Professional Documents

Culture Documents

Green Plastic Products - Question

Uploaded by

Naruto MangaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Green Plastic Products - Question

Uploaded by

Naruto MangaCopyright:

Available Formats

MULTI-COMPETENCY SIMULATION (120 minutes)

Geoff Great has developed an innovative, cost-effective and more environmentally-friendly process for

producing recycled plastic for use in the manufacture of plastic products and components of products.

Great developed the process while he was an employee of Plastics Inc. (PI). Great has applied for a

patent covering the process he developed.

Great subsequently resigned from PI and incorporated Great Plastic Products Inc. (GPP) and set up a

plastics recycling and manufacturing plant. The facilities were developed over a six month period from

June 30 to December 31, 2018 and commercial operations commenced on January 1, 2019.

GPP’s fiscal year end is December 31 and the first fiscal period was for the six months ended December

31, 2018. These financial statements are unaudited. McAudit and Ronald LLP, Chartered Accountants

(McAudit), has been appointed auditor of GPP’s financial statements for the year ending December 31,

2019.

You, CPA, are in charge of the GPP audit engagement, and recently met with Geoff Great and other

management employees to obtain information in order to plan the audit engagement. It is now late

August, 2019, and you have obtained GPP’s interim financial statements for the seven months ended July

31, 2019 (Exhibit I), and have obtained information pertaining to the preparation of these statements

(Exhibit II). You have also obtained information about GPP’s operations (Exhibit III). The company uses

ASPE to report their financial statements.

Great informed you of five concerns he has for which he wants McAudit to provide advice. His first

concern is whether GPP’s interim financial statements for the seven months ended July 31, 2019 have

been prepared properly by GPP’s accountant. He has asked McAudit to evaluate the preparation of these

statements. His second concern is the legal action threatened by PI against Great and GPP regarding

ownership of the process developed by Great (Exhibit IV). He is concerned about the financial impact on

GPP and its viability should PI’s claim be successful and has asked McAudit to analyze this matter for

him. Great’s third concern is that he believes that a financial statement value should be assigned to the

recycling process asset he contributed to GPP which is presently not reflected on GPP’s balance sheet.

He has asked for advice about how GPP should account for this asset. Great transferred the recycling

process that he developed personally to GPP and his fourth concern is what the taxation considerations

are pertaining to this transfer assuming that PI’s claim that it owns the recycling process is unsuccessful.

He has asked for taxation advice about the implications of this asset transfer for both himself and for

GPP. His fifth concern pertains to the distribution agreement that GPP has entered into with Outsource

Distribution Inc. (ODI), the exclusive distributor of GPP’s products. Information about the distribution

agreement is provided in Exhibit V. He is uncomfortable about the lack of control exercised by GPP over

ODI. Information about the initial financing of GPP is provided in Exhibit VI.

The partner responsible for the GPP engagement has asked you to prepare a memo for her review that

discusses the financial accounting issues and that identifies the general audit planning considerations and

discusses the audit strategy for the areas of significant risk pertaining to the audit of GPP’s financial

statements for the year ending December 31, 2019, and that provides the advice requested by Geoff Great.

2008 The Institute of Chartered Accountants of Ontario

Required:

Prepare the memo to the partner that addresses the requests made by the partner and the requests made by

Great.

2008 The Institute of Chartered Accountants of Ontario

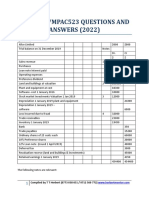

EXHIBIT I

GREAT PLASTIC PRODUCTS INC.

BALANCE SHEET

At July 31, 2019

(in thousands of dollars)

Assets

Cash $ 15

Receivable from ODI 1,600

Inventory 1,000

Other 35

2,650

Land 275

Recycling facilities 2,500

Office equipment 225

3,000

Deferred development expenditures 450

$ 6,100

Liabilities

Bank operating loan, prime plus 2% $ 1,400

Accounts payable 490

1,890

Long-term bank loan, 6%, due December 31, 2023 2,000

Debentures, due December 31, 2023 500

2,500

$ 4,390

Shareholder’s Equity

Common shares $ 50

Retained earnings 1,660

1,710

$ 6,100

2008 The Institute of Chartered Accountants of Ontario

EXHIBIT I (continued)

GREAT PLASTIC PRODUCTS INC.

