Professional Documents

Culture Documents

47528rmc No. 56-2009

Uploaded by

Ei Mi San0 ratings0% found this document useful (0 votes)

14 views1 pageThis Revenue Memorandum Circular updates the Government Money Payment Chart that prescribes the withholding tax rates to be used when computing taxes withheld on payments made by the government for goods and services. It applies the new tax rates from Revenue Regulations 12-2001, 14-2002, 17-2003, 30-2003, and 16-2005. All government withholding agents, revenue officials, employees, and others concerned are directed to use the updated chart and give this circular wide publicity.

Original Description:

Original Title

47528rmc no. 56-2009

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis Revenue Memorandum Circular updates the Government Money Payment Chart that prescribes the withholding tax rates to be used when computing taxes withheld on payments made by the government for goods and services. It applies the new tax rates from Revenue Regulations 12-2001, 14-2002, 17-2003, 30-2003, and 16-2005. All government withholding agents, revenue officials, employees, and others concerned are directed to use the updated chart and give this circular wide publicity.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 page47528rmc No. 56-2009

Uploaded by

Ei Mi SanThis Revenue Memorandum Circular updates the Government Money Payment Chart that prescribes the withholding tax rates to be used when computing taxes withheld on payments made by the government for goods and services. It applies the new tax rates from Revenue Regulations 12-2001, 14-2002, 17-2003, 30-2003, and 16-2005. All government withholding agents, revenue officials, employees, and others concerned are directed to use the updated chart and give this circular wide publicity.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

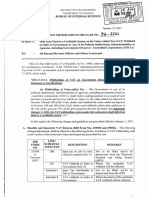

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

August 10, 2009

REVENUE MEMORANDUM CIRCULAR NO. 56 - 2009

SUBJECT: Prescribing the use of the Updated Government Money Payment

Chart (Annex “A”) to implement Sections 2.57.2, 4.114 and 5.116

of Revenue Regulations (RR) No. 2-98, as amended by RR No. 16-

2005, in relation to Sections 57(B), 114(C) and 116 to 123 of

Republic Act (RA) No. 8424, as amended by RA No. 9337,

amending for the purpose Revenue Memorandum Circular No. 5-

2006 (RMC 5-2006)

TO : All Government Withholding Agents, Internal Revenue Officials,

Employees and Others Concerned

For the information and guidance of all government withholding agents,

internal revenue officials, employees and others concerned, the Government

Money Payment Chart under RMC 5-2006 prescribing the withholding tax rates to

be used in the computation of taxes to be withheld (creditable and final) on the sale

of goods and services to the government or to any of its political subdivisions

including barangays, instrumentalities or agencies, and government-owned or

controlled-corporations (GOCCs), is hereby updated/amended. This new

Government Money Payment Chart which is attached hereto as Annex “A” and

made an integral part hereof, takes into consideration the new rates provided in RR

Nos. 12-2001, 14-2002, 17-2003, 30-2003, 16-2005 and other related issuances.

All concerned are hereby enjoined to give this circular as wide a publicity

as possible.

(Original Signed)

SIXTO S. ESQUIVIAS IV

Commissioner of Internal Revenue

J-2

A-1 LBH ______

NMA _____

VLT ______

MLR ______

TFF ______

J-2 MAG ____

You might also like

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- 27955rmc No. 05-2006 PDFDocument1 page27955rmc No. 05-2006 PDFrussel1435No ratings yet

- RMC No. 05-2006Document1 pageRMC No. 05-2006odessaNo ratings yet

- Service TAx - Notification-Nos-29-to-37Document6 pagesService TAx - Notification-Nos-29-to-37sd naikNo ratings yet

- Bureau of Internal RevenueDocument2 pagesBureau of Internal Revenueapi-247793055No ratings yet

- Venezuela Before Chávez: Anatomy of an Economic CollapseFrom EverandVenezuela Before Chávez: Anatomy of an Economic CollapseRating: 1 out of 5 stars1/5 (1)

