Professional Documents

Culture Documents

Exercise - Statement TP#1: Suggested Exercise For Management Accounting: 10904A

Exercise - Statement TP#1: Suggested Exercise For Management Accounting: 10904A

Uploaded by

Aya AzanarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise - Statement TP#1: Suggested Exercise For Management Accounting: 10904A

Exercise - Statement TP#1: Suggested Exercise For Management Accounting: 10904A

Uploaded by

Aya AzanarCopyright:

Available Formats

Suggested exercise Exercise - Statement TP#1

for Management Cost of goods manufactured and

Accounting : 10904A Income statement

(Exercise 4Sup_C.7 revised and adapted for TP1)

Happy Camper Inc. (HCI) is a recently started company founded by Lucy Smallpot on May 1 st,

20X2. HCI is specialized in the design and preparation of gourmet meals for those who love the

great outdoors. Its mission states that every camper should eat as well in his tent as he would in a

restaurant.

Every meal prepared by HCI is dehydrated and the user has only to pour in a small amount of

water to transform the meal into a 5-star camper dinner. Although the camper chef doesn’t have

much to do, this cannot be said for Lucy. Indeed, at the beginning she had to prepare the meals, go

through the complex process of dehydration, and do all that from her own kitchen!

At the end of the first year of business, on May 1st, 20X3, HCI already lacked the capacity needed

to produce all the meals demanded. Lucy therefore hired two chefs and rented a commercial space

equipped with a fully adapted kitchen for the dehydration process and an office. The kitchen

occupies 75 % of the total space.

Lucy contacted a bank in order to obtain a loan but her request was rejected due to the lack of

financial information. The bank requested an income statement and schedule of cost of goods

manufactured for the financial period ended April 30, 20X4.

Lucy is a real cordon bleu chef but not much of an accountant. Therefore, she asked you, her

lifelong friend, to help her. She collected the following information for you:

1. HCI produces two main meals: northern beef ragout and oriental pasta. The manufacturing

process is essentially the same for both products and manufacturing costs are exactly the

same.

2. Packaging cost per unit is $ 0.02 per bag. Packaging is the final step in the manufacturing

process; the meals have to be completely finished before this last step.

3. One meal requires 700 grams of ingredients at an average price of $ 3.00/kg. During the

financial period, HCI bought 44,100 kg of ingredients.

4. There were no ingredients in inventory at the beginning of the financial period because

Lucy purchases ingredients as needed (she always purchases the quantities required by

production). Nor was there any beginning work-in-process inventory. However, there were

5,000 packaging bags purchased at $ 0.02/bag were in inventory at the beginning of the

period, as well as 2,000 northern beef ragout meals and 1,500 oriental pasta meals that

were available for sale (unit manufacturing cost was $ 3.70 each).

5. During the period, HCI bought ingredients and packaging bags required to produce 37,500

northern beef ragout meals and 29,700 oriental pasta meals.

MANAGEMENT ACCOUNTING (10904A) (Ancien exercice 4C.8) Practice session 1 | 1 de 2

Département de sciences comptables, HEC Montréal (MAJ_A2020)

Suggested exercise Exercise - Statement TP#1

for Management Cost of goods manufactured and

Accounting : 10904A Income statement

(Exercise 4Sup_C.7 revised and adapted for TP1)

6. The (2) chefs work 35 hours weekly at an hourly rate of $ 15.00. They are paid for 52

weeks. Since being hired, they have been preparing all the meals and Lucy is now only in

charge of the supervision and administration of HCI. She estimates that she spends 40 % of

her time on administrative tasks. The rest is utilized for supervising production. Lucy paid

herself a salary of $ 56,000 for the period.

7. All meals are sold at $ 6.00 / unit.

8. The monthly rent is $ 3,000 and the fire-insurance premium is $ 900 for the period. These

expenses are allocated based on the surface occupied. Electricity and gas cost $ 4,200 and

$ 3,300 respectively. Lucy estimates that 90 % of these costs are driven by kitchen

activities.

9. Furniture and kitchen accessories used during the period cost $ 2,500. Administrative and

selling expenses totaled $ 2,250.

10. $ 12,000 was spent for housekeeping services as it is essential for HCI that the kitchen

remains clean at all times. The cleaning personnel only clean the kitchen.

