yet

- GrowIT 11Document16 pagesGrowIT 11Abdulla AlboininNo ratings yet

- TTR Ideals Brazil Venture Capital Handbook 2022Document55 pagesTTR Ideals Brazil Venture Capital Handbook 2022Andreia OlliveiraNo ratings yet

- Analyzing Financial Performance and Controls for ICL CafeDocument12 pagesAnalyzing Financial Performance and Controls for ICL CafeAyush BakshiNo ratings yet

- Artko Capital LP Q2 2017 Letter Highlights Strong Returns and Focus on ROICDocument7 pagesArtko Capital LP Q2 2017 Letter Highlights Strong Returns and Focus on ROICSmitty WNo ratings yet

- Cardians - Cardano 2021 Report v1Document27 pagesCardians - Cardano 2021 Report v1Homestay ParaNo ratings yet

- 20 Year Intrinsic ValueDocument27 pages20 Year Intrinsic ValueCaleb100% (2)

- Developing Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018Document5 pagesDeveloping Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018DenssNo ratings yet

- NPV of A Borders - APDocument1 pageNPV of A Borders - APpillai21No ratings yet

- Presentación User Valuation DamodaranDocument42 pagesPresentación User Valuation Damodaranfrank bautistaNo ratings yet

- Cfra - TmusDocument9 pagesCfra - TmusJeff SturgeonNo ratings yet

- Spotify Loose Ends: Pricing, Subscriber-Based Value and Big Data!Document15 pagesSpotify Loose Ends: Pricing, Subscriber-Based Value and Big Data!Rhein FathiaNo ratings yet

- Shapiro CapBgt IMDocument76 pagesShapiro CapBgt IMjhouvanNo ratings yet

- Crowdstrike Ipo Case: Denis Korablev July 12, 2019Document5 pagesCrowdstrike Ipo Case: Denis Korablev July 12, 2019Denis KorablevNo ratings yet

- Investment Calculator - SmartAssetDocument1 pageInvestment Calculator - SmartAssetSulemanNo ratings yet

- State of Pre-Seed and Seed Valuations 2022Document10 pagesState of Pre-Seed and Seed Valuations 2022Jordi from HitchNo ratings yet

- Africa Crypto LandscapeDocument28 pagesAfrica Crypto Landscapeace187No ratings yet

- CAG Financials 2019Document4 pagesCAG Financials 2019AzliGhaniNo ratings yet

- Business Plan - PresentationDocument35 pagesBusiness Plan - Presentationmhdalamoudi5184No ratings yet

- 2022 09Document7 pages2022 09Priyanshu SharmaNo ratings yet

- Digital Dispatch Initiating CoverageDocument30 pagesDigital Dispatch Initiating Coveragegreid34100% (1)

- TTR Ideals Brazil Handbook 2022Document257 pagesTTR Ideals Brazil Handbook 2022Alexandre GoncalvesNo ratings yet

- Your Kickstart Guide: Effortless Crypto InvestingDocument15 pagesYour Kickstart Guide: Effortless Crypto InvestingGodbless OmoyovwiriNo ratings yet

- Defi, Bitcoin and Cryptocurrency Trading and Investing for Beginners: Utilizing Decentralized Finance, Binance Trading, Tax Strategies, and Technical Analysis for Lending And Borrowing (2022)From EverandDefi, Bitcoin and Cryptocurrency Trading and Investing for Beginners: Utilizing Decentralized Finance, Binance Trading, Tax Strategies, and Technical Analysis for Lending And Borrowing (2022)No ratings yet

- Catch Me If You Can WorksheetDocument4 pagesCatch Me If You Can WorksheetHurleyHugoNo ratings yet

- Italy (Analysis)Document1 pageItaly (Analysis)Rain GuevaraNo ratings yet

- TCS L6 ActsDocument7 pagesTCS L6 ActsBhebz Erin MaeNo ratings yet

- Envi. Data AcquisitionDocument10 pagesEnvi. Data AcquisitionDexter John Gomez JomocNo ratings yet

- Югоизточна Европа под османско владичество 1354-1804Document531 pagesЮгоизточна Европа под османско владичество 1354-1804auroradentataNo ratings yet

