Professional Documents

Culture Documents

List of Common Terms:: Buy Volume

Uploaded by

ahmedalish0 ratings0% found this document useful (0 votes)

6 views3 pagesOriginal Title

market glossary

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesList of Common Terms:: Buy Volume

Uploaded by

ahmedalishCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

place a limit order for

List of Common security passion

Terms: Buy Volume:

Number of shares investor

Share: wants to buy

A security is a financial

instrument that represents an Sell:

ownership position in The rate at which investor

a publicly-traded Company. intends to execute order or

place a limit order to sale the

security.

Types of Trading Markets:

• Regular market Sell Volume:

• Deliverable future Number of shares investor

contracts wants to sell

• Initial Public Offering Change:

(IPO)

Price change represent in

• Stock Index future Percentage % with respect

Contracts (SIFC)

to yesterday closing.. Change

• Cash Settle Future

in green shows price increase

Contracts (CSF)

from yesterday and change in

red shows decline in price

Security Symbol:

from yesterday.

Unique identification code for

traded securities

Volume:

Market: Numbers of shares are traded

by investors in security.

There are few categories of

market trading. Such as Regular,

Closing Price:

Future, IPO, SIFC etc

Closing price at which

Buy: trading closed after the

The rate at which investor market closed.

intends to execute order or

Average Price: Confirmation Window:

Average price shows that Total Confirmation window shows

value of security traded, the status of order

dividend by Number of confirmation, order limit,

securities traded and remaining shares in the

order.

High Price:

Highest price at which security Trade Log:

traded on day of trading Shows the total detail of

executed trades by investor

Low Price: in his/her trading account

Lowest price at which security

traded on day of trading Outstanding Orders:

Shows the total un-executed

Limit Order:

trades or limit order by

Placing of order less than to investor in his/her trading

market price for the buying of account

securities or greater than to

market price for the selling of

securities is called limit order Previous closing Price:

Previous trading day closing

price

Market Order:

Execution of orders at current Trade Time:

market price is called market

order Time at which trade

executed by account holder

MBO/MBP Windows:

These Windows show the orders

queued.

• Market by price: shows

order queues by price

• Market by order: Shows

total volume at particular

price

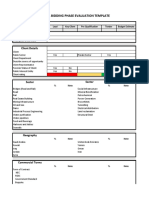

Market Lot: Short Sell:

As per PSX rule, Maket lots are A short sale is a share

as follow. transaction in which an

Price Range Marketable investor sells securities i n

Lots expectation of a price

Upto Rs. 100 500 Shares

decline without pre-existing

Above Rs. 100 100 Shares

up to Rs. 500 poistion

Above Rs. 500 50 Shares Portfolio:

up to Rs. 1000 Collection of shares held by

Above Rs. 20 Shares investor

1000

ODL Market: Any transaction less than

Market lot is called Odd lot.

Minimum odd lot is 1 share.

PSX design separate market for

odd lot trading for investor.

Stop Loss Order:

An order to buy or sell a

security when it reaches a

certain price. A stop-loss order

is designed to limit an

investor's loss on a position in

a security

Leverage Buying:

LB is designed for the investors

who want to buy the securities

on leverage

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Help Your Kids With MathDocument266 pagesHelp Your Kids With Mathsameerghouri89% (35)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 2014 CMT LEVEL I SAMPLE EXAM PREVIEWDocument31 pages2014 CMT LEVEL I SAMPLE EXAM PREVIEWMatthewTestaNo ratings yet

- Coca-Cola Working-From Sagar - PGPFIN StudentDocument23 pagesCoca-Cola Working-From Sagar - PGPFIN StudentAshutosh TulsyanNo ratings yet

- Bank Valuation and AssessmentDocument32 pagesBank Valuation and AssessmentIvan Lu100% (1)

- TCM 0787 Halloween ActivitiesDocument18 pagesTCM 0787 Halloween Activitiesrahuljay2k9100% (1)

- Rakesh JhunjhunwalaDocument5 pagesRakesh Jhunjhunwaladeshpandepooja1990100% (1)

- FINAL PROSPECTUS - ATRAM Philippine Balanced Fund (Updated 2.12.18)Document54 pagesFINAL PROSPECTUS - ATRAM Philippine Balanced Fund (Updated 2.12.18)Chris Bahilango100% (1)

