Professional Documents

Culture Documents

Student Excel Supplement Aspen Bank Launching Credit Card in Romania

Uploaded by

super manOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Student Excel Supplement Aspen Bank Launching Credit Card in Romania

Uploaded by

super manCopyright:

Available Formats

Exhibits

Table A Net Revenue Impact Estimates, 2007

Revenue per Cardholder

Annual Interest Other Annual

Segment

Income (€) Revenue (€) Revenue (€) Revenue (€)

Middle Class 3,000-4,500 37.13 23.50 60.63

Affluent 4,500-6,000 86.63 36.75 123.38

Most Affluent 6,000+ 148.50 61.25 209.75

Table B Customer Acquisition Estimates, Year 1 (all customers)

Prospects Response Qualification

Unit Cost (€)

Reached Rate Rate

Direct Mail 0.50 2,500,000 3.0% 60.0%

Take One 0.10 2,000,000 2.5% 30.0%

FSIs 0.05 3,500,000 1.5% 30.0%

Direct Sales €3000/rep 60,000 25.0% 60.0%

Branch Cross-Sell 1.00 50,000 50.0% 90.0%

Exhibit 1

2003 2004 2005

Net revenue 66.0 82.0 87.5

Fees/commissions/insurance 4.0 6.9 13.1

Customer net revenue 70.0 88.9 100.6

Net credit losses 9.8 11.5 14.4

Credit collection 3.3 3.9 4.9

Total credit cycle 13.2 15.5 19.3

Delivery expense 47.0 54.5 57.9

Other revenue/(expense) (4.9) (5.5) (6.7)

Earnings before tax 4.9 13.4 16.7

Customer liabilities (€M) 2,343 2,745 3,000

Customer assets (€M) 1,640 1,922 2,400

Average total assets (€M) 1,875 2,232 2,573

Full-time equivalent employees 564 611 705

Number of accounts (000) 209 256 297

Number of customers (000) 157 179 201

Number of branches 12 13 15

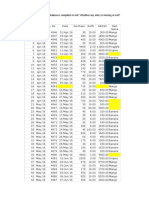

Exhibit 4

Credit Credit Card

Cards Utilization

Romanian Commercial Bank (BCR) 180,000 10%

Raifeissen Bank 200,000 70%

Bancpost 29,000 6%

Romanian Bank for Development (BRD) 606,000 27%

Estimated total credit cards, Romania 1,710,000 20%

Exhibit 5

% of

Annual Income (€)

Population

<1,500 23.2%

1,500 - 2,000 11.9%

2,000 - 3,000 18.8%

3,000 - 4,500 18.2%

4,500 - 6,000 15.0%

6,000 - 7,000 6.6%

7,000 - 10,000 3.8%

10,000 - 15,000 1.2%

>15,000 1.3%

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Benelite Process For Upgradation of IllemniteDocument6 pagesBenelite Process For Upgradation of Illemnitemadangk100% (1)

- Business Report - 2 (GODIGIT Bank)Document10 pagesBusiness Report - 2 (GODIGIT Bank)Rahul100% (1)

- Case Study 3 PDFDocument4 pagesCase Study 3 PDFBetheemae R. Matarlo100% (1)

- Test 1Document3 pagesTest 1super manNo ratings yet

- Day Date: Breakfast CornflakesDocument16 pagesDay Date: Breakfast Cornflakessuper manNo ratings yet

- Tenali LimitsDocument245 pagesTenali Limitssuper manNo ratings yet

- 9090 01 BGC MatrixDocument3 pages9090 01 BGC Matrixsuper manNo ratings yet

- Residents Say "Exciting" Development Not Welcome: Part 7 - Short ReadingsDocument13 pagesResidents Say "Exciting" Development Not Welcome: Part 7 - Short ReadingsQuân VõNo ratings yet

- F4 - Exam Paper 2Document32 pagesF4 - Exam Paper 2IVAN TIONG WEI JUN MoeNo ratings yet

- Recent Bank Written Math Solution: Prepared By: Musfik AlamDocument9 pagesRecent Bank Written Math Solution: Prepared By: Musfik AlamAbdullah Al NomanNo ratings yet

