Professional Documents

Culture Documents

Bajaj Healthcare Limited

Uploaded by

Pãräs PhútélàOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bajaj Healthcare Limited

Uploaded by

Pãräs PhútélàCopyright:

Available Formats

Date: 09th November, 2021.

To,

BSE Limited,

Phiroze Jeejeebhoy Towers,

Dalal Street, Fort,

Mumbai - 400 001.

Dear Sir,

Ref : Script Id “BAJAJHCARE”, Script Code “539872”.

Sub : Earning Updates for the Quarter and Half year ended 30th September, 2021.

In terms of regulation 30 of SEBI (LODR) Regulations, 2015, please find attached herewith Earning

Updates for the Quarter and half year ended 30th September, 2021.

Kindly take the same on record.

Thanking you,

For and on behalf of Board of Directors of

Bajaj Healthcare Limited

Aakash Keshari

Company Secretary

Encl: a/a

BAJAJ HEALTHCARE LIMITED

Registered Office: 602-606, Bhoomi Velocity Infotech Park, Plot No: B-39, B-39A, B-39A/1, Road No. 23, Wagle Ind. Estate, Thane (West), Thane - 400604

Tel. : + 91 22 66177400/ 401; Fax : +91 22 66177458; E-mail : bajajhealth@bajajhealth.com

CIN No. L99999MH1993PLC072892

BAJAJ HEALTHCARE LIMITED

CIN: L99999MH1993PLC072892

Registered Office:602-606, Bhoomi Velocity Infotech Park, Plot No. B-39, B-39A, B-39 A/1,

Rd No.23, Wagle Ind. Estate Thane West, Mumbai – 400604.

Q2 & H1 FY22 – Earning Updates

Revenue from Operations reported at Rs. 1509.13 Mn in Q2 and Rs. 3366.01 MN for H1 FY22

EBITDA stands at Rs. 290.84 MN in Q2 and Rs. 632.61 MN for H1 FY22

PAT at Rs. 172.51 MN in Q2 and Rs. 364.69 MN for H1 FY22

Thane, 9rd November 2021: Bajaj Healthcare Limited (BHL) one of the India’s leading manufacturers of

APIs, Intermediates and Formulations, in its board meeting held on 2nd November 2021 has inter-alia

considered and approved the Unaudited Financial Results of the Company for the Second Quarter & first

half year ended on 30th September 2021.

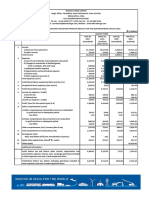

Financial Statement Highlights for Q2 FY22 v/s Q2 FY21

Particulars (INR MN) Q2 FY22 Q2 FY 21

Revenue from Operations 1,509.13 2,066.35

Other Income 1.18 20.95

Total Revenue 1,510.31 2,087.30

Total Expenses 1,288.54 1,804.73

EBITDA 290.84 344.04

EBITDA Margin (%) 19.26% 16.48%

Depreciation 44.07 39.75

Finance Cost 25.00 21.72

PBT with Exceptional Item 221.77 282.56

Exceptional Items - -

PBT 221.77 282.56

Current Tax 45.40 82.66

Earlier Years 0.21 (1.26)

Deferred Tax 3.64 -

Tax 49.25 81.40

PAT 172.51 201.17

Other comprehensive profit / loss

Net PAT 172.51 201.17

PAT Margin % 11.42% 9.64%

Diluted EPS 6.25 7.29

Q2 & H1 FY22 Earning Updates

Financial Performance Comparison – Q2 FY22 v/s Q2 FY21

Revenue from Operations De-grown by 27% from Rs. 2066.35 Mn in Q2 FY21 to Rs. 1509.13 Mn

in Q2 FY22 mainly due to decline in sales volume of Ascorbic Acid & CH Base.

Though The EBITDA has De-grown by 15.46% from Rs. 344.04 Mn in Q2 FY 21 to Rs. 290.84 Mn

in Q2 FY22, The EBITDA margins have improved to 19.26% in Q2 FY22 from 16.48% in Q2 FY21

due to implementation of better stock management policies by management and increase in

selling prices of products.

