Professional Documents

Culture Documents

2020 Russian Pharmaceutical Market Dynamics: Source: DSM Group

2020 Russian Pharmaceutical Market Dynamics: Source: DSM Group

Uploaded by

Маша СолодневаOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2020 Russian Pharmaceutical Market Dynamics: Source: DSM Group

2020 Russian Pharmaceutical Market Dynamics: Source: DSM Group

Uploaded by

Маша СолодневаCopyright:

Available Formats

For the pharmaceutical industry, the COVID-19 year became sort of a challenge and a

test of strength. Sale uplift due to the roaring demand for medicines, rise of the

national segment, increase in the value and speed of adoption of legislative proposals

—all of this had a significant impact both on the overall market dynamics and on its

conditions. Moreover, all of it was going on in a changing environment, to which we

all had to get used.

One of the most important legislative proposals of the government became

introduction of a fast track (a procedure for accelerated approval of medicines and

medical products in the event of an emergency). This provided domestic

manufacturers with an opportunity to promptly get approved and introduce two

medicines intended to treat the coronavirus disease, Favipiravir and Levilimab.

The accelerated approval also opened the way to the introduction of local vaccines

against COVID-19 and to the beginning of a mass vaccination as early as in January

2021.

2020 Russian Pharmaceutical Market Dynamics

The pharmaceutical market value in Russia in 2020 exceeded 2,040 billion rubles,

which is 9.8% more than in 2019. In terms of dollars and euro, there was stagnation in

2020. The March ruble depreciation resulted in a situation where the market capacity

did not really grow when translated. So, in dollar terms, the market value in 2020

amounted to 29 billion dollars, which is just 0.2% more than a year before. In euro,

driven by a higher increase in the exchange rate (11%), market dynamics is even

negative (-1.6%).

Source: DSM Group, Russian Pharmaceutical Market 2020

Sales of medicines in kind dropped by 4%, equal to 6.17 billion package items.

Source: DSM Group, Russian Pharmaceutical Market 2020

Dynamics in the commercial segment of medicines in 2020 was hard to forecast: all

trends that had been forming over extended periods collapsed. The sales gain noted in

March 2020 turned out to be one of the most substantial ones over the past number of

years. Such panic buying was caused by the beginning of the coronavirus disease

spread and an exacerbating economic crisis. Russians began buying up medicines left

and right, waiting for a price rise in the midst of an exchange rate leap and for a

shortage of necessary drugs because of restrictive measures. Naturally, after this

advance buying the sales dynamics was weak and even turned negative during some

months. Only in December the market got back to growth rates that were in January

and February (before the coronacrisis). The growth driver, starting from April, was

'anti-COVID drugs'. Their composition could vary, but due to a considerable demand

for them the market demonstrated overall positive dynamics in rubles (+10.6%) and

only dropped by 2.3% in package items.

The total share of imported medicines in the market totaled 56.3% in rubles and

31.4% in package items at year-end 2020. The market growth in kind was negative

both for drugs produced in Russia (-4%) and for foreign-made medicines (-3%). In

ruble equivalent, locally made medicines increased by 13% and imported ones by 8%.

Pharma Market Structure from Different Perspectives

Source: DSM Group, Russian Pharmaceutical Market 2020

In 2020, the leadership on the drug sales top list by volume as per ATC (Anatomical

Therapeutic Chemical) groups was taken over by Group A: Alimentary tract and

metabolism (15.09%). The second place is taken by Group N: Nervous system, with

the market share of 14.34% by volume. Top three is closed by Group R: Respiratory

system (12.86%).

Foreign companies—Sanofi, Novartis, Bayer—retained first places in the

manufacturer's ranking. The top 20 list includes three domestic manufacturers:

OTCPharm, Biocad, and Pharmstandard.

