Professional Documents

Culture Documents

DLD InsCom VUL Reviewer

Uploaded by

Maria Joselda VillanuevaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DLD InsCom VUL Reviewer

Uploaded by

Maria Joselda VillanuevaCopyright:

Available Formats

Insurance Commission Reviewer

Insurance Commission VUL Reviewer

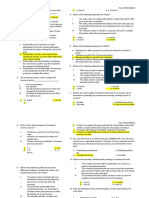

Direction: Choose the best answer. Write the CAPITAL LETTER of your answer on the answer sheet provided

1. Which of the following statements about option to top-up under variable life insurance products is FALSE ?

a. To top-up a policy, the policyowner pays further single premium at the time of top-up.

b. Policyowner may buy additional units in the variable life fund and these units will be allocated to

new variable life insurance policies.

c. Further premiums at time of top-up will be used in full, after deducting charges for top-ups, to

purchase additional units of the variable life funds.

d. Policyowners are normally allowed to top-up their policies at any time, subject to a minimum

amount

2. What are the disadvantages when investing in common shares?

I. Dividends are paid not more than fixed rates.

II. Investors are exposed to market and specific risks.

III. Shares can become worthless if company becomes insolvent.

a. I, and II

b. I, and III

c. II, and III

d. I, III, and III

3. Which of the following statements about the flexibility features of variable life policies is FALSE?

a. Policyholders may request for a partial withdrawal of the policy and the withdrawal amount will be

met by cashing the units at bid price.

b. Policyholders can take loans against their variable life policies up to the entire withdrawal value of

their policies.

c. Policyholders have the flexibility of switching from one fund to another, provided it satisfies the

company’s switching criteria.

d. Policyholders have the flexibility of increasing or decreasing their premiums for regular premiums

variable life policies.

4. What is the most suitable investment instrument for someone who is interested in protecting his

principal, while receiving a steady stream of income?

a. Equities

b. Warrants

c. Variable Life Policies

d. Fixed Income Securities

VUL IC Reviewer v.1.3

30 April 2021 Page 1

Insurance Commission Reviewer

5. A unit trust is ____.

a. Established by a trust deed, which enables a trustee to hold the pool of money and assets in trust

on behalf of the investor.

b. A close-end fund, and does not have to dispose of its assets if a large number of investors sell their

shares.

c. One whereby an investor buys units in the trust itself and not shares in the company.

d. An organization registered under the Securities and Exchange Commission (SEC) which usually

invests in a wide range of equities and other investments.

6. The following are characteristics of a variable life insurance policy Commented [JMT1]: This has been rephrased in the latest

version of the reviewer, based on the ILP source file. The answer in

I. Its withdrawal value and protection benefits are determined by the investment performance of the latest version is includes III as it states “Its commissions and

the underlying assets. company expenses are met by a variety of explicit charges, notice

of which is given by life companies normally 6 months prior to any

II. Its protection costs are generally met by implicit charges. change in such charges.” as Sir Cary validated. II was reworded “Its

III. Its commissions and company expenses are met by a variety of explicit charges, notice of which is protection costs are generally met by the explicit charges.”

given by life companies normally 6 months prior to any change in such charges.

IV. Its withdrawal value is normally the value of units allocated to the policyholder calculated at the

bid price

a. I, II and IV

b. II, III and IV

c. I, II and III

d. I, III and IV

7. Which of the following statements are TRUE?

I. The policy value of variable life policies is determined by the offer price at the time of valuation.

II. The policy value of endowment policies is the cash values plus any accumulated dividends less any

outstanding loans due at time of surrender.

III. The life company needs to maintain a separate account for variable life policies distinct from the

general account.

a. II and III

b. I, II, and III

c. I and III

d. I

8. Variable life insurance policy owners may withdraw in terms of ____.

a. Number of units or fixed monetary amount through cancellation of units.

b. Number of units or fixed monetary amount though reduction of the life cover sum assured.

c. Fixed monetary amount only through reduction of the life cover sum assured.

d. Number of units through cancellation of units.

VUL IC Reviewer v.1.3

30 April 2021 Page 2

Insurance Commission Reviewer

9. An investor in variable life funds gets to enjoy these benefits:

I. Policy owners have access to pooled or diversified portfolios of investment.

II. Policy owners can easily change the level of the premium payments as the product design of

variable life insurance policies have clear structures which cater separately for investment and

insurance protection.

III. Policy owners can gain access to variable life funds managed by professional investment managers

with proven track records.