INCOME STATEMENT

For The Seven Months Ended July 31, 2019

(in thousands of dollars)

Revenue

Plastic products and components $ 3,000

Recycled plastic resin 1,000

4,000

Cost of sales

Plastic products and components 1,560

Recycled plastic resin 320

Shipping 120

ODI fee 360

2,360

Gross margin 1,640

Expenses

Operating and administration 910

Interest on long-term bank loan 70

980

Net income $ 660

2008 The Institute of Chartered Accountants of Ontario

EXHIBIT II

GREAT PLASTIC PRODUCTS INC.

INFORMATION OBTAINED BY CA PERTAINING TO THE PREPARATION

OF GPP’S INTERIM FINANCIAL STATEMENTS

Revenue and Cost of Sales

All sales are made through a distributor, Outsource Distribution Inc. (ODI). Revenue of $4,000,000

represents the selling price to customers of the products shipped to ODI. At July 31, 2019, ODI had sold

goods to customers in the amount of $2,800,000 and is holding inventory received from GPP that is

valued at $1,200,000 based on selling prices. This inventory consists of $900,000 of plastic products and

components and $300,000 of recycled plastic resin. Accounts receivable pertaining to sales made to

customers by ODI are reported to GPP by ODI to be $400,000 at July 31, 2019.

Cost of sales is calculated using standard costs determined by management based on an analysis of

manufacturing costs. Cost of sales includes ODI’s fee of 15% of the revenue from sales made by ODI.

This fee totaled $360,000 for the seven months ended July 31, 2019. Cost of sales also includes costs

incurred to ship goods to ODI’s premises. Shipping costs amount to 3% of the selling price of the goods.

The receivable from ODI consists of the sales value of the inventory shipped to ODI minus the payments

received from ODI and ODI’s fee.

Inventory

Inventory on hand at GPP at July 31, 2019, valued at cost, consists of the following:

Reclaimed raw plastic $ 555,000

Work in process 50,000

Plastic products and components and recycled plastic resin 320,000

925,000

Standard cost variances 75,000

$1,000,000

Reclaimed raw plastic has not been processed into recycled plastic resin. Recycled plastic resin is held in

liquid form in storage tanks. The plastic products and components and recycled plastic resin inventory

have a combined sales value of $720,000.

Recycling Facilities and Office Equipment

Amortization for the recycling facilities and office equipment assets will be recorded in the same amount

as capital cost allowance claimed for income tax purposes for the particular fiscal year. No amortization

has been recognized to date.

Deferred Development Expenditures

This asset is comprised of all of the costs incurred during GPP’s development stage from June 30 to

December 31, 2018. No revenue was earned during this period.

2008 The Institute of Chartered Accountants of Ontario

EXHIBIT II (continued)

GREAT PLASTIC PRODUCTS INC.

INFORMATION OBTAINED BY CA PERTAINING TO THE PREPARATION

OF GPP’S INTERIM FINANCIAL STATEMENTS

Bank operating loan

The bank operating loan has a limit which is calculated as 75% of accounts receivable, net of an

appropriate allowance for uncollectible accounts, plus 60% of the cost of inventory, determined in

accordance with Canadian generally accepted accounting principles. GPP is required to repay to the

bank, within 30 days of the end of each fiscal quarter, the amount by which the operating loan exceeds

this limit. Interest pertaining to this loan is included in operating and administration expense.

Retained earnings

Retained earnings at July 31, 2019 has been determined as follows:

July 1 to December 31, 2018

Forgivable government development loan $1,000,000

January 1 to July 1, 2019

Net income 660,000

$1,660,000

Recycling process asset

Great transferred ownership of the recycling process to GPP as part of his initial investment in addition to

the $50,000 cash he invested to acquire the common shares issued by GPP. No value has as yet been

assigned to the transfer of the process from Great to GPP in the financial statements.

2008 The Institute of Chartered Accountants of Ontario

EXHIBIT III

INFORMATION OBTAINED BY CA ABOUT GPP’S OPERATIONS

Manufacturing

GPP operates in leased premises. The lease is for a term of 10 years with a renewal option for a further

10 years.

