Professional Documents

Culture Documents

945 - Jeevan Umang

Uploaded by

Saro SaravananOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

945 - Jeevan Umang

Uploaded by

Saro SaravananCopyright:

Available Formats

945 - JEEVAN UMANG

Jeevan Umang is a non-linked, with-profits whole life assurance plan. Survival

benefits from End of Premium Paying Term will be payable.

A Peculiar Asset Plan Presentation for, Mr/Mrs.

Benefits :-

• On Survival to the end of the policy term, Basic Sum Assured along with simple Bonus and

FinalAdditional Bonus, if any shall be payable.

• On Death During Policy Term Sum Assured on Death Vested simple reversionary Bonus

Plus FAB if any.

Grace Period To Pay Premium :-

• 31 or 30 days (depends on calendar month) for YLY, HLY and QLY payment modes.

• 15 days grace period for MLY Mode of Premium Payment.

Surrender Option and Loan Facility:-

• The policy can be surrendered (closed) only after 3 full years payment of premiums.

Eligibility Conditions :-

• Min Age: 90 days, Max: (55 years for PPT - 15),(50 years for PPT - 20),

• (45 years for PPT - 25),(40 years for PPT - 30).

• Term : 100 - Age at Entry, Maturity Age: 100 years.

Note :This PDF generated by Stickynote Planner App. Page No

Plan Details :-

Name of the Policy Holder Mr / Mrs :

Date Of Birth :

Age : 44

Term / Premium Paying Term (PPT): 55 / 20

Sum Assured by the Policy Holder : 20,00,000

Tax Benefit : 30%

Cash Return :-

Sum Assured on Maturity

Rs.20,00,000

Bonus Amount added with Maturity

Rs.1,59,80,000

Maturity return.

Rs.1,79,80,000

Survival Benefits :-

8% of SA till Maturity/Death of policy holder

Rs.1,60,000

Total Premium Paid :-

Total Premium Paid in 20 Years

Rs.22,20,481

Income Tax Saved :-

Tax Saved on First Year Rs.34,003 and Tax Saved on Next Year Rs.33,271

Rs.6,66,152

Note :This PDF generated by Stickynote Planner App. Page No

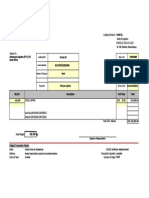

Premium - First Year (GST @ 4.5 %) :-

Mode Premium Tax Total

YLY 1,08,462 4,881 1,13,343

HLY 54,790 2,466 57,256

QLY 27,675 1,245 28,920

MLY 9,225 415 9,640

Premium - Next Year (GST @ 2.25 %) :-

Mode Premium Tax Total

YLY 1,08,462 2,440 1,10,902

HLY 54,790 1,233 56,023

QLY 27,675 623 28,298

MLY 9,225 208 9,433

Death Sum Assured :-

Sum Assured on Death Will be

Rs.20,00,000

Medical Reports :-

Requirements

Nil

Note :This PDF generated by Stickynote Planner App. Page No

Cash Flow Table :-

Year Age Premium Yearly Tax Saved

2022 44 1,13,343 34,003

2023 45 1,10,902 33,271

2024 46 1,10,902 33,271

2025 47 1,10,902 33,271

2026 48 1,10,902 33,271

2027 49 1,10,902 33,271

2028 50 1,10,902 33,271

2029 51 1,10,902 33,271

2030 52 1,10,902 33,271

2031 53 1,10,902 33,271

2032 54 1,10,902 33,271

2033 55 1,10,902 33,271

2034 56 1,10,902 33,271

2035 57 1,10,902 33,271

2036 58 1,10,902 33,271

2037 59 1,10,902 33,271

2038 60 1,10,902 33,271

2039 61 1,10,902 33,271

2040 62 1,10,902 33,271

2041 63 1,10,902 33,271

2078 100 Returns 1,79,80,000

Note :This PDF generated by Stickynote Planner App. Page No

Documents Required :-

Documents Accepted Aadhar Card / Ration Card / Election Card / Govt Id card

Pan Card / Driving Licence / School or College Certificate.

Compulsory Documents 2 Photos +(Address and Age) Proof +

Income Tax Returns(Optional)

Mr/Mrs. Thirupathi M Phone : 9443421032 .

Insurance Advisor Email :

mf.thirupathi@gmail.com .