Net profit fell by 14.24% from Rs. 201.17 Mn in Q2 FY21 to Rs. 172.51 in Q2 FY22, however Net

Profit Margins increased to 11.42% in Q2 FY22 from 9.64% in Q2 FY21 as a result of

implementation of new tax regime to the company.

Financial Statement Highlights for H1 FY22 v/s H1 FY21

Particulars (INR MN) H1 FY 22 H1 FY 21

Revenue from Operations 3,366.01 3,464.68

Other Income 7.98 29.97

Total Revenue 3,373.99 3,494.65

Total Expenses 2,879.69 3,007.74

EBITDA 632.61 606.52

EBITDA Margin (%) 18.75% 17.36%

Depreciation 85.38 77.40

Finance Cost 52.93 42.20

PBT with Exceptional Item 494.30 486.91

Exceptional Items - -

PBT 494.30 486.91

Current Tax 126.80 140.00

Earlier Years 0.20 -

Deferred Tax 2.61 (7.17)

Tax 129.61 132.83

PAT 364.69 354.08

Other comprehensive profit / loss - -

Net PAT 364.69 354.08

PAT Margin % 10.81% 10.13%

Diluted EPS 13.21 12.83

Q2 & H1 FY22 Earning Updates

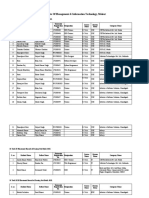

Financial Performance Comparison – H1 FY22 v/s H1 FY21

Income from Operation declined by 2.85% from Rs. 3,464.68 Mn in H1 FY21 to Rs. 3,366.01 Mn

in H1 FY22.

The EBITDA has increased by 4.03% from Rs. 606.51 Mn in H1 FY21 to Rs. 632.61 Mn in H1 FY22

and there is a gain in the EBITDA margins from 17.36% in H1 FY21 to 18.75% in H1 FY22.

Net profit stood at Rs. 364.69 Mn in H1 FY22, compared to Rs. 354.08 Mn in H1 FY21 recorded a

growth of 3%

Total Fixed Asset grew by 26.78% from Rs. 1,786 Mn in H1 FY21 to Rs. 2,264.27 Mn in H1 FY22.

Current Asset stood at Rs. 3720.39 Mn in H1 FY22, compared to Rs. 2192.32 Mn in H1 FY21

Long term borrowing stood at Rs. 762.88 Mn in H1 FY22, compared to Rs. 378.4 Mn in H1 FY21

and Short term borrowing at Rs. 1355.65 Mn in H1 FY22, compared to Rs. 731.90 Mn in H1 FY21

Finance Cost increased by 25.42% from Rs. 42.2 MN in H1 FY21 to Rs. 52.93 MN in H1 FY22 on

account of increase in the long term & short term borrowing.

Business Updates:-

BHL has commenced commercial production of Nimesulide API at Plot No. N-92, MIDC, Tarapur,

“Nimesulide API” which is used for relief from pain and prevention of fever.

BHL has commenced manufacturing of API and Formulation of “DGJAJ” (2-Deoxy-D-Glucose), an

antiviral drug used for treating COVID patients, in collaboration with Defence Research and

Development Organisation (DRDO).

Commercial Updates:-

Pursuant to approval of shareholders by way of postal ballot on September 17, 2021, one equity

share of Rs. 10/- each fully paid up was sub-divided into two Equity shares of Rs. 05/- each fully

paid up

BHL has recommended final dividend of Re. 0.5/- and Special Dividend of Re. 0.5/- per equity

share with face value of Rs. 10 each for FY 2020-21. The total dividend for the financial year 2020-

21 amounts to Rs. 2.75/- (Rupees Two and Seventy five paise only) (27.50%) per equity share of

the face value of Rs. 10/- (Rupees Ten only) each including special dividend.

Management Comments

Commenting on the performance of H1 FY22, Mr. Sajankumar Bajaj (Chairman) said:

“Bajaj Healthcare Limited delivered a moderate second quarter, driven by the momentum of consistent

revenue generated by our key brands. Our APIs business segment & formulation segment has

marginally de-grown on a half yearly basis as compared to H1 FY 21. With a fall in the level of Covid-19

cases across the nation and globe, The API segment has degrown due to fall in sales volumes of Ascorbic

Acid & CH Base, which were widely used during the pandemic. The Formulation business also

experienced a de-acceleration due to similar reasons, however we expect a considerable rise in our

Q2 & H1 FY22 Earning Updates

formulation segment revenue as we anticipate to increase our presence in the government tender

business Q3 of FY22.

