Professional Documents

Culture Documents

BreathBlue Air Purifiers Ms4704@Georgetown - Edu

Uploaded by

Aayush AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BreathBlue Air Purifiers Ms4704@Georgetown - Edu

Uploaded by

Aayush AgrawalCopyright:

Available Formats

BREATHE -BLUE AIR PURIFIERS

Market entry Medium difficulty

Consumer goods Interviewer-led case

This case discusses a new business idea involving air purification, and considers Beijing as the test

market to enter.

The case has a heavy focus on testing numeracy and judgement & insights, but does not cover creativity

directly.

ite u) ro

ib ed pi

oh n. ha

Problem definition

Pr w Sc

d

A friend of yours is an entrepreneur, and has designed an air purifier after visiting Beijing and

g to l

in ge ae

experiencing air pollution in the city. The product is called Breathe-Blue and is a relatively small unit

ar or ich

designed to clean air for a single apartment (or an equivalent-sized space).

Sh ge M

The air purifier is of excellent quality and is able to eliminate a high percentage of PM10 particles in an

d @ of

indoor area. PM10 is the main component of smog.

an 4 y

y 70 op

Your client is specifically looking to understand whether to enter Beijing as the market to launch Breathe-

op s4 C

Blue.

C m e

at

iv

How would you approach analyzing this opportunity?

Pr

(

Additional information

If asked at this stage or later, please share that:

• Beijing’s population is ~ 22.8M

• The typical lifespan of a Breathe-Blue purifier is 5 years

• Air purifiers use filters - these filters are typically replaced every 6 months

• The client is only interested in the residential market at this point

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Question 1 (Structuring)

How would you structure your approach to the question?

Possible answer

1. Market attractiveness:

a. Market size

b. Market growth rate

c. Market profit margins

d. Competitive intensity (i.e., competitor strength and concentration)

ib ) o

oh du pir

2. Product/market fit:

Pr .e a

a. What do customers want in this market?

g n ch

d

ite

b. How well can our product meet these requirements? To include areas such as:

in ow S

• Price point

ar get ael

• Design

Sh r h

• Effectiveness

d eo ic

•

an @g of M

Branding/Market positioning

3. Execution: Do we have what it takes to enter the market successfully?

ng 4 y

yi 70 op

a. Capital required

op s4 C

b. Access to distribution channels

C m e

c. Capabilities (branding, manufacturing, local language skills, etc.)

at

d. Access to regulators / approvers of products in the locality

iv

Pr

(

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Question 2 (Numeracy)

As discussed, your client is considering entering Beijing as their first market for the air purifiers.

What size do you estimate this market to be, in terms of units sold per year?

Guidance for interviewer

• A structure in line with the below can be used; however, the candidate is free to use others

• As a follow-up question, ask the candidate how they would check their answer in a real project.

Suitable answers may include: Buy market reports, conduct expert interviews, review annual reports,

triangulate to sense-check (e.g. perform another market sizing to sense-check the first answer)

ib ) o

oh du pir

Pr .e a

Possible answer

g n ch

d

ite

Example structure: in ow S

ar get ael

Sh r h

d eo ic

an @g of M

ng 4 y

yi 70 op

op s4 C

C m e

at

iv

Pr

(

Assumptions:

Beijing population: 22.8M

Average household size: 2

% households with above average income: 50%

Note: Any proxy to estimate the % of the population capable of spending money on air purification is fine

% households ‘health educated’, i.e. aware of and concerned about health concerns from smog: 45%

Note: Can assume health is still a relatively low concern. Any proxy estimating the number of people

interested in spending money on air purification works equally well.

# air purifiers bought / person / yr: 0.2

Because average lifespan of unit = 5 years = 1 bought every 5 years = 1/5 = 0.2

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Formula:

[Population] * [1/avg household size] * [% households above average income] * [% interested in health] *

(1/avg lifespan of purifier)

= 23M * (1/2) * 50% * 45% * (1/5)

= ~ 500,000 units per year

At half a million units per year, this does appear to be an attractive market size to consider.

ib ) o

oh du pir

Pr .e a

g n ch

d

ite

in ow S

ar get ael

Sh r h

d eo ic

an @g of M

ng 4 y

yi 70 op

op s4 C

C m e

at

iv

Pr

(

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Question 3 (Judgement & Insight)

You now move on to pricing the product, to determine the revenue potential for the business.

