Professional Documents

Culture Documents

MyCampus Revision Question on Investment-Linked Insurance Plans

Uploaded by

Qistina IzharOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MyCampus Revision Question on Investment-Linked Insurance Plans

Uploaded by

Qistina IzharCopyright:

Available Formats

CEILLI MyCampus Revision Question

1 _________________ plan offers a policyholder or investor a policy that is directly

connected to investment performance.

A. Whole life

B. Endowment

C. Annuity

D. Investment-linked

2 Investment-linked funds are managed by

I. The insurer’s own professional managers in its internal investment department.

II. The fund managers/fund houses appointed by the insurer through outsourcing.

III. The outsourcing to the funds of unit trust companies since investment-linked funds

are similar to unit trust funds.

IV. The insurer’s board of directors who can make special decisions on the types of

investment vehicles to offer to policy owners.

A. I

B. I and II

C. I and IV

D. I, II, III and IV

3 Since investment-linked insurance has an investment element, a prospective policy

owner is allowed to opt for

I. A nominal amount of sum assured of his selection.

II. No life protection at all.

III. At least the minimum amount of sum assured as set by the relevant regulator based

on age at the time of policy inception or opt for higher coverage.

IV. The sum assured offered by the insured concerned based on its internal

underwriting guidelines in relation to the financial status and circumstances of the

intended policy owner.

A. I

B. III

C. IV

D. I and II

4 What are the factors that have contributed to the steady growth of the life insurance

industry in Malaysia since 2000?

I. The Malaysian Government granting more flexibility to life insurance companies to

run business operations based on their own management philosophies and at their own

prudent discretion.

II. Malaysia’s dynamic economic growth experience.

III. Life insurers designing and offering customer-centric plans.

IV. The introduction of investment-linked insurance and its increasing popularity and

demand.

A. II

B. I and II

C. II and III

D. III and IV

This document is confidential and for internal training purposes only.

5 Select the following statement which is FALSE about investment-linked plans.

A. In the United States of America (USA), investment-linked is called universal life

insurance.

B. Each policy owner accumulates units in his selected fund as his share of the overall

accrued value.

C. The investment-linked funds of an insurer can acquire a wide array of assets like

equities or stocks, bonds, fixed interest,

foreign funds, real estate and currency.

D. Policy owners must be adequately informed and be made aware that their

investment-linked policy is directly linked to the investment performance of the

relevant funds.

6 Which options are open to policy owners of a regular premium investment-linked plan?

I. A policy owner may opt for higher a sum assured than the minimum amount

stipulated by the Sum Assured Multiple rule.

II. A policy owner can pay top-up premium to accelerate the accumulation of the

account value in the policy.

III. A prospective policy owner can apply to combine a single premium plan with a

regular premium plan into one policy.

IV. A prospective policy owner can select the death benefit based on either the sum

assured or the account value, whichever is higher.

A. I and II

B. II and III

C. I, II and III

D. I, III and IV

7 Which of the following statements are correct about regular premium investment-

linked?

I. Top-up premiums can either be paid on a regular basis or at any time.

II. Most insurers impose a minimum amount for both regular top-ups and ad hoc top-

ups.

III. Most insurers allow ad hoc top-ups once a year and impose a maximum amount.

IV. An upfront charge normally around 5 percent is deducted from each top-up.

A. I and IV

B. I, II and IV

C. II, III and IV

D. I, II, III and IV

8 A female aged 30 years has budgeted to set aside RM3,000 a year for a basic regular

premium investment-linked plan with a Unit-Deducting Hospitalization Rider. According

to the SAM formula, the multiple factor for her age is 50 times. How would you

calculate the minimum sum assured for the basic plan?

A. RM3,000 multiply by 50

B. RM3,000 multiply by 55

C. RM3,000 minus the notional premium for the rider, then multiply by 50

D. RM3,000 minus the notional premium for the rider, then multiply by 55

This document is confidential and for internal training purposes only.

9 Select the correct statements for regular premium investment-linked from the

following.

I. The Dollar Cost Averaging phenomenon leverages the long term or the acquisition of

more fund units when prices are down and the appreciation of units already acquired

when prices go up.

II. Some assets in a fund may perform well in a given short period while some may not

but the overall impact is the averaging effect due to the spreading out of risk. With

prudent management by fund managers, the unit price is likely to be higher in the

longer run.

III. The maximum tax relief for a qualified regular premium investment-linked medical

plan and an education plan is RM3,000 a year. If a policy owner has both, the combined

limit is also RM3,000.

IV. Whether a policy owner has a qualified regular premium investment-linked medical

plan or an education plan, or both, he qualifies for a tax relief of up to RM6,000 a year.

A. I and III

B. II and IV

C. I, II and III

D. I, II and IV

10 Which of the following is FALSE about allocated premium account?

A. It is a special account for buying units in vehicles by the various funds offered by the

insurer.