IV. Policy owners can buy a variable life insurance policy only with a high initial investment.

a. I, II, and IV

b. I, III, and IV

c. I, II, and III

d. II, III, and IV

10. Which of the following statements about rebating is/are TRUE ?

I. Rebating is prohibited under the Insurance Code.

II. Rebating deals with offering the prospect a special inducement to purchase a policy.

III. Rebating will enhance the sales performance and uphold the prestige of an agent.

a. I and II

b. I and III

c. II and III

d. III

11. Which of the following statements is FALSE?

a. Variable life insurance policies offer investors plans with values that are indirectly linked to the

investment performance of the life company.

b. A life insurance company will carry out a valuation of its funds yearly and any surplus may be

allocated to participating policyholders as cash dividends.

c. Both Whole Life and Endowment policies can be used as an investment media with benefits that

become payable at a future date.

d. The investment element of variable life policies varies according to underlying assets of portfolio.

12. Which of the following statements about single premium variable life policy are TRUE? Commented [JMT2]: I & II is correct – Single Pay Plan has

no fixed term coverage period (unlike a Structured Note)

I. There is no fixed term in a single premium variable life policy, and therefore, they are technically

because the coverage usually is up to maturity (88 for Sun

whole life insurance. Life). Top-ups or Single premium injections are allowed a

II. Top-up single premium injections are allowed in these plans. part of the Flexibility of the plan. Varying the Life coverage

III. Policyholders have the flexibility of varying the life coverage. is not flexible (Increasing/decreasing) once VUL policy is in

forced unless requested to the company (Like what we

have in Sun Life – decrease the FA).

a. I, II, and III

b. II and III

c. I and II

d. I and III

VUL IC Reviewer v.1.3

30 April 2021 Page 3

Insurance Commission Reviewer

13. Which of the following statements about variable life policies is/are TRUE?

I. The cash withdrawal value is not guaranteed.

II. The volatility of the returns depends on the investment strategy of the fund.

III. The variable life policyholder has direct control over the investment decisions of the variable life

fund.

a. I, II, and III

b. I and II

c. I and III

d. II and III

14. Which of the following statements about variable life policies are TRUE? Commented [JMT3]: Answer validated.

I. Variable life policies generally have larger exposure to equity investment than with participating

and other traditional policies.

II. The protection costs are generally met by implicit charges, which vary with age and level of cover.

III. Commissions and company expenses are met by a variety of explicit charges, some of which are

variable.

a. I, II, and III

b. I and II

c. II and III

d. I and III

15. The facility to do switching under a variable life insurance policy is a very useful ____.

a. For the purpose of profit planning by the life policies

b. For the purpose of assets planning by the trustee

c. For the purpose of sales planning by the fund managers

d. For the purpose of financial planning by the policy owners

16. Which of the following is/are TRUE about the flexibility benefit of investing in variable life funds?

I. Policy owners can easily change the level of sum assured and switch their investment between

funds.

II. Policy owners can easily take premium holidays and add single premium to top-ups.

III. Variable life insurance products have a single product design with a clear structure which cater

separately for investment and insurance protection.

IV. Policy owners can easily change the level of their premium payment.

a. All of the above Commented [JMT4]: Insurance and Investment components in

Variable Life products are inter-related, and are not treated

b. I, II, and III separately

c. I, II, and IV

d. I, III, and IV

17. Which of the following statements about risks of investing in variable life funds is TRUE?

a. Investment in variable life funds which are fully invested in units of equity is not suitable for

policyowners who can tolerate the risks of short term fluctuations in their account value.

VUL IC Reviewer v.1.3

30 April 2021 Page 4

Insurance Commission Reviewer

b. Policyowners who are risk averse should buy variable life insurance policies with high equity

investment.

c. Policyowners who are risk averse should not purchase life insurance policies with high protection

and guaranteed cash maturity values

d. Policyowners who invest in variable life funds with high equity investment face greater risk but

offer the potential for higher returns over the long term than traditional life insurance policies.

18. What would be the withdrawal value after a year?

Offer price = Ps 16.00

Bid-offer spread = 4.5%

Number of Units bought = 25,000 units

Policy Fee = Ps. 1,800

Admin and Mortality Charge = Ps. 8,750

Top-Up Fee = Ps. 700

Admin for Top-Up = Ps. 2,000

Sum assured is 190% of single premium of the value of the units, whichever is higher.