In what ways could you price the product?

Guidance for interviewer

There’s no need for a clear right answer at this stage; the candidate simply needs to list alternatives and

explain them logically.

ib ) o

oh du pir

Possible answer

Pr .e a

g n ch

d

There are at least three options to consider:

ite

in ow S

1. Cost-based pricing – estimate cost to produce each unit and add a margin for profit

ar get ael

2. Competitive pricing – consider competitor price points and price accordingly depending on

Sh r h

market positioning (e.g., low-end mass market, mid-market, high end)

d eo ic

an @g of M

3. Value-based pricing – estimate the value of the product to the customer in monetary terms and

price based on this

ng 4 y

yi 70 op

op s4 C

C m e

at

iv

Pr

(

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Question 4 (Judgement & Insight)

The market is growing very fast, and this is attracting both international companies (e.g. Philips, Daikin)

and local Chinese players (Xiaomi, Yuna). Currently more than 600 companies are active in the

residential air purifier market.

Given this information, which of the three pricing strategies would you recommend?

Guidance for interviewer

The candidate does not need to calculate anything for this answer; their response can be entirely

qualitative

ib ) o

oh du pir

Pr .e a

g n ch

d

Possible answer

ite

in ow S

ar get ael

We should use a value-based pricing approach and position ourselves as a high-end niche player,

because:

Sh r h

d eo ic

• Our product is very high quality

an @g of M

• It does not make sense to compete on price with the local Chinese players, since this will lead

to selling at negative margins

ng 4 y

yi 70 op

• A value-based approach will allow for the highest profit margin per product, and avoids money

op s4 C

being ‘left on the table’

C m e

at

iv

Pr

(

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Question 5 (Numeracy)

Your team performs a customer survey in Beijing, based on a sample of 2,000 target consumers. This

test, plus the results of an air quality text, should allow you to calculate a value-based price for the

product. [Share exhibits 1 & 2].

At what price point would you sell the air purifier, based on this information?

Guidance for interviewer

The candidate can assume that there is on average 2 individuals and 1 air-purifier per accommodation.

ib ) o

oh du pir

Possible answer

Pr .e a

g n ch

d

ite

Willingness to pay (WTP) for Breathe-Blue product

in ow S

= Number of individuals in household x Expected increase in life expectancy x Willingness to pay for

ar get ael

additional year of life expectancy / Number of air-purifier to purchase in remaining of life

Sh r h

d eo ic

an @g of M

Expected increase in life expectancy

= [% PM10 removed] x [average PM10] x [lifespan increase / 100µg decrease in PM10]

= 91% x 150 µg x [2.1/100µg PM10]

ng 4 y

yi 70 op

= ~2.9 years increase in expected lifespan

op s4 C

C m e

Willingness to pay for additional year of life expectancy

at

= $5,125

iv

Pr

(

Number of air-purifiers to purchase in remaining of life

= Average remaining life expectancy in household / Lifespan of a unit

= 40 / 5

= 8 units

WTP for Breathe-Blue product

= 2 x 2.9 x $5,125 / 8

= $3,715 per unit

We should price the purifier at $3,715 per unit. To provide a broader assessment, there are other

perspectives we should consider, such as the relative lifetime of our product compared to others.

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

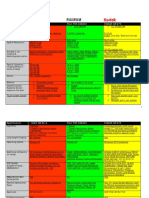

Exhibit 1: Average % of PM10 particles removed after 2 hours in 40m² accommodation

ib ) o

oh du pir

Pr .e a

g n ch

d

ite

in ow S

ar get ael

Sh r h

d eo ic

an @g of M

Exhibit 2: Customer survey results, n = 2.000

Average willingness to pay (WTP) for 1 year life expectancy $5,125 per individual

ng 4 y

yi 70 op

Average remaining life expectancy in household 40 years

op s4 C

Increase in life expectancy for every 100 microgram (µg) /m³ PM10 2.1 yrs

C m e

removed

at

Average PM10 levels in Beijing 150 µg / m³

iv

Pr

(

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Question 6 (Numeracy)

Your client is nervous about the projected sales over the next 3 years and asks you to calculate the

expected revenue for year 3 to check for viability of the product.