11. HCI bought a commercial refrigerator and an oven on May 1 st, 20X3 at a total cost of

$ 25,200. The useful life of each piece of equipment is ten years.

12. As of April 30,, 20X4, there were 2,500 northern beef ragout meals and 1,700 oriental

pasta meals that needed to be packaged. The total value of these meals is estimated at $

27,505.

13. As of April 30,, 20X4, there were 3,000 northern beef ragout meals available for sale.

There was no oriental pasta remaining in stock. HCI evaluates its inventories using FIFO.

14. The income tax rate is 30 %.

Required:

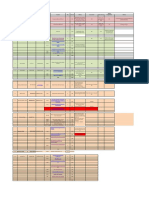

Prepare the schedule of the cost of goods manufactured and the income statement in proper form

for the financial period ended April 30, 20X4.

MANAGEMENT ACCOUNTING (10904A) (Ancien exercice 4C.8) Practice session 1 | 2 de 2

Département de sciences comptables, HEC Montréal (MAJ_A2020)

You might also like

- Wogenscky Description of The Maeseilles BlockDocument11 pagesWogenscky Description of The Maeseilles Blockcquinl2No ratings yet

- 100 Home Design IdeasDocument125 pages100 Home Design IdeasHuy Nguyen100% (3)

- Vastu For Home and OfficeDocument15 pagesVastu For Home and OfficejayjprNo ratings yet

- Process Costing ProblemsDocument9 pagesProcess Costing ProblemsAries Bautista67% (3)

- Feasibility Report: Food Canteen: Client: Mr. Toyin OlaitanDocument17 pagesFeasibility Report: Food Canteen: Client: Mr. Toyin OlaitanSeun Aderibigbe100% (6)

- AFAR-Learning Assessment 1-Cost Accounting-For PostingDocument11 pagesAFAR-Learning Assessment 1-Cost Accounting-For PostingEarl Justine Ferrer0% (1)

- Budgeting QuestionsDocument8 pagesBudgeting QuestionsumarNo ratings yet

- Safe Catering Service (Sop 06-611)Document23 pagesSafe Catering Service (Sop 06-611)aswar123100% (2)

- 2021 IKEA CatalogDocument288 pages2021 IKEA Catalogsvilen mollovNo ratings yet

- FBSDocument3 pagesFBSJay-ar rogonNo ratings yet

- 8 Process CostingDocument4 pages8 Process CostingMaria Cristina A. BarrionNo ratings yet

- Worldchefs Magazine Issue10 FINAL PDFDocument60 pagesWorldchefs Magazine Issue10 FINAL PDFRahulNo ratings yet

- Model Project ProfilesDocument125 pagesModel Project ProfilesMahesh DuraiNo ratings yet

- Woksheet in Grade 8 TLE Week 1Document4 pagesWoksheet in Grade 8 TLE Week 1Michelle Karen Llave AgtotoNo ratings yet

- Direct LabourDocument16 pagesDirect LabourUcca AmandaNo ratings yet

- Food Selection and Preparation: A Laboratory ManualFrom EverandFood Selection and Preparation: A Laboratory ManualRating: 2.5 out of 5 stars2.5/5 (2)

- Malaysia 2014: JUBM and Langdon Seah Construction Cost HandbookDocument9 pagesMalaysia 2014: JUBM and Langdon Seah Construction Cost Handbookasyreenhaikal100% (1)

- Process CostingDocument19 pagesProcess CostingmilleranNo ratings yet

- Table On Hotel RequirementsDocument9 pagesTable On Hotel RequirementsHannah SyNo ratings yet

- Production of Pili Pulp Oil 2Document14 pagesProduction of Pili Pulp Oil 2n3iviv100% (4)

- Bread Factory-5lDocument12 pagesBread Factory-5lGolden Shower தமிழ்No ratings yet

- Exercises - Process CostingDocument3 pagesExercises - Process CostingJazzyNo ratings yet

- Final Test - MA - 2021. 06. 05. New-Đã Chuyển ĐổiDocument9 pagesFinal Test - MA - 2021. 06. 05. New-Đã Chuyển ĐổiHồng Đức TrầnNo ratings yet

- Kuis Process CostingDocument1 pageKuis Process CostingA.R.A .T.ANo ratings yet

- Long Problems Process Costing PDFDocument8 pagesLong Problems Process Costing PDFPatDabzNo ratings yet