B. Monthly cost of insurance (COI), annual fund management fee, one-time policy fee

and other relevant charges are deducted from allocated account.

C. Agency commissions and other management-related expenses are deducted from

allocated account.

D. All of the above are TRUE

11 The Sum Assured Multiple (SAM) rule imposed by Bank Negara Malaysia (BNM)

stipulates the _____________.

A. Annual premium of life insured during policy inception

B. Maximum amount of premium payment

C. Maximum amount of life insurance coverage

D. Minimum amount of life insurance coverage

12 Which of the following is TRUE about fund switching?

I. Switching facility allows policy owners to switch part or all of their investment from

one fund to another fund.

II. Switching facility is very useful for the purpose of financial planning.

III. Switches between funds may be offered free of charge.

IV. Switches between funds may be offered free of charge for a limited number of

switches within a given period (normally a year) and charges imposed for subsequent

switches, or a specific charge for each and every switch.

A. I only

B. I and II

C. I, II and III

D. All of the above

This document is confidential and for internal training purposes only.

13 Which of the following is FALSE about investment-linked insurance?

A. Allowed to do regular and ad hoc top-ups.

B. Various types of supplementary coverage or riders offered as options to the basic

coverage.

C. Partial withdrawal from accrued account value is available only upon maturity.

D. When a due premium is not paid and if the accrued account value is sufficient to

cover due premiums, premium holiday comes into play to prevent the policy from

lapsing.

14 The death benefit for regular investment-linked is ____________.

A. Basic sum assured + accrued account value

B. Basic sum assured + accrued account value + bonus

C. Basic sum assured + accrued account value + surplus

D. Basic sum assured or accrued account value, whichever is higher

15 _____________ refers to the bid-offer spread, which is normally a 5% difference.

A. Single pricing

B. Dual pricing

C. Triple pricing

D. Disposal pricing

16 For single premium investment-linked insurance, _______________.

A. It has no allocated premium and unallocated premium ratio

B. The minimum basic single premium is at the discretion of individual insurers of

RM10,000

C. The priority for policy owners would presumably be protection first and investment

second

D. The priority for policy owners would presumably be investment first and protection

second

17 Top-ups for single premium investment-linked plans are encouraged when

I. The market is on the upturn and unit prices are rising.

II. A market downturn sets in not long after policy inception, thus causing the sum at

risk to prolong longer than expected based on the initial premium outlay.

III. The nation is experiencing a period of strong economic or GDP growth.

IV. The policy owner believes in the impact of Dollar Cost Averaging and wants to

leverage that to boost the account value instead of relying on just one single outlay.

A. II and IV

B. I and III

C. I, II and III

D. All of the above

This document is confidential and for internal training purposes only.

18 Which statements relate to the application of cost of insurance (COI) in single premium

investment-linked insurance?

I. COI is based on the account value, the higher the account value then COI will increase.

II. When the account value of a single premium investment-linked policy is still below

the sum assured, the shortfall gap between the two levels is called sum at risk.

III. Deduction of COI is not for the full sum assured but to cover the shortfall between

the account value and the sum assured.

IV. The sum at risk for COI is when the sum assured plus the account value at any point

in time.

A. I

B. III

C. IV

D. II and III

19 Which of the following is TRUE about single premium investment-linked insurance?

A. There is no unallocated premium charge unlike the regular premium.

B. The unallocated premium charge is a one-time payment which is unlike the regular

premium.

C. There is an upfront charge of about 10% from each top-up and rest is put into the

funds selected by the policy owner.

D. All of the above is FALSE.

20 The sum assured formula for single premium investment-linked insurance is

_______________.

A. 100% of the single premium paid

B. 125% of the single premium paid

C. 125% of the single premium paid for older age groups and sub-standard lives

D. None of the above is TRUE

21 The benefits of an investment-linked policy are

I. It provides access to a diversified investment portfolio. Thus, it has better risk

characteristics than a non-diversified portfolio.

II. It offers flexibilities.

III. Fixed nominal charges are levied on the policy.

IV. The life insurer insulates the policy owner against market risks.

A. I and II

B. I and III

C. II and IV

D. I, II, III and IV

This document is confidential and for internal training purposes only.

22 Which of the following statement is TRUE about the minimum age to enter a regular

premium investment-linked plan and a whole life participating plan?

I. The minimum age of 18 years to apply on own life for a regular investment-linked

plan.

II. A minor aged 16 who is applying for an investment-linked plan on own life needs

parental consent.

III. A minor aged 16 can apply for a whole life participating plan without parental

consent.

IV. Minors aged 10 to 15 can apply for a whole life participating plan with parental

consent.

A. I and III

B. I, II and III

C. I, III and IV

D. All of the above

23 As the sales illustration document printed by any life insurer is meant for reference and

view by a prospect, a sales intermediary is expected to observe certain rules. The sales

intermediary must

I. Get the new policy owner to sign the illustration as acknowledgement of having

understood the contents.