Disclaimer :-

Insurance is the subject matter of solicitation. These documents are only for the presentation

purpose. " +

"The actual results may vary based on the future performance by the policy holder. " +

"The illustration given by the presenter or insurer does not guarantee the benefits and

returns given in the above presentation. " +

Note :This PDF generated by Stickynote Planner App. Page No

"For more queries and terms and conditions cross check with your Insurance company.

Note :This PDF generated by Stickynote Planner App. Page No

You might also like

- Money & Law of Attraction - Cards (2009)Document60 pagesMoney & Law of Attraction - Cards (2009)sandyhexe95% (20)

- Sample University Deferment Letter PDFDocument1 pageSample University Deferment Letter PDFRishabh81% (27)

- Taxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Document15 pagesTaxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Harold Dan AcebedoNo ratings yet

- Exclusive License for "This ain't what you wantDocument2 pagesExclusive License for "This ain't what you wantGavin PaulNo ratings yet

- 09 D.M. Consunji vs. Court of AppealsDocument2 pages09 D.M. Consunji vs. Court of AppealsKristabelleCapaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- TAXATION EXAM REVIEWDocument16 pagesTAXATION EXAM REVIEWMOTC INTERNAL AUDIT SECTIONNo ratings yet

- SalaryDocument4 pagesSalarynitishsparxNo ratings yet

- ROOS INDUSTRIAL CONSTRUCTION Vs NLRCDocument6 pagesROOS INDUSTRIAL CONSTRUCTION Vs NLRCManuel DancelNo ratings yet

- Combi C2I & Sanchay - BrochureDocument6 pagesCombi C2I & Sanchay - BrochurePiyush100% (2)

- PHILSECO not a public utility despite shipyard operationsDocument4 pagesPHILSECO not a public utility despite shipyard operationsJul A.No ratings yet

- Special Power of Attorney: Attorneys-in-FactDocument1 pageSpecial Power of Attorney: Attorneys-in-FactElle Woods100% (1)

- PRTC 1stpb - 05.22 Sol TaxDocument21 pagesPRTC 1stpb - 05.22 Sol TaxCiatto SpotifyNo ratings yet

- JLR bond valuation and refinancing strategyDocument4 pagesJLR bond valuation and refinancing strategyDante Gustilo0% (2)

- Agreement On Delivery of Cash Funds For Investmen Transfer Via Ip/Ip Code ServerDocument13 pagesAgreement On Delivery of Cash Funds For Investmen Transfer Via Ip/Ip Code Serverpsv motors80% (10)

- HGC vs. Manpalaz (January 2021) - Civil Law Contract To Sell PD 957Document25 pagesHGC vs. Manpalaz (January 2021) - Civil Law Contract To Sell PD 957jansen nacarNo ratings yet

- PSPR210116124918Document5 pagesPSPR210116124918Manikandan ManoharNo ratings yet

- ae573e3d-8d8b-4612-8024-d3ccccbe3906Document3 pagesae573e3d-8d8b-4612-8024-d3ccccbe3906Vineet ShuklaNo ratings yet

- Deposit Insurance System in BangladeshDocument2 pagesDeposit Insurance System in BangladeshSohel RanaNo ratings yet

- Single Premium Endowment Plan Licindiagov - inDocument5 pagesSingle Premium Endowment Plan Licindiagov - inSampiNo ratings yet

- Jeevan Rekha Plan - Money Back Life InsuranceDocument4 pagesJeevan Rekha Plan - Money Back Life InsuranceRamu448No ratings yet

- Calculations for bond premium, discount, interest expense and carrying amountDocument9 pagesCalculations for bond premium, discount, interest expense and carrying amountClaire BarbaNo ratings yet

- Jyotika: Presented By: Senior Insurance AdvisorDocument8 pagesJyotika: Presented By: Senior Insurance AdvisorOjasvini SharmaNo ratings yet

- Combination of Umang & AnandDocument3 pagesCombination of Umang & AnandsatyakamNo ratings yet

- Rajasekar M 13228: ConfidentialDocument2 pagesRajasekar M 13228: Confidentialvijaykataria1989No ratings yet

- PremCal - 18-06-2020 184836 PMDocument7 pagesPremCal - 18-06-2020 184836 PMLeenaNo ratings yet

