Professional Documents

Culture Documents

Chapter One: Introduction: Page No

Chapter One: Introduction: Page No

Uploaded by

Atiqul IslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter One: Introduction: Page No

Chapter One: Introduction: Page No

Uploaded by

Atiqul IslamCopyright:

Available Formats

Table of Contents

Serial Contents Page No.

No.

Title i

Dedication ii

Declaration iii

Latter of Submission iv

Certificate of Supervisor v

Acknowledgements Vi

Abstract vii

Chapter One: Introduction 1-5

1.1 Problem of the study 2

1.2 Objective of the study 2

1.3 Methodology 3

1.3.1 Sampling 3

1.3.2 Sources & Collection of Data: 3

1.3.3 Processing & Analyzing Data 3

1.4 Limitation of the study 3

1.5 Chapterization 4

Chapter Two: Literature Review 6-9

Chapter three: Introduction of IBBL 10-27

3.1 Emergence of Islamic Banking 11

3.2 Background of IBBL 13

3.3 Product/Service Offerings 14

3.4 Values of the IBBL 20

3.5 Aims and Objectives of IBBL 20

3.6 Special Features of IBBL 20

3.7 Functions of IBBL 21

3.8 Goals of IBBL 21

3.9 Mission of IBBL 22

3.10 Vision of IBBL 22

3.11 Strategic objectives of IBBL 22

3.12 Commitments of IBBL 23

3.13 Management of IBBL 24

3.14 Organization Structure of IBBL 25

3.15 Corporate Information of IBBL 26

3.16 Milestone of IBBL 27

Chapter Four: Analyses & Findings 28-50

4.1 Perception analysis regarding 5 point likert scale 29

4.2 Results and Discussion 49

Chapter Five: Recommendations & Conclusion 51-53

5.1 Recommendations 52

5.2 Conclusion 53

References 54

Appendix 57

LIST OF FIGURES

Serial No. Contents Page No.

Figure 1.1 Organization structure of IBBL 25

Figure 1.2 Corporate Information of IBBL 26

Figure 1.3 Milestone of IBBL 27

Figure 4.1 Percentage of customers according to the Gender 30

Figure 4.2 Percentage of customers according to the age 31

Figure 4.3 Percentage of customers according to the occupation 32

Figure 4.4 Percentage of how satisfied a customer is with the products of 33

IBBL

Figure 4.5 Percentage of how satisfied a customer is with the services of 34

IBBL

Figure 4.6 Percentage of how satisfied a customer is with the cleanliness 35

Figure 4.7 Percentage of how satisfied a customer is with the length of time 36

it takes to receive requested service from the branch

Figure 4.8 Percentage of how satisfied are they with the security in 37

transacting from this bank

Figure 4.9 Percentage of how satisfied a customer is with the product 38

features of loan and deposit account

Figure 4.10 Percentage of how satisfied a customer is with the fees and 39

charges

Figure 4.11 Percentage of how satisfied a customer is with the ATM services 40

Figure 4.12 Percentage of how satisfied a customer is with the complaint 41

resolution

Figure 4.13 Percentage how customers are satisfied with the information 42

desk

Figure 4.14 Percentage of how satisfied a customer is with IBBL 43

overall

Figure 4.15 Percentage of how likely a customer is to purchase new services 45

Figure 4.16 Percentage of how likely a customer is to recommend IBBL’s 46

product/service to others

Figure 4.17 Percentage of how likely a customer is to recommend IBBL to 47

others

Figure 4.18 : Percentage of how likely a customer is to switch to a different 48

bank

You might also like

- 2022 C1 Promo Solutions - Comments For StudentsDocument31 pages2022 C1 Promo Solutions - Comments For StudentsVincentNo ratings yet

- Ratio Analysis of Nabil Bank LimitedDocument11 pagesRatio Analysis of Nabil Bank Limitedsangam rana64% (28)

- Internship ReportDocument6 pagesInternship ReportShristi50% (2)

- Exponentials of Operators - Baker-Campbell-Hausdorff Formula - Physics PagesDocument5 pagesExponentials of Operators - Baker-Campbell-Hausdorff Formula - Physics PagesJuan Camilo Rodríguez PérezNo ratings yet

- Layher Allround Industri Stillas 2015 - Engelsk - Utskrift.2Document68 pagesLayher Allround Industri Stillas 2015 - Engelsk - Utskrift.2cosmin todoran100% (1)

- A Study On Customer Service Department of Prabhu Bank Limited, Jaleswor BranchDocument10 pagesA Study On Customer Service Department of Prabhu Bank Limited, Jaleswor BranchPratibha YadavNo ratings yet