II. Get the new policy owner to sign the policy disclosure sheet and also to sign it

himself to declare that proper presentation has been carried out and the non-

guaranteed elements have been explained.

III. Highlight that all investment risks are borne by the policy owner, that all fees and

charges may be changed by the insurer giving 3 months’ notice, and that the cost of

insurance increases with attained age.

IV. Explain that the projected returns may be deemed likely returns of the selected

funds based on the past 5 years historical performance.

A. I and III

B. I, II and III

C. I, III and IV

D. All of the above

24 The flexibilities policy owners can make when purchasing investment-linked are

_____________.

A. Partial withdrawal

B. Top-ups

C. Fund switching

D. All of the above

25 Regular premium investment-linked insurance promotes full transparency relating to

official sales materials presented at the point of sale. Which of the following is NOT

available in the sales materials?

A. Descriptions of the benefits for the basic plan and riders.

B. A statement specifying that the cost of insurance (COI) will be levied monthly and

deducted from the funds up to the maximum tenure as long as the policy is maintained.

C. A statement that investment returns are based on assumed rates of return for the

high and low scenarios for the selected funds.

D. Proposal summary together with agent's statement.

This document is confidential and for internal training purposes only.

26 An example of investment in money market is _____________.

A. 5-Year Bond

B. Currencies and Forex

C. Treasury Bills

D. Savings account

27 Investors have secondary objectives that are more close to their hearts when investing

such as

I. Ensuring a comfortable standard of living

II. Providing funds for their dependents

III. Liability cancellation

IV. Provide adequate funding for their children’s education and their upbringing.

A. I, II and III

B. I, II and IV

C. II, III and IV

D. All of the above

28 Which of the statements below are TRUE about the investment horizon?

I. A person’s investment horizon is the length of time that he is prepared to hold a

particular asset before he liquidates it.

II. The investment horizon of an individual depends when he needs liquidity in the

future date for specific objectives.

III. The cost or penalty that an investor has to pay in the event he needs to liquidate the

asset earlier than expected also has a bearing on his choice of investment horizon.

IV. It is pertinent for an agent to strike a clear understanding with a potential client as

to how much the latter is willing to set aside or commit for acquiring an asset.

A. I, II and III

B. I, II and IV

C. II, III and IV

D. All of the above

29 Investor will invest with the objective to make money and he will need the money to

settle a specific event. The category of the accessibility of funds are

A. Investor would not want to place his money in an investment that will not allow him

to unlock it in a short time frame.

B. Cost or penalty that the investor has to pay if exits early, hence defeats the purpose

of the investment objectives.

C. Investor knows the exact amount of money needed to set up the investment account

and its cost.

D. All of the above

30 There is a possibility for an investor to have more than one investment objectives such

as

A. Invest for a steady stream of income

B. Invest in an ultimate safety through the purchase of Government issued bonds or

sukuk

C. Seek growth in the investments such as common stocks and commodities

D. All of the above

This document is confidential and for internal training purposes only.

31 Malaysian Treasury bills are debt instruments that are considered safe because

I. They are issued by the Government of Malaysia

II. They are short-term instruments

III. They are guaranteed by the World Bank

IV. The tenure is normally 12 months

A. I and II

B. I, II and III

C. I, II and IV

D. All of the above

32 Which of the following statements about the investment vehicles are correct?

I. Normally when interest rates fall, the prices of fixed income or bond assets may rise;

when interest rates rise, their prices may drop.

II. Government bonds are safer than corporate bonds but their returns are

comparatively lower.

III. The maturity period of short-term government bonds is usually less than 5 years, for

the medium-term it is usually 5-10 years and for the long-term ones it is usually above

15 years.

IV. Preference shares are hybrid securities with both equity and fixed income

characteristics. In the event the company concerned winds up, preferred shareholders

have the first right to be compensated from the company assets first before normal

shareholders.

A. I and IV

B. I, II and III

C. II, III and IV

D. All of the above

33 Which of the statements below is incorrect about Sukuk?

A. Sukuk are bonds but they are based on Shariah-compliant principles

B. Malaysia is the world’s largest issuer of sukuk

C. Sukuk securities are issued by Malaysia in Ringgit only

D. Sukuk securities may be issued in US dollars

34 Besides protect against the loss of deposits in the unlikely event of a bank failure,

Perbadanan Insurans Deposit Malaysia (PIDM) also protect owners of insurance policies

and holders of takaful in the event of the failure of a member insurance/takaful

institution. The maximum protection for insurance/takaful coverage is

_______________.

A. RM200,000

B. RM250,000

C. RM500,000

D. RM1,000,000

35 Select the incorrect statement about Fixed Income Securities.

A. It is a group of investment vehicles that offer a fixed periodic return.

B. It can be regarded as promissory notes issued by companies or the government to

raise funds.

C. Investor has the opportunity to realise capital gains since prices of fixed income

securities may rise if interest rates fall.