GPP commenced commercial production of recycled plastic and plastic products on January 1, 2019, after

six months of start-up activities which included equipment set-up and testing, training of employees and

trial production runs.

GPP purchases reclaimed plastic and recycles the plastic into resin which is sold or used in the

manufacture of plastic products and components of products.

The standard cost of producing recycled plastic resin is 32% of the selling price and the standard cost of

manufactured plastic products and components is 52% of the selling price. The actual manufacturing

costs exceeded the standard costs by $75,000 for the seven months ended July 31, 2019.

GPP is presently overstaffed by approximately 20% in order to comply with the conditions of the

forgiveable development loan and to have the trained employees needed when GPP operates at 80% of

capacity. GPP has operated at 60% of capacity to date. GPP’s standard costs are based on operating at

80% of capacity.

Management is presently investigating means for disposing of the hazardous waste generated by the

recycling process. Management is environmentally responsible and plans to dispose of the waste in a safe

manner. The waste is presently stored in drums. Management estimates that the disposal costs will be

5% of the selling price of the plastic products and components and recycled plastic resin produced.

Projected revenues and expenses

Great expects that revenue from sales to customers and expenses for the seven months ended July 31,

2019 are representative of revenue and expenses for the five months ending December 31, 2019.

Great has projected GPP’s revenues to be $6,000,000 in fiscal 2020 and to be $9,000,000 in fiscal 2021.

Revenue from the sale of recycled plastic resin is projected to account for 25% of these projected revenue

amounts.

Great has estimated that combined plastic products and components and recycled plastic resin inventory

held by GPP and by ODI will be equal to three months’ sales to customers by ODI at the end of each

fiscal year.

Great has estimated that operating and administration costs will total $1,400,000 in each of fiscal 2020

and fiscal 2021.

2008 The Institute of Chartered Accountants of Ontario

EXHIBIT IV

INFORMATION OBTAINED BY CA CONCERNING PI’S

LEGAL ACTION AGAINST GREAT AND GPP

PI claims ownership of the recycling process developed by Geoff Great because it was developed while

Great was an employee of PI.

Legal counsel for PI has advised GPP that PI is willing to transfer ownership of the process to Great

personally or to GPP in an out-of-court settlement, or if PI’s claim is upheld in court, in exchange for

Great or GPP agreeing to pay PI an amount of $1,000,000, payable in five annual payments of $200,000

plus 5% of the revenue generated from the sale of goods that are produced using this recycling process.

The 5% fee is applicable to the revenue earned by GPP commencing January 1, 2019, and the first

payment of $200,000 is due on December 31, 2019. If the claim goes to court and PI’s claim is

successful, Great or GPP will be required to pay an additional upfront amount of $250,000 to PI.

The position taken by Great and GPP’s legal counsel is that Great developed the process entirely on his

own time, in addition to fulfilling his employment responsibilities to PI. Accordingly, Great owns the

process and PI’s claim is unfounded.

2008 The Institute of Chartered Accountants of Ontario

EXHIBIT V

INFORMATION REGARDING THE DISTRIBUTION AGREEMENT BETWEEN GPP AND ODI

ODI is responsible for selling GPP’s products to customers (recycled plastic resin and plastic products)

and for managing the accounts receivable, including collection. ODI receives a fee of 15% of gross

revenue from the sale of GPP’s products for performing these services. ODI remits to GPP the amount

equal to the cash received for payments of GPP receivables for the reporting period less its 15% fee for

the reporting period.

ODI provides reports regularly to GPP. These reports provide details of the sales transactions, the

accounts receivable transactions and the inventory transactions. Supporting documentation for the sales

transactions and receivables is held by ODI at its premises. The distribution agreement provides GPP

with the right to inspect this documentation upon request.

By the end of each February, ODI is to advise GPP of the customer receivables that GPP should write off

as at December 31 of the year end just completed when preparing its year end financial statements.

2008 The Institute of Chartered Accountants of Ontario

EXHIBIT VI

INITIAL FINANCING OF GPP

Great’s initial investment

Geoff Great invested $50,000 cash in GPP and was issued 5,000 common shares with an assigned value

of $10 per share. Great also transferred ownership of the process to GPP. However, no value was

assigned to this asset and no consideration was provided by GPP to Great for the asset transferred.