Influence of COVID-19 on Retail Demand for

Medicines

However, the spread of a new coronavirus disease markedly altered the whole market

environment. Any new information about drugs that were included into a list for

coronavirus treatment or prevention led to a feverish demand for them and their

disappearance from drugstores. For example, at the start of the pandemic it was an

antimalaria drug with an INN of hydroxychloroquine that was believed to be

promising in combating the coronavirus. As a result, average monthly sales grew

almost twice in April-December as compared to the pre-COVID sales level (nearly

35-40K package items per month vs. 20K in 2019).

In 2020, there were neither seasonal patterns nor specific regularities that are common

to the pharma retail market. Antiviral drugs and antibiotics became leaders of

customer demand during the pandemic. What is more, even in summer sales in these

categories were notably higher than in previous years.

Source: DSM Group, Russian Pharmaceutical Market 2020

At year-end 2020, the retail sale market gain equaled to 11%, while turning negative

in package items (-2%). Therefore, nearly 5 billion package items of medicines

totaling to 1,128 billion rubles (in retail prices) were sold on the retail side.

At year-end 2020, the share of drugs produced in Russia increased from 2.3% to

44.2% in rubles and decreased by 0.2% down to 65.7% in package items. Locally

made medicines (+16.5% in rubles vs. 2019) have higher dynamics than imported

ones (+6.3%).

The change of the sales pattern in favor of locally made medicines was ensured, first

of all, by Russian antivirals Arbidol (+353.9% by value and +257.4% by volume) and

Ingavirin (+110.9% in rubles and +63.0% in package items).

The growth of the locally made medicines' share is an already long-held trend for the

pharmaceutical market. Since 2012, this rate has grown from 36% to 44%. In package

items, the dynamics is less evident: for 8 years, the share has only increased by 1.6%.

In spite of the fact that the number of Russian and foreign manufacturers in the market

is generally almost the same (nearly 540 and 560 companies respectively), there are

more foreign medicine brands presented in drugstores (around 3,368, which makes

9,053 SKU). This figure for domestic drugs is 36% less, equal to 2,480 brands (8,615

SKU). Therefore, it is apparent that foreign manufacturers sell more 'unique' units—

original medicines and branded generics. Russian medicines are issued in bulk in form

of non-branded generics by several companies simultaneously.

In 2020, the leader of medicine retail sales among ATC groups by volume became

Group A: Alimentary tract and metabolism (788.4 million package items). The best

sales dynamics in package items and by value was demonstrated by two groups: L:

Antineoplastic and immunomodulating agents (+30.9% in package items, +40.8% in

terms of total worth) and J: Antiinfectives for systemic use (+22.5% in package items,

+48.1% in terms of total worth).

Top Medicine Manufacturers in Retail Market

In 2020, more than 1,100 players were present in the Russian pharmaceutical market.

In aggregate, Top 20 companies cover 53.2% of the medicine sales total worth. As

compared to 2019, the total share of the Top 20 increased by 0.7%.

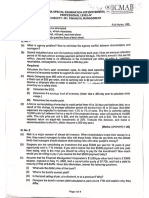

Top 10 Medicine Manufacturers by Total Worth in 2020

Position Sales, Gain, %

No. Manufacturer Share, %

change M RUB 2020/2019

1 - Bayer 51,602.4 4.6% +18.1%

2 +2 Novartis 47,044.8 4.2% +26.6%

3 +4 OTCPharm 44,275.6 3.9% +37.1%

4 -1 Sanof 41,351.0 3.7% +6.2%

5 -3 Stada 40,857.0 3.6% +3.2%

6 -1 Teva 38,014.4 3.4% +10.1%

7 -1 Servier 34,190.3 3.0% +2.3%

8 - KRKA 30,861.9 2.7% +6.1%

9 +1 A. Menarini 30,683.7 2.7% +11.5%

10 -1 GlaxoSmithKline 29,729.7 2.6% +3.2%

Source: DSM Group, Russian Pharmaceutical Market 2020

The leader in the pharmacy segment at year-end, already as ever, is Bayer (4.6% in

rubles), which pharma sales have increased by 18.1%. The German corporation's

portfolio includes 68 brands sold in drugstores. The first place by sales volume gain

(out of Top 10 Bayer portfolio brands) is taken by an antacid Rennie (+40.7% as

compared to the 2019 sales level).

