Professional Documents

Culture Documents

AARM PSX Lesson 8

Uploaded by

mahboob_qayyumCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AARM PSX Lesson 8

Uploaded by

mahboob_qayyumCopyright:

Available Formats

Lesson # 8

Topic of the Day

HOW TO PICK WINNERS, STEP 5

By

ALI AKBAR REAL MENTOR

HOW TO PICK WINNERS, STEP 5

Getting the News: What the Statistics Don’t Tell You

B y now, you’ve isolated a few companies with attractive valuations, solid

growth, and strong profitability trends. That kind of fundamental stock analysis

can eliminate most of the bad apples. Still, before you buy, set the numbers aside

and focus more on the words. Specifically, learn about the company behind the

ticker symbol in nonmonetary terms. Plenty of companies look good by the

numbers, but statistics rarely tell the whole

story.

This chapter provides 10 steps to transition you from a careful stock

analyst to a wise stock owner. The first five provide tips for making informed

stock purchases, while the second five illustrate some ways to keep your

portfolio fresh and vibrant after you buy.

Company Analysis: Beyond the Numbers

1) Keep up with news about your stocks. Following the financial news

can seem daunting. Thousands of stories compete for your attention

each day. You can safely ignore most of them, but if you own 25 stocks,

take the time to read the company releases about financial news or new

products. Many portfolio trackers allow you to view headlines related to

the ticker symbols on your list. See what analysts and journalists have to

say, including their views about competing companies. If Acme’s biggest

rival has just introduced a new widget that renders your company’s key

product obsolete, you should know about it.

2)Subscribe to the Wall Street Journal. If you hope to keep up with the

financial markets, no other news source will help you more. The Journal

has value less as a source of company news than as a gateway to the

broad market and the forces that drive it. Plus, the paper offers well-

written stories on a variety of topics.

Actually read the Wall Street Journal. Of course, this sounds obvious.

But no newspaper has ever spent more time on desks or in briefcases

without being used than the Wall Street Journal. Plenty of people carry

the Journal around—often for the same reason some people keep works

like The Critique of Pure Reason or Anna Karenina in a prominent place on

a living room shelf, despite never having read the books.

Believe half of what you read, and less of what you hear. If you want to

read Internet columnists or watch CNBC, go ahead. They can provide

valuable insight. However, you should also realize that many of these

commentators have agendas of their own. While most media outlets at

least attempt to remain unbiased, some do the job better than others, and

the pundits they interview have no compunction for pushing an agenda.

Never, ever, ever, ever act on a stock tip. At least not without doing

your own research. With more than 5,000 stocks on the market, you

can’t own all the good ones. Just because someone with a loud voice and

a million Twitter followers insists that you buy Acme Widget before it

triples doesn’t mean the stock makes sense for you—or that it will triple.

Following Through: Keeping Up with Your Stocks

Consider politics for a moment. During an election year, you research

candidates, assessing their positions and qualifications. In the end, you select

the one you believe will best represent your interests. And then, if you

operate like most people, you leave the ballot box and don’t think much

about your choice until the next election comes around. Four years later, if

the guy you elected did a good job, you vote for him again. If he messed

everything up, you get the chance to replace him with someone who can do

better. Sounds a lot like a stock portfolio.

But stocks offer at least one advantage over politicians. If your stocks

tank, you can get rid of them without going through the trouble of justifying

and then actually achieving an impeachment. Just sell them and find

replacements. No majority opinion needed. Unfortunately, as with politics,

too many investors don’t follow through on or keep up with their

investments. Buying the stock doesn’t end the process, because investing is

less of a job and more of a journey. You purchase a stock, you monitor the

stock, and you sell the stock when it no longer makes sense to own it. Along

the way, you’ll buy and sell other stocks. Each purchase and sale is a

destination along the way.

Conscientious investors—the kind who actually take steps to achieve

their financial goals rather than simply dream about them—never really take

off their investing hats. Managing your portfolio need not be a full-time job.

In fact, it shouldn’t take nearly that much time. For most people, spending

more than 10 hours a week working on investments reflects poor time

management. Of course, spending less than an hour a week reflects

foolishness, at least for anyone who wishes to do her own research.

Following your stocks generally takes less time—and less math—than

analyzing them. The following five steps should give you all you need to keep

up with your investments—without turning the task into a second job.