- CD4372 PDFDocument24 pagesCD4372 PDFSandeep VarmaNo ratings yet

- Bank Customer's Perception of Frontline Employee Service Delivery, Satisfaction and Behavioural Intentions in The Sunyani Municipality. by Armah Lawrence Kwaku and Agyabeng Felicia NkansahDocument73 pagesBank Customer's Perception of Frontline Employee Service Delivery, Satisfaction and Behavioural Intentions in The Sunyani Municipality. by Armah Lawrence Kwaku and Agyabeng Felicia NkansahLawrence ArmahNo ratings yet

- Declaration: Birendranagar, Surkhet" On Which I Have Conducted A Study Under The Guidance ofDocument9 pagesDeclaration: Birendranagar, Surkhet" On Which I Have Conducted A Study Under The Guidance ofPrakash KhadkaNo ratings yet

- Declaration: Bank LTD." Has Been Submitted To The Faculty of Management, Tribhuvan University IsDocument8 pagesDeclaration: Bank LTD." Has Been Submitted To The Faculty of Management, Tribhuvan University IsNepa9 ayoNo ratings yet

- Factors Affecting The Profitability of Interest Free Bank in Commercial Bank of EthiopiaDocument86 pagesFactors Affecting The Profitability of Interest Free Bank in Commercial Bank of EthiopiaDuke GlobalNo ratings yet

- Abul Hasnat CoverDocument11 pagesAbul Hasnat CoverRashel MahmudNo ratings yet

- Thi Han Nyein (EMBF - 68)Document48 pagesThi Han Nyein (EMBF - 68)htet aungNo ratings yet

- SIP Report - 105 Mrunalini MunjDocument65 pagesSIP Report - 105 Mrunalini MunjPrashant KokareNo ratings yet

- Serial No. Particulars Page No.: Chapter One 01-03Document2 pagesSerial No. Particulars Page No.: Chapter One 01-03যুবরাজ মহিউদ্দিনNo ratings yet

- Descriptions: Number NumbersDocument2 pagesDescriptions: Number NumbersZahid Bin IslamNo ratings yet

- Honey Aung, Roll No.22, MBF (Day) 2nd BatchDocument67 pagesHoney Aung, Roll No.22, MBF (Day) 2nd BatchNah Ooth WazNo ratings yet

- Financial Performance Analysis of NRB Global Bank Limited: Dhaka International UniversityDocument65 pagesFinancial Performance Analysis of NRB Global Bank Limited: Dhaka International UniversityTowhid EclipseNo ratings yet

- SL. No Page No.: Chapter OneDocument42 pagesSL. No Page No.: Chapter OneMehedi HasanNo ratings yet

- Table of ContentDocument5 pagesTable of Contentshaik iftiNo ratings yet

- A Comprehensive Study On Some NBFI's in BangladeshDocument64 pagesA Comprehensive Study On Some NBFI's in BangladeshMosharaf HossainNo ratings yet

- Education Service Experience From The Aspects of Students'Document34 pagesEducation Service Experience From The Aspects of Students'M. Nizam100% (1)

- 3 - Table of ContentsDocument1 page3 - Table of ContentsSohelNo ratings yet

- Thet Hsu Myint MG (MBF - 68)Document64 pagesThet Hsu Myint MG (MBF - 68)Anh Thư Đặng NgọcNo ratings yet

- Internship ReportDocument44 pagesInternship ReportRAihan AhmedNo ratings yet

- SL. No Page No.: Chapter OneDocument25 pagesSL. No Page No.: Chapter OneMehedi HasanNo ratings yet

- SL. No Page No.: Chapter OneDocument25 pagesSL. No Page No.: Chapter OneMehedi HasanNo ratings yet

- SL. No Page No.: Chapter OneDocument13 pagesSL. No Page No.: Chapter OneMehedi HasanNo ratings yet

- SL. No Page No.: Chapter OneDocument38 pagesSL. No Page No.: Chapter OneMehedi HasanNo ratings yet

- SL. No Page No.: Chapter OneDocument40 pagesSL. No Page No.: Chapter OneMehedi HasanNo ratings yet

- SL. No Page No.: Chapter OneDocument25 pagesSL. No Page No.: Chapter OneMehedi HasanNo ratings yet

- Certificate by The GuideDocument8 pagesCertificate by The GuideHimanshu SharmaNo ratings yet

- Customer Satisfaction TemplateDocument4 pagesCustomer Satisfaction TemplateGanesh BodreNo ratings yet

- The Recruitment and Selection Process ofDocument38 pagesThe Recruitment and Selection Process ofKishanNo ratings yet