The second place is taken by the Novartis corporation with a 4.2% share. A number of

the company's leading medicines was characterized by a notable sales increase—

Broncho-munal (+156.8 as compared to the 2019 sales level), ACC (+54.3%),

Amoksiklav (+35.7%).

The Russian manufacturer OTCPharm (+4 position) moved up to the third ranking

position, having fallen to the leader with just a 0.6% share difference in rubles. The

company's sales in 2020 increased by 37.1% as compared to the previous year.

Russian drugstores sell 37 brands of the company. Out of them, a remarkable growth

of demand was recorded for antivirals Arbidol (+353.9%) and Amixin (+104.7%).

Online Sales Development Trend

In April, the State Duma enacted a law on distance selling of medicines. In 2020, the

rules covered over-the-counter medication, but in the event of an emergency and a

disease distribution threat, which is dangerous to people, the government is entitled to

temporarily permit online sales of particular Rx drugs, too.

Despite of appearance of a 'new' sales channel—online—its main participants are still

pharmacy chains. That is why the volume that is currently accounted for by online

trade almost entirely remains in pharmacy retail. The volume of pharmacy eCom in

2020 equaled to nearly 93.2 billion rubles (medicines and parapharmaceuticals

jointly), which corresponds to 6.6% of the pharma market capacity). At the turn of the

year, in January, it was already at a rate of 8.2%. However, if market sales dynamics

in general is about 10%, the turnover that accrued to online has increased by 62% as

compared to 2019.

Pharmaceutical brands traditionally give their preference to TV ads, but in the new

reality, online ads showed good progress: in the first half of 2020, the medication

online advertising market increased by 43%.

You might also like

- Economics O LevelDocument9 pagesEconomics O LevelClaudia GomesNo ratings yet

- Bonds PayableDocument9 pagesBonds PayableKayla MirandaNo ratings yet

- Current Trends and Clinical Alerts in Nursing Pharmacology - FinaaalDocument7 pagesCurrent Trends and Clinical Alerts in Nursing Pharmacology - FinaaalSORENI SORENI50% (2)

- A45 Strategy-91Document84 pagesA45 Strategy-91Moses Tinyiko Shipalana88% (8)

- EferozDocument57 pagesEferozMehwish QureshiNo ratings yet

- Profile of The Indian ConsumerDocument10 pagesProfile of The Indian ConsumerSowjanya KunareddyNo ratings yet

- Pharmaceuticals Sector Analysis ReportDocument2 pagesPharmaceuticals Sector Analysis Reportabhinay reddyNo ratings yet

- T NG Quan NgànhDocument6 pagesT NG Quan Ngànhk60.2113340007No ratings yet

- Business Description: CFA Investment Research Challenge Student DHG Pharmaceutical CompanyDocument3 pagesBusiness Description: CFA Investment Research Challenge Student DHG Pharmaceutical CompanyVũ Đức TàiNo ratings yet

- The Indian Pharmaceutical Industry Is Highly FragmentedDocument3 pagesThe Indian Pharmaceutical Industry Is Highly FragmentedSanchit SawhneyNo ratings yet

- Pharma SwotDocument4 pagesPharma SwotzeeshannaqviNo ratings yet

- 1337161382an Overview of The Pharmaceutical Sector in Bangladesh (May 2012)Document12 pages1337161382an Overview of The Pharmaceutical Sector in Bangladesh (May 2012)Sharmin SultanaNo ratings yet

- Global Pharma Report PDFDocument8 pagesGlobal Pharma Report PDFMax MilanNo ratings yet

