Professional Documents

Culture Documents

Family Code of The Philippines: The Family Home Ponente: Justice Corona

Family Code of The Philippines: The Family Home Ponente: Justice Corona

Uploaded by

Janmari G. Fajardo0 ratings0% found this document useful (0 votes)

8 views2 pagesOriginal Title

103 PFRFC - Marriage Family Home Article 152_5 Kelley Jr v Planters Products Inc (Not in Syllabus) - Copy

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesFamily Code of The Philippines: The Family Home Ponente: Justice Corona

Family Code of The Philippines: The Family Home Ponente: Justice Corona

Uploaded by

Janmari G. FajardoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

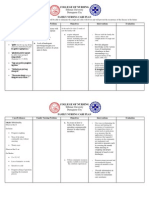

Civil Code: Persons, Family, and Relations Spouses Author Kelley Jr and Doris A.

Kelley v Planters Products Inc

Topic: Family Code of the Philippines: The Family Home G.R. No. 172263, July 9, 2008

Ponente: Justice Corona

Relevant Article/s: Article 152 of the Family Code

The family home, constituted jointly by the husband and the wife or by an unmarried head of a Facts:

family, is the dwelling house where they and their family reside, and the land on which it is situated.

(223a) Petitioner Auther G. Kelley, Jr. acquired agricultural chemical products on

consignment from respondent Planters Products, Inc. (PPI) in 1989.

Article 153 of the Family Code Due to Auther's failure to pay despite demand, PPI filed an action for sum of money

The family home is deemed constituted on a house and lot from the time it is occupied as a family against him in the RTC Makati City.

residence. From the time of its constitution and so long as any of its beneficiaries actually resides After trial on the merits, the RTC Makati City decided in favor of PPI and issued a writ

therein, the family home continues to be such and is exempt from execution, forced sale or of execution.

attachment except as hereinafter provided and to the extent of the value allowed by law. (223a) Pursuant to this, sheriff Jorge A. Ragutana sold on execution real property covered

by TCT No. 15079 located in Naga City.

Article 155 of the Family Code After being belatedly informed of the said sale, Auther and his wife Doris, filed a

The family home shall be exempt from execution, forced sale, or attachment except: motion to dissolve or set aside the notice of levy in the RTC Makati City on the

ground that the subject property was their family home which was exempt from

(1) For nonpayment of taxes execution.

(2) For debts incurred prior to the constitution of the family home Their motion was denied for failure to comply with the three-day notice requirement.

(3) For debts secured by mortgages on the premises before or after such constitution; and They again filed a complaint for declaration of nullity of levy and sale of the alleged

(4) For debts due to laborers, mechanics, architects, builders, material men, and others who have family home with damages against Ragutana and PPI in the RTC Naga City.

rendered service or furnished material for the construction of the building. (243a) The case was, however, dismissed for lack of jurisdiction and lack of cause of action

and the dismissal was upheld by the CA.

Article 162 of the Family Code Hence, this Petition.

The provisions in this Chapter shall also govern existing family residences insofar as said

provisions are applicable. (n)

Issue:

Whether or not the subject property is the family home of the Kelleys and if there is a

need to constitute the family home judicially or extrajudicially

by a mortgage on the premises before or after such constitution; and (4) For debts

due to laborers, mechanics, architects, builders, material men and others who have

Ruling/s:

rendered service or furnished material for the construction of the building.

NO Therefore, the Court, speaking thru Justice Corona, ruled that there is no need to constitute

Family Home is defined under Article 152 of the FC as the dwelling house where the the family home judicially or extrajudicially. However, if the subject property was the Kelley’s

husband and the wife, or by an unmarried head of a family, and their family reside, family home is to be determined for the instant case was remanded by the Court to the RTC.

and the land on which it is situated. Pursuant to Article 153, the family home is

deemed constituted on a house and lot from the time it is occupied as a family

residence. From the time of its constitution and so long as any of its beneficiaries

actually resides therein, the family home continues to be such and is exempt from

execution, forced sale, or attachment except for circumstances in Article 155 of the

Family Code.