Assumptions:

1. Charges and fees are deducted after the single premium has been invested into the account.

2. The growth rate of the unit price and the bid-offer spread is maintained at 8% and 4.5% respectively.

a. Ps. 432,000.00

b. Ps. 420,069.02

c. Ps. 401,107.58

d. Ps. 412,500.00

19. Which of the following statements about an investor diversifying his portfolio is FALSE?

a. A diversified portfolio provides greater security to an investor having to sacrifice the return for the

portfolio.

b. A diversified portfolio can completely eliminate the risk of investing the stocks in a portfolio.

c. A diversified portfolio can involve purchasing different types of stocks and investing in stocks of

different countries.

20. In traditional life insurance products, the allocations to policy owners in the form of dividends ____.

I. Are not directly linked to the life company’s investment performance

II. Have already been smoothened by the life company

III. Do not have the highs and lows of investment returns as in good investment years of the life

company

IV. Are not fixed at the inception of the policy, but are greatly dependent on the investment

performance of the life company.

a. I, II, and III

b. I, II, and IV

c. I, III, and IV

d. II, III, and IV

VUL IC Reviewer v.1.3

30 April 2021 Page 5

Insurance Commission Reviewer

21. Which of the following statements is TRUE about cash?

a. It has high yield potential.

b. Amount invested in cash depends on the size of the cash flow requirement.

c. Investment in cash increases when there is a bull run in the stock market.

d. Investment in cash decreases when interest rates rise.

22. Which of the following are main characteristics of variable life policies?

I. The policies can be used for investment, as a source of regular savings and protection.

II. The withdrawal values and protection benefits are determined by the investment performance of

the underlying assets.

III. The net cash values of the policies are the gross cash values shown in the policy that includes

dividends up to the date of surrender, less any indebtedness including interest.

a. II

b. I

c. I, II, and III

d. I and II

23. The duties of the trustee of unit investment trust do not include

a. Managing the portfolio of investment and administering the buying and selling of shares in the

unit trust itself

b. Ensuring that the fund manager adhere to the provision of trusts deeds

c. Acting generally to protect the unit-holders

d. Holding the pool of money and assets in trust in behalf of the investors

24. The policy fee payable by a variable life insurance policy owner is to cover ____.

a. The handling charges by professional investment managers

b. The prices for each unit bought under the variable life insurance policy

c. The mortality costs of the variable life insurance policy

d. The administrative expenses of setting up the variable life insurance policy

25. In risk-return profile of bond funds, cash funds, managed funds, balanced funds, and equity funds, a risk-

return graph will show that ____.

I. Higher return normally comes with lower risk.

II. Higher return normally comes with higher risk.

III. At the top end of the graph are the equity funds.

IV. The relatively risk-less cash funds sit at the bottom end of the graph.

a. I, II, and III

b. II, III, and IV

c. I, II, and IV

d. I, III, and IV

VUL IC Reviewer v.1.3

30 April 2021 Page 6

Insurance Commission Reviewer

26. Variable life funds can be invested in any financial instruments including bond funds, property funds,

specialized funds, and equity funds. Equity funds ____.

a. Invest in shares of stocks and the magnitude of the change in unit prices will only depend on the

quantity of the equities held

b. Invest in shares of stocks and during market recession, such assets are usually the last to

depreciate

c. Invest in share of stocks which are inherently of lower risk in nature and the prices of stocks are

stable

d. Invest in share of stocks and investor who buys such assets usually aims for capital appreciation

27. The investment returns under variable life insurance _____.

I. Are not guaranteed

II. Are assured

III. Are linked to the performance of the investment fund managed by the life company

IV. Fluctuate according to the rise and fall of the market prices

a. I, II, and III

b. I, II, and IV

c. I, III, and IV

d. II, III, and IV

28. Which of the following statements is FALSE? Commented [JMT5]: As per discussion with Jeri, C is false

because while twisting is a specific form of misrepresentation,

misrepresentation is NOT a specific form of twisting.

a. Rebating is to offer a prospect a special inducement to purchase a policy.

b. Twisting is a specific form of misrepresentation.

c. Misrepresentation is a specific form of twisting.

d. Switching is a facility allowing policyholder to switch to another variable life funds offered by the

company.

29. Which of the following statements about the differences between variable life policies and endowment

policies are FALSE?

I. The policy values of variable life and endowment policies directly reflect the performance of the

fund of the life company.

II. The premiums and benefits of the endowment policies are described at inception of the policy

whereas variable life policies are flexible as they are account-driven.