- World Preview 2016 Outlook To 2022Document49 pagesWorld Preview 2016 Outlook To 2022Willy Pérez-Barreto MaturanaNo ratings yet

- Pharma Industry Report Nov 16Document62 pagesPharma Industry Report Nov 16jonnyNo ratings yet

- Pakistan Pharmaceutical Industry SWOT AnalysisDocument7 pagesPakistan Pharmaceutical Industry SWOT AnalysisMehr SaqibNo ratings yet

- SECTOR STUDY-Pharmaceutical APRIL 2020 Kanwal - 1589554722Document13 pagesSECTOR STUDY-Pharmaceutical APRIL 2020 Kanwal - 1589554722Zia ul IslamNo ratings yet

- Pharmaceutical IndustryDocument34 pagesPharmaceutical Industryw3d001100% (1)

- Homeopathy Products MarketDocument15 pagesHomeopathy Products MarketNamrataNo ratings yet

- Macleods Pharmaceuticals - WIPDocument3 pagesMacleods Pharmaceuticals - WIPMinakshi XP23010No ratings yet

- Vietnam Pharmaceutical IndustryDocument28 pagesVietnam Pharmaceutical Industrysachinkumarapi100% (2)

- Pharmaceutical Industry in BangladeshDocument11 pagesPharmaceutical Industry in Bangladeshmd fahadNo ratings yet

- Antibacterial Drugs Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2013 - 2019Document13 pagesAntibacterial Drugs Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2013 - 2019api-247970851No ratings yet

- 2010.12.17-Pharma Sector Report - Initiating Coverage PDFDocument28 pages2010.12.17-Pharma Sector Report - Initiating Coverage PDFRaluca ArhireNo ratings yet

- 12-Sydney Clark-OTC Market in Latin AmericaDocument18 pages12-Sydney Clark-OTC Market in Latin Americasmanna77No ratings yet

- Expanding-into-Asia-Pacific-v2 by LEKDocument19 pagesExpanding-into-Asia-Pacific-v2 by LEKLong ChongNo ratings yet

- Công Ty DHGDocument83 pagesCông Ty DHGThu Hoai NguyenNo ratings yet

- Manufacturing Landscape: Clarivate Analytics NewportDocument6 pagesManufacturing Landscape: Clarivate Analytics NewportNarendra JoshiNo ratings yet

- Pharmaceutical Industry Aug 12Document45 pagesPharmaceutical Industry Aug 12kailas134100% (1)

- PHARMA - Monthly 20211109 MOSL RU PG026Document26 pagesPHARMA - Monthly 20211109 MOSL RU PG026Ravi KumarNo ratings yet

- Term Paper On Business Environment Topic: Pharmaceuticals:-PESTLE AnalysisDocument15 pagesTerm Paper On Business Environment Topic: Pharmaceuticals:-PESTLE Analysissarangk87No ratings yet

- PharmaSector - 29apr19Document13 pagesPharmaSector - 29apr19InciaNo ratings yet

- Strategic Grouping by Percent of Revenue Spent On R&DDocument3 pagesStrategic Grouping by Percent of Revenue Spent On R&DpracashNo ratings yet

- Identification of Strategic Groups Within The Global Pharmaceutical IndustryDocument9 pagesIdentification of Strategic Groups Within The Global Pharmaceutical IndustrypracashNo ratings yet

- Role of Pharmaceutical Sector in The National Economy of BangladeshDocument7 pagesRole of Pharmaceutical Sector in The National Economy of BangladeshMD Ruhul AminNo ratings yet

- IQ4I Research & Consultancy Published A New Report On "Active Pharmaceutical Ingredient (API) Global Market - Forecast To 2027"Document7 pagesIQ4I Research & Consultancy Published A New Report On "Active Pharmaceutical Ingredient (API) Global Market - Forecast To 2027"VinayNo ratings yet