- in The Export of Services Rules, 2005, in Rule 3, in Sub-Rule (1), in Clause (Ii)Document9 pagesin The Export of Services Rules, 2005, in Rule 3, in Sub-Rule (1), in Clause (Ii)shreyansghorawatNo ratings yet

- Revei (Ue Memorai/Dum Crrcular No.: Interi (AlDocument2 pagesRevei (Ue Memorai/Dum Crrcular No.: Interi (AlRONIN LEENo ratings yet

- Ministry: File IndiaDocument13 pagesMinistry: File IndiaNarayanaNo ratings yet

- The Marner The The Jurisdictional Principal 1, As by Time The or ToDocument1 pageThe Marner The The Jurisdictional Principal 1, As by Time The or ToElvisPresliiNo ratings yet

- 10 March 2011: Bureau of Internal RevenueDocument1 page10 March 2011: Bureau of Internal RevenueJaypee LegaspiNo ratings yet

- Manual On Position Classification and CompensationDocument14 pagesManual On Position Classification and Compensationedwin6656No ratings yet

- Service Tax-Point of TaxationDocument1 pageService Tax-Point of TaxationNamrata Parakh MarothiNo ratings yet

- COA CIRCULAR NO. 96 006 May 2 1996Document3 pagesCOA CIRCULAR NO. 96 006 May 2 1996Marcellanne VallesNo ratings yet

- DMC 20 s2020Document4 pagesDMC 20 s2020Abubacar SamsodenNo ratings yet

- RMC No. 03-2006 (Guidelines On Attachments)Document2 pagesRMC No. 03-2006 (Guidelines On Attachments)Marco RvsNo ratings yet

- Manual On Position Classification and CompensationDocument13 pagesManual On Position Classification and CompensationOmar Sana100% (1)

- RMC No. 16-2021Document2 pagesRMC No. 16-2021Leichelle BautistaNo ratings yet

- Coa C2017-004Document14 pagesCoa C2017-004RonnelMananganCorpuzNo ratings yet

- Annex2 PDFDocument116 pagesAnnex2 PDFSiddharth KumarNo ratings yet

- 13fcrengvol2 2009-15Document219 pages13fcrengvol2 2009-15Jayanthi KandhaadaiNo ratings yet

- Explanation 2.-New Levy or Tax Shall Be Payable On All The Cases Other Than SpecifiedDocument1 pageExplanation 2.-New Levy or Tax Shall Be Payable On All The Cases Other Than SpecifiedabracadabraNo ratings yet

- 20156302363822344492SROamendmentofSRO647 Sec8bDocument1 page20156302363822344492SROamendmentofSRO647 Sec8bMuhammadIjazAslamNo ratings yet

- Budgetcircular2010 11Document109 pagesBudgetcircular2010 11Vikas AnandNo ratings yet

- NIRC Table of AmendmentsDocument1 pageNIRC Table of AmendmentsAlejandro de LeonNo ratings yet

- Karnataka: in of of in of ofDocument2 pagesKarnataka: in of of in of ofShreenath KNNo ratings yet

- Coa C2017-004Document8 pagesCoa C2017-004Tom Louis HerreraNo ratings yet

- Finance Department Notifications-2006 (323-549)Document116 pagesFinance Department Notifications-2006 (323-549)Humayoun Ahmad Farooqi83% (6)

- RR 16-05 - AmendmentsDocument39 pagesRR 16-05 - AmendmentsArchie GuevarraNo ratings yet

- ICT Ordinance 2001 (Tax On Services) Updated Upto 30.06.2015Document12 pagesICT Ordinance 2001 (Tax On Services) Updated Upto 30.06.2015Muhammad MudasserNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- Finance Department Notifications 2006 323 549 PDFDocument116 pagesFinance Department Notifications 2006 323 549 PDFnonoo macNo ratings yet

- Department of Finance: Bureau of Internal RevenueDocument1 pageDepartment of Finance: Bureau of Internal RevenuePeggy SalazarNo ratings yet

- eSRE PRIMER PDFDocument20 pageseSRE PRIMER PDFBelenReyes100% (1)