In this case, the Court held that there is no need to constitute the family home

judicially or extrajudicially. It laid down the rules relative to the execution of the family

home, as follows:

First, family residences constructed before the effectivity of the Family Code

or before August 3, 1988, must be constituted as a family home either

judicially or extrajudicially in accordance with the provisions of the Civil Code

in order to be exempt from execution

Second, family residences constructed after the effectivity of the Family

Code on August 3, 1988, are automatically deemed to be family homes, and

thus exempt from execution from the time it was constituted and lasts as

long as any of its beneficiaries actually resides therein, pursuant to Article

153 of the Family Code.

Third, family residences which were not judicially or extrajudicially

constituted as a family home prior to the effectivity of the Family Code, but

were existing thereafter, are considered as family homes by operation of law

and are prospectively entitled to the benefits accorded to a family home

under the Family Code.

The rule, however, is not absolute. The Family Code, in fact expressly provides for

the following exceptions as stated in Article 155. The family home shall be exempt

from execution, forced sale or attachment except: (1) For non-payment of taxes; (2)

For debts incurred prior to the constitution of the family home; (3) For debts secured

You might also like

- Duties of Sheriffs and Process Servers Under The Rules of CourtDocument83 pagesDuties of Sheriffs and Process Servers Under The Rules of CourtAnton ArponNo ratings yet

- Liver CancerDocument8 pagesLiver CancerAlyssa Marie PepitoNo ratings yet

- Honrales Mateo Reviewer Special Civil ActionsDocument84 pagesHonrales Mateo Reviewer Special Civil ActionsMelissa ManansalaNo ratings yet

- 12 Angry Men Legal AnalysisDocument3 pages12 Angry Men Legal AnalysisRafie Juliano DevitoNo ratings yet

- Case Tickler 2nd PFR SyllabDocument13 pagesCase Tickler 2nd PFR SyllabAlexis Dominic San ValentinNo ratings yet

- 42 Navaja V People 62215 PrinciplesDocument1 page42 Navaja V People 62215 PrinciplesAli NamlaNo ratings yet

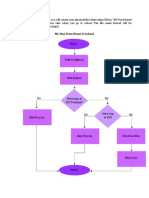

- My Way From School To Home FlowchartDocument1 pageMy Way From School To Home FlowchartRovie OlvidoNo ratings yet

- Communism Capitalishaham Pro ConDocument6 pagesCommunism Capitalishaham Pro ConitsaidaNo ratings yet

- Consti Finals Reviewer Part 2Document11 pagesConsti Finals Reviewer Part 2Noel Christian LucianoNo ratings yet

- Financial Accounting and Reporting: HTU CPA In-House Review (HCIR)Document4 pagesFinancial Accounting and Reporting: HTU CPA In-House Review (HCIR)AnonymousNo ratings yet

- Persons and Family Relations Syllabus-PangalanganDocument17 pagesPersons and Family Relations Syllabus-PangalanganBlack PhoenixNo ratings yet

- Maniago vs. Atty. de DiosDocument3 pagesManiago vs. Atty. de DiosSuzie100% (1)

- Kapampangan AuthorsDocument1 pageKapampangan AuthorsCram Llerad EugnubNo ratings yet

- ACYMAG2 NotesDocument60 pagesACYMAG2 NotesAngel JamianaNo ratings yet

- FYP ProposalDocument10 pagesFYP ProposalAbdur Rehman Tayyab100% (1)

- Llamado V CADocument9 pagesLlamado V CAMp CasNo ratings yet

- Non-Communication Graduates in The Broadcast Industry (2018)Document161 pagesNon-Communication Graduates in The Broadcast Industry (2018)Mark Neil AbieraNo ratings yet

- Resume MR DimsonDocument5 pagesResume MR DimsonblackspearmanNo ratings yet

- Persons and Family Relations SyllabusDocument3 pagesPersons and Family Relations SyllabusMikkaEllaAnclaNo ratings yet

- Ricardo A. Llamado V Honorable Court of Appeals and Leon Gaw G.R. No. 84850Document1 pageRicardo A. Llamado V Honorable Court of Appeals and Leon Gaw G.R. No. 84850cyndijocelleNo ratings yet

- FNCP - FinalDocument6 pagesFNCP - FinalmarkyabresNo ratings yet

- A Pre-Marketing ActivitiesDocument30 pagesA Pre-Marketing ActivitiesKaye DepabloNo ratings yet