- Investor News: Bayer Significantly Improves EarningsDocument8 pagesInvestor News: Bayer Significantly Improves EarningsAnonymous Y9PhqR4YEQNo ratings yet

- Economics Research PaperDocument7 pagesEconomics Research PaperSunidhiNo ratings yet

- USA - Regulatory Market Profile PharmexcilDocument22 pagesUSA - Regulatory Market Profile PharmexcilluckyprimeNo ratings yet

- OTC Drug Marketing - Global Trends and Indian ExperiencesDocument8 pagesOTC Drug Marketing - Global Trends and Indian Experienceskush_vashNo ratings yet

- Bangladesh Market Regulatory Report2020Document13 pagesBangladesh Market Regulatory Report2020itsshuvroNo ratings yet

- Pharmaceutical IndustryDocument4 pagesPharmaceutical Industrynoorullahj66No ratings yet

- 1 PBDocument24 pages1 PBMiy AichNo ratings yet

- Pharmaceutical Sector OverviewDocument5 pagesPharmaceutical Sector Overviewsh4dow.strid3r9581No ratings yet

- Production of Essential Drugs in BangladeshDocument18 pagesProduction of Essential Drugs in BangladeshAbdullah FaisalNo ratings yet

- Generic DrugDocument8 pagesGeneric DrugNur Md Al HossainNo ratings yet

- Natco Pharma LTD.: Financial Analysis Project Krishi Shah Roll No: 43 March 2022Document9 pagesNatco Pharma LTD.: Financial Analysis Project Krishi Shah Roll No: 43 March 2022Berwyn D'melloNo ratings yet

- Pharmaceuticals and Medical Devices SectorDocument3 pagesPharmaceuticals and Medical Devices Sectortsholofelo motsepeNo ratings yet

- Nepalese Pharmaceutical Industries & Who GMPDocument6 pagesNepalese Pharmaceutical Industries & Who GMPJaya Bir Karmacharya100% (1)

- Industry AnalysisDocument2 pagesIndustry AnalysisTowhid KamalNo ratings yet

- Global Pharmaceutical Industry AnalysisDocument16 pagesGlobal Pharmaceutical Industry AnalysisMohd Shahbaz HusainNo ratings yet

- Pakistan Pharmaceutical Industry Challenges & Future ProspectsDocument30 pagesPakistan Pharmaceutical Industry Challenges & Future ProspectsarifmukhtarNo ratings yet

- (In English) 2020 Korea Innovative PHARMACEUTICAL CompanyDocument82 pages(In English) 2020 Korea Innovative PHARMACEUTICAL CompanyMariana HernandezNo ratings yet

- Mahesh 6058Document114 pagesMahesh 6058ParthNo ratings yet

- IndusView Publication Vol4 Issue5 Special Report Pharma SectorDocument3 pagesIndusView Publication Vol4 Issue5 Special Report Pharma SectorSwapnil GangurdeNo ratings yet

- DSM Report 2014 20 05 1Document76 pagesDSM Report 2014 20 05 1Kushal TiwariNo ratings yet

- Characteristics of The World Pharmaceutical IndustryDocument11 pagesCharacteristics of The World Pharmaceutical IndustryLeila TorschoNo ratings yet

- Economics ProjectDocument10 pagesEconomics ProjectARYAN GUPTANo ratings yet

- Indian Pharma Industry Project 1st DraftDocument24 pagesIndian Pharma Industry Project 1st DraftsatinderpalkaurNo ratings yet

- Pharmaceutical Industry of PakistanDocument15 pagesPharmaceutical Industry of Pakistanzayan mustafaNo ratings yet

- Saudi Arabia Pharmaceutical Market Opportunity AnalysisDocument0 pagesSaudi Arabia Pharmaceutical Market Opportunity AnalysisNeeraj Chawla0% (1)

