Professional Documents

Culture Documents

AKUNTANSI KEUANGAN MENENGAH p5

Uploaded by

Naufalliani HACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AKUNTANSI KEUANGAN MENENGAH p5

Uploaded by

Naufalliani HACopyright:

Available Formats

SOAL 2

Dasar perhitungan tanggal 1 Maretl 2012

Nilai nominal obligasi = 10.000 x Rp 100.000,00 = Rp 1.000.000.000,00 → A

Bunga nominal: 9% : 3 = 3% x Rp 1.000.000.000,00 = Rp 30.000.000,00 → R

Bunga efektif: 12% : 3 = 4% → i

Jangka waktu obligasi: 5 tahun → n = 5 x 3 = 15

Nilai tunai nilai nominal utang obligasi::

1

A x ----------

(1 + i)n

1

Rp 1.000.000.000,00 x ----------------- = Rp 555.260.000

( 1 + 0.04)15

Nilai tunai bunga nominal utang obligasi

1

1 - -------------------

( 1 + i )n

R x -------------------------------

I

1

1 - -------------------

( 1 + 0.03)15

Rp 30.000.000,00 x ----------------------------- = Rp 333.555.000

0.03

----------------------------- +

Nilai tunai utang obligasi tanggal 1 pebruarit 2012 Rp 888.815.000

Bunga berjalan: 1Peb s/d 1 Maret 2012 = 1 bulan

Bunga efektif = 1/12 x 12% x Rp 888.815.000 = Rp 8.888.150

----------------------------------- +

Harga jual utang obligasi tanggal 1Maret 2012 Rp 897.703.150

Bunga nominal = 1/12 x 9% x Rp 1.000.000.000 = Rp 7.500.000

-------------------------------------- -

Nilai tunai utang obligasi tanggal 1 Maret 2012 Rp 890.203.150

========================

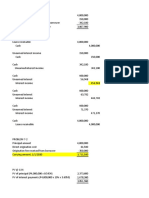

Lembar kerja soal 2 pertanyaan 2

PT Bintang Utara

General Journal

1 Maret 2012

Date / year Description Ref Debit Credit

(Rp) (Rp)

1 Maret 2012 Cash Rp 890.203.150

Bonds Payable Rp 890.203.150

Cash Rp 7.500.000

Bond Interest Expense Rp 7.500.000

PT Bintang Utara

Schedule of Discount Amotization on Bonds Payable

Date & Cash Paid Interest Expense Discount Carriying Amount

Years Amortized 0f Bonds

Rp Rp Rp Rp

01/02/12 Rp 888.815.000

01/03/12 Rp 890.203.150

01/06/12 3/12 x 9% x 3/12 x 12 % x 26.706.095 – Rp 890.203.150 +

1.000.000.000 = Rp 890.203.150 22.500.000 = 4.206.095 = Rp

22.500.000 = 26.706.095 4.206.095 894.409.245

01/10/12 4 / 12 x 9% x 4 / 12 x 12% x 35.776.370 – 894.409.245 +

1.000.000.000 = 894.409.245 = 30.000.000 = 5.776.370 =

30.000.000 35.776.370 5.776.370 900.185.615

31/12/12 3 / 12 x 9% x 3 / 12 x 12% x 27.005.568 - 900.185.615 +

1.000.000.000 = 900.185.615 = 22.500.000 = 4.505.568 =

22.500.000 27.005.568 4.505.568 904.691.183

01/02/13 1 / 12 x 9% x 3 / 12 x 12% x 9.046.912 - 904.691.183 +

1.000.000.000 = 904.691.183 = 7.500.000 = 1.546.912 =

7.500.000 9.046.912 1.546.912 906.238.095

01/06/13 4 / 12 x 9% x 4 / 12 x 12% x 36.249.524 - 906.238.095 +

1.000.000.000 = 906.238.095 = 30.000.000 = 6.249.524 =

30.000.000 36.249.524 6.249.524 912.487.619

01/10/13 4 / 12 x 9% x 4 / 12 x 12% x 36.499.505 – 912.487.619 +

1.000.000.000 = 912.487.619 = 30.000.000 = 6.499.505 =

30.000.000 36.499.505 6.499.505 918.987.124

31/12/13 3 / 12 x 9% x 3 / 12 x 12% x 27.569.614 – 918.987.124 +

1.000.000.000 = 918.987.124 = 22.500.000 = 5.069.614 =

22.500.000 27.569.614 5.069.614 924.056.738

01/02/14 1 / 12 x 9% x 1 / 12 x 12% x 9.240.567 – 924.056.738 +

1.000.000.000 = 924.056.738 = 7.500.000 = 1.740.567 =

7.500.000 9.240.567 1.740.567 925.797.305

Lembar kerja soal 2 pertanyaan 3 ( lihat tabel amortisasi di atas )