- IQ Coop Loan Applcation - Non Member - New Loan Form (Revised)Document6 pagesIQ Coop Loan Applcation - Non Member - New Loan Form (Revised)Cathlyn PalceNo ratings yet

- Acharya Electronics Bhakundebesi 07, Namobuddha Kavre Nepal Project Feasibility ReportDocument9 pagesAcharya Electronics Bhakundebesi 07, Namobuddha Kavre Nepal Project Feasibility ReportRamHari AdhikariNo ratings yet

- City of Fort St. John - Pandemic Effect On The Operating Budget, March 2020Document4 pagesCity of Fort St. John - Pandemic Effect On The Operating Budget, March 2020AlaskaHighwayNewsNo ratings yet

- KFD New20012024140359061 E35Document17 pagesKFD New20012024140359061 E35msaurabh9142No ratings yet

- 02 FAR02-answersDocument18 pages02 FAR02-answersBea GarciaNo ratings yet

- MA Submit-3Document19 pagesMA Submit-3KaiQiNo ratings yet

- Intermediate Accounting Course Investment in Bonds and Shifting to Pharmaceutical StocksDocument4 pagesIntermediate Accounting Course Investment in Bonds and Shifting to Pharmaceutical StocksAntor Podder 1721325No ratings yet

- Pratik Project Report (Bank OD)Document6 pagesPratik Project Report (Bank OD)Raghu RangrejNo ratings yet

- IllustrationDocument2 pagesIllustrationDeepakNo ratings yet

- PRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressDocument16 pagesPRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressNovemae CollamatNo ratings yet

- Mindtree Shareholders Report Q2 FY23Document6 pagesMindtree Shareholders Report Q2 FY23Punith DGNo ratings yet

- IllustrationDocument2 pagesIllustrationGanesh Raaja NatarajanNo ratings yet

- PSPR230523221442Document8 pagesPSPR230523221442Sudeep MandalNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- Finance ProjectDocument9 pagesFinance ProjectToheed TalaNo ratings yet

- Positivo Tecnologia S.ADocument82 pagesPositivo Tecnologia S.ALeonardo LimaNo ratings yet

- Profit & Loss A/c Projected Profit and Loss Account For The 3 YearsDocument3 pagesProfit & Loss A/c Projected Profit and Loss Account For The 3 Yearsforty oneNo ratings yet

- Tax Final Exam Practice Material - CompressDocument10 pagesTax Final Exam Practice Material - CompressNovemae CollamatNo ratings yet

- Benefit Illustration LIC's Amrit BaalDocument3 pagesBenefit Illustration LIC's Amrit BaalVENKATESHNo ratings yet

- Attock Refinery 2019 Financial Statement AnalysisDocument13 pagesAttock Refinery 2019 Financial Statement AnalysisVishal MalhiNo ratings yet

- Anikit Pradhan - 11Document4 pagesAnikit Pradhan - 11Anurag pradhanNo ratings yet

- Wilmington NC City Council Ordinance To Increase Employee CompensationDocument5 pagesWilmington NC City Council Ordinance To Increase Employee CompensationJamie BouletNo ratings yet

- Jamuna Bank Limited: Report Name: Income Expenditure Comparison ReportDocument35 pagesJamuna Bank Limited: Report Name: Income Expenditure Comparison Reportarman_277276271No ratings yet

- HDFC Life Half Yearly Unit StatementDocument3 pagesHDFC Life Half Yearly Unit StatementGURUMOORTHY PNo ratings yet

- MS Brothers Super Rice MillDocument9 pagesMS Brothers Super Rice MillMasud Ahmed khan100% (1)

- 08 Bond InvestmentDocument3 pages08 Bond InvestmentAllegria Alamo100% (1)

- WBD 1Q23 Trending Schedule Final 05 04 23Document12 pagesWBD 1Q23 Trending Schedule Final 05 04 23Stephano Gomes GabrielNo ratings yet

- FM - MA-2022 - Suggested - AnswersDocument10 pagesFM - MA-2022 - Suggested - AnswersBijoy BasakNo ratings yet

- SESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012Document38 pagesSESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012roalan1No ratings yet

- Working Capital ExerciseDocument2 pagesWorking Capital ExerciseKintali VinodNo ratings yet

- Gajala Jamir's Full and Final Settlement DetailsDocument3 pagesGajala Jamir's Full and Final Settlement Detailsgajala jamirNo ratings yet

