Professional Documents

Culture Documents

Illustration

Uploaded by

DeepakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration

Uploaded by

DeepakCopyright:

Available Formats

25-05-2022

Quote No : qb602ly8hwcsf

Benefit Illustration for HDFC Life Pension Guaranteed Plan - Enhanced

A single premium non-participating and non linked annuity policy

This illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Pension Guaranteed Plan.

PERSONAL DETAILS

Annuitant Type Name Age Gender

Primary Annuitant A 59 M

Age is taken as on last birthday

ANNUITY AND BENEFIT DETAILS

Date Of Commencement: 25-May-2022

Plan Option: Deferred Life Annuity ROPP

Deferment Period: 5 year(s)

Premium Payment Term: Single

Purchase Price(excluding taxes): 29,46,955

GST Rate: 1.8%

Taxes As Applicable#: 53,045

Purchase Price(including taxes): 30,00,000

Annuity Payable: 2,45,000

Frequency: Annual

First Annuity Date: 25-May-2028

"Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers

guaranteed benefits then these will be clearly marked "guaranteed" in the illustration table on this page. If your policy offers variable benefits then the illustrations on this page will

show two different rates of assumed future investment returns, of 8% p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits

of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance."

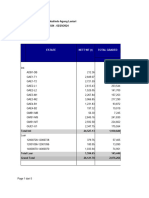

Death and Surrender benefits

Benefits after the Guaranteed Non Guaranteed

Guaranteed Death Total Surrender Benefit

completion of Policy Surrender Benefit Surrender Benefit

Benefit (A+B)

Year (A) (B)

1 32,41,651 22,10,216 0 22,10,216

2 34,36,956 22,10,216 0 22,10,216

3 36,81,956 22,10,216 95,899 23,06,115

4 39,26,956 26,52,260 0 26,52,260

5 41,71,957 26,52,260 87,503 27,39,763

6 39,26,956 26,52,260 2,08,215 28,60,475

7 36,81,956 24,07,259 4,55,256 28,62,515

8 34,36,956 21,62,259 6,99,164 28,61,423

9 32,41,651 19,17,258 9,46,996 28,64,254

10 32,41,651 16,72,258 11,91,696 28,63,954

11 32,41,651 14,27,258 14,39,730 28,66,988

12 32,41,651 11,82,257 16,84,044 28,66,301

13 32,41,651 9,37,257 19,31,985 28,69,242

14 32,41,651 6,92,257 21,77,771 28,70,028

15 32,41,651 4,47,256 24,24,442 28,71,698

16 32,41,651 2,02,256 26,71,407 28,73,663

17 32,41,651 0 28,73,473 28,73,473

18 32,41,651 0 28,75,732 28,75,732

19 32,41,651 0 28,78,287 28,78,287

20 32,41,651 0 28,78,096 28,78,096

21 32,41,651 0 28,80,356 28,80,356

22 32,41,651 0 28,82,321 28,82,321

23 32,41,651 0 28,81,246 28,81,246

24 32,41,651 0 28,85,072 28,85,072

25 32,41,651 0 28,85,563 28,85,563

26 32,41,651 0 28,85,760 28,85,760

27 32,41,651 0 28,87,817 28,87,817

28 32,41,651 0 28,88,990 28,88,990

29 32,41,651 0 28,89,574 28,89,574

30 32,41,651 0 28,92,018 28,92,018

31 32,41,651 0 28,93,579 28,93,579

32 32,41,651 0 28,94,550 28,94,550

33 32,41,651 0 28,94,637 28,94,637

Benefits after the Guaranteed Non Guaranteed

Guaranteed Death Total Surrender Benefit

completion of Policy Surrender Benefit Surrender Benefit

Benefit (A+B)

Year (A) (B)

34 32,41,651 0 28,96,289 28,96,289

35 32,41,651 0 28,97,353 28,97,353

36 32,41,651 0 28,97,237 28,97,237

37 32,41,651 0 28,98,983 28,98,983

38 32,41,651 0 29,00,139 29,00,139

39 32,41,651 0 29,00,116 29,00,116

40 32,41,651 0 29,01,953 29,01,953

41 32,41,651 0 29,03,202 29,03,202

Upon the payment of death or surrender benefit, the policy terminates and no further benefit becomes payable.