- The Richard D Wyckoff Method of Trading and Investing in Stocks A Course of Instruction in Stock Market Science and Technique by Richard D WyckoffDocument5 pagesThe Richard D Wyckoff Method of Trading and Investing in Stocks A Course of Instruction in Stock Market Science and Technique by Richard D WyckoffAsad AliNo ratings yet

- Finalchapter 20Document11 pagesFinalchapter 20Jud Rossette ArcebesNo ratings yet

- A To Zoo - Subject Access To Children's Picture Books, 10th EditionDocument3,914 pagesA To Zoo - Subject Access To Children's Picture Books, 10th EditionEmilio Vicente33% (3)

- CIR.81-YR5 Expo Trip-SaadDocument1 pageCIR.81-YR5 Expo Trip-SaadahmedalishNo ratings yet

- 20221010-saad-MSC-PBL Term On 12-14octDocument2 pages20221010-saad-MSC-PBL Term On 12-14octahmedalishNo ratings yet

- 20221010-Saad-Eng-More SuffixesDocument11 pages20221010-Saad-Eng-More SuffixesahmedalishNo ratings yet

- Saad Sci TerrariumDocument12 pagesSaad Sci TerrariumahmedalishNo ratings yet

- Waiver Letter For Parents - Expo2020 - Updated-SaadDocument1 pageWaiver Letter For Parents - Expo2020 - Updated-SaadahmedalishNo ratings yet

- Retail or Wholesale Outlet For Used Motor Vehicle Parts - Commercial Carriage Vehicles Rs. 14.31 Million Sep-2021Document43 pagesRetail or Wholesale Outlet For Used Motor Vehicle Parts - Commercial Carriage Vehicles Rs. 14.31 Million Sep-2021ahmedalishNo ratings yet

- Skin Care Products Manufacturing Marketing Rs. 11.63 Million Jun-2022Document27 pagesSkin Care Products Manufacturing Marketing Rs. 11.63 Million Jun-2022ahmedalish100% (1)

- Student Hostel Rs. 6.74 Million Mar-2021Document30 pagesStudent Hostel Rs. 6.74 Million Mar-2021ahmedalishNo ratings yet

- Peanuts Processing Unit Rs. 22.03 Million Dec-2020Document22 pagesPeanuts Processing Unit Rs. 22.03 Million Dec-2020ahmedalishNo ratings yet

- Small Corporate Law Firm Pre-FeasibilityDocument29 pagesSmall Corporate Law Firm Pre-FeasibilityahmedalishNo ratings yet

- Pre-Feasibility Study on Glass/Ceramic Coating of VehiclesDocument31 pagesPre-Feasibility Study on Glass/Ceramic Coating of VehiclesahmedalishNo ratings yet

- Guest House Rs. 14.19 Million Apr-2021Document33 pagesGuest House Rs. 14.19 Million Apr-2021ahmedalishNo ratings yet

- How To Become Member of CciDocument20 pagesHow To Become Member of CcisalmanNo ratings yet

- Dairy Shop Rs. 4.16 Million May-2021Document37 pagesDairy Shop Rs. 4.16 Million May-2021ahmedalishNo ratings yet

- Health & Beauty Promotion Jabel Ali NestoDocument2 pagesHealth & Beauty Promotion Jabel Ali NestoahmedalishNo ratings yet

- UBL Branches IBFT (Inter Bank Funds Transfer) : Category/guidelinesDocument2 pagesUBL Branches IBFT (Inter Bank Funds Transfer) : Category/guidelinesahmedalishNo ratings yet

- Opportunity Qualification Master Sheet Risk Class 22 Novemer 2021Document3 pagesOpportunity Qualification Master Sheet Risk Class 22 Novemer 2021ahmedalishNo ratings yet

- TX4400 Manual v0.94Document39 pagesTX4400 Manual v0.94ahmedalishNo ratings yet

- List of Common Terms:: Buy VolumeDocument3 pagesList of Common Terms:: Buy VolumeahmedalishNo ratings yet

- People Edge - Jethish JacobDocument7 pagesPeople Edge - Jethish JacobahmedalishNo ratings yet

- Schedule of Fees For IAS Updated July 2020 FinalDocument2 pagesSchedule of Fees For IAS Updated July 2020 FinalahmedalishNo ratings yet