PT Bintang Utara

General Journal

Juni – Desember 2012

Date / year Description Ref Debit(Rp) Credit(Rp)

1 Juni 2012 Bond interest expense 26.706.095

Cash 26.706.095

Bond interest expense 4.206.095

Bonds Payable 4.206.095

1 Okt 2012 Bond interest expense 35.776.370

Cash 35.776.370

Bond interest expense 5.776.370

Bonds Payable 5.776.370

31 Des 2012 Bond interest expense 27.005.568

Bonds Payable 4.505.568

Bond Interest Payable 22.500.000

Lembar kerja soal 2 pertanyaan 4 ( lihat tabel amortisasi di atas )

PT Bintang Utara

General Journal

Januari – Februari 2013

Date / year Description Ref Debit Credit

(Rp) (Rp)

1 Jan 2013 Bonds Payable 4.505.568

Bond Interest Payable 22.500.000

Bonds Payable 27.005.568

1 Feb 2013 Bonds Payable 27.005.568

Bond Interest Payable 7.500.000

Cash 34.505.568

Bond Interest Payable 1.546.912

Interest Payable 1.546.912

Lembar kerja soal 2 pertanyaan 5

Dasar perhitungan tanggal 1 Oktober 2014

Nilai tunai 2.000 lembar utang obligasi per 1 Februari 2014 :

2.000 / 10.000 x 925.797.305 = Rp 185.159.461

Nominal 2.000 lembar utang obligasi = Rp 100.000 x 2.000 = Rp 200.000.000 discount

Amortisasi discount untuk 2.000 lembar utang obligasi yg dilunasi = 1 Feb – 1 April = 2 bulan

Bunga efektif = 2 / 12 x 12% x Rp 185.159.461 = Rp 3.703.189

Bunga nominal = 2 / 12 x 9 % x Rp 200.000.000 = Rp 3.000.000

Amortisasi discount = Rp 703.189

Nilai tunai 2.000 lembar utang obligasi yg dilunasi per 1 April 2014 Adalah

Rp 185.159.461 + Rp 703.189= Rp 185.862.650

Kurs pelunasan = Rp 105.000 x 2.000 Rp 210.000.000

Rugi pelunasan utang obligasi Rp 24.137.350

Uang kas yang dibayarkan = Rp 210.000.000 + Rp 3.000.000 = Rp 213.000.000

PT Bintang Utara

General Journal

1 April 2012

Date / year Description Ref Debit Credit

(Rp) (Rp)

1 Apr 2014 Bond interest expense Rp 703.189

Bond Payable Rp 703.189

1 Apr 2014 Bond payable Rp 185.862.650

Bond interest expense Rp 3.000.000

Loss on Redemption Rp 24.137.350

Cash Rp 213.000.000

Tabel amortisasi setelah pelunasan tanggal 1 April 2014

Schedule of Discount Amotization on Bonds Payable

Date & Cash Paid Interest Expense DiscountCarriying Amount

Years amortized 0f Bonds

Rp Rp Rp Rp

01/02/14 Rp 925.797.305 –

Rp 185.159.461 =

Rp 740.637.844

01/06/14 4/12 x 9% x 4 / 12 x 12% x Rp 29.625.513 - Rp 740.637.844 +

(1.000.000.000 740.637.844 = 24.000.000 = Rp Rp 5.625.513

– 200.000.000 = Rp 29.625.513 5.625.513 =746.263.357

800.000.000) =

Rp 24.000.000

01/10/14 4/12 x 9% x 4 / 12 x 12% x 29.850.534 - 746.263.357 +

800.000.000 = 746.263.357 = 24.000.000 = 5.850.534 =

Rp 24.000.000 29.850.534 5.850.534 752.113.891

31/12;14 3/12 x 9% x 4 / 12 x 12% x 22.563.417 – 752.113.891 +

800.000.000= 752.113.891 = 18.000.000 = 4.563.417 =

Rp 18.000.000 22.563.417 4.563.417 756.677.308

Lembar kerja soal 2 pertanyaan 6 (lihat tabel di atas)