Track your portfolio. The Yahoo!, MSN, and Google finance websites

all offer portfolio trackers, as do a host of other sites, including many

brokerages. This advice first surfaced in Chapter 3, but it’s worth

repeating here: Use one of these services to create a portfolio that

includes all your stocks, mutual funds, and exchange-traded funds, and

visit it at least once a week. If you’re prone to panic whenever you see

the red of a price decline on the screen, don’t visit more often than a

couple times a week. Stock prices change, and even the best ones don’t

rise every day. Your portfolio will see good days and bad. The better you

manage it, the higher the percentage of good days.

Investigate problems. Say you check your portfolio for the first time in

a week and see that Acme Widget has declined 5% since the last time

you looked at it. If most of your stocks and the broader market have

posted similar declines, Acme probably warrants no extra attention. On

the other hand, if Acme has fallen despite steady or rising prices for

most of the market, you must find out why.

Reassess your stocks frequently. You don’t need to repeat your

statistical analysis every week. Even if a company doesn’t generate

much news regularly, be sure you think about it from time to time. If

shares rise or fall more than 10% from the point when you bought

them, you might want to repeat your valuation analysis.

Revisit the financials once a quarter. Every quarter, companies

release the next phase of their growth and profitability metrics

(discussed in Chapters 5 and 6). Once your company has updated all its

numbers, see if those profitability and growth trends have changed. You

may have to wait a while if the company doesn’t give you everything in

the earnings release. In that case, turn to the SEC filings. This shouldn’t

take long, as you’re just adding the most recent quarter to historical

data you’ve already collected.

Don’t overreact to the news. This may be the hardest advice to follow,

and it deserves some extra space. Sometimes your company posts bad

quarterly results, and the shares take a dive. Sometimes government

regulators enact new rules that will cost your company money. And

sometimes the stock simply declines because of weakness regarding its

industry or sector. In all three cases, knee-jerk reactions can cause you

to make mistakes.

Stocks often rally the day after bad news sparks a sell-off, and selling

immediately on bad news can cost you money. Of course, some stocks do

keep going down. For the most part, investors shouldn’t try to diagnose long-

term effects based on initial media reports—at least not enough to warrant

a quick sell decision. Plenty of companies see their stocks dip 10% (or even

20%), only to bounce back to new highs in a few weeks or months.

Determining whether or not a troubled stock will accomplish this feat may

be the toughest task an investor faces. Of course, there is no single formula

for doing it right, because no two situations are alike.

When deciding how to react in the wake of bad news, consider the

following points:

Put more weight on news that affects a company’s operations. If a rival

comes out with a new product that threatens to take market share,

look into it. Has your company historically responded well to such

crises, coming out with its own new products? What do analysts who

follow the stock say about its ability to compete? If you believe a

development will substantially slow sales or profit growth, it might be

time to sell.

Don’t get worked up over legal battles. The raft of tobacco lawsuits in

the early 2000s changed the way the industry did business, as did the

regulatory crackdown on banks after the fiscal crisis of 2008 and

2009. The vast majority of consumer lawsuits and antitrust actions

don’t have that effect. Additionally, remember those special items

companies

exclude from their earnings? Legal judgments and settlements

generally end up in that category. While headlines can hurt the stock

in the near term, the long-term picture probably hasn’t changed much.

The crowd isn’t always right, but most of the time, when the crowd zigs,

zagging will get you into trouble. The easiest way to make a fortune is

to take a stand and make a big bet when the entire market has bet on

the other side. Unfortunately, such strategies can cause investors to

lose fortunes even more easily.

If everyone sells the first day, you can equate it to sheep running from

danger. The same goes for the second day. But if the share price continues to

degrade and the news remains bad, ignore the headlines at your peril. By all

means, stick with a stock if you see reason for optimism and if you believe

the company can fix whatever problem caused the shares to fall. However, if

you lack such conviction, don’t fear selling, even if you end up getting it

wrong. There’s no shame in backing out of what looks like a bad investment

and switching into something with more potential. You won’t always act at

the proper time, and sometimes you’ll sell when you should have bought. It

happens. But what’s the best remedy for missing out on a rally in a stock you

sold too soon? The rally you enjoy from the stock you just purchased.