- 05 ContentDocument11 pages05 ContentNikhil ShuklaNo ratings yet

- Table of Content: Chapter No. Chapter Name Page NoDocument5 pagesTable of Content: Chapter No. Chapter Name Page NoFfffrrrrNo ratings yet

- A Study On Employee Welfare Measures at BHEL SujalDocument70 pagesA Study On Employee Welfare Measures at BHEL SujalAman MahatoNo ratings yet

- Internship ReportDocument54 pagesInternship ReportAnonymous ZAcI1vSCKrNo ratings yet

- Win Win Myint (EMBF - 77)Document51 pagesWin Win Myint (EMBF - 77)Melat FisshaNo ratings yet

- Executive Summary: Objectives of The StudyDocument6 pagesExecutive Summary: Objectives of The StudykeerthikumarbjNo ratings yet

- Impact of Leverage On Stock ReturnsDocument48 pagesImpact of Leverage On Stock ReturnsvaskhaNo ratings yet

- Table of ContentDocument2 pagesTable of Contentadnan04No ratings yet

- Chibueze Nwabinwe Project 2023Document71 pagesChibueze Nwabinwe Project 2023Yamah PrincewillNo ratings yet

- Effect of Investment Appraisal On The Profitability of Quoted Consumer Goods Companies in NigeriaDocument61 pagesEffect of Investment Appraisal On The Profitability of Quoted Consumer Goods Companies in NigeriaPrecious Chioma AgulukaNo ratings yet

- Table of Content: SL - No. Particulars Page No. 1Document64 pagesTable of Content: SL - No. Particulars Page No. 1Om KumarNo ratings yet

- Internship Report ID-10204082Document81 pagesInternship Report ID-10204082FarahKhanNo ratings yet

- Pubali Bank LTD Final 16-6-22Document65 pagesPubali Bank LTD Final 16-6-22siambangladesh2020No ratings yet

- MTB PDFDocument92 pagesMTB PDFtutulNo ratings yet

- MPRA Paper 65248 PDFDocument68 pagesMPRA Paper 65248 PDFsumaiya sumaNo ratings yet

- An Analysis of Credit Management in The Banking IndustryDocument8 pagesAn Analysis of Credit Management in The Banking IndustryIsaac UwangueNo ratings yet

- Olayemi Project Front PageDocument11 pagesOlayemi Project Front PagebrightnytNo ratings yet

- CRM in Banking SectorDocument54 pagesCRM in Banking SectorSakshi SharmaNo ratings yet

- Investment Management of Al-Arafah Islami Bank LTDDocument37 pagesInvestment Management of Al-Arafah Islami Bank LTDJamir UddinNo ratings yet

- A Study On Employee Welfare Measures at BHEL: Project Report (17MBAPR407)Document69 pagesA Study On Employee Welfare Measures at BHEL: Project Report (17MBAPR407)Keerthivasan sNo ratings yet

- Analysis of Non Performing Assets of Nepalese Commercial Banks PDFDocument150 pagesAnalysis of Non Performing Assets of Nepalese Commercial Banks PDFSudeep Baral100% (1)

- Deposit Analysis of NABIL Bank LTD Please Comment After Read ThisDocument43 pagesDeposit Analysis of NABIL Bank LTD Please Comment After Read ThisSuraj Patel50% (2)

- Table of Content: Chapter OneDocument2 pagesTable of Content: Chapter OneRahatNo ratings yet

- Thwin Htoo Aung (EMBF - 66)Document65 pagesThwin Htoo Aung (EMBF - 66)kringNo ratings yet

- Consular Behaviour With Respect To Decision Making Process of Motorbike Purchase in Butwal CityDocument55 pagesConsular Behaviour With Respect To Decision Making Process of Motorbike Purchase in Butwal CitySushil PaudelNo ratings yet

- Fron PageDocument4 pagesFron PageMd Khaled NoorNo ratings yet

- Supermarket differentiation in the UK: A theoretical and empirical investigationFrom EverandSupermarket differentiation in the UK: A theoretical and empirical investigationNo ratings yet

- Transforming Central Finance Agencies in Poor Countries: A Political Economy ApproachFrom EverandTransforming Central Finance Agencies in Poor Countries: A Political Economy ApproachNo ratings yet

- Chapter # 1Document48 pagesChapter # 1Atiqul IslamNo ratings yet

- What Does Product and Service Design DoDocument22 pagesWhat Does Product and Service Design DoAtiqul IslamNo ratings yet

- An Internship Report On: Customer Satisfaction of IBBL: A Study On Kushtia BranchDocument7 pagesAn Internship Report On: Customer Satisfaction of IBBL: A Study On Kushtia BranchAtiqul IslamNo ratings yet

- Chapter # 1: 1.1 Problem of The StudyDocument64 pagesChapter # 1: 1.1 Problem of The StudyAtiqul IslamNo ratings yet