Depending on the prevailing market conditions, the Non-Guaranteed surrender value may be revised.

All amounts are in Indian Rupees and are rounded to the nearest whole number.

# The Taxes and other levies as applicable

TERMS AND CONDITIONS

1. The Annuity or Purchase Price provided above is a provisional amount based on the annuity rates available currently. The Annuity or Purchase Price will be calculated based on

the Annuity Rates applicable as on the date of purchase of annuity.

2. This plan doesn't have any Maturity/vesting benefit.

3. All benefits under this Product are guaranteed.

4. For more details of the above benefits, please read the sales literature provided.

5. Taxes and levies as applicable will be charged and are payable by you by any method including by levy of an additional monetary amount in addition to purchase price and/or

charges.

6. This quote is valid till 01-Jun-2022

7. UIN for HDFC Life Pension Guaranteed Plan - 101N118V10

The values shown are for illustration only.

If you would like help to understand this illustration, please speak to your Financial Consultant.

I , have explained the premiums charges and benefits under the product fully to the I A ,having received the information with respect to the above, have understood the

prospect / policy holder. above statement before entering into the contract.

Place:

Date: Signature of Agent /Intermediary / Official Date: Signature of Prospect / Policyholder

Channel Name : Direct - Online

Note: Kindly note that name of the company has changed from "HDFC Standard Life Insurance Company Limited" to "HDFC Life Insurance Company Limited".

You might also like

- Illustration - 2023-09-15T140935.862Document3 pagesIllustration - 2023-09-15T140935.862Invest Aaj for kal Life insuranceNo ratings yet

- Single Premium Endowment Plan Licindiagov - inDocument5 pagesSingle Premium Endowment Plan Licindiagov - inSampiNo ratings yet

- Jyotika: Presented By: Senior Insurance AdvisorDocument8 pagesJyotika: Presented By: Senior Insurance AdvisorOjasvini SharmaNo ratings yet

- Systematic Withdrawal Plan (SWP) : Portfolio 1 (Equity Mutual Fund)Document4 pagesSystematic Withdrawal Plan (SWP) : Portfolio 1 (Equity Mutual Fund)KevalNo ratings yet

- Jeevan Labh Plan Licindiagov - inDocument5 pagesJeevan Labh Plan Licindiagov - inSampiNo ratings yet

- Aviva Life Insurance Company India Limited Premium QuotationDocument3 pagesAviva Life Insurance Company India Limited Premium QuotationMohan BNNo ratings yet

- PSPR210116124918Document5 pagesPSPR210116124918Manikandan ManoharNo ratings yet

- GTRB CrestDocument2 pagesGTRB CrestRaju JainNo ratings yet

- PSPR230523221442Document8 pagesPSPR230523221442Sudeep MandalNo ratings yet

- Plan 914 RR 20240218081935Document4 pagesPlan 914 RR 20240218081935Battleground CommandosNo ratings yet

- ae573e3d-8d8b-4612-8024-d3ccccbe3906Document3 pagesae573e3d-8d8b-4612-8024-d3ccccbe3906Vineet ShuklaNo ratings yet

- FY21 SchedulesDocument8 pagesFY21 Scheduleskumar sivaNo ratings yet

- Upr 2228669Document4 pagesUpr 2228669sammanihardware171No ratings yet

- Illustration: End of Pol Year Attained Age Annual PremiumDocument1 pageIllustration: End of Pol Year Attained Age Annual PremiumRon CatalanNo ratings yet

- 945 - Jeevan UmangDocument6 pages945 - Jeevan UmangSaro SaravananNo ratings yet

- ProjectionDocument3 pagesProjectionPrabhu SNo ratings yet

- AlibabaDocument101 pagesAlibabaSHRESTH NEHRANo ratings yet

- Jeevan Lakshay Plan Licindiagov - inDocument6 pagesJeevan Lakshay Plan Licindiagov - inSampiNo ratings yet

- S. S. Crushers: Particulars Amount Cost of The ProjectDocument11 pagesS. S. Crushers: Particulars Amount Cost of The Projectpatan nazeerNo ratings yet

- Invest For Just 5 Years and Keep Getting A Regular Income in Hand To Meet Your GoalsDocument2 pagesInvest For Just 5 Years and Keep Getting A Regular Income in Hand To Meet Your Goalsramanan_nNo ratings yet