- Clean Air Act - LGU Quezon, Bukidnon PresentationDocument24 pagesClean Air Act - LGU Quezon, Bukidnon PresentationalfiedeckNo ratings yet

- Shs Perforated Materials Vs DiazDocument4 pagesShs Perforated Materials Vs DiazKarl Marxcuz ReyesNo ratings yet

- Mantrade Workers Union V Bacungan DigestDocument2 pagesMantrade Workers Union V Bacungan DigestClyde TanNo ratings yet

- PFR Case DoctrinesDocument22 pagesPFR Case Doctrinessharppy38No ratings yet

- 11 - Persons Midterms AidDocument26 pages11 - Persons Midterms AidNoel Christian LucianoNo ratings yet

- Scope and Deliminations of Cyber-BullyingDocument2 pagesScope and Deliminations of Cyber-BullyingIvan Cabellon100% (1)

- By Kylie Dado: 285 Sabello V. Department of Education, Culture and Sports (Decs) GR No. 87687 26 December 1989Document1 pageBy Kylie Dado: 285 Sabello V. Department of Education, Culture and Sports (Decs) GR No. 87687 26 December 1989Kylie Kaur Manalon DadoNo ratings yet

- Case Digest in Persons and Family Relations, Property and SuccessionDocument61 pagesCase Digest in Persons and Family Relations, Property and SuccessionIcee GenioNo ratings yet

- Joint and Solidary Obligations: Article 1207-1222Document82 pagesJoint and Solidary Obligations: Article 1207-1222Carmela AlfonsoNo ratings yet

- BOTAONE Long Exam 4 PDFDocument19 pagesBOTAONE Long Exam 4 PDFKimNo ratings yet

- Wiegel v. Sempio-DiyDocument3 pagesWiegel v. Sempio-DiyVic FrondaNo ratings yet

- Urinary System 1Document24 pagesUrinary System 1Anna LaritaNo ratings yet

- Ethics Module Lesson5Document9 pagesEthics Module Lesson5Cristine Mae PreguntaNo ratings yet

- The Normal Antepartal PeriodDocument16 pagesThe Normal Antepartal PeriodAlessandra Franchesca CortezNo ratings yet

- Office of The City AccountantDocument2 pagesOffice of The City AccountantgiovanniNo ratings yet

- Judge Angeles V GaiteDocument8 pagesJudge Angeles V GaiteJan Igor GalinatoNo ratings yet

- Gayon vs. GayonDocument3 pagesGayon vs. Gayonyana100% (1)

- Ana Lou Navaja v. Hon. Manuel de Castro, G.R. No. 182926, June 22, 2015.Document3 pagesAna Lou Navaja v. Hon. Manuel de Castro, G.R. No. 182926, June 22, 2015.Greta Fe DumallayNo ratings yet

- QUEZON CITY PTCA FEDERATION Vs DepEd GR 188720Document2 pagesQUEZON CITY PTCA FEDERATION Vs DepEd GR 188720Ronnie Garcia Del RosarioNo ratings yet

- Neri Vs Senate Committee On Accountability of Public Officers and Investigations Et AlDocument7 pagesNeri Vs Senate Committee On Accountability of Public Officers and Investigations Et AlMarlouis U. PlanasNo ratings yet

- Sales G05 - Assignment 2Document125 pagesSales G05 - Assignment 2Jane GaliciaNo ratings yet

- Pajuyo v. CA, G.R. No. 146364, June 3, 2004Document3 pagesPajuyo v. CA, G.R. No. 146364, June 3, 2004catrina lobatonNo ratings yet

- Lacson-Magallanes V PanoDocument9 pagesLacson-Magallanes V PanoAndré BragaNo ratings yet

- Eugenio V Velez (1990) - Common Law Marriages or Live in RelationshipsDocument2 pagesEugenio V Velez (1990) - Common Law Marriages or Live in RelationshipsThird VillareyNo ratings yet

- 2010 TrussDocument69 pages2010 TrussAnissah ManialaNo ratings yet

- 35 FortunvQuinsayas VergaraDocument1 page35 FortunvQuinsayas VergaraGiancarlo FernandoNo ratings yet

- Gonzales v. Hechanova (9 SCRA 984) Case DigestDocument1 pageGonzales v. Hechanova (9 SCRA 984) Case DigestCarlota Nicolas VillaromanNo ratings yet