III. The benefits and risks variable life and endowment policies directly accrue to the policyholders.

a. I and II

b. I, II, and III

c. I and III

d. II and III

30. Which of the following statements about variable life policies are TRUE?

I. Offer price is used to determine the numbers of units to be cancelled to the account.

II. The margin between the bid and offer price is used to cover the management cost of the policy.

VUL IC Reviewer v.1.3

30 April 2021 Page 7

Insurance Commission Reviewer

III. The policy value is calculated based on the bid price of units allocated into the policy.

a. I, II, and III

b. I and II

c. I and III

d. II and III

31. Mr. Cruz is currently earning Ps 30,000 each month. He is 35 years old and has a reasonable amount of

savings. He has a moderate level for risk tolerance. What kind of policy would you recommend him to

buy?

a. Participating endowment

b. Variable life policies

c. Participating whole life

d. Annuities

32. Which of the following statements about twisting is FALSE? Commented [JMT6]: The B C D are all correct based on

the definition of Twisting. Twisting is not a special form of

a. Twisting is a special form of misrepresentation.

Misrepresentation. Misrep is one of acts that may lead to

b. It refers to an agent inducing a policyholder to discontinue a policy with another company without Twisting

disclosing the disadvantage of doing so.

c. It includes misleading or incomplete comparison of policies.

d. It refers to an agent offering a prospect a special inducement to purchase a policy.

33. Rank the following in terms of liquidity, from the least liquid to the most liquid: Commented [JMT7]: Answer validated

I. Short Term Securities

II. Property

III. Cash

IV. Equities

a. IV, I, III, I

b. III, I, IV, II

c. II, I, IV, III

d. II, IV, I, III

34. Which of the following best describes the benefits of variable life policies?

a. The policy benefits are payable only on death or disability.

b. The policy benefits will depend on the long-term performance of the life company.

c. The policy benefits are directly linked to the investment performance of the underlying assets.

d. The policy benefits are guaranteed.

35. Investing in bonds offers the following advantages EXCEPT : Commented [JMT8]: This has been rephrased in the latest

version of the reviewer, based on the ILP source file. The answer in

both files are both “Enabling the investors an opportunity for

a. It allows the investor a chance for capital preservation capital appreciation.” As discussed with Jeri, The answer is C

because it says “appreciation” which is not an advantage of

b. It is a place of temporary refuge when the investor foresees that the market outlook is uncertain investing in bonds.

c. It enables the investor an opportunity for capital appreciation

d. It offers protection to the principal and a guaranteed steady stream of income

VUL IC Reviewer v.1.3

30 April 2021 Page 8

Insurance Commission Reviewer

36. Which of the following statements about benefits in a variable life fund is FALSE?

a. The fund provides a highly diversified portfolio, thus, lowering the risk of investment.

b. The fund ensures definite high yield for the investor since it is managed by professionals who are

well versed in the management of risks of investment portfolios.

c. The fund relieves investor from the hassle of administering his/her investment.

d. The fund enable small investor to participate in a pool of diversified portfolio in which he/she with

low investment capital is likely to have acceded to.

37. The differences between traditional participating life insurance and variable life insurance include:

I. Variable life insurance policies are less likely to offer more choices in terms of the type of

investment funds.

II. The investment elements of variable life insurance policies is made known to the policy owner at

the outset and is invested in a separately identifiable fund which is made up units of investment.

III. Variable life insurance policies offer the potential for higher returns.

IV. Traditional participating policies aim to produce a steady return by smoothing out market

fluctuation.

a. I, III, and IV

b. II, III, and IV

c. I, II, and III

d. I, II, and IV

38. Advantages of investing in preferred shares are:

I. It gives shareholders the right to a fixed dividend.

II. Has the priority over company assets during dissolution.

III. They enjoy benefit of capital appreciation.

a. I, II, and III

b. I and II

c. I and III

d. II and III

39. Under regular premium, variable whole life insurance plan:

I. Premium top-ups and holidays, subject to the life company’s administrative rules are usually

allowed

II. Life protection is the main objective of the plan with investment as a nominal purpose.

III. Withdrawals after the payment of a few years premium are usually allowed.

IV. A single premium contribution is made to the policy which uses the premium to purchase units in

variable life fund and to provide certain level of life cover.

a. II, III, and IV

b. I, III, and IV

c. I, II, and IV

d. I, II, and III

VUL IC Reviewer v.1.3

30 April 2021 Page 9

Insurance Commission Reviewer

40. Risk can be classified into two particular categories in relation to investment. They include__________

I. The risk of not losing some or all of a person’s initial investment

II. The risk of rate of return on the investment not matching up to the individual’s expectation

III. The risk of rate of return on the investment matching up to the individual’s expectation

IV. The risk of losing some or all of a person’s initial investment

a. I and III

b. I and II

c. III and IV

d. II and IV

41. The selling price under a variable life insurance policy is ___.

a. The price at which units the policy are bought back by the life company

b. The price at which units under the policy are offered for sale by the life company

c. Also known as the bid price

d. A fixed amount throughout

42. When investing in variable life funds, what are the benefits available? Commented [JMT9]: Option III reworded to clarify

I. The variable life funds offer policyholders an access to pooled or diversified portfolios.

II. The variable life policyholder can vary his premium payments, take premium holidays, add single

premium top-ups, and change the level of sum assured easily.