- Reliance Bajaj Finance: Years Closing Price Returns Years Closing Price ReturnsDocument16 pagesReliance Bajaj Finance: Years Closing Price Returns Years Closing Price Returnsaditi anandNo ratings yet

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975No ratings yet

- Discover Funds To Grow My Wealth 23 Jan 2024 1554Document6 pagesDiscover Funds To Grow My Wealth 23 Jan 2024 1554sowntharyagbmNo ratings yet

- (Only Obtainable When You Die) : by Age 75 VUL Btid Self-InsuranceDocument10 pages(Only Obtainable When You Die) : by Age 75 VUL Btid Self-Insurancemichaila martinezNo ratings yet

- TM Public School Jail Road OraiDocument10 pagesTM Public School Jail Road OraiCA Shubham PatelNo ratings yet

- IA2 Exercise 8Document8 pagesIA2 Exercise 8Reign TambasacanNo ratings yet

- Jeevan Labh Jeevan Labh: Mr. Thangeswaran No: 318 Mr. Thangeswaran No: 318Document2 pagesJeevan Labh Jeevan Labh: Mr. Thangeswaran No: 318 Mr. Thangeswaran No: 318Carl JhonsonNo ratings yet

- Output Financial ManagemntDocument8 pagesOutput Financial ManagemntEmzNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisMohammad Abid MiahNo ratings yet

- Financial Report Analysis - HCL TechDocument31 pagesFinancial Report Analysis - HCL TechRakshana GopinathNo ratings yet

- OT Assignment Subham 2Document19 pagesOT Assignment Subham 2S SubhamNo ratings yet

- IllustrationDocument2 pagesIllustrationSakshi RaghuvanshiNo ratings yet

- Greenko Dutch B.V. (Restricted Group) : (All Amounts in US Dollars Unless Otherwise Stated)Document2 pagesGreenko Dutch B.V. (Restricted Group) : (All Amounts in US Dollars Unless Otherwise Stated)hNo ratings yet

- Ea MilkslushieDocument124 pagesEa MilkslushieFind DeviceNo ratings yet

- Contoh Gabungan Tugas A Kelas ZZZDocument189 pagesContoh Gabungan Tugas A Kelas ZZZMariaGeovana PingNo ratings yet

- Provisional Financial - Mar 2021Document8 pagesProvisional Financial - Mar 2021Anamika NandiNo ratings yet

- Proposal: Dzari Hasbullah Bin AB WahabDocument6 pagesProposal: Dzari Hasbullah Bin AB WahabDzari Hasbullah Ab wahabNo ratings yet

- Home Depot DCFDocument16 pagesHome Depot DCFAntoni BallaunNo ratings yet

- 3 Statement Model - Blank TemplateDocument3 pages3 Statement Model - Blank Templated11210175No ratings yet

- Life Insurance: This Shall Form A Part of The Policy ContractDocument3 pagesLife Insurance: This Shall Form A Part of The Policy ContractgoluNo ratings yet

- Member Statement - 2022: Your Personal DetailsDocument2 pagesMember Statement - 2022: Your Personal Detailschii1000jhayNo ratings yet

- Senthil Kumar MR IncomeShield 25.04.2019 19.23.38Document3 pagesSenthil Kumar MR IncomeShield 25.04.2019 19.23.38nataraj maxNo ratings yet

- LIC AgentDocument5 pagesLIC AgentHarish ChandNo ratings yet

- New India Floater Mediclaim Policy Premium ChartDocument2 pagesNew India Floater Mediclaim Policy Premium ChartSnehaAnilSurveNo ratings yet

- WB Grading Summary ReportDocument5 pagesWB Grading Summary ReportrohmanNo ratings yet

- Financial Statements - TATA - MotorsDocument5 pagesFinancial Statements - TATA - MotorsKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesDocument2 pagesData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesKIranNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- Chapter 3-Book ExercisesDocument2 pagesChapter 3-Book ExercisesRita Angela DeLeonNo ratings yet

- Distribution of Active Companies With Respect To Paidup CapitalDocument5 pagesDistribution of Active Companies With Respect To Paidup CapitaldipmalaNo ratings yet