- Time Schedule of IAS 1Document1 pageTime Schedule of IAS 1ahmedalishNo ratings yet

- S# Isin CFI Code (As Per New ISO) Security Name Security Symbol Sector Name Security Type StatusDocument25 pagesS# Isin CFI Code (As Per New ISO) Security Name Security Symbol Sector Name Security Type StatusahmedalishNo ratings yet

- People Edge - Mohammed AbdullahDocument3 pagesPeople Edge - Mohammed AbdullahahmedalishNo ratings yet

- The Central Depository Company of Pakistan Limited: Schedule of Fees For Investor Account ServicesDocument2 pagesThe Central Depository Company of Pakistan Limited: Schedule of Fees For Investor Account ServicesahmedalishNo ratings yet

- Karachi Stock Exchange Office: Tradecast User GuideDocument9 pagesKarachi Stock Exchange Office: Tradecast User GuideahmedalishNo ratings yet

- Quiz - Investment ANSWERDocument3 pagesQuiz - Investment ANSWERJaylord ReyesNo ratings yet

- Securities Markets and Regulation of Securities Markets in NepalDocument50 pagesSecurities Markets and Regulation of Securities Markets in NepalShivam KarnNo ratings yet

- Information On IPO in SingaporeDocument37 pagesInformation On IPO in SingaporeHemant SinghNo ratings yet

- Gazdasági Ismeretek Angol Nyelven EconomicsDocument7 pagesGazdasági Ismeretek Angol Nyelven Economics121CreativeCatNo ratings yet

- IFR Magazine March 24 2018Document108 pagesIFR Magazine March 24 2018santoshcal3183No ratings yet

- Sales Handbook: For PartnersDocument44 pagesSales Handbook: For PartnersAnantha RamanNo ratings yet

- CEILI Study Guide (Eng)Document46 pagesCEILI Study Guide (Eng)liksyarnahNo ratings yet

- CHAPTER 12 Stock ValuationDocument36 pagesCHAPTER 12 Stock ValuationVivi CheyNo ratings yet

- Amazon ResearchDocument39 pagesAmazon Researchmpjegan90No ratings yet

- Akw 104Document8 pagesAkw 104Ting Sie KimNo ratings yet

- Funds available to Invest categoriesDocument143 pagesFunds available to Invest categoriesArivalagan VeluNo ratings yet

- DSIJ3121Document68 pagesDSIJ3121Navin ChandarNo ratings yet

- Toaz - Info The Five Rules For Successful Stock Investing PRDocument4 pagesToaz - Info The Five Rules For Successful Stock Investing PRH Yudi IriantoNo ratings yet

- Assignment - Set CDocument5 pagesAssignment - Set CGaurav ThapliyalRocksNo ratings yet

- A Uncle Ji Project Sandeep JiDocument50 pagesA Uncle Ji Project Sandeep Jisandeep kumarNo ratings yet

- Yk (Eo Ãkâç÷Fuþlmk: Technical Trading TrendsDocument22 pagesYk (Eo Ãkâç÷Fuþlmk: Technical Trading TrendsHarshvardhan SurekaNo ratings yet

- Global Cost and Availability of Capital: QuestionsDocument5 pagesGlobal Cost and Availability of Capital: QuestionsCtnuralisyaNo ratings yet

- Trading Strategy: Morning NoteDocument6 pagesTrading Strategy: Morning Notenagaraja h iNo ratings yet

- List Jan 2020Document71 pagesList Jan 2020chauhanbrothers3423No ratings yet

- TWE Kamil Zielinski Long Run Stock Performance of Initial Public OfferingsDocument18 pagesTWE Kamil Zielinski Long Run Stock Performance of Initial Public Offeringsgogayin869No ratings yet

- RKSV Securities daily margin report provides funds available and obligationsDocument2 pagesRKSV Securities daily margin report provides funds available and obligationsGAURAV SONKARNo ratings yet

- Factors Affecting Investment Decisions in Stock MarketsDocument12 pagesFactors Affecting Investment Decisions in Stock MarketsAnubhav Singh GuleriaNo ratings yet

- Risk Management of Derivatives in BSEDocument55 pagesRisk Management of Derivatives in BSEDillip KhuntiaNo ratings yet