One of the key challenges faced by the pharma sector in the 2nd half of FY 22 is that of increasing prices

of raw materials due to productions abruptions in China. In order to mitigate this increased cost, the

management increased the level of inventory holding of raw materials in Q2 FY22 to ensure

uninterrupted production for balance period of FY 22. An increase in prices of raw materials was

complemented by an increase in the selling prices of final products. BHL’s policy of maintaining

increased inventory enabled us to earn higher EBITDA margins vis-à-vis the previous quarter, in-spite of

fall in sales revenues in Q2 FY22. In continuance of this, Our PAT margins also grew stronger supported

by the new tax regime from current quarter.

The Net Cash flow from operation has fallen during the half year ended 30th September, 2021 mainly

due to considerable increase in inventory and receivables during the period. Increase in inventory can

be mainly attributed to raw material pricing issues, which are procured from China. The company has

made an effort to mitigate this issue by increasing inventory levels to ensure smooth production. The

additional capital required to hold inventories has been raised by availing additional working capital

limits.

We continue to make progress by adding 3 to 4 additional APIs through reverse engineering; to our

current repertoire, which will be further supported by our strong in-house R&D team. We firmly believe

that BHL is well on its way to achieve its projections in terms of revenue and margins.

Guidance for FY22

The management has provided guidance to post growth of 18 to 22% for FY22, mainly driven by

growth in the formulation business, addition of new capacities through acquired assets, and with

the introduction of reverse engineering APIs launched in the last financial year.

The management believes that the margins will moderate minutely in some segments specifically

in some key products.

About Bajaj Healthcare Limited

Bajaj Healthcare Limited a leading Manufacturer of APIs, Intermediates and Formulations established in

the year 1993. It specializes in manufacturing of intermediates, API, formulations & Nutraceuticals. The

Company has state-of-art manufacturing facilities, of which 6 units are dedicated to APIs, 2 units to

intermediates and 1 unit formulations. These facilities are designed to meet the requirements of both

advanced as well as emerging market opportunities. BHL has a strong presence globally in countries like

Europe, USA, Australia, Middle East and South America.

For further information on the Company, please visit www.bajajhealth.com

Rupesh Nikam (CFO) Krunal Shah/ Vinayak Shirodkar

Bajaj Healthcare Limited Captive IR Strategic Advisors Pvt. Ltd.

Email: investors@bajajhealth.com krunal@cap-ir.com/Vinayak@cap-ir.com

Contact: +91 22 66177400 Contact: +91 9892288895

Q2 & H1 FY22 Earning Updates

You might also like

- LL Module Barrowmaze 1 (Lv1-8, GG, 2012)Document87 pagesLL Module Barrowmaze 1 (Lv1-8, GG, 2012)Tony Helano100% (3)

- Adverbs of IntensityDocument23 pagesAdverbs of IntensityRose D GuzmanNo ratings yet

- Dork Diaries 10: Tales From A Not-So-Perfect Pet SitterDocument20 pagesDork Diaries 10: Tales From A Not-So-Perfect Pet SitterWENLY NG MoeNo ratings yet

- A Practical Guide To Integrated Type II Diabetes CareDocument51 pagesA Practical Guide To Integrated Type II Diabetes CareusshashankNo ratings yet

- Bloomberg - Investment Banking CheatsheetDocument2 pagesBloomberg - Investment Banking CheatsheetjujonetNo ratings yet

- Corona vs. United Harbor Pilots Association of The Phils.Document10 pagesCorona vs. United Harbor Pilots Association of The Phils.Angelie MercadoNo ratings yet

- Arch DamDocument15 pagesArch DamHenok MandefroNo ratings yet

- Openshift LabDocument23 pagesOpenshift LabSriharshi YarraNo ratings yet

- Development of A Belt Conveyor For Small Scale Industry: Journal of Advancement in Engineering and TechnologyDocument5 pagesDevelopment of A Belt Conveyor For Small Scale Industry: Journal of Advancement in Engineering and TechnologyMuhammad Salman KhanNo ratings yet