- Elcano vs. HillDocument1 pageElcano vs. HillRyoNo ratings yet

- 245 Reyes Vs ComelecDocument2 pages245 Reyes Vs ComelecVanityHughNo ratings yet

- 01 Tupaz IV & Tupaz V CA & BPI (Gueco)Document7 pages01 Tupaz IV & Tupaz V CA & BPI (Gueco)gabbyborNo ratings yet

- PD 957 DigestedDocument7 pagesPD 957 DigestedAbegail AtokNo ratings yet

- Obana V CADocument2 pagesObana V CAIvan Montealegre ConchasNo ratings yet

- International Service v. Greenpeace: Delegation of Legislative PowerDocument3 pagesInternational Service v. Greenpeace: Delegation of Legislative PowersiyaonNo ratings yet

- LAW Title XVIIDocument3 pagesLAW Title XVIINavsNo ratings yet

- Case Doctrines On Persons and Family RelationsDocument3 pagesCase Doctrines On Persons and Family RelationsClyde Maglinte ElarcosaNo ratings yet

- Rule On Mandatory Legal Aid ServiceDocument3 pagesRule On Mandatory Legal Aid ServicePatricia Alexis ChanNo ratings yet

- VIivares v. ReyesDocument3 pagesVIivares v. ReyesJustineNo ratings yet

- 100 PFRFC - Marriage Family Home Article 152 - 2 Modequillo v. BrevaDocument2 pages100 PFRFC - Marriage Family Home Article 152 - 2 Modequillo v. BrevaJanmari G. FajardoNo ratings yet

- 100 PFRFC - Marriage Family Home Article 152 - 2 Modequillo v. BrevaDocument2 pages100 PFRFC - Marriage Family Home Article 152 - 2 Modequillo v. BrevaJanmari G. FajardoNo ratings yet

- FAMILYDocument6 pagesFAMILYSarah AljowderNo ratings yet

- Special Proceeding April 10 Assignment Page of 1 41Document41 pagesSpecial Proceeding April 10 Assignment Page of 1 41Victoria EscobalNo ratings yet

- 62 Consti 1 - Art VI Legislative Investigation - 3 Arnault V NazarenoDocument2 pages62 Consti 1 - Art VI Legislative Investigation - 3 Arnault V NazarenoJanmari G. FajardoNo ratings yet

- 64 Consti 1 - Art VI Board of Canvassers - 2 Pimentel V Joint Commitee of CongressDocument2 pages64 Consti 1 - Art VI Board of Canvassers - 2 Pimentel V Joint Commitee of CongressJanmari G. FajardoNo ratings yet

- 61 Consti 1 - Art VI Legislative Investigation - 2 Bengzon V Senate Blue Ribbon CommiteeDocument2 pages61 Consti 1 - Art VI Legislative Investigation - 2 Bengzon V Senate Blue Ribbon CommiteeJanmari G. FajardoNo ratings yet

- 92 PFRFC - Marriage Property Regime Article 147 - 3 Dino V DinoDocument3 pages92 PFRFC - Marriage Property Regime Article 147 - 3 Dino V DinoJanmari G. FajardoNo ratings yet

- 93 PFRFC - Marriage Property Regime Article 147 - 4 Valdes V RTCDocument2 pages93 PFRFC - Marriage Property Regime Article 147 - 4 Valdes V RTCJanmari G. FajardoNo ratings yet

- 97 PFRFC - Marriage Property Regime Article 148 - 4 Borromeo V DescallarDocument2 pages97 PFRFC - Marriage Property Regime Article 148 - 4 Borromeo V DescallarJanmari G. FajardoNo ratings yet

- Family Code of The Philippines: Property Regime of Unions Without MarriageDocument2 pagesFamily Code of The Philippines: Property Regime of Unions Without MarriageJanmari G. FajardoNo ratings yet

- 63 Consti 1 - Art VI Question Hour - Senate V ErmitaDocument3 pages63 Consti 1 - Art VI Question Hour - Senate V ErmitaJanmari G. FajardoNo ratings yet