III. The variable life policyholder can have access to the services of a pool of qualified and trained

professional fund managers

a. I and II

b. I and III

c. I, II, and III

d. II and III

43. Under variable life insurance policies, ____. Commented [JMT10]: I & II is incorrect – there’s always

a minimum DB (The Option A & B in computing for VUL

I. There is no guaranteed minimum sum assured for the purpose of declaring dividends

DB) for VUL Plans. III is correct – VUL can also be in dual

II. There is no guaranteed minimum sum assured as a level of life insurance protection pricing: Ask Price (Selling Price from the seller), then Bid

III. Each of the policyowner’s premium will be used to purchase units, the number of which is Price (For withdrawal). IV – Correct, we buy units in the

dependent on the selling price of each unit VUL Funds and once invested, it is represented in Units

and value is called Fund Value (Monetary Value)

IV. Purchase of units can only be made from the variable life fund itself, which will then create new

units and the investment will add value to the fund

a. I, II and III

b. I, II and IV

c. II and IV

d. III and IV

VUL IC Reviewer v.1.3

30 April 2021 Page 10

Insurance Commission Reviewer

44. Why is it important that the customer has to understand the sales proposal in full?

a. Because the insurer does not guarantee any return

b. Because the impact of changes in investment condition on variable life policy borne solely by the

customer

c. Because the agent may give the wrong recommendations

d. Because the policyholders expects higher returns

45. A single premium variable life insurance policy ____.

a. Has no withdrawal value

b. Must be issued with a maximum withdrawal value

c. Has no death benefit

d. Must be issued with a minimum death benefit

46. Which of the following statements about surrender value under traditional participating life insurance

products is TRUE? Commented [JMT11]: C is correct – Participating Plans

DB includes Dividends (Participating Plan), Non Par – No

Dividends. The statement in C that made it confusing is

a. When a participating insurance policy is surrendered, the surrender value is calculated by the age of the assured having a lower surrender value

multiplying the bid price with number of units because the Cash Value growth is guaranteed and

b. Cash value is paid when a yearly renewable term insurance policy is surrendered dividends are continuously paid. It could be about availing

a life plan at an older age, as it will accumulate CV and Div

c. The amount of surrender value is usually higher than the amount under non-participating policies at a slower rate compared to those who availed it at a

and it varies with the age of the assured, being lower at older ages young age.

d. Policyholders who are risk averse should purchase life insurance policies with high protection and

D is not related to surrender value under traditional par

guaranteed cash and maturity values life insurance.

47. Under a variable life insurance policy, the protection costs ____.

I. Are met by a flat initial charges for regular premium loans

II. Are generally covered by cancellation of units in the fund

III. Are generally met by explicit charges stipulated openly in the policy terms

IV. Vary with age of policy owner and level of coverage

a. I, II, and III

b. I, II, and IV

c. I, III, and IV

d. II, III, and IV

48. The objective of satisfying customers’ need and business profitability can be achieved by an agent through ______

I. The giving of freebies to customers

II. Extensive investment training by the company

III. The use of sales plan, where sales goals, strategic and objectives are coordinated with market

analysis, segmentation and targeting

IV. The giving of monetary assistance and discount to the customers

a. I and III

b. II and III

c. I, II, and IV

d. II, III, and IV

VUL IC Reviewer v.1.3

30 April 2021 Page 11

Insurance Commission Reviewer

49. Which of the following statements about investment objectives is FALSE ?

a. People invest money in fixed deposits to produce high and guaranteed returns.

b. People invest money to enhance a comfortable standard living.

c. People invest money to provide funds for higher education for their children.

d. Investment in commodities has no regular income.

50. Diversification in investment involves ___.

a. Putting all the funds under management into one category of investment

b. Spreading the risks of investment by not putting the fund into several categories investment

c. Reducing the risks of investment by putting one fund under management into several categories

of investment

d. Reducing the risks of investment by putting all one’s eggs in one basket

51. Which of the following statements about diversification in portfolio management is FALSE?

a. Diversification helps to spread the portfolio risk by investing in different categories of investment

in a portfolio.

b. Diversification can completely eliminate risk of investing in stocks in a portfolio.

c. A diversified portfolio provides greater security to an investor without sacrificing the returns of the

portfolio.

d. Diversification can involve purchasing different types of stocks and investing in stocks of different

countries.