- I.C. Chadda Deputy General Manager (Tech) Central Warehousing Corporation New DelhiDocument32 pagesI.C. Chadda Deputy General Manager (Tech) Central Warehousing Corporation New DelhimindpeaceNo ratings yet

- Brainaid CaseDocument4 pagesBrainaid CaseJyotiraditya Kumar JhaNo ratings yet

- Mini Project-2Document44 pagesMini Project-2ÇHäÎťÂñŸà MùŚïČÂłŚNo ratings yet

- Resumen de Contactos y Sensores Q409533Document19 pagesResumen de Contactos y Sensores Q409533Francisco Javier BurgosNo ratings yet

- Philippine Nurses Licensure Examination Results Released in Ten (10) Working DaysDocument5 pagesPhilippine Nurses Licensure Examination Results Released in Ten (10) Working DaysRapplerNo ratings yet

- Constitution of India and Professional Ethics (CIP) 21CIP37 IADocument8 pagesConstitution of India and Professional Ethics (CIP) 21CIP37 IAÅᴅᴀʀsʜ RᴀᴍNo ratings yet

- Business Meeting MinutesDocument3 pagesBusiness Meeting MinutesDenisa SecuiuNo ratings yet

- Project - File of Electricity Biling SystemDocument10 pagesProject - File of Electricity Biling SystemNiraj GuptaNo ratings yet

- Unit-4 Inventory and Management ProcessDocument83 pagesUnit-4 Inventory and Management ProcessUzma Rukhayya ShaikNo ratings yet

- Automobile Literature ReviewDocument8 pagesAutomobile Literature Reviewbzknsgvkg100% (1)

- Whocares Who Does 2022 CDocument35 pagesWhocares Who Does 2022 CTran Nguyen Anh TramNo ratings yet

- Steven Lim & Associates ProfileDocument6 pagesSteven Lim & Associates ProfileReika KuaNo ratings yet

- FulltextDocument46 pagesFulltextVaisakh DileepkumarNo ratings yet

- Exit Seminar Report Sachin S.Document23 pagesExit Seminar Report Sachin S.Kajal PundNo ratings yet

- PWC Annual Global Crypto Tax Report 2020Document53 pagesPWC Annual Global Crypto Tax Report 2020Дмитрий ПогорелыйNo ratings yet

- Service Bulletin 25-2016Document3 pagesService Bulletin 25-2016Leo ansinNo ratings yet

- Effect of Currency Redesign and Cashless Policy On Academic Performance of Students in Nigerian UniversitiesDocument43 pagesEffect of Currency Redesign and Cashless Policy On Academic Performance of Students in Nigerian UniversitiesWillis LavisNo ratings yet

- Sap La s4h01 en 14 SGDocument11 pagesSap La s4h01 en 14 SGThiago RigoNo ratings yet

- Week 6 MISCONCEPTIONS ON ENTRPRENEURSHIPDocument10 pagesWeek 6 MISCONCEPTIONS ON ENTRPRENEURSHIPXiet JimenezNo ratings yet

- Valiant Annual Report 2020 2021Document208 pagesValiant Annual Report 2020 2021Ameya WartyNo ratings yet

- GSIS TEMPLATE Fire Insurance Application Form (TRAD)Document3 pagesGSIS TEMPLATE Fire Insurance Application Form (TRAD)Ronan MaquidatoNo ratings yet

- Id Pengaruh Brand Image Dan Product Design Purchase Decision Purchase IntentionDocument14 pagesId Pengaruh Brand Image Dan Product Design Purchase Decision Purchase IntentionNi Kd Asrilina PutrawanNo ratings yet

- CoP Webinar Amtrak EAM Program Journey - Alex Berry 13th April 2023Document24 pagesCoP Webinar Amtrak EAM Program Journey - Alex Berry 13th April 2023Nico FriedmannNo ratings yet

- Lseg Esg Scores MethodologyDocument32 pagesLseg Esg Scores MethodologyIman GadzhikulievaNo ratings yet