D. There are 2 types of fixed income securities which are government bonds and

preference shares.

This document is confidential and for internal training purposes only.

36 Which of the following is TRUE about Debenture Stocks?

A. Debenture stocks are unsecured loans to a company.

B. If the company defaults on the loan, the investor can take over the said assets and

sell them to get his money back.

C. If the company defaults, the investor has no security as all the other unsecured

creditors of the company and he may or may not get back the capital.

D. All of the above is FALSE.

37 Select the statement that is TRUE about Ordinary Shares.

A. Give the holder the right to a fixed income provided enough profit has been made.

B. Dividends are usually paid semi-annually as income to shareholders.

C. Part-owner of the company and is entitled to share in its profits in the form of

dividends.

D. Ordinary shareholders do not have voting rights.

38 Select the correct statement between Unit Trust and Single Premium Investment-

linked.

A. Unit trust is authorised and supervised by Bank Negara Malaysia (BNM) while single

premium investment-linked is regulated by Securities Commission (SC).

B. Trustee must be appointed for both unit trust and single premium investment-linked.

C. It is not allowed to withdraw from Employees Provident Fund (EPF) account to invest

in unit trust and but it allowed to withdraw EPF for single premium investment-linked.

D. Unit trusts do not have any deduction for cost of insurance and policy fee charges

while it is available in single premium investment-linked.

39 What are the factors that affect the price of an agricultural property?

I. The location of the land

II. The volume and type of crops grown

III. Quality of the land

IV. Existing facilities on agricultural property such as power supply

A. I and II

B. I, II, III

C. I, III and IV

D. All of the above

40 Which of the following is TRUE about investment vehicles?

A. Cash and deposits refers to all liquid instruments that carry little or no risk.

B. Capital Guaranteed Fund is an investment vehicle offered by certain institutions that

guarantee the investor’s initial capital from any losses.

C. Properties can provide good capital appreciation and a steady flow of income.

D. All of the above is TRUE.

41 Select the correct statement about Government Bonds.

A. A financial instruments used by the government to borrow money from the public

and it is the safest type of investments carrying almost no default or credit risk.

B. The difference between government bonds and Treasury bills is the risk and

investment return rate.

C. Short-term bonds usually is less than one year.

D. The return potential is comparatively higher than for other assets such as corporate

bonds.

This document is confidential and for internal training purposes only.

42 Which of the following is TRUE when investing in Property.

A. Provides good capital appreciation and a steady flow of income.

B. When purchase a property in Malaysia, the initial fees that have to be paid such as

legal fees, stamp duty etc.

C. To really realize capital gains investors has to hold on to their properties for medium

to the long term.

D. All of the above is TRUE.

43 Sukuk is gaining ground in terms of transaction volumes in Malaysia including for

investment-linked funds because

I. This investment vehicle is becoming more popular among investors.

II. The strong support from the Government and mega corporations, especially

Malaysian ones.

III. The higher return experience compared to conventional bonds because of special

incentives provided by the Government.

IV. It is traded only in Malaysian Ringgit.

A. I and II

B. II and III

C. I, II and III

D. All of the above

44 The average yield of Malaysian Treasury bills with tenures of 6 to 12 months is

I. Around or slightly better than 3%.

II. Normally around 4 to 5 per cent.

III. Normally of very low volatility ratio but in periods when the Government embarks

on mass mega projects and needs funding, it may issue bills with yields as high as

corporate bonds.

IV. With wide variance, depending on the type of bill.

A. I

B. IV

C. II and IV

D. All of the above

45 Malaysian bonds are deemed to be

I. More volatile than global bonds

II. Less volatile than global bonds

III. Rated at very high preference because the country’s economy is growing vibrantly

IV. Experiencing better yields than global bonds for many years

A. II

B. IV

C. I and III

D. III and IV

This document is confidential and for internal training purposes only.

46 If is safer to rely on professional fund managers appointed for investment-linked funds

than to invest directly in the stock market because

I. An ordinary individual is generally not equipped to identify the right stock that will

reap gain.

II. The professional fund managers’ role is to ensure the assets and vehicles achieve a

certain minimum growth rate otherwise the fund managers and life insurer will be

obligated to make up the shortfall.

III. It is not easy for an ordinary individual to pick the right time to buy and the right

time to sell for optimising capital gains.

IV. Ordinary individuals especially those occupied with work do not have the time and

knowledge to properly monitor market trends.

A. I, II and III

B. I, III and IV

C. II, III and IV

D. All of the above

47 Which of the following funds reflects higher risk?

A. Sukuk

B. Equity Funds

C. Non-specialised Funds

D. Fixed Income Funds

48 Valuation of units in an investment-linked fund must be done ____________.

A. Six days in a week

B. Every business day

C. Every day

D. Seven days a week. For a day that falls on a weekend or a public holiday, valuation

processed by the automated system will be based on the same unit price as the

previous business day

49 Insurers may undertake unit splits for any investment-linked fund provided the

following conditions are met

A. There is an appreciation rate of at least 20 percent at the end of the current 6

months over the previous 12 months.