- Acc1 ADocument4 pagesAcc1 AJereek EspirituNo ratings yet

- Variances Spring 2023 RevisedDocument16 pagesVariances Spring 2023 Revisedzoyashaikh20No ratings yet

- Que 2Document3 pagesQue 2kundiarshdeepNo ratings yet

- CGS & CPR Half (Mid Term) 2021Document3 pagesCGS & CPR Half (Mid Term) 2021farukhmairaNo ratings yet

- CH 09Document3 pagesCH 09ghsoub77750% (2)

- TosinDocument13 pagesTosinSamson ArimatheaNo ratings yet

- Process Costing ProblemsDocument9 pagesProcess Costing ProblemsmilleranNo ratings yet

- Section 2-Production PlanDocument5 pagesSection 2-Production PlanMarianne Sophie AlmirolNo ratings yet

- Assignments For All Chapters Principle of Accounting IIDocument6 pagesAssignments For All Chapters Principle of Accounting IITolesa MogosNo ratings yet

- Process Extra QNSDocument4 pagesProcess Extra QNSkajaleNo ratings yet

- ABC AnalysisDocument2 pagesABC AnalysisAditya mannaNo ratings yet

- Process Costing Set B QuestionDocument4 pagesProcess Costing Set B QuestionTrixie HicaldeNo ratings yet

- Assignment 2 - Process Costing-1Document5 pagesAssignment 2 - Process Costing-1Hafsa HayatNo ratings yet

- Uts Ab 2007Document5 pagesUts Ab 2007AhmadAdiSuhendraNo ratings yet

- Review ExercisesDocument5 pagesReview ExercisesThy Tran HongNo ratings yet

- Job Order CostingDocument9 pagesJob Order CostingApple BaldemoroNo ratings yet

- Semifinal CostDocument6 pagesSemifinal CostALMA MORENANo ratings yet

- Ch6 - Coffee Flavoured MilkDocument5 pagesCh6 - Coffee Flavoured MilkMohammad Afreen RahmanNo ratings yet

- Cost Accounting ProblemsDocument9 pagesCost Accounting ProblemsLia AtilanoNo ratings yet

- Sample Action Plan 4apr2014Document9 pagesSample Action Plan 4apr2014carmelynmaglapidNo ratings yet

- PoultryDocument2 pagesPoultryHenry BilaNo ratings yet

- Animal Science Project Proposal I. Executive SummaryDocument12 pagesAnimal Science Project Proposal I. Executive SummaryRona Jane DesoyoNo ratings yet

- Inventory ManagementDocument14 pagesInventory ManagementAmzelle Diego LaspiñasNo ratings yet

- Budget and Budgetary ControlDocument7 pagesBudget and Budgetary ControlAkash GuptaNo ratings yet

- Local Media2422589097727665216 074325Document7 pagesLocal Media2422589097727665216 074325Nashebah A. BatuganNo ratings yet

- FIN202 Group AssignmentDocument14 pagesFIN202 Group Assignmentmai bannNo ratings yet

- Y 5 A 1 BX, Where Y Denotes Production Cost and X Denotes Quantity of Sausage Produced.)Document3 pagesY 5 A 1 BX, Where Y Denotes Production Cost and X Denotes Quantity of Sausage Produced.)muhammad saad ARIFNo ratings yet

- Day 13 Chap 8 Rev. FI5 Ex PRDocument13 pagesDay 13 Chap 8 Rev. FI5 Ex PRSubash ShresthaNo ratings yet

- BS June2016 PDFDocument17 pagesBS June2016 PDFSaif ali KhanNo ratings yet

- Acctg201 QuizDocument4 pagesAcctg201 QuizJehny AbelgasNo ratings yet

- 8408 Cost Accounting Past Paper 2019Document23 pages8408 Cost Accounting Past Paper 2019Fazila FaheemNo ratings yet

- Cost ClassificationDocument2 pagesCost ClassificationRasagnya reddyNo ratings yet

- Cost Accounting Worksheet Chap 3Document5 pagesCost Accounting Worksheet Chap 3Muhammad UsmanNo ratings yet