VUL IC Reviewer v.1.3

30 April 2021 Page 12

You might also like

- STD Insurance Commission VUL REVIEWER Answer Key 1.2Document12 pagesSTD Insurance Commission VUL REVIEWER Answer Key 1.2Shenna PalajeNo ratings yet

- STD InsCom VUL Reviewer 2019 0121Document12 pagesSTD InsCom VUL Reviewer 2019 0121Bestfriend Ng Lahat100% (1)

- VUL exam review: Key features and benefits of variable universal life insuranceDocument16 pagesVUL exam review: Key features and benefits of variable universal life insuranceDave Panulaya100% (2)

- Variable IC Mock Exam Version 2 10022023Document16 pagesVariable IC Mock Exam Version 2 10022023Jayr Purisima100% (1)

- Variable Reviewer12346Document17 pagesVariable Reviewer12346jeffNo ratings yet

- Variable Life Insurance ReviewDocument11 pagesVariable Life Insurance ReviewAlona Villamor Chanco100% (1)

- pruDocument14 pagespruJudy Ann LeguaNo ratings yet

- Variable Examination Review Session (Verse) Mock ExamDocument12 pagesVariable Examination Review Session (Verse) Mock ExamArvinALNo ratings yet

- VUL Mock Exam 1 (October 2018)Document12 pagesVUL Mock Exam 1 (October 2018)Alona Villamor ChancoNo ratings yet

- Insurance Commision Variable Insurance ContractsDocument11 pagesInsurance Commision Variable Insurance ContractsPetRe Biong PamaNo ratings yet

- IC Exam Reviewer For VULDocument9 pagesIC Exam Reviewer For VULjohninopatin94% (16)

- FWD Training and Development Academy VL MOCK Exam GuideDocument15 pagesFWD Training and Development Academy VL MOCK Exam GuideDalton Jay LuzaNo ratings yet

- Variable Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerDocument14 pagesVariable Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerKenneth QuiranteNo ratings yet

- IC Exam ReviewerDocument14 pagesIC Exam Reviewerfrancis75% (8)

- VUL Mock Exam Reviewer-Set 1 (For ACE With Answers)Document12 pagesVUL Mock Exam Reviewer-Set 1 (For ACE With Answers)Lady Glorien cayonNo ratings yet

- Variable Exam ReviewerDocument11 pagesVariable Exam ReviewerBryan MorteraNo ratings yet

- VUL ReviewerDocument11 pagesVUL ReviewerJohn Joshua JJ Jimenez100% (1)

- VUL Mock Exam 2 WITH EXPLANATIONS Answer KeyDocument16 pagesVUL Mock Exam 2 WITH EXPLANATIONS Answer KeyFranz JosephNo ratings yet

- ACE Variable IC Online Mock Exam - 08182021Document11 pagesACE Variable IC Online Mock Exam - 08182021Ana FelicianoNo ratings yet

- Variable - Online Mock ExamDocument11 pagesVariable - Online Mock ExamMitziRawrrNo ratings yet

- AXA Philippines Mock Exam Questions on Variable Life Insurance PoliciesDocument7 pagesAXA Philippines Mock Exam Questions on Variable Life Insurance PoliciesSHAMIR LUSTRE100% (1)

- VARIABLE MOCK EXAM Questionnaire and Answer Key 08172021.doc 1Document11 pagesVARIABLE MOCK EXAM Questionnaire and Answer Key 08172021.doc 1TANTAN TV100% (1)

- SunLEARN Variable Life InsuranceDocument10 pagesSunLEARN Variable Life InsuranceLady Glorien cayonNo ratings yet

- Variable life insurance withdrawal and flexibility featuresDocument10 pagesVariable life insurance withdrawal and flexibility featuresFranz JosephNo ratings yet

- Ic Exam Review: VariableDocument122 pagesIc Exam Review: VariableJL RangelNo ratings yet

- Variable Mock Exam UpdatedDocument14 pagesVariable Mock Exam UpdatedOliver papaNo ratings yet

- VUL Mock Exam Part 2Document2 pagesVUL Mock Exam Part 2Millet Plaza Abrigo95% (19)

- Consolidated Var. IC Mock Exam 09262023Document33 pagesConsolidated Var. IC Mock Exam 09262023Nicole Marie AlmarioNo ratings yet