PT Bintang Utara

General Journal

Juni – 31 Desember 2014

Date / year Description Ref Debit (Rp) Credit (Rp)

1 Juli 2012 Bond interest expense 29.625.513

Bond Payable 5.625.513

Cash Rp 24.000.000

1 Okt 2014 Bond interest expense 29.850.534

Bond Payable 5.850.534

Cash 24.000.000

31 Des 2014 Bond interest expense 22.563.417

Bond Payable 4.563.417

Bond Interest Payable 18.000.000

Lembar kerja soal 2 pertanyaan 7

PT Bintang Utara

Statement of Financial Position

December 31.2014

(partial)

Current Liablities:

Nominal Bond Interest Payable Rp 18.000.000

Non current liabilities:

Carrying Amount Of Bond 31 Des 2014 Rp 756.677.308

You might also like

- Calculating bond carrying value and amortizationDocument12 pagesCalculating bond carrying value and amortizationYoomaNo ratings yet

- Fa 2 1Document8 pagesFa 2 1Quỳnh Anh NguyễnNo ratings yet

- Sarkar Sailboats Bond EntriesDocument2 pagesSarkar Sailboats Bond EntriesannisaNo ratings yet

- Noncurrent Liabilities - PROBLEMS: B. A DiscountDocument12 pagesNoncurrent Liabilities - PROBLEMS: B. A DiscountIra Grace De Castro67% (3)

- Islamic Cultural Centre Architectural ThesisDocument4 pagesIslamic Cultural Centre Architectural Thesisrishad mufas100% (1)

- Assignment #1Document5 pagesAssignment #1FreelansirNo ratings yet

- IPPTChap010 1Document38 pagesIPPTChap010 1JackNo ratings yet

- Jawaban KK Pengantar Akuntansi 2 After MidtermDocument8 pagesJawaban KK Pengantar Akuntansi 2 After Midtermdinda ardiyaniNo ratings yet

- Ch14 Suggested HWDocument21 pagesCh14 Suggested HWLalangelaNo ratings yet

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsDocument9 pagesCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaNo ratings yet

- Intermediate Accounting II (ACCT 342/542) Winter, 2014 Exam 2 SolutionsDocument8 pagesIntermediate Accounting II (ACCT 342/542) Winter, 2014 Exam 2 SolutionsTzuyu TchaikovskyNo ratings yet

- Bonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ADocument8 pagesBonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ACamille BacaresNo ratings yet

- Effective Interest MethodDocument31 pagesEffective Interest MethodMikaela LacabaNo ratings yet

- PQ3 BondsDocument2 pagesPQ3 BondsElla Mae MagbatoNo ratings yet

- Accounting for Leasing DocumentsDocument7 pagesAccounting for Leasing DocumentsKurnia KhayaturohmahNo ratings yet

- Tugas AKM 2 Proportional MetodeDocument3 pagesTugas AKM 2 Proportional MetodeSheny WulandariNo ratings yet

- Rina Septiyani - 19021040Document4 pagesRina Septiyani - 19021040리나박No ratings yet

- Assignment4 HWDocument12 pagesAssignment4 HWRUPIKA R GNo ratings yet

- Noncurrent LiabilitiesDocument29 pagesNoncurrent LiabilitiesLuna MeowNo ratings yet

- Consolidated - BondDocument13 pagesConsolidated - BondNurul Waheedatun FatimahNo ratings yet

- Quantitative ProblemsDocument8 pagesQuantitative ProblemsrahimNo ratings yet

- Problem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDocument2 pagesProblem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDominic RomeroNo ratings yet

- Loans Receivable Practice (Review)Document6 pagesLoans Receivable Practice (Review)Deviline MichelleNo ratings yet

- Valuing bonds and loan calculationsDocument6 pagesValuing bonds and loan calculationsMuskan ValbaniNo ratings yet