B. Unit split/combination can only be done twice in a financial year.

C. The unit split may only be exercised when there is a sustainable appreciation in the

net asset value over a 6 months period preceding the split.

D. The unit split may only be exercised when there is a sustainable appreciation in the

net asset value over a 12 months period preceding the split.

This document is confidential and for internal training purposes only.

50 Life insurers offering investment-linked insurance are obligated to provide certain

fundamental transparencies as required by regulatory guidelines such as

I. A separate Fund Fact Sheet for each of the funds.

II. A statement on the value of the policy at least once a year.

III. A performance report on each fund of the policy owner at least once a year.

IV. Medical report together with the counter-offer letter during inception of

investment-linked insurance.

A. I and II

B. I, II and III

C. II, III and IV

D. All of the above

51 What are the pre-requisites for the launch of a new investment-linked fund?

I. A minimum fund size can be set by the insurer.

II. The initial offer period shall not be more than 2 months from the date of launch.

III. If the minimum fund size is not reached by the end of the initial offer period, the

insurer can call off the fund and refund all premiums collected.

IV The insurer will also have to pay interest or investment profit from the premiums

collected during the initial offer period to the intended policy owners.

A. I and II

B. I, II and III

C. I, III and IV

D. All of the above

52 What happens after a policy contract has been issued by a life insurer?

I. The insured can follow up and request agent to email the policy contract to review.

II. The agent should deliver the policy contract without delay.

III. The delivery process should entail the explanation of the contractual provisions and

re-explaining the benefits. The agent then has to request the new policy owner to sign

the delivery acknowledgement slip and return it to the insurer for recording and filing.

IV. If the new policy owner is unavailable at the first time of personal delivery by the

agent, representative of the policy owner’s household or office can sign it and shall be

deemed valid. The agent does not need to follow up on this.

A. I and II

B. II and III

C. I, III and IV

D. All of the above

This document is confidential and for internal training purposes only.

53 Agents who have sold investment-linked plans should conduct reviews with their clients

ideally once a year. The purpose is to

I. Provide updates on the performance progress of funds selected by the clients.

II. Discuss and ascertain whether the client’s financial objectives might have changed

due to certain circumstances.

III. Discuss and ascertain whether the original risk profile of the client has changed due

to certain circumstances.

IV. Discuss alternative next steps where necessary.

A. III and IV

B. I, II and IV

C. II, III and IV

D. All of the above

54 The Code of Conduct pertaining to life insurance selling applies to

I. All agents

II. All employees of life insurers

III. Insurance brokers

IV. Agents and insurance brokers

A. I and II

B. I and III

C. I, II, and IV

D. All of the above

55 Which of the following statements are important for an agent to know?

I. Agents are free to design their own financial planning form to gather financial data

and financial information of their prospective clients for analysis.

II. The Customer Fact Find form of a life insurer officially documents important facts

concerning the financial data concerning a prospective policy owner and his family.

III. Cancellation of a policy is allowed if the request by a new policy owner falls within

the 30 days free-look period. The period commences from the date the policy contract

is passed to the agent for delivery.

IV. The free-look period commences from the date the client signs the

acknowledgement slip upon receiving the policy.

A. I and IV

B. II and IV

C. I, II and III

D. I, II and IV

This document is confidential and for internal training purposes only.

56 The pertinent points highlighted by the Guidelines on Minimum Standards for Treating

Customers Fairly (TCF) for agents’ attention are

I. Agents should inform customers fully about the key benefits, key risks and exclusions.

II. Agents must first be well-trained, especially involving the sale of investment and

savings products.

III. Agents must guide the customers as to what details are necessary to declare and

what are not necessary so that the concise personal information captured in the

application documents will cater for a smooth underwriting process.

IV. The product being proposed to a customer should be based on suitability, needs and

risk appetite.

A. II and III

B. I, II and III

C. I, II and IV

D. All of the above

57 ____________ is a form of misrepresentation in which a policy owner is induced to

discontinue an insurance policy in order to purchase a new policy with another

company or the same company, without the policy owner being clearly informed of the

differences between the two policies and of the financial consequences of replacing the

original policy.

A. Non-disclosure

B. Non-forfeiture conditions

C. Incontestability Clause

D. Twisting

58 Under the Explanation of the Contract, an agent is expected to

A. Explain all the essential provisions of the contract he is recommending to ensure the

prospective policy owner understands what he is committing.

B. Draw attention to any restrictions including exclusions applying to the policy.

C. Draw attention to whether the policy qualifies for tax relief or otherwise.

D. All of the above is TRUE.

59 Select the correct statement which an agent should do

I. Avoid influencing the proposer and make it clear that all the answers or statements

are the proposer’s own responsibility.

