Professional Documents

Culture Documents

CMCP Chap 8

Uploaded by

Kei SenpaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CMCP Chap 8

Uploaded by

Kei SenpaiCopyright:

Available Formats

CMCP M3 Chapter 8: Financial Statements

I. Financial Statements

a. Income Statement

Income statement is a financial statement that summarizes a company's

revenues and expenses over a period, either quarterly or annually.

Understanding this is essential for investors who want to analyze the profitability

and future growth of a company.

b. Balance Sheet

The balance sheet is shows the balance of the entity’s assets, liabilities,

and equity at the end of the period of time. It also shows you a snapshot of

much money you would have left over if you sold all your assets and paid off all

your debts.

c. Statement of Changes in Equity

It is a financial statement which summarises the transactions related to

the shareholder's equity over an accounting period. I think it can be used to

clarify retained earnings and furnish shareholders with information that can

further inform their investment strategy.

d. Statement of Cash Flow

A cash flow statement is a financial statement that summarizes all cash

inflows received by a company from continuing activities and external investment

sources and cash outflows used to fund corporate operations and investments

over a certain time period. It tracks cash generated by the business in three

ways: operations, investment, and financing.

e. Notes to Financial Statements

Notes to the financial statements disclose the detailed assumptions made

by accountants when preparing a company's: income statement, balance sheet,

statement of changes of financial position or statement of retained earnings. The

notes are essential to fully understanding these financial statements.

II. Financial Ratios

a. Horizontal Analysis

Horizontal is a method where financial statements are compared to reveal

financial performance over a specific period of time. I think this is used to spot

financial trends of compnay whether it is growing over time or not.

b. Vertical Analysis

Vertical analysis is an approach wherein all line items in a financial

statement is listed as a percentage of a base amount. This is more like knowing

which activity of the company is using more of the base amount for just a certain

period of time unlike the horizontal analysis whoch measures the trend for at

least two years.

c. Ratio Analysis

Ratio analysis is a quantitative method of gaining insight into a company's

liquidity, operational efficiency, and profitability by studying its financial

statements such as the balance sheet and income statement. There are different

ratio analysis that are discussed by the lecturers like the liquidity ratios, activity

ratios, leverage ratios, profitability ratios, and market value ratios.

III. Cash Flow Analysis

The lecturers discussed that this is an analysis of the various cash inflows and

the cash outflows of the company during the reporting period. These include the

operating activities, investing activities and financing activities. They also

showede different ratios and methods to analyze the cash flow and I have been

thinking if doing the vertical and horizontal analysis on a cash flow statement is

also considered as a cash flow analysis.

You might also like

- Understanding Financial Statements in 40 CharactersDocument59 pagesUnderstanding Financial Statements in 40 CharactersMarc Lewis Brotonel100% (1)

- Understanding Financial StatementsDocument5 pagesUnderstanding Financial StatementsMark Russel Sean LealNo ratings yet

- Comparative Cash Flow Statement of The Listed CompaniesDocument34 pagesComparative Cash Flow Statement of The Listed Companieschetan vibhutimathNo ratings yet

- Accounting and Finance For Managers Assignment Assignment OneDocument6 pagesAccounting and Finance For Managers Assignment Assignment OneBirukee ManNo ratings yet

- 05 BSAIS 2 Financial Management Week 10 11Document9 pages05 BSAIS 2 Financial Management Week 10 11Ace San GabrielNo ratings yet

- Lesson 1. Financial Statements (Cabrera & Cabrera, 2017)Document10 pagesLesson 1. Financial Statements (Cabrera & Cabrera, 2017)Axel MendozaNo ratings yet

- CHAPTER - 3 Conceptual FrameworkDocument14 pagesCHAPTER - 3 Conceptual FrameworkSarva ShivaNo ratings yet

- AFM-Cash Flow StatementDocument14 pagesAFM-Cash Flow StatementkanikaNo ratings yet

- Muzzamil Janjua SAP ID 42618Document9 pagesMuzzamil Janjua SAP ID 42618Muzzamil JanjuaNo ratings yet

- Financial Analysis of Wipro LTD PDFDocument25 pagesFinancial Analysis of Wipro LTD PDFMridul sharda100% (2)