- Project Report 5Document27 pagesProject Report 5adwait kulkarniNo ratings yet

- Combo IllustrationDocument5 pagesCombo IllustrationInvest Aaj for kal Life insuranceNo ratings yet

- Accounting 22 - Final Exam - 2023Document9 pagesAccounting 22 - Final Exam - 2023LaurenNo ratings yet

- Business Plan CHPTR 1Document10 pagesBusiness Plan CHPTR 1Deepali SaxenaNo ratings yet

- Chandak Insurance IllustrationDocument5 pagesChandak Insurance IllustrationMohit DhakaNo ratings yet

- Mr. Bhatta: An Innovative Retirement Solution ForDocument8 pagesMr. Bhatta: An Innovative Retirement Solution ForTapan DuttaNo ratings yet

- UAW Contract Summary With GMDocument20 pagesUAW Contract Summary With GMWXYZ-TV Channel 7 Detroit100% (7)

- Jamil InsuranceDocument5 pagesJamil InsuranceAli HamzaNo ratings yet

- Ea MilkslushieDocument124 pagesEa MilkslushieFind DeviceNo ratings yet

- Systematic Withdrawal Plan (SWP) : Portfolio 1 (Equity Mutual Fund)Document4 pagesSystematic Withdrawal Plan (SWP) : Portfolio 1 (Equity Mutual Fund)KevalNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Nurse AgreementDocument5 pagesNurse AgreementAnjelyn BlanciaNo ratings yet

- Fuller Loch CovenantsDocument45 pagesFuller Loch CovenantsJeff BoutwellNo ratings yet

- Dasar Penilaian Bumi Dan Bangunan Dibawah Harga Pasar (Studi Di Dipenda Kabupaten Mojokerto)Document25 pagesDasar Penilaian Bumi Dan Bangunan Dibawah Harga Pasar (Studi Di Dipenda Kabupaten Mojokerto)Deni Dwi PutraNo ratings yet

- Tender33 210915 PDFDocument10 pagesTender33 210915 PDFShaan AmanNo ratings yet

- CIVICS-80 MarksDocument3 pagesCIVICS-80 MarksDaksh MandaveNo ratings yet

- Declaration of Secrecy & Independence: DTTL Member FirmDocument2 pagesDeclaration of Secrecy & Independence: DTTL Member FirmJOhnNo ratings yet

- Relationship between corrective and distributive justiceDocument13 pagesRelationship between corrective and distributive justiceShashank UpadhyayNo ratings yet

- 130 UDocument2 pages130 UNoelleNo ratings yet

- SK Basketball and Volleyball Rules AndregulationsDocument4 pagesSK Basketball and Volleyball Rules Andregulationsnikko fabriaNo ratings yet

- WebDocument134 pagesWebAmase Kis Ser100% (1)

- MCA Forms ListDocument4 pagesMCA Forms ListanvapNo ratings yet

- 1782052, Jyot Motwani, Environmental LawDocument4 pages1782052, Jyot Motwani, Environmental LawJyot MotwaniNo ratings yet

- McKee Tort NoticeDocument9 pagesMcKee Tort NoticeMegan BantaNo ratings yet

- Property and Supply Management in The Local GovernDocument2 pagesProperty and Supply Management in The Local GovernMaria Angelica PanongNo ratings yet

- Mirasol V DPWHDocument2 pagesMirasol V DPWHJeffrey Ahmed SampulnaNo ratings yet

- Alien's Right to Own Residential LandDocument2 pagesAlien's Right to Own Residential LandSab dela RosaNo ratings yet

- Commercial Invoice TitleDocument1 pageCommercial Invoice Titlealsone07No ratings yet

- Accident-Incident Investigation - HSE-AINI-01Document9 pagesAccident-Incident Investigation - HSE-AINI-01Syed Zahid AnwarNo ratings yet

- Vivifi India Finance PVT LTDDocument5 pagesVivifi India Finance PVT LTDRamesh yaraboluNo ratings yet

- I-Iib (E) 2015 11 13Document33 pagesI-Iib (E) 2015 11 13Manimekala ViswanathanNo ratings yet

- DSWD SB GF 097 - Rev 00 - Application Form For Accreditation of SWDDocument8 pagesDSWD SB GF 097 - Rev 00 - Application Form For Accreditation of SWDtagamjodielynNo ratings yet