- VUL Mock Exam Reviewer Set 2 For ACE With Answers 2Document11 pagesVUL Mock Exam Reviewer Set 2 For ACE With Answers 2Theo AgustinoNo ratings yet

- VL EXAM Set ADocument6 pagesVL EXAM Set ADavid GodiaNo ratings yet

- Exam MockDocument9 pagesExam MockJim Akino100% (1)

- Variable Life Licensing Mock Exam Set D 2Document13 pagesVariable Life Licensing Mock Exam Set D 2Neil ArmstrongNo ratings yet

- IC Exam Reviewer VUL No AnswerDocument12 pagesIC Exam Reviewer VUL No AnswerRoxanne Reyes-LorillaNo ratings yet

- Variable ReviewerDocument14 pagesVariable ReviewerMaria Teresa ArceNo ratings yet

- Vul Mock Exam 2Document15 pagesVul Mock Exam 2Mark Glenn Baluarte100% (3)

- Vul QuestionnaireDocument14 pagesVul QuestionnaireKyla Bianca Cuenco TadeoNo ratings yet

- VUL Mock ExamDocument5 pagesVUL Mock ExamZurc Nuaj III100% (1)

- CEILLI New Edition Questions English Set 1 PDFDocument19 pagesCEILLI New Edition Questions English Set 1 PDFTillie LeongNo ratings yet

- VUL MOCK EXAM 2 TITLEDocument5 pagesVUL MOCK EXAM 2 TITLEMillet Plaza Abrigo100% (2)

- VUL Mock ExamDocument5 pagesVUL Mock ExamMillet Plaza Abrigo93% (14)

- Variable Mock ExamDocument9 pagesVariable Mock ExamaileensambranoNo ratings yet

- Variable Life Reviewer: Key PointsDocument25 pagesVariable Life Reviewer: Key PointsJohn Michael FernandezNo ratings yet

- VUL Insurance Concepts Accreditation MaterialDocument13 pagesVUL Insurance Concepts Accreditation MaterialLady Glorien cayonNo ratings yet

- MyCampus Revision Question on Investment-Linked Insurance PlansDocument16 pagesMyCampus Revision Question on Investment-Linked Insurance PlansQistina IzharNo ratings yet

- VUL Reviewer Sample QuestionsDocument3 pagesVUL Reviewer Sample QuestionsBieNo ratings yet

- Mock ExamsDocument7 pagesMock ExamsJim AkinoNo ratings yet

- Variable Life Licensing Mock ExamDocument8 pagesVariable Life Licensing Mock ExamLance LimNo ratings yet

- VulDocument18 pagesVulAnna Kristine M. Nepomuceno100% (1)

- VL Mock Exam - Set2 PDFDocument12 pagesVL Mock Exam - Set2 PDFmaria Fe torres100% (2)

- VULDocument15 pagesVULlancekim21No ratings yet

- CEILI Set 1Document18 pagesCEILI Set 1Sarah May Miole InocandoNo ratings yet

- VARIABLE LIFE REVIEWER 140 Items With Answer Key TrainersDocument25 pagesVARIABLE LIFE REVIEWER 140 Items With Answer Key Trainersjima jam selomandinNo ratings yet

- CEILLI PDF Revision Questions v1.0 (2023)Document15 pagesCEILLI PDF Revision Questions v1.0 (2023)Qistina IzharNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Investing Made Easy: Finding the Right Opportunities for YouFrom EverandInvesting Made Easy: Finding the Right Opportunities for YouNo ratings yet

- Vendor Master Upload Unified Template Extend2Document14 pagesVendor Master Upload Unified Template Extend2Maria Joselda VillanuevaNo ratings yet

- 2306 Jan 2018 ENCS v4Document2 pages2306 Jan 2018 ENCS v4Mary Ann Pacariem100% (4)

- Insurance Commission Traditional Life ReviewerDocument42 pagesInsurance Commission Traditional Life Reviewerkristine de jesus100% (1)

- DLD InsCom VUL ReviewerDocument12 pagesDLD InsCom VUL ReviewerMaria Joselda VillanuevaNo ratings yet

- Insurance Commission Traditional Life ReviewerDocument42 pagesInsurance Commission Traditional Life Reviewerkristine de jesus100% (1)

- KKR Annual Review 2006Document53 pagesKKR Annual Review 2006AsiaBuyoutsNo ratings yet

- Cryptocurrency - Taming The Volatility Through Fund-InvestingDocument14 pagesCryptocurrency - Taming The Volatility Through Fund-InvestingPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- QM Assign3Document25 pagesQM Assign3Pratap singh chundawatNo ratings yet