You know that each air purifier sold will need replacement filters every 6 months, which cost $450 per

filter. The expected market growth is estimated at 10% per year.

What is the estimated revenue in year 3?

ib ) o

Guidance for interviewer

oh du pir

• The candidate can assume a 5% market share for Breathe-Blue in year 1

Pr .e a

• To answer this question successfully, it’s key for the candidate to realize she/he should calculate

g n ch

d

ite

the full installed volume of air purifiers before obtaining the revenues from filters during year 3.

in ow S

ar get ael

Sh r h

Possible answer

d eo ic

an @g of M

Revenues Year 3 = Revenue (filters) + Revenue (air purifiers)

ng 4 y

Revenue (filters) = ([installed purifiers at end of year 2] * [2 filters] * [price/filter]) + ([additional installed

yi 70 op

purifiers in year 3] * [average of 1 filter * price/filter])

op s4 C

Installed purifiers by end of year 2 = [sales of purifiers in year 1] + [sales of purifiers in year 2]

C m e

= 0.5M*5% + 0.5M*5%*1.1

at

iv

= 0.025M + 0.0275M = 0.0525M

Pr

Purifiers sold in year 3 = 0.5M * 5% * 1.1² = 0.03M

(

Revenue (filters) = (0.0525M*2*$450) + (0.03M*1*$450)

= $47M + $13.5M = $60.5M

Revenue (air purifiers) = 0.5M * 1.1² * 0.05 * $3,715 = $112.4M

Total sales = $60.5M + $112.4M = $173M

This feels like a substantial estimated revenue. However, to really know whether the business is viable, I

would also need to look at the costs and profit margin.

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Question 7 (Judgement & Insight)

Your team member does some research into pollution trends and buying behavior in the Chinese market

and shares the following charts with you [share exhibits 3 and 4].

What do these charts suggest about future customer purchasing behavior for air purifiers in

China?

Possible answer

Key insights:

ib ) o

• There is strong seasonality in smog levels and sales – e.g., closed window season, allergy

oh du pir

season

Pr .e a

• Sales are a direct response to increase in smog, suggesting high ‘impulsiveness’ of the

g n ch

d

ite

purchase. This could be mitigated by:

in ow S

- Targeting specific groups who are less prone to this impulsiveness effect - e.g., allergy

ar get ael

sufferers, asthma patients, new parents

Sh r h

- Partnering with influencers to reach these markets - e.g., doctors, new family support groups

d eo ic

an @g of M

In the long term, the smog problem in China will very likely improve due to governmental effort. However,

penetration rates are still extremely low compared with peer countries. This suggests substantial

ng 4 y

yi 70 op

potential to grow, which will likely offset this potential “negative growth”.

op s4 C

C m e

at

iv

Pr

(

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Exhibit 3: Penetration rate of air purifiers in selected markets

ib ) o

oh du pir

Pr .e a

g n ch

d

ite

in ow S

ar get ael

Sh r h

d eo ic

an @g of M

Exhibit 3: Air purifier sales vs SMOG levels

ng 4 y

yi 70 op

op s4 C

C m e

at

iv

Pr

(

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

Question 8 (Synthesis)

What recommendation would you put forward to your client?

Possible answer

We were asked whether to enter Beijing with the Breathe-Blue air purifier product. Based on the

research so far, the Chinese air purifier business is a highly attractive market and I would recommend

Breathe-Blue enters it for the following reasons:

• We can expect strong growth in an already big market of 0.5M units per year in Beijing

• Penetration of air purifiers in China is still nascent compared to peer countries, and revenue is

ib ) o

expected to be over $150m by year 3

oh du pir

• China as a whole shows potential to grow in air purifier sales. Beyond Beijing, the Chinese

Pr .e a

market has significant potential

g n ch

d

ite

in ow S

However, there are a few risks associated with entering this market, including the fact that there is a lot

ar get ael

of competition already selling air purifiers, and a positive market outlook will likely attract more entrants.