ALI AKBAR REAL MENTOR

THANKS FOR PARTICIPATION

End of lesson

You might also like

- Stock Market Investing for Beginners & DummiesFrom EverandStock Market Investing for Beginners & DummiesRating: 4.5 out of 5 stars4.5/5 (25)

- 10 Rules To Beat The MarketDocument4 pages10 Rules To Beat The MarketClipper231No ratings yet

- Rule 1 of Investing: How to Always Be on the Right Side of the MarketFrom EverandRule 1 of Investing: How to Always Be on the Right Side of the MarketRating: 4 out of 5 stars4/5 (3)

- How to Pick Winners Step 4: Putting Analysis TogetherDocument7 pagesHow to Pick Winners Step 4: Putting Analysis Togethermahboob_qayyumNo ratings yet

- Jim Cramer's Real Money (Review and Analysis of Cramer's Book)From EverandJim Cramer's Real Money (Review and Analysis of Cramer's Book)No ratings yet

- How To Invest in Stocks: How Stocks Work, How To Calculate Return On Investment and Other Investing BasicsDocument9 pagesHow To Invest in Stocks: How Stocks Work, How To Calculate Return On Investment and Other Investing BasicsAshok Subramaniam100% (1)

- The Secrets of Stock Market Success: How to Make Money Using Just a Few Blue Chip SharesFrom EverandThe Secrets of Stock Market Success: How to Make Money Using Just a Few Blue Chip SharesNo ratings yet

- 9 Points To Check Before Picking A MultibaggerDocument17 pages9 Points To Check Before Picking A MultibaggerbhatambarekarNo ratings yet

- Penny Stocks: A Practical Guide to Improve Your Trading Psychology (How to Find Penny Stocks Day Trading and Earning Big Money Online)From EverandPenny Stocks: A Practical Guide to Improve Your Trading Psychology (How to Find Penny Stocks Day Trading and Earning Big Money Online)No ratings yet

- Covered Call Expert ReportDocument50 pagesCovered Call Expert Reporttvadmaker100% (2)

- Discover Ideas Using Company Reports and Stock ScreeningDocument4 pagesDiscover Ideas Using Company Reports and Stock Screeningthepwner23No ratings yet

- Stocks GuideDocument13 pagesStocks Guideinternetisgreat12356No ratings yet

- You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market PFrom EverandYou Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market PRating: 4.5 out of 5 stars4.5/5 (42)

- Distressed Debt An Avenue To Profit in Corporate Bankruptcy Article 1Document2 pagesDistressed Debt An Avenue To Profit in Corporate Bankruptcy Article 1corporateboy36596No ratings yet

- Stock Market Investing for Beginners: 7 Steps to Learn How You Can Create Financial Freedom Through Stock Investing, With These Golden Nuggets!From EverandStock Market Investing for Beginners: 7 Steps to Learn How You Can Create Financial Freedom Through Stock Investing, With These Golden Nuggets!Rating: 4.5 out of 5 stars4.5/5 (2)

- One College Square SouthDocument16 pagesOne College Square SouthPrashantKNo ratings yet

- Binary Trading Strategies: Learn Binary Options Profit Making StrategiesFrom EverandBinary Trading Strategies: Learn Binary Options Profit Making StrategiesRating: 2 out of 5 stars2/5 (4)

- 7 Stock Buying Mistakes and How To Avoid ThemDocument5 pages7 Stock Buying Mistakes and How To Avoid ThemMohammad IskandarNo ratings yet

- Your Little Book of Dividend Investing: How To Get Rich SlowlyFrom EverandYour Little Book of Dividend Investing: How To Get Rich SlowlyNo ratings yet

- Mrdpaq'S Investment StrategyDocument4 pagesMrdpaq'S Investment Strategyapi-140385548No ratings yet

- Book Review - One Upon Wall StreetDocument20 pagesBook Review - One Upon Wall StreetPriya UpadhyayNo ratings yet

- Investing Success Tips From Peter LynchDocument7 pagesInvesting Success Tips From Peter LynchChinmay PanhaleNo ratings yet

- Day Trading: Strategies on How to Excel at Day Trading: Strategies On How To Excel At Trading, #1From EverandDay Trading: Strategies on How to Excel at Day Trading: Strategies On How To Excel At Trading, #1Rating: 4.5 out of 5 stars4.5/5 (2)