- ICT (Tax On Services) Updated Upto 15.01.2022Document15 pagesICT (Tax On Services) Updated Upto 15.01.2022Zafar IqbalNo ratings yet

- 1677rr27 02Document3 pages1677rr27 02Sy HimNo ratings yet

- Sro862 (I) 2010Document1 pageSro862 (I) 2010Muhammad Ammar KhanNo ratings yet

- Notificatiion (Sales Tax)Document1 pageNotificatiion (Sales Tax)inocentNo ratings yet

- Cic Oifd 07 08Document274 pagesCic Oifd 07 08Perkresht PawarNo ratings yet

- AMEND SEC 27 (C), RA No. 10026Document4 pagesAMEND SEC 27 (C), RA No. 10026Bing MendozaNo ratings yet

- 11 of 2011Document7 pages11 of 2011FelicianFernandopulleNo ratings yet

- Echapter Vol1 48Document1 pageEchapter Vol1 48Sagargn SagarNo ratings yet

- To Be Published in The Gazette of Pakistan Part-IiDocument23 pagesTo Be Published in The Gazette of Pakistan Part-IisadamNo ratings yet

- REVENUE REGULATIONS Issued On The 1st Semester of 2021Document71 pagesREVENUE REGULATIONS Issued On The 1st Semester of 2021HC LawNo ratings yet

- RMC No. 10-2020Document2 pagesRMC No. 10-2020Volt LozadaNo ratings yet

- RMC No. 8-2022Document1 pageRMC No. 8-2022Shiela Marie MaraonNo ratings yet

- Coa 2016-006Document8 pagesCoa 2016-006Genesis Caesar ManaliliNo ratings yet

- Government of TelanganaDocument3 pagesGovernment of TelanganaSrinivas NalimelaNo ratings yet

- GSR . (E) :-: (F.No.2-8/2004-NS-II) SD/ - (P.C. SINGH) Under Secretary To Government of IndiaDocument1 pageGSR . (E) :-: (F.No.2-8/2004-NS-II) SD/ - (P.C. SINGH) Under Secretary To Government of IndiaashaheerNo ratings yet

- Office of The SecretaryDocument2 pagesOffice of The Secretaryshane natividadNo ratings yet

- Arkansas Amendment SS To Bill SB131Document2 pagesArkansas Amendment SS To Bill SB131capsearchNo ratings yet

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- RR 2-98 - AmendmentsDocument196 pagesRR 2-98 - AmendmentsArchie Guevarra100% (2)

- Gis Intrest RatesDocument9 pagesGis Intrest RatesdayakarNo ratings yet

- RMC No 68-2017 PDFDocument2 pagesRMC No 68-2017 PDFPatrick John Castro BonaguaNo ratings yet

- Internal Revenue: Republic of Pfiilippines DepartmentDocument1 pageInternal Revenue: Republic of Pfiilippines DepartmentJohn RoeNo ratings yet

- 05-Balasan2022 Part1 Auditors ReportDocument2 pages05-Balasan2022 Part1 Auditors ReportEi Mi SanNo ratings yet

- 03-Estancia2022 Executive SummaryDocument4 pages03-Estancia2022 Executive SummaryEi Mi SanNo ratings yet

- Office of The SecretaryDocument8 pagesOffice of The SecretaryEi Mi SanNo ratings yet

- Audit Program Local Disaster Risk Reduction Management Fund CY 2021Document13 pagesAudit Program Local Disaster Risk Reduction Management Fund CY 2021Ei Mi San100% (1)

- Revised Audit Program - 20% DF Step by Step ProcessDocument8 pagesRevised Audit Program - 20% DF Step by Step ProcessEi Mi SanNo ratings yet

- LGS-B Antique - AP - Cash-and-Cash-Equivalents (Edited)Document7 pagesLGS-B Antique - AP - Cash-and-Cash-Equivalents (Edited)Ei Mi SanNo ratings yet

- Kapataganwd2013 Audit Report PDFDocument111 pagesKapataganwd2013 Audit Report PDFEi Mi SanNo ratings yet