- VMTC RAII Presentation PDFDocument154 pagesVMTC RAII Presentation PDFDarwin Nacion ManquiquisNo ratings yet

- CIR v. MarubeniDocument9 pagesCIR v. MarubeniMariano RentomesNo ratings yet

- Example 1: Analytical Exposition TextDocument1 pageExample 1: Analytical Exposition Textlenni marianaNo ratings yet

- 1412833607coal India LimitedDocument2 pages1412833607coal India LimitedSandy SandyNo ratings yet

- Cipla Limited: Quarterly Result UpdateDocument3 pagesCipla Limited: Quarterly Result UpdateMichelle CastelinoNo ratings yet

- Bajaj Finserve Limited: Quarterly Result UpdateDocument2 pagesBajaj Finserve Limited: Quarterly Result UpdateSagar JainNo ratings yet

- Profit and LossDocument1 pageProfit and LossYagika JagnaniNo ratings yet

- Cipla Limited: Quarterly Result UpdateDocument4 pagesCipla Limited: Quarterly Result UpdatePrajwal JainNo ratings yet

- Listed Subsidiary of Network18Document10 pagesListed Subsidiary of Network18xxxzzzzzNo ratings yet

- 1070954147bharti AirtelDocument3 pages1070954147bharti AirtelSanjeedeep Mishra , 315No ratings yet

- UntitledDocument357 pagesUntitledAlexNo ratings yet

- Book 1Document5 pagesBook 1312Gargi KapoorNo ratings yet

- Bhel P&LDocument2 pagesBhel P&LRutvik HNo ratings yet

- 1059661093coal India LimitedDocument2 pages1059661093coal India LimitedSandy SandyNo ratings yet

- Vodafone Idea Limited: PrintDocument1 pageVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Symphony - DCF Valuation - Group6Document17 pagesSymphony - DCF Valuation - Group6Faheem ShanavasNo ratings yet

- Grasim Q3FY09 PresentationDocument47 pagesGrasim Q3FY09 PresentationJasmine NayakNo ratings yet

- Apurva Ramteke (Work Allotment)Document20 pagesApurva Ramteke (Work Allotment)Apurva RamtekeNo ratings yet

- Sun Pharmaceutical Industries Limited: Quarterly Result UpdateDocument2 pagesSun Pharmaceutical Industries Limited: Quarterly Result UpdatePrajwal JainNo ratings yet

- BNK Sector NosDocument22 pagesBNK Sector NosKrishna Reddy SvvsNo ratings yet

- AsahiDocument2 pagesAsahiABHAY KUMAR SINGHNo ratings yet

- Profit / Loss Staement of Asian PaintsDocument3 pagesProfit / Loss Staement of Asian PaintsShivangi Gupta Student, Jaipuria LucknowNo ratings yet

- Bajaj Aut1Document2 pagesBajaj Aut1Rinku RajpootNo ratings yet

- Statement of Profit and Loss For The Year Ended 31 March 2020Document1 pageStatement of Profit and Loss For The Year Ended 31 March 2020Prathi KarthikNo ratings yet

- Book 2Document18 pagesBook 2Aishwarya DaymaNo ratings yet

- Investor - Presentation - Q1 FY23Document13 pagesInvestor - Presentation - Q1 FY23ElaineNo ratings yet

- NDTVAnnual Report 2022Document221 pagesNDTVAnnual Report 2022Vivek AdateNo ratings yet

- Bombay Dyeing P and L A - CDocument2 pagesBombay Dyeing P and L A - CPRATHAMNo ratings yet

- Indigo Income STMT 1Document1 pageIndigo Income STMT 1deepzNo ratings yet

- Asian Paints PLDocument2 pagesAsian Paints PLPriyalNo ratings yet

- Glenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateDocument9 pagesGlenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateAkatsuki DNo ratings yet

- Investor Presentation Q4FY22 and FY22Document17 pagesInvestor Presentation Q4FY22 and FY22Denish GalaNo ratings yet

- Group 3 Income StatementDocument1 pageGroup 3 Income StatementJastine CahimtongNo ratings yet

- T V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreDocument4 pagesT V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreRahul DesaiNo ratings yet