- Trading Stocks & Options 101-Min 2Document34 pagesTrading Stocks & Options 101-Min 2AjayNo ratings yet

- Day Trading: Strategies on How to Excel at Day Trading: Trade Like A King (Strategies On How To Excel At Day Trading: Trade Like A KingFrom EverandDay Trading: Strategies on How to Excel at Day Trading: Trade Like A King (Strategies On How To Excel At Day Trading: Trade Like A KingRating: 3 out of 5 stars3/5 (1)

- Suggestion and FormullaDocument35 pagesSuggestion and FormullapandeyshivpatiNo ratings yet

- Sell Short: A Simpler, Safer Way to Profit When Stocks Go DownFrom EverandSell Short: A Simpler, Safer Way to Profit When Stocks Go DownRating: 1 out of 5 stars1/5 (2)

- STT-ExplosiveProfitGuide v1c PDFDocument23 pagesSTT-ExplosiveProfitGuide v1c PDFIoannis Michelis100% (2)

- Penny Stocks Made Simple - A Beginners Guide To Day Trading Penny StocksFrom EverandPenny Stocks Made Simple - A Beginners Guide To Day Trading Penny StocksRating: 3 out of 5 stars3/5 (1)

- How Stocks and The Stock Market WorkDocument16 pagesHow Stocks and The Stock Market WorkVictoria GomezNo ratings yet

- The Alternate Road To InvestingDocument13 pagesThe Alternate Road To InvestingnatesanviswanathanNo ratings yet

- Biggest mistakes in value investing and lessons learnedDocument9 pagesBiggest mistakes in value investing and lessons learnedPook Kei JinNo ratings yet

- The Power of Pareto's Law - How To Win The Stock Market and Maximize Wealth Creation!Document24 pagesThe Power of Pareto's Law - How To Win The Stock Market and Maximize Wealth Creation!valleaxelssonNo ratings yet

- Stock StrategiesDocument29 pagesStock StrategiesHans CNo ratings yet

- Gibson, Paul - Notes From A Profitable Investor - NodrmDocument295 pagesGibson, Paul - Notes From A Profitable Investor - NodrmantonNo ratings yet

- TraderzLibrary The Definitive GuideDocument234 pagesTraderzLibrary The Definitive GuideAdiKangdra100% (2)

- One Up On Wall StreetDocument6 pagesOne Up On Wall StreetJohn McGinty25% (4)

- 13th Feb 2022 - MR CKR Presentation For How To Be AnalystDocument30 pages13th Feb 2022 - MR CKR Presentation For How To Be Analystaditya162100% (1)

- How To Create Investor Pitch & Financial ProjectionsDocument6 pagesHow To Create Investor Pitch & Financial Projectionsfalguni mathewsNo ratings yet

- Guide To StockDocument23 pagesGuide To StockKuldeep KushwahaNo ratings yet

- Investment Interview TipsDocument11 pagesInvestment Interview TipsSilviu TrebuianNo ratings yet

- Don Fishback The 3 Proven KeyDocument30 pagesDon Fishback The 3 Proven KeyCristinaNo ratings yet

- Stock-Picking Strategies: Introduction: StocksDocument38 pagesStock-Picking Strategies: Introduction: StocksNetViee Manalo Migriño100% (1)

- How To Make Money in The Stock MarketDocument4 pagesHow To Make Money in The Stock MarketKarthik PatilNo ratings yet

- How - To - Get - Ahead - Thread - by - Goodalexander - Jul 7, 23 - From - RattibhaDocument6 pagesHow - To - Get - Ahead - Thread - by - Goodalexander - Jul 7, 23 - From - RattibhanelsonxaviermailNo ratings yet

- Stock PitchDocument4 pagesStock PitchthatbassdudeNo ratings yet

- Stock-Picking Strategies: Fundamental Analysis TheoryDocument33 pagesStock-Picking Strategies: Fundamental Analysis TheoryFen Rajan100% (1)

- Imbang Klase How To Start TradingDocument24 pagesImbang Klase How To Start Tradingbbags myeverydaypartnerNo ratings yet

- Analyze Stocks Using Fundamental and Technical Data From MarketSmith PDFDocument7 pagesAnalyze Stocks Using Fundamental and Technical Data From MarketSmith PDFSwarna BhavanicharanprasadNo ratings yet