- Factors Affecting the Sales of Independent Drugstores (A Historical Perspective)From EverandFactors Affecting the Sales of Independent Drugstores (A Historical Perspective)No ratings yet

- An Analysis of Changes in the Global Tobacco Market and its Effects on PMI's Internationalization and ExpansionFrom EverandAn Analysis of Changes in the Global Tobacco Market and its Effects on PMI's Internationalization and ExpansionNo ratings yet

- UntitledDocument110 pagesUntitledtrang huyềnNo ratings yet

- Comparative Study On Initial Public Offer (Ipo) : Management of Indian Financial SystemsDocument21 pagesComparative Study On Initial Public Offer (Ipo) : Management of Indian Financial SystemsHimanshu JoshiNo ratings yet

- East West University: ''A Short Report On The Financial Highlights of The Selected Companies''Document16 pagesEast West University: ''A Short Report On The Financial Highlights of The Selected Companies''bonyNo ratings yet

- Ceb Proceedings 08 09 20102113Document361 pagesCeb Proceedings 08 09 20102113Dylan De SilvaNo ratings yet

- Introduction of The Company CaterpillarDocument5 pagesIntroduction of The Company CaterpillarJyoti Pathak FnEqfAISerNo ratings yet

- CosAcc Unit 1 Introduction PDFDocument13 pagesCosAcc Unit 1 Introduction PDFKrisha NicoleNo ratings yet

- AmazonDocument9 pagesAmazonPRATHAMESH WAJEKAR100% (1)

- DividendsDocument3 pagesDividendsClaudia ChoiNo ratings yet

- Hbs MCC GuideDocument114 pagesHbs MCC GuideSriram Thwar100% (1)

- The Ontology of Money by Geoffrey Ingham - TWILL #14Document8 pagesThe Ontology of Money by Geoffrey Ingham - TWILL #14Edward HillNo ratings yet

- ECON 1033 - Handout 1Document8 pagesECON 1033 - Handout 1Justin Deil AlbanoNo ratings yet

- MM ProjectDocument4 pagesMM ProjectShreya DNo ratings yet

- HMT: Relaunch Strategy by Rohan ChackoDocument35 pagesHMT: Relaunch Strategy by Rohan Chackorohanchacko67% (3)

- Depositoryparticipants NZDocument186 pagesDepositoryparticipants NZAabhishek BeezeeNo ratings yet

- GLOBALIZATIONDocument30 pagesGLOBALIZATIONClaire Canapi BattadNo ratings yet

- Consumer Behaviour (Rajesh)Document24 pagesConsumer Behaviour (Rajesh)Rajesh KumarNo ratings yet

- Cost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisDocument59 pagesCost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisHarold Dela Fuente100% (1)

- 9 - Pricing StrategyDocument23 pages9 - Pricing StrategyWaqas AhmadNo ratings yet

- WEEK 4 0 11. POJK 36 Shelf RegistrationDocument20 pagesWEEK 4 0 11. POJK 36 Shelf RegistrationgabiNo ratings yet

- I. Development Concepts & PrinciplesDocument23 pagesI. Development Concepts & PrinciplesRafael BacalandoNo ratings yet

- The Blue Collar Theoretically - John F LavelleDocument288 pagesThe Blue Collar Theoretically - John F LavelleawangbawangNo ratings yet

- Anthony Mckee: Email Marketing Tools Content Management SystemsDocument3 pagesAnthony Mckee: Email Marketing Tools Content Management SystemsAnts MckeeNo ratings yet

- Tractor Case StudyDocument24 pagesTractor Case StudyMazen BackupNo ratings yet

- 09marketstructure Past PaperDocument21 pages09marketstructure Past PaperJacquelyn ChungNo ratings yet

- Marketing MCQsDocument78 pagesMarketing MCQsTARIQKHAN747No ratings yet

- FIM Old Syllabus Questions - OcredDocument75 pagesFIM Old Syllabus Questions - OcredPavel DhakaNo ratings yet