- PROBLEM SOLUTIONSDocument6 pagesPROBLEM SOLUTIONSLovenia M. FerrerNo ratings yet

- ACCTG 102 Assignment - Mortgage and Bond Journal EntriesDocument3 pagesACCTG 102 Assignment - Mortgage and Bond Journal EntriesCindy YinNo ratings yet

- Acct3102 Chapter 14Document11 pagesAcct3102 Chapter 14monikademonisiaNo ratings yet

- HaftaDocument47 pagesHaftahasansekercioglu03No ratings yet

- Chapter 14 HomeworkDocument10 pagesChapter 14 HomeworkSaja AlbarjesNo ratings yet

- Aol AccDocument19 pagesAol AccANGELYCA LAURANo ratings yet

- Corporation: ExampleDocument3 pagesCorporation: Exampleibrahim mohamedNo ratings yet

- Acquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Document3 pagesAcquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Gray JavierNo ratings yet

- ACCO 20053 Lecture Notes 6 - Notes ReceivableDocument7 pagesACCO 20053 Lecture Notes 6 - Notes ReceivableVincent Luigil AlceraNo ratings yet

- Loan receivable journal entriesDocument10 pagesLoan receivable journal entriesClyde SaladagaNo ratings yet

- m7 - Note Sample Problems With Solutions Chs 14 and 15Document6 pagesm7 - Note Sample Problems With Solutions Chs 14 and 15Marie Fe GullesNo ratings yet

- Bond valuation and stock issuance calculationsDocument13 pagesBond valuation and stock issuance calculationsHENDY YUDHA PRAMANANo ratings yet

- Audit of bonds payable and convertible bondsDocument4 pagesAudit of bonds payable and convertible bondsspur iousNo ratings yet

- Milkita Cookies Financial Records 2012Document20 pagesMilkita Cookies Financial Records 2012Silih KurniAwanNo ratings yet

- Long-Term LiabilitiesDocument20 pagesLong-Term Liabilitiesshanky1124No ratings yet

- Investments in Debt Securities and Other Non-Current AssetsDocument14 pagesInvestments in Debt Securities and Other Non-Current AssetsMarjorie NepomucenoNo ratings yet

- Simple Interest 1Document88 pagesSimple Interest 1Sean Ray Silva DelgadoNo ratings yet

- Gonzalez, John Williever A. - Bonds Payable-Between Interest Dates and SerialDocument4 pagesGonzalez, John Williever A. - Bonds Payable-Between Interest Dates and SerialJohn Williever GonzalezNo ratings yet

- Solutions to Bond ExercisesDocument31 pagesSolutions to Bond ExercisesMaha M. Al-MasriNo ratings yet

- Ias 33 Icab AnswersDocument6 pagesIas 33 Icab AnswersIttihadul islamNo ratings yet

- Calculating Capital Lease LiabilityDocument2 pagesCalculating Capital Lease LiabilityFeruz Sha RakinNo ratings yet

- Solutions Guide: This Is Meant As A Solutions GuideDocument4 pagesSolutions Guide: This Is Meant As A Solutions GuideVivienne Lei BolosNo ratings yet

- Investment Fund InvestigationDocument5 pagesInvestment Fund InvestigationZvo UnilNo ratings yet

- Intacc 1Document17 pagesIntacc 1Xyza Faye RegaladoNo ratings yet

- 5 Investment AccountsDocument11 pages5 Investment AccountsBAZINGANo ratings yet

- Business Finance Peirson 11e CH 3Document24 pagesBusiness Finance Peirson 11e CH 3RitaNo ratings yet

- CH 3 Vol 1 AnswersDocument17 pagesCH 3 Vol 1 Answersjayjay112275% (4)

- Financial Investment PreliminariesDocument6 pagesFinancial Investment PreliminariesDanielle Alessandra T. CalpoNo ratings yet

- Q.3-Question and SolutionDocument4 pagesQ.3-Question and SolutionFIROZ KHANNo ratings yet

- Problem 14 10Document2 pagesProblem 14 10indri retnoningtyasNo ratings yet

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- Mathematics of Investment Reviewer FinalsDocument20 pagesMathematics of Investment Reviewer FinalsDawn VersatilityNo ratings yet

- Practice Problems, CH 9 10 SolutionDocument6 pagesPractice Problems, CH 9 10 SolutionscridNo ratings yet