- Financial Statements ExplainedDocument6 pagesFinancial Statements Explainednabeel aliNo ratings yet

- Financial Management AssignmentDocument8 pagesFinancial Management AssignmentMBA 8th Batch At MUSOMNo ratings yet

- Muzzamil Janjua SAP ID 42618Document9 pagesMuzzamil Janjua SAP ID 42618Muzzamil JanjuaNo ratings yet

- Module 3 Conceptual Frameworks and Accounting StandardsDocument10 pagesModule 3 Conceptual Frameworks and Accounting StandardsJonabelle DalesNo ratings yet

- 6. Chapter 3Document30 pages6. Chapter 3shaik iftiNo ratings yet

- Meaning of Financial StatementsDocument44 pagesMeaning of Financial Statementsparth100% (1)

- Senior High SchoolDocument18 pagesSenior High SchoolKOUJI N. MARQUEZNo ratings yet

- Introduction To Finl Statement AnalysisDocument23 pagesIntroduction To Finl Statement AnalysisMD Kawser Hamid RonyNo ratings yet

- Essential Accounting Concepts ExplainedDocument6 pagesEssential Accounting Concepts ExplainedShane CayyongNo ratings yet

- GayathriRamesh 121045 AccountingDocument12 pagesGayathriRamesh 121045 AccountingGayathri RameshNo ratings yet

- 5 Financial StatementsDocument8 pages5 Financial StatementsMuhammad Muzammil100% (2)

- Pre Test: Biliran Province State UniversityDocument6 pagesPre Test: Biliran Province State Universitymichi100% (1)

- FM TermpaoerDocument34 pagesFM TermpaoerFilmona YonasNo ratings yet

- shivam pandey ACCOUNT 3Document11 pagesshivam pandey ACCOUNT 3Madhaw ShuklaNo ratings yet

- A COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA" (Four Wheelers)Document100 pagesA COMPARATIVE STUDY ON FINANCIAL PERFORMANCE OF SELECT AUTOMOBILE INDUSTRIES IN INDIA" (Four Wheelers)Prashanth PB82% (17)

- Accounting and Financial StatementsDocument14 pagesAccounting and Financial StatementsMitha LarasNo ratings yet

- SHS Business Finance Chapter 2Document24 pagesSHS Business Finance Chapter 2Ji BaltazarNo ratings yet

- Allahabad BankDocument103 pagesAllahabad BankPiyush Gehlot0% (1)

- Unit - 10 Financial Statements and Ratio AnalysisDocument18 pagesUnit - 10 Financial Statements and Ratio AnalysisAayushi Kothari100% (1)

- Accounts Jun 21Document5 pagesAccounts Jun 21Nisha MandaleNo ratings yet

- RATIO ANALYSIS INTRODocument53 pagesRATIO ANALYSIS INTROGuru Murthy D R0% (1)

- AFSA 2 AssignmentDocument7 pagesAFSA 2 AssignmentharoonNo ratings yet

- Chapter 01 (FSA)Document3 pagesChapter 01 (FSA)Prasenjit SahaNo ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementAeilin AgotoNo ratings yet

- Unit 2 Financial Statement and Cash Flows BBS Notes EduNEPAL - InfoDocument1 pageUnit 2 Financial Statement and Cash Flows BBS Notes EduNEPAL - InfoGrethel Tarun MalenabNo ratings yet

- Accounting For Managers ExtraDocument6 pagesAccounting For Managers ExtraNantha KumaranNo ratings yet

- Advanced Accounting Cash Flow StatementDocument27 pagesAdvanced Accounting Cash Flow StatementHaris MalikNo ratings yet

- The Financial Statements: Chapter OutlineDocument15 pagesThe Financial Statements: Chapter OutlineBhagaban DasNo ratings yet

- Q.9) A) What Are The Objectives of Financial Statement Analysis? Explain in BriefDocument4 pagesQ.9) A) What Are The Objectives of Financial Statement Analysis? Explain in BriefCyrus JainNo ratings yet

- Lec 3 Introduction To FSA 2023Document3 pagesLec 3 Introduction To FSA 2023Khadeeza ShammeeNo ratings yet