- 100 PFRFC - Marriage Family Home Article 152 - 2 Modequillo v. BrevaDocument2 pages100 PFRFC - Marriage Family Home Article 152 - 2 Modequillo v. BrevaJanmari G. FajardoNo ratings yet

- 53 PFRFC - Marriage Effect of Absence, Defect, or Irregularity - 4 Alcantara V AlcantaraDocument2 pages53 PFRFC - Marriage Effect of Absence, Defect, or Irregularity - 4 Alcantara V AlcantaraJanmari G. FajardoNo ratings yet

- Family Code of The Philippines: The Family Home Ponente: Justice MeloDocument2 pagesFamily Code of The Philippines: The Family Home Ponente: Justice MeloJanmari G. FajardoNo ratings yet

- 100 PFRFC - Marriage Family Home Article 152 - 2 Modequillo v. BrevaDocument2 pages100 PFRFC - Marriage Family Home Article 152 - 2 Modequillo v. BrevaJanmari G. FajardoNo ratings yet

- 101 PFRFC - Marriage Family Home Article 152 - 3 Olivia-De Mesa V Acero Jr.Document3 pages101 PFRFC - Marriage Family Home Article 152 - 3 Olivia-De Mesa V Acero Jr.Janmari G. FajardoNo ratings yet

- 102 PFRFC - Marriage Family Home Article 152 - 4 Salazar V FeliasDocument2 pages102 PFRFC - Marriage Family Home Article 152 - 4 Salazar V FeliasJanmari G. FajardoNo ratings yet

- 98 PFRFC - Marriage Property Regime Article 148 - 5 Carino V CarinoDocument2 pages98 PFRFC - Marriage Property Regime Article 148 - 5 Carino V CarinoJanmari G. FajardoNo ratings yet

- 54 PFRFC - Marriage Effect of Absence, Defect, or Irregularity - 5 Aranes V OccianoDocument2 pages54 PFRFC - Marriage Effect of Absence, Defect, or Irregularity - 5 Aranes V OccianoJanmari G. FajardoNo ratings yet

- 52 PFRFC - Marriage Effect of Absence, Defect, or Irregularity - 3 Republic V AlbiosDocument2 pages52 PFRFC - Marriage Effect of Absence, Defect, or Irregularity - 3 Republic V AlbiosJanmari G. FajardoNo ratings yet

- 47 PFRFC - Marriage Requisites - 2 Sevilla V CardenasDocument2 pages47 PFRFC - Marriage Requisites - 2 Sevilla V CardenasJanmari G. FajardoNo ratings yet

- 51 PFRFC - Marriage Effect of Absence, Defect, or Irregularity - 2 Go-Bangayan V Bangayan, Jr.Document2 pages51 PFRFC - Marriage Effect of Absence, Defect, or Irregularity - 2 Go-Bangayan V Bangayan, Jr.Janmari G. FajardoNo ratings yet

- 48 PFRFC - Marriage Requisites - 3 Silverio V RepublicDocument2 pages48 PFRFC - Marriage Requisites - 3 Silverio V RepublicJanmari G. FajardoNo ratings yet

- 46 PFRFC - Marriage Requisites - 1 Republic V CA and CastroDocument2 pages46 PFRFC - Marriage Requisites - 1 Republic V CA and CastroJanmari G. FajardoNo ratings yet

- 49 PFRFC - Marriage Requisites - 4 Nollora JR V PeopleDocument2 pages49 PFRFC - Marriage Requisites - 4 Nollora JR V PeopleJanmari G. FajardoNo ratings yet

- 21 Consti 1 - Declaration of Principles and State PoliciesDocument1 page21 Consti 1 - Declaration of Principles and State PoliciesJanmari G. FajardoNo ratings yet

- 18 Consti 1 - Declaration of Principles and State PoliciesDocument1 page18 Consti 1 - Declaration of Principles and State PoliciesJanmari G. FajardoNo ratings yet

- 30 Consti 1 - Legislation, Creation of Legislative Districts EtcDocument2 pages30 Consti 1 - Legislation, Creation of Legislative Districts EtcJanmari G. FajardoNo ratings yet

- Imperial Chemical Industries Limited v. National Distillers and Chemical Corporation, 342 F.2d 737, 2d Cir. (1965)Document13 pagesImperial Chemical Industries Limited v. National Distillers and Chemical Corporation, 342 F.2d 737, 2d Cir. (1965)Scribd Government DocsNo ratings yet