- Mcgill Personal Finance Essentials Transcript Module 5: The Art of Investing 1, Part 1Document11 pagesMcgill Personal Finance Essentials Transcript Module 5: The Art of Investing 1, Part 1shourav2113No ratings yet

- Notes To One Up On Wall Street PDFDocument8 pagesNotes To One Up On Wall Street PDFBien GrubaNo ratings yet

- 5 Trading Clichés That Can Keep You From Building WealthDocument13 pages5 Trading Clichés That Can Keep You From Building WealthChiedozie OnuegbuNo ratings yet

- Newsletter BasantDocument6 pagesNewsletter BasantAshish AgrawalNo ratings yet

- 10 Estrategia para InvertirDocument13 pages10 Estrategia para InvertirMauricio Herrera DiazNo ratings yet

- One Upon W StreetDocument35 pagesOne Upon W StreetAlisha ShwetaNo ratings yet

- David Ryan's stock selling strategy and conviction levelsDocument17 pagesDavid Ryan's stock selling strategy and conviction levelsKhúc Ngọc TuyênNo ratings yet

- Valves & Controls: FCT Trunnion Mounted Split Body Ball ValvesDocument16 pagesValves & Controls: FCT Trunnion Mounted Split Body Ball ValvesadrianioantomaNo ratings yet

- Aarm PSX Lesson 1 Why To Invest in Stock MarketDocument7 pagesAarm PSX Lesson 1 Why To Invest in Stock Marketmahboob_qayyumNo ratings yet

- AARM PSX Lesson 4Document11 pagesAARM PSX Lesson 4mahboob_qayyumNo ratings yet

- AARM PSX Lesson 3Document6 pagesAARM PSX Lesson 3mahboob_qayyumNo ratings yet

- Aarm PSX Lesson 5Document14 pagesAarm PSX Lesson 5mahboob_qayyumNo ratings yet

- AARM PSX Lesson 4Document11 pagesAARM PSX Lesson 4mahboob_qayyumNo ratings yet

- Aarm PSX Lesson 1 Why To Invest in Stock MarketDocument7 pagesAarm PSX Lesson 1 Why To Invest in Stock Marketmahboob_qayyumNo ratings yet

- International Standard: Industrial Valves - Pressure Testing of Metallic ValvesDocument20 pagesInternational Standard: Industrial Valves - Pressure Testing of Metallic Valvesmahboob_qayyumNo ratings yet

- Energy Institute AVIFF GuidelinesDocument236 pagesEnergy Institute AVIFF GuidelinesMohd Reza Mohsin100% (2)

- AARM PSX Lesson 3Document6 pagesAARM PSX Lesson 3mahboob_qayyumNo ratings yet

- Vol. 2 CapDocument13 pagesVol. 2 Capmahboob_qayyumNo ratings yet

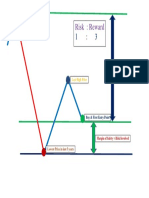

- Risk: Reward: Highest Price in Last 5 YearsDocument1 pageRisk: Reward: Highest Price in Last 5 Yearsmahboob_qayyumNo ratings yet

- Induction Water Bath HeaterDocument2 pagesInduction Water Bath Heatermahboob_qayyum100% (2)

- AMFI Sample 500 QuestionsDocument36 pagesAMFI Sample 500 QuestionsSuraj KumarNo ratings yet

- Balance Sheet Information: AssetsDocument10 pagesBalance Sheet Information: AssetsNicole Athena CruzNo ratings yet

- BMA 12e SM CH 28 Final PDFDocument13 pagesBMA 12e SM CH 28 Final PDFNikhil ChadhaNo ratings yet

- Business Strategy Final ReportDocument20 pagesBusiness Strategy Final ReportAxathor Lo60% (5)

- FinGame 5.0 Participants Ch03Document24 pagesFinGame 5.0 Participants Ch03Martin VazquezNo ratings yet

- Week 2 Problem 29 - Aurea StraubDocument11 pagesWeek 2 Problem 29 - Aurea StraubPetraNo ratings yet

- Turkcell en FR 2010Document105 pagesTurkcell en FR 2010Yuri TerrorhamsterNo ratings yet

- M&A in Indian BankingDocument51 pagesM&A in Indian BankingKundan Hood88% (8)