- DownloadDocument38 pagesDownloadadityapareek23984No ratings yet

- Q2-FY19 Result Update: CMP: 125 Target: 263Document7 pagesQ2-FY19 Result Update: CMP: 125 Target: 263Ashutosh GuptaNo ratings yet

- RavalgaonresultsadDocument1 pageRavalgaonresultsadvahora123No ratings yet

- AFM Project Sec J Group 10Document32 pagesAFM Project Sec J Group 10J40Santhosh KrishnaNo ratings yet

- Idea Vs RelianceDocument1 pageIdea Vs RelianceMayank BhardwajNo ratings yet

- Investor Presentation Mar21Document34 pagesInvestor Presentation Mar21Sanjay RainaNo ratings yet

- Q1FY22Document8 pagesQ1FY22Anjalidevi TNo ratings yet

- Moneycontrol. P&L BataDocument2 pagesMoneycontrol. P&L BataSanket BhondageNo ratings yet

- Nesco 19.05.20Document19 pagesNesco 19.05.20Miku DhanukaNo ratings yet

- Ecobank Ghana Limited: Un-Audited Financial Statements For The Three-Month Period Ended 31 March 2022Document8 pagesEcobank Ghana Limited: Un-Audited Financial Statements For The Three-Month Period Ended 31 March 2022Fuaad DodooNo ratings yet

- Solution To Reexam NaNafW7R9yDocument3 pagesSolution To Reexam NaNafW7R9yAbhijeet GautamNo ratings yet

- Account Cca (AutoRecovered) 1Document13 pagesAccount Cca (AutoRecovered) 1Saloni BaisNo ratings yet

- Financial Model SolvedDocument29 pagesFinancial Model SolvedSaad KhanNo ratings yet

- Eicher Motors Profit and Loss AccountDocument2 pagesEicher Motors Profit and Loss AccountVaishnav Sunil100% (1)

- Valuation: Beta and WACCDocument4 pagesValuation: Beta and WACCnityaNo ratings yet

- DownloadDocument22 pagesDownloadAshwani KesharwaniNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- MahindraDocument5 pagesMahindraworkf17hoursformeNo ratings yet

- Nippon Life India Asset Management Profit & Loss Account, Nippon Life India Asset Management Financial Statement & AccountsDocument1 pageNippon Life India Asset Management Profit & Loss Account, Nippon Life India Asset Management Financial Statement & AccountsToxic MaviNo ratings yet

- Persistent Systems - 31st Annual Report 2020-21Document2 pagesPersistent Systems - 31st Annual Report 2020-21Ashwin GophanNo ratings yet

- Performance of Infosys For The Third Quarter Ended December 31Document33 pagesPerformance of Infosys For The Third Quarter Ended December 31ubmba06No ratings yet

- Ca 1Document4 pagesCa 1Aravind ShekharNo ratings yet

- 1 - BK - Can Fin HomesDocument9 pages1 - BK - Can Fin HomesGirish Raj SankunnyNo ratings yet

- Directors' Report: Larsen & Toubro Infotech LimitedDocument33 pagesDirectors' Report: Larsen & Toubro Infotech LimitedNirmal Rintu RaviNo ratings yet

- Persistent Annual Report 2022Document2 pagesPersistent Annual Report 2022Ashwin GophanNo ratings yet

- Final Press ReleaseDocument4 pagesFinal Press ReleaseMeghaNo ratings yet

- Assignment: Dr. Gazi Mohammad Hasan Jamil SL No. Name Student IDDocument26 pagesAssignment: Dr. Gazi Mohammad Hasan Jamil SL No. Name Student IDMd. Tauhidur Rahman 07-18-45No ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Authorized Signatory: R Gi T Ed of I: 15 5, H D in T - 9 129 50 E-Mai Esco Tsgroup C S Co I S Om Ra I N I LDocument3 pagesAuthorized Signatory: R Gi T Ed of I: 15 5, H D in T - 9 129 50 E-Mai Esco Tsgroup C S Co I S Om Ra I N I LPãräs PhútélàNo ratings yet

- Dolat: Algoieg-IlimitedDocument14 pagesDolat: Algoieg-IlimitedPãräs PhútélàNo ratings yet