- GROWTH ASSESSMENT FOR 10-YEAR-OLD SCHOOLERDocument4 pagesGROWTH ASSESSMENT FOR 10-YEAR-OLD SCHOOLERYashoda SatputeNo ratings yet

- (Oxford Studies in Digital Politics) Jack Parkin - Money Code Space - Hidden Power in Bitcoin, Blockchain, and Decentralisation-Oxford University Press (2020)Document297 pages(Oxford Studies in Digital Politics) Jack Parkin - Money Code Space - Hidden Power in Bitcoin, Blockchain, and Decentralisation-Oxford University Press (2020)berpub0% (1)

- Telecom Business Management Systems Net ProjectDocument68 pagesTelecom Business Management Systems Net ProjectRahul RaiNo ratings yet

- Literature Review On OscilloscopeDocument5 pagesLiterature Review On Oscilloscopedhjiiorif100% (1)

- Ngāti Kere: What 87 Can Achieve Image 500Document17 pagesNgāti Kere: What 87 Can Achieve Image 500Angela HoukamauNo ratings yet

- Class9-NTSE MATH WORKSHEETDocument4 pagesClass9-NTSE MATH WORKSHEETJeetu RaoNo ratings yet

- Touch-Tone Recognition: EE301 Final Project April 26, 2010 MHP 101Document20 pagesTouch-Tone Recognition: EE301 Final Project April 26, 2010 MHP 101Sheelaj BabuNo ratings yet

- Michigan English TestDocument22 pagesMichigan English TestLuisFelipeMartínezHerediaNo ratings yet

- Sap GlossaryDocument324 pagesSap GlossaryNikos TataliasNo ratings yet

- Roke TsanDocument53 pagesRoke Tsanhittaf_05No ratings yet

- Bungsuan NHS Then and Now in PerspectiveDocument2 pagesBungsuan NHS Then and Now in Perspectivedanicafayetamagos02No ratings yet

- NES 362 Type and Production Testing of Mechanical Equipment Category 3Document36 pagesNES 362 Type and Production Testing of Mechanical Equipment Category 3JEORJENo ratings yet

- CWI - Part A Fundamentals Examination (Full) PDFDocument43 pagesCWI - Part A Fundamentals Examination (Full) PDFJulian Ramirez Ospina100% (4)

- 4 McdonaldizationDocument17 pages4 McdonaldizationAngelica AlejandroNo ratings yet

- Oil Well Drilling Methods: University of Karbala College of Engineering Petroleum Eng. DepDocument8 pagesOil Well Drilling Methods: University of Karbala College of Engineering Petroleum Eng. DepAli MahmoudNo ratings yet

- Negros IslandDocument18 pagesNegros IslandGrace AmaganNo ratings yet

- Knowledge, Attitudes and Practices of Nursing Students on Dengue FeverDocument9 pagesKnowledge, Attitudes and Practices of Nursing Students on Dengue FeverElinNo ratings yet

- Rocha Et Al 2020 Fostering Inter - and Transdisciplinarity in Discipline-Oriented Universities To Improve Sustainability Science and PracticeDocument12 pagesRocha Et Al 2020 Fostering Inter - and Transdisciplinarity in Discipline-Oriented Universities To Improve Sustainability Science and PracticeAna CarolinaNo ratings yet

- Detailed CET ListDocument11 pagesDetailed CET ListBhagya H SNo ratings yet

- Feminist Criticism in Frankenstein, Equus and The Turn of The ScrewDocument4 pagesFeminist Criticism in Frankenstein, Equus and The Turn of The ScrewLucia ToledoNo ratings yet

- MTA powerVAL Technical Data Sheet v00Document1 pageMTA powerVAL Technical Data Sheet v00muhammetNo ratings yet

- Philippine School Action Plan for Scouting ProgramDocument1 pagePhilippine School Action Plan for Scouting ProgramLaira Joy Salvador - ViernesNo ratings yet

- UX5HPDocument2 pagesUX5HPNazih ArifNo ratings yet

- LLM Thesis On Human RightsDocument7 pagesLLM Thesis On Human Rightswssotgvcf100% (2)

- Basic Encaustic Manual Author R&FDocument16 pagesBasic Encaustic Manual Author R&Fagustin arellanoNo ratings yet