- Nestle IndiaDocument74 pagesNestle IndiaKiranNo ratings yet

- 2 SM Tariq Zafar 36 Research Article BMAEBM September 2012Document10 pages2 SM Tariq Zafar 36 Research Article BMAEBM September 2012muktisolia17No ratings yet

- Investment Week - Matrix Article - 21 March 2011Document2 pagesInvestment Week - Matrix Article - 21 March 2011Eden Rock Capital ManagementNo ratings yet

- Chapter 2 - Financial Statements & The Annual Report: Objectives of Financial ReportingDocument6 pagesChapter 2 - Financial Statements & The Annual Report: Objectives of Financial ReportingHareem Zoya WarsiNo ratings yet

- Interim Order in The Matter of Wasankar Wealth Management LTD., Mr. Prashant Wasankar and Ors.Document14 pagesInterim Order in The Matter of Wasankar Wealth Management LTD., Mr. Prashant Wasankar and Ors.Shyam SunderNo ratings yet

- ACC 642 - CH 01 SolutionsDocument17 pagesACC 642 - CH 01 SolutionstboneuncwNo ratings yet

- Business Tax, Income Tax, and Transfer Tax RulesDocument143 pagesBusiness Tax, Income Tax, and Transfer Tax RulesTerces100% (5)

- Completed CH6 Mini Case Pharma Biotech Working Papers Fall 2014Document3 pagesCompleted CH6 Mini Case Pharma Biotech Working Papers Fall 2014ZachLoving50% (2)

- AIF NewsDocument3 pagesAIF NewsDiksha DuttaNo ratings yet

- ch09 Beams12ge SMDocument31 pagesch09 Beams12ge SMMutia Wardani50% (2)

- Emerging Oil MarketsDocument230 pagesEmerging Oil MarketsdragoslavaNo ratings yet

- Finance 345 MidtermDocument2 pagesFinance 345 MidtermMatthew MurrayNo ratings yet

- Reliance Industries Limited - Letter of Offer - May 15 2020 PDFDocument335 pagesReliance Industries Limited - Letter of Offer - May 15 2020 PDFnitiwari92No ratings yet

- Cmfas Module 8a 1st Edition Mock PaperDocument13 pagesCmfas Module 8a 1st Edition Mock PaperJkNo ratings yet

- Muthoot Finance Marketing StrategyDocument32 pagesMuthoot Finance Marketing StrategyMayank Jain NeerNo ratings yet

- Take Home QuizDocument5 pagesTake Home QuizMA ValdezNo ratings yet

- Thematic Study | December 2020: 25 years of Wealth CreationDocument118 pagesThematic Study | December 2020: 25 years of Wealth CreationDylanNo ratings yet

- Citigroup LBODocument32 pagesCitigroup LBOLindsey Santos88% (8)

- F2019 Final Exam Review With AnswersDocument16 pagesF2019 Final Exam Review With AnswersRob WangNo ratings yet

- Corporation Accounting - DividendsDocument6 pagesCorporation Accounting - DividendsGuadaMichelleGripalNo ratings yet

- WQU Financial Markets Module 2 PDFDocument34 pagesWQU Financial Markets Module 2 PDFAbhishek Jyoti100% (1)

- Silicon Valley Bank PDFDocument33 pagesSilicon Valley Bank PDFM.Fazha QolbiNo ratings yet

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeFrom EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeNo ratings yet

- The 5 Second Rule: Transform your Life, Work, and Confidence with Everyday CourageFrom EverandThe 5 Second Rule: Transform your Life, Work, and Confidence with Everyday CourageRating: 5 out of 5 stars5/5 (7)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4 out of 5 stars4/5 (1)

- No Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelFrom EverandNo Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelRating: 5 out of 5 stars5/5 (2)

- Eat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less TimeFrom EverandEat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less TimeRating: 4.5 out of 5 stars4.5/5 (3224)

- Uptime: A Practical Guide to Personal Productivity and WellbeingFrom EverandUptime: A Practical Guide to Personal Productivity and WellbeingNo ratings yet

- Growth Mindset: 7 Secrets to Destroy Your Fixed Mindset and Tap into Your Psychology of Success with Self Discipline, Emotional Intelligence and Self ConfidenceFrom EverandGrowth Mindset: 7 Secrets to Destroy Your Fixed Mindset and Tap into Your Psychology of Success with Self Discipline, Emotional Intelligence and Self ConfidenceRating: 4.5 out of 5 stars4.5/5 (561)