Sh r h

d eo ic

an @g of M

As next steps, I would want to analyze and optimize the costs of the Breathe-Blue air purifier and ensure

the market can be entered in a profitable way.

ng 4 y

yi 70 op

op s4 C

C m e

at

iv

Pr

(

Puzzled by some case interview charts?

Practice on your own with the Exhibit Drills in the

Interview Prep Course

Private Copy of Michael Schapiro (ms4704@georgetown.edu)

Copying and Sharing Prohibited

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TAB Procedures From An Engineering FirmDocument18 pagesTAB Procedures From An Engineering Firmtestuser180No ratings yet

- Fake PDFDocument2 pagesFake PDFJessicaNo ratings yet

- Mat Boundary Spring Generator With KX Ky KZ KMX KMy KMZDocument3 pagesMat Boundary Spring Generator With KX Ky KZ KMX KMy KMZcesar rodriguezNo ratings yet

- ARUP Project UpdateDocument5 pagesARUP Project UpdateMark Erwin SalduaNo ratings yet

- COOKERY10 Q2W4 10p LATOJA SPTVEDocument10 pagesCOOKERY10 Q2W4 10p LATOJA SPTVECritt GogolinNo ratings yet

- Rebar Coupler: Barlock S/CA-Series CouplersDocument1 pageRebar Coupler: Barlock S/CA-Series CouplersHamza AldaeefNo ratings yet

- Role of The Government in HealthDocument6 pagesRole of The Government in Healthptv7105No ratings yet

- Heavy LiftDocument4 pagesHeavy Liftmaersk01No ratings yet

- Computer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Document5 pagesComputer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Tanya HemnaniNo ratings yet

- Supergrowth PDFDocument9 pagesSupergrowth PDFXavier Alexen AseronNo ratings yet

- Allan ToddDocument28 pagesAllan ToddBilly SorianoNo ratings yet

- Catalog Celule Siemens 8DJHDocument80 pagesCatalog Celule Siemens 8DJHAlexandru HalauNo ratings yet

- Engineering Notation 1. 2. 3. 4. 5.: T Solution:fDocument2 pagesEngineering Notation 1. 2. 3. 4. 5.: T Solution:fJeannie ReguyaNo ratings yet

- Agfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Document3 pagesAgfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Youness Ben TibariNo ratings yet

- Internship ReportDocument46 pagesInternship ReportBilal Ahmad100% (1)

- TEVTA Fin Pay 1 107Document3 pagesTEVTA Fin Pay 1 107Abdul BasitNo ratings yet

- Load Data Sheet: ImperialDocument3 pagesLoad Data Sheet: ImperialLaurean Cub BlankNo ratings yet

- Hayashi Q Econometica 82Document16 pagesHayashi Q Econometica 82Franco VenesiaNo ratings yet

- Weekly Learning PlanDocument2 pagesWeekly Learning PlanJunrick DalaguitNo ratings yet

- Instructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsDocument9 pagesInstructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsAnders LaursenNo ratings yet

- 09 WA500-3 Shop ManualDocument1,335 pages09 WA500-3 Shop ManualCristhian Gutierrez Tamayo93% (14)

- BluetoothDocument28 pagesBluetoothMilind GoratelaNo ratings yet

- Transparency Documentation EN 2019Document23 pagesTransparency Documentation EN 2019shani ChahalNo ratings yet

- Digital LiteracyDocument19 pagesDigital Literacynagasms100% (1)

- CH 1 India Economy On The Eve of Independence QueDocument4 pagesCH 1 India Economy On The Eve of Independence QueDhruv SinghalNo ratings yet

- Fedex Service Guide: Everything You Need To Know Is OnlineDocument152 pagesFedex Service Guide: Everything You Need To Know Is OnlineAlex RuizNo ratings yet

- Lockbox Br100 v1.22Document36 pagesLockbox Br100 v1.22Manoj BhogaleNo ratings yet

- Draft Contract Agreement 08032018Document6 pagesDraft Contract Agreement 08032018Xylo SolisNo ratings yet

- Ces Presentation 08 23 23Document13 pagesCes Presentation 08 23 23api-317062486No ratings yet

- Working Capital ManagementDocument39 pagesWorking Capital ManagementRebelliousRascalNo ratings yet