- SRZ PIF 2018 Permanent Capital Investment Vehicles PDFDocument19 pagesSRZ PIF 2018 Permanent Capital Investment Vehicles PDFRegis e Fabiela Vargas e AndrighiNo ratings yet

- 5984 17474 1 PBDocument13 pages5984 17474 1 PBTiarannisaaNo ratings yet

- Topic: Capital Markets in Pakistan: Course: Financial Instituions Submitted To: Sir Sharique Ayubi Submitted byDocument17 pagesTopic: Capital Markets in Pakistan: Course: Financial Instituions Submitted To: Sir Sharique Ayubi Submitted byKnowledge PediaNo ratings yet

- Pakistan Institute of Corporate GovernanceDocument14 pagesPakistan Institute of Corporate GovernanceAnham DarNo ratings yet

- PSE Training Institute seminar on stock market basicsDocument3 pagesPSE Training Institute seminar on stock market basicsJonathan Andrew Pepito100% (1)

- Sample Sumptuous Cuisine CateringDocument25 pagesSample Sumptuous Cuisine CateringPalo Alto Software100% (6)

- Guide-to-Venture-Capital IVA PDFDocument90 pagesGuide-to-Venture-Capital IVA PDFNaveen AwasthiNo ratings yet

- Sample Client: CLS Investments, LLC Is Independent of Your Advisor's Broker/dealer And/or Registered Investment AdvisorDocument15 pagesSample Client: CLS Investments, LLC Is Independent of Your Advisor's Broker/dealer And/or Registered Investment AdvisorLaskar PejuangNo ratings yet

- Factors That Affected Apple Stock PriceDocument8 pagesFactors That Affected Apple Stock PriceSuk Yee Suk YeeNo ratings yet

- Eis Media PackDocument5 pagesEis Media PackMarkus MilliganNo ratings yet

- XBRL All Case StudiesDocument13 pagesXBRL All Case StudiesSadar CmNo ratings yet

- Vallibel Power Erathna PLC (VPEL) - 4Q FY21 - HOLDDocument9 pagesVallibel Power Erathna PLC (VPEL) - 4Q FY21 - HOLDjdNo ratings yet

- 4439 Chap01Document28 pages4439 Chap01bouthaina otNo ratings yet

- LM1-BF-XII-1st SemesterDocument4 pagesLM1-BF-XII-1st SemesterMark Gil GuillermoNo ratings yet

- Fiat Investment ThesisDocument7 pagesFiat Investment Thesisqigeenzcf100% (1)

- Spdji Strategy Index DirectoryDocument8 pagesSpdji Strategy Index DirectoryAayush MittalNo ratings yet

- Oddball Stocks Newsletter - Tower Properties - Issue 13Document5 pagesOddball Stocks Newsletter - Tower Properties - Issue 13Nate TobikNo ratings yet

- Unit 2 Kiều Văn Kiên - 1811110301Document3 pagesUnit 2 Kiều Văn Kiên - 1811110301Kiều Văn KiênNo ratings yet

- IFM AssignmentDocument27 pagesIFM AssignmentImranNo ratings yet

- The Greatest Moneymaking Machine in HistoryDocument27 pagesThe Greatest Moneymaking Machine in HistoryBrian Chung100% (1)

- The Principal-Agent ProblemDocument9 pagesThe Principal-Agent ProblemAssignmentLab.comNo ratings yet

- April 6 16 Webinar Stock Study Session Mark DavDocument57 pagesApril 6 16 Webinar Stock Study Session Mark Davetuz89% (18)

- Vatsal Black BookDocument37 pagesVatsal Black BookParth PatelNo ratings yet

- Charles P. Jones, Investments: Analysis and Management, 12th Edition, John Wiley & SonsDocument19 pagesCharles P. Jones, Investments: Analysis and Management, 12th Edition, John Wiley & Sonssarah123No ratings yet

- Gainesboro Machine Tools Corporatio1Document7 pagesGainesboro Machine Tools Corporatio1Endrit Avdullari100% (1)

- Incognito Investor Trading Strategies EbookDocument49 pagesIncognito Investor Trading Strategies EbookIncognito InvestorNo ratings yet

- Good Corporate Governance Manual: PT Apexindo Pratama Duta, Tbk. Dan Seluruh Unit-Unit UsahaDocument66 pagesGood Corporate Governance Manual: PT Apexindo Pratama Duta, Tbk. Dan Seluruh Unit-Unit UsahaapingNo ratings yet