- Chapter 4 International Trade TheoryDocument40 pagesChapter 4 International Trade TheoryAtiqul IslamNo ratings yet

- Accounting Theory 7th Edition Isi1118592Document106 pagesAccounting Theory 7th Edition Isi1118592Atiqul Islam100% (2)

- Chapter 2 The Cultural EnvironmentDocument42 pagesChapter 2 The Cultural EnvironmentAtiqul IslamNo ratings yet

- Chapter 3 Political Legal EnvironmentDocument39 pagesChapter 3 Political Legal EnvironmentAtiqul IslamNo ratings yet

- Mbamca - Exam Centre n10Document2 pagesMbamca - Exam Centre n10Indhumathi SubbiahNo ratings yet

- LN - 10 - 47 - E-Learning Synoptic MeteorologyDocument30 pagesLN - 10 - 47 - E-Learning Synoptic MeteorologyPantulu MurtyNo ratings yet

- Institute Name: Jawaharlal Nehru Technological University (IR-E-U-0017)Document2 pagesInstitute Name: Jawaharlal Nehru Technological University (IR-E-U-0017)Shwetha MudireddyNo ratings yet

- Newshound MagazineDocument24 pagesNewshound MagazineLovely BeconiaNo ratings yet

- Properties of Pure SubstanceDocument26 pagesProperties of Pure SubstanceMahadi HasanNo ratings yet

- An Introduction To Organizational Communication PDFDocument524 pagesAn Introduction To Organizational Communication PDFMihaela Badea100% (1)

- Indian Dairyman Nov 2021Document3 pagesIndian Dairyman Nov 2021Amritha JayanNo ratings yet

- Raising Succesfull Children: Pre-Listening ExerciseDocument5 pagesRaising Succesfull Children: Pre-Listening ExerciseAndrea SzigetfalviNo ratings yet

- OS6860 (E) AOS 8.2.1.R01 CLI Reference GuideDocument3,454 pagesOS6860 (E) AOS 8.2.1.R01 CLI Reference GuideTrung Bui QuangNo ratings yet

- GasTIPS Winter04 PDFDocument36 pagesGasTIPS Winter04 PDFmelvincabeNo ratings yet

- Distributed Control SystemDocument8 pagesDistributed Control SystemParth ShethNo ratings yet

- Lecture-II Basics of Reinforced Concrete DesignDocument61 pagesLecture-II Basics of Reinforced Concrete Designjs kalyana rama100% (1)

- CMM Galley g3 25-35-78 Rev 01Document395 pagesCMM Galley g3 25-35-78 Rev 01VassilisNo ratings yet

- SmartTrap Launcher ReceiverDocument4 pagesSmartTrap Launcher ReceiverKehinde AdebayoNo ratings yet

- Improving Fluency in Young Readers - Fluency InstructionDocument4 pagesImproving Fluency in Young Readers - Fluency InstructionPearl MayMayNo ratings yet

- Kinematic Structure of Machine ToolsDocument23 pagesKinematic Structure of Machine ToolswagoheNo ratings yet

- Double Reeds: The OboeDocument1 pageDouble Reeds: The OboeTom HartNo ratings yet

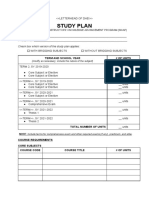

- Study Plan Template (Annex C)Document3 pagesStudy Plan Template (Annex C)khiemons1No ratings yet

- Cell 7Document6 pagesCell 7XI-A Vishal BishnoiNo ratings yet

- Glycolysis ProcessDocument7 pagesGlycolysis ProcessBlister CountNo ratings yet

- February 01, 2016 at 0731AMDocument5 pagesFebruary 01, 2016 at 0731AMJournal Star police documentsNo ratings yet

- TM M672320 340Document2 pagesTM M672320 340Ara AkramNo ratings yet

- Unit-1 Sewing Machine ControlDocument16 pagesUnit-1 Sewing Machine ControlumidgrtNo ratings yet

- 4.0 Manual Kelman TransfixDocument31 pages4.0 Manual Kelman Transfixcorreo_hechizo100% (2)

- Session-1: Unpacking Agenda 2030: 1.4. Categorization of 17 Sdgs Into 5PsDocument2 pagesSession-1: Unpacking Agenda 2030: 1.4. Categorization of 17 Sdgs Into 5PsPal GuptaNo ratings yet

- Rap + Keb. Bahan. Hit 1Document173 pagesRap + Keb. Bahan. Hit 1ChairilSaniNo ratings yet

- Sung Hung KaiDocument17 pagesSung Hung KaiTay Kuan YoungNo ratings yet