Government assistance

GPP obtained a forgivable development loan from the provincial government in the amount of

$1,000,000 to finance the development of the recycling facilities. The loan is forgivable in equal amounts

over a five year period if two conditions are met: GPP must maintain a specified minimum employment

level and must not violate specified environmental protection standards. The recycling process produces

hazardous waste which must be carefully stored and disposed of.

Debentures

GPP obtained financing of $500,000 in the form of debentures on January 1, 2019. The debentures have

a maturity date of December 31, 2023 and interest of $63,025 is payable annually for three years

commencing December 31, 2021. No interest is payable in 2019 and 2020.

2008 The Institute of Chartered Accountants of Ontario

You might also like

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- Business Accounting (LO 03,4,5) - Alternative AssessmentDocument7 pagesBusiness Accounting (LO 03,4,5) - Alternative Assessmentpiumi100% (1)

- ACC2002 Practice 1Document9 pagesACC2002 Practice 1Đan LêNo ratings yet

- Principles of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceDocument2 pagesPrinciples of Accounts: Name and Index No: Class: Date Topic: Level: ReferenceCindy SweNo ratings yet

- P64571RA Lcci Level 4 Certificate in Financial Accounting ASE20101 RB Sep 2020Document8 pagesP64571RA Lcci Level 4 Certificate in Financial Accounting ASE20101 RB Sep 2020Musthari KhanNo ratings yet

- ACCT 2208 - Final Review (Ch. 18, 22, 23)Document16 pagesACCT 2208 - Final Review (Ch. 18, 22, 23)MitchieNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- FM COURSEWORK 1 2019 Rev2Document6 pagesFM COURSEWORK 1 2019 Rev2Marilyn SinghNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- P76987 LCCI Level 3 Certificate in Accounting ASE20104 Resource BookletDocument8 pagesP76987 LCCI Level 3 Certificate in Accounting ASE20104 Resource Booklethlaingminnlatt1490% (1)

- Lcci Level 4 Certificate in Financial Accounting ASE20101 Jun 2019 RBDocument8 pagesLcci Level 4 Certificate in Financial Accounting ASE20101 Jun 2019 RBYAN YAN TSOINo ratings yet

- Solution Practice 6 Consolidations 3Document8 pagesSolution Practice 6 Consolidations 3Mya Hmuu KhinNo ratings yet

- Audit Practice & Assurance Services: Professional 2 Examination - August 2017Document19 pagesAudit Practice & Assurance Services: Professional 2 Examination - August 2017Vitalis MbuyaNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- P67656 Lcci Level 3 Certificate in Financial Accounting ASE20097 Resource Booklet Jun 2021Document8 pagesP67656 Lcci Level 3 Certificate in Financial Accounting ASE20097 Resource Booklet Jun 2021Musthari KhanNo ratings yet

- AP Module 01 - Accounting Changes and ErrorsDocument10 pagesAP Module 01 - Accounting Changes and ErrorsjasfNo ratings yet

- Wednesday 9 September 2020: Certificate in Accounting (VRQ)Document8 pagesWednesday 9 September 2020: Certificate in Accounting (VRQ)KoniiNo ratings yet

- Competency Exam Practice-211Document5 pagesCompetency Exam Practice-211marites yuNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- ACC2002 Practice 2Document8 pagesACC2002 Practice 2Đan LêNo ratings yet

- E 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Document10 pagesE 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Lusiana Purnama SariNo ratings yet

- Batch 2-1Document2 pagesBatch 2-1kp7659165No ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- AFA Tut11 Anaylsis & Interpretation of FSDocument9 pagesAFA Tut11 Anaylsis & Interpretation of FSJIA HUI LIMNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- AP Review NotesDocument2 pagesAP Review NotesCattleyaNo ratings yet

- Ap 9004-IntangiblesDocument5 pagesAp 9004-IntangiblesSirNo ratings yet

- November 2020 Professional Examiniations Public Sector Accounting and Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeDocument23 pagesNovember 2020 Professional Examiniations Public Sector Accounting and Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeThomas nyadeNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument11 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk Şhïï0% (1)