II. Ensure that the consequences of non-disclosure and inaccuracies are pointed out to

the proposed by drawing his attention to the relevant statements in the proposal form.

III. Where authorized by the life insurer, acknowledge receipt and maintain a proper

account of all monies received in connection with an insurance policy.

IV. Forward to the company any monies received for life insurance when the agent is

free and convenient to do so.

A. I, II and III

B. I, II and IV

C. I, III and IV

D. All of the above

This document is confidential and for internal training purposes only.

60 The Seven Principles Underlying the Guidelines are as below EXCEPT

A. To avoid conflict of interest

B. To prevent misuse of information

C. To ensure completeness and accuracy of relevant records

D. To ensure fair and equitable treatment to certain and selected policy owners only

This document is confidential and for internal training purposes only.

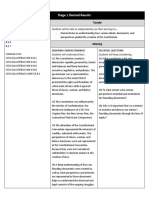

Answers:

1. D 11. D 21. A 31. C 41. A 51. D

2. B 12. D 22. C 32. D 42. D 52. B

3. B 13. C 23. B 33. C 43. A 53. D

4. D 14. A 24. D 34. C 44. A 54. A

5. A 15. B 25. D 35. D 45. A 55. B

6. A 16. D 26. C 36. B 46. B 56. C

7. B 17. A 27. D 37. C 47. B 57. D

8. C 18. D 28. D 38. D 48. B 58. D

9. C 19. B 29. D 39. C 49. C 59. A

10. C 20. B 30. D 40. D 50. B 60. D

This document is confidential and for internal training purposes only.

You might also like

- Business Formation & Business Credit GuideDocument14 pagesBusiness Formation & Business Credit GuideMonique100% (4)

- Election Offenses Omnibus Election CodeDocument12 pagesElection Offenses Omnibus Election CodeRaziele RanesesNo ratings yet

- Ceilli EnglishDocument84 pagesCeilli EnglishKanna Nayagam100% (1)

- ADIB YAZID - Nota Ringkas PCEIA Study Guide (Bahasa Inggeris)Document36 pagesADIB YAZID - Nota Ringkas PCEIA Study Guide (Bahasa Inggeris)Hanis Ahmad Badri50% (2)

- STD Insurance Commission VUL REVIEWER Answer Key 1.2Document12 pagesSTD Insurance Commission VUL REVIEWER Answer Key 1.2Shenna PalajeNo ratings yet

- Update Will with Charity GiftDocument2 pagesUpdate Will with Charity GiftRandy Lorenzana100% (1)

- Ceili Sample Questions Set 1Document14 pagesCeili Sample Questions Set 1jsdawson29% (7)

- Ceilli1 SQ en Eah PDFDocument24 pagesCeilli1 SQ en Eah PDFLeevya GeethanjaliNo ratings yet

- Understanding Takaful Principles and BenefitsDocument6 pagesUnderstanding Takaful Principles and BenefitsEileen WongNo ratings yet

- PCEIA Exam PaperDocument20 pagesPCEIA Exam PaperShiharu Comil0% (1)

- DAILY INCOME FOR HOSPITAL STAYSDocument8 pagesDAILY INCOME FOR HOSPITAL STAYSnusthe2745No ratings yet

- Ceilli Sample Questions (Eng) – Set 1Document13 pagesCeilli Sample Questions (Eng) – Set 1Premkumar NadarajanNo ratings yet

- Pre-Contract Study Guide for Insurance ExamDocument36 pagesPre-Contract Study Guide for Insurance Exammohdhafizmdali0% (2)

- Tbe Part Ac Set 1 100qa 2019 With AnswerDocument23 pagesTbe Part Ac Set 1 100qa 2019 With AnswerMuhammad Haziq Ilham Bin Roslan100% (1)

- PCE Mock Examination - Set 2: Hong Leong Assurance Berhad (94613-X) Financial Services Academy (Jul 2011Document19 pagesPCE Mock Examination - Set 2: Hong Leong Assurance Berhad (94613-X) Financial Services Academy (Jul 2011Zarina GhazaliNo ratings yet

- PCE A & C Insurance Basics and PrinciplesDocument35 pagesPCE A & C Insurance Basics and Principlescarollim1008100% (1)

- CEILLI New Edition Questions (English - Set 1)Document19 pagesCEILLI New Edition Questions (English - Set 1)Gary Teong75% (8)

- Ic Exam Review: VariableDocument122 pagesIc Exam Review: VariableJL RangelNo ratings yet

- PCE Sample Questions SET 2 ENG PDFDocument20 pagesPCE Sample Questions SET 2 ENG PDFVivekananthiny Raman100% (2)

- Insurance Basics and Risk ManagementDocument187 pagesInsurance Basics and Risk ManagementYamunaa PalaniNo ratings yet

- Ceilli 8Document18 pagesCeilli 8HemaNo ratings yet

- Internal Insurance Exam Question BankDocument33 pagesInternal Insurance Exam Question BankKishenthi KerisnanNo ratings yet