- 09 D.M. Consunji vs. Court of AppealsDocument2 pages09 D.M. Consunji vs. Court of AppealsKristabelleCapaNo ratings yet

- PIL Case Digest 1 To 7Document7 pagesPIL Case Digest 1 To 7Clea C.LagcoNo ratings yet

- USA V Fox, Et Al (Whitmer Plot) : Appeal of Magistrate Judge's Order Denying MTN To CompelDocument15 pagesUSA V Fox, Et Al (Whitmer Plot) : Appeal of Magistrate Judge's Order Denying MTN To CompelPatriots Soapbox InternalNo ratings yet

- Mock Trial OutlineDocument7 pagesMock Trial OutlineMohamedNo ratings yet

- In Re TAMPOY v. ALBERASTINEDocument2 pagesIn Re TAMPOY v. ALBERASTINENOLLIE CALISINGNo ratings yet

- People v. Givera, G.R. No. 132159, January 18, 2001 PDFDocument40 pagesPeople v. Givera, G.R. No. 132159, January 18, 2001 PDFJohzzyluck R. MaghuyopNo ratings yet

- People vs. Concepcion PDFDocument4 pagesPeople vs. Concepcion PDFRuby Patricia MaronillaNo ratings yet

- Criminal ProcedureDocument4 pagesCriminal ProcedureChristian Rize NavasNo ratings yet

- State of UP and Ors Vs Saroj Kumar Sinha 02022010 s100081COM531313Document11 pagesState of UP and Ors Vs Saroj Kumar Sinha 02022010 s100081COM531313Yug SinghNo ratings yet

- Exercise 2 - Practice Court II - Expropriation - ComplaintDocument5 pagesExercise 2 - Practice Court II - Expropriation - ComplaintPaula Bianca EguiaNo ratings yet

- Murray v. Berg, CUMcv-07-215 (Cumberland Super. CT., 2009)Document6 pagesMurray v. Berg, CUMcv-07-215 (Cumberland Super. CT., 2009)Chris BuckNo ratings yet

- Evidence Act NotesDocument57 pagesEvidence Act NotesharshalNo ratings yet

- Leave To InterveneDocument3 pagesLeave To InterveneAgitha GunasagranNo ratings yet

- Template Case Review Ting Ling Kiew & AnorDocument8 pagesTemplate Case Review Ting Ling Kiew & AnorRash DeansaNo ratings yet

- Comparative Analysis On Types of InjunctionDocument9 pagesComparative Analysis On Types of InjunctionNiti KaushikNo ratings yet

- Answer (Fotyong)Document7 pagesAnswer (Fotyong)Patricia CastroNo ratings yet

- 6 Gallo Vs CorderoDocument1 page6 Gallo Vs CorderoTynny Roo BelduaNo ratings yet

- Sebial vs. Sebial, 64 SCRA 385Document8 pagesSebial vs. Sebial, 64 SCRA 385DAISY REE JANE LUPASENo ratings yet

- Williams vs. ZerdaDocument12 pagesWilliams vs. ZerdaCA DTNo ratings yet

- Pdea V BrodettDocument2 pagesPdea V BrodettRey Malvin SG PallominaNo ratings yet

- Civil Case Flow Chart in Subordinate CourtsDocument2 pagesCivil Case Flow Chart in Subordinate Courtsmoses ochiengNo ratings yet

- NMC Tc03 Resp PDFDocument26 pagesNMC Tc03 Resp PDFAsmita GhadigaonkarNo ratings yet

- Cachero Vs ManilaDocument6 pagesCachero Vs ManilaWEDDANEVER CORNELNo ratings yet

- The Government of Philippine Islands-Vs-De PiedadDocument1 pageThe Government of Philippine Islands-Vs-De PiedadPrincess Loyola TapiaNo ratings yet

- Cease & Desist IIIF/U To Oct 12 and 24, 2023 (Threat of Unlawful Forcible EntDocument13 pagesCease & Desist IIIF/U To Oct 12 and 24, 2023 (Threat of Unlawful Forcible Entmaria-bellaNo ratings yet

- Assignment ViDocument2 pagesAssignment ViSougata BanikNo ratings yet