- Quantum Success: 7 Essential Laws for a Thriving, Joyful, and Prosperous Relationship with Work and MoneyFrom EverandQuantum Success: 7 Essential Laws for a Thriving, Joyful, and Prosperous Relationship with Work and MoneyRating: 5 out of 5 stars5/5 (38)

- Indistractable: How to Control Your Attention and Choose Your LifeFrom EverandIndistractable: How to Control Your Attention and Choose Your LifeRating: 3.5 out of 5 stars3.5/5 (4)

- Summary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearFrom EverandSummary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearRating: 4.5 out of 5 stars4.5/5 (557)

- Get to the Point!: Sharpen Your Message and Make Your Words MatterFrom EverandGet to the Point!: Sharpen Your Message and Make Your Words MatterRating: 4.5 out of 5 stars4.5/5 (280)

- The Secret of The Science of Getting Rich: Change Your Beliefs About Success and Money to Create The Life You WantFrom EverandThe Secret of The Science of Getting Rich: Change Your Beliefs About Success and Money to Create The Life You WantRating: 5 out of 5 stars5/5 (34)

- Own Your Past Change Your Future: A Not-So-Complicated Approach to Relationships, Mental Health & WellnessFrom EverandOwn Your Past Change Your Future: A Not-So-Complicated Approach to Relationships, Mental Health & WellnessRating: 5 out of 5 stars5/5 (85)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsFrom EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsRating: 4.5 out of 5 stars4.5/5 (708)

- The High 5 Habit: Take Control of Your Life with One Simple HabitFrom EverandThe High 5 Habit: Take Control of Your Life with One Simple HabitRating: 5 out of 5 stars5/5 (1)

- Think Faster, Talk Smarter: How to Speak Successfully When You're Put on the SpotFrom EverandThink Faster, Talk Smarter: How to Speak Successfully When You're Put on the SpotRating: 5 out of 5 stars5/5 (1)

- Summary: Hidden Potential: The Science of Achieving Greater Things By Adam Grant: Key Takeaways, Summary and AnalysisFrom EverandSummary: Hidden Potential: The Science of Achieving Greater Things By Adam Grant: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (15)

- Seeing What Others Don't: The Remarkable Ways We Gain InsightsFrom EverandSeeing What Others Don't: The Remarkable Ways We Gain InsightsRating: 4 out of 5 stars4/5 (288)

- Joy on Demand: The Art of Discovering the Happiness WithinFrom EverandJoy on Demand: The Art of Discovering the Happiness WithinRating: 3.5 out of 5 stars3.5/5 (19)

- Spark: How to Lead Yourself and Others to Greater SuccessFrom EverandSpark: How to Lead Yourself and Others to Greater SuccessRating: 4.5 out of 5 stars4.5/5 (130)

- Coach Builder: How to Turn Your Expertise Into a Profitable Coaching CareerFrom EverandCoach Builder: How to Turn Your Expertise Into a Profitable Coaching CareerRating: 5 out of 5 stars5/5 (1)

- Think Faster, Talk Smarter: How to Speak Successfully When You're Put on the SpotFrom EverandThink Faster, Talk Smarter: How to Speak Successfully When You're Put on the SpotRating: 4.5 out of 5 stars4.5/5 (55)

- Napoleon Hill's Keys to Positive Thinking: 10 Steps to Health, Wealth, and SuccessFrom EverandNapoleon Hill's Keys to Positive Thinking: 10 Steps to Health, Wealth, and SuccessRating: 5 out of 5 stars5/5 (306)

- How to Be Better at Almost Everything: Learn Anything Quickly, Stack Your Skills, DominateFrom EverandHow to Be Better at Almost Everything: Learn Anything Quickly, Stack Your Skills, DominateRating: 4.5 out of 5 stars4.5/5 (857)

- Think Big: Make It Happen in Business and LifeFrom EverandThink Big: Make It Happen in Business and LifeRating: 4 out of 5 stars4/5 (37)

- Summary of 12 Rules for Life: An Antidote to Chaos by Jordan B. PetersonFrom EverandSummary of 12 Rules for Life: An Antidote to Chaos by Jordan B. PetersonRating: 5 out of 5 stars5/5 (4)