- Resource Booklet Jun 2021Document8 pagesResource Booklet Jun 2021ElenaNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Final Individual Assignment - 4 Nov 2022Document6 pagesFinal Individual Assignment - 4 Nov 2022Vernice CuffyNo ratings yet

- Sample Final Exam With SolutionDocument17 pagesSample Final Exam With SolutionYevhenii VdovenkoNo ratings yet

- ACCO 420 Final F2020 Version 2Document4 pagesACCO 420 Final F2020 Version 2Wasif SethNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- Workshop 2 Qs As Introduction To A FDocument18 pagesWorkshop 2 Qs As Introduction To A FYeoh Tze ShinNo ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- FR 2021 Paper PrelimDocument10 pagesFR 2021 Paper PrelimshashalalaxiangNo ratings yet

- Coffee Shop Business Plan - Financial PL PDFDocument18 pagesCoffee Shop Business Plan - Financial PL PDFSamenNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- GZU Fin Reporting Masters Question BankDocument31 pagesGZU Fin Reporting Masters Question BankTawanda Tatenda Herbert100% (2)

- ACW1120-Week 5 Practice Q-Topic 5-Prepare FSDocument8 pagesACW1120-Week 5 Practice Q-Topic 5-Prepare FSGan ZhengweiNo ratings yet

- Question 1Document2 pagesQuestion 1Charles MachuvaireNo ratings yet

- Chapter 4 4 4 4 4Document7 pagesChapter 4 4 4 4 4Rabie HarounNo ratings yet

- Faculty of Management Studies: Department of Business AdministrationDocument8 pagesFaculty of Management Studies: Department of Business AdministrationEtNo ratings yet

- AFO+ +Mock+TestDocument12 pagesAFO+ +Mock+TestArrow NagNo ratings yet

- POADocument7 pagesPOAjohnnyNo ratings yet

- Sample Midterm Exam With SolutionDocument17 pagesSample Midterm Exam With Solutionq mNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Quiz 2 - CFR2018Document4 pagesQuiz 2 - CFR2018Ananya DevNo ratings yet

- AC2091 ZB Final For UoLDocument16 pagesAC2091 ZB Final For UoLkikiNo ratings yet

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- 9706 m17 QP 32Document12 pages9706 m17 QP 32FarrukhsgNo ratings yet

- Warren FA17e SM Ch01 FinalDocument49 pagesWarren FA17e SM Ch01 Finalmuzaffarovh271No ratings yet

- Individual/Group Assignments (Optional) Assignment 1Document3 pagesIndividual/Group Assignments (Optional) Assignment 1Robin GhotiaNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwaneNo ratings yet

- Week 5 Tutorial Solutions PDFDocument19 pagesWeek 5 Tutorial Solutions PDFwainikitiraculeNo ratings yet

- ACCT1101 Week 5 Practical SolutionsDocument8 pagesACCT1101 Week 5 Practical SolutionskyleNo ratings yet

- Intermediate Accounting ExamDocument6 pagesIntermediate Accounting ExamPISONANTA KRISETIANo ratings yet

- Topic - Thank You!Document1 pageTopic - Thank You!Naruto MangaNo ratings yet

- Topic - Support Your Classmates - RSM100 Business Plan Competition Final RoundDocument1 pageTopic - Support Your Classmates - RSM100 Business Plan Competition Final RoundNaruto MangaNo ratings yet

- Topic - Sequence Numbers For The Final ExamDocument1 pageTopic - Sequence Numbers For The Final ExamNaruto MangaNo ratings yet

- Topic - Over $2000 in Prize Money From CPA Ontario!Document1 pageTopic - Over $2000 in Prize Money From CPA Ontario!Naruto MangaNo ratings yet

- Topic - Walmart Video ReminderDocument1 pageTopic - Walmart Video ReminderNaruto MangaNo ratings yet

- Topic - Week 6 LectureDocument1 pageTopic - Week 6 LectureNaruto MangaNo ratings yet

- Make-Up Exam: Search Entries or AuthorDocument1 pageMake-Up Exam: Search Entries or AuthorNaruto MangaNo ratings yet

- M2 - Sunkick Coffee - QuestionDocument5 pagesM2 - Sunkick Coffee - QuestionNaruto MangaNo ratings yet