- Activity 2Document6 pagesActivity 2Jeanette AndoNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Afcons Africa Company ProfileDocument80 pagesAfcons Africa Company ProfileHarrison O OdoyoNo ratings yet

- Doc637541838 612447676Document9 pagesDoc637541838 612447676Brittany RamirezNo ratings yet

- Employment and Labor LawsDocument7 pagesEmployment and Labor LawsTrisha RamentoNo ratings yet

- PRIDE AND PREJUDICE (Slides)Document2 pagesPRIDE AND PREJUDICE (Slides)Phương Trinh NguyễnNo ratings yet

- Chapter 4 Canadian Constitutional Law IntroDocument62 pagesChapter 4 Canadian Constitutional Law Introapi-241505258No ratings yet

- Code of Ethics Caselet AnalysisDocument2 pagesCode of Ethics Caselet AnalysisBSA3Tagum MariletNo ratings yet

- Assignment On Procurement and Contract AdministrationDocument5 pagesAssignment On Procurement and Contract Administrationasterayemetsihet87No ratings yet

- Blair Shareholdervalue 2003Document30 pagesBlair Shareholdervalue 2003Anonymous o6OMUCkqdNo ratings yet

- Zsuzsanna Budapest - The Holy Book of Women's Mysteries (PP 104-305)Document109 pagesZsuzsanna Budapest - The Holy Book of Women's Mysteries (PP 104-305)readingsbyautumn100% (1)

- Avarice Sheet PDFDocument1 pageAvarice Sheet PDFNainoa NaffNo ratings yet

- The Essential Drucker Book Review 131012023243 Phpapp02Document39 pagesThe Essential Drucker Book Review 131012023243 Phpapp02germinareNo ratings yet

- Article Practive Sheet LatestDocument3 pagesArticle Practive Sheet LatestNahian NishargoNo ratings yet

- MFL Company ProfileDocument55 pagesMFL Company ProfileKaviya KaviNo ratings yet

- A Statement of Commitment To The Profession of TeachingDocument2 pagesA Statement of Commitment To The Profession of TeachingMICHELLE ORGENo ratings yet

- Oil & Gas Industry in Libya 3Document16 pagesOil & Gas Industry in Libya 3Suleiman BaruniNo ratings yet

- Financial Analysis of AUTOMOBILE COMPANIES (BMW & Daimler (Mercedes-Benz) )Document17 pagesFinancial Analysis of AUTOMOBILE COMPANIES (BMW & Daimler (Mercedes-Benz) )GUDDUNo ratings yet

- Trade Rutes of EuropeDocument1 pageTrade Rutes of EuropeNico BelloNo ratings yet

- LLF 2017 ProgramDocument2 pagesLLF 2017 ProgramFasih Ahmed100% (2)

- Wilkins, A Zurn CompanyDocument8 pagesWilkins, A Zurn CompanyHEM BANSALNo ratings yet

- Annexure M - Bank Guarantee FormatDocument2 pagesAnnexure M - Bank Guarantee FormatRafikul RahemanNo ratings yet

- RishabhDocument38 pagesRishabhpooja rodeNo ratings yet

- Finding Buyers Leather Footwear - Italy2Document5 pagesFinding Buyers Leather Footwear - Italy2Rohit KhareNo ratings yet

- Magsumbol vs. People 743 SCRA 188, November 26, 2014Document6 pagesMagsumbol vs. People 743 SCRA 188, November 26, 2014CHENGNo ratings yet

- Chapter 8Document66 pagesChapter 8Jamaica Rose Salazar0% (1)

- Final Result Qualified UploadDocument35 pagesFinal Result Qualified UploadAnkit TiwariNo ratings yet

- COM 4 HSC - Korean WarDocument10 pagesCOM 4 HSC - Korean Warmanthan pujaraNo ratings yet

- Mentor Trainee Contact List ExcelDocument4 pagesMentor Trainee Contact List ExcelShivam SharmaNo ratings yet

- Byzantine and Islamic ArtDocument3 pagesByzantine and Islamic ArtRachel LynnNo ratings yet

- View - Print Submitted Form PassportDocument2 pagesView - Print Submitted Form PassportRAMESH LAISHETTYNo ratings yet