- Acct 4102Document40 pagesAcct 4102Shimul HossainNo ratings yet

- Financial Performance AnalysisDocument110 pagesFinancial Performance AnalysisNITHIN poojaryNo ratings yet

- 3 unitDocument9 pages3 unitNirmal MNo ratings yet

- Cash Flow StatementDocument39 pagesCash Flow StatementBollu TulasiNo ratings yet

- Financial: StatementDocument31 pagesFinancial: StatementGrace Joy100% (1)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Answer To Tutorial 7 ToADocument3 pagesAnswer To Tutorial 7 ToAidt12990No ratings yet

- INTRODUCTIONDocument80 pagesINTRODUCTIONparth100% (1)

- Financial Statement Analysis (Nov-20)Document51 pagesFinancial Statement Analysis (Nov-20)Aminul Islam AmuNo ratings yet

- Financial Accounting ReportDocument11 pagesFinancial Accounting Reportthu thienNo ratings yet

- Financial ManagementDocument26 pagesFinancial ManagementHILLARY SHINGIRAI MAPIRANo ratings yet

- Chapter 9 - Financial AnalysisDocument13 pagesChapter 9 - Financial AnalysisNicole Feliz InfanteNo ratings yet

- Financial statement analysis of Tensile Pro PipesDocument89 pagesFinancial statement analysis of Tensile Pro PipeseshuNo ratings yet

- Name: Abdul Gani Roll No: 201DDE1184 Course: MCA Year/Sem: 2 / 3 Paper Code: MCA 304 Paper Name: (Principles of Accounting)Document7 pagesName: Abdul Gani Roll No: 201DDE1184 Course: MCA Year/Sem: 2 / 3 Paper Code: MCA 304 Paper Name: (Principles of Accounting)logicballiaNo ratings yet

- Fiscal Management - Financial Statement AnalysisDocument60 pagesFiscal Management - Financial Statement AnalysisBCC 27 AccountNo ratings yet

- Acc ContentDocument16 pagesAcc ContentSP SanjayNo ratings yet

- Accounting Defination and Basic TermsDocument10 pagesAccounting Defination and Basic TermsJahanzaib ButtNo ratings yet

- A Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyDocument62 pagesA Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyeshuNo ratings yet

- Powers and Duties of Elected Local Government OfficialsDocument2 pagesPowers and Duties of Elected Local Government OfficialsKei SenpaiNo ratings yet

- AccountantDocument3 pagesAccountantKei SenpaiNo ratings yet

- Government Administrative Division LevelsDocument2 pagesGovernment Administrative Division LevelsKei SenpaiNo ratings yet

- Assessment of Local Fiscal Performance DevelopmentsDocument2 pagesAssessment of Local Fiscal Performance DevelopmentsKei SenpaiNo ratings yet

- Guide to Local Finance Committees & Budget ProcessDocument3 pagesGuide to Local Finance Committees & Budget ProcessKei SenpaiNo ratings yet

- From The Pre HistoricDocument3 pagesFrom The Pre HistoricKei SenpaiNo ratings yet

- CMCP Chap 12Document2 pagesCMCP Chap 12Kei SenpaiNo ratings yet

- CMCP Chap 9Document1 pageCMCP Chap 9Kei SenpaiNo ratings yet

- CMCP Chap 13Document2 pagesCMCP Chap 13Kei SenpaiNo ratings yet

- Credit Information Sources Code EthicsDocument1 pageCredit Information Sources Code EthicsKei SenpaiNo ratings yet

- CMCP Chap QaDocument2 pagesCMCP Chap QaKei SenpaiNo ratings yet

- Credit Information Sources Code EthicsDocument1 pageCredit Information Sources Code EthicsKei SenpaiNo ratings yet

- CMCP Chap 11Document2 pagesCMCP Chap 11Kei SenpaiNo ratings yet

- Final Vertical AnalysisDocument2 pagesFinal Vertical AnalysisKei SenpaiNo ratings yet

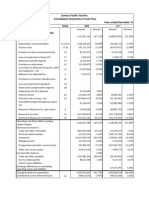

- Century Pacific Food Inc. Consolidated Statements of Cash Flow AnalysisDocument5 pagesCentury Pacific Food Inc. Consolidated Statements of Cash Flow AnalysisKei SenpaiNo ratings yet