- Afar ProcessDocument2 pagesAfar ProcessRyan Julius RullanNo ratings yet

- Weighted and FIFO Costing - Practice ProblemsDocument9 pagesWeighted and FIFO Costing - Practice ProblemsEki OmallaoNo ratings yet

- Project Profile On Idli Dosa MixDocument8 pagesProject Profile On Idli Dosa MixbillyNo ratings yet

- Adobe Scan Feb 09, 2024Document5 pagesAdobe Scan Feb 09, 2024Fundikira HarunaNo ratings yet

- Project Report For Dairy Farm With Fifty Murrah Buffaloes: This Project Report Is Based On Following AssumptionsDocument9 pagesProject Report For Dairy Farm With Fifty Murrah Buffaloes: This Project Report Is Based On Following AssumptionsJillam ParidaNo ratings yet

- Acc2233 Hand in Assignment 7 Problem One Absorption and Variable Costing CVP Analysis HawkesburyDocument4 pagesAcc2233 Hand in Assignment 7 Problem One Absorption and Variable Costing CVP Analysis HawkesburyDoreenNo ratings yet

- BUDGETINGDocument3 pagesBUDGETINGcharlyneabay8No ratings yet

- 2 5370806713307890464 PDFDocument5 pages2 5370806713307890464 PDFMekuriawAbebawNo ratings yet

- Rural Livestock AdministrationFrom EverandRural Livestock AdministrationNo ratings yet

- Increasing Access to Clean Cooking in the Philippines: Challenges and ProspectsFrom EverandIncreasing Access to Clean Cooking in the Philippines: Challenges and ProspectsNo ratings yet

- Restaurant For B4EDocument3 pagesRestaurant For B4EKAINAT TARIQNo ratings yet

- UTEC Training Manual - 24062022Document185 pagesUTEC Training Manual - 24062022mani narayananNo ratings yet

- Cairnhill Nine FactsheetDocument7 pagesCairnhill Nine Factsheetapi-276519044No ratings yet

- Buying Guide 2018: Appliances - EU - Cover - Indd 2 22/06/2017 12:35:39Document100 pagesBuying Guide 2018: Appliances - EU - Cover - Indd 2 22/06/2017 12:35:39Thomas PreeceNo ratings yet

- 1.4 Adaptable Housing Accommodation Schedule - Rev 2020Document19 pages1.4 Adaptable Housing Accommodation Schedule - Rev 2020dawitgggNo ratings yet

- Specs SampleDocument14 pagesSpecs SampleAThaddeusAntonioNo ratings yet

- Zanussi Catalogue 2018 PDFDocument70 pagesZanussi Catalogue 2018 PDFАлина ВладиславовнаNo ratings yet

- Ecom Order 220620 PDFDocument1 pageEcom Order 220620 PDFvishalNo ratings yet

- Module On Banquet and CateringDocument169 pagesModule On Banquet and Cateringbarabas skyNo ratings yet

- Abbattitori Web Eng-1Document16 pagesAbbattitori Web Eng-1Alexutza StanNo ratings yet

- Butterfly SS Products Catalogue-NEWDocument31 pagesButterfly SS Products Catalogue-NEWTrade EasyNo ratings yet

- VW 2009 BulthaupDocument9 pagesVW 2009 BulthaupthislandNo ratings yet

- HIN CargoTech Collection BookDocument39 pagesHIN CargoTech Collection BookArun Chand C VNo ratings yet

- Malvern Property News 18/02/2011Document26 pagesMalvern Property News 18/02/2011NQDMSNo ratings yet

- TLE Cookery7 8 Week1 2 PDFDocument3 pagesTLE Cookery7 8 Week1 2 PDFdhyovhein mhalaepaedNo ratings yet

- A. Reading: Read The Text CarefullyDocument2 pagesA. Reading: Read The Text CarefullyJohn Leader PandiaNo ratings yet

- Charaf Hamdouni Resume21Document7 pagesCharaf Hamdouni Resume21CharafNo ratings yet

- Agenda and SpeakersDocument4 pagesAgenda and SpeakersHari SeshasayeeNo ratings yet

- MOS Civil EngineeringDocument19 pagesMOS Civil EngineeringSahar GulNo ratings yet

- Stock Qty Model Wise WSMBRD: Waseem ElectronicsDocument1 pageStock Qty Model Wise WSMBRD: Waseem ElectronicsWaseem ElectronicsNo ratings yet