- Final English 2015 PCE PDFDocument192 pagesFinal English 2015 PCE PDFCheong Weng ChoyNo ratings yet

- PCIL Set 5Document8 pagesPCIL Set 5renugaNo ratings yet

- VARIABLE MOCK EXAM Questionnaire and Answer Key 08172021.doc 1Document11 pagesVARIABLE MOCK EXAM Questionnaire and Answer Key 08172021.doc 1TANTAN TV100% (1)

- Pceia BiDocument407 pagesPceia BiWenny Khoo100% (1)

- PCE Sample Questions - SET 6 (ENG)Document15 pagesPCE Sample Questions - SET 6 (ENG)Raja Mohan100% (1)

- Data Center Design & Planning RFP PDFDocument16 pagesData Center Design & Planning RFP PDFJava NitnutNo ratings yet

- PCIL Set 2 Ver 1.0 - 20200816Document9 pagesPCIL Set 2 Ver 1.0 - 20200816KOLEJ ALPHA100% (1)

- Ceilli PresentationDocument197 pagesCeilli PresentationjsdawsonNo ratings yet

- Employee Benefits: Qualified Retirement Plans: OverviewDocument14 pagesEmployee Benefits: Qualified Retirement Plans: OverviewAtticus SinNo ratings yet

- STD InsCom VUL Reviewer 2019 0121Document12 pagesSTD InsCom VUL Reviewer 2019 0121Bestfriend Ng Lahat100% (1)

- CEILLI New Edition Questions English Set 1 PDFDocument19 pagesCEILLI New Edition Questions English Set 1 PDFTillie LeongNo ratings yet

- Mock Exam - Set 4: Compiled by FSA As at April 2008Document14 pagesMock Exam - Set 4: Compiled by FSA As at April 2008Farah S Noshirwani67% (3)

- PCEIA, CEILLI & TBE Study NotesDocument3 pagesPCEIA, CEILLI & TBE Study NotesBaizura RahmanNo ratings yet

- PCE SET 3 Version August 2015Document11 pagesPCE SET 3 Version August 2015Kalai Arasen PerumalNo ratings yet

- CEILLI Slides 2019 (English)Document147 pagesCEILLI Slides 2019 (English)HemaNo ratings yet

- CEILLI Slides (English)Document148 pagesCEILLI Slides (English)Arvin Kovan100% (1)

- Variable Exam ReviewerDocument11 pagesVariable Exam ReviewerBryan MorteraNo ratings yet

- Pre-Contract Agents Exam & Investment-Linked Life Insurance Sample QuestionsDocument9 pagesPre-Contract Agents Exam & Investment-Linked Life Insurance Sample QuestionsKOLEJ ALPHA50% (2)

- PCEIA Sample Questions Set 2Document19 pagesPCEIA Sample Questions Set 2kenny sanNo ratings yet

- CEILLI Training Slide PDFDocument221 pagesCEILLI Training Slide PDFtharan100% (1)

- PCE Slides 2019 (English)Document192 pagesPCE Slides 2019 (English)Hema100% (2)

- TO Indian Government Accounts and Audit: (Fifth Edition)Document347 pagesTO Indian Government Accounts and Audit: (Fifth Edition)RananjaySinghNo ratings yet

- PCE Sample Questions (Eng) - Set 1Document20 pagesPCE Sample Questions (Eng) - Set 1Thennarasu Don100% (1)

- PCIL Set 1 Key Insurance ConceptsDocument24 pagesPCIL Set 1 Key Insurance ConceptsIsaac WongNo ratings yet

- ABS-CBN v. Phil Multi Media CaseDocument4 pagesABS-CBN v. Phil Multi Media CaseSean GalvezNo ratings yet

- Ic33 Print Out 660 English PDFDocument54 pagesIc33 Print Out 660 English PDFumesh100% (1)

- CEILLI Exam Revision GuideDocument242 pagesCEILLI Exam Revision GuidePeter YowNo ratings yet

- Crew Deal MemoDocument2 pagesCrew Deal MemoEz A FilmmakerNo ratings yet

- Online+trad.+ic+mock+exam 09262023Document9 pagesOnline+trad.+ic+mock+exam 09262023Sonny CandidoNo ratings yet

- PCE Life Past QuestionsDocument42 pagesPCE Life Past QuestionsJo Yong60% (5)

- Individual Assignment FIN533Document16 pagesIndividual Assignment FIN533SHAHRIZMAN INDRANo ratings yet

- Soalan Pce ExamDocument8 pagesSoalan Pce Examsukahati0% (1)

- Introduction to Investment-Linked InsuranceDocument197 pagesIntroduction to Investment-Linked InsuranceSitisaiful0% (1)

- CEILI PREPARATORY PACK English PDFDocument96 pagesCEILI PREPARATORY PACK English PDFHanis Ahmad BadriNo ratings yet