- Credit Information Sources Code EthicsDocument1 pageCredit Information Sources Code EthicsKei SenpaiNo ratings yet

- Chapter Video Lecture CommentDocument1 pageChapter Video Lecture CommentKlester Kim Sauro ZitaNo ratings yet

- Forward Rates - March 25 2021Document2 pagesForward Rates - March 25 2021Lisle Daverin BlythNo ratings yet

- ABC of StockDocument174 pagesABC of StockumaatntpcNo ratings yet

- Soal Asistensi Akm 3 Pertemuan 4 Cash FlowDocument2 pagesSoal Asistensi Akm 3 Pertemuan 4 Cash Flowaldo sinagaNo ratings yet

- BCG - ACC3 - 28 June 2021 - S1Document5 pagesBCG - ACC3 - 28 June 2021 - S1Ntokozo Siphiwo Collin DlaminiNo ratings yet

- THESISDocument62 pagesTHESISBetelhem EjigsemahuNo ratings yet

- Full Notes SapmDocument472 pagesFull Notes SapmJobin JohnNo ratings yet

- Joint VentureDocument2 pagesJoint VentureAries Gonzales CaraganNo ratings yet

- Module 6 - Project Closure and TerminationDocument29 pagesModule 6 - Project Closure and TerminationAnthonyNo ratings yet

- ProspectusDocument2 pagesProspectusJuliana Mae FradesNo ratings yet

- CSG International Corporate BrochureDocument18 pagesCSG International Corporate BrochurePrabir MishraNo ratings yet

- Import Purchase ProcedureDocument20 pagesImport Purchase ProcedureAbdul KhaderNo ratings yet

- JGB v4n1 17Document8 pagesJGB v4n1 17Roel SisonNo ratings yet

- The Billabong CaseDocument14 pagesThe Billabong CaseRati Sinha100% (1)

- Assignment BRDocument7 pagesAssignment BRprerana sharmaNo ratings yet

- Presentation - Reconciling Supply and DemandDocument21 pagesPresentation - Reconciling Supply and DemandArthur BouchardetNo ratings yet

- GE MatrixDocument34 pagesGE MatrixKeshav BhatiaNo ratings yet

- Class XI QPDocument100 pagesClass XI QPDevansh DwivediNo ratings yet

- Stone Supplier at PSN Project PT. Elektrindo Solusi EnergiDocument26 pagesStone Supplier at PSN Project PT. Elektrindo Solusi EnergiElektrindo Solusi EnergiNo ratings yet

- Salary StructureDocument1 pageSalary Structureomer farooqNo ratings yet

- Barcelona PDFDocument165 pagesBarcelona PDFHector Alberto Garcia LopezNo ratings yet

- So PaidDocument7 pagesSo Paidjames pearsonNo ratings yet

- Factors Affecting The Income Velocity of Money in The Commonwealth PDFDocument20 pagesFactors Affecting The Income Velocity of Money in The Commonwealth PDFmaher76No ratings yet

- Anan University case study examines IT infrastructure relationshipsDocument3 pagesAnan University case study examines IT infrastructure relationshipsSam PatriceNo ratings yet

- Ra 11058 OshlawDocument17 pagesRa 11058 OshlawArt CorbeNo ratings yet

- Account Statement: Parikshit YadavDocument19 pagesAccount Statement: Parikshit YadavParikshit YadavNo ratings yet

- International Business Machines Corporation or IBM, Is An AmericanDocument35 pagesInternational Business Machines Corporation or IBM, Is An AmericanmanishaNo ratings yet

- Marketing Vocabulary: Term MeaningDocument3 pagesMarketing Vocabulary: Term MeaningSudarmika KomangNo ratings yet

- Quote 023Document1 pageQuote 023Matthew LeeNo ratings yet

- Gar 7Document2 pagesGar 7Surendra DevadigaNo ratings yet

- Test Bank For Financial Reporting Financial Statement Analysis and Valuation 8th EditionDocument23 pagesTest Bank For Financial Reporting Financial Statement Analysis and Valuation 8th Editionbriansmithmwgrebcstd100% (25)