- Group #1 - Presentation - Super Sports - QuestionDocument8 pagesGroup #1 - Presentation - Super Sports - QuestionNaruto MangaNo ratings yet

- Sunbeam Case StudyDocument9 pagesSunbeam Case StudyHangga DarismanNo ratings yet

- Management Accounting: Contributing Margin, Break-Even Point Cakelesious CompanyDocument4 pagesManagement Accounting: Contributing Margin, Break-Even Point Cakelesious CompanySaketh ChowdaryNo ratings yet

- BEP ProblemsDocument1 pageBEP ProblemsSuresh Kumar NayakNo ratings yet

- The Cpa Licensure Examination Syllabus Advanced Financial Accounting and ReportingDocument4 pagesThe Cpa Licensure Examination Syllabus Advanced Financial Accounting and ReportingClaiver SorianoNo ratings yet

- Financial Management BookDocument199 pagesFinancial Management BookSourav BasuNo ratings yet

- A Study of Corporate Tax in IndiaDocument27 pagesA Study of Corporate Tax in IndiaKHUSHBOO GOYAL - DMNo ratings yet

- Internship Report On: Jamuna Bank LimitedDocument41 pagesInternship Report On: Jamuna Bank Limitedsumaiya suma0% (1)

- Module 2 Managerial EconomicsDocument29 pagesModule 2 Managerial EconomicsCharice Anne VillamarinNo ratings yet

- Financial Management - DefinitionDocument13 pagesFinancial Management - DefinitionAmol AgarwalNo ratings yet

- CH 08Document42 pagesCH 08Jamesno LumbNo ratings yet

- Basic Structure of Accounting 1: Chapter OneDocument15 pagesBasic Structure of Accounting 1: Chapter OneSeid KassawNo ratings yet

- Dunes IncDocument3 pagesDunes IncMartina AttallahNo ratings yet

- Louis Dreyfus Company LDC-mergedDocument11 pagesLouis Dreyfus Company LDC-mergedbiatcchNo ratings yet

- Inkel Limited: KakkanadDocument10 pagesInkel Limited: KakkanadNareshkumarNo ratings yet

- 2021 Tax Year - Virtual Tax Solutions LLCDocument14 pages2021 Tax Year - Virtual Tax Solutions LLCgregNo ratings yet

- Financial ModellingDocument27 pagesFinancial Modellingtejaas100% (1)

- Paper 4-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 4 - UnlockedDocument19 pagesPaper 4-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 4 - UnlockedHirak Jyoti Das100% (2)

- GOs & Circular 2009Document319 pagesGOs & Circular 2009kalkibook100% (1)

- CH 5Document15 pagesCH 5alfiNo ratings yet

- Audit Procedures For Cash and Cash Equivalents - WIKIACCOUNTINGDocument13 pagesAudit Procedures For Cash and Cash Equivalents - WIKIACCOUNTINGsninaricaNo ratings yet

- Abm Business Finance 12 q1 w4 Mod5Document21 pagesAbm Business Finance 12 q1 w4 Mod5Edmon Jr Udarbe69% (13)

- Lieberose Solar ParkDocument23 pagesLieberose Solar ParkNeetu RajaramanNo ratings yet

- QP Xii Accs PB 2Document8 pagesQP Xii Accs PB 2Balbir S BhatiNo ratings yet

- Financial Statement Analysis: Group MembersDocument11 pagesFinancial Statement Analysis: Group Membersk_adhikaryNo ratings yet

- Babasab Patil 1: Project FinancingDocument81 pagesBabasab Patil 1: Project Financinguser 02No ratings yet

- Vending Machine Business GuideDocument78 pagesVending Machine Business Guidesteve1848375100% (8)

- Entrepreneur: by Shruti BhatterDocument16 pagesEntrepreneur: by Shruti BhatterhemdinsNo ratings yet

- IA2 06 - Handout - 1 PDFDocument5 pagesIA2 06 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- Dividend DecisionDocument36 pagesDividend DecisionAam aadmiNo ratings yet

- Ishani Sathish (PGP/25/331) : 1. T-AccountsDocument5 pagesIshani Sathish (PGP/25/331) : 1. T-AccountsishaniNo ratings yet