- Pce EnglishDocument27 pagesPce EnglishVictor WSNo ratings yet

- CEILI Study Guide (Eng)Document46 pagesCEILI Study Guide (Eng)liksyarnahNo ratings yet

- CEILLI Training Slide 20150810Document221 pagesCEILLI Training Slide 20150810Nurul AfifahNo ratings yet

- Pce & Ceili Important Terms 13.08.12Document27 pagesPce & Ceili Important Terms 13.08.12Manivannan KasiNo ratings yet

- C12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyDocument5 pagesC12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyStef CNo ratings yet

- Mock 01Document5 pagesMock 01api-26863276100% (1)

- Investment Link ExamDocument73 pagesInvestment Link ExamPravin Vjai AiyanakavandanNo ratings yet

- Fmutm Mock 05Document8 pagesFmutm Mock 05api-2686327667% (3)

- PART ONE APPLICATION QUESTIONS ANSWERDocument3 pagesPART ONE APPLICATION QUESTIONS ANSWERAbdelnasir HaiderNo ratings yet

- QUESTION One (Multiple Choice) : Insurance Company OperationsDocument14 pagesQUESTION One (Multiple Choice) : Insurance Company Operationsmamush fikaduNo ratings yet

- Rnis College of Insurance: New Ic 33 - Model Test 4Document6 pagesRnis College of Insurance: New Ic 33 - Model Test 4Raj Kumar DepalliNo ratings yet

- CEILLI PDF Revision Questions v1.0 (2023)Document15 pagesCEILLI PDF Revision Questions v1.0 (2023)Qistina IzharNo ratings yet

- Dáil Eireann Debate OF PESCO EU ARMY IN SECRETDocument488 pagesDáil Eireann Debate OF PESCO EU ARMY IN SECRETRita CahillNo ratings yet

- Andhra Pradesh (Telangana Area) Land Revenue Act 1317 FDocument81 pagesAndhra Pradesh (Telangana Area) Land Revenue Act 1317 Fmanikanth4reddyNo ratings yet

- ST Money and Banking British English Student Ver2Document3 pagesST Money and Banking British English Student Ver2pucillo majoNo ratings yet

- Ubd Unit PlanDocument4 pagesUbd Unit Planapi-351329785No ratings yet

- Pos 100: Politics and Governance (3 Units)Document7 pagesPos 100: Politics and Governance (3 Units)Dianne Dela CruzNo ratings yet

- Post TestDocument40 pagesPost TestRubyJadeRoferosNo ratings yet

- 论公民不服从(小姜老师整理)Document24 pages论公民不服从(小姜老师整理)James JiangNo ratings yet

- A-Life Medik FamiliDocument2 pagesA-Life Medik FamiliZaiham ZakariaNo ratings yet

- Torts SyllabusDocument3 pagesTorts SyllabusRushmi NNo ratings yet

- Investment Pattern of Salaried Persons in MumbaiDocument62 pagesInvestment Pattern of Salaried Persons in MumbaiyopoNo ratings yet

- Marc Johanna L. Villacora Activity 2.1 Citizenship TrainingDocument6 pagesMarc Johanna L. Villacora Activity 2.1 Citizenship TrainingDhision VillacoraNo ratings yet

- Introduction To Philippine HistoryDocument20 pagesIntroduction To Philippine HistoryCatie Raw AyNo ratings yet

- BS7419 1991 PDFDocument13 pagesBS7419 1991 PDFsurangaNo ratings yet

- Barangay Summary Proceedings PDFDocument7 pagesBarangay Summary Proceedings PDFMichelangelo TiuNo ratings yet

- LANPoker EULA ENGDocument2 pagesLANPoker EULA ENGMealone NiceNo ratings yet

- Philippine EgovernanceDocument25 pagesPhilippine EgovernanceMiriam Hannah BordalloNo ratings yet

- FRM - Financial Management and Implementation Modalities - UNDP Guidelines For Engagement With NGOsDocument25 pagesFRM - Financial Management and Implementation Modalities - UNDP Guidelines For Engagement With NGOsRaheem BanguraNo ratings yet

- RDO No. 33 - Intramuros-Ermita-MalateDocument1 pageRDO No. 33 - Intramuros-Ermita-MalateMNo ratings yet

- Radin (1910) Greek Law in Roman ComedyDocument4 pagesRadin (1910) Greek Law in Roman ComedyVerónica Díaz PereyroNo ratings yet

- Edited-Preschool LiteracyDocument22 pagesEdited-Preschool LiteracyEdna ZenarosaNo ratings yet

- Tax.3105 - Capital Asset VS Ordinary Asset and CGTDocument10 pagesTax.3105 - Capital Asset VS Ordinary Asset and CGTZee QBNo ratings yet

- Islamic Reformism and ChristianityDocument6 pagesIslamic Reformism and ChristianityJojo HohoNo ratings yet