- 31-October-2021 1.30 PM To 3.00 PM Centre No: 1: Attendance Sheet (For Examination Centre)Document4 pages31-October-2021 1.30 PM To 3.00 PM Centre No: 1: Attendance Sheet (For Examination Centre)Pãräs PhútélàNo ratings yet

- Kind Attn: Head - Listing Department Kind Attn: Sr. General Manager - DCS Listing DepartmentDocument46 pagesKind Attn: Head - Listing Department Kind Attn: Sr. General Manager - DCS Listing DepartmentPãräs PhútélàNo ratings yet

- Gujarat Industries Power Company LTD.: Date: 03" December, 2021Document16 pagesGujarat Industries Power Company LTD.: Date: 03" December, 2021Pãräs PhútélàNo ratings yet

- India Pesticides Limited: An ISO 9001:2015, 1 2015,45001 2018 and 10002:2018 CIN No. U24112 UP1984PLC006894Document20 pagesIndia Pesticides Limited: An ISO 9001:2015, 1 2015,45001 2018 and 10002:2018 CIN No. U24112 UP1984PLC006894Pãräs PhútélàNo ratings yet

- Thomas EditingDocument5 pagesThomas EditingPãräs PhútélàNo ratings yet

- Healthy Growth in Long Term Operating Profits: Very Positive Bullish Attractive Market Beating ReturnsDocument21 pagesHealthy Growth in Long Term Operating Profits: Very Positive Bullish Attractive Market Beating ReturnsPãräs PhútélàNo ratings yet

- Malout Institute of Management & Information Technology, MaloutDocument5 pagesMalout Institute of Management & Information Technology, MaloutPãräs PhútélàNo ratings yet

- L7 Nonideal Flow Example ProblemsDocument33 pagesL7 Nonideal Flow Example ProblemsRicky JayNo ratings yet

- Clinical InterviewDocument29 pagesClinical InterviewVasundhara RanaNo ratings yet

- South Sector: Ig/Ss HQ ChennaiDocument11 pagesSouth Sector: Ig/Ss HQ Chennaisohalsingh1No ratings yet

- Fault Codes VauxhallDocument7 pagesFault Codes VauxhallMatt DuffillNo ratings yet

- Notatek PL Present Simple A Present ContinuousDocument2 pagesNotatek PL Present Simple A Present ContinuousSlawomir WalczakNo ratings yet

- Adani Ports & SEZ LimitedDocument9 pagesAdani Ports & SEZ LimitedHaider ChakiNo ratings yet

- Glass Performance Days 2007Document5 pagesGlass Performance Days 2007Daren Talana0% (1)

- Reactivation+KYC 230328 184201Document4 pagesReactivation+KYC 230328 184201Vivek NesaNo ratings yet

- I&m RF Interference HuntingDocument75 pagesI&m RF Interference HuntingPer KoNo ratings yet

- Gold Exp B1P U4 Skills Test BDocument6 pagesGold Exp B1P U4 Skills Test BVanina BuonagennaNo ratings yet

- Courier 17 (1438) PDFDocument19 pagesCourier 17 (1438) PDFHamid DjnNo ratings yet

- Ionic Liquids As Novel Surfactants For The Potential Use in Enhanced Oil RecoveryDocument10 pagesIonic Liquids As Novel Surfactants For The Potential Use in Enhanced Oil RecoveryKhalid Al-KhidirNo ratings yet

- Chapter 1Document43 pagesChapter 1arun neupaneNo ratings yet

- Group-6, Team Creative, Investment Mechanism and Modes of IBBLDocument46 pagesGroup-6, Team Creative, Investment Mechanism and Modes of IBBLhtc626No ratings yet

- MT-HN-RCTI-13 - Sealing CracksDocument20 pagesMT-HN-RCTI-13 - Sealing CracksManuela Angulo TrianaNo ratings yet

- Cat and Dog Classification Using CNN: Project ObjectiveDocument7 pagesCat and Dog Classification Using CNN: Project Objectivecoursera detailsNo ratings yet

- Lister LPW Marine Spec SheetDocument2 pagesLister LPW Marine Spec SheetMartyn PitmanNo ratings yet

- Fiat 500L Owner's Manual (Page 370 of 428) - ManualsLib1Document2 pagesFiat 500L Owner's Manual (Page 370 of 428) - ManualsLib1FabrizioNo ratings yet