- Small Cap FundsDocument91 pagesSmall Cap FundsArmstrong CapitalNo ratings yet

- Book 2Document2 pagesBook 2Bharathi 3280No ratings yet

- LIC's Dhan Rekha (Plan No. 863) : Benefit IllustrationDocument3 pagesLIC's Dhan Rekha (Plan No. 863) : Benefit Illustrationsb RogerdatNo ratings yet

- Aggressive Growth Funds 29 Aug 2020 1922Document6 pagesAggressive Growth Funds 29 Aug 2020 1922Ankit GoelNo ratings yet

- Tata Steel: PrintDocument1 pageTata Steel: PrintSEHWAG MATHAVANNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- 08 - Chapter 4Document33 pages08 - Chapter 4Vinay Kumar KumarNo ratings yet

- Partnership (Hand Out)Document43 pagesPartnership (Hand Out)Roy Kenneth LingatNo ratings yet

- Hernando R. Penalosa vs. Severino SantosDocument2 pagesHernando R. Penalosa vs. Severino SantosAnonymous NqaBAyNo ratings yet

- Labor Law 08,15,16 Bar Q&ADocument46 pagesLabor Law 08,15,16 Bar Q&ARoy DalNo ratings yet

- Monthly Statement ConsultantDocument2 pagesMonthly Statement ConsultantPRBFRMP DWRINo ratings yet

- MEMORANDUM OF AGREEMENT - Arman BabasaDocument4 pagesMEMORANDUM OF AGREEMENT - Arman BabasaHoward UntalanNo ratings yet

- SALES Obligation of The Buyer and Action For BreachDocument26 pagesSALES Obligation of The Buyer and Action For Breachmich3300No ratings yet

- Wyoming LLC StatutesDocument34 pagesWyoming LLC Statutespetsagree100% (2)

- Commentary On UccDocument27 pagesCommentary On UccncwazzyNo ratings yet

- ContractDocument20 pagesContractAbhishek KumarNo ratings yet

- Contracts UCC SalesDocument89 pagesContracts UCC Salesalbtros100% (6)

- UntitledDocument4 pagesUntitledmarsonhardware staffNo ratings yet

- FIDIC Model Ugovora o Pruzanju UslugaDocument50 pagesFIDIC Model Ugovora o Pruzanju UslugaJelena Peric100% (7)

- Agency and Partnership Syllabus-Prof PonferradaDocument9 pagesAgency and Partnership Syllabus-Prof PonferradaangelomoragaNo ratings yet

- Imb 543 Wses Data AssignmentDocument312 pagesImb 543 Wses Data AssignmentMithun SNo ratings yet

- Truth in Lending Act Case LawDocument5 pagesTruth in Lending Act Case Lawdbush2778100% (1)

- Supplier AgreementDocument4 pagesSupplier AgreementLINA JACOSALEMNo ratings yet

- d2xx Jar LicenseDocument5 pagesd2xx Jar LicenseGabriel NinaNo ratings yet

- Film Scoring ContractDocument10 pagesFilm Scoring ContractJames Ryan CeballosNo ratings yet

- Business Associate AgreementDocument11 pagesBusiness Associate AgreementRahul KumarNo ratings yet

- TT 253Document4 pagesTT 253Saleh AkramNo ratings yet

- Guaranty Atty Uribe Chavez MarianDocument5 pagesGuaranty Atty Uribe Chavez MarianKenneth AbuanNo ratings yet

- Credit Operational Manual PDFDocument183 pagesCredit Operational Manual PDFAwais Alvi93% (14)

- KCA Deutag Supplier Terms and Conditions (Short Form)Document22 pagesKCA Deutag Supplier Terms and Conditions (Short Form)g5nbNo ratings yet

- BLR 211 Final ExamDocument19 pagesBLR 211 Final ExammercyvienhoNo ratings yet

- Enaki Sale AgreementDocument24 pagesEnaki Sale AgreementmorreyNo ratings yet

- Sterling Agreement in DerbyDocument10 pagesSterling Agreement in DerbyThe Valley IndyNo ratings yet

- Form GST REG-06: Government of IndiaDocument5 pagesForm GST REG-06: Government of IndiaVANAJAKSHI SNo ratings yet

- Understanding and Using Letters of Credit, Part IDocument6 pagesUnderstanding and Using Letters of Credit, Part IAerologic Impex Pvt. Ltd.No ratings yet

- Actl 2267 Bonus 2022Document29 pagesActl 2267 Bonus 2022mrinalbohra100% (1)